Oxalic Acid Market Report Scope & Overview:

The Oxalic Acid Market size was valued at USD 962 million in 2023. It is estimated to hit USD 1475.97 million by 2032 and grow at a CAGR of 4.87% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Oxalic Acid Market - Request Sample Report

Oxalic acid, a colorless, crystalline organic compound, is utilized across various industries due to its versatile properties. In the pharmaceutical sector, it serves as a precursor in the synthesis of antibiotics and other medicinal compounds. Its role as a bleaching and purifying agent is significant in the textile industry, where it aids in removing stains and brightening fabrics. Additionally, oxalic acid is employed in metal processing for rust removal and as a reducing agent in chemical reactions. The market for oxalic acid has experienced steady growth, driven by advancements in chemical manufacturing and increased industrial applications. Notably, the pharmaceutical industry's expansion has significantly contributed to this growth, with oxalic acid being integral in producing various drugs. The textile industry's demand for effective bleaching agents has further bolstered the market. Additionally, the metal processing industry's need for rust removal and other applications has sustained the demand for oxalic acid.

Recent trends indicate a growing interest in sustainable and green technologies, leading to increased adoption of oxalic acid in eco-friendly cleaning solutions. The development of advanced water treatment solutions has also spurred demand for oxalic acid, highlighting its versatility and importance across multiple sectors. Furthermore, the pharmaceutical industry's substantial investments in research and development have created opportunities for oxalic acid in drug discovery and development.

MARKET DYNAMICS

DRIVERS

-

Oxalic acid drives demand in automotive, metal treatment, and pharmaceuticals for rust removal, metal polishing, and drug formulation, with growth fueled by industrialization and eco-friendly trends.

Oxalic acid plays a pivotal role in various industrial applications, driving significant demand in sectors such as automotive, metal treatment, and pharmaceuticals. In the automotive industry, it is used for rust removal, cleaning, and surface treatment, enhancing vehicle maintenance and manufacturing processes. In metal treatment, oxalic acid serves as an effective agent for polishing and brightening metals like stainless steel, ensuring a high-quality finish. The pharmaceutical sector also relies on oxalic acid in drug formulations and as a precursor for other chemicals. As industries continue to grow, the demand for oxalic acid is expanding, particularly with the rise of industrialization in emerging markets. The increasing focus on eco-friendly and efficient cleaning agents, as well as advancements in pharmaceutical research, further fuels market growth. Trends show a steady rise in demand for oxalic acid as a critical ingredient for manufacturing, cleaning, and chemical synthesis across these industries.

RESTRAINT

-

Environmental concerns surrounding oxalic acid stem from its toxic and corrosive nature, requiring strict waste management to prevent contamination and pollution, which can increase operational costs and hinder market growth.

Environmental concerns related to oxalic acid arise primarily from the disposal of its waste, which can pose significant risks to ecosystems and human health. Oxalic acid, being corrosive and toxic in large quantities, requires careful handling to avoid contamination of water sources and soil. Improper disposal of oxalic acid waste can lead to environmental pollution, harming aquatic life, soil quality, and vegetation. In response to these risks, many countries have implemented strict environmental regulations governing the disposal of hazardous chemicals like oxalic acid. These regulations require companies to invest in proper waste management systems, such as neutralization or treatment processes, to minimize environmental damage. While these measures help protect the environment, they also increase operational costs for businesses. The compliance with these stringent regulations can limit market growth by imposing additional financial burdens on manufacturers and suppliers, which may hinder the overall expansion of the oxalic acid market.

MARKET SEGMENTATION

By Grade

Standard Grade Purity 96%-99% segment dominated with the market share over 46% in 2023, widely used in various applications such as cleaning agents, rust removers, and bleaching agents. Its cost-effectiveness and versatility make it a preferred choice for both industrial and household uses. This grade plays a crucial role in metal processing, where it is used for rust removal and surface cleaning. Additionally, it finds significant application in the textile industry for bleaching and finishing fabrics. The combination of affordability, effectiveness, and broad application scope ensures that standard-grade oxalic acid maintains a dominant position in the market.

By Application

The bleaching and purifying agents’ segment dominated with the market share over 32% in 2023. Oxalic acid's effectiveness as a cleaning and bleaching agent has led to its widespread adoption across various industries, including textiles, leather, and metal processing. Its ability to efficiently remove stains, rust, and discoloration makes it a preferred choice for these applications. The expanding construction, textile, and furniture industries further drive the demand for oxalic acid in wood bleaching and metal cleaning processes. Additionally, the compound's role in pharmaceuticals and agriculture, particularly as a pesticide, contributes to its heightened demand.

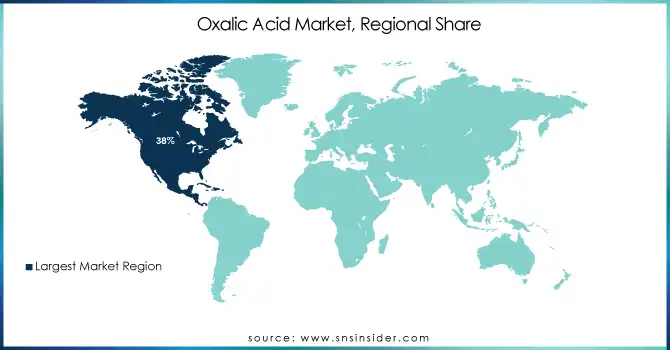

KEY REGIONAL ANALYSIS

The North American region dominated with the market share over 38% in 2023, due to its well-established industrial infrastructure and diverse applications. Oxalic acid is crucial in industries like textiles, where it is used for dyeing and bleaching, and in cleaning agents for descaling purposes. Additionally, it plays a vital role in metal processing, especially in rust removal and as a reducing agent. Strong demand from key sectors such as automotive, construction, and agriculture further bolsters its market share. The region’s advanced manufacturing capabilities, technological innovations, and high consumption of oxalic acid in various industries contribute to its dominance.

The Asia-Pacific region is the fastest-growing in the oxalic acid market, driven by rapid industrialization and urbanization. Countries like China and India are experiencing a surge in demand due to the expansion of their textile and chemical industries, where oxalic acid is used in dyeing, cleaning, and as a raw material in chemical synthesis. The growing population and infrastructure development in these countries further fuel this demand. As the manufacturing sector continues to expand, the need for oxalic acid in various applications, including agriculture and metal processing, propels the market's rapid growth in the region.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the major key players of the Oxalic Acid Market

-

UBE Industries Ltd.

-

Indian Oxalate Ltd.

-

Oxaquim S.A.

-

Mudanjiang Fengda Chemical Co. Ltd.

-

Star Oxochem Pvt. Ltd.

-

Honeywell International Inc.

-

Shandong Fengyuan Chemical Co., Ltd.

-

Punjab Chemicals & Crop Protection Limited

-

Shandong Yuanping Chemical Co., Ltd.

-

Dongfeng Chemical Co., Ltd.

-

Mudanjiang Hongli Chemicals Co., Ltd.

-

GEM Chemical

-

Shaowu Fine Chemical Co., Ltd.

-

Yuanping Chemical Co., Ltd.

-

Tianjin Bohai Chemical Industry Co., Ltd.

-

Shenzhen Kemi-Works Co., Ltd.

-

Zhejiang Zhenlong Chemical Co., Ltd.

Suppliers for (Acid with a high purity level (usually 99%), which is critical for applications in industries like textiles, chemicals, and pharmaceuticals) on Oxalic Acid Market

-

Vinipul Chemicals Pvt. Ltd.

-

S K Enterprise

-

Cotex Chem Pvt Ltd

-

Meru Chem Pvt. Ltd.

-

Alpha Chemika

-

Jigchem Universal

-

Gandhi Chemicals

-

Nike Chemical India

-

Shanti Food Industries

-

Balaji Trading Company

Recent Development:

In January 6, 2025: Merck successfully acquired HUB Organoids Holding B.V., expanding its next-generation biology portfolio to accelerate drug development. This acquisition bolsters Merck’s cell culture capabilities by incorporating HUB’s cutting-edge organoid technology, enabling faster and more efficient drug discovery.

In 4 October, 2024: Oxaquim and other suppliers in India and China are facing extended anti-dumping duties on oxalic acid imports to the EU. The European Commission found that these countries continue to sell at unfairly low prices, harming European producers. To prevent circumvention, importers must now submit detailed invoices about the product’s origin and manufacturer. The EU also warned that any significant increase in exports could lead to further investigations and potential higher duties.

| Report Attributes | Details |

| Market Size in 2023 | USD 962 Million |

| Market Size by 2032 | USD 1475.97 Million |

| CAGR | CAGR of 4.87% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Standard Grade (Purity 96%-99%), Technical/Pharma Grade (Purity 99%-99.9%)), Electronic/Food Grade (Purity 99.9%-99.999%) • By Application (Bleaching & Purifying Agents, Sterilization, Stain & Rust Removers, Reducing Agents, Precipitation Agents, Miticide, and Others) • By End-use (Pharmaceuticals, Metallurgy, Water Treatment Chemicals, Food & Beverage, Agriculture, Paints & Coatings, Textiles & Leathers, Electronics & Semiconductor, Plastics, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Clariant International Ltd., UBE Industries Ltd., Indian Oxalate Ltd., Oxaquim S.A., Merck KGaA, Spectrum Chemical Manufacturing Corp., Mudanjiang Fengda Chemical Co. Ltd., Star Oxochem Pvt. Ltd., Honeywell International Inc., Shandong Fengyuan Chemical Co., Ltd., Punjab Chemicals & Crop Protection Limited, Shandong Yuanping Chemical Co., Ltd., Dongfeng Chemical Co., Ltd., Mudanjiang Hongli Chemicals Co., Ltd., GEM Chemical, Shaowu Fine Chemical Co., Ltd., Yuanping Chemical Co., Ltd., Tianjin Bohai Chemical Industry Co., Ltd., Shenzhen Kemi-Works Co., Ltd., and Zhejiang Zhenlong Chemical Co., Ltd. |

| Key Drivers | • Oxalic acid drives demand in automotive, metal treatment, and pharmaceuticals for rust removal, metal polishing, and drug formulation, with growth fueled by industrialization and eco-friendly trends. |

| RESTRAINTS | • Environmental concerns surrounding oxalic acid stem from its toxic and corrosive nature, requiring strict waste management to prevent contamination and pollution, which can increase operational costs and hinder market growth. |