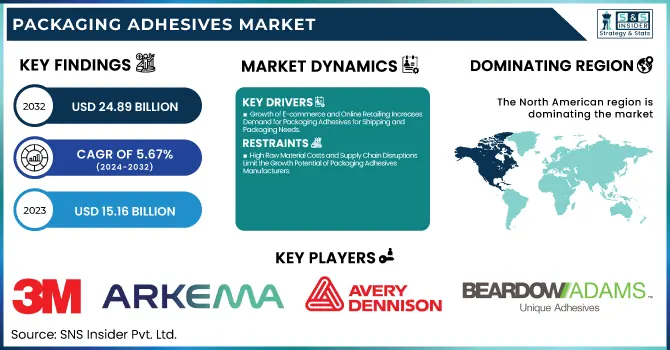

The Packaging Adhesives Market Size was valued at USD 15.16 Billion in 2023 and is expected to reach USD 24.89 Billion by 2032, growing at a CAGR of 5.67% over the forecast period of 2024-2032.

To Get more information on Packaging Adhesives Market - Request Free Sample Report

The Packaging Adhesives Market is evolving rapidly, shaped by innovation, sustainability, and shifting industry needs. Investment and funding trends reveal increased capital in research and development, driving eco-friendly adhesive solutions. Raw material analysis uncovers volatility in polymer and resin costs, affecting pricing and supply chains. A thorough cost structure and profitability analysis examines production expenses and market feasibility. Customer demographics and end-user preferences play a crucial role, with industries like food, pharmaceuticals, and e-commerce demanding specialized adhesives. Meanwhile, private label and small-scale manufacturers are gaining traction, offering competitive and customized solutions. Our report explores these key dynamics, offering deep insights into opportunities, challenges, and the future outlook of the packaging adhesives industry.

The US Packaging Adhesives Market Size was valued at USD 3.80 Billion in 2023 and is expected to reach USD 6.01 Billion by 2032, growing at a CAGR of 5.23% over the forecast period of 2024-2032. The U.S. Packaging Adhesives Market is experiencing steady growth, driven by advancements in sustainable packaging, increasing e-commerce activities, and stringent FDA regulations on food-safe adhesives. The Flexible Packaging Association (FPA) reports rising demand for flexible and lightweight packaging, boosting the need for high-performance adhesives. Additionally, companies like H.B. Fuller and Avery Dennison are investing in bio-based and recyclable adhesives to meet sustainability goals. Growth in the pharmaceutical and food industries, supported by the American Chemistry Council (ACC), further accelerates innovation in solvent-free and low-VOC adhesives. Our report explores these market dynamics, key players, and regulatory influences shaping the industry.

Drivers

Growth of E-commerce and Online Retailing Increases Demand for Packaging Adhesives for Shipping and Packaging Needs

The exponential growth of e-commerce and online retailing has created new opportunities for the Packaging Adhesives Market. As consumer preferences shift towards online shopping, there is an increasing need for protective packaging to ensure the safe delivery of goods. Packaging adhesives play a crucial role in this process, especially in packaging for shipping and product protection. With Amazon and other major e-commerce players expanding their operations in the U.S., packaging solutions that offer both durability and cost-effectiveness have become essential. E-commerce companies are increasingly turning to adhesives for sealing packages, ensuring that products remain intact during transit. The growing adoption of flexible and corrugated packaging, commonly used in the e-commerce sector, is contributing to the increased demand for high-performance adhesives that can withstand handling, stacking, and shipping conditions. The Packaging Adhesives Market is benefiting from innovations in adhesives that offer faster curing times, better adhesion strength, and reduced waste, making them ideal for e-commerce packaging. This growing sector presents a significant opportunity for manufacturers to innovate and meet the unique packaging needs of online retailers.

Restraints

High Raw Material Costs and Supply Chain Disruptions Limit the Growth Potential of Packaging Adhesives Manufacturers

High raw material costs and supply chain disruptions present significant challenges to the growth of the Packaging Adhesives Market. The prices of key raw materials like resins, polymers, and solvents have been volatile, largely due to global supply chain issues and the limited availability of raw materials. These disruptions, exacerbated by geopolitical tensions and the COVID-19 pandemic, have impacted manufacturers' ability to maintain consistent production schedules and control costs. For instance, companies relying on imported raw materials are facing delays, leading to increased production costs. These challenges hinder the market's growth potential, especially for small and medium-sized manufacturers who are less equipped to absorb these cost increases. As a result, adhesive manufacturers are seeking alternative solutions, such as sourcing local materials and investing in technology to streamline production processes. However, these adjustments require significant investment, which could delay the widespread adoption of innovative packaging adhesives in the market.

Opportunities

Rising Demand for Lightweight and Flexible Packaging Drives Innovation in Adhesives for Sustainable Solutions

The growing demand for lightweight and flexible packaging solutions offers substantial opportunities for the Packaging Adhesives Market. As consumer preference shifts toward convenience, brands are adopting packaging formats that are not only lightweight but also more adaptable to various product types. Flexible packaging, which is often made from multi-layered materials, is gaining popularity due to its ability to preserve product freshness and reduce transportation costs. This trend has led to an increased demand for packaging adhesives that provide strong bonding while maintaining flexibility. Companies like Sika and Wacker Chemie are investing in the development of adhesives that are both lightweight and sustainable, meeting the growing need for flexible packaging in industries such as food, pharmaceuticals, and personal care. The rise of eco-friendly flexible packaging solutions further emphasizes the need for innovative adhesive technologies that can meet sustainability goals while offering the necessary performance characteristics. This trend is expected to continue driving opportunities for adhesive manufacturers to expand their product offerings.

Challenge

Intense Competition from Small-Scale Manufacturers and Private Labels Hinders Pricing and Market Share for Large Companies

The Packaging Adhesives Market is facing heightened competition from small-scale manufacturers and private label producers, which is creating pricing pressures for large companies. Smaller manufacturers are often able to offer competitive pricing, especially in niche markets, by leveraging cost-effective production methods and offering specialized adhesive formulations. These small-scale producers are increasingly gaining market share by targeting local and regional customers who prefer more affordable, customized solutions. As a result, large companies in the packaging adhesives sector are finding it challenging to maintain their dominant market position, particularly in price-sensitive markets. To combat this challenge, major players such as 3M and H.B. Fuller are focusing on product differentiation, investing in research and development to create high-performance adhesives that can command premium pricing. However, the pressure from private labels and smaller manufacturers is expected to intensify, particularly as consumers continue to demand more cost-effective, eco-friendly packaging solutions.

By Resin

Polyvinyl Chloride (PVC) resins dominated the Packaging Adhesives Market in 2023, with a market share of 28.6%. PVC adhesives are known for their excellent bonding properties and high durability, making them ideal for packaging applications in industries such as food and beverage, pharmaceuticals, and consumer goods. PVC adhesives offer robust resistance to environmental factors, providing strong bonds even in challenging conditions. The increasing demand for rigid packaging, especially bottles and containers, has contributed to the surge in PVC's usage. Companies like 3M and H.B. Fuller are continuously innovating to produce PVC-based adhesives that ensure optimal performance while reducing environmental impact. The rise in consumer demand for longer shelf-life products and the growing trend of lightweight, cost-effective packaging solutions further solidify PVC’s leading position in the market. Additionally, regulatory frameworks advocating for recyclable and reusable packaging have supported PVC’s adoption in packaging adhesives. The expansion of the packaging industry across emerging economies has also fueled the market for PVC resins, making it a dominant force in 2023.

By Technology

Water-based adhesives dominated the Packaging Adhesives Market in 2023, with a market share of 41.2%. The significant growth of water-based adhesives can be attributed to their environmentally friendly attributes, as they do not contain harmful solvents or volatile organic compounds (VOCs), aligning with stricter environmental regulations. The shift towards water-based technology is driven by the increasing consumer preference for sustainable products and the pressure from regulatory agencies such as the Environmental Protection Agency (EPA) to reduce emissions from packaging materials. Water-based adhesives are highly effective in a variety of packaging applications, including food and beverage packaging, where health and safety standards are critical. Major companies like Henkel and BASF have developed advanced formulations of water-based adhesives that offer superior performance, such as fast-drying and strong bonding capabilities, without compromising environmental responsibility. The rising focus on sustainable packaging solutions and eco-friendly products is expected to propel water-based adhesives to greater market share in the coming years. Moreover, government initiatives encouraging the reduction of plastic waste and promoting the use of water-based adhesives play a significant role in this technology’s dominance.

By Application

Flexible packaging dominated the Packaging Adhesives Market in 2023, accounting for 27.8% of the market share. The flexibility, cost-effectiveness, and convenience offered by flexible packaging solutions have led to their widespread adoption, particularly in the food, beverage, and pharmaceutical industries. Flexible packaging materials are lightweight, customizable, and provide excellent barrier protection against moisture, oxygen, and contaminants, making them ideal for preserving the freshness and quality of products. Leading packaging companies like Amcor and Sealed Air have significantly expanded their portfolios in flexible packaging, pushing the demand for adhesives that enhance the performance and sustainability of these materials. The growing consumer preference for convenient and eco-friendly packaging solutions has further fueled the rise of flexible packaging. Moreover, flexible packaging plays a key role in reducing material waste, offering manufacturers an environmentally responsible option. The Flexible Packaging Association highlights the industry’s shift toward more sustainable materials and adhesives, which is in line with governmental policies and consumer demand for environmentally conscious products. This combination of convenience, performance, and sustainability has ensured that flexible packaging remains the dominant segment in 2023.

The North American region dominated the Packaging Adhesives Market in 2023, accounting for an estimated market share of 37.8%. This dominance can be attributed to the region's strong consumer demand for sustainable and high-performance packaging solutions, particularly within the food and beverage, healthcare, and consumer goods industries. The United States stands out as the largest contributor in this region, driven by the presence of key players like 3M, H.B. Fuller, and Dow Inc., which continue to innovate in developing environmentally friendly adhesives for diverse packaging needs. For instance, in the food sector, the demand for flexible packaging with high barrier properties has spurred the growth of packaging adhesives. Furthermore, the United States is home to stringent environmental regulations, such as the Environmental Protection Agency (EPA) standards, which have encouraged the adoption of water-based and solvent-free adhesives. Canada follows as a strong player, with rising investments in sustainable packaging technologies. Mexico also plays a significant role, due to its growing packaging industry and proximity to major manufacturers in the region. Together, these factors ensure North America's continued dominance in the Packaging Adhesives Market in 2023.

Moreover, the Asia Pacific region emerged as the fastest-growing region in the Packaging Adhesives Market during the forecast period, with a significant CAGR. This rapid growth can be attributed to the region's expanding industrial base, increasing population, and the rising demand for packaged goods, particularly in emerging economies like China, India, and Indonesia. In China, the largest packaging market in the region, demand for packaging adhesives is driven by sectors such as food and beverage, pharmaceuticals, and e-commerce. The government's focus on sustainability and the implementation of stricter environmental regulations have bolstered the adoption of eco-friendly adhesives. In India, rapid urbanization, increasing disposable income, and a growing middle class are propelling the packaging industry, further boosting the demand for adhesives. Japan, known for its advanced packaging solutions, continues to focus on innovative technologies and high-quality adhesives for a variety of industries. With these countries pushing towards sustainability and increased consumption of packaged goods, the Asia Pacific region is expected to continue leading the market's growth during the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

3M Company (3M Hot Melt Adhesive 3762, 3M Scotch-Weld Hot Melt Adhesive 3748, 3M Adhesive 100MP)

Arkema S.A. (Bostik) (Bostik 1000, Bostik Glue Dots, Bostik M1000)

Avery Dennison Corporation (Fasson S692N, Fasson S2000N, Fasson S2045)

Beardow Adams (BAMFutura 1, BAMFutura 3, BAMFutura 51)

DIC Corporation (DICDRY LQ-3600, DICSEAL SB-2000, DICDRY LQ-3300)

Dow Inc. (The Dow Chemical Company) (DOWSIL 732 Multi-Purpose Sealant, DOWSIL 256 Structural Adhesive, DOWSIL 2020 Adhesive)

Evonik Industries AG (TEGO® RC 100, TEGO® RC 110, VESTAMELT 1030)

Franklin International (Titebond III, Titebond II Premium, Titebond Original)

H.B. Fuller Company (Advantra 9280, SwiftTak 5730, Fuller 1280)

Henkel AG & Co. KGaA (Technomelt Supra 100, Technomelt Supra 300, Aquence PS 3017)

ITW Performance Polymers (Illinois Tool Works Inc.) (Plexus MA310, Plexus MA300, Devcon 5 Minute Epoxy)

Jowat SE (Jowatherm 245.00, Jowatherm 250.00, Jowacoll 103.10)

Paramelt RMC B.V. (Paraflex M, Paraflex A, Paraflex R)

Sika AG (Sikaflex-221, Sikaflex-265, SikaBond T-8)

Toyochem Co., Ltd. (Oribain EXK-3, Oribain EXK-5, Oribain EXK-7)

Wacker Chemie AG (VINNAPAS EP 7000, VINNAPAS EP 8000, VINNAPAS EP 8010)

Wisdom Adhesives Worldwide (Wisdom Hot Melt Adhesive, Wisdom Water-Based Adhesive, Wisdom Pressure-Sensitive Adhesive)

Hexion Inc. (EPIKURE Curing Agent 8530, EPIKURE Curing Agent 8540, EPIKURE Curing Agent 8535)

Mitsui Chemicals, Inc. (TAFMER XM-7070, TAFMER XM-7080, TAFMER XM-7090)

Sun Chemical (a member of DIC Group) (SunLam SFC100, SunLam SFC200, SunLam SFC300)

Recent Developments

December 2024: Arkema finalized its acquisition of Dow’s flexible packaging laminating adhesives business for $150 million. The acquisition includes sites in Italy, the U.S., and Mexico, expanding Arkema’s adhesive portfolio and strengthening its specialty materials business.

December 2024: Dow completed the $150 million sale of its flexible packaging laminating adhesives business to Arkema. The transaction includes five production sites and aligns with Dow’s focus on high-value markets and sustainability goals, with proceeds reinvested into growth initiatives.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.16 Billion |

| Market Size by 2032 | USD 24.89 Billion |

| CAGR | CAGR of 5.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Resin (Polyvinyl Alcohol (PVA), Acrylics, Polyvinyl chloride (PVC), Polyurethane, Others) •By Technology (Water Based, Solvent Based, Hot Melt, Others) •By Application (Case & Carton, Corrugated Packaging, Labeling, Flexible Packaging, Folding Cartons, Specialty Packaging, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, The Dow Chemical Company (Dow Inc.), Arkema S.A. (Bostik), Avery Dennison Corporation, Sika AG, Wacker Chemie AG, DIC Corporation, Ashland Inc. and other key players |

Ans: The Packaging Adhesives Market is expected to grow at a CAGR of 5.67% from 2024 to 2032.

Ans: The growth of e-commerce and online retailing is a key driver for the Packaging Adhesives Market.

Ans: Polyvinyl Chloride (PVC) resins dominate the Packaging Adhesives Market with a market share of 28.6% in 2023.

Ans: High raw material costs and supply chain disruptions are major challenges facing the market.

Ans: North America, with the United States as the largest contributor, dominates the Packaging Adhesives Market.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Investment and Funding Trends

5.2 Raw Material Analysis

5.3 Cost Structure and Profitability Analysis

5.4 Customer Demographics and End-User Preferences

5.5 Private Label and Small-Scale Manufacturers' Role

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Packaging Adhesives Market Segmentation, by Resin

7.1 Chapter Overview

7.2 Polyvinyl Alcohol (PVA)

7.2.1 Polyvinyl Alcohol (PVA) Market Trends Analysis (2020-2032)

7.2.2 Polyvinyl Alcohol (PVA) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Acrylics

7.3.1 Acrylics Market Trends Analysis (2020-2032)

7.3.2 Acrylics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Polyvinyl chloride (PVC)

7.4.1 Polyvinyl chloride (PVC) Market Trends Analysis (2020-2032)

7.4.2 Polyvinyl chloride (PVC) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Polyurethane

7.5.1 Polyurethane Market Trends Analysis (2020-2032)

7.5.2 Polyurethane Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Packaging Adhesives Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Water Based

8.2.1 Water Based Market Trends Analysis (2020-2032)

8.2.2 Water Based Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Solvent Based

8.3.1 Solvent Based Market Trends Analysis (2020-2032)

8.3.2 Solvent Based Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Hot Melt

8.4.1 Hot Melt Market Trends Analysis (2020-2032)

8.4.2 Hot Melt Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Packaging Adhesives Market Segmentation, by Application

9.1 Chapter Overview

9.2 Case & Carton

9.2.1 Case & Carton Market Trends Analysis (2020-2032)

9.2.2 Case & Carton Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Corrugated Packaging

9.3.1 Corrugated Packaging Market Trends Analysis (2020-2032)

9.3.2 Corrugated Packaging Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Labeling

9.4.1 Labeling Market Trends Analysis (2020-2032)

9.4.2 Labeling Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Flexible Packaging

9.5.1 Flexible Packaging Market Trends Analysis (2020-2032)

9.5.2 Flexible Packaging Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Folding Cartons

9.6.1 Folding Cartons Market Trends Analysis (2020-2032)

9.6.2 Folding Cartons Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Specialty Packaging

9.7.1 Specialty Packaging Market Trends Analysis (2020-2032)

9.7.2 Specialty Packaging Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Others

9.8.1 Others Market Trends Analysis (2020-2032)

9.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Packaging Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.2.4 North America Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.5 North America Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.2.6.2 USA Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.6.3 USA Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.2.7.2 Canada Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.7.3 Canada Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.2.8.2 Mexico Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.8.3 Mexico Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Packaging Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.1.6.2 Poland Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.6.3 Poland Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.1.7.2 Romania Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.7.3 Romania Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Packaging Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.2.4 Western Europe Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.5 Western Europe Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.2.6.2 Germany Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.6.3 Germany Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.2.7.2 France Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.7.3 France Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.2.8.2 UK Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.8.3 UK Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.2.9.2 Italy Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.9.3 Italy Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.2.10.2 Spain Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.10.3 Spain Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.2.13.2 Austria Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.13.3 Austria Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Packaging Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.4.4 Asia Pacific Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.5 Asia Pacific Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.4.6.2 China Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.6.3 China Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.4.7.2 India Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.7.3 India Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.4.8.2 Japan Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.8.3 Japan Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.4.9.2 South Korea Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.9.3 South Korea Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.4.10.2 Vietnam Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.10.3 Vietnam Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.4.11.2 Singapore Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.11.3 Singapore Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.4.12.2 Australia Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.12.3 Australia Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Packaging Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.5.1.4 Middle East Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.5 Middle East Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.5.1.6.2 UAE Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.6.3 UAE Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Packaging Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.5.2.4 Africa Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.5 Africa Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Packaging Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.6.4 Latin America Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.5 Latin America Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.6.6.2 Brazil Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.6.3 Brazil Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.6.7.2 Argentina Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.7.3 Argentina Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.6.8.2 Colombia Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.8.3 Colombia Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Packaging Adhesives Market Estimates and Forecasts, by Resin (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Packaging Adhesives Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Packaging Adhesives Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Henkel AG & Co. KGaA

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 3M Company

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 H.B. Fuller Company

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 The Dow Chemical Company (Dow Inc.)

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Arkema S.A. (Bostik)

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Avery Dennison Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Sika AG

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Wacker Chemie AG

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 DIC Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Ashland Inc.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Resin

Polyvinyl Alcohol (PVA)

Acrylics

Polyvinyl chloride (PVC)

Polyurethane

Others

By Technology

Water Based

Solvent Based

Hot Melt

Others

By Application

Case & Carton

Corrugated Packaging

Labeling

Flexible Packaging

Folding Cartons

Specialty Packaging

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

Hydrogen Gas Market size was valued at USD 227.7 billion in 2023 and is expected to reach USD 320.4 billion by 2032, growing at a CAGR of 3.9% from 2024-2032.

Laminating Adhesives Market Size was valued at USD 3.54 Billion in 2023 and is expected to reach USD 5.80 Billion by 2032 and grow at a CAGR of 5.64% over the forecast period 2024-2032.

The Multi-Layer Cryogenic Insulation Market size was valued at USD 1114.6 Million in 2023 and is expected to reach USD 1981.22 Million by 2032, growing at a CAGR of 6.60% over the forecast period 2024-2032.

Biodegradable Plastic Additives Market was valued at USD 1.65 Bn in 2023 and is expected to reach USD 3.79 Bn by 2032, at a CAGR of 9.74% from 2024 to 2032.

The Fermentation Chemicals Market Size was valued at USD 74.50 billion in 2023 and is expected to reach USD 132.04 billion by 2032 and grow at a CAGR of 7.54% over the forecast period 2024-2032.

The 2-Ethyl-3,4-ethylenedioxythiophene Market size was USD 20.55 million in 2023 and is expected to reach USD 29.25 million by 2032 and grow at a CAGR of 4.00% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone