Get more information on Optical Communication and Networking Market - Request Sample Report

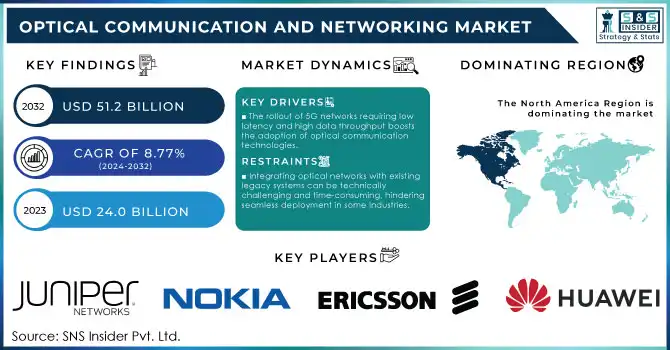

The Optical Communication and Networking Market was valued at USD 24.0 billion in 2023 and is expected to reach USD 51.2 billion by 2032, growing at a CAGR of 8.77% over 2024-2032.

The Optical Communication and Networking Market is witnessing robust growth, fueled by the rising demand for high-speed data transmission, the rollout of 5G networks, and the widespread adoption of cloud computing. Leveraging light to transmit data through optical fibers, optical communication systems are integral to high-performance networks due to their ability to deliver low latency, high bandwidth, and long-distance connectivity. Widely utilized across sectors such as telecommunications, data centers, enterprise networks, and healthcare, this technology provides scalable and efficient solutions for handling data-intensive operations. The global surge in internet consumption, driven by trends like remote work, online education, and digital entertainment, has further amplified the need for reliable optical networking solutions. A significant growth driver is the rapid deployment of 5G networks, which necessitate advanced optical communication systems to support their high-speed data requirements and ultra-reliable low-latency performance. For instance, the global demand for optical transceivers—vital components in these systems—has surged, with sales surpassing USD 10 billion in 2023, reflecting the substantial investments in this technology. The growing adoption of data centers and hyperscale infrastructure also fuels market expansion. As applications such as artificial intelligence (AI), machine learning (ML), and big data analytics become mainstream, data centers are increasingly adopting optical technologies to manage higher data volumes more efficiently. Recent figures reveal that leading operators like Google and Amazon significantly increased spending on optical networking equipment, with global investments in optical transport equipment exceeding USD 16 billion in 2023, underscoring the critical role of optical communication in powering cloud services.

The market is further bolstered by the integration of optical technologies in smart cities and IoT ecosystems. Optical fiber serves as the backbone for high-speed connectivity in applications like smart grids, intelligent transportation, and video surveillance. Governments worldwide are prioritizing investments in fiber optic infrastructure, such as India’s BharatNet initiative, aimed at delivering high-speed optical connectivity to rural areas. Advancements in wavelength-division multiplexing (WDM), photonic integrated circuits (PICs), and coherent optical solutions continue to drive innovation, making optical communication systems more efficient and cost-effective. Coupled with the global push for digital transformation, these technological breakthroughs are set to propel the market's sustained growth in the coming years.

Drivers

The rollout of 5G networks requiring low latency and high data throughput boosts the adoption of optical communication technologies.

Development of smart cities and IoT ecosystems relies on optical fiber for high-speed connectivity in applications such as smart grids and surveillance.

Growing use of data-intensive technologies like AI, ML, and cloud computing necessitates optical networking for efficient data transmission.

The proliferation of data-intensive technologies such as Artificial Intelligence (AI), Machine Learning (ML), and cloud computing has emerged as a key driver of growth in the Optical Communication and Networking Market. These technologies generate and process enormous volumes of data, necessitating robust, efficient, and reliable networks for seamless storage, computation, and transmission. Optical communication systems, known for their exceptional bandwidth and low latency, are essential to meet these requirements. AI and ML applications demand real-time data processing, which relies on networks capable of rapidly and securely transmitting large datasets. For instance, training complex machine learning models requires high-performance computing infrastructures supported by optical networking to ensure smooth data exchange across distributed data centers. Similarly, cloud computing heavily relies on optical communication to facilitate efficient data transfer between geographically dispersed servers, enabling services like video streaming, SaaS platforms, and collaborative online tools.

