To Get More Information on Over The Counter Drugs Market - Request Sample Report

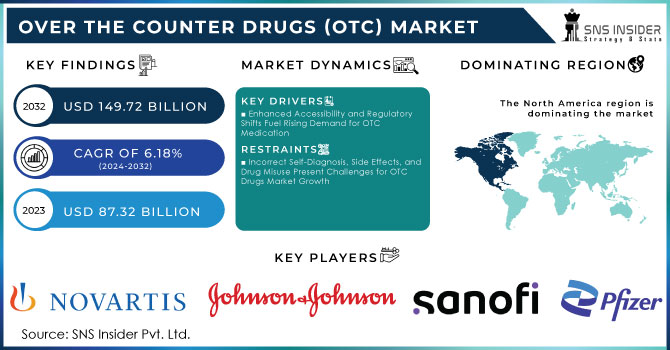

The Over-The-Counter Drugs (OTC) Market Size was valued at USD 87.32 billion in 2023 and is expected to reach USD 149.72 billion by 2032 and grow at a CAGR of 6.18% over the forecast period of 2024-2032.

Growth in the over-the-counter drugs market has been steady for several reasons. For one, consumers increasingly feel comfortable shelling out money on OTC medicines and are more aware of their benefits. Lifestyle-related disorders such as obesity and diabetes are increasingly causing problems, especially among the aged. Such trends have seen an increase in demand for easily accessible, non-prescription treatment options that can be acquired without medical consultation.

An increase in disposable income and a higher number of distribution channels have made OTC drugs more accessible to a wider range of consumers. A stronger availability of all these products in retail outlets and online platforms has simplified the purchasing process and led to more and more direct involvement in self-managed minor health issues. Accessibility to such quick relief in case of common ailments is more appealing to people, thereby fuelling the market further.

Moreover, chronic diseases like osteoarthritis contribute to the demand for OTC drugs, especially for pain relief medicines. According to the World Health Organization, approximately 528 million people worldwide are suffering from osteoarthritis condition based on estimates released in 2019. Patients who have joint pain and stiffness symptoms usually resort to available over-the-counter analgesics such as acetaminophen and NSAIDs for symptom management. The fact that these drugs can be had over the counter makes a person visit a doctor even though their symptoms are not too severe, thus increasing the OTC pain relief market.

Such factors will most likely continue to expand the market for OTC drugs because they align with the increasing acceptance of self-medication and the ease it brings. The prevalence of chronic diseases and a geriatric population will further mean that OTC medications will necessarily continue to fill the needs of consumers about easy access to healthcare solutions. Changing consumer preferences and a greater variety of products available over the counter are also expected to contribute to this trend.

| Country | Pain Relievers | Cold & Flu | Allergy Medication | Digestive Aids | Antacids | Sleep Aids |

|---|---|---|---|---|---|---|

| United States | Tylenol (Acetaminophen) | NyQuil | Benadryl | Pepto-Bismol | Tums | Unisom |

| United Kingdom | Nurofen (Ibuprofen) | Lemsip | Piriton (Chlorpheniramine) | Gaviscon | Rennie | Nytol |

| Germany | IbuHEXAL (Ibuprofen) | Wick MediNait | Cetirizine ADGC | Rennie | Maalox | Hoggar Night |

| Japan | Eve (Ibuprofen) | Contac | Allegra (Fexofenadine) | Gaster 10 | Gaviscon | Restamin |

| Canada | Advil (Ibuprofen) | Benylin | Reactine | Diovol | Pepcid | Sleep-eze |

| Australia | Panadol (Paracetamol) | Codral | Telfast (Fexofenadine) | Quick-Eze | Mylanta | Restavit |

| France | Doliprane (Paracetamol) | Actifed | Aerius (Desloratadine) | Mopral | Gaviscon | Donormyl |

| India | Crocin (Paracetamol) | D-Cold Total | Cetzine (Cetirizine) | Digene | Eno | Sleepwell |

| Brazil | Dipirona (Metamizole) | Benegrip | Polaramine (Dexchlorpheniramine) | Epocler | Estomazil | Dormont |

| South Korea | Tylenol (Acetaminophen) | Pan Cold | Zyrtec (Cetirizine) | Gaster N | Gaston | Tylenol PM |

Drivers

Enhanced Accessibility and Regulatory Shifts Fuel Rising Demand for OTC Medications

Major market players such as Johnson & Johnson Services Inc., Bayer AG, Novartis AG, Sanofi S.A., Dr. Reddy's Laboratories Ltd., and Pfizer, among others, have provided immense support to the market for over-the-counter drugs. These players have been making continuous investments in research and development activities and have recently launched a wide range of OTC products that deal with different health conditions. An example includes the firm of Dr. Reddy's Laboratories, which recently launched an OTC eye allergy solution, Olopatadine Hydrochloride in September 2020. The increase in the introduction of new products is expected to spur growth in the market due to the furthering of the portfolio of Over-the-Counter drugs.

Accessibility and affordability also fuel the market. Many retail stores cater to this category of products, thereby making it more accessible to consumers. Private sector investments in developing distribution channels in both developed and emerging countries open the avenues for further product presence. NCBI reported in 2020 that the sale of OTC products is majorly contributed by the U.S., Japan, Germany, and the UK, which implies the significant presence of retail networks in these regions.

Additional impetus to the market's growth is being provided by various regulatory approvals for the transition of prescription drugs into the OTC space. To this end, several prescription allergy medicines that were previously unaffordable are now converted into OTC products contributing to their general affordability for the consumer. According to the CHPA, in the year 2022, many allergy medications were transitioned from prescription-only drugs to being sold over-the-counter, indicating the general trend to affordable and accessible treatment options. As demand for affordable, easily accessible medications in the OTC space continues to increase, this is also certain to continue driving the market.

Restraints

Incorrect Self-Diagnosis, Side Effects, and Drug Misuse Present Challenges for OTC Drugs Market Growth

By Product Type

Cold & cough remedies comprised the largest market share 21.9% in 2023 because of an increased incidence of seasonal colds and coughs. These conditions were particularly common among children under 10 and individuals 65 years of age and older, reported the Centers for Disease Control and Prevention, creating a need for therapeutic solutions in this category. The ease of access and facilitation of self-administration by customers also helped this segment command market leadership.

Analgesics is the second largest helped by the surging geriatric population, as well as the high demand for pain relief products. This segment has been furthered by recent innovation in the form of new product launches; for instance, the US witnessed the launch of over-the-counter Diclofenac Sodium topical gel, a new product from Dr. Reddy's Laboratories Ltd. during the third quarter of 2020. On the other hand, such a strong market share of OTC analgesics is maintained by the fact that these drugs are available and quite accessible for simple, convenient use, allowing for self-medication; hence, not very surprisingly, they were in such heavy demand among pain sufferers seeking effective analgesia.

By Distribution Channel

The drug stores & retail pharmacies segment dominated the market in 2023 with a 38.6% share, as it accounts for the largest market share. This dominance is attributed to the rising patient preference for purchasing OTC products from retail pharmacies and the increasing number of retail locations offering these products. Consumers tend to favor drug stores and retail pharmacies for OTC drugs due to their accessibility and the ability to seek guidance from pharmacy staff, reinforcing this segment's leading position.

The hospital pharmacies segment holds the second-largest market share, supported by the growing availability of OTC drugs in hospital settings and the wide range of products available to patients.

Meanwhile, online pharmacies are anticipated to experience rapid growth at a lucrative compound annual growth rate (CAGR). This surge is driven by increased internet penetration, especially in emerging markets, and the competitive discounts offered by online platforms, making them a convenient choice for consumers seeking affordable and accessible OTC products.

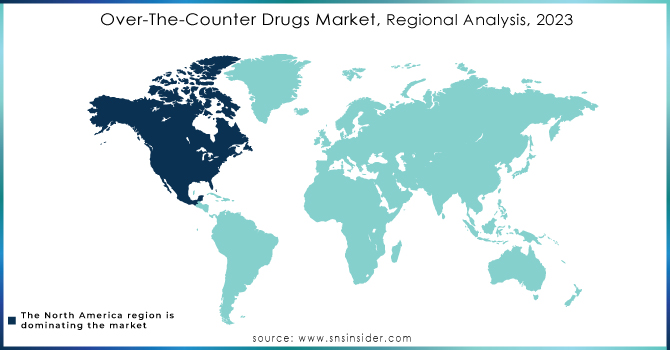

In 2023, North America remained the largest OTC drugs market. To a great extent, this was driven by the free availability of the over-the-counter emergency contraceptive pill known as Plan B One-Step. Since this drug is available without age restrictions, its free availability and the placement of this product without a prescription on pharmacy shelves greatly strengthened the OTC market in the region. Moreover, in 2023, the fact that many essential prescription drugs could be bought over the counter helped grow the sector further. Of note, those were Narcan and RiVive, which are naloxone nasal sprays used as emergency drugs in an overdose of opioids, and Opill, which is the first progestin-only oral birth control sold OTC in the U.S. Advances in this area are showing the trend of making essential medicines ready for full access, improvement of the OTC drugs market in North America in general.

Asia Pacific region is expected to grow at a strong pace during the forecast period. This is one factor making to growth of the OTC drugs market in the emerging markets: increasing disposable incomes, increasing healthcare awareness, and expanding the distribution networks. The compound annual growth rate (CAGR) for the Asia Pacific market, with a health-conscious consumer looking for convenient treatment options, will likely be robust.

Do You Need any Customization Research on Over The Counter Drugs Market - Enquire Now

Over-The-Counter Drugs Market Players

Johnson & Johnson Services Inc.

Sanofi S.A.

Pfizer

Mylan

GlaxoSmithKline Plc

Boehringer Ingelheim International GmbH

Reckitt Benckiser Group PLC

Perrigo Company plc

The Blackstone Group, Inc. (Alinamin Pharmaceutical Co., Ltd.)

Aytu Biopharma, Inc. (Aytu Consumer Health, Inc.)

Dr. Reddy's Laboratories

Viatris, Inc. and others.

Recent Developments

June 2023: McKesson Corporation, a diversified pharmaceutical company, announced the launch of Foster & Thrive, a curated private brand of over-the-counter health and wellness products aimed at addressing evolving patient needs and increasing demand.

July 2022: RLG Limited, an e-commerce and digital marketing firm, partnered with AFT Pharmaceuticals, a company based in New Zealand, to introduce a range of OTC drugs via the online marketplace Tmall Global.

| Report Attributes | Details |

| Market Size in 2023 | US$ 87.32 Bn |

| Market Size by 2032 | US$ 149.72 Bn |

| CAGR | CAGR of 6.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Analgesics, Cold & Cough remedies, Digestives & Intestinal remedies, Skin Treatment, Others) • By Distribution Channel (Drug Stores & Retail Pharmacies, Hospital Pharmacies, Online) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Johnson & Johnson, Bayer Ag, Novartis Ag, Sanofi, Pfizer, Takeda pharmaceutical, Reckitt Benckiser group and Others. |

| Key Drivers | • Enhanced Accessibility and Regulatory Shifts Fuel Rising Demand for OTC Medications |

| Market Restraints | • Incorrect Self-Diagnosis, Side Effects, and Drug Misuse Present Challenges for OTC Drugs Market Growth |

Ans : Over The Counter Drugs market size was valued at USD 87.12 billion in 2023 and is expected to reach at USD 149.72 billion by 2030, and grow at a CAGR of 6.18% over the forecast period of 2024-2032.

ANS : Enhanced Accessibility and Regulatory Shifts Fuel Rising Demand for OTC Medications

Ans ; The major key players are Johnson & Johnson, Bayer Ag, Novartis Ag, Sanofi, Pfizer, Takeda pharmaceutical, Reckitt Benckiser group and Others.

Ans :North America region will dominate this market.

Ans : The impact of recession will be moderate on this market

Table of Contents

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Drug Volume: Production and usage volumes of pharmaceuticals.

5.4 Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients.

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Service Benchmarking

6.3.1 Service specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Service launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Over-the-counter Drugs Market Segmentation, by Product Type

7.2 Analgesics

7.2.1 Analgesics Market Trends Analysis (2020-2032)

7.2.2 Analgesics Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Cold & Cough Remedies

7.3.1 Cold & Cough Remedies Market Trends Analysis (2020-2032)

7.3.2 Cold & Cough Remedies Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Digestives & Intestinal Remedies

7.4.1 Digestives & Intestinal Remedies Market Trends Analysis (2020-2032)

7.4.2 Digestives & Intestinal Remedies Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Skin Treatment

7.5.1 Skin Treatment Market Trends Analysis (2020-2032)

7.5.2 Skin Treatment Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Vitamins & Minerals

7.6.1 Vitamins & Minerals Market Trends Analysis (2020-2032)

7.6.2 Vitamins & Minerals Market Size Estimates and Forecasts to 2032 (USD Million)

7.7 Others

7.7.1 Others Market Trends Analysis (2020-2032)

7.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Over-the-counter drugs Market Segmentation, by Distribution Channel

8.2 Drug Stores & Retail Pharmacies

8.2.1 Drug Stores & Retail Pharmacies Market Trends Analysis (2020-2032)

8.2.2 Drug Stores & Retail Pharmacies Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Hospital Pharmacies

8.3.1 Hospital Pharmacies Market Trends Analysis (2020-2032)

8.3.2 Hospital Pharmacies Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Online Pharmacies

8.4.1 Online Pharmacies Market Trends Analysis (2020-2032)

8.4.2 Online Pharmacies Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Over-the-counter Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.2.4 North America Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.2.5.2 USA Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.2.6.2 Canada Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.2.7.2 Mexico Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Over-the-counter Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.1.5.2 Poland Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.1.6.2 Romania Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.1.7.2 Hungary Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.1.8.2 Turkey Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Over-the-counter Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.2.4 Western Europe Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.2.5.2 Germany Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.2.6.2 France Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.2.7.2 UK Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.2.8.2 Italy Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.2.9.2 Spain Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.2.12.2 Austria Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Over-the-counter Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia Pacific Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.4.4 Asia Pacific Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.4.5.2 China Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.4.5.2 India Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.4.5.2 Japan Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.4.6.2 South Korea Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.2.7.2 Vietnam Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.4.8.2 Singapore Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.4.9.2 Australia Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.4.10.2 Rest of Asia Pacific Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Over-the-counter Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.5.1.4 Middle East Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.5.1.5.2 UAE Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.5.1.6.2 Egypt Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.5.1.8.2 Qatar Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Over-the-counter Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.5.2.4 Africa Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.5.2.5.2 South Africa Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Over-the-counter Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.6.4 Latin America Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.6.5.2 Brazil Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.6.6.2 Argentina Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.6.7.2 Colombia Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Over-the-counter Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Over-the-counter Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Million)

10. Company Profiles

10.1 Johnson & Johnson Services Inc.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Services/ Services Offered

110.1.4 SWOT Analysis

10.2 Bayer AG

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Services/ Services Offered

10.2.4 SWOT Analysis

10.3 Novartis AG

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Services/ Services Offered

10.3.4 SWOT Analysis

10.4 Sanofi S.A.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Services/ Services Offered

10.4.4 SWOT Analysis

10.5 Pfizer

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Services/ Services Offered

10.5.4 SWOT Analysis

10.6 GlaxoSmithKline Plc

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Services/ Services Offered

10.6.4 SWOT Analysis

10.7 Boehringer Ingelheim International GmbH

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Services/ Services Offered

10.7.4 SWOT Analysis

10.8 Reckitt Benckiser Group PLC

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Services/ Services Offered

10.8.4 SWOT Analysis

10.9 Takeda Pharmaceutical Company Ltd.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Services/ Services Offered

10.9.4 SWOT Analysis

10.10 Dr. Reddy's Laboratories

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Services/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product Type

Analgesics

Cold & Cough Remedies

Digestives & Intestinal Remedies

Skin Treatment

Vitamins & Minerals

Others

By Distribution Channel

Drug Stores & Retail Pharmacies

Hospital Pharmacies

Online Pharmacies

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Mass Spectrometry Market size was valued at USD 5.76 billion in 2023 and is projected to reach USD 11.25 billion by 2032 at a CAGR of 7.74% from 2024 to 2032

The Protein Purification and Isolation Market size was estimated at USD 9.25 billion in 2023 and is expected to reach USD 23.10 billion by 2032 with a growing CAGR of 10.7% during the forecast period of 2024-2032.

Canine orthopedics Market Size was valued at USD 367.9 million in 2023 and is expected to reach USD 765.07 million by 2032, growing at a CAGR of 8.5% over the forecast period 2024-2032.

The Cold, Cough, and Sore Throat Remedies Market size was estimated USD 41.22 billion in 2023 and is expected to reach USD 56.17 billion by 2032 at a CAGR of 3.5% during the forecast period of 2024-2032.

The Military Wearable Medical Device Market Size was valued at USD 7.84 billion in 2023 and is expected to reach USD 64.47 billion by 2032, and grow at a CAGR of 26.40% over the forecast period 2024-2032.

The Proteomics Market Size was valued at USD 30.61 billion in 2023 and is expected to reach USD 96.35 Billion by 2032, growing at a CAGR of 13.61% from 2024-2032.

Hi! Click one of our member below to chat on Phone