Get more information on Orthopedic Joint Replacement Market - Request Sample Report

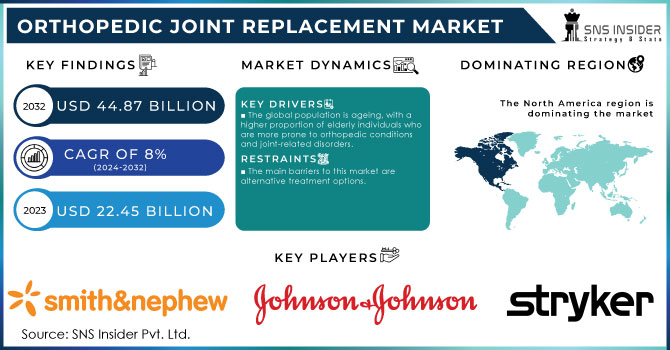

The Orthopedic Joint Replacement Market size was estimated at USD 22.45 billion in 2023 and is expected to reach USD 44.87billion by 2032 at a CAGR of 8% during the forecast period of 2024-2032.

The Orthopedic Joint Replacement Market refers to the market for medical devices and procedures used in orthopedic surgery to replace damaged or diseased joints, such as knees, hips, shoulders, and ankles. Joint replacement surgery is typically performed to relieve pain and improve mobility in patients with conditions like arthritis, joint degeneration, or joint trauma. The market encompasses a wide range of products, including implants, prosthetics, surgical instruments, and other related devices. These devices are designed to mimic the structure and function of natural joints, allowing patients to regain mobility and improve their quality of life.

The global orthopedic joint replacement market has experienced significant growth in recent years due to various factors, including an ageing population, increasing prevalence of orthopedic disorders, technological advancements in implant materials and surgical techniques, and rising patient awareness and demand for improved healthcare outcomes. It's important to note that market size and specific trends within the orthopedic joint replacement market can vary depending on factors like geographic region, type of joint replacement procedure, and regulatory environment. For the most up-to-date and detailed market information, consulting industry reports and market research studies specific to the desired region or segment are recommended.

Osteoarthritis is among the conditions that older citizens experience most often. Joint replacement is the most popular form of osteoarthritis treatment, which has increased patient acceptance of joint implants. There is a clearly rising elderly population as a result of hip fractures occurring more frequently in older people, which is aiding in the growth of the orthopaedic joint replacement industry. Technology developments, particularly in the area of extremities like the knees and hips, are increasing sales. For instance, Stryker Corporation introduced Mako Total Hip 4.0, a sophisticated robotic system, in 2020. The technology enables surgeons and medical professionals to plan a patient's implant placement while accounting for variations in pelvic tilt in the patient's standing, sitting, and supine positions. To enhance its market share in this industry, Smith+Nephew purchased Integra Lifesciences' extremities orthopaedic business in 2020.

Along with smaller, more niche producers, huge multinational corporations are important players in the orthopaedic joint replacement business. Along with Zimmer Biomet Holdings Inc., Stryker Corporation, Johnson & Johnson (DePuy Synthes), Smith & Nephew Plc, and Medtronic Plc., some significant businesses in this market.

DRIVERS:

Patients are becoming more and more aware of the advantages of joint replacement surgeries in terms of pain alleviation and enhanced quality of life. Patients are more inclined to choose joint replacement surgery and seek medical attention, which helps the industry expand.

RESTRAIN:

Although many people find joint replacement surgery to be a beneficial treatment option, other options include medication, physical therapy, lifestyle changes, and pain management approaches. Patients may decide against surgery depending on the severity of their ailment, which may influence the demand for joint replacement operations.

OPPORTUNITY:

Due to their benefits, such as smaller incisions, decreased post-operative discomfort, quicker healing, and shorter hospital stays, minimally invasive procedures for joint replacement surgeries have become more and more common. Since less intrusive procedures result in better patient outcomes and satisfaction, there is potential for market expansion.

CHALLENGES:

Although joint replacements have advanced over time, issues with implant lifetime and durability still exist. Implant deterioration over time can result in issues such as implant loosening, wear debris, and the requirement for revision procedures. For manufacturers, ensuring implant function and durability over the long term is a constant issue.