Data centers, which form the backbone of AI, ML, and cloud computing operations, are increasingly adopting advanced optical technologies such as wavelength-division multiplexing (WDM) and photonic integrated circuits (PICs). These innovations allow data centers to scale efficiently by enabling multiple data streams to travel through a single optical fiber, reducing costs and enhancing performance. Furthermore, the rapid expansion of hyperscale data centers by leading cloud providers such as AWS, Microsoft Azure, and Google Cloud has resulted in significant investments in optical transport equipment, further fueling market development. The demand for secure, energy-efficient, and high-speed data transmission has reinforced the importance of optical networking. Businesses are turning to optical communication systems for faster, more reliable, and scalable connectivity, meeting the growing need for data-driven services in enterprise and consumer domains.

| Technology | Data Requirement | Optical Networking Role | Example Use Case |

|---|---|---|---|

| AI & ML | High-speed data transfer for model training | Supports distributed data centers with low latency | Training neural networks |

| Cloud Computing | Large-scale data storage and sharing | Enables seamless connectivity between servers | SaaS platforms like Office 365 |

| Big Data Analytics | Real-time data analysis | Facilitates high-throughput data transmission | Market trend analysis |

| Video Streaming | High-bandwidth demand | Ensures smooth content delivery | Platforms like Netflix |

Restraints

Integrating optical networks with existing legacy systems can be technically challenging and time-consuming, hindering seamless deployment in some industries.

A shortage of skilled professionals for the installation, maintenance, and operation of advanced optical systems poses challenges to market growth.

Optical fiber networks are prone to physical damage such as fiber cuts during construction, leading to service disruptions and increased maintenance costs.

The availability of skilled professionals for the installation, maintenance, and operation of advanced optical systems acts as a major hindrance to the Optical Communication and Networking Market. With the development of new technologies for optical communication, such as wavelength-division multiplexing (WDM), photonic integrated circuits (PICs), and coherent optical solutions, the need for skilled professionals to design, deploy, and troubleshoot such systems has been significantly expanded. Nonetheless, a skills gap exists, with a small number of professionals qualified to operate contemporary optical networks. Fiber splicing, connectorization, and testing of optical communication systems must be carried out with precision and require specialized training. The increasing density of high bandwidth as business and service providers extend optical networks to meet the ongoing demand for fast, high-capacity connectivity without the professionals required to deploy them can lead to delays and increased operating expenses.

Further, they often require sophisticated network monitoring, analysis, and fault management tools to operate high-performance optical systems. Insufficient workforce counts affect network reliability and effectiveness, which, in turn, negatively influences the user experience. In emerging markets, this problem is particularly severe, as the investment in programs for training and technical education was not at the same pace as the adoption of lattice technology and other optical technologies. In response, companies and governments are focusing on upskilling, creating certification programs, and partnering with universities to create a better workforce.

By Component

The Optical Fiber segment dominated the Optical Communication and Networking Market and represented a significant revenue share of 39.9% in 2023, due to its vital role in data transmission. With the growing demand for high-speed internet and the ongoing expansion of 5G networks, optical fiber remains the foundation of these advanced communication infrastructures. The segment is set for continuous growth, driven by the increasing adoption of cloud computing, AI, and IoT, all of which require high-performance, efficient networks. Additionally, global initiatives like fiber-to-the-home (FTTH) will contribute to sustained demand. The segment is expected to maintain a stable CAGR, with continued investments in fiber infrastructure supporting global digital transformation.

