Packaging Barrier Films Market Report Scope & Overview:

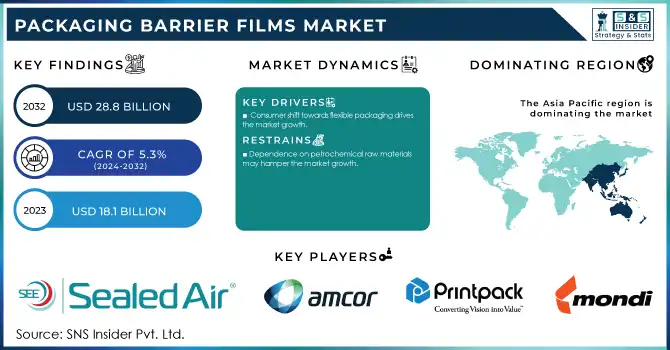

The Packaging Barrier Films Market size was USD 18.1 billion in 2023 and is expected to reach USD 28.8 billion by 2032 and grow at a CAGR of 5.3% over the forecast period of 2024-2032.

Get more information on Packaging Barrier Films Market - Request Sample Report

One of the major growth factors influencing the demand for packaging barrier films is the rising requirement for food preservation. An increasing trend of packaged and processed food worldwide has put a spotlight on consumers and manufacturers alike seeking solutions that allow for the freshness of the products while extending shelf life. Barrier films are used for food protection from moisture, oxygen, light, and other external factors quality, and safety. It is particularly important for urban areas where busy lifestyles lead to a demand for ready-to-eat and convenience foods. The global trend of minimizing food wastage is also fuelling the need for innovative packaging material. With governments and organizations pushing for food safety standards, the regulatory environment is set for high-performance barrier films in the packaging industry to dominate.

Food waste contributes significantly to global greenhouse gas emissions, with the United Nations Environment Programme (UNEP) reporting that in 2022, there were 1.05 billion tonnes of food waste generated, amounting to 132 kilograms per capita.

Technological advancements in film technology are expected to be important aspects driving the growth of the global packaging barrier films market. Emerging trends, including multilayer films, the integration of nanotechnology coatings, and the use of bio-based materials, enhance the performance, sustainability, and functional versatility of barrier films. An example of this is multilayer films, where different polymer layers are combined to provide improved moisture, oxygen, and UV barrier properties, increasing the shelf life of foods. Likewise, the incorporation of nanotechnology facilitates the formulation of very thin films having improved barrier properties, high mechanical strength, and cost-effective quality. In addition to this, the rise of sustainability has resulted in the use of more bio-based and biodegradable materials, in compliance with environmental policies all over the world and also, for consumers who focus on sustainability.

In 2023, Amcor introduced a new line of recyclable barrier films designed to meet the growing demand for sustainable packaging solutions. These films offer enhanced barrier properties while being compatible with existing recycling infrastructures.

Packaging Barrier Films Market Dynamics:

Drivers

-

Consumer shift towards flexible packaging drives the market growth.

One of the important drivers stimulating growth of the packaging barrier films market is the ascending consumer preference towards flexible packaging. Flexible packages comprise pouches, bags, wraps etc., and is widely used due to benefits over the conventional rigid packages that utilize less material, cost-effective, and easily sustainable and more effective during transport. Consumer demand for convenience and on-the-go products continues to grow, and flexible packaging has emerged as the packaging choice of many industries especially food, beverages and personal care. Flexible packaging effectively meets the key requirements of contemporary consumers, who increasingly demand products that are all about convenience, portability and functionality. These, materials are a key interface during this transition, acting as protective enclosures for products, keeping them fresh for as long as possible, and ensuring their preservation. Such films are protective from various environmental factors such as moisture, oxygen, and light which is important for protecting the quality of perishable goods. In addition, flexible packaging is also being planned for sustainability with the use of recyclable and bio-based barrier films by manufacturers owing to the rising awareness of environmental issues.

Restraint

-

Dependence on petrochemical raw materials may hamper the market growth.

The raw materials derived from petrochemicals is a major factor restraining packaging barrier films market growth. Barrier films are manufactured using fossil fuel-derived polymers (like PE, PP, and PET). There are some problems with this reliance on these petrochemical materials. To begin with, the crude oil price volatility, especially when it is increasingly responsible for the sticker prices to manufacture packaging, products can cause the barrier films costs to go up or plummet. In price-sensitive regions, this means that any increase in raw materials can lead to a rise in production costs, ultimately forcing manufacturers to pass this cost to the customers, thereby constraining the growth.

In addition, petroleum-based packaging is being criticized more and more due to its environmental impact. There is a global effort toward sustainability and a reduction in plastic waste, meaning stronger regulations on plastic packaging, particularly in Europe and North America.

Opportunities

Customers' changing food consumption choices are driving the preference for ready-to-eat food in the current circumstances. Furthermore, due to a busy lifestyle, students eager to spend more money on processed and packaged food, and an increase in the need for comfort products, the market is expected to grow rapidly. Ready-to-eat and ready-to-cook foods, ready-made packed foods, rapid food packages, and processed foods, which are very portable and can be carried anywhere and cooked in a short amount of time, are in high demand.

In recent years, there has been an increase in demand for food delivery at work or home, as well as sales of ready-to-eat and ready-to-keep on-the-shelf products. Even so, following interaction with the physical and chemical environment, as well as other atmospheric circumstances, processed food packaged items lose their quality and authenticity. As a result, high-barrier packaging films' high-quality packaging could lengthen the shelf life of these packed products, and high-barrier packaging films keep food products exceptionally fresh.

Packaging Barrier Films Market Segments

By Material

Polyethylene held the largest market share around 22% in 2023. It is because of its versatile properties, cost-effectiveness, and easy availability. PE (Polyethylene) - Polyethylene, mostly low-density polyethylene (LDPE) and high-density polyethylene (HDPE), is commonly the most significant polymer used for the production of barrier films, as it offers high moisture resistance, flexibility, and easy processing properties. It is often employed in food packaging applications that demand freshness preservation and/or shelf-life extension. Polyethylene films also find great application within beverage and personal care industries, as they are lightweight and offer an excellent barrier of protection against external factors.

In addition, polyethylene is a very flexible polymer, and the barrier properties can be improved with additional characteristics during the manufacturing processes (ex. through blending with other polymers or the addition of additives). made it the 1st ever reusable 3600 when combined with 3600 comes with recyclable material which is in sync with the ever-growing customer need for sustainable packing solutions.

By Product

Multi-layer films held the largest market share around 38% in 2023. This is due to their cost-effectiveness, efficiency, and ability to produce large volumes of high-precision components. The press and sinter process with packaging barrier films, where high packing pressures compact powder into molds, along with heating in a sintering furnace, allows for the bonding of the particles to produce parts in a solid form. This process is frequently used in the automotive, aerospace, and industrial equipment sectors to produce parts including gears, bearings, and filters. Press and sinter provide advantages over traditional machining methods, such as the ability to produce complex shapes while minimizing material losses, making it more cost-effective. Moreover, it can be used with various packaging barrier films that cover ferrous and non-ferrous materials, expanding its application even more.

By Application

Food and Beverage segment held the largest market share around 40% in 2023. It is owing to the need of packaging barrier films to keep the product freshness, quality, and shelf life. In the food and beverage industry, packaging barrier films, facilitates protection against outside contents, such as moisture, oxygen, light, and contaminants all factors that impede the integrity and safety of the product. The growing convenience-centric demand among consumers, coupled with the growing consumer inclination toward ready-to-eat food items, is progressively driving the demand for advanced barrier films in the food and beverage product packaging solutions. In the food industry, where it is vital to preserve the nutritional value, taste, and texture of perishables, barrier films become especially important.

Packaging Barrier Films Market Regional Outlook

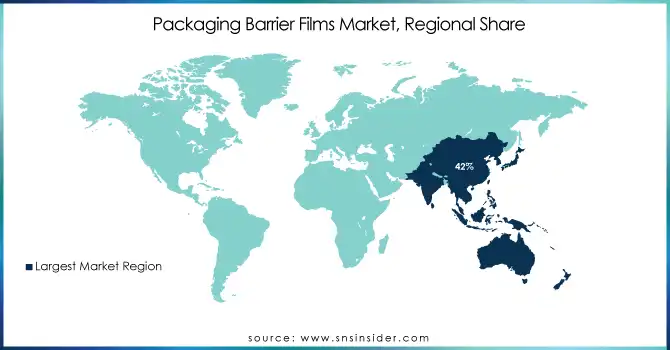

Asia Pacific held the largest market share around 42% in 2023. It is owing to rapid industrialization, population and demand of packaged food and beverages in the countries like India, China, and Japan. Asia-Pacific has some of the largest and fastest growing economies in the world such as China, India, Japan and more, where consumer spending is on the rise, urbanization is increasing, and demand for convenient food products is growing at a fast pace. Resulting in higher demand for packaging solutions that are designed to deliver extended shelf life, product safety, and convenience, provided that a role is played by the advanced barrier films. Moreover, it has also emerged as a region manufacturing center for packaging material with market land size players and barrier film suppliers based in China and India itself. Barrier films are thus more accessible and cheaper in such countries, where low production factor and mass scale manufacturing infrastructure making it beneficial. In addition, the expansion of the e-commerce sector in the Asia-Pacific region has led to an increase in the demand for protective packaging solutions which are provided by barrier films to ensure safety during transportation and also maintain longer life of the product in transit.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Sealed Air Corporation (Bubble Wrap, Cryovac)

-

Amcor Limited (Amcor Flexibles, Amcor Rigid Plastics)

-

Printpack Inc. (Food Packaging, Medical Packaging)

-

The Mondi Group (Mondi BarrierPack, EcoWipes)

-

Constantia Flexibles Group GmbH (FlexiFoil, Food Packaging Solutions)

-

Berry Plastics Corporation (Flexibles Packaging, Protective Packaging)

-

Wipak Walsrode GmbH & Co. KG (Wipak Fresh, Wipak Eco)

-

Linpac Packaging Limited (LINPAC Fresh, LINPAC Flexi)

-

Sonoco Products Company (Sonoco ThermoSafe, Sonoco Flexibles)

-

Bemis Company Inc. (Bemis Food Packaging, Bemis Flexible Packaging)

-

Huhtamaki Group (Huhtamaki Flexible Packaging, Huhtamaki Foodservice Packaging)

-

Uflex Limited (Uflex Barrier Films, Uflex Pouches)

-

Tredegar Corporation (Tredegar Barrier Films, Tredegar Packaging)

-

Sappi Lanaken Mill (Sappi Barrier Coating, Sappi Food Packaging)

-

Kraton Polymers (Kraton SBS, Kraton Polymers Barrier Films)

-

Schur Flexibles Group (Schur Flexibles Barrier Films, Schur Flexibles Food Packaging)

-

Mitsubishi Chemical Corporation (Mitsubishi Barrier Films, Mitsubishi Packaging Solutions)

-

Toppan Printing Co., Ltd. (Toppan Barrier Films, Toppan Packaging Solutions)

-

Christie Digital Systems (Christie Barrier Films, Christie Food Packaging)

-

Asahi Kasei Corporation (Asahi Barrier Films, Asahi Flexible Packaging Solutions

Recent Development:

-

In 2023, Sealed Air launched a new line of sustainable packaging solutions, focusing on advanced barrier films that are both recyclable and biodegradable. This innovation aligns with their commitment to reducing plastic waste in packaging.

-

In 2023, Amcor introduced its "AmLite" Ultra Recyclable barrier films, which are designed to reduce environmental impact while maintaining high-performance properties for food preservation. The product is fully recyclable and reduces the amount of plastic used in packaging.

-

In 2022, Printpack launched a new line of barrier films for medical packaging that offers superior protection against moisture and oxygen, ensuring the safety and quality of pharmaceutical products throughout their shelf life.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 18.1 Billion |

| Market Size by 2032 | USD 28.8 Billion |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Polyvinyl Chloride, Ethylene-vinyl Alcohol, Polyethylene, Polypropylene, Transparent high-barrier films, Others) • By Product (Wrapping film, Pouches & bags, Tray Lidding film, Others) • By Application (Personal care and Cosmetics, Food & Beverages, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sealed Air Corporation (U.S), Amcor Limited (Australia), Printpack Inc. (U.S), The Mondi Group (Austria), Constantia Flexibles Group GmbH (Austria), Berry Plastics Corporation (U.S), Wipak Walsrode GmbH & Co. KG (Germany), Linpac Packaging Limited (U.K), Sonoco Products Company (U.S), Bemis Company Inc. (U.S) and Huhtamaki Group (Finland) |

| Key Drivers | • Consumer shift towards flexible packaging drives the market growth. |

| Restraints | • Dependence on petrochemical raw materials may hamper the market growth. |