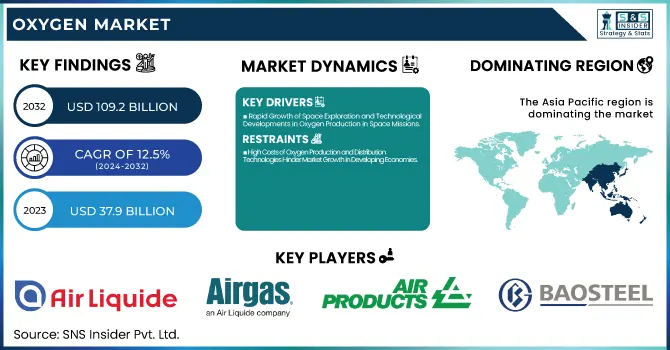

The Oxygen Market size was valued at USD 37.9 billion in 2023 and is expected to reach USD 109.2 billion by 2032, growing at a CAGR of 12.5% over the forecast period 2024-2032.

To Get more information on Oxygen Market - Request Free Sample Report

The Oxygen Market is influenced by several dynamic factors, including the increasing demand for medical oxygen, advancements in oxygen generation technologies, and environmental concerns. The need for oxygen in healthcare settings has surged, particularly with the rise in respiratory diseases and medical conditions requiring supplemental oxygen. Additionally, the growing focus on reducing carbon emissions and improving air quality has accelerated investments in innovative oxygen generation systems. Companies are continuously advancing their technologies to meet these needs, with a growing emphasis on efficiency and sustainability. For example, in January 2025, a new oxygen park was launched in South Bopal, Ahmedabad, by the municipal authorities, aimed at improving air quality and promoting well-being in the region. This development reflects the increasing focus on addressing environmental concerns through innovations in oxygen supply and air purification systems. As urban areas become more densely populated, the demand for clean air solutions is expected to further drive market growth, with oxygen parks like this one playing a key role in enhancing urban air quality and supporting public health.

Recent technological advancements are also shaping the future of the oxygen market. In January 2025, a profound discovery related to deep-sea oxygen was made by researchers, shedding light on how deep-sea ecosystems manage oxygen, which could have significant implications for environmental science. This discovery could lead to new applications in sustainable oxygen management and atmospheric studies. On a different front, in September 2023, NASA's Oxygen Generating Experiment (MOXIE) completed its mission on Mars, showcasing the potential of oxygen generation in space. MOXIE's success marks a major leap in space exploration technology, as it demonstrated the feasibility of producing oxygen from the Martian atmosphere. This milestone could influence future space missions, providing valuable insights for oxygen generation technologies on Earth as well. In January 2025, China made significant strides in space exploration by generating oxygen from rocket fuel aboard its Tiangong space station, a development by the China National Space Administration (CNSA). This leap could revolutionize space missions and have implications for the oxygen market, as it paves the way for the use of oxygen generation technologies in extreme environments. These breakthroughs in space and environmental research, led by organizations like NASA and CNSA, are likely to have cascading effects on the oxygen market, driving innovations that could eventually be applied on Earth to enhance oxygen production and sustainability efforts across various sectors. These advancements illustrate the growing intersection of technology, sustainability, and market demand in shaping the future of oxygen solutions globally.

Drivers

Growing Demand for Medical Oxygen Boosts Market Expansion in Healthcare and Respiratory Care Sectors

Rising Awareness of Air Pollution and Government Initiatives to Improve Urban Air Quality Stimulate Market Demand

Rapid Growth of Space Exploration and Technological Developments in Oxygen Production in Space Missions

The rapidly growing space exploration sector is driving the demand for innovative oxygen production technologies. As countries like the United States, China, and Russia invest in advanced space missions, including manned spaceflights and lunar missions, the demand for oxygen generation technologies in space has surged. In September 2023, NASA's successful MOXIE mission demonstrated the potential for generating oxygen on Mars from its carbon dioxide-rich atmosphere, a breakthrough that could pave the way for future human colonization of other planets. This not only has implications for oxygen production in space but also drives technological advancements that could be adapted for use on Earth. Moreover, oxygen production systems designed for extreme environments like space could be applied to remote and industrial areas, further expanding the market opportunities in oxygen generation technologies.

