Orthobiologics Market Report Scope & Overview:

To Get More Information on Orthobiologics Market - Request Sample Report

The orthobiologics market size was USD 6.46 Billion in 2023 and is expected to reach USD 10.55 Billion by 2032 and grow at a CAGR of 5.60% over the forecast period of 2024-2032. The report includes the prevalence of musculoskeletal disorders, with osteoarthritis affecting over 500 million people globally. It covers market adoption rates of bone graft substitutes, Visco supplements, and stem cell therapies, highlighting their increasing demand due to minimally invasive procedures. The report examines healthcare expenditure trends, showing a rise in orthopedic treatment costs and insurance reimbursement patterns across key regions. It also presents clinical trial data and R&D investments, showcasing innovation in biologic implants and regenerative medicine advancements. Furthermore, the report includes geographic distribution and accessibility trends, emphasizing disparities in treatment availability and market penetration in emerging economies.

The US held the largest market share 76% in 202. This is owing to the presence of a higher number of musculoskeletal disorders, Infrastructure, and favorable reimbursement policies in the United States. This necessitates the need for orthobiologic treatments such as bone graft substitutes. In addition, the USA is ahead in terms of clinical research and FDA approvals, rapidly pushing these novel regenerative therapies (i.e. Stem Cell and platelet-rich plasma (PRP) therapies) into practice. Moreover, the availability of advanced technology with the accessibility of prominent market players like Medtronic and Stryker will aid in providing product options. The U.S. market also benefits from favorable insurance coverage for orthopedic procedures and an increasing aging population, establishing it as a favorable center for orthobiologics.

Rising prevalence of musculoskeletal disorders and sports injuries accelerates orthobiologics market growth.

The increasing incidence of musculoskeletal disorders, osteoarthritis, and sports-related injuries is a key driver of the Orthobiologics Market. According to the World Health Organization (WHO), musculoskeletal disorders affect approximately 1.71 billion people globally, with osteoarthritis being the most common condition. The rising aging population, particularly in developed countries like the U.S., Japan, and Germany, is further fueling the demand for bone graft substitutes, platelet-rich plasma (PRP) therapy, and stem cell treatments. Additionally, the increasing participation in sports and physical activities has led to a surge in ligament and tendon injuries, driving the adoption of orthobiologic solutions for faster recovery. The demand for minimally invasive procedures has also contributed to market expansion, as orthobiologics offer quicker healing, reduced hospital stays, and improved patient outcomes. Furthermore, advancements in tissue engineering and regenerative medicine have enhanced the effectiveness of orthobiologic products, making them a preferred choice among healthcare professionals. Government initiatives supporting biologic research and increasing FDA approvals for innovative therapies are expected to further propel market growth. With orthopedic injuries and degenerative joint diseases on the rise, the Orthobiologics Market is set for substantial expansion in the coming years.

High costs of orthobiologic treatments and limited insurance coverage restrains market growth.

Despite the promising growth of the Orthobiologics Market, the high cost of orthobiologic treatments and limited insurance coverage pose significant challenges to widespread adoption. Orthobiologic procedures, including stem cell therapy, bone graft substitutes, and PRP injections, are expensive and not always covered by insurance providers, making them inaccessible to a large portion of the population. In many countries, including the U.S., insurance companies often classify these therapies as experimental or elective, resulting in out-of-pocket expenses for patients. This lack of reimbursement significantly impacts the adoption rate, especially in developing regions where healthcare affordability is a major concern. Additionally, regulatory challenges and stringent approval processes further limit market expansion, as companies face hurdles in launching innovative biologic solutions. The lack of standardization in treatment protocols and varying clinical outcomes also contribute to the hesitancy among healthcare providers to recommend orthobiologic products. To overcome these restraints, industry players must focus on cost-effective product development, securing insurance approvals, and increasing awareness about the long-term benefits of orthobiologics.

Advancements in regenerative medicine and stem cell therapies create lucrative opportunities in the orthobiologics market.

The growing focus on regenerative medicine and stem cell therapies presents a significant opportunity for the Orthobiologics Market. Advances in biotechnology, tissue engineering, and cellular therapies have revolutionized orthopedic treatments by offering natural healing solutions with minimal risk of rejection or complications. Stem cell-based treatments, in particular, have gained widespread interest due to their potential to regenerate damaged cartilage, tendons, and bones. According to recent studies, mesenchymal stem cells (MSCs) have shown promising results in treating osteoarthritis and spinal injuries, leading to increased research and clinical trials in this domain. Additionally, the rising adoption of 3D bioprinting and bioengineered implants has further enhanced the efficacy of orthobiologic treatments, offering personalized solutions for patients. Governments and private organizations are heavily investing in regenerative medicine research, with funding initiatives aimed at accelerating FDA approvals and commercialization of innovative therapies. With an increasing number of clinical studies demonstrating the long-term benefits of orthobiologics, patient acceptance is also expected to rise. As the demand for natural, minimally invasive, and highly effective orthopedic solutions grows, companies investing in stem cell research and next-generation biologics are likely to gain a competitive edge in the market.

Stringent regulatory approval processes and product standardization pose challenges for the orthobiologics market.

The Orthobiologics Market faces a major challenge due to stringent regulatory approval processes and the lack of standardized product guidelines. Regulatory agencies, such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan, impose strict requirements for the approval of orthobiologic products, making it a time-consuming and expensive process for manufacturers. Clinical trials for stem cell therapies, PRP injections, and bone graft substitutes often require extensive safety and efficacy data, leading to delays in product commercialization. Additionally, the lack of standardization in production techniques and treatment protocols further complicates market adoption, as healthcare providers often face difficulties in selecting the most effective therapy. Variability in clinical outcomes, inconsistent regulatory frameworks across different countries, and ethical concerns surrounding stem cell research add to the complexity.

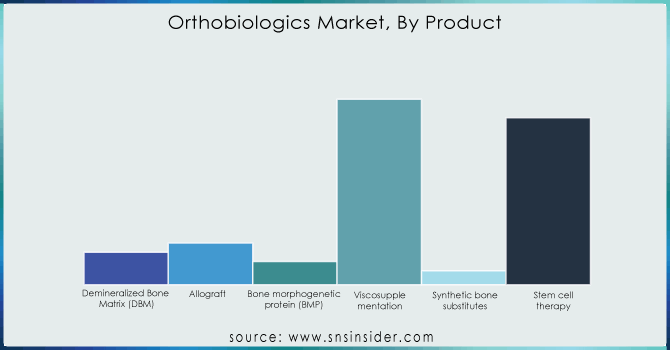

By Product

In 2023, the Viscosupplementation segment dominated the market with a revenue share of over 44.00%, due to the rising prevalence of osteoarthritis (OA) and the availability of advanced hyaluronic acid-based injections. Visosupplements are focused on reducing joint pain and improving mobility as over 32.5 million adults in the U.S. suffer from OA according to the Arthritis Foundation. The higher degree of pain relief achieved with the combined approach gave rise to companies such as Anika Therapeutics introducing CINGAL, the combination of hyaluronic acid and corticosteroid, able to provide longer duration of pain relief. Likewise, Bioventus came out with its own single-injection viscosupplement, DUROLANE to provide the patients with ample convenience. Such innovations tie in with the growth of the Orthobiologics Market, which is seeing a gradual shift from the time-consuming and invasive surgical procedures to minimally invasive biologic treatments a reflection of the larger regenerative medicine trend and the non-surgical joint care solutions.

Do You Need any Customization Research on Orthobiologics Market - Enquire Now

By Application

The spinal fusion segment is projected to hold the largest market share of around 52% during the forecasted period, driven by the growing prevalence of spinal disorders and technological advancements in biologic implants. According to the National Spinal Cord Injury Statistical Center (NSCISC), nearly 17,000 new spinal cord injury cases occur annually in the U.S., increasing the demand for bone grafts and biologic fusion materials. Companies such as Medtronic launched the INFUSE Bone Graft, a recombinant human bone morphogenetic protein (rhBMP-2), promoting bone growth in spinal fusion surgeries. Similarly, Zimmer Biomet introduced the Zyston Strut Open Titanium Interbody Spacer, designed for enhanced fusion rates and stability. These innovations contribute to the Orthobiologics Market, as biologics play a vital role in reducing surgery time, improving fusion success rates, and enhancing patient recovery, making spinal fusion a leading application in orthopedic treatments.

By End Use

The hospital segment is expected to dominate the Orthobiologics Market with a 72% market share during the forecast period, owing to the high volume of orthopedic surgeries, access to advanced biologic treatments, and specialized care facilities. Hospitals serve as primary centers for joint replacement, spinal fusion, and regenerative therapies, increasing the adoption of viscosupplements, stem cell treatments, and bone grafts. Leading hospitals are integrating innovative biologics, such as the Mayo Clinic utilizing stem cell therapies for knee osteoarthritis and the Cleveland Clinic adopting PRP injections for tendon injuries. Additionally, companies like Stryker introduced the BIO4 Viable Bone Matrix, enhancing bone healing in surgical procedures. This dominance aligns with the Orthobiologics Market’s growth, as hospitals remain the preferred setting for complex orthopedic procedures, ensuring safety, efficiency, and advanced biological applications.

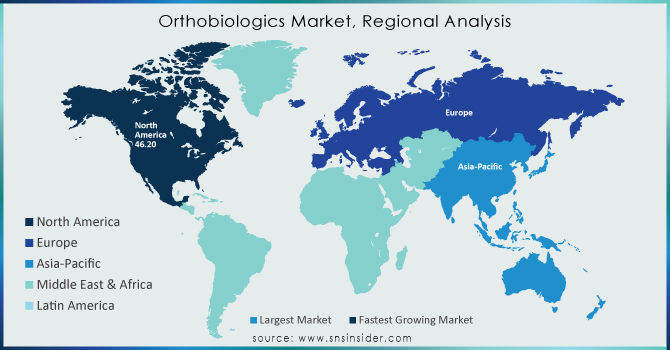

North America held the largest market share around 48% in 2023. Rising incidence of musculoskeletal disorders, and key market competitors. Its annual orthopedic surgeries are enormous in the district with over 1.2 million joint replacements directed in total yearly according to CDC. Some of the major players involved in the market are Medtronic, Stryker, Zimmer Biomet, and Bioventus which keep on innovating more advanced orthobiologics offering more efficient results. In addition, agreeable reimbursement policies are paving the way to accessibility along with rising healthcare expenditure, where the U.S. seems to have crossed USD 4.3 trillion in strategic spending in the year 2023, thus driving the demand for telecasting the necessitated need for the orthobiologic treatment market. North America is estimated to exhibit the majority market share in the regenerative medicines market due to prominent research institutes and more clinical trials for regenerative medicine being carried out in North America. Moreover, the USA holds the largest share in the global Orthobiologics

Asia Pacific's significant market share in 2023. This growth is driven by the growing geriatric population, the higher prevalence of orthobiologics disorders, and the rapid expansion of healthcare infrastructure in the Asia Pacific region. With more than 630 million people over the age of 65 years within Asia Pacific, a surge in osteoarthritis, osteoporosis, and spinal disorders is expected in turn, increasing the demand for bone grafts, viscosupplementation, and stem cell therapies according to the growth of the segment, as reported by the United Nations. With healthcare reforms imposed by the government and rising medical tourism, orthopedic procedures are on the rise in Asia, and especially China, Japan, and India. In contrast, other countries such as India have expanded access to orthopedic treatments through schemes such as the Ayushman Bharat scheme while Japan remains at the forefront of research and development in regenerative medicine, stemming the development of novel stem cell-based orthobiologics products. Also, the relatively cheaper price of orthopedic procedures in comparison with Western countries has attracted medical tourism, which in turn increases market demand.

Bone Biologics Corp. (NELL-1 Bone Regeneration Protein, Urist-3D Matrix)

Medtronic PLC (Infuse Bone Graft, Grafton DBM)

Anika Therapeutics, Inc. (HYALOFAST, CINGAL)

DePuy Synthes (HEALOS Bone Graft, VISTAFIX Craniofacial Implants)

Arthrex, Inc. (ArthroFlex, AlloSync Demineralized Bone Matrix)

Zimmer Biomet (PrimaGen Advanced Allograft, Puros Demineralized Bone Matrix)

Globus Medical (SIGNIFY Bioactive Bone Graft, EXCELSIUS GPS)

Stryker Corporation (Vitoss Bone Graft Substitute, BIO4 Viable Bone Matrix)

Orthofix, Inc. (Trinity ELITE Allograft, Physio-Stim Bone Growth Stimulator)

Bioventus LLC (EXOGEN Ultrasound Bone Healing System, OsteoAMP Allograft)

Sanofi (Synvisc-One, Hyalgan)

SeaSpine Holdings Corporation (OsteoStrand Demineralized Bone Fibers, Vu aPOD Prime NanoMetalene System)

RTI Surgical (map3 Cellular Allogeneic Bone Graft, ViBone Viable Bone Matrix)

Kuros Biosciences (MagnetOs Granules, Neuroseal)

Xtant Medical (OsteoSponge, OsteoVive)

NuVasive, Inc. (AttraX Scaffold, Osteocel Plus)

Integra LifeSciences (BioFix Osteoconductive Scaffold, DuraGen)

Smith & Nephew (Regeneten Bioinductive Implant, TRUCLEAR System)

Terumo Corporation (Aquarius Blood and Fluid Warming System, CAPIOX FX Oxygenator)

Seikagaku Corporation (Gel-One, HyLink)

In January 2024, Xenco Medical introduced the TrabeculeX Continuum at the Consumer Electronics Show (CES) in Las Vegas. This groundbreaking innovation integrates orthobiologics with digital health, featuring a regenerative biomaterial designed for 3D bone formation alongside a remote therapeutic monitoring app for virtual physical therapy.

In May 2024, Isto Biologics introduced the Fibrant Liberty allograft, a dry allograft blend that combines durable cortical fibers with mineralized cortical cancellous chips. When hydrated, the graft becomes flexible and adaptable, making it suitable for a range of surgical procedures while promoting bone healing and fusion.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD6.46 Billion |

| Market Size by 2032 | USD 10.55 Billion |

| CAGR | CAGR of 5.60 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product, (Demineralized Bone Matrix, Allograft, Bone Morphogenetic Protein (BMP), Viscosupplementation, Synthetic Bone Substitutes, Stem Cell Therapy) • By Application (Spinal fusion, Trauma repair, Reconstructive surgery) • By End-Use (Hospitals, Outpatient Facilities) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bone Biologics Corp., Medtronic PLC, Anika Therapeutics, Inc., DePuy Synthes, Arthrex, Inc., Zimmer Biomet, Globus Medical, Stryker Corporation, Orthofix, Inc., Bioventus LLC, Sanofi, SeaSpine Holdings Corporation, RTI Surgical, Kuros Biosciences, Xtant Medical, NuVasive, Inc., Bone Biologics Corp., Medtronic PLC, Anika Therapeutics, Inc., DePuy Synthes, Arthrex, Inc., Zimmer Biomet, Globus Medical, Stryker Corporation, Orthofix, Inc., Bioventus LLC, Sanofi, SeaSpine Holdings Corporation, RTI Surgical, Kuros Biosciences, Xtant Medical, NuVasive, Inc., Integra LifeSciences, Smith & Nephew, Terumo Corporation, Seikagaku Corporation |

Ans: The Orthobiologics Market was valued at USD 6.46 Billion in 2023.

Ans: The expected CAGR of the global Orthobiologics Market during the forecast period is 5.60%

Ans: Spinal fusion will grow rapidly in the Orthobiologics Market from 2024-2032.

Ans: Rising prevalence of musculoskeletal disorders and sports injuries accelerates orthobiologics market growth.

Ans: North America led the Orthobiologics Market in the region with the highest revenue share in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Prevalence and Incidence Data

5.2 Diagnostic and Treatment Statistics

5.3 Clinical Trials and R&D Investments

5.4 Insurance and Reimbursement Trends

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Orthobiologics Market Segmentation, by Product

7.1 Chapter Overview

7.2 Demineralized Bone Matrix

7.2.1 Demineralized Bone Matrix Market Trends Analysis (2020-2032)

7.2.2 Demineralized Bone Matrix Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Allograft

7.3.1 Allograft Market Trends Analysis (2020-2032)

7.3.2 Allograft Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Bone morphogenetic protein (BMP)

7.4.1 Bone morphogenetic protein (BMP) Market Trends Analysis (2020-2032)

7.4.2 Bone morphogenetic protein (BMP) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Viscosupplementation

7.5.1 Viscosupplementation Market Trends Analysis (2020-2032)

7.5.2 Viscosupplementation Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Synthetic bone substitutes

7.6.1 Synthetic Bone Substitutes Market Trends Analysis (2020-2032)

7.6.2 Synthetic Bone Substitutes Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Stem cell therapy

7.7.1 Stem Cell Therapy Market Trends Analysis (2020-2032)

7.7.2 Stem Cell Therapy Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Orthobiologics Market Segmentation, By Application

8.1 Chapter Overview

8.2 Spinal fusion

8.2.1 Spinal Fusion Market Trends Analysis (2020-2032)

8.2.2 Spinal Fusion Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Trauma repair

8.3.1 Trauma Repair Market Trends Analysis (2020-2032)

8.3.2 Trauma Repair Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Reconstructive Surgery

8.4.1 Reconstructive Surgery Market Trends Analysis (2020-2032)

8.4.2 Reconstructive Surgery Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Orthobiologics Market Segmentation, By End-Use

9.1 Chapter Overview

9.2 Hospitals

9.2.1 Hospitals Market Trends Analysis (2020-2032)

9.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Outpatient Facilities

9.3.1 Outpatient Facilities Market Trends Analysis (2020-2032)

9.3.2 Outpatient Facilities Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Orthobiologics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.4 North America Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.5 North America Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.6.2 USA Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.3 USA Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.7.2 Canada Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.3 Canada Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Orthobiologics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Orthobiologics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.7.2 France Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.3 France Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Orthobiologics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.4 Asia Pacific Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.6.2 China Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.3 China Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.7.2 India Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.3 India Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.8.2 Japan Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.3 Japan Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.12.2 Australia Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.3 Australia Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Orthobiologics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Orthobiologics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.4 Africa Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.5 Africa Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Orthobiologics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.4 Latin America Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.5 Latin America Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Orthobiologics Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Orthobiologics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Orthobiologics Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Teva Pharmaceutical

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product/ Services Offered

11.1.4 SWOT Analysis

11.2 Pfizer Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product/ Services Offered

11.2.4 SWOT Analysis

11.3 Sanofi

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product/ Services Offered

11.3.4 SWOT Analysis

11.4 Eli Lilly and Co.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product/ Services Offered

11.4.4 SWOT Analysis

11.5 Bayer AG

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product/ Services Offered

11.5.4 SWOT Analysis

11.6 Boehringer Ingelheim

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product/ Services Offered

11.6.4 SWOT Analysis

11.7 Merck & Co.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product/ Services Offered

11.7.4 SWOT Analysis

11.8 Widex A/S

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product/ Services Offered

11.8.4 SWOT Analysis

11.9 GN Hearing A/S

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product/ Services Offered

11.9.4 SWOT Analysis

11.10 Neuromod Devices Ltd.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Demineralized Bone Matrix

Allograft

Bone morphogenetic protein (BMP)

Viscosupplementation

Synthetic bone substitutes

Stem cell therapy

By Application

Spinal fusion

Trauma repair

Reconstructive surgery

By End-use

Hospitals

Outpatient Facilities

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Medical Supply Delivery Service Market was valued at USD 65.67 billion in 2023 and is expected to reach USD 126.92 billion by 2032, growing at a CAGR of 7.57% from 2024-2032.

The Pressure Monitoring Market was valued at USD 12.74 billion in 2023 and is expected to reach USD 27.07 billion by 2032, growing at a CAGR of 8.75% over the forecast period of 2024-2032.

The Ferritin Testing Market Size was valued at USD 840.40 million in 2023 and is expected to reach USD 1684.34 million by 2032 and grow at a CAGR of 8.05% over the forecast period 2024-2032.

Laryngoscopes Blades and Handles Market Size was valued at USD 936 million in 2023 and is expected to reach USD 2036.3 million by 2032, growing at a CAGR of 9.04% over the forecast period 2024-2032.

The Contraceptives Market size was USD 26.29 billion in 2023, projected to hit USD 44.71 billion by 2032, growing at a 6.10% CAGR.

Urinary Tract Infection Testing Market was valued at USD 625.23 million in 2023 and is expected to reach USD 1004.64 million by 2032, growing at a CAGR of 5.45% from 2024-2032.

Hi! Click one of our member below to chat on Phone