Get more information on P2P Payment Market - Request Sample Report

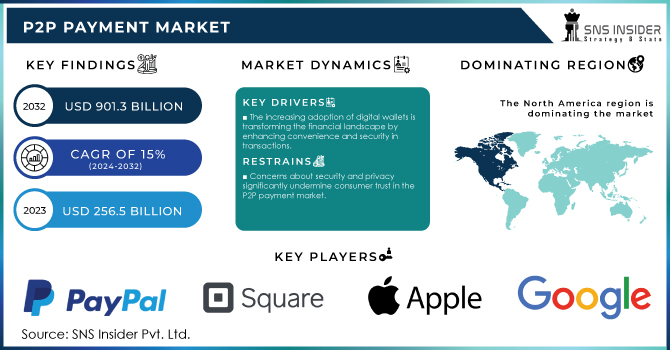

The P2P Payment Market Size was USD 256.5 Billion in 2023 and is expected to reach USD 901.3 billion by 2032 and grow at a CAGR of 15% over the forecast period of 2024-2032.

The P2P payment market is experiencing significant expansion, driven by factors such as the widespread adoption of smartphones, increased internet penetration, and a growing preference for cashless transactions among consumers. Technological advancements, including block chain and artificial intelligence, are shaping the P2P payment landscape by enhancing security, streamlining transactions, and improving user experiences. As a result, consumers are increasingly inclined to use P2P payment apps for personal transactions, paying bills, and making purchases from small retailers. Moreover, the integration of new features, such as the recently launched "Tap to Cash" by Apple, demonstrates the industry's focus on innovation to retain and attract users. However, the P2P payment market also faces challenges, including security concerns and a lack of transparency in reimbursement policies, particularly concerning scams. Regulatory bodies are stepping up to address these issues, aiming to create a safer environment for users. Overall, the future of the P2P payment market looks promising, with continued growth driven by evolving consumer preferences and technological advancements. As competition intensifies, P2P payment providers must focus on enhancing their offerings and addressing user concerns to remain relevant in this rapidly changing landscape.

Consumer digital payments have become mainstream, with P2P payment systems gaining substantial traction. The U.S. mobile P2P payments market has shown impressive growth, with transaction values reaching USD 1,261.53 billion in 2023 and projected to increase to approximately USD 1,375.93 billion in 2024. This shift towards P2P payments has prompted many consumers to seek safer and more efficient ways to conduct financial transactions. Younger consumers are more inclined to adopt digital payment methods, preferring the instant transaction capabilities offered by platforms like Venmo, Cash App, and Zelle. Furthermore, the seamless integration of P2P payment services into social media and e-commerce platforms has enhanced accessibility and appeal among users. However, challenges remain, including concerns over security, transaction fees, and regulatory scrutiny. Despite these challenges, the potential for technological innovations, such as block chain and decentralized finance, provides exciting opportunities for the market. Overall, as consumer preferences continue to evolve, the P2P payment market is positioned for sustained growth, solidifying its importance in the broader financial services landscape.

Drivers

The increasing adoption of digital wallets is transforming the financial landscape by enhancing convenience and security in transactions.

Digital wallets provide users with a convenient way to store multiple payment methods in one platform, facilitating seamless P2P transactions. The ease of use and enhanced security features have made these wallets increasingly popular among consumers. For instance, 54% of UK consumers have already embraced digital wallets, with a notable 43% expressing a preference for these platforms over traditional payment methods. This shift towards digital wallets is further propelled by the rapid growth of smartphone penetration and advancements in mobile technology. Approximately 70% of mobile users in the United States now utilize digital payment solutions, demonstrating a strong correlation between smartphone usage and the rise of digital wallets. As businesses adapt to this consumer trend, many have reported a 65% increase in sales after implementing digital wallet solutions, showcasing the positive impact on business revenues. Moreover, the integration of advanced technologies like biometric authentication and AI-driven fraud detection enhances consumer confidence in using digital wallets, resulting in greater market penetration. A survey indicated that 59% of businesses are either exploring or actively implementing digital wallet solutions as part of their payment strategies, emphasizing the growing recognition of digital wallets as a critical component in modern financial transactions. As digital wallets continue to gain traction, the P2P payment market is poised for significant growth. The increasing reliance on these platforms not only streamlines transactions for users but also contributes to the broader shift towards cashless economies, aligning with global trends in digital transformation and financial inclusion. This momentum positions the P2P payment market for robust expansion, driven by the ongoing popularity of digital wallets as a primary method for personal and business transactions.

