Orthopedic Devices Market Report Scope & Overview:

Get More Information on Orthopedic Devices Market - Request Sample Report

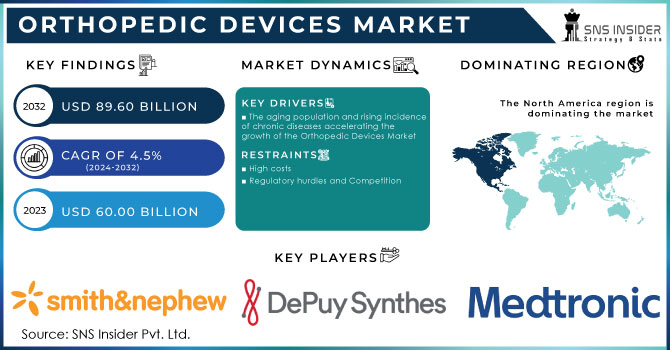

The Orthopedic Devices Market size was USD 60.00 Billion in 2023 and is expected to reach USD 89.60 Billion by 2032 and grow at a CAGR of 4.5% over the forecast period of 2024-2032.

The orthopedic devices market has had significant growth in recent years, driven by factors such as an aging population, increasing incidence of chronic diseases, and advancements in surgical techniques. The market is characterized by a complex interplay of demand and supply factors, influenced by government regulations, technological innovations, and economic conditions.

The orthopedic devices market is driven by various factors, including a high incidence of orthopedic disorders, a growing aging population, an increasing prevalence of degenerative bone diseases, and a rising number of road accidents. Additionally, the early onset of musculoskeletal disorders due to sedentary lifestyles and obesity is expected to fuel market growth. According to the Lancet Rheumatology, the number of people with musculoskeletal disorders has surged by 123.4% since 1990 and is expected to grow by another 115% by 2050.

Demand for orthopedic devices has been steadily rising, primarily due to the growing prevalence of musculoskeletal disorders like arthritis, osteoporosis, and sports-related injuries. Aging populations in developed and developing countries have contributed significantly to this surge in demand. Additionally, advancements in surgical techniques and the introduction of minimally invasive procedures have led to increased utilization of orthopedic devices. According to Johns Hopkins Medicine, sports injuries affect over 3.5 million people annually. The aging population is a key driver of market growth for orthopedic devices. As people get older, their bones naturally become weaker due to bone loss, which accelerates after the age of 55. This trend is exacerbated by the significant increase in the number of individuals aged 60 and older. By 2030, it's projected that one in six people worldwide will be in this age group, and by 2050, this figure is expected to double to 2.1 billion.

The market is being positively influenced by the availability of advanced orthopedic devices, rapid development in healthcare infrastructure globally, and increasing awareness and availability of minimally invasive surgical techniques. Additionally, the rising number of people participating in sports and physical activities, leading to an increase in sports-related injuries, is expected to further drive market growth. As per the American Academy of Pediatrics and the National SAFE KIDS Campaign, over 3.5 million children aged 14 and under suffer injuries annually while playing sports or engaging in recreational activities, with more than 775,000 children in the same age group being treated in emergency rooms for sports-related injuries annually.

Regulatory bodies such as the Food and Drug Administration (FDA) in the United States and the European Medicines Agency (EMA) in Europe impose stringent requirements on the safety and efficacy of orthopedic devices. Robotics are also revolutionizing orthopedic surgery by providing precise, personalized treatment plans. This is evident in the growing popularity of robotic-assisted procedures like Mako robotic arm surgery, which is performed on approximately 13,000 patients worldwide each month according to Stryker UK Limited.

Recent news highlights the dynamic nature of the orthopedic devices market. For instance, major players in the market such as Zimmer Biomet, Johnson & Johnson, Stryker, and Smith+Nephew, have recently announced the launch of a new, innovative hip replacement implant. This product is expected to revolutionize joint replacement surgery and drive market growth. Moreover, there have been advancements in additive manufacturing technologies, which are being explored for the production of customized orthopedic implants. The growing adoption of advanced technologies, like UV light-treated dental implants, contributes to the growth of the orthopedic industry.

