To get more information on Optical Measurement Market - Request Free Sample Report

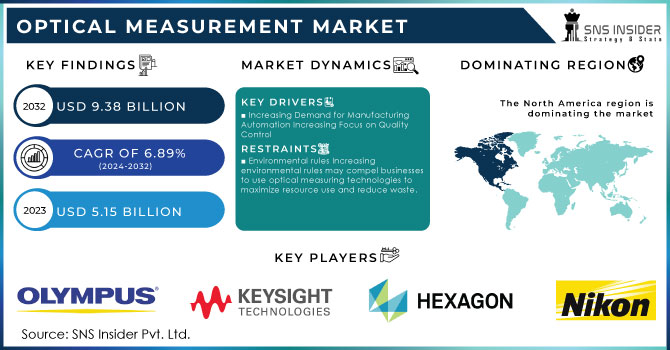

The Optical Measurement Market size was estimated at USD 5.15 billion in 2023 and is expected to reach USD 9.38 billion by 2032 at a CAGR of 6.89% during the forecast period of 2024-2032.

Optical measuring methods are used in various industries as a non-contact method that is often the fastest and most accurate. This method is very advantageous, and the devices can be applied to complete some challenging and quickly implemented tasks. The equipment has a benefit of real-time data transfers. As far as the devices are non-contact, the surface of the component under consideration will not be damaged. The technology is applied in a great number of areas ranging from assuring the quality of products to controlling vehicle speeds for road safety. The increasing demand for optical measuring instruments in the aerospace, automotive, military, medical, industrial, electronics manufacturing, energy, and power industries will propel market expansion. To keep mission-critical applications on track, the military Vertical demands precise measuring equipment that has undergone calibration and traceability scrutiny. Additionally, these instruments should comply with such bodies’ regulatory requirements standards like AS9100, ISO 9001, and their combinations to provide the most reliable and accurate metrology solutions.

The several factors prompt the growth of the optical measurement market. The increasing complexity of manufactured products suggests a need for high-precision measurement solutions, which serves as an enabler for the adoption of advanced optical measurement systems. At the same time, the ongoing development of Industry 4.0 and smart manufacturing gives rise to the integration of optical measurement technologies into automated production lines, facilitating the improvement of efficiency and the reduction of human errors. In many cases, the goal of miniaturization set in electronics and medical devices dictates the high growth rate for the given market due to the need to ensure product quality and accuracy using measurement systems. The demand for integrated automation solutions is also increased through remarkable stringency of quality standards and norms applied in such large-scale industries as automotive and aerospace.

MARKET DYNAMICS

DRIVER

Technological progress in the future decade is not expected to slow down, given the constricted collaboration between different industries. These trends suggest a growing demand for various optical measurement systems, as witnessed in the rise of its markets.

The advancement of the optical measurement nowadays is induced by the developed of high-resolution cameras and innovative 3D scanning technology. Due to the technological breakthrough, the opportunities for the application of optical measurement have enlarged on the market both in the industrial and scientific spheres. The high-resolution cameras are improved in terms of the sensor, resolution, and image processing technology. Thus, the imaging is more vivid, clear, and distinct in details, therefore, the application range is broadened. Specifically, resolution and accuracy are highly required in industrial areas including manufacturing, medicine, and remote sensing. In such industries as aeronautics, automotive or electronics, high-resolution cameras are used for more precise component recognition and considerable decrease of defective objects in the flight or final products.

The 3D scanning technology is also upgraded in form of the rapid and precise three-dimensional design of an object. The laser or structured light captures the geometric details and provides profound images of an object. The latter is extremely important for industrial purposes such as reverse engineering, architecture, and virtual reality. The technology gives an opportunity to create digital models required for further improvements, control and examination in order to make it a reality. In such a way, the 3D scanning technology is used for more precise scientific investigation, analysis, and identification of multi-dimensional structures.

The increasing demand for such equipment originates from its market applications in industrial and scientific fields. The automotive and aerospace sectors are also expanding because of greater production rates and technology advancement.

