Get more information on Optical Modulators Market - Request Sample Report

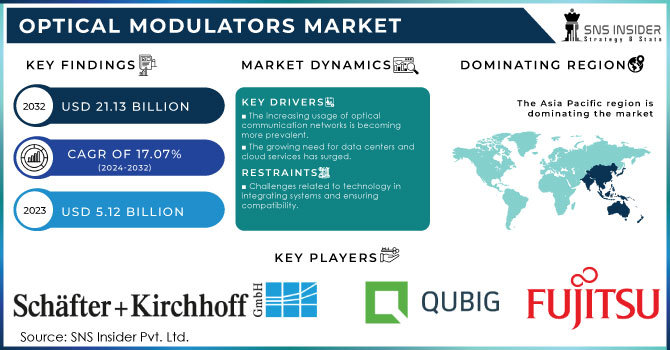

The Optical Modulators Market size was valued at USD 5.12 Billion in 2023 and is expected to reach USD 21.13 Billion by 2032 and grow at a CAGR of 17.07% over the forecast period 2024-2032.

The optical modulators market is now a vital part of the larger photonics sector, serving a critical function in transmitting optical signals. The market has been driven significantly by the increasing need for fast internet, data processing, and communication, with optical modulators allowing for the effective management of large data volumes on fiber optic networks. The increasing growth of 5G networks has led to a higher demand for advanced optical modulators, necessary for handling greater bandwidths and quicker data transfer speeds. The drive towards 5G has had a notable impact on the market, leading to ongoing advancements in modulator technologies to satisfy the strict performance demands of these advanced networks. by the middle of 2024, significant advancements and widespread adoption of 5G technology have been observed in the United States. About 90% of the American population now has access to 5G networks, thanks to the rapid spread of services provided by top carriers such as Verizon, AT&T, and T-Mobile. Among these options, T-Mobile boasts the largest 5G network in terms of coverage area. Around 150 million people in the United States are presently using 5G services, resulting in a notable growth in the number of subscribers for this technology. The number continues to rise, driven by an annual growth rate of around 25% to 30%. Government efforts have allocated more than USD 100 billion towards enhancing infrastructure for the rollout of 5G networks.

Significant growth is also being observed in the field of quantum computing for the market of optical modulators. Significant funding has been allocated to quantum computing in the United States, with worldwide investments totaling around USD 1.5 billion in 2023. The increase in funding is leading to significant progress in the sector, as major technology firms and research organizations are making significant advancements. Important figures in the field of quantum computing include IBM, Google, Microsoft, Rigetti Computing, and D-Wave Systems. Quantum computing necessitates extremely accurate and dependable photonic components, such as optical modulators, to harness the power of quantum mechanics and achieve blazing-fast information processing capabilities. These controllers are utilized to influence quantum states and manage quantum bits (qubits), which serve as the basic components of quantum data. With the progression of research and development in quantum computing, there is anticipated growth in the demand for state-of-the-art optical modulators, which will create new prospects for market expansion.

Drivers

The increasing usage of optical communication networks is becoming more prevalent.

The increasing usage of optical communication networks is a significant factor influencing the optical modulation technologies market. Optical communication networks utilize light signals for transmitting data over long distances with minimal loss, which makes them well-suited for high-speed data transmission. The increasing need for quicker and more dependable communication networks is leading to a rise in the use of optical networks, which is driving the need for optical modulators. The growing need for high-definition video streaming, online gaming, and other bandwidth-intensive applications is a crucial factor in the popularity of optical communication networks. These apps need to transmit huge amounts of data rapidly and consistently, a task most effectively done through optical communication systems. Optical modulators are essential in these networks as they facilitate the modulation of light signals, which leads to the efficient transfer of data at fast rates.

The growth of the optical modulators market is also being fueled by the increasing advancement of fiber-optic infrastructure expansion. Governments and private companies worldwide are making substantial investments in the installation of fiber-optic networks to accommodate the increasing need for fast internet access. Fiber-optic networks have multiple benefits compared to conventional copper-based networks, such as increased bandwidth, quicker data transfer speeds, and improved reliability. Optical modulators play a vital role in fiber-optic networks by allowing the modulation of light signals to facilitate data transmission. As fiber-optic networks grow, the need for optical modulators is also expected to rise.

The growing need for data centers and cloud services has surged.

