Optical Character Recognition Market Report Scope & Overview:

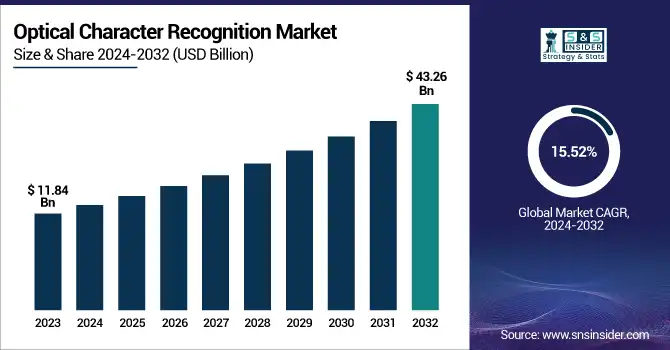

The Optical Character Recognition Market was valued at USD 11.84 billion in 2023 and is expected to reach USD 43.26 billion by 2032, growing at a CAGR of 15.52% from 2024-2032.

To Get more information on Optical Character Recognition Market - Request Free Sample Report

This report includes insights into accuracy improvement trends, highlighting AI-driven enhancements and machine learning models refining OCR precision. It explores the integration with other technologies, such as RPA, cloud computing, and NLP, expanding OCR applications. The report also examines cost reduction statistics, showing how advancements in processing power and open-source solutions lower implementation expenses. Furthermore, it analyzes government vs. private sector demand, revealing increasing adoption in regulatory compliance, digital transformation, and automated data processing across industries. The market's rapid growth is fueled by automation needs, document digitization, and AI-driven analytics, making OCR a critical tool for businesses and governments alike.

U.S. Optical Character Recognition Market was valued at USD 3.33 billion in 2023 and is expected to reach USD 12.14 billion by 2032, growing at a CAGR of 15.44% from 2024-2032

This growth is driven by increasing automation in enterprises, digital transformation initiatives, and rising adoption of AI-powered OCR solutions. The demand for efficient document management, data extraction, and compliance automation in sectors like BFSI, healthcare, and government is accelerating adoption. Additionally, integration with AI, cloud computing, and RPA is enhancing OCR accuracy and scalability. Cost reductions and expanding applications in e-commerce, logistics, and legal sectors further fuel market expansion.

Optical Character Recognition Market Dynamics

Drivers

-

Digital Transformation and Automation Driving the Adoption of OCR Technology for Efficient Document Processing Across Industries

The rapid digital transformation across industries is a key factor driving the adoption of Optical Character Recognition (OCR) technology. As businesses seek to streamline operations, OCR enables the automated conversion of paper documents into editable digital formats, significantly reducing manual data entry efforts. This transition helps companies save time, enhance productivity, and minimize human error, all while ensuring faster processing of critical documents. Due to growing dependence on decision-making from data and requirement for real-time information, firms are increasingly deploying OCR systems in order to convert and organize documents digitally. Gains in the fields of e-commerce, documentation required for laws, and paperless business further stimulate the OCR solution demand. All these have helped to contribute toward tremendous growth in the market for OCR.

Restraints

-

Challenges in Accuracy and Document Quality Limit the Effectiveness of OCR Technology Across Various Industries

In spite of the increasing use of Optical Character Recognition (OCR), there are still some limitations that affect its performance in different industries. OCR software tends to struggle with complex documents, including those with poor handwriting, complex fonts, or low-quality scans. Such problems may result in text recognition inaccuracies, which restrict the technology from delivering accurate results in high-stakes applications. Furthermore, when it comes to handwritten text, torn papers, or faded prints, OCR software can fail to recover accurate data, which can result in errors or omissions. Such accuracy limitations render OCR unreliable in some applications, especially those in healthcare, law, and finance, where data accuracy is essential for processing and decision-making.

Opportunities

-

AI and Machine Learning Integration Enhancing OCR Accuracy and Expanding Its Applications Across Various Industries

The integration of Artificial Intelligence (AI) and Machine Learning (ML) with Optical Character Recognition (OCR) is unleashing new capabilities and fueling growth in the market. Through the use of AI, OCR systems can achieve much higher accuracy, particularly in identifying complex documents, like handwritten text, multiple fonts, or low-resolution scanned images. Machine learning algorithms enable OCR to learn and adapt to particular document types, enhancing performance over time. This convergence of technologies makes OCR more capable of processing a larger variety of documents, and it can be applied across sectors such as healthcare, law, and finance. As companies and institutions look for faster, automated document processing, the ongoing evolution of AI and ML will make OCR systems more accurate, further driving market uptake and increasing its applications.