The increasing demand for precise optical measurement systems is closely connected with the growing automotive and aerospace industries. The heightened production rates and rapid technological development observed in these segments explain the surge and the role of optical equipment in supporting them. Both automotive and aerospace producers witness an increased demand for a high level of production and the quality of the items they produce. With growing production rates, there is a need for the technologies that would facilitate a significant inspection and check of their characteristics at high precision and with minimal errors. Featuring a light-based technology, these systems measure dimensions, shapes and other characteristics of the objects they are directed at. A great advantage of these systems is the fact that they allow measurement without contact. It is imperative for many of the smaller and more intricate parts and devices produced in car engines, sensors, and safety systems. With the increased production, these units need to be tested and the optical measurement ensures they meet the necessary requirements. Similarly to the automotive industry, producers in the aerospace industry strive to speed up the production process and the increase in the production of aircraft leads to the increased demand for measurement of specific technical components.

It increased technological progress which has allowed the application of advanced sensors and the development of software, has further increased the opportunities and the scale of the use of optical measurement systems. On the one hand, they are able to provide the most accurate and reliable information. The manufacturers ensure efficiency and timeliness of these processes. The advantages are such that the automotive and aerospace industries, with their focus on increasing production rates and efforts to avoid errors in the process, prove to be the key segments causing the growing demand for precise and optical measurement systems in general.

RESTRAIN

The obstacle one may find with the adoption of advanced optical measurement systems is their high cost, which serves to hinder their adoption among small and medium-sized enterprises.

The primary contentious issue with the advanced optical measurement systems is their high initial cost that serves as a powerful barrier between the technology and adoption. This technology requires a considerable upfront payment to secure the installation and ever mounting procurement costs in the form of purchases of equipment to people with generally tight budgets, small and medium-sized enterprises. In summary, by being expensive to procure and furthermore requiring a considerable number of resources to be operational, this complicated system of sensors and tools serves to deny these businesses the opportunity to leverage their advantages in precision and performance. In turn, it limits their spread and cements a technological gap between setting corporations and smaller enterprises, hindering the effective rate of growth and innovation within the industries dependent on precise optical measurements.

By Offering

The hardware segment dominated with a market share of over 46% in 2023. The different types of measuring instruments, cameras, optical sensors, etc., since, they are an essential part of the development of almost any system, make the functionality of the developed system possible to great extent. Furthermore, such devices are widely used in many industries, including automotive, aerospace, electronics, healthcare and many others, and the high demand is observed from one of the latter because extremely precise and highly reliable equipment is needed.

The software segment is currently fastest-growing segment in the Optical Measurement Market. It is associated with the growth of the competencies of the engines applied in the systems and the growing demand in integrating solutions. However, the software must become much more sophisticated to handle the tasks facing modern optical measurement systems.

By Component

The Video Measuring Machines segment held the largest market share in 2023 of more than 32%. The VMM’s have got a high degree of precision, can sample a variety of measurement points and perform multi-sensor inspection, and can do precisely and accurately that which they are designed to do. They are used widely in the manufacturing industry and quality inspection to handle the measurement of complex geometries. Therefore, they are dominating the microelectromechanical systems market.

Optical Digitizers and Scanners is the fastest growing segment in the market, as similar to VMM’s, the increasing demand for 3-dimensional scanning has increased the growth rate of ODS’s. The ODS’s form an important technology in the market and is used in the automotive and aerospace industries, manufacturing and electronics industries, R&D labs, and quality inspection departments.

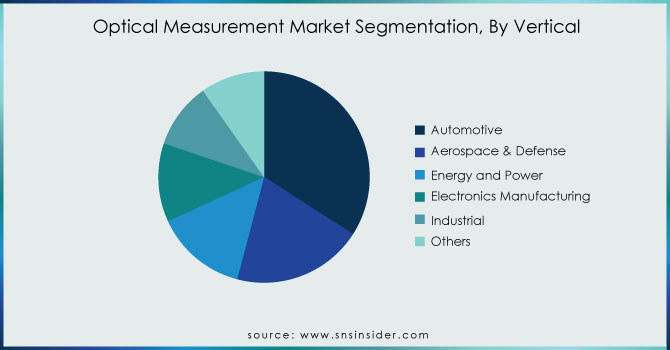

By Vertical

The automotive industry dominated with a market share of over 34.08% in 2023. The reason for that is increasing usage of advanced driver assistance systems and autonomous cars, as well as tighter safety regulations. All those factors call for precise optical measurement tools to ensure the quality and performance of the systems and vehicles produced.