The optical modulators market is being significantly driven by the growing need for data centers and cloud services. Data centers are essential for the digital economy, offering the infrastructure needed to store, manage, and transmit large volumes of data. With the increase in businesses and consumers utilizing cloud services, there is a growing requirement for data centers, leading to a higher demand for high-speed optical communication networks and optical modulators. Cloud computing has become an essential element of contemporary business operations, providing flexible and affordable options for storing and managing data. With the rising popularity of cloud services among businesses, the demand for data centers is on the rise, leading to a greater need for fast data transmission. Optical modulators are essential for facilitating the efficient transfer of data in and out of data centers, enabling real-time processing and communication. The increasing demand for cloud services is anticipated to result in a rise in demand for optical modulators.

Moreover, the rising usage of IoT devices is fueling the expansion of data centers. IoT devices produce vast quantities of data that must be stored, processed, and transferred. Data centers are necessary to control this information, and fast optical communication networks are needed to manage the massive amounts of data produced by IoT devices. Optical modulators play a crucial role in these networks, allowing for the effective transfer of data. The increasing use of IoT devices will lead to a rise in the need for data centers and optical modulators.

Restraints

Challenges related to technology in integrating systems and ensuring compatibility.

The integration and compatibility of optical modulators with current communication systems pose a major hurdle for the market due to technical challenges. Incorporating optical modulators into intricate optical communication networks poses difficulties concerning signal processing, alignment, and compatibility with other components. Integrating optical modulators with current electronic and photonic systems is a significant technical difficulty. Optical modulators need to function smoothly alongside lasers, detectors, and amplifiers in an optical communication network. Ensuring that these components are compatible can be difficult, especially when working with various technologies and materials. For instance, the complexity of integrating silicon photonics-based optical modulators with conventional electronic components may necessitate specialized interfaces or signal-processing techniques. One more obstacle is guaranteeing the correct positioning of optical modulators in a communication system. Correct alignment of optical modulators with other optical components is necessary for effective signal transmission and reduction of signal loss. It can be challenging to achieve this alignment, especially in complex deployments with numerous modulators and components. Misalignment may cause deterioration in signals and decreased efficiency, affecting the overall performance of the optical communication network.

by Type

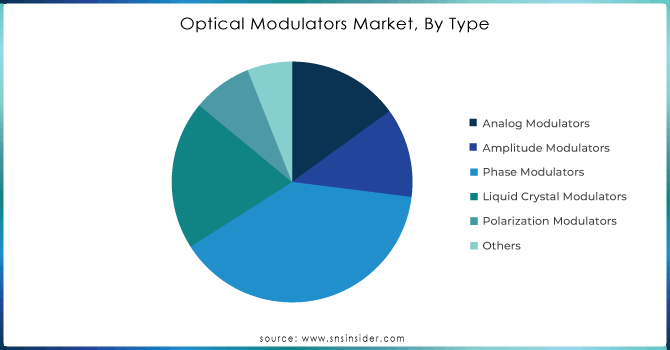

Phase modulators held a market share of over 38% in 2023 and dominated the market because of their vital function in sophisticated optical communication systems. These devices manipulate the phase of an optical signal while leaving its amplitude unchanged, which is necessary for fast data transmission. Phase modulators excel in the areas of high precision and stability, which are demanded by these networks. Lumentum and Thorlabs incorporate phase modulators in their optical network equipment to improve the quality and efficiency of data transmission. The growth of phase modulators in the market is driven by the rising need for bandwidth and the growth of fiber-optic infrastructure.

Liquid Crystal Modulators are expected to have rapid growth in the market during 2024-2032, due to their flexibility and ability to be used in different applications. LCMs control light by changing how liquid crystals are aligned, allowing for accurate adjustment of light brightness, polarization, and phase. Leading the development of advanced LCMs for various purposes, companies such as Meadowlark Optics and Santec Corporation are at the forefront in industries like holographic displays and optical coherence tomography. A growing need for high-quality screens and sophisticated imaging technology is driving the expansion of liquid crystal modulators, positioning them as a critical area of interest within the optical modulator sector.

Get Customized Report as per your Business Requirement - Request For Customized Report

by Application

The optical communication sector led the market with over 41% market share in 2023, due to increased data traffic, cloud services, and the rollout of 5G networks. Optical modulators are essential for improving the effectiveness of data transfer in fiber optic communication systems, which serve as the foundation of contemporary telecommunications. The growth of this sector is being driven by the rising need for greater bandwidth and reduced latency in data centers, telecommunications networks, and internet infrastructure. For example, Cisco Systems and Huawei Technologies utilize advanced optical modulators to enhance the functionality of their fiber optic communication devices, guaranteeing quicker and more dependable data transfer.

The space and defense segment is the most rapidly growing application in the optical modulators market during the forecast period, driven by the growing need for advanced, secure communication systems in military and space operations. Optical modulators play a crucial role in satellite communication, radar systems, and secure data links by facilitating the transfer of high-frequency signals with little loss and interference. For instance, Northrop Grumman and Lockheed Martin are incorporating optical modulator technologies into their advanced defense systems, such as space-based communication platforms and electronic warfare systems, to guarantee secure and efficient communication during important operations.

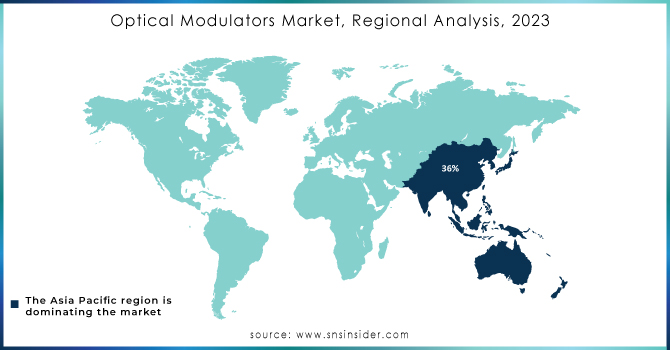

Asia-Pacific dominated the market in 2023 with more than 36% market share. Nations such as China, Japan, and South Korea are leading in the implementation of 5G technology, driving up the need for optical modulators in the area. The increase in data usage, along with the rise in data center quantity, is boosting market expansion even more. Fujitsu and Sumitomo Electric are important companies in the APAC region, working on the development of optical modulators for different uses like telecommunications, data centers, and fiber-optic networks. The optical modulators market in APAC is projected to experience continued growth due to the region's emphasis on digital transformation and smart city projects, especially in China and India, positioning it as a key area for advancing optical communication technologies.

North America is accounted to have the fastest CAGR during 2024-2032 because of its state-of-the-art telecommunications infrastructure and substantial funding for research and development. Market growth has been driven by the existence of large technology firms and the quick acceptance of advanced communication technologies. Main companies such as Lumentum Holdings and Cisco Systems are leading advancements in optical modulators for high-speed data transmission in this area. The strong need for high-bandwidth communication networks in the area, fueled by cloud computing, data centers, and the rollout of 5G technology, reinforces its top status. Furthermore, efforts by the government to improve broadband connection in the U.S. and Canada are helping to boost the growth of the optical modulators market.

The key market players in Global Optical Modulators Market are Fujitsu Ltd., QuantaTech, QUBIG GmbH, Schafter + Kirchhoff GmbH, IBM Corp, Agiltron Inc, Cisco Systems Inc, Intel Corp, Gooch & Housego PLC, Jenoptik AG, Lumentum Holdings Inc, Inrad Optics, Inc., Intel Corporatonm, IPG Photonics Corporation, iXBlue Inc, Jenoptik AG, Newport Corporation, MKS Instruments Inc, Thorlabs Inc, Brimrose Corporation of America, Conoptics, Inc., Felles Photonic Instruments Limited, Sumitomo Corporation, Thorlabs, Inc., Viavi Solutions, Inc. and Other.

In March 2024, Coherent Inc. announced a nano-second optical modulator designed to enhance laser systems for telecommunication and medical equipment applications. It is characterized by the improved switching speed and flexibility of integration. The tool is geared toward high-growing industries.

In January 2024, Lumentum announced the innovation of the new high-speed silicon photonics modulator. As the industry was in great demand for a new solution for data centers and 5G networks, the tool was expected to be consumed on the highest level. The advantage of the new modulator was the low power dissipation and improved bandwidth.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.12 Billion |

| Market Size by 2032 | US$ 21.13 Billion |

| CAGR | CAGR of 17.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Analog, Modulators, Amplitude Modulators, Phase Modulators, Liquid Crystal Modulators, Polarization Modulators, Others) • By Application (Optical Communication, Fiber Optic Sensors, Space And Defense, Industrial Systems, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fujitsu Ltd., QuantaTech, QUBIG GmbH, Schafter + Kirchhoff GmbH, IBM Corp, Agiltron Inc, Cisco Systems Inc, Intel Corp, Gooch & Housego PLC, Jenoptik AG, Lumentum Holdings Inc, Inrad Optics, Inc., Intel Corporatonm, IPG Photonics Corporation |

| Key Drivers |

• Growing demand for high-speed communications. • Developments in the telecommunications sector |

| OPPORTUNITIES |

• Growing demand of optical modulators in smart homes • The rise of silicon photonics |

The Optical Modulators Market size was valued at 5.12 billion in 2023 at a CAGR of 17.07%.

Fiber-coupled integrated optical modulators, Cloud-based storage, Optical fibers are the drivers of the Optical Modulators Market.

The key market players in Global Optical Modulators Market are Fujitsu Ltd., QuantaTech, QUBIG GmbH, Schafter + Kirchhoff GmbH, IBM Corp, Agiltron Inc, Cisco Systems Inc, Intel Corp, Gooch & Housego PLC, Jenoptik AG, Lumentum Holdings Inc, Inrad Optics, Inc., Intel Corporatonm, IPG Photonics Corporation, iXBlue Inc, Jenoptik AG, Newport Corporation, MKS Instruments Inc, Thorlabs Inc, Brimrose Corporation of America, Conoptics, Inc., Felles Photonic Instruments Limited , Sumitomo Corporation, Thorlabs, Inc., Viavi Solutions, Inc. and Other.

Top-down research, bottom-up research, qualitative research, quantitative research, and Fundamental research.

Manufacturers, Consultants, Association, Research Institutes, private and university libraries, suppliers, and distributors of the product.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Optical Modulators Wafer Production Volumes, by Region (2023)

5.2 Optical Modulators Wafer Chip Design Trends (Historic and Future)

5.3 Optical Modulators Wafer Fab Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Optical Modulators Market Segmentation, by Type

7.1 Chapter Overview

7.2 Analog Modulators

7.2.1 Analog Modulators Market Trends Analysis (2020-2032)

7.2.2 Analog Modulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Amplitude Modulators

7.3.1 Amplitude Modulators Market Trends Analysis (2020-2032)

7.3.2 Amplitude Modulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Phase Modulators

7.4.1 Phase Modulators Market Trends Analysis (2020-2032)

7.4.2 Phase Modulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Liquid Crystal Modulators

7.5.1 Liquid Crystal Modulators Market Trends Analysis (2020-2032)

7.5.2 Liquid Crystal Modulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Polarization Modulators

7.6.1 Polarization Modulators Market Trends Analysis (2020-2032)

7.6.2 Polarization Modulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.7.1 Others Market Trends Analysis (2020-2032)

7.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Optical Modulators Market Segmentation, by Application

8.1 Chapter Overview

8.2 Optical Communication

8.2.1 Optical Communication Market Trends Analysis (2020-2032)

8.2.2 Optical Communication Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Space and Defense

8.3.1 Space and Defense Market Trends Analysis (2020-2032)

8.3.2 Space and Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Industrial Systems

8.4.1 Industrial Systems Market Trends Analysis (2020-2032)

8.4.2 Industrial Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Fiber Optic Sensors

8.5.1 Fiber Optic Sensors Market Trends Analysis (2020-2032)

8.5.2 Fiber Optic Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Others

8.6.1 Others Market Trends Analysis (2020-2032)

8.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Optical Modulators Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Optical Modulators Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Optical Modulators Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific Optical Modulators Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia-Pacific Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia-Pacific Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia-Pacific Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Optical Modulators Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Optical Modulators Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Optical Modulators Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Optical Modulators Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Optical Modulators Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Fujitsu Ltd.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 QuantaTech

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 QUBIG GmbH

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Schafter + Kirchhoff GmbH

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 IBM Corp

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Agiltron Inc.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Cisco Systems Inc

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Intel Corp

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Gooch & Housego PLC

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Jenoptik AG

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Analog Modulators

Amplitude Modulators

Phase Modulators

Liquid Crystal Modulators

Polarization Modulators

Others

By Application

Space and Defense

Industrial Systems

Fiber Optic Sensors

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Mobile TV Market Size was valued at USD 13.26 Billion in 2023 and is expected to grow at a CAGR of 8.53% to Reach USD 27.70 Billion by 2032.

The DRAM Module and Component Market Size was valued at $96.91 Billion in 2023 and is expected to grow at a CAGR of 1.75% to reach $113.26 Billion by 2032

The Semiconductor Teardown Services Market Size was valued at USD 1.37 Billion in 2023 and is expected to grow at a CAGR of 7.37% During 2024-2032.

The 3D Printing Materials Market Size USD 2.8 Billion in 2023 and is expected to reach USD 20.53 Billion by 2032 and grow at a CAGR of 24.81% by 2024-2032.

The Digital KVMs Market size was valued at USD 10.30 Billion in 2023 and is expected to reach USD 31.56 Billion by 2032 and grow at a CAGR of 13.29% over the forecast period 2024-2032.

The Smart Mirror Market Size was valued at USD 548.21 million in 2023 and is expected to grow at a CAGR of 8.9% to reach at USD 1132.94 million in 2032.

Hi! Click one of our member below to chat on Phone