The Optical Transceivers segment is anticipated to experience the highest CAGR in the Optical Communication and Networking Market. As data centers and telecom networks place greater reliance on high-capacity optical systems to manage expanding data traffic, the need for optical transceivers—key components for converting electrical to optical signals—is rising. The growth of 5G networks, hyperscale data centers, and the increasing demand for low-latency, high-speed communication are primary drivers for this segment. Advances in more compact, efficient transceivers, coupled with the growing adoption of 100G and 400G transceivers, will further boost growth. As these technologies advance, the optical transceivers segment is expected to capture a greater share of the market.

By Technology

The Wavelength Division Multiplexing (WDM) segment dominated the Optical Communication and Networking Market and accounted for 41.0% in 2023, primarily due to its ability to transmit multiple data streams over a single optical fiber using different wavelengths. This technology enables telecom operators and data centers to maximize fiber utilization, significantly increasing network capacity without additional physical infrastructure. With the surging demand for higher bandwidth driven by 5G expansion, cloud computing, and data-heavy applications like AI and IoT, WDM adoption continues to rise. As the need for high-speed, scalable communication solutions grows, WDM is expected to maintain its strong position, efficiently managing vast data traffic in the coming years.

The SONET/SDH segment is projected to register the highest CAGR within the Optical Communication and Networking Market. SONET (Synchronous Optical Network) and SDH (Synchronous Digital Hierarchy) technologies are known for their high-capacity, reliable, and scalable data transmission capabilities over long distances. The segment’s growth is driven by the increasing demand for robust, high-speed backbone networks, especially in telecom infrastructure. With internet traffic continually growing, telecom providers are modernizing their infrastructure with SONET/SDH solutions to ensure reliable communication. As telecom services evolve and digitalization increases, SONET/SDH is expected to experience significant growth, particularly in emerging markets.

By Vertical

The IT & Telecom segment dominated the optical communication and networking Market with a significant revenue share of more than 36.0% in 2023. Both telecom operators as well as vendors are adopting optical communication technologies due to growing demand for higher bandwidth and low-latency data transmission. The quick 5G rollout and growing data centers and telecom infrastructure have provided significant funds to optical networks. Continuous digital transformation along with the demand for ever-faster and more reliable communication services is expected to drive steady growth in this sector. High data traffic globally is expected to grow in the future, therefore, the IT & Telecom sector is again expected to retain its stronghold in the optical communication market due to continued investments.

The Healthcare segment is expected to experience the highest CAGR during the forecast period. As telemedicine, electronic health records (EHR), and remote monitoring grows, the need for swift and secure data transmission continues to expand. Optical communication technologies play a crucial role in facilitating the safe and efficient transfer of medical data between hospitals, clinics, and remote care settings. Innovative healthcare technologies, including telehealth, AI diagnostics, patient data analytics, and others will continue to emerge, leading to increased demand for high-bandwidth, low-latency networks. As the investments in digital healthcare keep on building, the healthcare sector looks designed for a robust growth trajectory in the years to return.

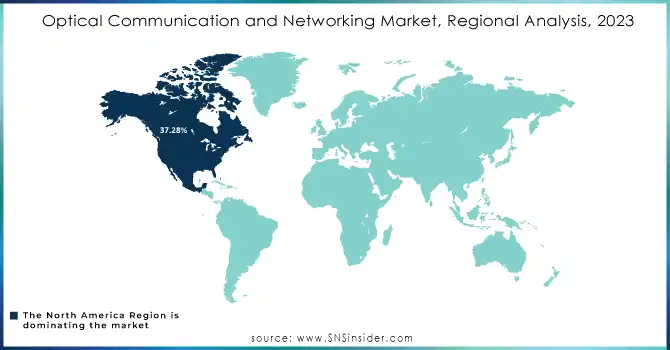

In 2023, North America dominated the market and represented a significant revenue share of more than 37.28%, due to early adoption of innovative technologies along with the presence of major telecom and data center operators. The rapid roll-out of 5G networks, combined with the growing expansion of cloud and IoT services, has driven strong investments in optical communications infrastructure. With ongoing infrastructure expansion, technological innovations, and growing demand for high bandwidth–low latency solutions, North America is projected to continue as the market leader. The region is continued to dominate with the expansion of 5G networks and data centers due to stable government policies.