Need any customization research on Optical Measurement Market - Enquiry Now

REGIONAL ANALYSIS

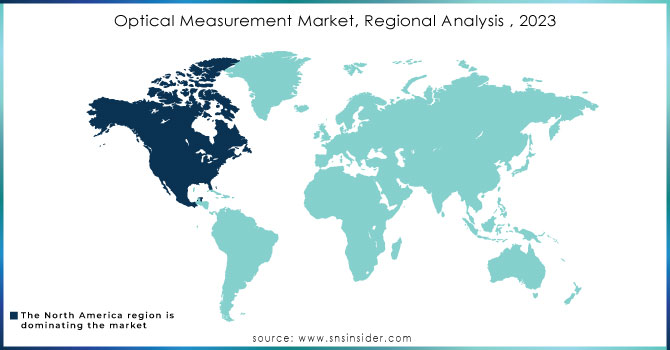

The Asia Pacific dominated the market with more than 38% in 2023. One of the reasons is the fast pace of the region’s industrialization pervading China, India, South Korea, and others. The industrial growth of those countries is immense and fuels the demand for precise measurement solutions. Additionally, the manufacturers are becoming more and more concerned with quality and are advocating reliable and steady, which is met by optical measurement technology. Finally, the governments of the majority of APAC countries recognize the value of technologies and innovation in the modern world and invest heavily in the advanced manufacturing sector, including the optical measurement market.

The North America will be the fastest-growing region in the optical measurement market. The first reason is the prevalence of technology companies on the continent, especially in the United States. Many technological developments, including optical measurement devices, are made in R&D in North America. The region also has both automotive and aerospace industries and both fields are major customers of optical measurement solutions.

The major key players are Nikon Corporation,, Hexagon AB, Keysight Technologies Inc.., R&D Vision, AMETEK, Inc., Olympus Corporation, FARO Technologies Inc., Carl Zeiss AG,, Jenoptik AG, Keyence Corporation and others.

RECENT DEVELOPMENT

In January 2023: ZEISS acquired LENSO, one of the leading partners for 3D optical systems based in Poland. The main goal of the acquisition refers to the attempt to improve ZEISS’s position in the country and make it stronger on the market.

In November 2022: A transaction with RTDS Technologies, Inc., and Navitar was concluded by AMETEK, Inc. The value of this acquisition is USD 430 million. This acquisition helps AMETEK gain a unique position in those industries that are rapidly growing and adds more depth to its product line.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.15 Bn |

| Market Size by 2032 | US$ 9.38 Bn |

| CAGR | CAGR of 6.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Camera, Lens and Sensors, Light Sources, Others, Software, Services, After Sales Services, Measurement Services) • By Component (Profile Projectors, Autocollimators, Measuring Microscopes, Video Measuring Machines, Optical Digitizers and Scanner) • By Vertical (Automotive, Aerospace & Defense, Energy and Power, Electronics Manufacturing, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Nikon Corporation, Hexagon AB, Keysight Technologies Inc., R&D Vision, AMETEK, Inc., Olympus Corporation, FARO Technologies Inc., Carl Zeiss AG, Jenoptik AG, and Keyence Corporation |

| Key Drivers | • Technological progress in the future decade is not expected to slow down, given the constricted collaboration between different industries. These trends suggest a growing demand for various optical measurement systems, as witnessed in the rise of its markets.

• The increasing demand for such equipment originates from its market applications in industrial and scientific fields. The automotive and aerospace sectors are also expanding because of greater production rates and technology advancement. |

| Market Restrain | • The obstacle one may find with the adoption of advanced optical measurement systems is their high cost, which serves to hinder their adoption among small and medium-sized enterprises. |

Ans: The Optical Measurement Market is expected to grow at a CAGR of 6.89%.

Ans: Optical Measurement Market size was USD 5.15 Billion in 2023 and is expected to Reach USD 9.38 Billion by 2032.

Ans: Hardware is the dominating segment by offering capacity in the Optical Measurement Market.

Ans: Technological progress in the future decade is not expected to slow down, given the constricted collaboration between different industries. These trends suggest a growing demand for various optical measurement systems, as witnessed in the rise of its markets.