Restraints

Concerns about security and privacy significantly undermine consumer trust in the P2P payment market.

Consumer trust issues significantly hinder the growth of the Peer-to-Peer (P2P) payment market, as many users remain skeptical about the security of digital wallets and payment apps. While P2P payment apps offer ease and convenience, they also pose potential financial and privacy risks, leading to heightened concerns among users. A recent report found that approximately 55% of consumers are worried about the security of their financial information when using digital wallets. Additionally, nearly 40% of users believe that P2P payment services are not as safe as traditional credit cards. The lack of transparency regarding potential scams further exacerbates these concerns, as many users have reported experiencing scams while using these services. As these platforms continue to evolve, addressing trust issues is critical for market growth. Providers must enhance security measures, improve transparency regarding risks, and educate consumers on safe usage practices to foster confidence in digital payment solutions. Building consumer trust is essential for increasing adoption rates and solidifying the future of P2P payment services.

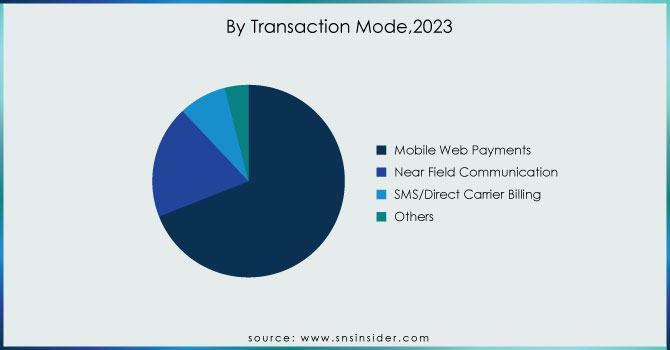

By Transaction Mode

In 2023, mobile web payments secured the largest revenue share in the transaction mode segment, accounting for approximately 69%. This significant market share reflects the increasing preference for mobile web payment solutions among both consumers and businesses. Several key factors contribute to this trend. First, the widespread use of smartphones has enabled consumers to easily conduct online transactions, enhancing access to mobile payment options. Additionally, mobile web payments offer unmatched convenience, allowing users to make transactions anytime and anywhere, which resonates with the fast-paced lifestyles of today’s consumers. User-friendly interfaces are also crucial; advancements in mobile web technology have resulted in intuitive designs that improve the overall user experience, making features like one-click payments and straightforward navigation more appealing. Furthermore, the integration of mobile web payment solutions with major e-commerce platforms has accelerated their adoption, as businesses increasingly optimize their websites for mobile transactions. Enhanced security features, including biometric authentication and encryption, have addressed previous security concerns, boosting consumer confidence and leading to increased usage of mobile web payments. Merchants also incentivize consumers by offering exclusive promotions and discounts for mobile transactions, further encouraging this payment method. As mobile web payments continue to dominate the transaction mode segment, businesses are likely to invest more in optimizing their payment systems. The combination of convenience, accessibility, and security will propel further growth in this segment, establishing it as a vital part of the overall P2P payment market.

By End User

In 2023, the personal end-user segment dominated the Peer-to-Peer (P2P) payment market, capturing around 75% of the revenue share. This significant market presence is driven by the growing adoption of P2P payment solutions among individual consumers, owing to several appealing factors. The ease of use of P2P payment apps, offering quick and simple transactions with features like instant money transfers and user-friendly interfaces, makes them highly attractive for daily use. The rise of digital communication and social media has also transformed how people share expenses, split bills, and transfer money, particularly among younger users. The shift toward a cashless society further fuels this trend, with mobile wallets and payment apps offering a convenient way to manage personal finances without physical cash. Integration with social media platforms has simplified transactions, encouraging more users to adopt these services. Enhanced security measures such as encryption, fraud detection, and identity verification have also boosted consumer confidence in P2P payment platforms. Additionally, promotional offers, discounts, and referral bonuses attract personal users, driving growth in this segment. As the P2P payment market expands, the personal end-user segment is expected to remain a dominant force due to its convenience, social integration, and security.

In 2023, North America captured approximately 40% of the global Peer-to-Peer (P2P) payment market, making it the largest regional player. This dominance is driven by several key factors. North America, particularly the United States and Canada, boasts advanced digital infrastructure, including widespread internet access, robust mobile networks, and high smartphone penetration, enabling seamless P2P payment transactions. The region has also seen a surge in mobile wallet usage, with consumers increasingly relying on apps like PayPal, Venmo, Zelle, and Cash App for daily financial transactions. The well-established financial ecosystem in North America, backed by strong banks and fintech companies, has integrated P2P payment solutions, providing users with fast and secure fund transfers. Additionally, a clear shift in consumer behavior toward digital and cashless payments, driven by the convenience and security of P2P platforms, has accelerated market growth. The demand for contactless payment solutions, especially post-pandemic, further strengthens this trend. North America benefits from a robust regulatory framework, ensuring consumer protection and instilling trust in digital payment systems. As a result, the region’s leadership in the P2P payment market is expected to continue, driven by growing adoption of cashless transactions and advanced digital solutions.

In 2023, Asia-Pacific became the fastest-growing region in the Peer-to-Peer (P2P) payment market, driven by rapid digital transformation, increased smartphone penetration, and the expansion of mobile payment platforms. Several factors have fueled this growth, making the region a hub for P2P payment innovation. The region's digital infrastructure has significantly improved, particularly in countries like China, India, and Southeast Asia. Better internet connectivity and mobile networks have enabled more consumers to access digital financial services, boosting the demand for P2P payments. Asia-Pacific also has one of the highest rates of smartphone adoption globally, providing a vast user base for mobile payments. As more consumers use smartphones for online transactions, P2P payments have become an increasingly popular and convenient way to transfer funds. Leading companies in the region are driving growth through product development. For example, Ant Group’s Alipay and Tencent’s WeChat Pay continue to dominate the Chinese market, while India’s Paytm has expanded its offerings to include P2P payments. In 2023, Grab in Southeast Asia enhanced its financial services by integrating P2P payment features. Additionally, government support and fintech development across the region have encouraged the adoption of digital payments, leading to rapid market expansion.

Need any customization research on P2P Payment Market - Enquiry Now

Some of the Major key Players in P2P Payment market who provide product:

PayPal Holdings Inc (PayPal, Venmo)

Square, Inc. (Cash App)

Zelle (Zelle)

Google (Google Pay)

Samsung (Samsung Pay)

Alipay (Ant Group)

WePay Inc (Tencent)

TransferWise (Wise)

Revolut (Revolut)

Venmo (PayPal)

Facebook (Facebook Pay)

Cash App (Square, Inc.)

Doku (Doku)

Skrill (Skrill)

Remitly (Remitly)

Payoneer (Payoneer)

CashSend (CashSend)

Dwolla (Dwolla)

WorldRemit (WorldRemit)

FIS

PayU

Adyen

Stripe

Worldpay

Payoneer

Braintree

Authorize.Net

BlueSnap

Alipay

WePay

Dwolla

Zalando Payments

Paya

NMI

Skrill

Rapyd

Klarna

TrueLayer

Plaid

On October 2, 2024, Consumer Reports highlighted a lack of transparency among popular P2P payment services like Zelle, Cash App, Apple Cash, and Venmo regarding reimbursement policies for scam victims. The advocacy group reviewed user agreements from 2022 and again this year, urging these companies to provide clearer information on their refund processes.

In the May 2024 report "Real-Time Payments Tracker® Series Report: P2P Payment Potential," it was noted that while P2P payments have surged in popularity for personal transactions and small purchases, there is an urgent need for financial institutions to enhance security measures to protect users from scams and fraud.

On June 17, 2024, Apple announced the launch of "Tap to Cash," a new P2P feature that enables iPhone users to transfer money by simply holding their phones together. This innovative feature aims to streamline the process of peer-to-peer payments among users.

In the May 28, 2024 report "US Mobile P2P Payments Forecast 2024," Tyler Van Dyke highlights that while P2P transaction value growth will significantly outpace user growth, Zelle remains the dominant player in the market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 256.5 Billion |

| Market Size by 2032 | USD 901.3 Billion |

| CAGR | CAGR of 15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Transaction Mode (Mobile Web Payments, Near Field Communication, SMS/Direct Carrier Billing and Others) • By Payment Type (Remote and Proximity) • By End User (Personal and Business) • By Application (Media & Entertainment, Energy & Utilities, Healthcare, Retail and Hospitality & Transportation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PayPal, Square, Zelle, Google, Apple, Samsung, Ant Group, Tencent, Wise, Revolut, Facebook, Doku, Skrill, Remitly, Payoneer, CashSend, Dwolla, and WorldRemit. |

| Key Drivers | • The increasing adoption of digital wallets is transforming the financial landscape by enhancing convenience and security in transactions. |

| RESTRAINTS | • Concerns about security and privacy significantly undermine consumer trust in the P2P payment market. |

Ans: The growth rate of the P2P Payment Market is 15% over the forecast period 2024-2032.