Following the start of Russia's invasion of Ukraine, the international community has intensified its response by imposing broad economic sanctions. As sanctions target both Russian banking transactions and the sale of high-tech items, the Russian market is becoming more and more cut off with every new step. Given humanitarian concerns, it is doubtful that medical technologies and gadgets would be widely targeted. Specific diagnostic and cutting-edge surgical equipment will undoubtedly be caught in export regulations pertaining to semiconductors, lasers, and other technologies. Medical equipment exports to Russia that are permitted by sanctions will continue but against stronger economic forces.

$875 million, or 1.8% of the anticipated worldwide market size for that market sector, will be accounted for by the Russian orthopaedic device market in 2023. The company Zimmer Biomet Holdings, Inc. is the market leader with an estimated 18% market share for orthopaedic devices. Although it is still too early to define upper and lower limitations with certainty, the pattern indicates that device revenue will significantly fall for the Russian market.

IMPACT OF ONGOING RECESSION

Doctors and hospitals are saying that as the recession worsens, financially strapped patients are postponing elective surgeries like knee replacements and nose jobs while others are hastening non-urgent ones out of concern that they could soon lose their jobs and health insurance. There is significant regional and surgical variance with unemployment continuing to grow. Because of this, renowned orthopaedic surgeons in Chicago may be busier than ever, but gastroenterologists in Atlanta are frantically trying to fill openings. Even still, doctors whose operating rooms are already fully booked think a downturn is coming later this year. Johnson & Johnson's sales from orthopaedics fell by 12.6% to around $8.1 billion. Organic net sales at Stryker Orthopaedics fell by 8.3% last year, with unit volume falling by 6.8% and prices falling by 1.8%. With regard to its orthopaedics and sports medicine division, Smith and Nephew reported a 12% sales decline.

By Anatomy

Shoulder

Ankle

Knee

Hip

Others

By Procedure

Partial Replacement

Total Replacement

By Appication

Ambulatory Centers

Hospitals

Clinics

Other

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

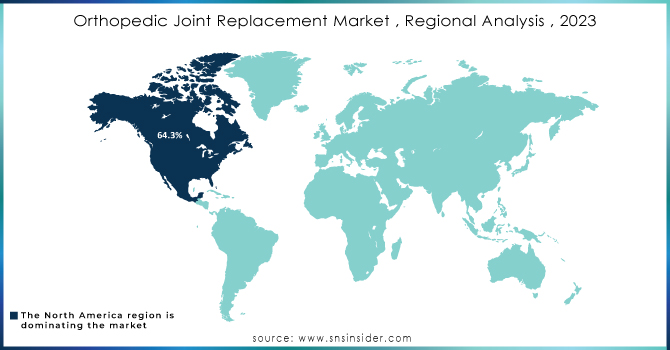

REGIONAL ANALYSIS

North America: With a revenue share of more than 64.3% in 2023, North America dominated the joint replacement market. The demand for joint replacements in North America is anticipated to rise as a result of causes like the incidence of osteoarthritis, the elderly population, the availability of insurance coverage, or a number of trauma & accident cases. For example, the American Joint Replacement Registry (AJRR) reports that around 1.8 million hip and knee arthroplasty procedures were documented in the registry in 2020. As a result, this promotes the market for joint replacements to grow. The market for joint replacement is projected to develop in the area as a result of the rising frequency of orthopaedic illnesses and the quick uptake of novel products.

Asia Pacific: The market for joint replacement is predicted to develop at the quickest rate in Asia Pacific during the forecast period because of increased healthcare spending, rapidly changing healthcare infrastructure, and expanding medical tourism in the area. According to The Asian Federation of Osteoporosis Societies (AFOS), there were 1.5 million hip fractures overall in 2020 and 3.1 million are anticipated by 2050. It is anticipated that additional factors, such as the ageing population, rising healthcare spending in developing Asian economies, & an increase in the prevalence of osteoarthritis, osteoporosis, bone injuries, diabetes, and obesity, will have an impact on the joint replacement market over the coming years.