MARKET DYNAMICS

Market Drivers

-

The aging population and rising incidence of chronic diseases accelerating the growth of the Orthopedic Devices Market

The orthopedic devices market is witnessing robust growth, driven by several critical factors. One of the most significant contributors is the aging global population, which is increasingly susceptible to musculoskeletal disorders. As the number of elderly individuals rises, so does the prevalence of conditions such as arthritis and osteoporosis, creating a greater demand for orthopedic interventions and devices.

In addition to the aging population, the rising incidence of chronic diseases plays a crucial role in market expansion. Conditions like arthritis and osteoporosis are becoming more widespread, particularly in developed nations, leading to an increased need for effective orthopedic solutions. This growing demand is further supported by advancements in surgical techniques. Minimally invasive surgeries and robotic-assisted procedures have revolutionized the field of orthopedics, offering improved patient outcomes and faster recovery times. These innovations have significantly boosted the adoption of orthopedic devices, as they allow for more precise and less invasive interventions.

Technological innovations are also a key driver of market growth. Advances in materials science and device design have led to the development of more effective and durable orthopedic products. These innovations not only enhance the functionality of the devices but also improve patient comfort and reduce the likelihood of complications. As a result, both patients and healthcare providers are increasingly opting for these advanced orthopedic solutions.

Moreover, the market is benefiting from rising healthcare spending across many countries. Increased investment in healthcare infrastructure and services is creating a favorable environment for the growth of the orthopedic devices market. As governments and private entities continue to allocate more resources to healthcare, the availability and adoption of orthopedic devices are expected to rise, further propelling market expansion.

Market Restraints

-

High costs

The cost of orthopedic devices can be prohibitive for many patients, limiting market penetration.

-

Regulatory hurdles and Competition

Obtaining regulatory approvals for new products can be time-consuming and expensive as well as the intense competition among market players can lead to price pressures and margin erosion.

KEY MARKET SEGMENTATION

By Product type

Joint replacements, particularly hip and knee replacements, dominate the market with a 32.99% share due to the high prevalence of osteoarthritis and other degenerative joint diseases. However, there is growing interest in shoulder replacements, driven by advancements in surgical techniques and the increasing demand for active lifestyles. Spinal implants are another major segment, with a focus on minimally invasive procedures and fusion devices. Trauma and fracture devices cater to acute injuries, while sports medicine devices address the needs of athletes and active individuals. Arthroscopy devices are used for minimally invasive surgical procedures, gaining popularity due to their benefits in terms of reduced recovery time and improved patient outcomes.

By Material

In the medical device market, implant materials play a crucial role in determining the success and longevity of various surgical procedures. Traditionally, metal implants, such as titanium and stainless steel, have held a dominant position, accounting for approximately 44.09% of the market share. Their strength, durability, and biocompatibility have made them a reliable choice for a wide range of applications.

However, recent years have witnessed a growing trend towards alternative materials that offer specific advantages. Polymers like PEEK (Polyetheretherketone) and UHMWPE (Ultra-High Molecular Weight Polyethylene) are gaining popularity due to their biocompatibility, reduced wear, and flexibility. These materials have shown promise in applications such as spinal implants and joint replacements. Ceramics, particularly zirconium oxide, are also making significant strides, especially in hip and knee replacements. Their low friction and wear properties make them attractive options for long-term durability and patient comfort.

By End-user

Hospitals continue to be the dominant end-users of medical devices, accounting for 66.09% of the market share. This is primarily due to the wide range of complex procedures and specialized care that hospitals can provide. However, there is a noticeable shift towards outpatient procedures, with ambulatory surgery centers (ASCs) experiencing a steady increase in demand. ASCs offer a more cost-effective and convenient alternative for many patients, especially for those undergoing minor surgeries or routine procedures.

In addition to hospitals and ASCs, clinics and rehabilitation centers also contribute to the medical device market. Clinics cater to a variety of medical needs, from primary care to specialized treatments. Rehabilitation centers focus on providing specialized therapies and equipment to help patients recover from injuries, illnesses, or surgeries. These end-users play a vital role in the market by driving demand for specific types of medical devices tailored to their respective areas of expertise.

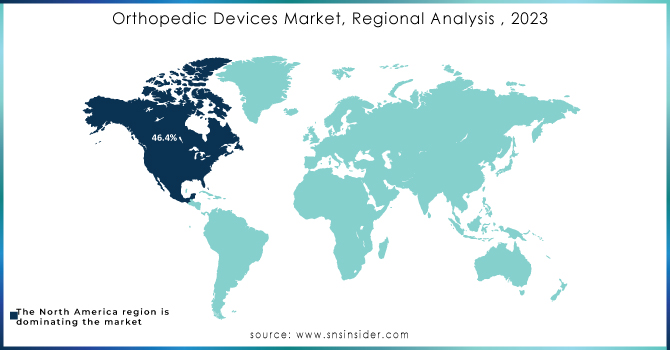

REGIONAL ANALYSIS

North America dominated the market with a 46.4% revenue share in 2023. The United States and Canada are major markets, driven by factors such as a large aging population and well-developed healthcare infrastructure. Europe is expected to be the fastest-growing region of the market due to the European market is characterized by a mix of developed and emerging economies, with Germany, France, and the United Kingdom being key players. Asia-Pacific region is experiencing rapid growth, fueled by increasing healthcare spending, rising disposable incomes, and a growing middle class. China and India are particularly attractive markets. While the Latin American market is smaller than North America and Europe, it shows steady growth, driven by economic development and improved healthcare access.

Get More Information on Orthopedic Devices Market - Enquiry Now

Key Players

Some major players in Orthopedic Devices Market are DePuySynthes, Medacta, Medtronic, Smith & Nephew, Stryker, MicroPort Scientific Corporation, Zimmer Biomet, ConforMIS, DJO Global, NuVasive, and other players

RECENT DEVELOPMENTS

-

In July 2024, ZSFab made history by becoming the first company to implant its 3D-printed lumbar interbody system in a U.S. patient.

-

In April 2024, Zimmer Biomet Holdings launched the Persona IQ Knee System in Europe. This is a smart knee implant that combines Zimmer Biomet’s traditional knee replacement technology with smart sensor technology for real-time data collection post-surgery.

-

In May 2024: Stryker Corporation announced the acquisition of Orthopaedic Innovations, a company specializing in advanced surgical tools for joint replacement procedures. This acquisition is expected to enhance Stryker's portfolio in minimally invasive orthopedic surgery.

-

In June 2024: Smith & Nephew introduced a new generation of the Legion Revision Knee System designed to provide greater flexibility and stability in complex knee revision surgeries. The system features enhanced materials and design for longer-lasting outcomes.

-

In July 2024: DePuy Synthes, a Johnson & Johnson company, received FDA clearance for its Velys Robotic-Assisted Solution for hip replacement surgery, expanding its robotic technology applications beyond knee surgeries.

-

In August 2024: Medtronic announced a collaboration with Mako Surgical to integrate their spinal surgery solutions with Mako’s robotic-arm-assisted technology, aiming to improve precision in spinal implant procedures.

-

In September 2024: Conformis, Inc. unveiled its new Conformis Hip System, which uses 3D printing technology to create patient-specific hip implants, promising improved fit and reduced recovery times for patients undergoing hip replacement surgery.

| Report Attributes | Details |

| Market Size in 2023 | US$ 60.00 Bn |

| Market Size by 2032 | US$ 89.60 Bn |

| CAGR | CAGR of 4.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type [Joint replacements (hip, knee, shoulder), Spinal implants, Trauma and fracture devices, Sports medicine devices, Arthroscopy devices] • By Material [Metal (titanium, stainless steel), Polymers (PEEK, UHMWPE), Ceramics (alumina, zirconia)] • By End-user [Hospitals, Ambulatory surgery centers, Clinics, Rehabilitation centers] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | DePuySynthes, Medacta, Medtronic, Smith & Nephew, Stryker, MicroPort Scientific Corporation, Zimmer Biomet, ConforMIS, DJO Global, NuVasive |

| Key Drivers | • The aging population and rising incidence of chronic diseases accelerating the growth of the Orthopedic Devices Market |

| Market Restraints | • High costs • Regulatory hurdles and Competition |