The Asia-Pacific (APAC) region is anticipated to grow at the highest CAGR during the forecast period, driven by rapid digitalization, growing telecom networks, and rising 5G demand among countries, such as China, India, and Japan. The demand for more advanced communication infrastructure is largely being driven by APAC, due to its growing population and increasing internet penetration. Increasing demand for optical communication technologies due to factors such as growth in cloud computing, IoT, and smart city projects. The continuous investment in telecom infrastructure as well as the accelerated pace in technology adoption by telecom operators in the APAC region is likely to enable the region to witness significant growth in the issue of high-speed internet access expanding its role in the global transition towards optical networks.

Need any customization research on Optical Communication and Networking Market - Enquiry Now

The major key players along with their products are

Cisco Systems – Cisco Optical Networking Solutions

Huawei Technologies – Huawei OptiXtrans DC908

Ericsson – Ericsson Optical Transport Network

Juniper Networks – Juniper MX Series 5G Routers

Nokia Corporation – Nokia 1830 Photonic Service Engine

Ciena Corporation – Ciena WaveLogic Ai

Infinera Corporation – Infinera ICE6

ZTE Corporation – ZTE 5G Optical Transport Network Solution

ADVA Optical Networking – ADVA FSP 3000

Corning Inc. – Corning Optical Fiber Solutions

Fujitsu Ltd. – Fujitsu Flashwave 9500

Neos Networks – Neos Networks Optical Transport Solutions

Broadcom Inc. – Broadcom Optoelectronics

Mellanox Technologies (acquired by NVIDIA) – Mellanox InfiniBand

Lumentum – Lumentum Optical Components

Viavi Solutions – Viavi ONX Optical Network Monitoring Solutions

Keysight Technologies – Keysight Optoelectronic Test Equipment

Nexans – Nexans Optical Cables

Sumitomo Electric Industries – Sumitomo Electric’s Optical Fiber Cables

II-VI Incorporated – II-VI Photonic Components

January 2024 – Precision OT highlighted key trends shaping optical networking in 2024, including the rising adoption of XGS-PON technology in FTTH (Fiber to the Home) networks and the push toward DOCSIS 4.0 in HFC (Hybrid Fiber Coaxial) networks. The company noted that operators are increasingly seeking integrated systems and engineering support to meet the growing demand for fiber-based connectivity, especially in rural areas.

February 2024 – Nokia expanded its efforts in high-speed optical networks by launching its 400G coherent optics solutions. This technology is expected to enhance bandwidth capabilities, reduce latency, and improve overall network efficiency, catering to the rising demands for faster data transmission.

| Report Attributes | Details |

| Market Size in 2023 | US$ 24.0 Bn |

| Market Size by 2031 | US$ 51.2 Bn |

| CAGR | CAGR of 8.77% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Optical Fiber, Optical Transceivers, Optical Amplifiers, Optical Switches, Optical Circulators, Others) • By Technology (WDM, SONET/SDH, Fiber Channel, Others) • By Application (Data Center, Telecom, Enterprise, Others) • By Vertical (IT & Telecom, BFSI, Government and Aerospace & Defense, Healthcare, Energy & Utilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems, Huawei Technologies, Ericsson, Juniper Networks, Nokia Corporation, Ciena Corporation, Infinera Corporation, ZTE Corporation, ADVA Optical Networking, Corning Inc, Fujitsu Ltd, Neos Networks, Broadcom Inc, Mellanox Technologies, Lumentum, Viavi Solutions, Keysight Technologies, Nexans, Sumitomo Electric Industries, II-VI Incorporated |

| Key Drivers | • The rollout of 5G networks requiring low latency and high data throughput boosts the adoption of optical communication technologies. • Development of smart cities and IoT ecosystems relies on optical fiber for high-speed connectivity in applications such as smart grids and surveillance. • Growing use of data-intensive technologies like AI, ML, and cloud computing necessitates optical networking for efficient data transmission. |

| Market Restraints | • Integrating optical networks with existing legacy systems can be technically challenging and time-consuming, hindering seamless deployment in some industries. • A shortage of skilled professionals for the installation, maintenance, and operation of advanced optical systems poses challenges to market growth • Optical fiber networks are prone to physical damage such as fiber cuts during construction, leading to service disruptions and increased maintenance costs. |

Ans The Optical Communication and Networking Market was valued at USD 24.0 billion in 2023 and is expected to reach USD 51.2 billion by 2032.

Ans- The Optical Communication and Networking Market is expected to grow at a CAGR of 8.77% during the forecast period of 2024-2032.

Ans- The North American region dominated the Optical Communication and Networking Market.

Ans- Some of the major growth drivers of the Optical Communication and Networking Market are:

The rollout of 5G networks requiring low latency and high data throughput boosts the adoption of optical communication technologies.

Development of smart cities and IoT ecosystems relies on optical fiber for high-speed connectivity in applications such as smart grids and surveillance.

Growing use of data-intensive technologies like AI, ML, and cloud computing necessitates optical networking for efficient data transmission.

Ans- Some of the challenges in the Optical Communication and Networking Market are:

Integrating optical networks with existing legacy systems can be technically challenging and time-consuming, hindering seamless deployment in some industries.

A shortage of skilled professionals for the installation, maintenance, and operation of advanced optical systems poses challenges to market growth.

Optical fiber networks are prone to physical damage such as fiber cuts during construction, leading to service disruptions and increased maintenance costs.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Optical Communication and Networking Market Segmentation, by Component

7.1 Chapter Overview

7.2 Optical Fiber

7.2.1 Optical Fiber Market Trends Analysis (2020-2032)

7.2.2 Optical Fiber Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Optical Transceivers

7.3.1 Optical Transceivers Market Trends Analysis (2020-2032)

7.3.2 Optical Transceivers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Optical Amplifiers

7.4.1 Optical Amplifiers Market Trends Analysis (2020-2032)

7.4.2 Optical Amplifiers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Optical Switches

7.5.1 Optical Switches Market Trends Analysis (2020-2032)

7.5.2 Optical Switches Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Optical Circulators

7.6.1 Optical Circulators Market Trends Analysis (2020-2032)

7.6.2 Optical Circulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.7.1 Others Market Trends Analysis (2020-2032)

7.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Optical Communication and Networking Market Segmentation, by Technology

8.1 Chapter Overview

8.2 WDM

8.2.1 WDM Market Trends Analysis (2020-2032)

8.2.2 WDM Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 SONET/SDH

8.3.1 SONET/SDH Market Trends Analysis (2020-2032)

8.3.2 SONET/SDH Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Fiber Channel

8.4.1 Fiber Channel Market Trends Analysis (2020-2032)

8.4.2 Fiber Channel Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Optical Communication and Networking Market Segmentation, by Application

9.1 Chapter Overview

9.2 Data Center

9.2.1 Data Center Market Trends Analysis (2020-2032)

9.2.2 Data Center Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Telecom

9.3.1 Telecom Market Trends Analysis (2020-2032)

9.3.2 Telecom Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Enterprise

9.4.1 Enterprise Market Trends Analysis (2020-2032)

9.4.2 Enterprise Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Optical Communication and Networking Market Segmentation, by Vertical

10.1 Chapter Overview

10.2 BFSI

10.2.1 BFSI Market Trends Analysis (2020-2032)

10.2.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Energy & Utilities

10.3.1 Energy & Utilities Market Trends Analysis (2020-2032)

10.3.2 Energy & Utilities Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 IT & Telecom

10.4.1 IT & Telecom Market Trends Analysis (2020-2032)

10.4.2 IT & Telecom Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Healthcare

10.5.1 Healthcare Market Trends Analysis (2020-2032)

10.5.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Government and Aerospace & Defense

10.6.1 Government and Aerospace & Defense Market Trends Analysis (2020-2032)

10.6.2 Government and Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Others

10.7.1 Others Market Trends Analysis (2020-2032)

10.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Optical Communication and Networking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.4 North America Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.5 North America Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.6 North America Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.7.2 USA Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.7.3 USA Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.4 USA Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.8.2 Canada Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.8.3 Canada Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.4 Canada Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.9.2 Mexico Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.9.3 Mexico Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.4 Mexico Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Optical Communication and Networking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.7.2 Poland Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.7.3 Poland Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.4 Poland Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.8.2 Romania Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.8.3 Romania Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.4 Romania Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Optical Communication and Networking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.4 Western Europe Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.5 Western Europe Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.6 Western Europe Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.7.2 Germany Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.7.3 Germany Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.4 Germany Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.8.2 France Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.8.3 France Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.4 France Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.9.2 UK Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.9.3 UK Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.4 UK Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.10.2 Italy Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.10.3 Italy Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.4 Italy Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.11.2 Spain Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.11.3 Spain Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.4 Spain Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.14.2 Austria Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.14.3 Austria Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.4 Austria Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Optical Communication and Networking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.4 Asia Pacific Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.5 Asia Pacific Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.6 Asia Pacific Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.7.2 China Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.7.3 China Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.4 China Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.8.2 India Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.8.3 India Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.4 India Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.9.2 Japan Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.9.3 Japan Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.4 Japan Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.10.2 South Korea Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.10.3 South Korea Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.4 South Korea Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.11.2 Vietnam Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.11.3 Vietnam Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.4 Vietnam Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.12.2 Singapore Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.12.3 Singapore Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.4 Singapore Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.13.2 Australia Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.13.3 Australia Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.4 Australia Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Optical Communication and Networking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.4 Middle East Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.5 Middle East Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.6 Middle East Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.7.2 UAE Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.7.3 UAE Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.4 UAE Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Optical Communication and Networking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.4 Africa Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.5 Africa Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.6 Africa Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Optical Communication and Networking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.4 Latin America Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.5 Latin America Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.6 Latin America Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.7.2 Brazil Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.7.3 Brazil Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.4 Brazil Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.8.2 Argentina Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.8.3 Argentina Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.4 Argentina Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.9.2 Colombia Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.9.3 Colombia Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.4 Colombia Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Optical Communication and Networking Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Optical Communication and Networking Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Optical Communication and Networking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Optical Communication and Networking Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

12. Company Profiles

12.1 Cisco Systems

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Huawei Technologies

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Ericsson

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Juniper Networks

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Nokia Corporation

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Ciena Corporation

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Infinera Corporation

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 ZTE Corporation

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 ADVA Optical Networking

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Corning Inc

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Optical Fiber

Optical Transceivers

Optical Amplifiers

Optical Switches

Optical Circulators

Others

By Technology

WDM

SONET/SDH

Fiber Channel

Others

By Application

Data Center

Telecom

Enterprise

Others

By Vertical

IT & Telecom

BFSI

Government and Aerospace & Defense

Healthcare

Energy & Utilities

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The DataOps Platform Market was valued at USD 4.0 Billion in 2023 and is expected to reach USD 24.5 Billion by 2032, growing at a CAGR of 22.20% from 2024-2032.

The Contactless Payment Market was valued at USD 45.33 billion in 2023 and will reach USD 194.51 Billion by 2032, growing at a CAGR of 17.59 % by 2032.

The Metrology Services Market was valued at USD 817.77 million in 2023 and is expected to reach USD 1370.14 million by 2032, growing at a CAGR of 5.95% over the forecast period 2025-2032.

The Endpoint Detection and Response Market Size was USD 3.6 Billion in 2023 and will reach USD 25.7 Billion by 2032 and grow at a CAGR of 24.6% by 2024-2032.

The Containerized Data Center Market size was valued at USD 11.4 billion in 2023 and is expected to reach USD 66.9 Billion by 2032, with a growing at CAGR of 21.73% Over the Forecast Period of 2024-2032.

SCADA Market was valued at USD 10.61 billion in 2023 and is expected to reach USD 23.57 billion by 2032, growing at a CAGR of 9.34% from 2024-2032.

Hi! Click one of our member below to chat on Phone