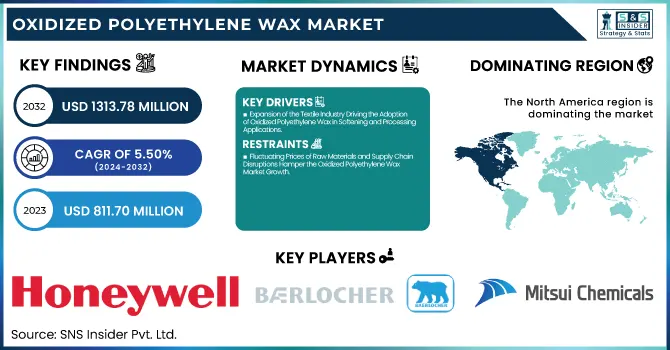

The Oxidized Polyethylene Wax Market Size was valued at USD 811.70 Million in 2023 and is expected to reach USD 1,313.78 Million by 2032, growing at a CAGR of 5.50% over the forecast period of 2024-2032.

To Get more information on Oxidized Polyethylene Wax Market - Request Free Sample Report

The Oxidized Polyethylene Wax Market is evolving as industries prioritize efficiency and sustainability. Raw material sourcing and pricing trends shape production costs, influenced by petroleum-based feedstocks and supply chain fluctuations. Investment and funding trends highlight capital influx for capacity expansion and innovation. A detailed cost structure analysis in the report uncovers key expenses, including raw materials, energy, and labor. As regulations tighten, social and environmental impact assessments gain prominence, driving eco-conscious manufacturing. The rise of sustainability and green alternatives is reshaping strategies, leading to advancements in bio-based and biodegradable waxes. Our report explores these pivotal aspects, offering a comprehensive analysis of market dynamics and future opportunities in this rapidly transforming industry.

Drivers

Expansion of the Textile Industry Driving the Adoption of Oxidized Polyethylene Wax in Softening and Processing Applications

The Oxidized Polyethylene Wax Market is witnessing strong growth due to its increasing application in the textile industry for softening, finishing, and processing fabrics. Textile manufacturers are adopting oxidized polyethylene wax as an essential processing aid to enhance fabric softness, smoothness, and durability. With the growing demand for high-performance textiles in apparel, home furnishings, and industrial applications, the need for advanced softening agents has surged. Additionally, the rise of sustainable and eco-friendly textile processing has prompted manufacturers to explore non-toxic and biodegradable alternatives, where oxidized polyethylene wax plays a crucial role. The demand for high-quality textile finishes, particularly in luxury clothing and technical textiles, has further propelled market expansion. Furthermore, the textile sector’s push toward energy-efficient and cost-effective processing techniques is increasing the adoption of oxidized polyethylene wax, as it reduces friction in fiber processing and improves dye penetration. The growing emphasis on wrinkle-free, water-repellent, and durable fabrics is also creating a favorable environment for the expansion of oxidized polyethylene wax applications in textile finishing.

Restraints

Fluctuating Prices of Raw Materials and Supply Chain Disruptions Hamper the Oxidized Polyethylene Wax Market Growth

The Oxidized Polyethylene Wax Market faces challenges due to fluctuating raw material prices and supply chain disruptions. Since the production of oxidized polyethylene wax is heavily dependent on petroleum-based feedstocks, price volatility in crude oil and petrochemical derivatives significantly impacts manufacturing costs. Additionally, supply chain constraints, including trade restrictions, transportation bottlenecks, and geopolitical tensions, have led to unpredictable availability of raw materials, affecting the overall production process. Many manufacturers are struggling to maintain cost efficiency while ensuring consistent product quality. The ongoing global push for sustainability has further pressured the market, as companies explore alternative bio-based and synthetic waxes, leading to increased competition and uncertainty. The reliance on limited suppliers and regional disparities in raw material sourcing has further contributed to price instability. These factors collectively hinder the widespread adoption of oxidized polyethylene wax, especially in price-sensitive industries such as packaging and textiles.

Opportunities

Adoption of Oxidized Polyethylene Wax in Advanced Electronic and Semiconductor Manufacturing Applications

The increasing integration of oxidized polyethylene wax in electronics and semiconductor manufacturing is unlocking new market opportunities. With the growing demand for precision coatings, thermal management, and anti-static applications, oxidized polyethylene wax is being utilized in electronic encapsulants, circuit board coatings, and conductive adhesives. The shift toward miniaturization of electronic components and the rise of wearable devices, flexible displays, and high-performance semiconductors are fueling the adoption of advanced wax formulations. Additionally, the emphasis on low-friction, heat-resistant coatings in microelectronics manufacturing is further boosting market demand. As the electronics and semiconductor industry expands globally, the use of oxidized polyethylene wax in specialized coatings and processing applications is expected to grow significantly.

Challenge

Limited Awareness and Standardization in Emerging Markets Restrict the Growth of the Oxidized Polyethylene Wax Market

One of the major challenges in the Oxidized Polyethylene Wax Market is the lack of awareness and standardization in emerging markets. While developed regions such as North America and Europe have established regulations and industrial applications for oxidized polyethylene wax, many developing economies lack standardized guidelines for its usage. This has resulted in inconsistent product quality, varied performance attributes, and limited adoption across industries such as plastics, coatings, and adhesives. The absence of strict industry standards and regulatory frameworks in regions like Latin America, the Middle East, and parts of Asia Pacific is restricting market penetration. Manufacturers must focus on awareness campaigns, regulatory compliance, and strategic partnerships to bridge the knowledge gap and enhance market acceptance in these regions.

By Product

High-Density Oxidized Polyethylene Wax dominated the Oxidized Polyethylene Wax Market in 2023, holding a 54.2% market share. This dominance is driven by its superior thermal stability, hardness, and high molecular weight, making it the preferred choice in plastics, coatings, and adhesives. High-density oxidized polyethylene wax is widely used in polyvinyl chloride (PVC) processing, where it enhances lubrication, melt flow, and surface finish, making it essential for the construction and packaging industries. According to the American Chemistry Council (ACC), the increasing demand for durable and lightweight plastics in automotive and industrial applications has significantly boosted the adoption of high-density variants. Additionally, government initiatives promoting energy-efficient and recyclable materials have favored its use over alternative processing aids. For instance, the U.S. Environmental Protection Agency (EPA) has encouraged the shift towards low-emission additives in polymer production, reinforcing the market leadership of high-density oxidized polyethylene wax.

By Application

Plastics & Polymer Processing led the Oxidized Polyethylene Wax Market in 2023, securing a 38.5% market share. The sector's growth is primarily fueled by the rising demand for high-performance lubricants, dispersing agents, and mold release agents in PVC, polypropylene (PP), and polyethylene (PE) manufacturing. The Plastics Industry Association (PLASTICS) has reported a surge in PVC pipe production for infrastructure projects, significantly driving oxidized polyethylene wax consumption. Additionally, government-backed policies, such as the EU’s Circular Economy Action Plan, emphasize sustainable plastic production, increasing the adoption of oxidized polyethylene wax as a processing aid. The expansion of the automotive and packaging industries, where high-performance polymers are essential for lightweight and durable components, has further strengthened this segment’s dominance. With growing innovations in biodegradable plastics and high-strength composites, the demand for oxidized polyethylene wax in plastics and polymer processing is expected to remain strong.

In 2023, North America dominated the Oxidized Polyethylene Wax Market, accounting for 45.3% market share. This dominance is largely driven by the United States, which has seen significant growth in industries such as plastic manufacturing, automotive, and packaging, all of which utilize oxidized polyethylene wax as a vital processing aid. For example, the U.S. is home to major companies like Honeywell International Inc., which produces advanced polymer additives for the manufacturing sector. Government regulations, such as the EPA's restrictions on harmful chemicals in polymers, have boosted the adoption of eco-friendly and sustainable materials, increasing the demand for high-performance additives like oxidized polyethylene wax. Additionally, the U.S. construction and infrastructure sectors have contributed to growth, with rising demand for high-quality PVC pipes. Canada and Mexico, benefiting from the USMCA trade agreement, have also seen an increase in oxidized polyethylene wax consumption, especially in automotive and industrial coatings.

Moreover, Asia Pacific emerged as the fastest growing region in the Oxidized Polyethylene Wax Market, with a significant growth rate during the forecast period. This rapid growth is propelled by China, India, and Japan, where expanding manufacturing sectors and increasing demand for plastics and packaging have boosted the consumption of oxidized polyethylene wax. China’s dominance in the plastic processing industry, particularly in polyethylene and polypropylene production, has led to increased use of oxidized polyethylene wax in enhancing polymer properties like flowability and durability. Furthermore, India’s automotive and infrastructure sectors are growing rapidly, contributing to the demand for this product. The Chinese government’s support for manufacturing and sustainable technologies, as part of their Made in China 2025 initiative, has created a favorable environment for the market. As the Asia Pacific's industrialization continues, the demand for performance additives like oxidized polyethylene wax is set to surge, strengthening its position in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Honeywell International Inc. (AC 629, AC 316)

Baerlocher GmbH (BAEROPOL RST, BAEROPOL T-Blend)

SCG Chemicals Co., Ltd. (SCG PE WAX LP1020P, SCG PE WAX LP1020F)

Mitsui Chemicals, Inc. (Hi-WAX 110P, Hi-WAX 220P)

Clariant (Licowax PE 520, Licowax PE 130)

Trecora Resources (PERFORMALENE 400, PERFORMALENE 500)

Westlake Chemical Corporation (Epolene N-10, Epolene N-34)

Deurex AG (DEUREX X 50, DEUREX X 51)

Marcus Oil & Chemical (OPE Wax 1020, OPE Wax 1025)

Munzing Chemie GmbH (CERETAN ME 0825, CERETAN ME 0830)

Sanyo Chemical Industries Ltd. (SANWAX 161P, SANWAX 171P)

Shanghai Fine Chemical Co., Ltd. (OPE Wax 629A, OPE Wax 629B)

Qingdao Sainuo Chemical Co., Ltd. (Sainuo OPE Wax 102, Sainuo OPE Wax 105)

EUROCERAS Sp. z o.o. (CERONAS OX 12, CERONAS OX 14)

Hase Petroleum Wax Company (Hase OPE Wax 100, Hase OPE Wax 200)

BASF (Luwax OA 3, Luwax OA 6)

Innospec Inc. (VISCO 200, VISCO 250)

Zell Wax (Zellwax OPE 85, Zellwax OPE 90)

MPI Chemie B.V. (MICHEM OX 12, MICHEM OX 14)

Industrial Raw Material LLC (IRM OPE Wax 100, IRM OPE Wax 200)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 811.70 Million |

| Market Size by 2032 | USD 1,313.78 Million |

| CAGR | CAGR of 5.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (High Density, Low Density) •By Application (Plastics & Polymer Processing, Paints, Coatings & Printing Inks, Textile Processing, Rubber Processing, Adhesives, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., The Lubrizol Corporation (Berkshire Hathaway Inc.), SCG Chemicals Co., Ltd., Baerlocher GmbH, BASF SE, Clariant AG, Deurex AG, Mitsui Chemicals Inc., Sanyo Chemical Industries Ltd., Marcus Oil and other key players |

Ans: The Oxidized Polyethylene Wax Market size was valued at USD 811.70 Million in 2023.

Ans: The Oxidized Polyethylene Wax Market is expected to reach USD 1,313.78 Million by 2032.

Ans: The Oxidized Polyethylene Wax Market is expected to grow at a CAGR of 5.50% over the forecast period from 2024 to 2032.

Ans: The electronics and semiconductor manufacturing sectors are experiencing significant adoption of Oxidized Polyethylene Wax for specialized coatings and applications.

Ans: The United States contributed the most to the Oxidized Polyethylene Wax Market in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Raw material sourcing and pricing trends

5.2 Investment and Funding Trends

5.3 Cost Structure Analysis

5.4 Social and Environmental Impact Assessments

5.5 Impact of Sustainability and Green Alternatives

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Oxidized Polyethylene Wax Market Segmentation, by Product

7.1 Chapter Overview

7.2 High Density

7.2.1 High Density Market Trends Analysis (2020-2032)

7.2.2 High Density Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Low Density

7.3.1 Low Density Market Trends Analysis (2020-2032)

7.3.2 Low Density Market Size Estimates and Forecasts to 2032 (USD Million)

8. Oxidized Polyethylene Wax Market Segmentation, by Application

8.1 Chapter Overview

8.2 Plastics & Polymer Processing

8.2.1 Plastics & Polymer Processing Market Trends Analysis (2020-2032)

8.2.2 Plastics & Polymer Processing Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Paints, Coatings & Printing Inks

8.3.1 Paints, Coatings & Printing Inks Market Trends Analysis (2020-2032)

8.3.2 Paints, Coatings & Printing Inks Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Textile Processing

8.4.1 Textile Processing Market Trends Analysis (2020-2032)

8.4.2 Textile Processing Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Rubber Processing

8.5.1 Rubber Processing Market Trends Analysis (2020-2032)

8.5.2 Rubber Processing Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Adhesives

8.6.1 Adhesives Market Trends Analysis (2020-2032)

8.6.2 Adhesives Market Size Estimates and Forecasts to 2032 (USD Million)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Oxidized Polyethylene Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.4 North America Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.5.2 USA Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.6.2 Canada Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.7.2 Mexico Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Oxidized Polyethylene Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.5.2 Poland Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.6.2 Romania Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.7.2 Hungary Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.8.2 Turkey Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Oxidized Polyethylene Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.4 Western Europe Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.5.2 Germany Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.6.2 France Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.7.2 UK Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.8.2 Italy Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.9.2 Spain Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.12.2 Austria Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Oxidized Polyethylene Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia Pacific Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.4 Asia Pacific Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.5.2 China Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.5.2 India Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.5.2 Japan Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.6.2 South Korea Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.7.2 Vietnam Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.8.2 Singapore Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.9.2 Australia Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.10.2 Rest of Asia Pacific Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Oxidized Polyethylene Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.4 Middle East Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.5.2 UAE Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.6.2 Egypt Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.8.2 Qatar Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Oxidized Polyethylene Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.4 Africa Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.5.2 South Africa Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.7.2 Rest of Africa Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Oxidized Polyethylene Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.4 Latin America Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.5.2 Brazil Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.6.2 Argentina Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.7.2 Colombia Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Oxidized Polyethylene Wax Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Oxidized Polyethylene Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10. Company Profiles

10.1 Honeywell International Inc.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 The Lubrizol Corporation (Berkshire Hathaway Inc.)

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 SCG Chemicals Co., Ltd.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Baerlocher GmbH

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 BASF SE

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Clariant AG

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Deurex AG

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Mitsui Chemicals Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Sanyo Chemical Industries Ltd.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Marcus Oil

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

High Density

Low Density

By Application

Plastics & Polymer Processing

Paints, Coatings & Printing Inks

Textile Processing

Rubber Processing

Adhesives

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Fly Ash Market size was USD 13.42 Billion in 2023 and is expected to reach USD 23.30 Billion by 2032, growing at a CAGR of 5.67% from 2024 to 2032.

The Bonding Sheet Market Size was valued at USD 406.33 Million in 2023 and is expected tot reach at USD 777.60 Million by 2032, and grow at a CAGR of 7.48% over the forecast period 2024-2032.

The Rodenticides market size was valued at USD 5.52 billion in 2023 and is expected to reach USD 9.10 billion by 2032, growing at a CAGR of 5.72% over the forecast period of 2024-2032.

The Metal Finishing Chemicals Market Size was USD 12.1 billion in 2023, and will reach USD 18.8 billion by 2032, and grow at a CAGR of 5.1% by 2024-2032.

Transmission Fluids Market was valued at USD 8.1 Billion in 2023 and is expected to grow to USD 11.1 Billion by 2032, growing at a CAGR of 3.6% from 2024-2032.

Polylactic Acid (PLA) Market was valued at USD 1.2 Billion in 2023 and is expected to reach USD 5.2 Billion by 2032, growing at a CAGR of 17.7% from 2024-2032.

Hi! Click one of our member below to chat on Phone