Do You Need any Customization Research on Orthopedic Joint Replacement Market - Enquire Now

Some major players in Orthopedic Joint Replacement Market are Stryker, Johnson & Johnson Private Limited, Zimmer Biomet, Arthrex, Inc, Smith+Nephew, Corin Group, Exactech, Inc, Beijing Chunlizhengda Medical Instruments Co., Ltd, DJO LLC, B. Braun Melsungen AG and other players.

Stryker: In 2021, Mako Total Hip 4.0 has been made available by Stryker for robotic hip replacement procedures. Based on the patient's sitting, standing, and supine positions, the new software will assist the doctor in planning the patient's hip implant location.

Globus Medical: In 2020, To diversify its product line, Globus Medical purchased StelKast, a renowned producer of knee and hip implants.

| Report Attributes | Details |

| Market Size in 2023 | US$ 22.45 Bn |

| Market Size by 2032 | US$ 44.87 Bn |

| CAGR | CAGR of 8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Anatomy (Shoulder, Ankle, Knee, Hip, Others) • By Procedure (Partial Replacement, Total Replacement) • By Application (Ambulatory Centers, Hospitals, Clinics, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Stryker, Johnson & Johnson Private Limited, Zimmer Biomet, Arthrex, Inc, Smith+Nephew, Corin Group, Exactech, Inc, Beijing Chunlizhengda Medical Instruments Co., Ltd, DJO LLC, B. Braun Melsungen AG |

| Key Drivers | • The global population is ageing, with a higher proportion of elderly individuals who are more prone to orthopedic conditions and joint-related disorders. • Increasing Patient Awareness and Demand are the main drivers of this market. |

| Market Restraints | • Joint replacement surgeries and associated implants can be expensive, including the cost of preoperative assessments, surgical procedures, hospital stays, post-operative rehabilitation, and follow-up care. • The main barriers to this market are alternative treatment options. |

Ans: The market for orthopedic joint replacements is anticipated to expand at a CAGR of 8%.

Ans: The market for Orthopedic Joint Replacement was worth USD 22.45 Billion in 2023 and is expected to increase to USD 44.87 Billion by 2032.

Ans: An increase in the incidence of orthopaedic diseases, osteoporosis, osteoarthritis (OA), and ailments affecting the lower extremities is driving the market for joint replacement.

Ans: The projection period for the Orthopedic Joint Replacement market is 2022 to 2030.

Ans: In terms of market share, North America dominated in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Orthopedic Joint Replacement Market Segmentation, By Anatomy

8.1 Shoulder

8.2 Ankle

8.3 Knee

8.4 Hip

8.5 Others

9. Orthopedic Joint Replacement Market Segmentation, By Procedure

9.1 Partial Replacement

9.2 Total Replacement

10. Orthopedic Joint Replacement Market Segmentation, By Application

10.1 Ambulatory Centers

10.2 Hospitals

10.3 Clinics

10.4 Other

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Orthopedic Joint Replacement Market by Country

11.2.2 North America Orthopedic Joint Replacement Market by Anatomy

11.2.3 North America Orthopedic Joint Replacement Market by Procedure

11.2.4 North America Orthopedic Joint Replacement Market by Application

11.2.5 USA

11.2.5.1 USA Orthopedic Joint Replacement Market by Anatomy

11.2.5.2 USA Orthopedic Joint Replacement Market by Procedure

11.2.5.3 USA Orthopedic Joint Replacement Market by Application

11.2.6 Canada

11.2.6.1 Canada Orthopedic Joint Replacement Market by Anatomy

11.2.6.2 Canada Orthopedic Joint Replacement Market by Procedure

11.2.6.3 Canada Orthopedic Joint Replacement Market by Application

11.2.7 Mexico

11.2.7.1 Mexico Orthopedic Joint Replacement Market by Anatomy

11.2.7.2 Mexico Orthopedic Joint Replacement Market by Procedure

11.2.7.3 Mexico Orthopedic Joint Replacement Market by Application

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Orthopedic Joint Replacement Market by Country

11.3.1.2 Eastern Europe Orthopedic Joint Replacement Market by Anatomy

11.3.1.3 Eastern Europe Orthopedic Joint Replacement Market by Procedure

11.3.1.4 Eastern Europe Orthopedic Joint Replacement Market by Application

11.3.1.5 Poland

11.3.1.5.1 Poland Orthopedic Joint Replacement Market by Anatomy

11.3.1.5.2 Poland Orthopedic Joint Replacement Market by Procedure

11.3.1.5.3 Poland Orthopedic Joint Replacement Market by Application

11.3.1.6 Romania

11.3.1.6.1 Romania Orthopedic Joint Replacement Market by Anatomy

11.3.1.6.2 Romania Orthopedic Joint Replacement Market by Procedure

11.3.1.6.4 Romania Orthopedic Joint Replacement Market by Application

11.3.1.7 Turkey

11.3.1.7.1 Turkey Orthopedic Joint Replacement Market by Anatomy

11.3.1.7.2 Turkey Orthopedic Joint Replacement Market by Procedure

11.3.1.7.3 Turkey Orthopedic Joint Replacement Market by Application

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Orthopedic Joint Replacement Market by Anatomy

11.3.1.8.2 Rest of Eastern Europe Orthopedic Joint Replacement Market by Procedure

11.3.1.8.3 Rest of Eastern Europe Orthopedic Joint Replacement Market by Application

11.3.2 Western Europe

11.3.2.1 Western Europe Orthopedic Joint Replacement Market by Country

11.3.2.2 Western Europe Orthopedic Joint Replacement Market by Anatomy

11.3.2.3 Western Europe Orthopedic Joint Replacement Market by Procedure

11.3.2.4 Western Europe Orthopedic Joint Replacement Market by Application

11.3.2.5 Germany

11.3.2.5.1 Germany Orthopedic Joint Replacement Market by Anatomy

11.3.2.5.2 Germany Orthopedic Joint Replacement Market by Procedure

11.3.2.5.3 Germany Orthopedic Joint Replacement Market by Application

11.3.2.6 France

11.3.2.6.1 France Orthopedic Joint Replacement Market by Anatomy

11.3.2.6.2 France Orthopedic Joint Replacement Market by Procedure

11.3.2.6.3 France Orthopedic Joint Replacement Market by Application

11.3.2.7 UK

11.3.2.7.1 UK Orthopedic Joint Replacement Market by Anatomy

11.3.2.7.2 UK Orthopedic Joint Replacement Market by Procedure

11.3.2.7.3 UK Orthopedic Joint Replacement Market by Application

11.3.2.8 Italy

11.3.2.8.1 Italy Orthopedic Joint Replacement Market by Anatomy

11.3.2.8.2 Italy Orthopedic Joint Replacement Market by Procedure

11.3.2.8.3 Italy Orthopedic Joint Replacement Market by Application

11.3.2.9 Spain

11.3.2.9.1 Spain Orthopedic Joint Replacement Market by Anatomy

11.3.2.9.2 Spain Orthopedic Joint Replacement Market by Procedure

11.3.2.9.3 Spain Orthopedic Joint Replacement Market by Application

11.3.2.10 Netherlands

11.3.2.10.1 Netherlands Orthopedic Joint Replacement Market by Anatomy

11.3.2.10.2 Netherlands Orthopedic Joint Replacement Market by Procedure

11.3.2.10.3 Netherlands Orthopedic Joint Replacement Market by Application

11.3.2.11 Switzerland

11.3.2.11.1 Switzerland Orthopedic Joint Replacement Market by Anatomy

11.3.2.11.2 Switzerland Orthopedic Joint Replacement Market by Procedure

11.3.2.11.3 Switzerland Orthopedic Joint Replacement Market by Application

11.3.2.1.12 Austria

11.3.2.12.1 Austria Orthopedic Joint Replacement Market by Anatomy

11.3.2.12.2 Austria Orthopedic Joint Replacement Market by Procedure

11.3.2.12.3 Austria Orthopedic Joint Replacement Market by Application

11.3.2.13 Rest of Western Europe

11.3.2.13.1 Rest of Western Europe Orthopedic Joint Replacement Market by Anatomy

11.3.2.13.2 Rest of Western Europe Orthopedic Joint Replacement Market by Procedure

11.3.2.13.3 Rest of Western Europe Orthopedic Joint Replacement Market by Application

11.4 Asia-Pacific

11.4.1 Asia-Pacific Orthopedic Joint Replacement Market by Country

11.4.2 Asia-Pacific Orthopedic Joint Replacement Market by Anatomy

11.4.3 Asia-Pacific Orthopedic Joint Replacement Market by Procedure

11.4.4 Asia-Pacific Orthopedic Joint Replacement Market by Application

11.4.5 China

11.4.5.1 China Orthopedic Joint Replacement Market by Anatomy

11.4.5.2 China Orthopedic Joint Replacement Market by Application

11.4.5.3 China Orthopedic Joint Replacement Market by Procedure

11.4.6 India

11.4.6.1 India Orthopedic Joint Replacement Market by Anatomy

11.4.6.2 India Orthopedic Joint Replacement Market by Procedure

11.4.6.3 India Orthopedic Joint Replacement Market by Application

11.4.7 japan

11.4.7.1 Japan Orthopedic Joint Replacement Market by Anatomy

11.4.7.2 Japan Orthopedic Joint Replacement Market by Procedure

11.4.7.3 Japan Orthopedic Joint Replacement Market by Application

11.4.8 South Korea

11.4.8.1 South Korea Orthopedic Joint Replacement Market by Anatomy

11.4.8.2 South Korea Orthopedic Joint Replacement Market by Procedure

11.4.8.3 South Korea Orthopedic Joint Replacement Market by Application

11.4.9 Vietnam

11.4.9.1 Vietnam Orthopedic Joint Replacement Market by Anatomy

11.4.9.2 Vietnam Orthopedic Joint Replacement Market by Procedure

11.4.9.3 Vietnam Orthopedic Joint Replacement Market by Application

11.4.10 Singapore

11.4.10.1 Singapore Orthopedic Joint Replacement Market by Anatomy

11.4.10.2 Singapore Orthopedic Joint Replacement Market by Procedure

11.4.10.3 Singapore Orthopedic Joint Replacement Market by Application

11.4.11 Australia

11.4.11.1 Australia Orthopedic Joint Replacement Market by Anatomy

11.4.11.2 Australia Orthopedic Joint Replacement Market by Procedure

11.4.11.3 Australia Orthopedic Joint Replacement Market by Application

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Orthopedic Joint Replacement Market by Anatomy

11.4.12.2 Rest of Asia-Pacific Orthopedic Joint Replacement Market by Procedure

11.4.12.3 Rest of Asia-Pacific Orthopedic Joint Replacement Market by Application

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Orthopedic Joint Replacement Market by Country

11.5.1.2 Middle East Orthopedic Joint Replacement Market by Anatomy

11.5.1.3 Middle East Orthopedic Joint Replacement Market by Procedure

11.5.1.4 Middle East Orthopedic Joint Replacement Market by Application

11.5.1.5 UAE

11.5.1.5.1 UAE Orthopedic Joint Replacement Market by Anatomy

11.5.1.5.2 UAE Orthopedic Joint Replacement Market by Procedure

11.5.1.5.3 UAE Orthopedic Joint Replacement Market by Application

11.5.1.6 Egypt

11.5.1.6.1 Egypt Orthopedic Joint Replacement Market by Anatomy

11.5.1.6.2 Egypt Orthopedic Joint Replacement Market by Procedure

11.5.1.6.3 Egypt Orthopedic Joint Replacement Market by Application

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Orthopedic Joint Replacement Market by Anatomy

11.5.1.7.2 Saudi Arabia Orthopedic Joint Replacement Market by Procedure

11.5.1.7.3 Saudi Arabia Orthopedic Joint Replacement Market by Application

11.5.1.8 Qatar

11.5.1.8.1 Qatar Orthopedic Joint Replacement Market by Anatomy

11.5.1.8.2 Qatar Orthopedic Joint Replacement Market by Procedure

11.5.1.8.3 Qatar Orthopedic Joint Replacement Market by Application

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Orthopedic Joint Replacement Market by Anatomy

11.5.1.9.2 Rest of Middle East Orthopedic Joint Replacement Market by Procedure

11.5.1.9.3 Rest of Middle East Orthopedic Joint Replacement Market by Application

11.5.2 Africa

11.5.2.1 Africa Orthopedic Joint Replacement Market by Country

11.5.2.2 Africa Orthopedic Joint Replacement Market by Anatomy

11.5.2.3 Africa Orthopedic Joint Replacement Market by Procedure

11.5.2.4 Africa Orthopedic Joint Replacement Market by Application

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Orthopedic Joint Replacement Market by Anatomy

11.5.2.5.2 Nigeria Orthopedic Joint Replacement Market by Procedure

11.5.2.5.3 Nigeria Orthopedic Joint Replacement Market by Application

11.5.2.6 South Africa

11.5.2.6.1 South Africa Orthopedic Joint Replacement Market by Anatomy

11.5.2.6.2 South Africa Orthopedic Joint Replacement Market by Procedure

11.5.2.6.3 South Africa Orthopedic Joint Replacement Market by Application

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Orthopedic Joint Replacement Market by Anatomy

11.5.2.7.2 Rest of Africa Orthopedic Joint Replacement Market by Procedure

11.5.2.7.3 Rest of Africa Orthopedic Joint Replacement Market by Application

11.6 Latin America

11.6.1 Latin America Orthopedic Joint Replacement Market by Country

11.6.2 Latin America Orthopedic Joint Replacement Market by Anatomy

11.6.3 Latin America Orthopedic Joint Replacement Market by Procedure

11.6.4 Latin America Orthopedic Joint Replacement Market by Application

11.6.5 Brazil

11.6.5.1 Brazil America Orthopedic Joint Replacement Market by Anatomy

11.6.5.2 Brazil America Orthopedic Joint Replacement Market by Procedure

11.6.5.3 Brazil America Orthopedic Joint Replacement Market by Application

11.6.6 Argentina

11.6.6.1 Argentina America Orthopedic Joint Replacement Market by Anatomy

11.6.6.2 Argentina America Orthopedic Joint Replacement Market by Procedure

11.6.6.3 Argentina America Orthopedic Joint Replacement Market by Application

11.6.7 Colombia

11.6.7.1 Colombia America Orthopedic Joint Replacement Market by Anatomy

11.6.7.2 Colombia America Orthopedic Joint Replacement Market by Procedure

11.6.8.3Colombia America Orthopedic Joint Replacement Market by Application

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Orthopedic Joint Replacement Market by Anatomy

11.6.8.2 Rest of Latin America Orthopedic Joint Replacement Market by Procedure

11.6.8.3 Rest of Latin America Orthopedic Joint Replacement Market by Application

12. Company profile

12.1 Stryker

12.1.1 Company Overview

12.1.2 Financials

12.1.3 Product/Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Johnson & Johnson Private Limited

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Zimmer Biomet

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Arthrex, Inc

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Smith+Nephew

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Corin Group

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Exactech, Inc

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 Beijing Chunlizhengda Medical Instruments Co.Ltd

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Product/Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 DJO LLC

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 B. Braun Melsungen AG

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Long Read Sequencing Market was valued at USD 595.91 million in 2023 and is expected to reach USD 6977.05 million by 2032, growing at a CAGR of 31.53% from 2024-2032.

The Teleradiology Services Market was valued at USD 24.0 billion in 2023 and is projected to reach USD 29.1 billion by 2032, growing at a CAGR of 2.18%.

The Surgical Tables Market size was estimated at USD 1.47 billion in 2023 and is expected to reach USD 2.39 billion by 2032 at a CAGR of 5.56%.

The Immuno-oncology Clinical Trials Market was valued at USD 8.30 billion in 2023 and is expected to reach USD 23.63 billion by 2032, growing at a CAGR of 12.37% from 2024-2032.

The Research Antibodies Market Size was valued at USD 1.4 billion in 2023 and expected to reach USD 2.3 billion by 2032 and grow at a CAGR of 5.5%.

The Diabetic Nephropathy Market size was valued at USD 2.33 Billion in 2023 and is expected to reach USD 3.72 Billion By 2031 and grow at a CAGR of 6.04% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone