Get E-PDF Sample Report on Organic Seed Market - Request Sample Report

The Organic Seed Market size was valued at USD 4.21 billion in 2023 and is expected to grow to USD 11.17 billion by 2032 with a growing at a CAGR of 11.49% over the forecast period of 2024-2032.

A natural seed is a seed delivered by natural cultivating strategies. Natural seeds are fabricated by complying with a bunch of rules, which limits the utilization of synthetics or engineered items. Natural seeds are produced utilizing bio composts, bio pesticides, and natural fertilizer.

Developing mindfulness in regards to the less utilization of synthetic substances in horticulture is supposed to fuel the interest in natural seeds. Government drives in regards to the utilization of manures and pesticides in farming are supposed to drive the market. Rising mindfulness in regards to the utilization of natural food is supposed to support the interest in natural seeds over the conjecture period. Developing exploration and improvement exercises connected with natural seeds is assessed to emphatically affect the development of the market.

Vegetable seeds are supposed to rule the natural seed market and keep up with their strength over the conjecture period. High wholesome level, better taste, simple absorption, and higher enemy of oxidant properties are supposed to drive the natural seeds market over the figure period. Developing customer inclination towards normally obtained items is assessed to fuel the market development.

Be that as it may, to develop plants without utilizing pesticides, natural cultivation requires a ton of day-to-day work from ranchers as well as a huge time responsibility. Clients view the expense of natural items as ridiculously high, which is the reason a significant number of them go against natural rural strategies. Cross-reproducing and the implantation of yields, frequently known as hereditarily adjusted plants, whose DNA structures have been modified can rapidly wreck the line between natural and non-GMO. A natural homestead has lower efficiency since it can't create as much yield as a regular ranch. In this manner, these issues are obstructing the natural seed market's extension.

Driving Factors:

Growing government focus on the use of pesticides and compost in agriculture, improved flavour, easy digestion, and strong anti-oxidant characteristics, as well as growing consumer preference for things that can be easily accessed.

Increasing one's consciousness of non-compound cultivating due to unavoidable concerns.

Market dynamics are changing as a greater awareness of non-compound cultivating practises grows as a result of escalating environmental concerns. There is a trend towards more sustainable and conscious farming practises as people become more aware of the environmental effect of traditional agricultural methods. Alternatives that prioritise biodiversity, soil health, and less chemical use are being sought by consumers and producers. This revolution in thinking is altering the agricultural landscape, boosting demand for non-compound techniques of cultivation and generating a market climate in which ecologically sensitive practises are highly valued.

Opportunities:

Extending natural seed-related research and development projects.

Participants in the market for natural seeds.

The growing demand for sustainable and organic agriculture presents players in the natural seeds industry with exciting potential. As consumers and farmers alike prioritise ecologically friendly practises, there is an increasing desire for natural seeds that provide better biodiversity, resilience, and less reliance on synthetic inputs. This transformation is consistent with the global trend towards healthier, more environmentally conscious food systems. Natural seed companies can capitalise on this trend by offering a diverse range of non-genetically modified seeds, promoting regenerative farming practises, and contributing to the overall improvement of agricultural sustainability while meeting market demand for high-quality, naturally grown produce.

Restraining Factors/Challenges:

The lack of a basis for administrative agencies to oversee natural farming in light of antiquated rural customs.

Genetic diversity in organic seeds is limited as a result of the emphasis on certain crops and kinds.

One of the major issues confronting the organic seed market is a lack of genetic variety as a result of a predominance of certain crops and kinds. While the organic farming movement pushes for ecologically beneficial and sustainable agricultural practises, the concentration on particular popular crops might result in a more limited number of organic seed selections. This has the potential to weaken agricultural systems' resilience, making them more vulnerable to pests, diseases, and changing environmental circumstances. The dominance of a few preferred types also limits crops' adaptive capacity to emerging difficulties, thereby jeopardizing organic agriculture's long-term survival

Natural Seed Market is rapidly arriving at its pre-COVID levels and a sound development rate is normal over the gauge period driven by the V-formed recuperation in a large portion of the emerging countries.

Key techniques of organizations working in the Organic Seed Market Industry are distinguished as displaying their contactless assembling and conveyance strategies, featuring USP explanations, centered around item bundling, and expanding the presence of items on web-based stages.

According to SPINS statistics and research by New Hope, the sales growth of natural and organic goods soared up 10% to nearly $250 billion in 2020 from pre-pandemic year-over-year levels of roughly 6% in 2019, totaling about $225 billion in sales.

However, since then, sales growth has gradually slowed down, reaching 7.7% in 2021. It is anticipated to increase by about 6% in 2022, peak at about 4% in 2023, and then gradually increase to around 5% growth in 2024. According to Carlotta Mast, SVP and market leader at New Hope, even if sales growth is slowing, overall industry sales are still increasing, hitting a record $272 billion in 2021 and forecast to reach $300 billion by 2023. Even though it is slowing down, the ongoing growth is noteworthy because it is still exceeding the pandemic-era dollar highs. This suggests that many of the customers who initially entered the natural and organic market in 2020 to stock their pantries are still doing so even though they now have more options, according to Mast.

The data from SPINS, which show consumers purchasing natural goods at a greater pace than other product sales increase, reflect this. From April 2020 to May 2022, buyers bought natural items at a rate that surpassed the rise in sales of other products across all retail channels. The difference between the two was frequently in the high single digits, but in recent months it has shrunk to the point that, according to the statistics, in August, the sales growth rate of all other items surpassed that of natural products at 7.4% vs. 6.7% year-over-year.

The Russia Ukraine war had an impact on the vegetable fats complex; sunflower oil has seen the greatest price spike and dip in the recent year. Not unexpected, given that Ukraine and Russia produced roughly 58% of the world's supply of this oilseed in 2021-22. Prices increased when the conflict cut off their supply via the Black Sea ports.

The size of the world market for pomegranate seed oil, which was estimated at USD 21.43 million in 2022, is anticipated to grow at a CAGR of 5.15% over the course of the forecast period and reach USD 28.96 million by 2028.

A vegetable oil made from pomegranate seeds is called pomegranate seed oil. Punicic acid, palmitic acid, stearic acid, oleic acid, and linoleic acid are all present in pomegranate seed oil.

By Crop Type:

Vegetable seeds imply the seeds of those harvests which are filled in gardens and on truck cultivates and are by and large known and sold under the name of vegetable or spice seeds in this State. Syngenta field crop seeds incorporate significant yields like corn, sunflower, and cross-breed rice. Created utilizing progressed reproducing strategies, these seeds are custom-made for individual geological districts to be high yielding and solid. A seed is the experienced prepared ovule of a plant; it comprises three sections, the incipient organism which will form into another plant, put away nourishment for the incipient organism, and a defensive seed coat. Naturally, a nut is an organic product with a woody pericarp created from a syncarpous gynoecium.

By Farm Type:

Outside vertical ranch arrangement of creation of vegetables by tank-farming strategies, to amplify the utilization of the accessible space for vegetable development, for creation not safeguarded Vertical Farms are measured and can be acclimated to fit any land. The strategy for developing plants and yields on a huge or limited scope completely inside and with the assistance of tank-farming and fake light is known as Indoor Farming or Indoor cultivating. Counterfeit light is expected for giving the plant supplements and it likewise adds to establishing development.

By Distribution Channel:

Various Wholesalers, retailers, and cooperatives are supplying and distributing organic seeds.

By Crop Type:

Vegetable Seeds

Field Crop Seeds

Fruits & Nuts Seeds

Other

By Farm Type:

Indoor

Outdoor

By Distribution Channel:

Wholesalers

Retailers

Cooperatives

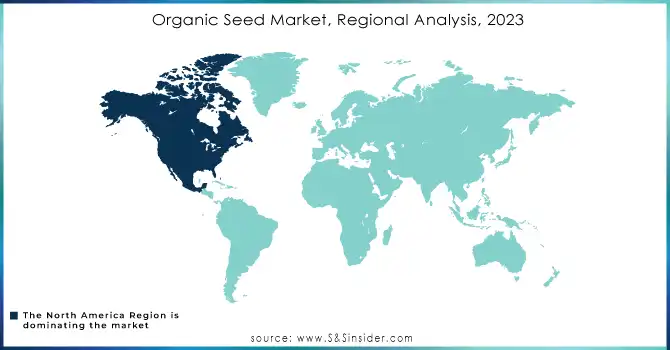

North America is the market leader for organic seeds due to the region's large producer concentration and growing vegan population.

Asia-Pacific is expected to grow between 2022 and 2030 as a result of rising disposable income and public awareness of the health benefits of organic seeds. The country section of the study also includes a list of particular market-impacting factors and regulatory changes that have an impact on both the current and future growth of the market.

To promote organic farming, governments and agricultural organizations have undertaken a number of efforts, including favorable legislation and tax breaks. Such activities, together with rising consumer knowledge of the health advantages of food, are anticipated to help the local market soon. The increased demand for organic food in developed countries is met by Asia Pacific and Central and South America. In established markets like North America and Europe, the majority of the output from emerging areas is exported. Over the next seven years, it is anticipated that China, India, Brazil, Argentina, and Australia would dominate their respective regional marketplaces.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Southern Exposure Seed Exchange, Territorial Seeds Company, The Kusa Seed Research Foundation, Seed Savers Exchange, Fedco Seeds, Inc., Johnny's Selected Seeds, Wild Garden Seed, Rijk Zwaan Zaadteelt en Zaadhandel B.V., Organic Seed Alliance, Navdanya.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.21 Billion |

| Market Size by 2032 | US$ 11.17 Billion |

| CAGR | CAGR 11.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Crop Type (Vegetable Seeds, Field Crop Seeds, Fruits & Nuts Seeds, Other) • by Farm Type (Indoor, Outdoor) • by Distribution Channel (Wholesalers, Retailers, Cooperatives) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Southern Exposure Seed Exchange, Territorial Seeds Company, The Kusa Seed Research Foundation, Seed Savers Exchange, Fedco Seeds, Inc., Johnny's Selected Seeds, Wild Garden Seed, Rijk Zwaan Zaadteelt en Zaadhandel B.V., Organic Seed Alliance, Navdanya |

| Drivers | • Growing government focus on the use of pesticides and compost in agriculture, improved flavour, easy digestion, and strong anti-oxidant characteristics, as well as growing consumer preference for things that can be easily accessed. • Increasing one's consciousness of non-compound cultivating due to unavoidable concerns. |

| Market Opportunities | • Extending natural seed-related research and development projects. • Participants in the market for natural seeds. |

Ans: The Vegetable Seeds segment is projected to make a foothold in the worldwide Organic Seed Market.

Ans: Crop Type, Farm Type, and Distribution Channel segments are covered in the Organic Seed Market.

Ans: The absence of a foundation of administrative bodies for natural cultivation in regards to the conjunction of going against rural practices are the restraining factors and challenges faced by the Condensed Milk market.

Ans: Manufacturers, Research Institutes, university libraries, suppliers, and distributors of the product.

Ans: The Global Organic Seed Market Size was esteemed at USD 3.3 billion out of 2021

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine war

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Organic Seed Market, By Crop Type

8.1 Vegetable Seeds

8.2 Field Crop Seeds

8.3 Fruits & Nuts Seeds

8.4 Other

9. Organic Seed Market By Farm Type

9.1 Indoor

9.2 Outdoor

10. Organic Seed Market, By Distribution Channel

10.1 Wholesalers

10.2 Retailers

10.3 Cooperatives

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Organic Seed Market by Country

11.2.2 North America Organic Seed Market by Crop Type

11.2.3 North America Organic Seed Market by Farm Type

11.2.4 North America Organic Seed Market by Distribution Channel

11.2.5 USA

11.2.5.1 USA Organic Seed Market by Crop Type

11.2.5.2 USA Organic Seed Market by Farm Type

11.2.5.3 USA Organic Seed Market by Distribution Channel

11.2.6 Canada

11.2.6.1 Canada Organic Seed Market by Crop Type

11.2.6.2 Canada Organic Seed Market by Farm Type

11.2.6.3 Canada Organic Seed Market by Distribution Channel

11.2.7 Mexico

11.2.7.1 Mexico Organic Seed Market by Crop Type

11.2.7.2 Mexico Organic Seed Market by Farm Type

11.2.7.3 Mexico Organic Seed Market by Distribution Channel

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Organic Seed Market by Country

11.3.1.2 Eastern Europe Organic Seed Market by Crop Type

11.3.1.3 Eastern Europe Organic Seed Market by Farm Type

11.3.1.4 Eastern Europe Organic Seed Market by Distribution Channel

11.3.1.5 Poland

11.3.1.5.1 Poland Organic Seed Market by Crop Type

11.3.1.5.2 Poland Organic Seed Market by Farm Type

11.3.1.5.3 Poland Organic Seed Market by Distribution Channel

11.3.1.6 Romania

11.3.1.6.1 Romania Organic Seed Market by Crop Type

11.3.1.6.2 Romania Organic Seed Market by Farm Type

11.3.1.6.4 Romania Organic Seed Market by Distribution Channel

11.3.1.7 Turkey

11.3.1.7.1 Turkey Organic Seed Market by Crop Type

11.3.1.7.2 Turkey Organic Seed Market by Farm Type

11.3.1.7.3 Turkey Organic Seed Market by Distribution Channel

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Organic Seed Market by Crop Type

11.3.1.8.2 Rest of Eastern Europe Organic Seed Market by Farm Type

11.3.1.8.3 Rest of Eastern Europe Organic Seed Market by Distribution Channel

11.3.2 Western Europe

11.3.2.1 Western Europe Organic Seed Market by Country

11.3.2.2 Western Europe Organic Seed Market by Crop Type

11.3.2.3 Western Europe Organic Seed Market by Farm Type

11.3.2.4 Western Europe Organic Seed Market by Distribution Channel

11.3.2.5 Germany

11.3.2.5.1 Germany Organic Seed Market by Crop Type

11.3.2.5.2 Germany Organic Seed Market by Farm Type

11.3.2.5.3 Germany Organic Seed Market by Distribution Channel

11.3.2.6 France

11.3.2.6.1 France Organic Seed Market by Crop Type

11.3.2.6.2 France Organic Seed Market by Farm Type

11.3.2.6.3 France Organic Seed Market by Distribution Channel

11.3.2.7 UK

11.3.2.7.1 UK Organic Seed Market by Crop Type

11.3.2.7.2 UK Organic Seed Market by Farm Type

11.3.2.7.3 UK Organic Seed Market by Distribution Channel

11.3.2.8 Italy

11.3.2.8.1 Italy Organic Seed Market by Crop Type

11.3.2.8.2 Italy Organic Seed Market by Farm Type

11.3.2.8.3 Italy Organic Seed Market by Distribution Channel

11.3.2.9 Spain

11.3.2.9.1 Spain Organic Seed Market by Crop Type

11.3.2.9.2 Spain Organic Seed Market by Farm Type

11.3.2.9.3 Spain Organic Seed Market by Distribution Channel

11.3.2.10 Netherlands

11.3.2.10.1 Netherlands Organic Seed Market by Crop Type

11.3.2.10.2 Netherlands Organic Seed Market by Farm Type

11.3.2.10.3 Netherlands Organic Seed Market by Distribution Channel

11.3.2.11 Switzerland

11.3.2.11.1 Switzerland Organic Seed Market by Crop Type

11.3.2.11.2 Switzerland Organic Seed Market by Farm Type

11.3.2.11.3 Switzerland Organic Seed Market by Distribution Channel

11.3.2.1.12 Austria

11.3.2.12.1 Austria Organic Seed Market by Crop Type

11.3.2.12.2 Austria Organic Seed Market by Farm Type

11.3.2.12.3 Austria Organic Seed Market by Distribution Channel

11.3.2.13 Rest of Western Europe

11.3.2.13.1 Rest of Western Europe Organic Seed Market by Crop Type

11.3.2.13.2 Rest of Western Europe Organic Seed Market by Farm Type

11.3.2.13.3 Rest of Western Europe Organic Seed Market by Distribution Channel

11.4 Asia-Pacific

11.4.1 Asia-Pacific Organic Seed Market by country

11.4.2 Asia-Pacific Organic Seed Market by Crop Type

11.4.3 Asia-Pacific Organic Seed Market by Farm Type

11.4.4 Asia-Pacific Organic Seed Market by Distribution Channel

11.4.5 China

11.4.5.1 China Organic Seed Market by Crop Type

11.4.5.2 China Organic Seed Market by Farm Type

11.4.5.3 China Organic Seed Market by Distribution Channel

11.4.6 India

11.4.6.1 India Organic Seed Market by Crop Type

11.4.6.2 India Organic Seed Market by Farm Type

11.4.6.3 India Organic Seed Market by Distribution Channel

11.4.7 Japan

11.4.7.1 Japan Organic Seed Market by Crop Type

11.4.7.2 Japan Organic Seed Market by Farm Type

11.4.7.3 Japan Organic Seed Market by Distribution Channel

11.4.8 South Korea

11.4.8.1 South Korea Organic Seed Market by Crop Type

11.4.8.2 South Korea Organic Seed Market by Farm Type

11.4.8.3 South Korea Organic Seed Market by Distribution Channel

11.4.9 Vietnam

11.4.9.1 Vietnam Organic Seed Market by Crop Type

11.4.9.2 Vietnam Organic Seed Market by Farm Type

11.4.9.3 Vietnam Organic Seed Market by Distribution Channel

11.4.10 Singapore

11.4.10.1 Singapore Organic Seed Market by Crop Type

11.4.10.2 Singapore Organic Seed Market by Farm Type

11.4.10.3 Singapore Organic Seed Market by Distribution Channel

11.4.11 Australia

11.4.11.1 Australia Organic Seed Market by Crop Type

11.4.11.2 Australia Organic Seed Market by Farm Type

11.4.11.3 Australia Organic Seed Market by Distribution Channel

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Organic Seed Market by Crop Type

11.4.12.2 Rest of Asia-Pacific Organic Seed Market by Farm Type

11.4.12.3 Rest of Asia-Pacific Organic Seed Market by Distribution Channel

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Organic Seed Market by Country

11.5.1.2 Middle East Organic Seed Market by Crop Type

11.5.1.3 Middle East Organic Seed Market by Farm Type

11.5.1.4 Middle East Organic Seed Market by Distribution Channel

11.5.1.5 UAE

11.5.1.5.1 UAE Organic Seed Market by Crop Type

11.5.1.5.2 UAE Organic Seed Market by Farm Type

11.5.1.5.3 UAE Organic Seed Market by Distribution Channel

11.5.1.6 Egypt

11.5.1.6.1 Egypt Organic Seed Market by Crop Type

11.5.1.6.2 Egypt Organic Seed Market by Farm Type

11.5.1.6.3 Egypt Organic Seed Market by Distribution Channel

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Organic Seed Market by Crop Type

11.5.1.7.2 Saudi Arabia Organic Seed Market by Farm Type

11.5.1.7.3 Saudi Arabia Organic Seed Market by Distribution Channel

11.5.1.8 Qatar

11.5.1.8.1 Qatar Organic Seed Market by Crop Type

11.5.1.8.2 Qatar Organic Seed Market by Farm Type

11.5.1.8.3 Qatar Organic Seed Market by Distribution Channel

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Organic Seed Market by Crop Type

11.5.1.9.2 Rest of Middle East Organic Seed Market by Farm Type

11.5.1.9.3 Rest of Middle East Organic Seed Market by Distribution Channel

11.5.2 Africa

11.5.2.1 Africa Organic Seed Market by Country

11.5.2.2 Africa Organic Seed Market by Crop Type

11.5.2.3 Africa Organic Seed Market by Farm Type

11.5.2.4 Africa Organic Seed Market by Distribution Channel

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Organic Seed Market by Crop Type

11.5.2.5.2 Nigeria Organic Seed Market by Farm Type

11.5.2.5.3 Nigeria Organic Seed Market by Distribution Channel

11.5.2.6 South Africa

11.5.2.6.1 South Africa Organic Seed Market by Crop Type

11.5.2.6.2 South Africa Organic Seed Market by Farm Type

11.5.2.6.3 South Africa Organic Seed Market by Distribution Channel

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Organic Seed Market by Crop Type

11.5.2.7.2 Rest of Africa Organic Seed Market by Farm Type

11.5.2.7.3 Rest of Africa Organic Seed Market by Distribution Channel

11.6 Latin America

11.6.1 Latin America Organic Seed Market by country

11.6.2 Latin America Organic Seed Market by Crop Type

11.6.3 Latin America Organic Seed Market by Farm Type

11.6.4 Latin America Organic Seed Market by Distribution Channel

11.6.5 Brazil

11.6.5.1 Brazil Organic Seed Market by Crop Type

11.6.5.2 Brazil Organic Seed Market by Farm Type

11.6.5.3 Brazil Organic Seed Market by Distribution Channel

11.6.6 Argentina

11.6.6.1 Argentina Organic Seed Market by Crop Type

11.6.6.2 Argentina Organic Seed Market by Farm Type

11.6.6.3 Argentina Organic Seed Market by Distribution Channel

11.6.7 Colombia

11.6.7.1 Colombia Organic Seed Market by Crop Type

11.6.7.2 Colombia Organic Seed Market by Farm Type

11.6.7.3 Colombia Organic Seed Market by Distribution Channel

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Organic Seed Market by Crop Type

11.6.8.2 Rest of Latin America Organic Seed Market by Farm Type

11.6.8.3 Rest of Latin America Organic Seed Market by Distribution Channel

12 Company profile

12.1 Southern Exposure Seed Exchange

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Territorial Seeds Company

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 The Kusa Seed Research Foundation

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Seed Savers Exchange

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Fedco Seeds

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Johnny's Selected Seeds

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Wild Garden Seed

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 Rijk Zwaan Zaadteelt en Zaadhandel B.V.

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Product/Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Organic Seed Alliance

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Navdanya

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

13. Competitive Landscape

13.1 Competitive Bench marking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Non-Carbonated Soft Drinks Market Report Scope & Overview: Non-Carbonated Soft Drinks Mar

Human Milk Oligosaccharides (HMO) Market Report Scope & Overview: Human Milk Oligosaccharides (HMO) Market

Pet Supplements Market Report Scope & Overview: The Pet Supplements Market Size was valued at USD

The Apple Cider Vinegar Market size was valued at USD 873.91 million in 2023 and is expected to grow to USD 1384.92 million by 2032 with a growing CAGR of 5.78% over the forecast period of 2024-2032.

Tonic Water Market Report Scope & Overview: The Tonic Water Market Size was esteemed at USD 1.41

The Pregelatinized Starch Market size was USD 1.86 billion in 2022 and is expected to Reach USD 2.58 billion by 2030 and grow at a CAGR of 4.2 % over the forecast period of 2023-2030.

Hi! Click one of our member below to chat on Phone