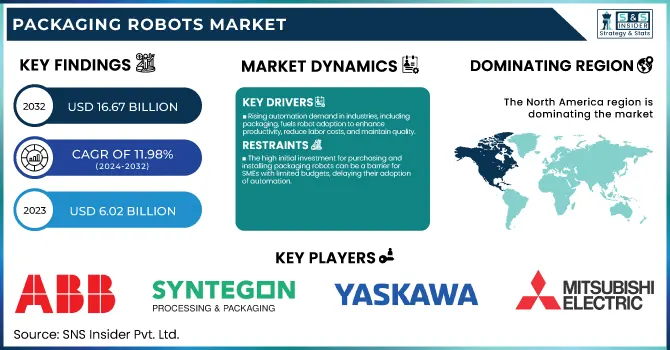

Packaging Robots Market Report Scope & Overview:

The Packaging Robots Market size was estimated at USD 6.02 billion in 2023 and is expected to reach USD 16.67 billion by 2032 at a CAGR of 11.98% during the forecast period of 2024-2032. This report highlights some prominent trends include the rising penetration of collaborative robots (cobots) across various industries, further augmenting production efficiency and decreasing labor costs. Robots are being improved in terms of adaptability and flexibility through AI. Technological advances are in the areas of energy efficiency and accommodating products with irregular shapes. Market share and adoption rates are highest in the Asia-Pacific region, where industrialization is most widespread and automated processes are in high demand. Similar growth can be seen in North America and Europe as well, with a stronger emphasis on predictive maintenance and real-time monitoring along with an increased integration between IoT.

To Get more information on Packaging Robots Market - Request Free Sample Report

Packaging Robots Market Dynamics

DRIVERS

-

The growing demand for automation in industries, including packaging, drives the adoption of robots to boost productivity, cut labor costs, and ensure consistent quality.

The increased demand for automation across various industries, particularly packaging, is a key driver for the adoption of packaging robots. Automating activities enables the businesses to optimize their process, and hence this results in a high amount of improvement in the productivity level due to lesser time consumption in performing similar activities. This efficiency improvement also results in lower labor costs, as robots are very cheap to operate and replace humans for tasks on a mass scale. Moreover, using robotic arms for packaging ensures that the products are of consistent quality, as there is no scope of human error and the right amount is packaged every single time. This trend also creates a pressing demand for more efficient and dependable packaging solutions, specifically in sectors with surging demands, like e-commerce, fueling the transition to automation. As businesses aim to keep up with rising consumer expectations on speed and quality while driving down operational costs, packaging robots have become a strategic option that drives long-term improvement in both cost-per-pack and operational efficiency.

RESTRAINT

-

The high initial investment for purchasing and installing packaging robots can be a barrier for SMEs with limited budgets, delaying their adoption of automation.

The high initial investment required for purchasing and installing packaging robots can be a significant barrier, especially for small and medium-sized enterprises (SMEs). While these machines offer long-term cost savings, the initial outlay is considerable, with purchase price, installation, and any necessary customisation for specific packaging needs, all to factor in. For small business owners with constrained budgets, this upfront cost may be disincentivizing them to put money toward automating their processes. The cost of training personnel to work the robots and the cost to establish efficient integration into existing systems also add to the costs. Big companies may have the capital to absorb these costs, but SMEs struggle to justify the cost which is unlikely to pay off in the short-term. Consequently, despite the long-term operational efficiency these solutions can bring, many SMEs may postpone or avoid implementation of robotic solutions altogether, thus potentially compromising their competitive advantage in an ever-automated market.

OPPORTUNITY

-

Robotic as a Service (RaaS) allows businesses to lease packaging robots, reducing upfront costs and offering flexible, scalable automation solutions.

Robotic as a Service (RaaS) is a business model that enables companies to lease robotic systems, such as packaging robots, rather than purchasing them outright. This model helps businesses, especially small and medium-sized enterprises (SMEs), reduce the high capital expenditures associated with buying expensive robots. RaaS provides more financial flexibility because you trade capital expenses in exchange for operational expenses in the form of subscription-based payments. It also gives companies access to the latest tech without the long-term commitment of ownership. RaaS also allows businesses to scope their robotic capabilities according to the changing demand, enabling them to remain competitive while limiting potential investments in equipment that may quickly become outdated. Moreover, since RaaS vendors usually take care of maintenance, application updates, and troubleshooting, organizations need less specialized in-house expertise. It is especially useful for companies interested in automating their packaging processes, but not in a position to make the usual large capital expenditure necessary for robotic systems.

CHALLENGES

-

Workforce resistance to automation arises from fears of job displacement, requiring clear communication and retraining to ease transitions.

Workforce resistance to automation is a significant challenge for companies adopting robotic systems, especially in the packaging industry. In recent times employees have often feared losing their jobs as robots have taken over repetitive and manual jobs, raising job security concerns. A lack of knowledge about the potential benefits including less physical strain and the ability to concentrate on high-value tasks is driving this resistance, Companies must engage in robust change management, communicating to staff that automation is a way to support, not supplement, their role. Re-training and reskilling employees can help you transition employees into higher-skilled roles in the organization. Engaging workers in decisions and being open about the effects of automation on their jobs can also help release resistance. Successfully managing this cultural shift ensures that automation is embraced, leading to a smoother integration of robotic systems into packaging operations.

Packaging Robots Market Segmentation Analysis

By Robot Type

The Cobots segment dominated packaging robots market with a revenue share of over 42% in 2023, because of their exceptional flexibility, safety features, and seamless integration into existing packaging workflows. Unlike conventional industrial robots, cobots have been designed specifically to work alongside human operators in a joint workspace, helping to eliminate the need for expensive safety fences, which can consume space. With their pain-free programming and versatility, they are perfect for small to mid-sized firms that want to automate without forcing an interruption in business processes. Cobots further enhance operational efficiency by automating repetitive tasks, freeing up human workers to concentrate on more complex activities. This combination of safety, flexibility, and ease of integration has driven their widespread adoption across industries, including food, pharmaceuticals, and consumer goods packaging, making them the dominant force in the market.

By Operation Type

The Pick and Place segment dominated with a market share of over 32% in 2023, due to their versatility and widespread adoption across various industries. These types of robots play an important role in the handling and packing of products and are indispensable in sectors such as food and beverage, pharmaceuticals and consumer goods. They are commonly used in automated production lines by picking and placing goods from one spot to a packaged spot or container. This form of operation is well-suited for rapid production, minimizing human labor and boosting overall efficiency. Pick and Place segment is also the leading segment of Packing Robots Market, as companies are gaining synergies derived from these businesses for greater efficiency and lowering costs to focus on the growth opportunities.

By Industry

The Consumer Goods segment dominated with a market share of over 35% in 2023, driven by the increasing demand for automation to improve efficiency and reduce labor costs. With the strains of high production volumes and product quality, packaging companies have turned to robotics to take on these tasks. Personal care products, home goods and small consumer electronics fall into this category, and demand robotic solutions that optimise packaging operations. These machines provide high precision, flexibility, and consistency enabling quicker production cycles along with less involvement of human labor. Moreover, owing to the growth of e-commerce and need for customized packaging solutions, robotics are being embraced in this industry faster than ever before and making it the leading segment in the market.

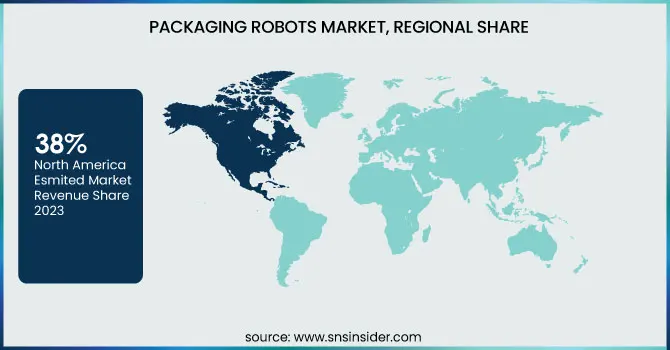

Packaging Robots Market Regional Outlook

North America region dominated with a market share of over 38% in 2023, driven by its well-established automation ecosystem and strong technological advancements. high labor costs throughout the region, there has been a rapid shift to much more robotic-based solutions that are efficient and cost effective. All of that has been accelerated by the growing adoption of Industry 4.0 technologies, including AI, IoT, and machine learning. As consumer demand rises, industries such as food & beverage, Pharmaceuticals, and e-commerce are gradually trying towards making packaging automated to improve their productivity. The presence of key robotic manufacturers and consistent R&D investments also aids in the market expansion. This and many other factors make North America the key destination for packaging automation and innovation.

The Asia-Pacific region is the fastest-growing region for packaging robots market, driven by rising labor costs, rapid industrialization, and strong government support for automation. countries including China, Japan and India are experiencing industrial development primarily fueled by manufacturing components, such as food & beverage, pharmaceuticals, and e-commerce that can reduce business expenses through automated packaging options. The consumer base is expanding, resulting in high demand for packaged products, which would further stimulate market growth. In addition, advanced technologies, particularly AI robotics and the cobots, are likewise being incorporated into production lines as part of the business sector.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players of the Packaging Robots Market

-

ABB (Switzerland): Robotics and automation solutions for packaging processes.

-

Syntegon Technology GmbH (Germany): Packaging machines and automation for pharmaceutical and

food industries. -

YASKAWA ELECTRIC CORPORATION (Japan): Robotics for packaging and automation.

-

Universal Robots (U.S.): Collaborative robots for packaging tasks.

-

Mitsubishi Electric Corporation (Japan): Robots and automation for packaging applications.

-

NACHI-FUJIKOSHI CORP. (Japan): Robotics and automation solutions for various packaging needs.

-

Doosan Robotics (South Korea): Collaborative robots for packaging and material handling.

-

Comau SpA (Italy): Industrial robots for packaging and automation in various industries.

-

KUKA AG (Germany): Robotics and automation solutions for packaging and material handling.

-

Krones Group (Germany): Packaging technology and automation solutions for beverage industries.

-

FANUC CORPORATION (Japan): Robotics for packaging, material handling, and automation.

-

Schubert Group (Germany): Automation solutions for packaging in the food and pharmaceutical sectors.

-

DENSO CORPORATION (Japan): Robotics for packaging, material handling, and industrial automation.

-

Kawasaki Heavy Industries, Ltd. (Japan): Robotics for packaging, assembly, and material handling.

-

Omron Corporation (Japan): Automation and robotics solutions for packaging processes.

-

Bastian Solutions (U.S.): Automation systems, including robotics for packaging.

-

Marel (Iceland): Robotics for food packaging and processing automation.

-

Rockwell Automation (U.S.): Packaging automation systems with robotics integration.

-

Siemens (Germany): Robotics and automation systems for packaging industries.

-

Pacepacker Services (U.K.): Custom robotic packaging solutions for various industries.

Suppliers for (high-speed packaging, palletizing, and material handling. Known for their flexibility and innovation in automation solutions) on Packaging Robots Market

-

ABB

-

Syntegon Technology GmBH

-

YASKAWA ELECTRIC CORPORATION

-

Universal Robots

-

Mitsubishi Electric Corporation

-

NACHI-FUJIKOSHI CORP.

-

Doosan Robotics

-

Comau SpA

-

KUKA AG

-

Krones Group

RECENT DEVELOPMENT

In August 2024: Syntegon Group sold its liquid food filling business, Osgood Industries, LLC, and Ampack GmbH, to DUBAG Group. The companies, now part of Ceratech Group, specialize in filling and packaging equipment for preformed cups and bottles.

In March 2024: ABB opened its upgraded U.S. robotics headquarters and manufacturing facility in Auburn Hills, Michigan. This expansion strengthens ABB’s presence in the U.S. market, supporting robotics growth and job creation. It is part of ABB’s global strategy to enhance Robotics and Automation capacity, marking its third major robotics facility expansion in three years, following developments in China and Europe.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 6.02 Billion |

|

Market Size by 2032 |

USD 16.67 Billion |

|

CAGR |

CAGR of 11.98% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Robot Type (Delta Robots, Scara Robots, Cobots, Others (CRX Robots) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

ABB, Syntegon Technology GmbH, YASKAWA ELECTRIC CORPORATION, Universal Robots, Mitsubishi Electric Corporation, NACHI-FUJIKOSHI CORP., Doosan Robotics, Comau SpA, KUKA AG, Krones Group, FANUC CORPORATION, Schubert Group, DENSO CORPORATION, Kawasaki Heavy Industries, Ltd., Omron Corporation, Bastian Solutions, Marel, Rockwell Automation, Siemens, Pacepacker Services. |