Restraints

High Costs of Oxygen Production and Distribution Technologies Hinder Market Growth in Developing Economies

The oxygen market faces a significant restraint due to the high costs associated with oxygen production and distribution technologies, which can be a barrier to adoption in developing economies. Advanced systems like cryogenic oxygen plants, oxygen concentrators, and transportation infrastructure require substantial investments in both initial capital and ongoing maintenance. These costs can limit access to oxygen in regions with lower economic capabilities, especially in rural or underserved areas. Additionally, the complex logistics involved in transporting oxygen in bulk or as compressed cylinders, especially to remote locations, contribute to high operational costs. While larger markets and advanced economies can absorb these expenses, developing countries may struggle to afford these technologies, limiting their ability to meet the growing demand for oxygen in the healthcare and industrial sectors. Reducing these costs through technological innovation and more efficient production processes is crucial to ensuring wider access and stimulating further market growth.

Opportunities

Increasing Demand for Oxygen in the Growing Healthcare Sector Offers Expansive Market Potential

The growing demand for healthcare services, particularly in the aging population, presents significant opportunities for the oxygen market. As populations in developed nations age, the incidence of respiratory conditions such as COPD, asthma, and sleep apnea is rising, necessitating greater access to medical oxygen. Additionally, emerging healthcare markets, particularly in Asia and Africa, are experiencing rapid growth in demand for medical oxygen, spurred by increasing healthcare access and infrastructure improvements. Opportunities are particularly abundant in the homecare segment, where oxygen concentrators and portable oxygen therapy equipment are becoming more popular. Companies providing homecare oxygen solutions are well-positioned to tap into this expanding market by offering products tailored to the specific needs of aging individuals and those with chronic respiratory conditions. With healthcare infrastructure improving globally, the demand for medical oxygen is expected to continue its upward trajectory.

Innovations in Sustainable Oxygen Solutions and Green Technologies Create New Market Opportunities

Expansion of Oxygen Generation Technologies into New Emerging Markets Presents Growth Opportunities

Challenge

Difficulty in Ensuring Consistent Oxygen Supply in Remote and Underdeveloped Areas Limits Market Access

One of the major challenges the oxygen market faces is ensuring a consistent and reliable supply of oxygen in remote, rural, and underdeveloped areas. Despite technological advancements in oxygen production, transportation infrastructure, and storage solutions, providing a continuous and efficient oxygen supply to regions with limited access to medical facilities remains difficult. The logistics involved in transporting oxygen cylinders or liquid oxygen to remote locations are complex and costly. In addition, some areas lack the necessary infrastructure to support the safe storage and use of oxygen. For example, rural hospitals and healthcare centers in developing nations may not have access to large-scale oxygen production systems or the necessary equipment for storage and distribution. This challenge impacts the overall growth of the market, particularly in regions that are heavily dependent on external oxygen supply chains, creating a need for improved distribution networks and cost-effective solutions to address these challenges.

| Customer/End-User Segment | Insight/Preference | Impact on Oxygen Market |

|---|---|---|

| Healthcare Providers (Hospitals) | Increasing demand for high-purity medical oxygen for intensive care and emergency use. | Leads to higher demand for reliable and consistent oxygen supply and storage systems. |

| Homecare Oxygen Users | Growing preference for portable oxygen concentrators due to ease of use and mobility. | Drives innovation in compact, efficient, and user-friendly home oxygen devices. |

| Industrial Sector (Steel & Metal) | Increased requirement for oxygen in metal cutting, welding, and production processes. | Fuels demand for bulk oxygen in industrial applications and advancements in storage and distribution technologies. |

| Aerospace & Space Exploration | High demand for oxygen generation technologies that can function in space environments. | Promotes investment in advanced oxygen generation systems for spacecraft and future space missions. |

| Environmental and Eco-conscious Consumers | Preference for sustainable and eco-friendly oxygen generation technologies. | Stimulates growth in green technologies and demand for oxygen production with minimal environmental impact. |

Understanding customer and end-user preferences is critical for shaping product offerings and driving market growth in the oxygen industry. Healthcare providers, particularly hospitals, are increasingly prioritizing high-purity medical oxygen for emergency and intensive care use, which is leading to a demand for more robust, reliable, and consistent oxygen supply solutions. In the homecare sector, users are shifting towards portable oxygen concentrators for their convenience, portability, and independence, prompting advancements in the design of more compact and efficient devices. Additionally, the industrial sector, particularly steel and metal industries, has heightened the need for oxygen in metal cutting and welding processes, encouraging suppliers to enhance bulk oxygen delivery systems. In the aerospace sector, space exploration and research have driven the development of advanced oxygen generation technologies for both short- and long-term space missions, further expanding the scope for innovation. Finally, with growing environmental awareness, eco-conscious consumers are fueling the demand for sustainable oxygen production technologies that minimize environmental impact, prompting businesses to adopt green technologies in their oxygen generation and distribution processes. These insights illustrate how various sectors are shaping and influencing the oxygen market, driving growth in both demand and technological innovation.

By Form

In 2023, the gas form of oxygen dominated the market due to its widespread usage across multiple industries, with a market share of 60%. This form of oxygen is favored for its ease of distribution and application, particularly in the medical and industrial sectors. In healthcare, oxygen gas is vital for emergency treatment, intensive care units (ICUs), and homecare settings where portability is key. Hospitals often rely on large cylinders and centralized systems to ensure a continuous supply for patients requiring oxygen therapy. The gas form is also heavily utilized in industrial applications, such as metal cutting, welding, and other high-temperature processes where pure oxygen is needed to enhance combustion and improve efficiency. The well-established infrastructure for gas distribution, including cylinder gas distribution networks, further contributes to the dominance of this segment. Additionally, the cost-effectiveness of gas distribution for large-scale industries and healthcare systems that require consistent and high-volume oxygen supply has helped the gas form maintain its leading position in the market.

By Application

The medical application segment dominated the oxygen market in 2023, with a market share of 45%. Within the medical segment, hospital use emerged as the dominant sub-segment, accounting for the majority of the demand. Oxygen is an essential component in critical care units, emergency rooms, and for treating patients with respiratory diseases or conditions requiring supplemental oxygen. The increasing prevalence of respiratory disorders, such as Chronic Obstructive Pulmonary Disease (COPD), asthma, and pneumonia, has further fueled the demand for oxygen in healthcare settings. Additionally, the global pandemic heightened awareness of the importance of oxygen therapy, especially in ICU wards and for ventilator-assisted patients. The demand for homecare oxygen solutions also contributed significantly to the growth of this segment, as aging populations and patients with chronic conditions require ongoing oxygen therapy at home. Innovations in portable oxygen concentrators and delivery systems have made oxygen more accessible for home use, leading to further expansion in this segment.

By Distribution Mode

In 2023, Cylinder gas distribution dominated the distribution mode segment in the oxygen market, accounting for 40% of the overall market share. This method is particularly prevalent in both the healthcare and industrial sectors, where portability, convenience, and flexibility are essential. In healthcare, oxygen cylinders are often used for emergencies and in homecare applications, where patients require a steady supply of oxygen outside of hospital settings. The use of portable cylinders allows for easy transportation and ensures that oxygen can be delivered precisely when and where it is needed, such as during medical transportation or for patients living in remote areas. In industrial settings, cylinder gas distribution is commonly used in applications like welding, metal cutting, and other high-temperature industrial processes. The flexibility of cylinder distribution allows companies to scale their oxygen supply as per their operational requirements. The well-established logistics networks and infrastructure for cylinder storage, transportation, and distribution further contribute to the segment's dominance, making it the preferred choice for many end-users.

By End-use

In 2023, healthcare dominated the end-use segment for the oxygen market, with a market share of 50%. The healthcare sector's large share in the oxygen market is driven primarily by the critical role oxygen plays in the treatment of various respiratory conditions and life-saving medical procedures. Hospitals and healthcare facilities use oxygen in critical care units (CCUs), emergency rooms, and for patients undergoing surgery or intensive treatments. The increasing incidence of chronic diseases, such as Chronic Obstructive Pulmonary Disease (COPD), asthma, and COVID-19, has further raised the demand for oxygen in medical settings. Moreover, the aging global population has resulted in a higher need for homecare oxygen solutions, such as portable oxygen concentrators, enabling patients to continue their therapy outside hospital environments. The demand for at-home oxygen therapy has been significantly bolstered by advancements in technology that allow for more user-friendly, compact, and efficient systems. The ongoing need for medical oxygen due to respiratory health concerns continues to position the healthcare sector as the largest end-user, influencing market dynamics in a significant way.

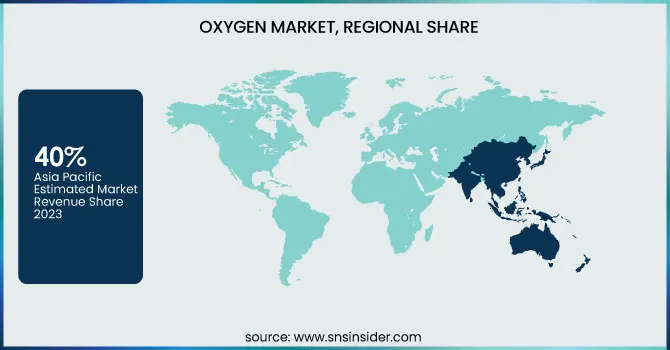

In 2023, Asia Pacific dominated the oxygen market, holding a market share of 40%. The region's dominance is driven by rapid industrialization, significant healthcare infrastructure growth, and an increasing need for oxygen across various applications. China, India, and Japan are among the leading countries driving this dominance. China, as the largest industrial and manufacturing hub, saw substantial demand for oxygen in industries like steel production, chemical processing, and welding. Moreover, China's healthcare sector has experienced rapid growth, particularly in the wake of the COVID-19 pandemic, which accelerated the need for medical oxygen. India followed closely behind, with a burgeoning healthcare infrastructure, growing elderly population, and rising prevalence of respiratory diseases contributing to an increased demand for oxygen in medical facilities. India also saw a surge in demand for oxygen in industrial processes, particularly in sectors like petrochemicals and metal manufacturing. Japan, with its well-established medical and industrial sectors, continues to contribute significantly to the market, especially in medical oxygen and advanced healthcare technology. The government and private investments in healthcare infrastructure, alongside an aging population, further solidified the region's position. Additionally, the growing trend of homecare oxygen systems in countries like India and China has spurred demand for portable oxygen concentrators. The regional dominance is supported by robust distribution networks, technological advancements, and a strong market presence of major suppliers like Air Liquide, Linde Group, and Taiyo Nippon Sanso.

On the other hand, North America emerged as the fastest-growing region in the oxygen market in 2023, with a approximate CAGR of 14%. The region’s rapid growth can be attributed to its well-established healthcare infrastructure, increasing demand for medical oxygen, and a rising focus on respiratory health due to the aging population and the impact of respiratory diseases like COPD and COVID-19. The United States, as the dominant country in the region, leads the market with its advanced healthcare system, significant investments in medical technologies, and a growing elderly population, that requires homecare oxygen therapy. In 2023, the U.S. accounted for the largest market share in North America, with a continued increase in the use of oxygen therapy for both emergency and long-term treatment. The demand for oxygen in medical applications, especially in hospitals, home care, and long-term care facilities, surged in response to chronic respiratory diseases and post-pandemic care. Canada also contributed to the region’s growth, with increasing healthcare spending and a rise in the number of healthcare facilities offering advanced respiratory treatments. Furthermore, advancements in oxygen generation technology, such as oxygen concentrators and oxygen-generating systems, have contributed to the growth of the market. The presence of key industry players like Air Products and Chemicals Inc., Airgas Inc., and Linde Group, coupled with the adoption of cutting-edge technologies in oxygen production and distribution, supports the rapid expansion of the market. The focus on improving air quality and adopting oxygen solutions for a variety of medical conditions has driven North America's dynamic growth trajectory.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Air Gas Inc. (Oxygen Cylinders, Liquid Oxygen)

Air Liquide (AL PHARMA Oxygen, OxyPharma)

Air Products and Chemicals Inc. (Oxygen Generators, Oxygen Supply Systems)

Air Water Inc. (Oxygen Gas, Medical Oxygen)

Baosteel Metal Co. Ltd. (Industrial Oxygen, Oxygen Cylinders)

Guangdong Huate Gas Co., Ltd. (Oxygen Gas, Industrial Oxygen Systems)

Gulf Cryo (Oxygen Gas, Medical Oxygen Solutions)

Linde Group (Oxygen Gas, Linde OxyCare)

Messer Group GmbH (Oxygen Gas, Medical Oxygen)

Mitsubishi Chemical Holdings Corporation (Oxygen Gas, Liquid Oxygen)

Nippon Gases (Industrial Oxygen, Medical Oxygen)

Norco, Inc. (Oxygen Cylinders, Liquid Oxygen)

Praxair Technology Inc. (Oxygen Generators, Oxygen Cylinders)

SCGC (Oxygen Gas, Liquid Oxygen)

Shanghai Baosteel Gases Ltd. (Oxygen Gas, Oxygen Generators)

Smiths Group plc. (Oxygen Therapy Equipment, Oxygen Flow Regulators)

Taiyo Nippon Sanso (Oxygen Gas, Medical Oxygen)

The Messer Group GmbH (Medical Oxygen, Oxygen Gas)

Yingde Gases (Oxygen Gas, Industrial Oxygen)

Yingde Gases Group (Oxygen Cylinders, Industrial Oxygen)

Recent Development:

July 2024: Air Liquide India opened a new manufacturing facility in Mathura, Uttar Pradesh, with an investment of INR 3500 million (around USD 41.79 million). This air separation unit, with a production capacity exceeding 300 tonnes daily, will support healthcare and industrial operations in Kosi, Mathura, producing both liquid and medical oxygen.

August 2023: Two oxygen generator plants were launched in Bhutan to enhance the country's healthcare systems and emergency preparedness. Located at Jigme Dorji Wangchuk National Referral Hospital and Mongar Regional Referral Hospital, these PSA plants can produce and refill 100 medical oxygen cylinders daily, contributing to the oxygen market’s growth.

March 2023: Air Liquide announced a EUR 60 million (USD 67.8 million) investment in the refurbishment of two air separation units (ASUs) in the Tianjin industrial basin, China. These electrified units, capable of producing 4,000 tons of oxygen per day, will supply YLC and other industrial clients in the region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 37.9 Billion |

| Market Size by 2032 | US$ 109.2 Billion |

| CAGR | CAGR of 12.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Form (Solid, Liquid, Gas) •By Application (Medical [Hospital Use, Homecare], Industrial [Welding, Cutting, Chemical Process, Aerospace, Others], Others) •By Distribution Mode (Onsite Gas Generation, Cylinder Gas Distribution, Bulk Tank Distribution) •By End-use (Metals and Mining, Chemical Industry, Oil and Gas, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Linde Group, Praxair Technology Inc., Air Liquide, Taiyo Nippon Sanso, Air Products and Chemicals Inc., Airgas Inc., The Messer Group GmbH, Yingde Gases, Air Water Inc., Guangdong Huate Gas Co., Ltd. and other key players |

| Key Drivers | •Growing Demand for Medical Oxygen Boosts Market Expansion in Healthcare and Respiratory Care Sectors •Rising Awareness of Air Pollution and Government Initiatives to Improve Urban Air Quality Stimulate Market Demand |

| Restraints | •High Costs of Oxygen Production and Distribution Technologies Hinder Market Growth in Developing Economies |

Ans: The Oxygen Market is expected to grow at a CAGR of 12.5%

Ans: The Oxygen Market size was valued at USD 37.9 billion in 2023 and is expected to reach USD 109.2 billion by 2032.

Ans: The increasing demand for medical oxygen driven by aging populations and respiratory conditions, expansion of oxygen generation technologies in emerging markets, and innovations in sustainable, energy-efficient oxygen production methods create significant growth opportunities across healthcare, industrial, and green technology sectors.

Ans: The challenge of ensuring a consistent and reliable oxygen supply to remote, rural, and underdeveloped areas, due to logistical complexities and limited infrastructure, hampers market growth, particularly in developing regions.

Ans: Asia Pacific dominated the oxygen market in 2023 with a 40% market share, driven by rapid industrialization, healthcare infrastructure growth, and rising oxygen demand in leading countries like China, India, and Japan.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, 2023

5.2 Customer/End-User Insights and Preferences, 2023

5.3 Regulatory and Policy Framework, 2023

5.4 Investment and Funding Trends, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Oxygen Market Segmentation, by Form

7.1 Chapter Overview

7.2 Solid

7.2.1 Solid Market Trends Analysis (2020-2032)

7.2.2 Solid Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Liquid

7.3.1 Liquid Market Trends Analysis (2020-2032)

7.3.2 Liquid Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Gas

7.4.1 Gas Market Trends Analysis (2020-2032)

7.4.2 Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Oxygen Market Segmentation, by Application

8.1 Chapter Overview

8.2 Medical

8.2.1 Medical Market Trends Analysis (2020-2032)

8.2.2 Medical Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.3 Hospital Use

8.2.3.1 Hospital Use Market Trends Analysis (2020-2032)

8.2.3.2 Hospital Use Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.4 Homecare

8.2.4.1 Homecare Market Trends Analysis (2020-2032)

8.2.4.2 Homecare Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Industrial

8.3.1 Industrial Market Trends Analysis (2020-2032)

8.3.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.3 Welding

8.3.3.1 Welding Market Trends Analysis (2020-2032)

8.3.3.2 Welding Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.4 Cutting

8.3.4.1 Cutting Market Trends Analysis (2020-2032)

8.3.4.2 Cutting Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.5 Chemical Process

8.3.5.1 Chemical Process Market Trends Analysis (2020-2032)

8.3.5.2 Chemical Process Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.6 Aerospace

8.3.6.1 Aerospace Market Trends Analysis (2020-2032)

8.3.6.2 Aerospace Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.7 Others

8.3.7.1 Others Market Trends Analysis (2020-2032)

8.3.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Oxygen Market Segmentation, by Distribution Mode

9.1 Chapter Overview

9.2 Onsite Gas Generation

9.2.1 Onsite Gas Generation Market Trends Analysis (2020-2032)

9.2.2 Onsite Gas Generation Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Cylinder Gas Distribution

9.3.1 Cylinder Gas Distribution Market Trends Analysis (2020-2032)

9.3.2 Cylinder Gas Distribution Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Bulk Tank Distribution

9.4.1 Bulk Tank Distribution Market Trends Analysis (2020-2032)

9.4.2 Bulk Tank Distribution Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Oxygen Market Segmentation, by End-use

10.1 Chapter Overview

10.2 Metals and Mining

10.2.1 Metals and Mining Market Trends Analysis (2020-2032)

10.2.2 Metals and Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Chemical Industry

10.3.1 Chemical Industry Market Trends Analysis (2020-2032)

10.3.2 Chemical Industry Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Oil and Gas

10.4.1 Oil and Gas Market Trends Analysis (2020-2032)

10.4.2 Oil and Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Healthcare

10.5.1 Healthcare Market Trends Analysis (2020-2032)

10.5.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Others

10.6.1 Others Market Trends Analysis (2020-2032)

10.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Oxygen Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.2.4 North America Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.5 North America Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.2.6 North America Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.2.7.2 USA Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.3 USA Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.2.7.4 USA Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.2.8.2 Canada Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.3 Canada Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.2.8.4 Canada Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.2.9.2 Mexico Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.3 Mexico Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.2.9.4 Mexico Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Oxygen Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.1.7.2 Poland Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.3 Poland Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.1.7.4 Poland Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.1.8.2 Romania Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.3 Romania Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.1.8.4 Romania Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Oxygen Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.4 Western Europe Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.5 Western Europe Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.2.6 Western Europe Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.7.2 Germany Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.3 Germany Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.2.7.4 Germany Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.8.2 France Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.3 France Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.2.8.4 France Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.9.2 UK Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.3 UK Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.2.9.4 UK Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.10.2 Italy Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.3 Italy Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.2.10.4 Italy Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.11.2 Spain Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.3 Spain Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.2.11.4 Spain Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.14.2 Austria Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.3 Austria Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.2.14.4 Austria Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Oxygen Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.4 Asia Pacific Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.5 Asia Pacific Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.4.6 Asia Pacific Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.7.2 China Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.3 China Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.4.7.4 China Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.8.2 India Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.3 India Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.4.8.4 India Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.9.2 Japan Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.3 Japan Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.4.9.4 Japan Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.10.2 South Korea Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.3 South Korea Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.4.10.4 South Korea Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.11.2 Vietnam Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.3 Vietnam Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.4.11.4 Vietnam Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.12.2 Singapore Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.3 Singapore Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.4.12.4 Singapore Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.13.2 Australia Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.3 Australia Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.4.13.4 Australia Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Oxygen Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.1.4 Middle East Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.5 Middle East Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.5.1.6 Middle East Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.1.7.2 UAE Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.3 UAE Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.5.1.7.4 UAE Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Oxygen Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.2.4 Africa Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.5 Africa Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.5.2.6 Africa Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Oxygen Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.6.4 Latin America Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.5 Latin America Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.6.6 Latin America Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.6.7.2 Brazil Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.3 Brazil Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.6.7.4 Brazil Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.6.8.2 Argentina Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.3 Argentina Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.6.8.4 Argentina Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.6.9.2 Colombia Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.3 Colombia Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.6.9.4 Colombia Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Oxygen Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Oxygen Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Oxygen Market Estimates and Forecasts, by Distribution Mode (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Oxygen Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

12. Company Profiles

12.1 Linde Group

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Praxair Technology Inc.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Air Liquide

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Taiyo Nippon Sanso

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Air Products and Chemicals Inc.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Airgas Inc.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 The Messer Group GmbH

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Yingde Gases

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Air Water Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Guangdong Huate Gas Co., Ltd.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Form

Solid

Liquid

Gas

By Application

Medical

Hospital Use

Homecare

Industrial

Welding

Cutting

Chemical Process

Aerospace

Others

Others

By Distribution Mode

Onsite Gas Generation

Cylinder Gas Distribution

Bulk Tank Distribution

By End-use

Metals and Mining

Chemical Industry

Oil and Gas

Healthcare

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Graphene Market Size was valued at USD 366.5 Million in 2023 and is expected to grow to USD 4997.1 Million by 2032, exhibiting a CAGR of 33.2% from 2024-2032.

Explore the Hydroxyethyl Cellulose (HEC) Market, covering its applications in personal care, paints, and pharmaceuticals. Learn about rising demand for HEC as a thickening and stabilizing agent and its growth in eco-friendly formulations for diverse indus

The Packaging Barrier Films Market size was USD 18.1 billion in 2023 and is expected to reach USD 28.8 billion by 2032 and grow at a CAGR of 5.3% over the forecast period of 2024-2032.

The Synthetic Leather Market Size was valued at USD 38.7 billion in 2023, and is expected to reach USD 71.2 billion by 2032, and grow at a CAGR of 7.0% over the forecast period 2024-2032.

Propanol Market size was valued at USD 3.85 Billion in 2023 and is expected to reach USD 6.34 Billion by 2032, growing at a CAGR of 5.70% from 2024-2032.

The CNG, RNG, and Hydrogen Tanks Market Size was USD 2.6 billion in 2023 & is expected to reach USD 6.6 Bn by 2032 & grow at a CAGR of 10.6% by 2024-2032.

Hi! Click one of our member below to chat on Phone