Challenges

-

Data Security and Privacy Concerns Hindering OCR Adoption Due to Compliance and Risk of Data Breaches

With the growing use of Optical Character Recognition (OCR) technology, data security and privacy issues are becoming important barriers. Sensitive data like personal identification details, financial information, or health records are often handled by OCR systems. Consequently, companies need to make sure that such systems meet strict regulatory requirements, including GDPR and HIPAA. Failure to protect this sensitive information can result in serious legal repercussions, including fines and loss of customer confidence. In addition, possible data breaches or unauthorized access to data pose a serious threat to organizations employing OCR technology, especially in highly regulated industries like healthcare, finance, and government. These security issues make it necessary for the creation of stronger and more secure OCR systems to guarantee safe data processing and compliance.

Optical Character Recognition Market Segment Analysis

By Type

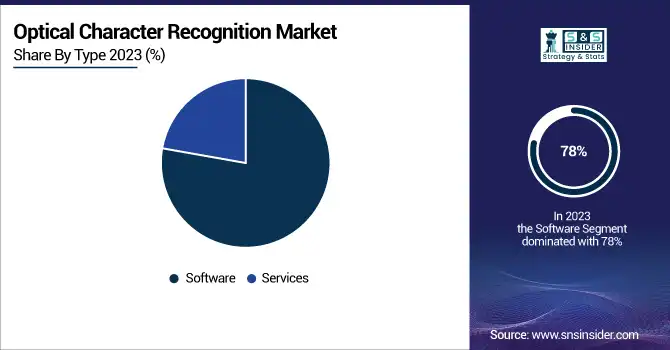

The Software segment dominated the Optical Character Recognition (OCR) market with the highest revenue share of about 78% in 2023 due to the increasing adoption of OCR solutions across various industries. Software-based OCR systems offer advanced features such as document automation, text recognition, and digitalization of paper-based processes, making them essential for businesses looking to enhance efficiency. The demand for these solutions in sectors like healthcare, finance, and legal has contributed to their dominance in the market.

The Services segment is expected to grow at the fastest CAGR of about 17.87% from 2024-2032, driven by the rising demand for customized OCR solutions and system integration. As businesses increasingly adopt OCR technology, the need for professional services, including implementation, support, and consulting, is growing. These services ensure smooth integration with existing systems and help companies optimize OCR applications for specific needs, driving rapid growth in this segment.

By Vertical

The BFSI (Banking, Financial Services, and Insurance) segment dominated the Optical Character Recognition (OCR) market with the highest revenue share of about 26% in 2023. This dominance is due to the extensive use of OCR technology in automating document management, improving operational efficiency, and ensuring compliance with regulatory standards. Banks and financial institutions rely on OCR for processing checks, invoices, contracts, and customer identification, which significantly reduces manual labor, speeds up transactions, and enhances accuracy in data extraction.

The Transport and Logistics segment is expected to grow at the fastest CAGR of about 20.24% from 2024-2032, driven by the increasing need for efficient document handling and automation in supply chain management. OCR technology helps logistics companies automate the processing of shipping labels, invoices, and customs documentation, enhancing speed and reducing human error. As the sector embraces digitalization to improve efficiency and track shipments in real-time, the demand for OCR solutions continues to rise.

By End-use

The BFSI (Banking, Financial Services, and Insurance) segment dominated the Optical Character Recognition (OCR) market with the highest revenue share of about 26% in 2023. This dominance is attributed to the significant reliance of financial institutions on OCR for automating document processing, enhancing operational efficiency, and ensuring compliance with regulations. OCR aids in processing checks, invoices, contracts, and customer identification, improving accuracy and reducing manual labor. Meanwhile, the Transport and Logistics segment is expected to grow at the fastest CAGR of about 20.24% from 2024-2032, driven by the increasing need for automation in supply chain management. OCR technology is helping logistics companies automate the processing of shipping labels, invoices, and customs documentation, improving speed, reducing errors, and optimizing operational workflows, making it a crucial solution for the sector's digital transformation.

Regional Analysis

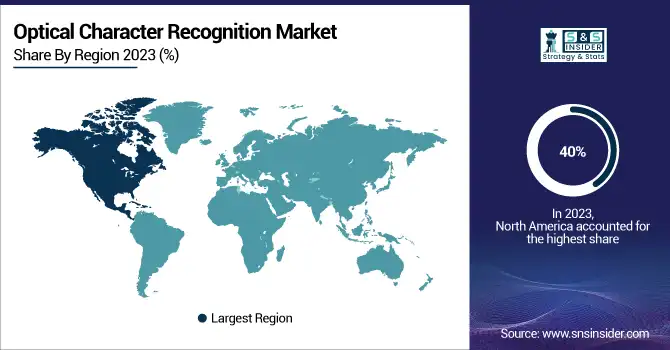

North America dominated the Optical Character Recognition (OCR) market with the highest revenue share of about 40% in 2023. This dominance is primarily due to the early adoption of OCR technology by industries in the region, including healthcare, BFSI, and retail. The region's strong technological infrastructure, high investment in digital transformation, and widespread demand for automation solutions across businesses have led to the extensive use of OCR for document processing, compliance, and data management.

Asia Pacific is expected to grow at the fastest CAGR of about 17.66% from 2024-2032, driven by rapid digital transformation and increasing investments in automation technologies. The growing adoption of OCR in emerging economies like China and India, coupled with the region's expanding e-commerce, logistics, and healthcare sectors, is fueling this growth. The demand for efficient document processing, cost reduction, and enhanced operational efficiency is propelling OCR adoption across various industries in Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

ABBYY: FineReader, FlexiCapture

-

Adobe: Acrobat Pro DC, Scan

-

Anyline GmbH: Anyline OCR SDK, Anyline Mobile Scanning App

-

ATAPY Software: OCR SDK, Document Conversion Services

-

Captricity Inc.: Captricity Data Capture, ReadAPI

-

Creaceed S.P.R.L.: Prizmo, Prizmo Go

-

CVISION Technologies, Inc.: Maestro Recognition Server, PdfCompressor

-

Exper-OCR, Inc.: ExperVision OCR, TypeReader

-

Google LLC: Cloud Vision API, Google Drive OCR

-

International Business Machines Corporation (IBM): Datacap, IBM Content Analyzer

-

IntSig Information Co., Ltd. Corporation: CamScanner, CamCard

-

IRIS S.A.: Readiris, IRIScan

-

LEAD Technologies, Inc.: LEADTOOLS OCR SDK, LEADTOOLS Document Imaging

-

Microsoft: Azure Computer Vision, OneNote OCR

-

NAVER Corp.: Clova OCR, Papago

-

Nuance Communications, Inc.: OmniPage, Power PDF

-

Open Text Corporation: Capture Center, Document Capture

-

CME Imaging Solutions: Document Scanning Services, Microfilm Conversion

-

Rely Services Inc: Data Entry Services, Document Management Solutions

-

Archive Power Systems, Inc.: Archive Power, DocuPower

-

Sage Document Services Group LLC: Document Scanning, Digital Conversion

-

ZYCLYX CONSULTING SERVICES PVT. LTD: OCR Processing, Data Digitization

-

Anderson Archival: Digital Archiving, OCR Services

-

KAYMAN VAULTS: Secure Document Storage, OCR-Based Document Management

-

Scanning America, Inc.: OCR Scanning Services, Document Imaging Solutions

Recent Developments:

-

In 2024, ABBYY introduced purpose-built AI capabilities to enhance its document processing solutions, focusing on automation and intelligent data extraction, aiming to improve efficiency and accuracy for businesses worldwide.

-

In February 2025, Adobe introduced Acrobat AI Assistant, an advanced feature designed to streamline contract review by automating tasks like data extraction, analysis, and providing intelligent suggestions for faster document processing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.84 Billion |

| Market Size by 2032 | US$ 43.26 Billion |

| CAGR | CAGR of 15.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Software, Services) • By End-use (B2B, B2C) • By Vertical (Retail, BFSI, Government, Transport and Logistics, Healthcare, IT & Telecom, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABBYY, Adobe, Anyline GmbH, ATAPY Software, Captricity Inc., Creaceed S.P.R.L., CVISION Technologies, Inc., Exper-OCR, Inc., Google LLC, International Business Machines Corporation (IBM), IntSig Information Co., Ltd. Corporation, IRIS S.A., LEAD Technologies, Inc., Microsoft, NAVER Corp., Nuance Communications, Inc., Open Text Corporation, CME Imaging Solutions, Rely Services Inc, Archive Power Systems, Inc., Sage Document Services Group LLC, ZYCLYX CONSULTING SERVICES PVT. LTD, Anderson Archival, KAYMAN VAULTS, Scanning America, Inc. |