The Oral Care Market Size was valued at USD 35.16 billion in 2023 and is expected to reach USD 56.93 billion by 2032, growing at a CAGR of 5.52% over the forecast period 2024-2032.

Get more information on Oral Care Market - Request Sample Report

The global oral care market is experiencing remarkable growth, driven by evolving consumer behavior, technological innovations, and increasing awareness of oral hygiene. For instance, surveys indicate that almost 50% of adults worldwide suffer from untreated dental caries, underscoring the need for preventive oral care products. Rising awareness campaigns, such as World Oral Health Day celebrated in over 70 countries, have played a significant role in educating consumers about maintaining proper oral health practices.

Technological advancements have revolutionized the industry, with smart electric toothbrushes equipped with AI-enabled features now widely available. Products like the Oral-B iO Series 10 offer real-time feedback on brushing patterns, encouraging better oral hygiene habits. Similarly, teledentistry platforms such as SmileDirectClub have made dental consultations accessible from home, benefitting underserved populations. The development of fluoride-free toothpaste, such as those by Tom’s of Maine, caters to the growing demand for natural and chemical-free oral care products.

Sustainability trends are reshaping the market as well. Eco-friendly alternatives like bamboo toothbrushes by Humble Co. and refillable toothpaste by Bite are becoming mainstream, addressing environmental concerns. Moreover, government initiatives such as the Healthy People 2030 campaign in the United States emphasize the reduction of oral diseases, further driving the adoption of oral care products.

Cosmetic dentistry is another thriving segment. According to industry studies, nearly 32% of consumers are interested in teeth-whitening products, fueling demand for at-home solutions like whitening strips and LED kits from brands such as Crest and Snow Teeth Whitening. Orthodontic innovations, like clear aligners from Invisalign, have also gained popularity for their discreet and effective results.

E-commerce has become a key growth driver, with platforms like Amazon and Alibaba enabling seamless access to oral care products globally. The convenience of doorstep delivery has particularly appealed to younger consumers and urban populations.

Drivers

Rising Prevalence of Dental Issues and Preventive Care Awareness

The increasing incidence of oral health issues, such as cavities, periodontal diseases, and halitosis, is driving the demand for effective oral care solutions. Factors like high sugar consumption, poor dietary habits, and lack of routine dental check-ups exacerbate these problems. As a result, consumers are placing greater emphasis on preventive care, adopting products such as fluoride toothpaste, antibacterial mouthwash, and dental floss to maintain oral hygiene. Additionally, awareness campaigns led by organizations such as the World Dental Federation are educating the public about the long-term benefits of maintaining healthy oral habits, further boosting market growth.

Technological Advancements in Oral Care Products

The integration of advanced technology into oral care products is transforming the market landscape. Smart electric toothbrushes equipped with AI features, like brushing pattern analysis and real-time feedback, are gaining popularity. Innovations like water flossers and UV sterilizers are enhancing oral hygiene routines, making them more efficient and user-friendly. Moreover, tele-dentistry solutions are improving accessibility by offering virtual consultations and remote monitoring of dental health. These technological advancements not only cater to convenience but also improve the efficacy of oral care practices, driving consumer adoption globally.

Sustainability and Demand for Natural Products

The growing consumer focus on sustainability has spurred the development of eco-friendly and natural oral care products. Brands are introducing biodegradable toothbrushes, refillable toothpaste packaging, and natural ingredient-based formulations, such as herbal toothpaste and fluoride-free options. This shift aligns with global environmental goals and appeals to environmentally conscious consumers. Additionally, regulatory support and certifications for sustainable practices further encourage manufacturers to innovate in this direction. This trend is particularly strong among millennials and Gen Z, who prioritize eco-conscious purchasing decisions, making sustainability a critical growth driver in the oral care market.

Restraints

One of the significant restraints in the oral care market is the high cost associated with advanced dental products and technologies.

Premium items like AI-enabled electric toothbrushes, water flossers, and teeth whitening kits often remain unaffordable for a large segment of the population, particularly in low- and middle-income countries. Additionally, the availability of these innovative products is often limited to urban and developed regions, leaving rural and underserved areas reliant on traditional and basic oral care solutions. This disparity is further exacerbated by the lack of dental insurance coverage and limited access to dental care professionals in many parts of the world. As a result, the adoption of high-end oral care products remains uneven, hindering the market’s potential growth and making affordability and accessibility critical challenges for manufacturers and policymakers to address.

By Product

Toothbrushes dominated the oral care product market in 2023, accounting for 28.2% of the market share. This dominance is attributed to their essential role in maintaining oral hygiene, making them a staple in every household. The market has witnessed a steady demand for manual toothbrushes due to their affordability and widespread availability. Simultaneously, electric toothbrushes have gained significant traction among urban consumers seeking advanced oral care solutions. Innovations like pressure sensors, app connectivity, and sustainable options, such as bamboo toothbrushes, have further bolstered their appeal. Regular replacement of toothbrushes recommended every 3–4 months, has also sustained demand in this category.

Toothbrushes also emerged as the fastest-growing product segment in the oral care market. The rapid adoption of electric and smart toothbrushes is driving this growth, supported by rising consumer awareness of the benefits of advanced dental technologies. Features like AI-enabled brushing assistance, multiple cleaning modes, and UV sanitizers have revolutionized this segment, appealing to tech-savvy and health-conscious individuals. The growth is particularly robust in developed markets, where consumers prioritize innovative, premium products for improved oral health outcomes.

By Distribution Channel

Supermarkets and hypermarkets emerged as the dominant distribution channels for oral care products in 2023, accounting for 32.2% of the market share. This dominance is driven by the convenience of purchasing a wide variety of oral care products under one roof, combined with attractive discounts and promotional offers. Consumers benefit from in-store comparisons of different brands, enabling informed purchasing decisions. Additionally, the frequent restocking of everyday oral care essentials, such as toothpaste, toothbrushes, and mouthwash, makes supermarkets the go-to choice for a significant portion of the population. Their extensive presence in urban and suburban areas further reinforces their leadership in this segment.

Online retail stores are the fastest-growing distribution channel, experiencing exponential growth due to the rising penetration of e-commerce platforms. The convenience of browsing and purchasing products from the comfort of home, coupled with features like subscription services and personalized product recommendations, has driven consumer preference toward online shopping. Competitive pricing, frequent discounts, and the availability of niche and premium products have also contributed to this growth. The segment has particularly flourished in emerging markets, where increased internet access and smartphone usage are transforming consumer purchasing behavior.

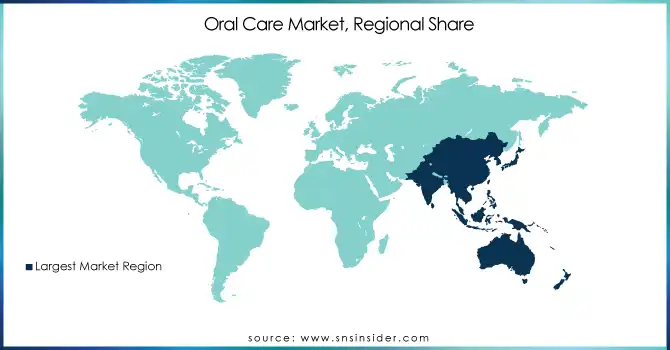

Regional Insights

In 2023, Asia-Pacific emerged as the dominant region in the global oral care market, accounting for a significant market share. The region's vast population, coupled with increasing awareness of oral hygiene and rising disposable incomes, propelled this growth. Key countries like China, India, and Japan played a central role, with their large consumer bases seeking preventive dental care solutions. The expansion of e-commerce platforms has made oral care products more accessible in both rural and urban areas, fueling demand. Furthermore, the growing adoption of affordable, locally manufactured products and government-led initiatives to promote oral health awareness have strengthened market growth in the region.

North America remained a vital market, known for its high adoption of premium oral care products. The demand for advanced products, such as electric toothbrushes and medicated toothpaste, is driven by consumer spending, along with robust awareness programs from organizations like the American Dental Association (ADA). The focus on preventive care and advanced oral health solutions continues to make North America a key player in the global market.

In Europe, there is a strong emphasis on sustainability, with a growing demand for eco-friendly and innovative oral care products. Countries like Germany and the UK lead the charge, driven by consumer demand for environmentally conscious products. The European market continues to see steady growth as more consumers seek solutions that align with both their oral health needs and environmental values.

Need any customization research on Oral Care Market - Enquiry Now

Key Players

Colgate-Palmolive Company – Colgate Toothpaste, Colgate Total, Colgate Optic White, Colgate MaxFresh, Colgate 360° Toothbrushes

GSK plc – Sensodyne Toothpaste, Parodontax, Poligrip, Biotène Mouthwash, Oral-B (joint venture)

Johnson & Johnson Services, Inc. – Listerine Mouthwash, Reach Toothbrushes, Reach Dental Floss

Church & Dwight Co., Inc. – Arm & Hammer Toothpaste, Orajel, Orajel Toothache Gel

Procter & Gamble – Oral-B Toothbrushes, Oral-B Toothpaste, Crest Toothpaste, Crest Whitestrips

Unilever PLC – Signal Toothpaste, Close Up, Pepsodent, Mentadent

GC Corporation – GC Tooth Mousse, GC Dental Products, GC America Dental Solutions

Lion Corporation – Systema Toothbrushes, Systema Toothpaste, Shokubutsu Toothpaste

Henkel AG & Co. KGaA – Theramed Toothpaste, Parodontax, Oral-B (partnered products)

Sunstar Suisse S.A. – GUM Toothbrushes, GUM Toothpaste, GUM Dental Floss

Koninklijke Philips N.V. – Sonicare Electric Toothbrush, Sonicare Mouthwash, Sonicare AirFloss

Ultradent Products, Inc. – UltraEZ, Opalescence Whitening, PerioMax

3M Company – 3M Dental Products, Clinpro Toothpaste, 3M Filtek Dental Restoratives

Hain Celestial Group (Jason Natural Products, Inc.) – Jason Natural Toothpaste, Jason Natural Toothbrushes

Supersmile – Supersmile Whitening Toothpaste, Supersmile Toothbrushes

CloSYS – CloSYS Toothpaste, CloSYS Mouthwash

Hawley & Hazel (BVI) Co. Ltd. – Darlie Toothpaste, Darlie Toothbrushes

Recent Developments

In Jan 2025, Delta Dental of Idaho allocated USD 177,000 in grants to support local organizations focused on enhancing oral health education, access, and care throughout the state. This investment aims to strengthen community oral health initiatives in Idaho.

In Jan 2025, The American Dental Association (ADA) urged the Trump administration to prioritize oral health as a key component of overall well-being and to maintain fluoride levels in public water systems. This request emphasized the crucial role of oral care in supporting general health.

In Jan 2025, Pearl partnered with Centaur, a leading provider of dental practice management systems in Australia, to expand the adoption of its Second Opinion AI software. This collaboration integrates Pearl’s advanced disease detection technology into Centaur’s Mediasuite platform, enhancing access for dental professionals in Australia, the Middle East, and globally.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 35.16 Billion |

| Market Size by 2032 | US$ 56.93 Billion |

| CAGR | CAGR of 5.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Toothbrush, Toothpaste, Mouthwash/Rinse, Dental Accessories ) • By Type (Supermarkets/ Hypermarkets, Convenience Stores, Online retail stores, Pharmacies Drug Stores, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Colgate-Palmolive Company, GSK Plc, Johnson & Johnson Services Inc.,Church Dwight Co. Inc., Procter & Gamble, Unilever PLC, GC Corporation, Lion Corporation, Henkel AG & Co. KGaA, Sunstar Suisse S. A., Koninklijke Phiilips. N. V. ,Ultradent Products Inc., 3M Company, Hain Celestail Group, Supersmile, CloSYS, Hawley & Hazel Co. Ltd. |

| Drivers |

• Rising Prevalence of Dental Issues and Preventive Care Awareness. |

| Restraints | • One of the significant restraints in the oral care market,is the high cost associated with advanced dental products and Technologies. |

Ans: - The Oral Care Market size is estimated to reach US$ 56.93 bn by 2032.

Ans:- The Oral Care Market is growing at a CAGR of 5.52% over the forecast period 2024-2032.

Major product introductions by market companies have become more common. A rechargeable toothbrush that provides a professional dental cleaning experience at home.

The toothpaste sub-segment of products is leading the oral care market.

Colgate-Palmolive Company, GSK Plc, Johnson & Johnson Services Inc.,Church Dwight Co. Inc., Procter & Gamble, Unilever PLC, GC Corporation, Lion Corporation, Henkel AG & Co. KGaA, Sunstar Suisse S. A., Koninklijke Phiilips. N. V. ,Ultradent Products Inc., 3M Company, Hain Celestail Group, Supersmile, CloSYS, Hawley & Hazel Co. Ltd.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of the Ukraine-Russia War

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Global Oral Care Market Segmentation, by Product Outlook

8.1 Toothbrush:

8.1.1 Manual

8.1.2 Electric (rechargeable)

8.1.3Battery-powered (non-rechargeable)

8.2 Toothpaste:

8.2.1 Gel

8.2.2 Polish

8.2.3 Paste

8.2.4 Powder

8.2.5 Mouthwash/rinse:

8.2.6 Medicated

8.2.7 Non-medicated

8.2.8 Denture Products:

8.2.9 Cleaners

8.2.10 Fixatives

8.2.11 Others

8.3 Dental Accessories :

8.3.1 Cosmetic Whitening Products

8.3.2 Fresh Breath Dental Chewing Gum

8.3.3 Tongue Scrapers

8.3.4 Fresh Breath Strips

8.3.5 Floss

9. Global Oral Care Market Segmentation, by Type

9.1 Countertop

9.2 Cordless

10. Global Oral Care Market Segmentation, By Application Outlook

10.1 Home

10.2 Dentistry

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 USA

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 UK

11.3.3 France

11.3.4 Italy

11.3.5 Spain

11.3.6 The Netherlands

11.3.7 Rest of Europe

11.4 Asia-Pacific

11.4.1 Japan

11.4.2 South Korea

11.4.3 China

11.4.4 India

11.4.5 Australia

11.4.6 Rest of Asia-Pacific

11.5 The Middle East & Africa

11.5.1 Israel

11.5.2 UAE

11.5.3 South Africa

11.5.4 Rest

11.6 Latin America

11.6.1 Brazil

11.6.2 Argentina

11.6.3 Rest of Latin America

12. Company Profiles

12.1Procter & Gamble Company

12.1.1 Financial

12.1.2 Products/ Services Offered

12.1.3 SWOT Analysis

12.1.4 The SNS view

12.2 Johnson & Johnson Services, Inc.

12.3 Colgate-Palmolive Company

12.4 GlaxoSmithKline plc

12.5 Church & Dwight Co., Inc.

12.6 Dr. Fresh, LLC

12.7 Dentaid Lion Corporation

12.8 Sunstar Suisse S.A.

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Toothbrush

Manual

Electric

Battery powered

Others

Toothpaste

Gel

Polish

Paste

Powder

Mouthwash/Rinse

Medicated

Non-medicated

Denture Products

Cleaners

Fixatives

Others

Dental accessories

Cosmetic whitening product

Fresh breath dental chewing gum

Tongue scrappers

Fresh breath strips

Others

Oral irrigators

Countertop

Cordless

Mouth freshener sprays

By Distribution Channel

Supermarkets/Hypermarkets

Convenience stores

Online retail stores

Pharmacies and Drug stores

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Medical Radiation Shielding Market size was estimated at USD 1.44 billion in 2023 and is expected to reach USD 2.57 billion by 2032 with a growing CAGR of 6.65% during the forecast period of 2024-2032.

The Consumer Healthcare market was valued at USD 302.87 billion in 2023 and is expected to reach USD 588.68 billion by 2032 and grow at a CAGR of 7.68% over the forecast period of 2024-2032.

Veterinary Microchips Market Size was valued at USD 686.3 million in 2023 and is expected to reach USD 1637.41 million by 2032, growing at a CAGR of 10.16% over the forecast period 2024-2032.

Nursing Products Market was valued at USD 5.73 billion in 2023 and is expected to reach USD 10.95 billion by 2032, growing at a CAGR of 7.48% over the forecast period 2024-2032.

The Pressure Monitoring Market was valued at USD 12.74 billion in 2023 and is expected to reach USD 27.07 billion by 2032, growing at a CAGR of 8.75% over the forecast period of 2024-2032.

The global Eyewear Market was valued at USD 189.93 billion in 2023 and is projected to grow at a CAGR of 7.65%, reaching USD 368.45 billion by 2032.

Hi! Click one of our member below to chat on Phone