Organic Chemicals Market Report Scope & Overview:

Get More Information on Organic Chemicals Market - Request Sample Report

The Organic Chemicals Market Size was valued at USD 12.75 billion in 2023 and is expected to reach USD 24.25 billion by 2032 and grow at a CAGR of 7.40% over the forecast period 2024-2032.

The Organic Chemicals market is influenced by several dynamic factors, including technological advancements, shifting regulatory landscapes, and growing consumer demand for sustainable products. Recent developments reflect these trends. In September 2024, Laxmi Organic Industries explored a land parcel in Odisha for a new chemical manufacturing unit, marking a significant step in expanding its synthetic organic chemical production capabilities. This is part of their ongoing effort to strengthen their position in acetyl intermediaries and ketene & diketene intermediaries, where they hold a leading market share globally, excluding China. This initiative is a strategic move to enhance further their R&D-driven portfolio of over 30 in-house developed products.

Simultaneously, technological innovations continue to shape the industry. For example, a breakthrough discovery in August 2024 demonstrated how nickel tools could enhance organic chemical reactions, improving drug-creation processes. This development showcases the impact of advanced materials in streamlining chemical synthesis, driving efficiency, and reducing costs. Furthermore, in October 2024, UCLA chemists challenged a fundamental rule in organic chemistry, providing new insights into reaction mechanisms that could influence the design of future chemical processes. These advancements highlight the ongoing evolution of the organic chemicals sector, underscoring the importance of innovation and adaptability in maintaining competitiveness in the global market.

Organic Chemicals Market Dynamics:

Drivers:

-

Rising Demand for Organic Chemicals in Agricultural and Pharmaceutical Applications Drives Market Expansion

The organic chemicals market is expanding significantly due to the increasing demand in agricultural and pharmaceutical sectors. In agriculture, organic chemicals such as pesticides, herbicides, and fertilizers are essential for enhancing crop yields and pest control. With the global population rising, the need for efficient and sustainable agricultural practices has amplified. Additionally, pharmaceuticals are heavily reliant on organic chemicals for the development of vital drugs and medical compounds. Organic chemicals play a crucial role in drug synthesis, particularly in creating life-saving treatments for various diseases. As these industries evolve and grow, they continue to drive the demand for organic chemicals, fostering significant market expansion. Moreover, as developing countries invest in improving agricultural practices and healthcare systems, the need for organic chemicals will only increase, ensuring steady market growth.

-

Growing Demand for Specialty Chemicals in Electronics and Automotive Sectors Fuels Organic Chemicals Growth

-

Increased Focus on Sustainable Practices and Green Chemistry Benefits Organic Chemicals Market Growth

Sustainability has become a driving force in the organic chemicals market, with a growing focus on green chemistry and eco-friendly production practices. As environmental concerns rise globally, companies are adopting sustainable practices to minimize waste, reduce emissions, and decrease their reliance on non-renewable resources. Green chemistry has led to the development of biodegradable organic chemicals and renewable alternatives to traditional petrochemical-based products. Additionally, the demand for more sustainable and less toxic products has created new opportunities for organic chemical companies to innovate and meet evolving consumer preferences. This shift towards sustainability is not only improving the environmental footprint of organic chemicals but is also benefiting companies by opening new markets. Consumers and businesses alike are increasingly prioritizing eco-friendly options, driving the growth of organic chemicals that are both sustainable and high-performing. The transition to sustainable chemical production will continue to play a crucial role in shaping the future of the organic chemicals market.

Restraint:

-

High Production Costs and Complex Regulations Pose Challenges to Organic Chemicals Market Growth

Opportunity:

-

Increased Research and Development Investments in Advanced Organic Chemicals for Medical Applications Create New Market Potential

-

Growth in Renewable Energy and Clean Technologies Stimulates Demand for Organic Chemicals

The global shift towards renewable energy and clean technologies presents new opportunities for organic chemicals. Organic chemicals are crucial components in renewable energy technologies, including organic solar cells, batteries, and biofuels. With the increasing adoption of solar energy, wind energy, and electric vehicles, the demand for organic chemicals used in energy storage devices and power generation systems is on the rise. Organic materials, such as organic semiconductors and polymers, are being used to improve the efficiency and performance of solar panels and energy storage systems. As the world moves towards clean energy and carbon-neutral goals, the role of organic chemicals in advancing renewable energy technologies will continue to expand. This transition towards cleaner energy sources and sustainable technologies will provide significant growth opportunities for the organic chemicals market in the coming years.

| Consumer Behavior/Demand Shift | Description |

|---|---|

| Preference for Sustainable Products | Consumers increasingly prefer eco-friendly products, leading to higher demand for biodegradable and renewable organic chemicals. |

| Demand for High-Performance Products | There is a growing expectation for organic chemicals to meet higher performance standards in applications like agriculture and electronics. |

| Increased Awareness of Health and Safety | Consumers are becoming more health-conscious, prompting a shift toward organic chemicals that are safer and less toxic. |

| Rise of Customization and Specialty Products | The demand for specialized organic chemicals tailored for specific applications is rising, driven by diverse industry needs. |

| Shift Toward Local Sourcing | Consumers are favoring locally sourced products, influencing the supply chain and production of organic chemicals. |

Consumer behavior is significantly shifting in the Organic Chemicals Market, driven by evolving preferences and awareness. A growing preference for sustainable products is pushing manufacturers to develop biodegradable and renewable alternatives, responding to the demand for eco-friendly solutions. Additionally, there is an increasing expectation for high-performance organic chemicals that meet stringent standards across industries such as agriculture and electronics. As consumers become more health-conscious, they seek organic chemicals that prioritize safety and lower toxicity. The trend towards customization reflects diverse industrial needs, leading to higher demand for specialized organic products. Finally, the inclination toward local sourcing is reshaping supply chains, prompting producers to adapt their strategies to meet consumer preferences. These shifts are shaping the future landscape of the organic chemicals market.

Organic Chemicals Market Segments

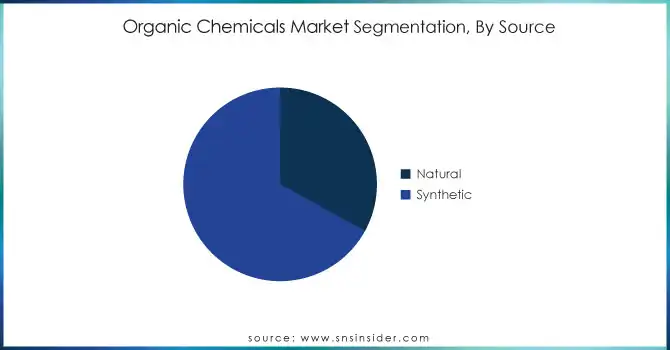

By Source

Synthetic chemicals dominated the Organic Chemicals Market in 2023, accounting for 67% of the market share. Synthetic organic chemicals are extensively used due to their consistency, availability, and scalability. They are pivotal in the production of a wide range of products including plastics, solvents, and resins. Industries like automotive, electronics, and agriculture heavily rely on synthetic chemicals because of their cost-effectiveness and ability to meet specific performance standards. For example, in automotive manufacturing, synthetic chemicals are used in the production of durable and lightweight components. Similarly, in agriculture, synthetic pesticides and herbicides are crucial for crop protection and increasing agricultural productivity. As the demand for cost-effective and high-performance materials rises, synthetic organic chemicals continue to dominate, enabling innovation across various sectors, from polymers to industrial chemicals.

By Product Type

Aromatic chemicals dominated the Organic Chemicals Market in 2023, capturing 38% of the market share. Aromatic chemicals are characterized by their distinct ring-like molecular structure, which includes compounds such as benzene, toluene, and xylene. These chemicals are integral to various industries, particularly in the manufacturing of plastics, synthetic fibers, and resins. Aromatic chemicals are also widely used in the production of fragrances, dyes, and adhesives. The growing demand for polymers in the automotive and construction industries contributes to the dominance of aromatic chemicals in the market. Additionally, their applications in the healthcare sector for drug formulations, including anti-inflammatory drugs, boost their market share. As industries continue to seek versatile, high-performance chemicals for a wide range of applications, aromatic chemicals are expected to maintain their dominance in the market. The ability to produce high-volume, cost-effective aromatic compounds further cements their crucial role in the organic chemicals market.

By Application

The pharmaceutical application dominated the Organic Chemicals Market in 2023, accounting for 32% of the market share. Organic chemicals are essential in the pharmaceutical industry for the production of active pharmaceutical ingredients (APIs), excipients, and intermediates used in drug formulations. As the global demand for healthcare products and treatments continues to rise, the need for organic chemicals in pharmaceuticals has grown significantly. Organic chemicals are crucial in the synthesis of various drugs, including antibiotics, analgesics, and antivirals. They also play a vital role in the development of advanced drug delivery systems, including controlled-release medications. With the increasing prevalence of chronic diseases, aging populations, and innovations in personalized medicine, the pharmaceutical industry's demand for organic chemicals is expected to grow. Furthermore, the rise of biologics and biosimilars, which require specific organic chemical components, continues to drive the market. The pharmaceutical sector’s dominance reflects its heavy reliance on organic chemicals for drug production and formulation.

By End-use Industry

The healthcare industry dominated the Organic Chemicals Market in 2023, holding 28% of the market share. Organic chemicals are indispensable in healthcare applications, from pharmaceutical drugs to medical devices and personal care products. The demand for organic chemicals in healthcare has surged due to the growing aging population, advancements in medical treatments, and the increasing focus on healthcare innovations. Organic chemicals are used in the production of essential pharmaceutical ingredients, vitamins, vaccines, and diagnostic reagents. In addition, organic chemicals contribute to medical devices, including wound care materials, diagnostic devices, and coatings. Moreover, the skincare and personal care industry also significantly contributes to the healthcare sector’s demand for organic chemicals, as these chemicals are involved in the formulation of lotions, creams, and other therapeutic products. With the global focus on improving health outcomes, especially in emerging markets, the healthcare sector remains a key driver for the organic chemicals market. As demand for health-related products grows, so does the need for organic chemicals across various sub-segments.

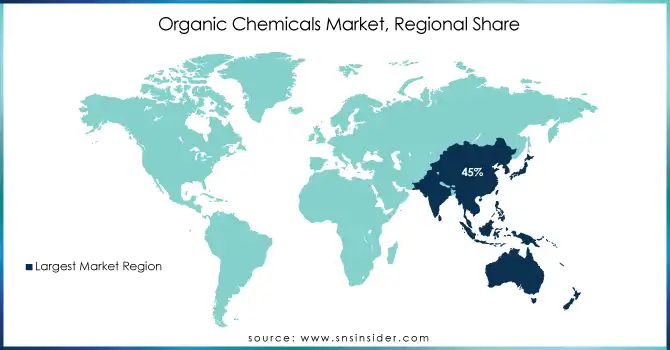

Organic Chemicals Market Regional Analysis

Asia-Pacific (APAC) dominated the Organic Chemicals Market in 2023, holding a significant share of approximately 45%. The region's dominance is primarily driven by rapid industrialization, large-scale manufacturing, and the high demand for organic chemicals in countries like China, India, and Japan. In China, the organic chemicals market benefits from strong production capabilities, particularly in the petrochemical sector, where organic chemicals are used in the production of plastics, resins, and pharmaceuticals. The Chinese government’s initiatives to expand manufacturing facilities and develop chemical plants also support this growth. India, with its rapidly expanding chemical sector, is seeing significant demand for organic chemicals in agrochemicals, pharmaceuticals, and food processing, thus contributing to the region's leading position. Japan’s technological advancements in chemical processes further bolster the region’s position in the market. The robust infrastructure and cost-effective manufacturing processes in these countries help maintain their leadership in the global market for organic chemicals.

Get Customized Report as per your Business Requirement - Request For Customized Report

Recent Developments

-

December 2024: Azerbaijan launched a new chemical complex in Sumgayit aimed at producing advanced chemicals and plastics, bolstering its global position in the chemical industry and meeting growing sector demands.

-

September 2024: Laxmi Organic Industries plans to establish a chemical manufacturing unit in Odisha to enhance production capacity for intermediates and specialty chemicals, addressing rising demand domestically and globally.

Key Players:

-

AkzoNobel (Peroxide, Acrylics, Alkyd Resins)

-

Alpek (PTA, PET, MEG)

-

BASF SE (Polyurethane, Styrenics, Acrylic Acid)

-

Cargill (Glycerin, Propylene Glycol, Sorbitol)

-

China National Petroleum Corporation (CNPC) (Methanol, Acetone, Butadiene)

-

Eastman Chemical Company (Acetate Tow, PET Resins, Plasticizers)

-

ExxonMobil (Ethylene, Propylene, Butylene)

-

Ineos (Styrene, Ethylene Oxide, Polyethylene)

-

Koninklijke DSM N.V. (Methyl Methacrylate, Polyamide, Engineering Plastics)

-

LG Chem (Acrylic Acid, PVC, Polycarbonate)

-

LyondellBasell Industries (Polypropylene, Polyethylene, Ethylene)

-

Mitsubishi Chemical Corporation (Acetic Acid, Epoxy Resins, Polycarbonate)

-

Reliance Industries (PET, Polyethylene, Polypropylene)

-

Royal Dutch Shell (Aromatics, Ethylene, Butadiene)

-

SABIC (Acrylonitrile, Polyethylene, Methanol)

-

Sinopec (Ethylene, Polyethylene, Propylene)

-

The Dow Company (Polyurethane, Polyethylene, Propylene Glycol)

-

PPG Industries (Epoxies, Acrylic Resins, Coatings)

-

Huntsman Corporation (Polyurethane, Epoxy Resins, Specialty Chemicals)

-

DuPont (Nylon, Teflon, Surlyn)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.75 Billion |

| Market Size by 2032 | US$ 24.25 Billion |

| CAGR | CAGR of 7.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Natural, Synthetic) • By Product Type (Aromatic Chemicals, Aliphatic Chemicals, Chlorinated Hydrocarbons, Alcohols, Acids, Amides, Others) • By Application (Pharmaceuticals, Pesticides, Agrochemicals, Plastics and polymers, Cosmetics, Food & Beverages, Others) • By End-use Industry (Automotive, Construction, Electronics, Healthcare, Agriculture, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Bayer AG, Lonza Group AG, Azelis, Huntsman Corporation, Evonik Industries AG, Syngenta AG, Wacker Chemie AG, Albemarle Corporation, Taj Pharmaceuticals Ltd. and other key players |

| Key Drivers | • Growing Demand for Specialty Chemicals in Electronics and Automotive Sectors Fuels Organic Chemicals Growth • Increased Focus on Sustainable Practices and Green Chemistry Benefits Organic Chemicals Market Growth |

| Restraints | • High Production Costs and Complex Regulations Pose Challenges to Organic Chemicals Market Growth |