Ans: Asia-Pacific is the dominating region in the Optical Measurement Market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Optical Measurement Market Segmentation, by offering

7.1 Introduction

7.2 Hardware

7.2.1 Camera

7.2.2 Lens and Sensors

7.2.3 Light Sources

7.2.4 Others

7.3 Software

7.4 Services

7.4.1 After Sales Services

7.4.2 Measurement Services

8. Optical Measurement Market Segmentation, by component

8.1 Introduction

8.2 Profile Projectors

8.3 Autocollimators

8.4 Measuring Microscopes

8.5 Video Measuring Machines

8.6 Optical Digitizers and Scanners

8.6.1 3D Laser Scanners

8.6.2 Structured Light Scanners

8.6.3 Laser Trackers

9. Optical Measurement Market Segmentation, by vertical

9.1 Introduction

9.2 Automotive

9.3 Aerospace & Defense

9.4 Energy and Power

9.5 Electronics Manufacturing

9.6 Industrial

9.7 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Optical Measurement Market, By Country

10.2.3 North America Optical Measurement Market, by offering

10.2.4 North America Optical Measurement Market, by Component

10.2.5 North America Optical Measurement Market, by Vertical

10.2.6 USA

10.2.6.1 USA Optical Measurement Market, by offering

10.2.6.2 USA Optical Measurement Market, by Component

10.2.6.3 USA Optical Measurement Market, by vertical

10.2.7 Canada

10.2.7.1 Canada Optical Measurement Market, by offering

10.2.7.2 Canada Optical Measurement Market, by Component

10.2.7.3 Canada Optical Measurement Market, by vertical

10.2.8 Mexico

10.2.8.1 Mexico Optical Measurement Market, by offering

10.2.8.2 Mexico Optical Measurement Market, by Component

10.2.8.3 Mexico Optical Measurement Market, by vertical

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Optical Measurement Market, By Country

10.3.2.2 Eastern Europe Optical Measurement Market, by offering

10.3.2.3 Eastern Europe Optical Measurement Market, by Component

10.3.2.4 Eastern Europe Optical Measurement Market, by Vertical

10.3.2.5 Poland

10.3.2.5.1 Poland Optical Measurement Market, by offering

10.3.2.5.2 Poland Optical Measurement Market, by Component

10.3.2.5.3 Poland Optical Measurement Market, by vertical

10.3.2.6 Romania

10.3.2.6.1 Romania Optical Measurement Market, by offering

10.3.2.6.2 Romania Optical Measurement Market, by Component

10.3.2.6.4 Romania Optical Measurement Market, by vertical

10.3.2.7 Hungary

10.3.2.7.1 Hungary Optical Measurement Market, by offering

10.3.2.7.2 Hungary Optical Measurement Market, by Component

10.3.2.7.3 Hungary Optical Measurement Market, by vertical

10.3.2.8 Turkey

10.3.2.8.1 Turkey Optical Measurement Market, by offering

10.3.2.8.2 Turkey Optical Measurement Market, by component

10.3.2.8.3 Turkey Optical Measurement Market, by vertical

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Optical Measurement Market, by offering

10.3.2.9.2 Rest of Eastern Europe Optical Measurement Market, by component

10.3.2.9.3 Rest of Eastern Europe Optical Measurement Market, by vertical

10.3.3 Western Europe

10.3.3.1 Western Europe Optical Measurement Market, By Country

10.3.3.2 Western Europe Optical Measurement Market, by offering

10.3.3.3 Western Europe Optical Measurement Market, by component

10.3.3.4 Western Europe Optical Measurement Market, by Vertical

10.3.3.5 Germany

10.3.3.5.1 Germany Optical Measurement Market, by offering

10.3.3.5.2 Germany Optical Measurement Market, by component

10.3.3.5.3 Germany Optical Measurement Market, by vertical

10.3.3.6 France

10.3.3.6.1 France Optical Measurement Market, by offering

10.3.3.6.2 France Optical Measurement Market, by component

10.3.3.6.3 France Optical Measurement Market, by vertical

10.3.3.7 UK

10.3.3.7.1 UK Optical Measurement Market, by offering

10.3.3.7.2 UK Optical Measurement Market, by component

10.3.3.7.3 UK Optical Measurement Market, by vertical

10.3.3.8 Italy

10.3.3.8.1 Italy Optical Measurement Market, by offering

10.3.3.8.2 Italy Optical Measurement Market, by component

10.3.3.8.3 Italy Optical Measurement Market, by vertical

10.3.3.9 Spain

10.3.3.9.1 Spain Optical Measurement Market, by offering

10.3.3.9.2 Spain Optical Measurement Market, by component

10.3.3.9.3 Spain Optical Measurement Market, by vertical

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Optical Measurement Market, by offering

