Get More Information on Packaging Machinery Market - Request Sample Report

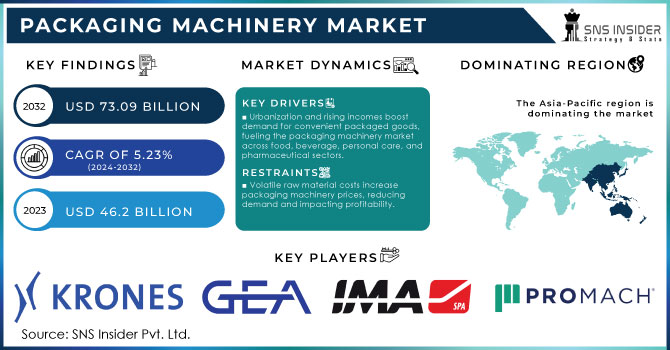

The Packaging Machinery Market size was valued at USD 46.2 Billion in 2023 and is now anticipated to grow to USD 73.09 Billion by 2032, displaying a compound annual growth rate CAGR of 5.23% during the forecast Period 2024-2032.

The Packaging Machinery market growth is being fueled by the increasing need for faster production, improved accuracy, and meeting consumer demand for packaged goods through automation. Processed food and beverages offer advantages in terms of convenience, simplicity, and saving time. These features of packaged food and drinks are what drive consumers to purchase these products. The increasing number of millennials and Gen-Z in consumer demographics is expected to increase the demand for convenient products. In addition, progress in technology and creativity is driving the expansion. Technology advancements such as automation, robots, and other devices are expanding the reach of products across various industries. Food was the leading customer sector in Europe 2023, accounting for 30.9% of the total turnover at €2.856 billion, with an export intensity of 74.5%. The second most important sector is beverages, accounting for 26.2% of the overall revenues. 83.3% of sales in this sector are allocated for foreign markets. The main packaging machine group continued to lead with 52.4% of revenue, while the end-of-line, labelling, and ancillary equipment sector followed with 27.2%, and the remaining 20.4% was attributed to secondary packaging.

By 2030 the U.S. packaging machinery is estimated to undergo significant improvements, as more than 60% of machines will be automated and equipped with the Internet of Things. This figure is expected to promote efficiency and reduction of labor costs in the segment. The market is projected to expand at a rate of 7% annually in relation to machinery aimed for the needs of biodegradable and recyclable materials, which indicates a strong trend toward sustainability, and more and more participants engage in using eco-friendly packaging for their goods. Besides, it is expected that within a shorter period to 2027, there will be a 15% share in sales related to customized and flexible solutions.

MARKET DYNAMICS

DRIVERS

Urbanization and rising incomes boost demand for convenient packaged goods, fueling the packaging machinery market across food, beverage, personal care, and pharmaceutical sectors.

The increasing worldwide demand for convenience and packaged products is greatly impacted by the quick urbanization and growth in incomes. With the increase in urban population, there is a growing need for fast, simple meals and products that can be consumed on the move, indicating a trend towards convenience-focused lifestyles. This pattern is especially noticeable in the use of pre-prepared meals, drinks, grooming products, and medicines, as customers look for items that easily integrate into their hectic schedules. The increase in need for packaged goods has a direct influence on the packaging machinery sector, which is essential for the successful and productive manufacturing process of these products. Packaging machinery needs to adjust to changing industry needs by offering solutions that improve speed, efficiency, and product quality. Due to this, manufacturers and suppliers of packaging machinery are facing an increase in demand, driven by the requirement to keep up with the growing market for convenient and packaged goods. This growing need for advanced packaging solutions highlights the vital importance of packaging machinery in satisfying contemporary consumer demands and aiding the overall packaged goods sector.

Sustainability prioritizes eco-friendly materials and waste reduction, boosting demand for packaging machinery aligned with these goals.

Focus on sustainable and environmentally friendly packaging is key in current environmental initiatives, emphasizing the utilization of recyclable and biodegradable materials to decrease ecological footprints and cut down on waste. This method is guided by the rising expectations from consumers and regulations for more environmentally-friendly practices, as well as a greater recognition of environmental concerns. Businesses are embracing sustainable practices to comply with global environmental objectives, causing an increased need for packaging machinery that can handle these materials. One example is the growing demand for machinery that can process biodegradable films, compostable containers, and recycled materials. This change not only reduces carbon emissions but also improves brand image and meets environmental guidelines. Consequently, there is a notable increase in demand for advanced, environmentally-friendly packaging options and the equipment that goes with them, in line with the overall shift towards environmental consciousness and efficient use of resources.

RESTRAIN

Volatile raw material costs increase packaging machinery prices, reducing demand and impacting profitability.

Fluctuations in prices of raw materials like steel, aluminum, and plastics have a significant effect on the manufacturing industry, particularly in packaging machinery. When the prices of these essential materials vary unexpectedly, manufacturing costs for equipment increase, potentially causing disruptions in manufacturers' overall cost framework. When production costs rise, companies must choose between absorbing them or passing them on to customers as higher prices. Using the latter method could result in lower demand because increased prices might discourage potential purchasers or cause current clients to look for more affordable options. This scenario presents a dual challenge for companies to both retain their market share and manage their profits effectively by striking a balance between increasing expenses and staying competitive with pricing. To cope with these changes, strategic planning and efficiency enhancements are needed to reduce the impact on financial performance.

KEY SEGMENTATION ANALYSIS

By Type

The Form-Fill-Seal type is dominating the market with a share of around 35.4% of the total market. The dominance is because of all-in-one operation of formation of the packaging material, filling of the product, and as-well-as sealing. This type is highly efficient and widely used in the food and beverage sector. This type of machine is used for high-production manufacturing serve, pack, and shipping of edible goods. Thus, saving time and money due to speed and efficiency in sealing and vacuum sealing of products.

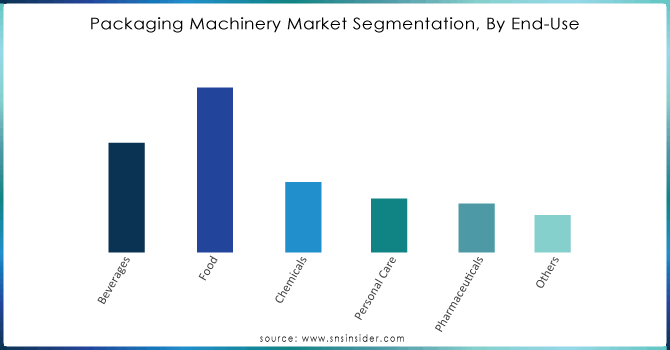

By End Use

The Food is dominating the market with a share of around 36.2%, and the rising need for packaged food for convenience and the rising consumption of organic food product requiring specialized packaging solution are likely to augment the demand for packaging equipment. In addition to this, automation & industry 4.0 is expected to help in enhancement of productivity and provide safety without and human intervention.

Need any customization research on Packaging Machinery Market - Enquiry Now

KEY REGIONAL ANALYSIS

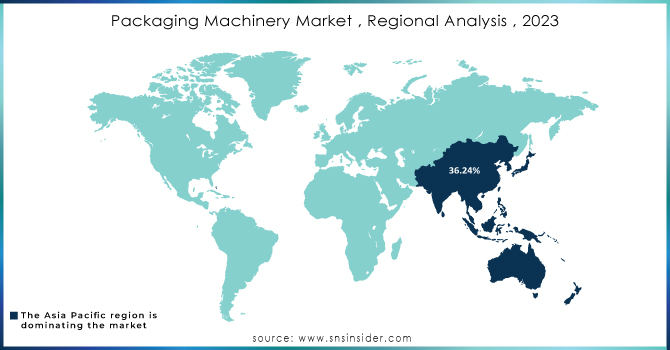

The Asia-Pacific region is dominating the market with a share of about 36.24% of the total market. It was due to rapid growth of population and rising purchasing power of consumers throughout the region creating the demand for packaged goods. Also, the rising e-commerce industry is supporting to grow the market.

The North America is experiencing rapid growth due to high demand for automation and technological advancements in sectors like food and beverage, pharmaceuticals, and e-commerce. The growing demand for effective packaging solutions to meet higher consumer expectations and strict regulatory standards has driven the adoption of advanced packaging machinery.

The major key players are Krones AG, GEA Group, M.A. Industria Macchine Automatiche S.p.A., Tetra Laval International S.A., ProMach, Aktiengesellschaf, Syntegon Technology GmbH, Coesia S.p.A., Duravant, Maillis Group and others.

In November 2023, ELITER Packaging Machinery launched GRAN SONATA its newly designed and enhanced automatic cartooning machine, featuring an open profile, multi-axis servo drive system, and stainless-steel construction offering a compact secondary and tertiary packaging automation option that can handle both large-sized cartooning and medium-sized case packing.

In May 2023, Barry-Wehmiller unveiled its new facility in Minnesota, US, to develop innovative packaging machinery.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 46.2 Billion |

| Market Size by 2032 | US$ 73.09 Billion |

| CAGR | CAGR of 5.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (General Packaging, Modified Atmosphere Packaging, Vacuum Packaging) • By Type (Filling, Labeling, Form-Fill-Seal, Cartooning, Wrapping, Palletizing, Bottling Line, Others) • By End Use (Beverages, Food, Chemicals, Personal Care, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Krones AG, GEA Group, M.A. Industria Macchine Automatiche S.p.A., Tetra Laval International S.A., ProMach, Aktiengesellschaf, Syntegon Technology GmbH, Coesia S.p.A., Duravant |

| Key Drivers | • Urbanization and rising incomes boost demand for convenient packaged goods, fueling the packaging machinery market across food, beverage, personal care, and pharmaceutical sectors. • Sustainability prioritizes eco-friendly materials and waste reduction, boosting demand for packaging machinery aligned with these goals. |

| RESTRAINTS | • Volatile raw material costs increase packaging machinery prices, reducing demand and impacting profitability. |

Ans: The Packaging Machinery Market is expected to grow at a CAGR of 5.23%.

Ans: Packaging Machinery Market size was USD 46.2 billion in 2023 and is expected to Reach USD 69.46 billion by 2031.

Ans: The Form-Fill-Seal is the dominating segment by Technology in the Packaging Machinery Market.

Ans: The aerospace and automotive industries are increasingly adopting Friction Stir Welding (FSW) for its ability to join dissimilar metals with high-strength, defect-free welds, driven by the need for lightweight, fuel-efficient vehicles and aircraft.

Ans: Asia-Pacific is the dominating region in the Packaging Machinery Market.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Packaging Machinery Market Segmentation, by Technology

7.1 Chapter Overview

7.2 General Packaging

7.2.1 General Packaging Market Trends Analysis (2020-2032)

7.2.2 General Packaging Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Modified Atmosphere Packaging

7.3.1 Modified Atmosphere Packaging Market Trends Analysis (2020-2032)

7.3.2 Modified Atmosphere Packaging Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Vacuum Packaging

7.4.1 Vacuum Packaging Market Trends Analysis (2020-2032)

7.4.2 Vacuum Packaging Market Size Estimates and Forecasts to 2032 (USD Million)

8. Packaging Machinery Market Segmentation, by Type

8.1 Chapter Overview

8.2 Filling

8.2.1 Filling Market Trends Analysis (2020-2032)

8.2.2 Filling Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Labeling

8.3.1 Labeling Market Trends Analysis (2020-2032)

8.3.2 Labeling Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Form-Fill-Seal

8.4.1 Form-Fill-Seal Market Trends Analysis (2020-2032)

8.4.2 Form-Fill-Seal Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Cartooning

8.5.1 Cartooning Market Trends Analysis (2020-2032)

8.5.2 Cartooning Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Wrapping

8.6.1 Wrapping Market Trends Analysis (2020-2032)

8.6.2 Wrapping Market Size Estimates and Forecasts to 2032 (USD Million)

8.7 Palletizing

8.7.1 Palletizing Market Trends Analysis (2020-2032)

8.7.2 Palletizing Market Size Estimates and Forecasts to 2032 (USD Million)

8.8 Bottling Line

8.8.1 Bottling Line Market Trends Analysis (2020-2032)

8.8.2 Bottling Line Market Size Estimates and Forecasts to 2032 (USD Million)

8.9 Others

8.9.1 Others Market Trends Analysis (2020-2032)

8.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Packaging Machinery Market Segmentation, by End User

9.1 Chapter Overview

9.2 Beverages

9.2.1 Beverages Market Trends Analysis (2020-2032)

9.2.2 Beverages Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Food

9.3.1 Food Market Trends Analysis (2020-2032)

9.3.2 Food Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Chemicals

9.4.1 Chemicals Market Trends Analysis (2020-2032)

9.4.2 Chemicals Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Personal Care

9.5.1 Personal Care Market Trends Analysis (2020-2032)

9.5.2 Personal Care Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Pharmaceuticals

9.6.1 Pharmaceuticals Market Trends Analysis (2020-2032)

9.6.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Packaging Machinery Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.4 North America Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.5 North America Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.6.2 USA Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.6.3 USA Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.7.2 Canada Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.7.3 Canada Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.2.8.2 Mexico Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.8.3 Mexico Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Packaging Machinery Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.6.2 Poland Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.6.3 Poland Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.7.2 Romania Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.7.3 Romania Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.8.2 Hungary Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.8.3 Hungary Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.9.2 Turkey Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.9.3 Turkey Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Packaging Machinery Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.4 Western Europe Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.5 Western Europe Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.6.2 Germany Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.6.3 Germany Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.7.2 France Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.7.3 France Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.8.2 UK Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.8.3 UK Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.9.2 Italy Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.9.3 Italy Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.10.2 Spain Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.10.3 Spain Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.13.2 Austria Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.13.3 Austria Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Packaging Machinery Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.4 Asia Pacific Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.5 Asia Pacific Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.6.2 China Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.6.3 China Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.7.2 India Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.7.3 India Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.8.2 Japan Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.8.3 Japan Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.9.2 South Korea Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.9.3 South Korea Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.10.2 Vietnam Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.10.3 Vietnam Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.11.2 Singapore Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.11.3 Singapore Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.12.2 Australia Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.12.3 Australia Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Packaging Machinery Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.4 Middle East Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.5 Middle East Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.6.2 UAE Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.6.3 UAE Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.7.2 Egypt Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.7.3 Egypt Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.9.2 Qatar Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.9.3 Qatar Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Packaging Machinery Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.4 Africa Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.5 Africa Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.6.2 South Africa Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.6.3 South Africa Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Packaging Machinery Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.4 Latin America Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.5 Latin America Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.6.2 Brazil Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.6.3 Brazil Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.7.2 Argentina Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.7.3 Argentina Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.8.2 Colombia Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.8.3 Colombia Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Packaging Machinery Market Estimates and Forecasts, by Technology (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Packaging Machinery Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Packaging Machinery Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11. Company Profiles

11.1 Krones AG

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 GEA Group

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 M.A. Industria Macchine Automatiche S.p.A.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Tetra Laval International S.A.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 ProMach

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Aktiengesellschaf

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Syntegon Technology GmbH

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Coesia S.p.A.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Duravant

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Maillis Group

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Technology

General Packaging

Modified Atmosphere Packaging

Vacuum Packaging

By Type

Filling

Form-Fill-Seal

Cartooning

Wrapping

Palletizing

Bottling Line

Others

By End Use

Beverages

Food

Chemicals

Personal Care

Pharmaceuticals

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Machine Bench Vices Market size was valued at USD 476.30 Million in 2023 and is now anticipated to grow to USD 654.81 Million by 2032, displaying a compound annual growth rate CAGR of 3.6% during the forecast Period 2024-2032.

The Spray Dryer Market Size was valued at USD 5.55 Billion in 2023 and is now anticipated to grow to USD 8.83 Billion by 2032, displaying a compound annual growth rate of 5.29% during the forecast Period 2024 - 2032.

The Vacuum Valve Market Size was esteemed at USD 1.37 billion in 2023 and is supposed to arrive at USD 2.80 billion by 2031 and develop at a CAGR of 9.3% over the forecast period 2024-2031.

The 3D Printing Construction Market Size was valued at USD 36.71 million in 2023 and it is expected to reach USD 20556 million by 2032, growing at a compounded annual growth rate (CAGR) of 102% between 2024 and 2032.

The Storage Tank Market Size was esteemed at USD 24.34 billion in 2023 and is supposed to arrive at USD 44.82 billion by 2032 and develop at a CAGR of 7.02% over the forecast period 2024-2032.

The Microplastic Detection Market Size was valued at USD 4.55 Billion in 2023 and is expected to reach USD 7.91 Billion by 2032 and grow at a CAGR of 6.41% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone