Ortho Phthalaldehyde Market Report Scope & Overview:

The Ortho Phthalaldehyde Market size was valued at USD 5.83 billion in 2023. It is expected to grow to USD 9.25 billion by 2032 and grow at a CAGR of 5.26% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Ortho Phthalaldehyde Market - Request Sample Report

Ortho Phthalaldehyde (OPA) is a versatile chemical compound renowned for its exceptional antimicrobial properties, making it indispensable in various industries, particularly healthcare and food processing. In healthcare settings, OPA serves as a high-level disinfectant and sterilant, effectively eliminating a broad spectrum of pathogens from medical instruments and surfaces. This efficacy is crucial in preventing hospital-acquired infections (HAIs), which remain a significant concern globally. The increasing number of surgical procedures and medical interventions worldwide has further amplified the demand for reliable sterilization solutions like OPA. Beyond healthcare, OPA finds applications in the food and beverage industry, where stringent hygiene standards are paramount. Its ability to maintain high levels of sanitation in food processing and packaging facilities underscores its versatility. Additionally, OPA is utilized in biochemistry for protein and enzyme immobilization, highlighting its importance in research and development.

The OPA market is experiencing robust growth, driven by the escalating need for effective disinfectants across various sectors. Technological advancements have led to more efficient and sustainable production methods, enhancing the compound's accessibility and cost-effectiveness. This trend is expected to continue, with OPA's applications expanding into new areas, further solidifying its position as a critical component in infection control and sanitation practices.

MARKET DYNAMICS

DRIVERS

-

The increasing demand for Ortho Phthalaldehyde (OPA) in healthcare is driven by the rising need for effective infection control, sterilization of medical equipment, and prevention of healthcare-associated infections (HAIs).

The increasing demand for Ortho Phthalaldehyde (OPA) in healthcare is primarily driven by the growing need for effective infection control and sterilization. OPA is a potent disinfectant and sterilant used in hospitals and clinics to ensure the safety of medical equipment and prevent healthcare-associated infections (HAIs). With the rising incidence of HAIs globally, healthcare facilities are adopting stringent infection control protocols, which boosts the demand for sterilizing agents like OPA. The growing awareness of the importance of sterilization in medical settings, alongside advancements in medical technology, is fueling market growth. Additionally, OPA’s advantages, such as its broad-spectrum antimicrobial properties, rapid action, and reduced toxicity compared to alternatives, make it a preferred choice for sterilizing high-risk medical instruments. As the healthcare industry continues to expand and emphasize patient safety, the OPA market is expected to experience steady growth, driven by these evolving trends and increasing sterilization requirements.

RESTRAINT

-

Stringent regulatory compliance for OPA, due to health and environmental concerns, raises production costs but drives innovation, supporting market growth in key sectors.

Stringent regulatory compliance is a significant factor influencing the growth of the Ortho Phthalaldehyde (OPA) market. Due to its chemical properties, OPA is subject to strict environmental and health regulations aimed at minimizing risks such as toxicity, irritation, and long-term environmental damage. These regulations often require manufacturers to adopt specific safety measures, including protective handling and disposal protocols, which can increase production costs and operational complexity. As regulations become more stringent, particularly in regions with high environmental standards, compliance becomes a barrier to market expansion. However, this also drives innovation in safer production methods and eco-friendly alternatives. Despite these challenges, the market continues to grow due to the increasing demand for effective disinfectants, particularly in healthcare, food processing, and water treatment sectors. The market is expected to benefit from technological advancements and the development of new formulations that comply with regulations while meeting industry needs, contributing to a steady market expansion.

MARKET SEGMENTATION

By End-Use

The Disinfection segment dominated with the market share over 32% in 2023, primarily due to its effectiveness as a high-performance disinfectant. OPA is widely used in healthcare for sterilizing medical equipment, surgical instruments, and endoscopes, offering a strong antimicrobial action against bacteria, viruses, and fungi. Its application extends to water treatment systems and cleaning in healthcare settings, ensuring a safe, hygienic environment. The demand for OPA in disinfection is driven by its ability to function effectively at low concentrations and under varying conditions, making it an essential tool in maintaining sanitation standards in hospitals and other critical environments.

By Application

The Amino Acids & Detection segment dominated with the market share over 62% in 2023. This growth is driven by the increasing demand for precise and reliable amino acid detection across various industries, including pharmaceuticals, biotechnology, and diagnostics. Ortho-Phthalaldehyde is widely used due to its high sensitivity and specificity, which allows for accurate quantification and analysis of amino acids. Its ability to efficiently detect amino acids in complex biological samples makes it a valuable tool in drug development, protein analysis, and clinical diagnostics, fueling its widespread adoption and market expansion.

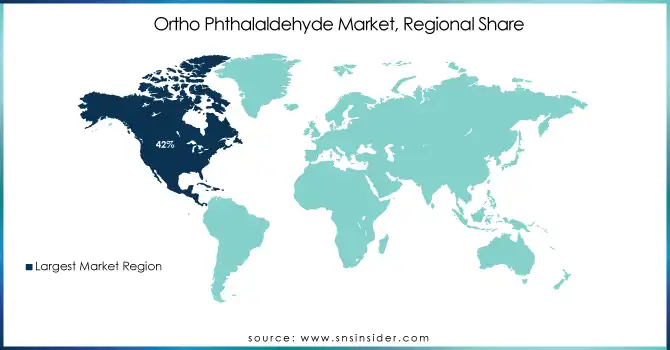

KEY REGIONAL ANALYSIS

North America region dominated with the market share over 42% in 2023, primarily due to its well-established healthcare infrastructure and strict infection control regulations. The region's advanced medical facilities rely heavily on OPA as a potent disinfectant for sterilizing medical devices and ensuring safety in water treatment processes. With growing concerns over healthcare-associated infections, OPA's effectiveness as a broad-spectrum disinfectant has solidified its position in the region. Additionally, the strong presence of major pharmaceutical and healthcare companies in North America drives the demand for high-quality sterilization solutions, further contributing to the region's market dominance in OPA.

The Asia-Pacific region is witnessing the fastest growth in the Ortho Phthalaldehyde (OPA) market, driven by a rapidly expanding healthcare sector. Increased awareness of healthcare-associated infections and a rising focus on stringent hygiene standards have further fueled demand. As medical facilities and water treatment processes require more effective disinfectants, the market is experiencing substantial growth. The growing need for sterilization solutions, combined with improving infrastructure and healthcare practices in countries across Asia-Pacific, has positioned the region as a key driver in the global OPA market, contributing to its accelerated expansion in recent years.

Get Customised Report as per Your Business Requirement - Enquiry Now

Some of the major key players of the Ortho Phthalaldehyde Market

- AK Scientific Inc.

- Alfa Aesar

- MP Biomedicals

- DPX Fine Chemicals

- Virox

- Thermo Fisher Scientific Inc.

- Parchem Fine & Specialty Chemicals

- TCI America

- Merck Millipore Corporation

- Sigma-Aldrich Co. LLC

- OCI Company Limited

- Hanwha Chemical Corporation

- Thirumalai Chemicals Ltd

- Slovnaft

- Proviron Basic Chemicals

- LANXESS

- Cp-Chem Co. Ltd.

- Shandong Hongxin

- Asian Paints

- A Johnson Matthey Company

Suppliers for (specialize in providing OPA with high purity levels (typically above 99%), ensuring quality for various applications, including disinfection and pharmaceutical synthesis) on Ortho Phthalaldehyde Market

- Seema Biotech

- Shodhana Laboratories Pvt. Ltd.

- Garonit Pharma

- N.S. Chemicals

- Showa America

- Jinan Finer Chemical Co., Ltd

- Microwin Labs Private Limited

- Ebele Cosmeceuticals

- Aadish Impex Private Limited

- Snow Chemical Industries Pvt Ltd

RECENT DEVELOPMENT

In November 2024: a recent review emphasized the versatile roles of O-Phthalaldehyde, highlighting its use as a disinfectant, an analytical tool for detecting biogenic amines, and a synthetic precursor for creating unique small molecules and photoactive polymers since 2004.

In January 2023: The Binding Site Group, a global leader in specialty diagnostics, was acquired by Thermo Fisher Scientific Inc., the world leader in science services, in an all-cash deal valued at EUR 2.3 billion (approximately USD 2.8 billion at the current exchange rate). The acquisition was made from a shareholder group led by European private equity firm Nordic Capital.

| Report Attributes | Details |

| Market Size in 2023 | USD 5.83 billion |

| Market Size by 2032 | USD 9.25 billion |

| CAGR | CAGR of 5.26% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End-use (Biochemistry, Organic Synthesis, Disinfection, Isomeric Han LT Hides in Winemaking, Polymerization, Testing, and Others) • By Application (Quantization of High-Pressure Liquid Chromatography and Amino Acids & Detection) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AK Scientific Inc., Alfa Aesar, MP Biomedicals, DPX Fine Chemicals, Virox, Thermo Fisher Scientific Inc., Parchem Fine & Specialty Chemicals, TCI America, Merck Millipore Corporation, Sigma-Aldrich Co. LLC, OCI Company Limited, Hanwha Chemical Corporation, Thirumalai Chemicals Ltd, Slovnaft, Proviron Basic Chemicals, LANXESS, Cp-Chem Co. Ltd., Shandong Hongxin, Asian Paints, A Johnson Matthey Company. |

| Key Drivers | • The increasing demand for Ortho Phthalaldehyde (OPA) in healthcare is driven by the rising need for effective infection control, sterilization of medical equipment, and prevention of healthcare-associated infections (HAIs). |

| RESTRAINTS | • Stringent regulatory compliance for OPA, due to health and environmental concerns, raises production costs but drives innovation, supporting market growth in key sectors. |