10.3.3.10.2 Netherlands Optical Measurement Market, by component

10.3.3.10.3 Netherlands Optical Measurement Market, by vertical

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Optical Measurement Market, by offering

10.3.3.11.2 Switzerland Optical Measurement Market, by component

10.3.3.11.3 Switzerland Optical Measurement Market, by vertical

10.3.3.12 Austria

10.3.3.12.1 Austria Optical Measurement Market, by offering

10.3.3.12.2 Austria Optical Measurement Market, by component

10.3.3.12.3 Austria Optical Measurement Market, by vertical

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Optical Measurement Market, by offering

10.3.3.13.2 Rest of Western Europe Optical Measurement Market, by component

10.3.3.13.3 Rest of Western Europe Optical Measurement Market, by vertical

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Optical Measurement Market, By Country

10.4.3 Asia-Pacific Optical Measurement Market, by offering

10.4.4 Asia-Pacific Optical Measurement Market, by component

10.4.5 Asia-Pacific Optical Measurement Market, by vertical

10.4.6 China

10.4.6.1 China Optical Measurement Market, by offering

10.4.6.2 China Optical Measurement Market, by component

10.4.6.3 China Optical Measurement Market, by vertical

10.4.7 India

10.4.7.1 India Optical Measurement Market, by offering

10.4.7.2 India Optical Measurement Market, by component

10.4.7.3 India Optical Measurement Market, by vertical

10.4.8 Japan

10.4.8.1 Japan Optical Measurement Market, by offering

10.4.8.2 Japan Optical Measurement Market, by component

10.4.8.3 Japan Optical Measurement Market, by vertical

10.4.9 South Korea

10.4.9.1 South Korea Optical Measurement Market, by offering

10.4.9.2 South Korea Optical Measurement Market, by component

10.4.9.3 South Korea Optical Measurement Market, by vertical

10.4.10 Vietnam

10.4.10.1 Vietnam Optical Measurement Market, by offering

10.4.10.2 Vietnam Optical Measurement Market, by component

10.4.10.3 Vietnam Optical Measurement Market, by vertical

10.4.11 Singapore

10.4.11.1 Singapore Optical Measurement Market, by offering

10.4.11.2 Singapore Optical Measurement Market, by component

10.4.11.3 Singapore Optical Measurement Market, by vertical

10.4.12 Australia

10.4.12.1 Australia Optical Measurement Market, by offering

10.4.12.2 Australia Optical Measurement Market, by component

10.4.12.3 Australia Optical Measurement Market, by vertical

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Optical Measurement Market, by offering

10.4.13.2 Rest of Asia-Pacific Optical Measurement Market, by component

10.4.13.3 Rest of Asia-Pacific Optical Measurement Market, by vertical

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Optical Measurement Market, By Country

10.5.2.2 Middle East Optical Measurement Market, by offering

10.5.2.3 Middle East Optical Measurement Market, by component

10.5.2.4 Middle East Optical Measurement Market, by vertical

10.5.2.5 UAE

10.5.2.5.1 UAE Optical Measurement Market, by offering

10.5.2.5.2 UAE Optical Measurement Market, by component

10.5.2.5.3 UAE Optical Measurement Market, by vertical

10.5.2.6 Egypt

10.5.2.6.1 Egypt Optical Measurement Market, by offering

10.5.2.6.2 Egypt Optical Measurement Market, by component

10.5.2.6.3 Egypt Optical Measurement Market, by vertical

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Optical Measurement Market, by offering

10.5.2.7.2 Saudi Arabia Optical Measurement Market, by component

10.5.2.7.3 Saudi Arabia Optical Measurement Market, by vertical

10.5.2.8 Qatar

10.5.2.8.1 Qatar Optical Measurement Market, by offering

10.5.2.8.2 Qatar Optical Measurement Market, by component

10.5.2.8.3 Qatar Optical Measurement Market, by vertical

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Optical Measurement Market, by offering

10.5.2.9.2 Rest of Middle East Optical Measurement Market, by component

10.5.2.9.3 Rest of Middle East Optical Measurement Market, by vertical

10.5.3 Africa

10.5.3.1 Africa Optical Measurement Market, By Country

10.5.3.2 Africa Optical Measurement Market, by offering

10.5.3.3 Africa Optical Measurement Market, by component

10.5.3.4 Africa Optical Measurement Market, by vertical

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Optical Measurement Market, by offering

10.5.3.5.2 Nigeria Optical Measurement Market, by component

10.5.3.5.3 Nigeria Optical Measurement Market, by vertical

10.5.3.6 South Africa

10.5.3.6.1 South Africa Optical Measurement Market, by offering

10.5.3.6.2 South Africa Optical Measurement Market, by component

10.5.3.6.3 South Africa Optical Measurement Market, by vertical

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Optical Measurement Market, by offering

10.5.3.7.2 Rest of Africa Optical Measurement Market, by component

10.5.3.7.3 Rest of Africa Optical Measurement Market, by vertical

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Optical Measurement Market, By Country

10.6.3 Latin America Optical Measurement Market, by offering

10.6.4 Latin America Optical Measurement Market, by component

10.6.5 Latin America Optical Measurement Market, by vertical

10.6.6 Brazil

10.6.6.1 Brazil Optical Measurement Market, by offering

10.6.6.2 Brazil Optical Measurement Market, by component

10.6.6.3 Brazil Optical Measurement Market, by vertical

10.6.7 Argentina

10.6.7.1 Argentina Optical Measurement Market, by offering

10.6.7.2 Argentina Optical Measurement Market, by component

10.6.7.3 Argentina Optical Measurement Market, by vertical

10.6.8 Colombia

10.6.8.1 Colombia Optical Measurement Market, by offering

10.6.8.2 Colombia Optical Measurement Market, by component

10.6.8.3 Colombia Optical Measurement Market, by vertical

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Optical Measurement Market, by offering

10.6.9.2 Rest of Latin America Optical Measurement Market, by component

10.6.9.3 Rest of Latin America Optical Measurement Market, by vertical

11. Company Profiles

11.1 Nikon Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Hexagon AB

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Keysight Technologies Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 R&D Vision

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 AMETEK, Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Olympus Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 FARO Technologies Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Carl Zeiss AG

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Jenoptik AG

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Keyence Corporation

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Offering

Hardware

Camera

Lens and Sensors

Light Sources

Others

Software

Services

After Sales Services

Measurement Services

By Component

Profile Projectors

Autocollimators

Measuring Microscopes

Video Measuring Machines

Optical Digitizers and Scanners

3D Laser Scanners

Structured Light Scanners

Laser Trackers

By Vertical

Automotive

Aerospace & Defense

Energy and Power

Electronics Manufacturing

Industrial

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Hydraulic Equipment Market Size was valued at USD 49.34 Billion in 2023 and is now anticipated to grow to USD 114.4 Billion by 2032, displaying a compound annual growth rate (CAGR) of 9.8% during the forecast Period 2024-2032.

Economizer Market Size was valued at USD 10.75 Billion in 2023 and is expected to reach USD 17.45 Billion by 2032 and grow at a CAGR of 5.59% over the forecast period 2024-2032.

The Deep Hole Drilling Machines Market was estimated at USD 784.70 Million in 2023 and is expected to reach USD 1435.51 million by 2032, with a growing CAGR of 6.94% over the forecast period 2024-2032.

Plate and Frame Heat Exchanger Market was valued at USD 5.90 Bn in 2023 and is supposed to arrive at USD 10.13 Bn by 2032, at a CAGR of 6.19% from 2024-2032.

Modular Chillers Market Size was valued at USD 2.93 Billion in 2023 and is expected to reach USD 5.07 Billion by 2032 and grow at a CAGR of 6.33% over the forecast period 2024-2032.

The Parcel Sorter Market size was estimated at USD 3.6 billion in 2023 and is expected to reach USD 9.1 billion by 2032 at a CAGR of 10.8% during the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone