Packaging Solution Market Report Scope & Overview:

Get More Information on Packaging Solution Market - Request Sample Report

The Packaging Solution Market Size was valued at USD 1184.3 billion in 2023 and is projected to reach USD 1845.13 billion by 2032 growing at a CAGR of 5.05% from 2024 to 2032.

The packaging solutions market is thriving, fueled by a surge in demand from the food, beverage, and cosmetics industries. Companies like Nestle are building new facilities to keep pace, while eco-friendly innovations like Albea's paper bottle are capturing market share.

This growth is creating a ripple effect, benefiting related markets for packaging design and machinery. However, the road is not without obstacles. Manufacturers struggle with fluctuating raw material costs, stricter environmental regulations, and fierce competition from established players like Mondi Group.

Despite ongoing global challenges, the long-term forecast remains bright. Rising incomes and a growing focus on fresh produce packaging to minimize food waste are key drivers. This fragmented market offers fertile ground for companies to develop innovative and sustainable solutions, ensuring a future filled with opportunity.

MARKET DYNAMICS

KEY DRIVERS:

The packaging market is positioned to boom as demand for packaging in food, beverages, and cosmetics surges.

The surge in demand for cosmetic products directly translates to growth in the packaging solutions market.

The rise of the cosmetics industry is a benefit for the packaging solutions market. Since most cosmetics need jars, bottles, or tubes, this surge in demand translates directly to a need for innovative and functional packaging. For example, Albea, a leading beauty packaging manufacturer, introduced the world's first squeezable paper-based bottle in October 2022, showcasing the push for sustainable solutions.

RESTRAINTS:

Tighter government regulations on non-ecofriendly packaging could hamper the packaging market's growth.

Shifting production towards eco-friendly materials may require upfront investments in new technologies and supply chains, potentially raising production costs. Strict regulations could discourage innovation in the packaging sector. Manufacturers may be hesitant to invest in developing novel packaging solutions if they fear these innovations might not meet evolving regulatory standards.

OPPORTUNITY:

Tamper-proof packaging has revolutionized the market, driving its growth.

As regulations become more stringent, the potential for reputation damage for companies due to product tampering increases. Criminal activities like theft, counterfeiting, and deliberate product tampering pose a significant risk within food, beverage, and healthcare sectors. Tamper-proof packaging is no longer just an option it's becoming a necessity that aligns perfectly with current industry trends and analysis.

The development of novel packaging solutions opens doors to exciting product presentations and functionality.

CHALLENGES:

The unpredictable fluctuations in the cost of raw materials create challenges for manufacturers in the packaging industry.

Global packaging regulations pose challenges in navigating trade access and fostering technological innovation for the packaging industry.

Globalization has created pressure on the packaging industry to adapt rapidly with ever-changing technologies and practices. However, national regulatory bodies often struggle to keep pace, hindering trade access for developing countries in particular. The constant variations and policy changes, coupled with compliance challenges, can lead to product damage, shipment rejections, and unnecessary waste. This lack of clear information sharing, especially regarding packaging requirements, is a major contributor to these issues.

IMPACT OF RUSSIA UKRAINE WAR

The Russia-Ukraine conflict is disrupting the recovering global supply chain, posing significant challenges to the packaging solutions market. The war adds another layer of complexity to the already stressed supply chains recovering from the pandemic. The war adds another layer of complexity to the already stressed supply chains recovering from the pandemic. Lack of raw materials and components from Ukraine disrupts factories in key markets like Germany and Japan. The invasion triggers a spike in oil and gas prices, impacting production costs for packaging materials. The conflict has driven up oil prices to $120/bbl for dated BFOE, a multi-year high. Similarly, natural gas prices in northwest Europe surged to over €270 per megawatt-hour. Uncertainty surrounding Russia's export capabilities for oil and gas further fuels price hikes. Many Western companies are exiting Russia and Ukraine, leading to widespread closures of packaging and production facilities.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can have a mixed impact on the packaging solution market, with both challenges and opportunities emerging. Consumer product goods (CPG) companies may be more hesitant to invest in brand new packaging machinery during a recession. As companies seek to reduce overhead costs, there could be a surge in demand for co-packing and contract-packaging services. Companies may seek out packaging partners with strong project management skills to minimize errors, delays, and cost overruns during production and distribution. Overall, an economic slowdown can lead to a shift in the packaging solutions market, with a focus on cost-effectiveness and efficiency. Companies that can adapt their offerings and provide valuable partnerships to manufacturers are likely to be more successful during these challenging times.

KEY MARKET SEGMENTS

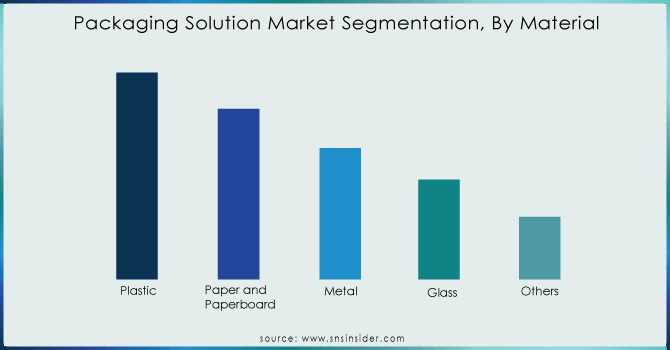

By Material

Paper and Paperboard

Plastic

Metal

Glass

Others

Plastic dominates in the packaging solution market with share of 48%, plastic packaging is known for its durability, moisture resistance, and ability to shield products from contamination. Its lightweight nature makes it easy to handle for both consumers and those working in the supply chain. Paper & Paperboard is versatile category encompasses everything from lightweight tissues to sturdy corrugated boxes. It's a popular choice for paper bags, cartons, and even molded pulp containers.

Get More Information on Packaging Solution Market - Enquiry Now

By Packaging Type

New

Recycled

The packaging solutions market can be categorized into two main segments: new and recycled. While new packaging currently holds the larger revenue share of 55%, the recycled segment is projected to experience the fastest growth in the coming years.Recycled packaging utilizes materials that have already been used, such as glass, metal, cardboard, and some plastics. Consumer demand for eco-friendly options is driving this growth.

By End-user Industry

Food and Beverage

Healthcare

Personal Care

Industrial

Others

The packaging industry caters to a wide range of needs. Food and beverages utilize everything from cans and cartons to plastic wrap. Healthcare prioritizes safety with blister packs and vials, while personal care products often feature aesthetically pleasing glass or plastic containers. Industrial packaging is heavy-duty and custom-made, while other consumer goods encompass everything from packaging for electronics to clothing. This segmentation ensures the perfect fit for every product.

REGIONAL ANALYSIS

Asia-Pacific region is forecast to dominate the market due to its established packaging industry. India's growing population fuels investments in paper packaging, anticipating significant sector expansion. Latin America, Middle East, and Africa are projected for significant growth as their packaging industries expand. This region sees high demand for flexible packaging in the food and beverage industry, as demonstrated by Smurfit Kappa's recent acquisition in Brazil.

The rise of eco-friendly alternatives like corrugated packaging is gaining traction globally, as seen in WestRock Company's "EverGrow" product launch in the US. European manufacturers are leading the way in innovation, with examples like Mondi Group's recyclable packaging solutions. The packaging solutions market experiences a boom across the globe, with each region experiencing its own unique trends and drivers.

REGIONAL COVERAGE:

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

Key players

Some of the major players in the Packaging Solution Market are Smurfit Kappa Group PLC, Ball Corporation,WestRock Company, Crown Holdings, Inc., Sealed Air Corporation, International Paper Company, Mondi Group, DS Smith Plc, Silgan Holdings Inc., Amcor PLC, stora enso oyj, Berry Global Group, Graphic Packaging International And Others Players.

RECENT DEVELOPMENTS

Amcor PLC acquired a cutting-edge flexible packaging facility in the Czech Republic in August 2022. This well-located plant allows Amcor to significantly boost its ability to meet the rising demand for flexible packaging solutions across its entire European network.

Crown Holdings, Inc. announced plans to solidify its foothold in Europe in March 2022. To achieve this, they're constructing a brand new beverage can facility in Peterborough, UK. This expansion will significantly strengthen their position within the European beverage can market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1184.3 Bn |

| Market Size by 2032 | US$ 1845.13 Bn |

| CAGR | CAGR of 5.05% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Paper And Paperboard, Plastic, Metal, Glass, Others) • By Packaging Type (New, Recycled) • By End-User Industry (Food And Beverage, Healthcare, Personal Care, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Smurfit Kappa Group PLC, Ball Corporation,WestRock Company, Crown Holdings, Inc., Sealed Air Corporation, International Paper Company, Mondi Group, DS Smith Plc, Silgan Holdings Inc., Amcor PLC, stora enso oyj, Berry Global Group, Graphic Packaging International |

| Key Drivers | • The packaging market is positioned to boom as demand for packaging in food, beverages, and cosmetics surges. • The surge in demand for cosmetic products directly translates to growth in the packaging solutions market. |

| Key Restraints | • Tighter government regulations on non-ecofriendly packaging could hamper the packaging market's growth. |

Ans: The Packaging Solution Market is expected to grow at a CAGR of 5.05%.

Ans: Packaging Solution Market size was USD 1184.3 billion in 2023 and is expected to Reach USD 1845.13 billion by 2032.

Ans: The surge in demand for cosmetic products directly translates to growth in the packaging solutions market.

Ans: Tighter government regulations on non-ecofriendly packaging could hamper the packaging market's growth.

Asia Pacific holds the dominant position in the Packaging Solution Market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Packaging Solution Market Segmentation, By Material

9.1 Introduction

9.2 Trend Analysis

9.3 Paper and Paperboard

9.4 Plastic

9.5 Metal

9.6 Glass

9.7 Others

10. Packaging Solution Market Segmentation, By Packaging Type

10.1 Introduction

10.2 Trend Analysis

10.3 New

10.4 Recycled

11. Packaging Solution Market Segmentation, By End-user Industry

11.1 Introduction

11.2 Trend Analysis

11.3 Food and Beverage

11.4 Healthcare

11.5 Personal Care

11.6 Industrial

11.7 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Packaging Solution Market By Country

12.2.3 North America Packaging Solution Market By Material

12.2.4 North America Packaging Solution Market By Packaging Type

12.2.5 North America Packaging Solution Market By End-user Industry

12.2.6 USA

12.2.6.1 USA Packaging Solution Market By Material

12.2.6.2 USA Packaging Solution Market By Packaging Type

12.2.6.3 USA Packaging Solution Market By End-user Industry

12.2.7 Canada

12.2.7.1 Canada Packaging Solution Market By Material

12.2.7.2 Canada Packaging Solution Market By Packaging Type

12.2.7.3 Canada Packaging Solution Market By End-user Industry

12.2.8 Mexico

12.2.8.1 Mexico Packaging Solution Market By Material

12.2.8.2 Mexico Packaging Solution Market By Packaging Type

12.2.8.3 Mexico Packaging Solution Market By End-user Industry

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Packaging Solution Market By Country

12.3.2.2 Eastern Europe Packaging Solution Market By Material

12.3.2.3 Eastern Europe Packaging Solution Market By Packaging Type

12.3.2.4 Eastern Europe Packaging Solution Market By End-user Industry

12.3.2.5 Poland

12.3.2.5.1 Poland Packaging Solution Market By Material

12.3.2.5.2 Poland Packaging Solution Market By Packaging Type

12.3.2.5.3 Poland Packaging Solution Market By End-user Industry

12.3.2.6 Romania

12.3.2.6.1 Romania Packaging Solution Market By Material

12.3.2.6.2 Romania Packaging Solution Market By Packaging Type

12.3.2.6.4 Romania Packaging Solution Market By End-user Industry

12.3.2.7 Hungary

12.3.2.7.1 Hungary Packaging Solution Market By Material

12.3.2.7.2 Hungary Packaging Solution Market By Packaging Type

12.3.2.7.3 Hungary Packaging Solution Market By End-user Industry

12.3.2.8 Turkey

12.3.2.8.1 Turkey Packaging Solution Market By Material

12.3.2.8.2 Turkey Packaging Solution Market By Packaging Type

12.3.2.8.3 Turkey Packaging Solution Market By End-user Industry

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Packaging Solution Market By Material

12.3.2.9.2 Rest of Eastern Europe Packaging Solution Market By Packaging Type

12.3.2.9.3 Rest of Eastern Europe Packaging Solution Market By End-user Industry

12.3.3 Western Europe

12.3.3.1 Western Europe Packaging Solution Market By Country

12.3.3.2 Western Europe Packaging Solution Market By Material

12.3.3.3 Western Europe Packaging Solution Market By Packaging Type

12.3.3.4 Western Europe Packaging Solution Market By End-user Industry

12.3.3.5 Germany

12.3.3.5.1 Germany Packaging Solution Market By Material

12.3.3.5.2 Germany Packaging Solution Market By Packaging Type

12.3.3.5.3 Germany Packaging Solution Market By End-user Industry

12.3.3.6 France

12.3.3.6.1 France Packaging Solution Market By Material

12.3.3.6.2 France Packaging Solution Market By Packaging Type

12.3.3.6.3 France Packaging Solution Market By End-user Industry

12.3.3.7 UK

12.3.3.7.1 UK Packaging Solution Market By Material

12.3.3.7.2 UK Packaging Solution Market By Packaging Type

12.3.3.7.3 UK Packaging Solution Market By End-user Industry

12.3.3.8 Italy

12.3.3.8.1 Italy Packaging Solution Market By Material

12.3.3.8.2 Italy Packaging Solution Market By Packaging Type

12.3.3.8.3 Italy Packaging Solution Market By End-user Industry

12.3.3.9 Spain

12.3.3.9.1 Spain Packaging Solution Market By Material

12.3.3.9.2 Spain Packaging Solution Market By Packaging Type

12.3.3.9.3 Spain Packaging Solution Market By End-user Industry

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Packaging Solution Market By Material

12.3.3.10.2 Netherlands Packaging Solution Market By Packaging Type

12.3.3.10.3 Netherlands Packaging Solution Market By End-user Industry

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Packaging Solution Market By Material

12.3.3.11.2 Switzerland Packaging Solution Market By Packaging Type

12.3.3.11.3 Switzerland Packaging Solution Market By End-user Industry

12.3.3.1.12 Austria

12.3.3.12.1 Austria Packaging Solution Market By Material

12.3.3.12.2 Austria Packaging Solution Market By Packaging Type

12.3.3.12.3 Austria Packaging Solution Market By End-user Industry

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Packaging Solution Market By Material

12.3.3.13.2 Rest of Western Europe Packaging Solution Market By Packaging Type

12.3.3.13.3 Rest of Western Europe Packaging Solution Market By End-user Industry

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Packaging Solution Market By Country

12.4.3 Asia-Pacific Packaging Solution Market By Material

12.4.4 Asia-Pacific Packaging Solution Market By Packaging Type

12.4.5 Asia-Pacific Packaging Solution Market By End-user Industry

12.4.6 China

12.4.6.1 China Packaging Solution Market By Material

12.4.6.2 China Packaging Solution Market By Packaging Type

12.4.6.3 China Packaging Solution Market By End-user Industry

12.4.7 India

12.4.7.1 India Packaging Solution Market By Material

12.4.7.2 India Packaging Solution Market By Packaging Type

12.4.7.3 India Packaging Solution Market By End-user Industry

12.4.8 Japan

12.4.8.1 Japan Packaging Solution Market By Material

12.4.8.2 Japan Packaging Solution Market By Packaging Type

12.4.8.3 Japan Packaging Solution Market By End-user Industry

12.4.9 South Korea

12.4.9.1 South Korea Packaging Solution Market By Material

12.4.9.2 South Korea Packaging Solution Market By Packaging Type

12.4.9.3 South Korea Packaging Solution Market By End-user Industry

12.4.10 Vietnam

12.4.10.1 Vietnam Packaging Solution Market By Material

12.4.10.2 Vietnam Packaging Solution Market By Packaging Type

12.4.10.3 Vietnam Packaging Solution Market By End-user Industry

12.4.11 Singapore

12.4.11.1 Singapore Packaging Solution Market By Material

12.4.11.2 Singapore Packaging Solution Market By Packaging Type

12.4.11.3 Singapore Packaging Solution Market By End-user Industry

12.4.12 Australia

12.4.12.1 Australia Packaging Solution Market By Material

12.4.12.2 Australia Packaging Solution Market By Packaging Type

12.4.12.3 Australia Packaging Solution Market By End-user Industry

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Packaging Solution Market By Material

12.4.13.2 Rest of Asia-Pacific Packaging Solution Market By Packaging Type

12.4.13.3 Rest of Asia-Pacific Packaging Solution Market By End-user Industry

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Packaging Solution Market By Country

12.5.2.2 Middle East Packaging Solution Market By Material

12.5.2.3 Middle East Packaging Solution Market By Packaging Type

12.5.2.4 Middle East Packaging Solution Market By End-user Industry

12.5.2.5 UAE

12.5.2.5.1 UAE Packaging Solution Market By Material

12.5.2.5.2 UAE Packaging Solution Market By Packaging Type

12.5.2.5.3 UAE Packaging Solution Market By End-user Industry

12.5.2.6 Egypt

12.5.2.6.1 Egypt Packaging Solution Market By Material

12.5.2.6.2 Egypt Packaging Solution Market By Packaging Type

12.5.2.6.3 Egypt Packaging Solution Market By End-user Industry

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Packaging Solution Market By Material

12.5.2.7.2 Saudi Arabia Packaging Solution Market By Packaging Type

12.5.2.7.3 Saudi Arabia Packaging Solution Market By End-user Industry

12.5.2.8 Qatar

12.5.2.8.1 Qatar Packaging Solution Market By Material

12.5.2.8.2 Qatar Packaging Solution Market By Packaging Type

12.5.2.8.3 Qatar Packaging Solution Market By End-user Industry

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Packaging Solution Market By Material

12.5.2.9.2 Rest of Middle East Packaging Solution Market By Packaging Type

12.5.2.9.3 Rest of Middle East Packaging Solution Market By End-user Industry

12.5.3 Africa

12.5.3.1 Africa Packaging Solution Market By Country

12.5.3.2 Africa Packaging Solution Market By Material

12.5.3.3 Africa Packaging Solution Market By Packaging Type

12.5.3.4 Africa Packaging Solution Market By End-user Industry

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Packaging Solution Market By Material

12.5.3.5.2 Nigeria Packaging Solution Market By Packaging Type

12.5.3.5.3 Nigeria Packaging Solution Market By End-user Industry

12.5.3.6 South Africa

12.5.3.6.1 South Africa Packaging Solution Market By Material

12.5.3.6.2 South Africa Packaging Solution Market By Packaging Type

12.5.3.6.3 South Africa Packaging Solution Market By End-user Industry

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Packaging Solution Market By Material

12.5.3.7.2 Rest of Africa Packaging Solution Market By Packaging Type

12.5.3.7.3 Rest of Africa Packaging Solution Market By End-user Industry

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Packaging Solution Market By country

12.6.3 Latin America Packaging Solution Market By Material

12.6.4 Latin America Packaging Solution Market By Packaging Type

12.6.5 Latin America Packaging Solution Market By End-user Industry

12.6.6 Brazil

12.6.6.1 Brazil Packaging Solution Market By Material

12.6.6.2 Brazil Packaging Solution Market By Packaging Type

12.6.6.3 Brazil Packaging Solution Market By End-user Industry

12.6.7 Argentina

12.6.7.1 Argentina Packaging Solution Market By Material

12.6.7.2 Argentina Packaging Solution Market By Packaging Type

12.6.7.3 Argentina Packaging Solution Market By End-user Industry

12.6.8 Colombia

12.6.8.1 Colombia Packaging Solution Market By Material

12.6.8.2 Colombia Packaging Solution Market By Packaging Type

12.6.8.3 Colombia Packaging Solution Market By End-user Industry

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Packaging Solution Market By Material

12.6.9.2 Rest of Latin America Packaging Solution Market By Packaging Type

12.6.9.3 Rest of Latin America Packaging Solution Market By End-user Industry

13. Company Profiles

13.1 Smurfit Kappa Group PLC

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Ball Corporation

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 WestRock Company

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Crown Holdings, Inc.

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Sealed Air Corporation

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 International Paper Company

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Mondi Group

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 DS Smith Plc

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Silgan Holdings Inc.

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Amcor PLC

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

13.11 stora enso oyj

13.11.1 Company Overview

13.11.2 Financial

13.11.3 Products/ Services Offered

13.11.4 SWOT Analysis

13.11.5 The SNS View

13.12 Berry Global Group

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

13.12.5 The SNS View

13.13 Graphic Packaging International

13.13.1 Company Overview

13.13.2 Financial

13.13.3 Products/ Services Offered

13.13.4 SWOT Analysis

13.13.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Pallet Racking Market size was USD 11.74 billion in 2023 and is expected to Reach USD 19.73 billion by 2031 and grow at a CAGR of 6.7 % over the forecast period of 2024-2031.

The Bag-in-Box Container Market size was USD 4.21 billion in 2023 and is expected to Reach USD 7.17 billion by 2031 and grow at a CAGR of 6.80 % over the forecast period of 2024-2031.

The Corrugated Bulk Bins Market size was USD 12.43 billion in 2023 and is expected to Reach USD 17.68 billion by 2031 and grow at a CAGR of 4.5 % over the forecast period of 2024-2031.

The Returnable Packaging Market size was valued at USD 111.40 billion in 2023 and is expected to Reach USD 185.04 billion by 2032 and grow at a CAGR of 5.8 % over the forecast period of 2024-2032.

The Grab-and-Go Bottles Market Size was valued at USD 82.32 billion in 2023 and is expected to reach USD 122.55 billion by 2031 and grow at a CAGR of 5.1% over the forecast period 2024-2031.

The Container Liner Market Size was valued at USD 892 million in 2023 and is expected to reach USD 1360.24 million by 2032 and grow at a CAGR of 4.8 % over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone