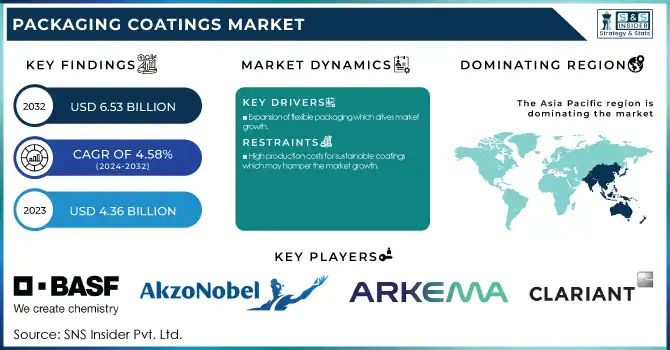

The Packaging Coatings Market size was USD 4.36 Billion in 2023 and is expected to reach USD 6.53 Billion by 2032 and grow at a CAGR of 4.58 % over the forecast period of 2024-2032. This report provides statistical insights and key trends shaping the packaging coatings market in 2023. It analyzes production capacity and utilization by country and type, along with raw material price trends across regions. The study evaluates regulatory impacts and compliance affecting market growth, while also highlighting sustainability metrics, including VOC emissions, recyclability, and eco-friendly coatings. Additionally, it covers technological advancements and R&D investments, driving innovation in water-based and UV-cured coatings. The report offers a comprehensive outlook on market adoption trends, helping stakeholders navigate evolving industry dynamics.

To Get more information on Packaging Coatings Market - Request Free Sample Report

Expansion of flexible packaging which drives market growth.

The rising adoption of flexible packaging across food & beverage, pharmaceuticals, and personal care industries is one of the prominent drivers fueling the demand for the packaging coatings market. Products such as pouches, sachet, wraps, and film are lightweight compared to rigid packaging, having a longer shelf life, and needing less material than traditional packaging which is reusable, making flexible packaging cost-effective & eco-friendly. Because of this, producers are concentrating on new methods to reinforce wetness, and oxygen permeability, and safeguard high quality with the growing search for blow coating, warmth-lower accessories, and also anti-bacterial covers. Moreover, the rapid expansion of e-commerce & online food delivery has fuelled the demand for long-lasting and protective coatings that enhance the packaging integrity while in transit. The growing awareness of recyclability and biodegradability trends in flexible packaging spurring the demand for sustainable packaging has, in turn, increased the adoption of water-based and solvent-free coatings, thereby accelerating market growth.

Restraint

High production costs for sustainable coatings which may hamper the market growth.

Sustainable coatings face enormous production costs, which is a key hindrance to the growth of the packaging coatings market. A growing interest in eco-friendly, low-VOC, and bio-based coatings across all industries, has also led to an upward trend in RM costs for manufacturers utilizing the use of renewable resins, biodegradables, and water-based formulations. Furthermore, Research and Development (R&D) costs for developing new solutions for fresh BPA-free, solvent-free, and recyclable coatings increase production costs. Sustainable alternatives, on the other hand, call for advanced production processes and novel raw materials, hence pricier for end users compared to traditional solvent-based coatings, which are cost-effective and readily available in the market. The difference in cost can discourage small and mid-sized packaging manufacturers from adopting green coatings, hampering the growth of the market. Large-scale adoption will always be financially challenging in some industries as regulatory compliance and certifications of eco-friendly coatings also add to the cost.

Increasing investments in nanocoatings create an opportunity in the market.

Nanocoatings hold healthy opportunities in the packaging coatings market, attributed to rising investments due to their beneficial properties including better durability coupled with increased barrier performance along with superior moisture and oxygen barrier with antibacterial properties. Nanocoatings act by laying down thin, nanometer-scale layers of nanoparticles as protective barriers for a consumed product, and are slowly being recognized for having a high potential to enhance the shelf life and freshness of food, pharmaceutical, and personal care packaging. On top of that, antibacterial uses of Nano-based antimicrobial coatings are being used widely to improve food safety by preventing bacterial growth. Along with the increased focus on sustainability, manufacturers are also considering bio-based nanocoatings offering high-performance protection free of unwanted chemicals. The increasing requirement for high-barrier, lightweight, and functional packaging systems, along with technology developments, has prompted manufacturers to invest in R&D and enter into strategic alliances for technological innovations associated with nanocoatings. Nanotechnology is expected to emerge as a fundamental growth factor in the coatings market as industries seeking cost-effective, high-performance, and regulatory-compliant coatings are increasingly adopting nanotechnology-based coating solutions.

Consumer preference for cost-effective solutions may challenge the market growth.

One of the major challenges of the Packaging Coatings market is consumer tendency towards economical solutions, especially in the case of high-value and green offerings. Most industries are now moving towards eco-friendly and regulatory-compliant coatings, but several businesses, particularly in price-sensitive domains, consider affordability a bigger concern than sustainability. Due to lower production costs, availability, and proven performance, legacy solvent-based and BPA-containing coatings are still the predominant choice. Comparatively, waterborne, bio-based , and recyclable coatings tend to be costly because of high raw material costs and/or complicated production methods. The greater investment required to adopt sustainable packaging may be less justifiable for small and mid-sized packaging manufacturers operating in developing economies, stalling wider adoption. Also, lowcost consumers through the food & provide personal care, and pharmaceutical industries are impartially not sophisticated in their packaging and prefer the benefit and cost to package than the ecosystem, which is also restraining the market from growing in scope.

Epoxies held the largest market share around 28% in 2023. This is owing to their better chemical resistance, adhesion, and durability as compared to other coating types. In metal packaging applications, epoxy-based coatings are used in a variety of uses including food and beverage cans, bottle caps, and aerosol containers providing outstanding corrosion protection, durability at high temperatures, and extended food shelf life. Because of their unique ability to create a robust barrier against acidity, oil, and moisture, they are ideal for packaging high-acid products like carbonated drinks, canned foods, and dairy products. Further, the versatility of formulations with epoxies allows coatings to be developed to comply with various regulations and performance requirements. Epoxy coatings also lead the market due to the widespread industrial adoption of epoxy coatings at a cost-effective price.

Insulation held the largest market share around 34% in 2023. Flexible packaging has better barriers, longer shelf life, and convenience than rigid packaging. Especially, in the food industry the growing trend of single-use and on-the-go packaging has accentuated its adoption. Further, the design progress made in high-performance coatings such as barrier, heat-seal, and antimicrobial coatings, continues to improve the functionality of flexible packaging while also extending its moisture, oxygen, and contaminants protection abilities. The increasing penetration of e-commerce and online food delivery services has created a surge in demand for flexible packaging with performance coatings to maintain product quality during transport. Moreover, the development of sustainable and recyclable packaging alternatives or solutions has opened several growth pathways for innovative or water-based and solvent-free coatings, thus strengthening the flexible packaging market share.

Food & Beverage held the largest market share around 30% in 2023. It is owing to the demand for protective, safe food coatings that comply with regulations to ensure the safety and extended shelf life of Foods & Beverages. As, the consumption of processed, packaged and ready-to-eat foods has been increasing, the demand for barrier coating that minimizes moisture, oxygen, chemicals, and microbial contamination is also increasing. For metal cans, flexible pouches, cartons, and glass bottles, packaging coatings are critical in preventing corrosion, spoilage, and flavor degradation. In addition, rigorous food safety regulations by the FDA, EFSA, and other authorities are driving food packaging towards fast adoption of BPA-free, solvent-free, and food-grade coatings. Additionally, the explosion of e-commerce, online food delivery, and convenience packing trends have escalated the demand for durable, heat-seal, and antimicrobial coating.

Asia Pacific held the largest market share around 40% in 2023. This is due to high industrialization, flourishing food & beverage and pharmaceutical sectors, and the growing need for flexible and eco-friendly packaging solutions in the region. The e-commerce and packaged food consumption in these regions is rising significantly due to urbanization and growing population, hence, boosting the demand for advanced packaging coatings with barrier protection, heat, and shelf-life stability. In addition, increasing disposable income and shifting consumer lifestyles have resulted in increased consumption of convenience foods, beverages, and personal care products, thus creating demand for coated packaging materials. It is also one of the centers for the manufacturing of packaging materials, owing to the facile availability of raw materials at economical rates, giving a huge dominance on the global level. In addition, the growing government regulations are used to avoid food safety and sustainable packaging practices, creating the impetus to develop a cost-effective yet high-performance alternative to synthetic coatings that are completely BPA-free, as well as water-based and bio-based, accelerating the transition even further cementing the leadership of Asia-Pacific in the market.

North America held a significant market share in 2023. This is due to the strong regulatory framework, a high rate of consumption of packaged food & beverages, and advanced packaging technologies. Strong demand for high-performance packaging coatings for food, beverage, pharmaceuticals, and personal care industries in the U.S. and Canada has led to the high revenue during this forecast period which collectively have a high presence in the U.S. and Canada. Stringent regulations by the FDA, EPA, and other agencies have also driven the development of BPA-free, solvent-free, food-grade coatings, especially in applications for metal cans, flexible packaging, and rigid plastic containers. Additionally, the presence of a developed e-commerce and retail industry in the region is also expected to drive the demand for protective, heat-seal, and antimicrobial coatings in packaging applications. As a result, the rise in demand for sustainable and recyclable packaging solutions among consumers has driven bio-based & waterborne coatings and has reaffirmed North America with the larger market share.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Akzo Nobel NV (Dulux, Sikkens)

BASF SE (Functional Packaging Coatings, Heat Seal Lacquers)

Arkema Group (Sartomer Specialty Resins, Kynar Coatings)

Berger Paints India Limited (Bison Acrylic Emulsion, Luxol High Gloss Enamel)

Clariant (Hostavin Light Stabilizers, Hostanox Antioxidants)

Chemetall (Oxsilan Pretreatment, Gardobond)

Chugoku Marine Paints Ltd (SEAFLO NEO, FASTAR)

HEMPEL A/S (Hempadur, Hempathane)

Jotun (Penguard Primer, Hardtop AX)

Kansai Paint Co. Ltd (Ales Shiquy, Eco-Gloss)

Axalta Coating Systems (Imron, Alesta Powder Coatings)

DowDuPont (Surlyn, Nucrel)

Evonik Industries AG (TEGO Additives, Dynasylan)

Henkel AG & Co. KGaA (Loctite, Technomelt)

Allnex (Crylcoat Powder Coating Resins, EBECRYL)

Sun Chemical (SunPak Packaging Inks, SunCure Coatings)

Sherwin-Williams (Sherwin-Williams Industrial Enamel, Kem Aqua)

H.B. Fuller (Swifttak, Advantra Packaging Adhesives)

Mondi (BarrierPack Recyclable, FunctionalBarrier Paper)

Amcor (AmLite Ultra Recyclable, UltraFlex)

Recent Development:

In November 2024, AkzoNobel introduced a new range of antimicrobial coatings designed for the food and beverage packaging sector, focusing on improving product durability and safety.

In May 2023, In January 2024, Stahl unveiled a refreshed visual brand identity, highlighting its strategic evolution to meet customer needs while reinforcing its dedication to innovation in specialty coatings and treatments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.36 Billion |

| Market Size by 2032 | US$ 6.53 Billion |

| CAGR | CAGR of 4.58 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin (Epoxies, Acrylics, Polyurethane, Polyolefins, Polyester, Other), • By Packaging Type (Rigid Packaging, Flexible Packaging, Others), • By End Use Industry (Food & Beverages, Cosmetics, Pharmaceuticals, Consumer Electronics, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Akzo Nobel NV, BASF SE, Arkema Group, Berger Paints India Limited, Clariant, Chemetall, Chugoku Marine Paints Ltd, HEMPEL A/S, Jotun, Kansai Paint Co. Ltd, Axalta Coating Systems, DowDuPont, Evonik Industries AG, Henkel AG & Co. KGaA, Allnex, Sun Chemical, Sherwin-Williams, H.B. Fuller, Mondi, Amcor |

Ans: The Packaging Coatings Market was valued at USD 4.36 Billion in 2023.

Ans: The expected CAGR of the global Packaging Coatings Market during the forecast period is 4.58%

Ans: Flexible Packaging will grow rapidly in the Packaging Coatings Market from 2024-2032.

Ans: Expansion of flexible packaging which drives market growth.

Ans: Asia Pacific led the Packaging Coatings Market in the region with the highest revenue share in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 By Production Capacity and Utilization, by Country, By Type, 2023

5.2 Feedstock Prices, by Country, By Type, 2023

5.3 Regulatory Impact, by l Country, By Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Packaging Coatings Market Segmentation, By Resin

7.1 Chapter Overview

7.2 Epoxies

7.2.1 Epoxies Market Trends Analysis (2020-2032)

7.2.2 Epoxies Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Acrylics

7.3.1 Acrylics Market Trends Analysis (2020-2032)

7.3.2 Acrylics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Polyurethane

7.4.1 Polyurethane Market Trends Analysis (2020-2032)

7.4.2 Polyurethane Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Polyolefins

7.5.1 Polyolefins Market Trends Analysis (2020-2032)

7.5.2 Polyolefins Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Polyester

7.6.1 Polyester Market Trends Analysis (2020-2032)

7.6.2 Polyester Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Other

7.7.1 Other Market Trends Analysis (2020-2032)

7.7.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Packaging Coatings Market Segmentation, By Packaging Type

8.1 Chapter Overview

8.2 Rigid Packaging

8.2.1 Rigid Packaging Market Trends Analysis (2020-2032)

8.2.2 Rigid Packaging Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Flexible Packaging

8.3.1 Flexible Packaging Market Trends Analysis (2020-2032)

8.3.2 Flexible Packaging Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Packaging Coatings Market Segmentation, By End-Use Industry

9.1 Chapter Overview

9.2 Food & Beverages

9.2.1 Food & Beverages Market Trends Analysis (2020-2032)

9.2.2 Food & Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Cosmetics

9.3.1 Cosmetics Market Trends Analysis (2020-2032)

9.3.2 Cosmetics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Pharmaceuticals

9.4.1 Pharmaceuticals Market Trends Analysis (2020-2032)

9.4.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Consumer Electronics

9.5.1 Consumer Electronics Market Trends Analysis (2020-2032)

9.5.2 Consumer Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Other

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Packaging Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.2.4 North America Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.2.5 North America Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.2.6.2 USA Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.2.6.3 USA Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.2.7.2 Canada Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.2.7.3 Canada Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.2.8.2 Mexico Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Packaging Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.1.6.2 Poland Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.1.7.2 Romania Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Packaging Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.2.4 Western Europe Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.2.6.2 Germany Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.2.7.2 France Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.2.7.3 France Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.2.8.2 UK Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.2.9.2 Italy Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.2.10.2 Spain Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.2.13.2 Austria Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Packaging Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.4.4 Asia Pacific Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.4.6.2 China Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.4.6.3 China Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.4.7.2 India Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.4.7.3 India Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.4.8.2 Japan Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.4.8.3 Japan Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.4.9.2 South Korea Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.4.10.2 Vietnam Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.4.11.2 Singapore Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.4.12.2 Australia Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.4.12.3 Australia Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Packaging Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.5.1.4 Middle East Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.5.1.6.2 UAE Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Packaging Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.5.2.4 Africa Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.5.2.5 Africa Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Packaging Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.6.4 Latin America Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.6.5 Latin America Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.6.6.2 Brazil Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.6.7.2 Argentina Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.6.8.2 Colombia Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Packaging Coatings Market Estimates and Forecasts, By Resin (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Packaging Coatings Market Estimates and Forecasts, By Packaging Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Packaging Coatings Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

11. Company Profiles

11.1 Akzo Nobel NV

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product/ Services Offered

11.1.4 SWOT Analysis

11.2 BASF SE

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product/ Services Offered

11.2.4 SWOT Analysis

11.3 Arkema Group

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product/ Services Offered

11.3.4 SWOT Analysis

11.4 Berger Paints India Limited

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product/ Services Offered

11.4.4 SWOT Analysis

11.5 Clariant

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product/ Services Offered

11.5.4 SWOT Analysis

11.6 Chugoku Marine Paints Ltd

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product/ Services Offered

11.6.4 SWOT Analysis

11.7 DowDuPont

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product/ Services Offered

11.7.4 SWOT Analysis

11.8 Evonik Industries AG

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product/ Services Offered

11.8.4 SWOT Analysis

11.9 H.B. Fuller

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product/ Services Offered

11.9.4 SWOT Analysis

11.10 Sun Chemical

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Resin

Epoxies

Acrylics

Polyurethane

Polyolefins

Polyester

Other

By Packaging Type

Rigid Packaging

Flexible Packaging

Others

By End-Use Industry

Food & Beverages

Cosmetics

Pharmaceuticals

Consumer Electronics

Other

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Cold Flow Improver Market size was USD 812.49 Million in 2023 and is expected to reach USD 1348.74 Million by 2032, at a CAGR of 5.79 % from 2024-2032.

The Refinery Catalyst Market size was valued at USD 5.8 Billion in 2023. It is expected to reach to USD 8.5 Billion by 2032 and grow at a CAGR of 4.4% over the forecast period of 2024-2032.

The N-Methyltaurine Sodium Salt Market Size was valued at USD 0.65 Billion in 2023 and is expected to reach USD 1.08 Billion by 2032, growing at a CAGR of 5.80% over the forecast period of 2024-2032.

The Pelargonic Acid market size was valued at USD 189.55 million in 2023 and is expected to reach USD 345.14 million by 2032, growing at a CAGR of 6.89% over the forecast period of 2024-2032.

The Wax Emulsion Market was valued at USD 1.95 Billion in 2023 and is expected to reach USD 2.93 Billion by 2032, growing at a CAGR of 4.66% from 2024-2032.

The Glutaraldehyde Market size was valued at USD 701.3 million in 2023. It is estimated to hit USD 1039.1 million by 2032 and grow at a CAGR of 4.5% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone