Outsourced Global Capability Centers (GCCs) Market Report Scope & Overview:

Get more information on Outsourced Global Capability Centers Market - Request Free Sample Report

The Outsourced Global Capability Centers Market Size was valued at USD 20.14 billion in 2023 and is expected to reach USD 78.71 billion by 2032 and grow at a CAGR of 14.79% over the forecast period 2024-2032.

The Outsourced Global Capability Centers (GCC) market has witnessed significant growth as firms increasingly leverage these centers to enhance their operational efficiency and cost-effectiveness. GCCs play a crucial role in supporting organizations with various functions, including IT services, customer support, and business operations, allowing firms to tap into global talent pools while minimizing operational costs. The rise of remote work and digital transformation initiatives has further accelerated the demand for GCCs, particularly in regions known for their skilled workforce, such as India. This trend reflects a shift in corporate strategies, focusing on building agile and adaptable business models capable of responding to changing market dynamics.

The developments in the outsourced global capability centers market (GCCs) highlight the growing importance of GCCs in India, where they have become major contributors to the real estate market, leasing over 46% of office space as of April 2024. This trend demonstrates the confidence global firms like Tata Consultancy Services (TCS) and Infosys have in the Indian workforce, which is recognized for its technical expertise and cost-effectiveness. As organizations seek to establish or expand their GCCs, cities like Bengaluru and Hyderabad in India have emerged as preferred destinations, offering a conducive business environment and access to a large pool of talented professionals. The strategic location of these cities, coupled with supportive government policies, has made them attractive for multinational companies looking to optimize their operations. In August 2024, it was reported that the Big Four professional services firms such as Deloitte, PwC, EY, and KPMG are intensifying their recruitment efforts for roles within their GCCs. This shift is a testament to the growing significance of GCCs in meeting client demands and enhancing service delivery. The firms are recognizing the need for skilled talent to support their expanding operations, particularly in areas such as data analytics, cybersecurity, and digital transformation. This trend reflects the broader industry movement towards leveraging technology and skilled personnel to drive innovation and improve customer experiences, thereby solidifying the role of GCCs in the global business landscape.

The continued investment in GCCs is also driven by the competitive advantages offered by low-cost talent in India. As reported in September 2024, companies such as Accenture and Capgemini are increasingly betting on the Indian market due to its availability of highly skilled professionals at competitive wage levels. Factors contributing to the success of Bengaluru and Hyderabad as leading hubs for GCCs include the presence of educational institutions producing a steady stream of graduates, favorable regulatory environments, and robust infrastructure. These cities are not only attracting investments from large multinational corporations but are also witnessing the establishment of new GCCs, which underscores the growing recognition of India as a strategic location for global operations. The combination of skilled workforce availability, supportive government policies, and infrastructure development will likely continue to fuel the growth of GCCs in the region, reinforcing their role as pivotal players in the global outsourcing landscape.

Drivers:

Growing Adoption of Digital Transformation Strategies by Enterprises Fuels Expansion of Global Capability Centers Across Multiple Sectors

The digital transformation wave is reshaping how businesses operate, leading to increased reliance on Global Capability Centers (GCCs) for IT services, data analytics, and customer support. Organizations recognize that leveraging technology can enhance operational efficiency and drive innovation, prompting them to establish or expand their GCCs. As companies seek to remain competitive in rapidly changing markets, they are integrating digital solutions into their workflows. GCCs provide the necessary infrastructure and skilled talent to support these initiatives, enabling firms to access advanced technologies and expertise. This trend is particularly pronounced in sectors like finance, healthcare, and retail, where data-driven decision-making is paramount. As enterprises increasingly prioritize agility and adaptability, the demand for GCCs is expected to rise, driving market growth.

Rise in the Need for Cost-Effective Solutions in Business Operations Promotes Growth of Global Capability Centers Worldwide

Cost efficiency remains a critical focus for businesses aiming to improve profitability without sacrificing quality. By outsourcing various functions to Global Capability Centers, organizations can significantly reduce operational costs while maintaining high standards of service delivery. GCCs, particularly those located in regions with a skilled yet cost-effective workforce, provide an attractive solution for companies looking to optimize their operations. This trend is increasingly evident as organizations transition to remote work models and seek ways to enhance productivity while minimizing overhead costs. The ability to scale operations quickly and access specialized talent without incurring substantial expenses further propels the growth of GCCs. As companies navigate economic uncertainties, the emphasis on cost-effective solutions will continue to shape their operational strategies, making GCCs a key component of their business models.

Restraint:

Concerns Regarding Data Security and Compliance Hinder the Growth of Global Capability Centers in Sensitive Industries

While the advantages of outsourcing to Global Capability Centers are compelling, concerns surrounding data security and compliance are significant barriers for businesses, especially in sensitive industries such as finance and healthcare. Companies are increasingly aware of the potential risks associated with sharing sensitive information with third-party vendors, leading to hesitation in fully committing to GCCs. Regulatory requirements, such as GDPR in Europe or HIPAA in the United States, further complicate the outsourcing landscape, as organizations must ensure that their GCCs adhere to stringent compliance standards. Failure to meet these regulations can result in severe penalties, reputational damage, and loss of customer trust. As a result, businesses may be reluctant to fully leverage the capabilities of GCCs, opting instead to maintain in-house operations to safeguard sensitive data. This caution can stifle the potential for growth in the GCC market, limiting its overall expansion.

Opportunity:

Emerging Markets Present Lucrative Growth Opportunities for Global Capability Centers Seeking Expansion and Diversification

As businesses increasingly seek to diversify their operations and tap into new markets, emerging economies present a unique opportunity for the growth of Global Capability Centers. Countries in regions such as Southeast Asia, Eastern Europe, and Africa are becoming attractive destinations for companies looking to establish GCCs due to their growing skilled labor pools and competitive operating costs. These regions offer the potential for companies to access untapped talent and explore new customer bases, thereby driving innovation and enhancing service delivery. Additionally, governments in these regions are implementing favorable policies and incentives to attract foreign investment, further encouraging companies to consider GCCs in these markets. As organizations look to enhance their global footprint, the opportunity to establish GCCs in emerging markets can lead to significant competitive advantages, fostering growth and sustainability in the long run.

Challenge:

Intensifying Competition Among Global Capability Centers Requires Continuous Innovation and Differentiation Strategies for Sustained Success

The GCC landscape is becoming increasingly competitive as more companies recognize the advantages of outsourcing operations. As the market grows, existing centers must continually innovate and differentiate their offerings to retain clients and attract new business. The challenge lies in maintaining a competitive edge amidst this rising competition, which can lead to price wars and diminished profit margins. To overcome this hurdle, GCCs need to focus on enhancing their service quality, adopting advanced technologies, and providing specialized expertise that meets the evolving needs of their clients. Companies must invest in research and development to stay ahead of industry trends and address customer demands effectively. Furthermore, building strong relationships with clients and delivering exceptional customer service will be critical in establishing brand loyalty and ensuring long-term success in an increasingly saturated market.

|

Technological Innovation |

Impact on GCC Landscape |

Examples |

|---|---|---|

|

Automation & AI |

Streamlines operational processes, enhances efficiency, and reduces costs by automating repetitive tasks. |

Accenture utilizes AI-driven chatbots in customer support for quicker responses. |

|

Cloud Computing |

Provides flexibility and scalability, enabling remote work and real-time collaboration across global teams. |

Dell Technologies uses cloud-based solutions for global collaboration and data sharing. |

|

Data Analytics |

Empowers data-driven decision-making, optimizing processes and improving service quality through trend identification. |

Infosys implements analytics capabilities to enhance business intelligence. |

|

Cybersecurity Enhancements |

Protects sensitive data and ensures compliance against evolving threats, maintaining customer trust. |

IBM integrates advanced security measures to safeguard GCC operations. |

|

Collaboration Tools |

Facilitates communication and teamwork among geographically dispersed teams, enhancing productivity. |

Wipro employs various collaboration technologies to support remote work strategies. |

|

Internet of Things (IoT) |

Improves operational efficiency through real-time monitoring and data collection for informed decision-making. |

Manufacturing companies use IoT devices to monitor equipment performance and predict maintenance needs. |

By Service Model

In 2023, the Captive Center segment dominated the Outsourced Global Capability Centers market with a market share of 37.60%. Captive centers, where organizations set up their own facilities in offshore locations to manage operations internally, have become increasingly popular as companies look to maintain control over their processes while benefiting from lower operational costs. For instance, major firms like Accenture and Tata Consultancy Services have established captive centers in India to leverage the country's skilled workforce while ensuring adherence to their specific operational standards and practices. This model allows for better alignment with corporate culture and business objectives, making it a preferred choice for many enterprises aiming for strategic operational efficiency.

By Functionality

The IT Services segment dominated the Outsourced Global Capability Centers market in 2023 accounting for around 39.60% of the total market share. As organizations increasingly rely on technology to drive business outcomes, the demand for IT services provided by GCCs has surged. Companies such as IBM and Infosys have significantly expanded their GCCs to deliver software development, cloud services, and cybersecurity solutions. This focus on IT services is driven by the need for digital transformation across various sectors, as organizations strive to innovate and enhance customer experiences. The robust growth in IT service demand showcases the central role these capabilities play in enabling businesses to thrive in a technology-driven landscape.

By Organization Size

In 2023, the Large Enterprise segment dominated the Outsourced Global Capability Centers market with a market share of 64.70%. Large enterprises are increasingly adopting GCCs to optimize their vast operational needs and improve efficiency across multiple functions. For example, global giants like Microsoft and Amazon have established extensive GCCs that cater to various business functions, from customer support to IT development, capitalizing on the cost advantages offered by locations like India and the Philippines. These organizations benefit from scalability, access to a larger talent pool, and the ability to implement standardized processes across different geographical regions, solidifying their dominance in this segment.

By End-use Industry

The Healthcare & Pharmaceuticals segment dominated the Outsourced Global Capability Centers (GCC) market in 2023 with a market share of approximately 38.90%. This dominance can be attributed to the increasing demand for cost-effective solutions, enhanced operational efficiency, and improved patient care in the healthcare sector. As healthcare organizations seek to optimize their processes, many have turned to GCCs to handle various functions such as IT services, customer support, and regulatory compliance. For instance, major pharmaceutical companies like Pfizer and Johnson & Johnson have established GCCs to streamline their research and development processes, enabling them to accelerate drug discovery while reducing operational costs. Additionally, the rise of telehealth services and digital health technologies has driven the need for advanced analytics and customer support, further solidifying the healthcare sector's reliance on outsourced capabilities. As these trends continue to grow, the Healthcare & Pharmaceuticals segment is likely to maintain its leading position within the GCC market.

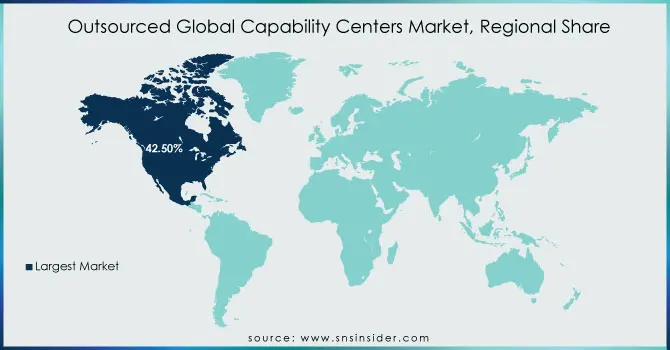

In 2023, North America dominated the Outsourced Global Capability Centers market, with a market share of 42.50%. This region's dominance is driven by the presence of numerous multinational corporations that leverage GCCs to optimize their operations and enhance service delivery. Companies like Microsoft and Amazon have established significant capabilities in countries such as India and the Philippines, utilizing these centers to manage IT services, customer support, and back-office functions. The strategic geographic positioning and time zone advantages of these offshore locations enable North American companies to operate efficiently and respond promptly to market demands. Furthermore, the need for cost-effective solutions while maintaining high-quality service levels has reinforced North America's leading position in the GCC market.

Moreover, in 2023, Asia-Pacific emerged as the fastest-growing region in the Outsourced Global Capability Centers market, with a CAGR of 18.21%. This rapid growth can be attributed to the increasing establishment of GCCs in countries like India, China, and the Philippines, which offer a large pool of skilled talent at competitive labor costs. For instance, companies such as Accenture and IBM are expanding their operations in these regions to capitalize on the availability of highly educated professionals proficient in IT and business processes. The region's favorable government policies and investment in infrastructure further enhance its attractiveness for global organizations seeking to establish GCCs. As more businesses recognize the potential for operational efficiency and cost savings, Asia-Pacific's growth trajectory is expected to continue on this upward trend.

Get Customized Report as per your Business Requirement - Request For Customized Report

Accenture (myConcerto, Accenture Cloud Platform, Accenture Applied Intelligence)

Capgemini (Capgemini Cloud Platform, Perform AI, Insights & Data)

Cognizant (TriZetto Healthcare Products, Cognizant Digital Systems & Technology, Cognizant Cloud Services)

Deloitte (Deloitte Analytics, ConvergeHEALTH, Greenhouse)

DXC Technology (DXC Bionix, DXC Platform X, DXC Cloud)

EY (Ernst & Young) (EY Intelligent Automation, EY Digital Audit, EY Nexus)

Genpact (Cora, Genpact Data-Tech AI, Genpact Risk & Compliance)

HCL Technologies (DRYiCE, HCL Software, Cloud Native Labs)

IBM (IBM Cloud, IBM Watson, IBM Blockchain)

Infosys (Infosys Cobalt, Infosys Finacle, Infosys NIA)

KPMG (KPMG Clara, KPMG Digital Gateway, KPMG Powered Enterprise)

L&T Infotech (Mosaic, Leni, L&T Infotech Cloud)

McKinsey & Company (Wave, QuantumBlack, McKinsey Digital)

NTT Data (Nucleus Intelligent Enterprise, NTT Data Cloud, NTT Data Business Solutions)

PwC (PricewaterhouseCoopers) (PwC Digital Fitness, PwC Perform, PwC Insights)

Sutherland Global Services (Sutherland Automation Anywhere, Sutherland Robility, Sutherland AI)

Tata Consultancy Services (TCS) (TCS BaNCS, TCS MasterCraft, TCS iON)

Tech Mahindra (TechM NXT.NOW, Tech Mahindra Mhealthy, Tech Mahindra NetOps.ai)

Wipro (Wipro HOLMES, Wipro Cloud Studio, Wipro BoundaryLess Enterprise)

Zensar Technologies (ZENCare, Zensar SmartWork, Zensar Digital Foundation)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 20.14 Billion |

| Market Size by 2032 | US$ 78.71 Billion |

| CAGR | CAGR of 14.79% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Service Model (Captive Center, Hybrid Model, Fully Outsourced Model, Build-Operate-Transfer (BOT), Joint Ventures, Offshore Dedicated Center (ODC), Others) •By Functionality (IT Services, Customer Support, Finance & Accounting, Human Resources, Marketing & Sales, Supply Chain Management, Others) •By Organization Size (Large Enterprise, Small & Medium Enterprise) •By End-use Industry (Technology & Communications, Financial Services, Healthcare & Pharmaceuticals, Retail & Consumer Goods, Automotive & Manufacturing, Energy & Utilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tata Consultancy Services (TCS), Infosys, Wipro, Accenture, Cognizant, IBM, Capgemini, HCL Technologies, Tech Mahindra, Genpact and other key players |

| Key Drivers | • Growing Adoption of Digital Transformation Strategies by Enterprises Fuels Expansion of Global Capability Centers Across Multiple Sectors • Rise in the Need for Cost-Effective Solutions in Business Operations Promotes Growth of Global Capability Centers Worldwide |

| RESTRAINTS | • Concerns Regarding Data Security and Compliance Hinder the Growth of Global Capability Centers in Sensitive Industries |

Ans: The Outsourced Global Capability Centers (GCCs) Market was valued at USD 20.14 billion in 2023.

Ans: The Outsourced Global Capability Centers (GCCs) Market is expected to reach USD 78.71 billion by 2032, growing at a CAGR of 14.79%.

Ans: Companies leverage the Outsourced Global Capability Centers (GCCs) Market to enhance operational efficiency and cost-effectiveness.

Ans: Data security and regulatory compliance concerns are key challenges in the Outsourced Global Capability Centers (GCCs) Market.

Ans: Large enterprises accounted for 64.70% of the Outsourced Global Capability Centers (GCCs) Market in 2023, leveraging GCCs for scalability and efficiency.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Industry-Wise Utilization of Outsourced Global Capability Centers

5.2 Cost-Benefit Analysis for Companies Using Outsourced Global Capability Centers

5.3 Innovation and R&D Investments by Leading Companies

5.4 Industry-Wise Utilization of Outsourced Global Capability Centers

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Outsourced Global Capability Centers Market Segmentation, by Service Model

7.1 Chapter Overview

7.2 Captive Center

7.2.1 Captive Center Market Trends Analysis (2020-2032)

7.2.2 Captive Center Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Hybrid Model

7.3.1 Hybrid Model Market Trends Analysis (2020-2032)

7.3.2 Hybrid Model Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Fully Outsourced Model

7.4.1 Fully Outsourced Model Market Trends Analysis (2020-2032)

7.4.2 Fully Outsourced Model Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Build-Operate-Transfer (BOT)

7.5.1 Build-Operate-Transfer (BOT) Market Trends Analysis (2020-2032)

7.5.2 Build-Operate-Transfer (BOT) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Joint Ventures

7.6.1 Joint Ventures Market Trends Analysis (2020-2032)

7.6.2 Joint Ventures Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Offshore Dedicated Center (ODC)

7.7.1 Offshore Dedicated Center (ODC) Market Trends Analysis (2020-2032)

7.7.2 Offshore Dedicated Center (ODC) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Others

7.8.1 Others Market Trends Analysis (2020-2032)

7.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Outsourced Global Capability Centers Market Segmentation, by Functionality

8.1 Chapter Overview

8.2 IT Services

8.2.1 IT Services Market Trends Analysis (2020-2032)

8.2.2 IT Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Customer Support

8.3.1 Customer Support Market Trends Analysis (2020-2032)

8.3.2 Customer Support Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Finance & Accounting

8.4.1 Finance & Accounting Market Trends Analysis (2020-2032)

8.4.2 Finance & Accounting Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Human Resources

8.5.1 Human Resources Market Trends Analysis (2020-2032)

8.5.2 Human Resources Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Marketing & Sales

8.6.1 Marketing & Sales Market Trends Analysis (2020-2032)

8.6.2 Marketing & Sales Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Supply Chain Management

8.7.1 Supply Chain Management Market Trends Analysis (2020-2032)

8.7.2 Supply Chain Management Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Outsourced Global Capability Centers Market Segmentation, by Organization Size

9.1 Chapter Overview

9.2 Large Enterprise

9.2.1 Large Enterprise Market Trends Analysis (2020-2032)

9.2.2 Large Enterprise Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Small & Medium Enterprise

9.3.1 Small & Medium Enterprise Market Trends Analysis (2020-2032)

9.3.2 Small & Medium Enterprise Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Outsourced Global Capability Centers Market Segmentation, by End-use Industry

10.1 Chapter Overview

10.2 Technology & Communications

10.2.1 Technology & Communications Market Trends Analysis (2020-2032)

10.2.2 Technology & Communications Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Financial Services

10.3.1 Financial Services Market Trends Analysis (2020-2032)

10.3.2 Financial Services Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Healthcare & Pharmaceuticals

10.4.1 Healthcare & Pharmaceuticals Market Trends Analysis (2020-2032)

10.4.2 Healthcare & Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Retail & Consumer Goods

10.5.1 Retail & Consumer Goods Market Trends Analysis (2020-2032)

10.5.2 Retail & Consumer Goods Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Automotive & Manufacturing

10.6.1 Automotive & Manufacturing Market Trends Analysis (2020-2032)

10.6.2 Automotive & Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Energy & Utilities

10.7.1 Energy & Utilities Market Trends Analysis (2020-2032)

10.7.2 Energy & Utilities Market Size Estimates and Forecasts to 2032 (USD Billion)

10.8 Others

10.8.1 Others Market Trends Analysis (2020-2032)

10.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Outsourced Global Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.2.4 North America Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.2.5 North America Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.6 North America Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.2.7.2 USA Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.2.7.3 USA Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.7.4 USA Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.2.8.2 Canada Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.2.8.3 Canada Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.8.4 Canada Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.2.9.2 Mexico Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.2.9.3 Mexico Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.9.4 Mexico Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.1.7.2 Poland Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.1.7.3 Poland Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.7.4 Poland Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.1.8.2 Romania Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.1.8.3 Romania Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.8.4 Romania Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.2.4 Western Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.2.5 Western Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.6 Western Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.2.7.2 Germany Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.2.7.3 Germany Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.7.4 Germany Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.2.8.2 France Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.2.8.3 France Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.8.4 France Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.2.9.2 UK Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.2.9.3 UK Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.9.4 UK Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.2.10.2 Italy Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.2.10.3 Italy Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.10.4 Italy Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.2.11.2 Spain Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.2.11.3 Spain Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.11.4 Spain Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.2.14.2 Austria Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.2.14.3 Austria Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.14.4 Austria Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Outsourced Global Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.4.4 Asia Pacific Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.4.5 Asia Pacific Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.6 Asia Pacific Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.4.7.2 China Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.4.7.3 China Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.7.4 China Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.4.8.2 India Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.4.8.3 India Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.8.4 India Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.4.9.2 Japan Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.4.9.3 Japan Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.9.4 Japan Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.4.10.2 South Korea Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.4.10.3 South Korea Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.10.4 South Korea Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.4.11.2 Vietnam Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.4.11.3 Vietnam Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.11.4 Vietnam Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.4.12.2 Singapore Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.4.12.3 Singapore Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.12.4 Singapore Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.4.13.2 Australia Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.4.13.3 Australia Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.13.4 Australia Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Outsourced Global Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.5.1.4 Middle East Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.5.1.5 Middle East Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.6 Middle East Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.5.1.7.2 UAE Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.5.1.7.3 UAE Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.7.4 UAE Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Outsourced Global Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.5.2.4 Africa Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.5.2.5 Africa Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.6 Africa Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Outsourced Global Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.6.4 Latin America Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.6.5 Latin America Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.6 Latin America Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.6.7.2 Brazil Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.6.7.3 Brazil Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.7.4 Brazil Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.6.8.2 Argentina Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.6.8.3 Argentina Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.8.4 Argentina Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.6.9.2 Colombia Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.6.9.3 Colombia Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.9.4 Colombia Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Outsourced Global Capability Centers Market Estimates and Forecasts, by Service Model (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Outsourced Global Capability Centers Market Estimates and Forecasts, by Functionality (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Outsourced Global Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Outsourced Global Capability Centers Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

12. Company Profiles

12.1 Tata Consultancy Services (TCS)

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Infosys

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Wipro

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Accenture

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Cognizant

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 IBM

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Capgemini

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 HCL Technologies

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Tech Mahindra

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Genpact

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Service Model

Captive Center

Hybrid Model

Fully Outsourced Model

Build-Operate-Transfer (BOT)

Joint Ventures

Offshore Dedicated Center (ODC)

Others

By Functionality

IT Services

Customer Support

Finance & Accounting

Human Resources

Marketing & Sales

Supply Chain Management

Others

By Organization Size

Large Enterprise

Small & Medium Enterprise

By End Use Industry

Technology & Communications

Financial Services

Healthcare & Pharmaceuticals

Retail & Consumer Goods

Automotive & Manufacturing

Energy & Utilities

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Enterprise Architecture Tools Market, valued at USD 1.11 billion in 2023 is expected to grow to USD 1.74 billion by 2032, at a CAGR of 5.1% over 2024-2032.

Wearable Technology Market was valued at USD 62.5 billion in 2023 and is expected to reach USD 198.8 billion by 2032, growing at a 13.73% CAGR over 2024-2032.

The Pipeline Safety Market was valued at USD 9.98 billion in 2023 and is expected to reach USD 22.57 billion by 2032, growing at a CAGR of 9.54% by 2032.

Drone Analytics Market was valued at USD 3.02 billion in 2023 and is expected to reach USD 26.41 billion by 2032, growing at a CAGR of 27.31% by 2032.

Carrier Aggregation Solutions Market was valued at USD 3.92 billion in 2023 and is expected to reach USD 17.77 billion by 2032, growing at a CAGR of 18.35% from 2024-2032.

The Customer Communication Management Market was valued at USD 1.7 Bn in 2023 and is expected to grow to USD 4.5 Bn by 2032, at a CAGR of 11.3% over 2024-2032.

Hi! Click one of our member below to chat on Phone