Ans: The market size of the P2P Payment Market is expected to reach USD 901.39 billion by 2032.

Ans: The Covid-19 pandemic impacted the P2P Payment Market significantly. The detailed analysis is included in the final report.

Ans: The key players of the P2P Payment Market are Alibaba.com, Apple Inc., Circle International Financial Limited, Google LLC, One97 Communications Limited (Paytm), PayPal Holdings Inc., Square, Inc., WePay Inc., Wise Payments Limited, and Zelle.

Ans: Asia-Pacific region dominated the P2P Payment Market.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Transaction Volumes and User Growth, 2020-2032, by Region

5.2 Regulatory Compliance and Data Security Standards, by Region

5.3 Technological Innovation and Platform Adoption, by Region

5.4 Consumer Behavior and Payment Preferences, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. P2P Payment Market Segmentation, by Transaction Mode

7.1 Chapter Overview

7.2 Mobile Web Payments

7.2.1 Mobile Web Payments Market Trends Analysis (2020-2032)

7.2.2 Mobile Web Payments Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Near Field Communication

7.3.1 Near Field Communication Market Trends Analysis (2020-2032)

7.3.2 Near Field Communication Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 SMS/Direct Carrier Billing

7.4.1 SMS/Direct Carrier Billing Market Trends Analysis (2020-2032)

7.4.2 SMS/Direct Carrier Billing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. P2P Payment Market Segmentation, by Payment Type

8.1 Chapter Overview

8.2 Remote

8.2.1 Remote Market Trends Analysis (2020-2032)

8.2.2 Remote Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Proximity

8.3.1 Proximity Market Trends Analysis (2020-2032)

8.3.2 Proximity Market Size Estimates and Forecasts to 2032 (USD Billion)

9. P2P Payment Market Segmentation, by End User

9.1 Chapter Overview

9.2 Personal

9.2.1 Personal Market Trends Analysis (2020-2032)

9.2.2 Personal Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.3 18 to 30 Year

9.2.3.1 18 to 30 Year Market Trends Analysis (2020-2032)

9.2.3.2 18 to 30 Year Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.4 31 to 54 Year

9.2.4.1 31 to 54 Year Market Trends Analysis (2020-2032)

9.2.4.2 31 to 54 Year Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.5 55 to 73 Year

9.2.5.1 55 to 73 Year Market Trends Analysis (2020-2032)

9.2.5.2 55 to 73 Year Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Business

9.3.1 Business Market Trends Analysis (2020-2032)

9.3.2 Business Market Size Estimates and Forecasts to 2032 (USD Billion)

10. P2P Payment Market Segmentation, by Application

10.1 Chapter Overview

10.2 Media & Entertainment

10.2.1 Media & Entertainment Market Trends Analysis (2020-2032)

10.2.2 Media & Entertainment Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Energy & Utilities

10.3.1 Energy & Utilities Market Trends Analysis (2020-2032)

10.3.2 Energy & Utilities Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Healthcare

10.4.1 Healthcare Market Trends Analysis (2020-2032)

10.4.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Retail

10.5.1 Retail Market Trends Analysis (2020-2032)

10.5.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Hospitality & Transportation

10.6.1 Hospitality & Transportation Market Trends Analysis (2020-2032)

10.6.2 Hospitality & Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America P2P Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.2.4 North America P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.2.5 North America P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.2.6 North America P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.2.7.2 USA P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.2.7.3 USA P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.2.7.4 USA P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.2.8.2 Canada P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.2.8.3 Canada P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.2.8.4 Canada P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.2.9.2 Mexico P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.2.9.3 Mexico P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.2.9.4 Mexico P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe P2P Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.1.7.2 Poland P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.1.7.3 Poland P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.7.4 Poland P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.1.8.2 Romania P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.1.8.3 Romania P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.8.4 Romania P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.1.9.2 Hungary P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.1.9.3 Hungary P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.9.4 Hungary P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.1.10.2 Turkey P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.1.10.3 Turkey P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.10.4 Turkey P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe P2P Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.2.4 Western Europe P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.2.5 Western Europe P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.6 Western Europe P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.2.7.2 Germany P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.2.7.3 Germany P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.7.4 Germany P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.2.8.2 France P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.2.8.3 France P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.8.4 France P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.2.9.2 UK P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.2.9.3 UK P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.9.4 UK P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.2.10.2 Italy P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.2.10.3 Italy P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.10.4 Italy P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.2.11.2 Spain P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.2.11.3 Spain P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.11.4 Spain P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.2.14.2 Austria P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.2.14.3 Austria P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.14.4 Austria P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4 Asia-Pacific

11.4.1 Trends Analysis

11.4.2 Asia-Pacific P2P Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia-Pacific P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.4.4 Asia-Pacific P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.4.5 Asia-Pacific P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.6 Asia-Pacific P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.4.7.2 China P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.4.7.3 China P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.7.4 China P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.4.8.2 India P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.4.8.3 India P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.8.4 India P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.4.9.2 Japan P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.4.9.3 Japan P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.9.4 Japan P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.4.10.2 South Korea P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.4.10.3 South Korea P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.10.4 South Korea P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.4.11.2 Vietnam P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.4.11.3 Vietnam P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.11.4 Vietnam P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.4.12.2 Singapore P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.4.12.3 Singapore P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.12.4 Singapore P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.4.13.2 Australia P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.4.13.3 Australia P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.13.4 Australia P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia-Pacific P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia-Pacific P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia-Pacific P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East P2P Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.5.1.4 Middle East P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.5.1.5 Middle East P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.6 Middle East P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.5.1.7.2 UAE P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.5.1.7.3 UAE P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.7.4 UAE P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.5.1.8.2 Egypt P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.5.1.8.3 Egypt P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.8.4 Egypt P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.5.1.10.2 Qatar P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.5.1.10.3 Qatar P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.10.4 Qatar P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa P2P Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.5.2.4 Africa P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.5.2.5 Africa P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.2.6 Africa P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.5.2.7.2 South Africa P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.5.2.7.3 South Africa P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.2.7.4 South Africa P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America P2P Payment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.6.4 Latin America P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.6.5 Latin America P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.6 Latin America P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.6.7.2 Brazil P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.6.7.3 Brazil P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.7.4 Brazil P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.6.8.2 Argentina P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.6.8.3 Argentina P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.8.4 Argentina P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.6.9.2 Colombia P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.6.9.3 Colombia P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.9.4 Colombia P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America P2P Payment Market Estimates and Forecasts, by Transaction Mode (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America P2P Payment Market Estimates and Forecasts, by Payment Type (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America P2P Payment Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America P2P Payment Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

12. Company Profiles

12.1 PayPal

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Square

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Zelle

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Google

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Apple

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Samsung

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Ant Group

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Tencent

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Wise

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Revolut

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Transaction Mode:

Mobile Web Payments

Near Field Communication

Others

By Payment Type:

Remote

Proximity

By End User:

Personal

18 to 30 Year

31 to 54 Year

55 to 73 Year

Business

By Application:

Media & Entertainment

Energy & Utilities

Healthcare

Retail

Hospitality & Transportation

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Intelligent Document Processing Market size was valued at USD 1.81 billion in 2023 and is expected to grow to USD 19.47 billion by 2032 and grow at a CAGR of 30.21% over the forecast period of 2024-2032.

IT & Telecom Cyber Security Market was valued at USD 30.87 billion in 2023 and is expected to reach USD 102.53 billion by 2032, growing at a CAGR of 14.33% from 2024-2032.

Deep Learning Market was valued at USD 72.31 billion in 2023 and is expected to reach USD 858.69 billion by 2032, growing at a CAGR of 31.69% by 2032.

Language Translation Device Market was valued at USD 1.22 billion in 2023 and is expected to reach USD 3.46 billion by 2032, growing at a CAGR of 12.37% from 2024-2032.

The Cybersecurity Market was valued at USD 195.1 billion in 2023 and is expected to reach USD 542.3 Billion by 2032, growing at a CAGR of 12.05% by 2032.

The Public Key Infrastructure (PKI) Market size was valued at USD 2.75 Billion in 2023 and is expected to reach USD 3.77 Billion by 2032, growing at a CAGR of 3.62% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone