Operational Technology Market Report Scope & Overview:

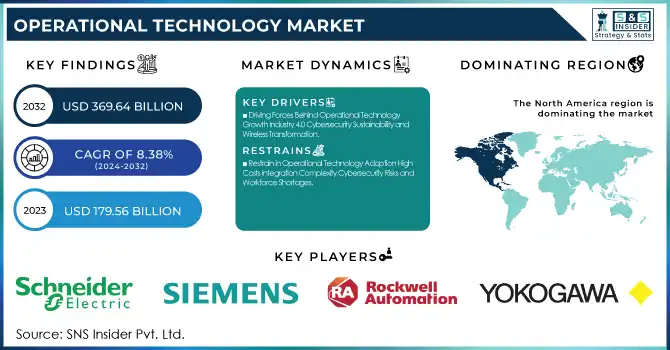

The Operational Technology Market was valued at USD 179.56 billion in 2023 and is expected to reach USD 369.64 billion by 2032, growing at a CAGR of 8.38% over the forecast period 2024-2032. With the evolution of business transformation, the Industrial Internet of Things (IIoT), Artificial Intelligence (AI), and Automation, the Operational Technology (OT) market is adopting at such a high pace across sectors fueled by automation across systems & processes, cybersecurity threats, and IIoT and AI-driven solutions. Companies are becoming more goal-oriented by committing to performance indicators, such as the decrease of unplanned outages, predictive maintenance effectiveness, and asset utilization in work processes. Subscription-based models managed services, and vendors fighting each other in the market are now changing the marketplace. Going forward, the need for entry to skilled OT professionals has been growing, creating a challenge of workforce shortages, in turn, attracting investment in training and certifications, etc.

Get more information on Operational Technology Market - Request Sample Report

Market Dynamics

Key Drivers:

-

Driving Forces Behind Operational Technology Growth Industry 4.0 Cybersecurity Sustainability and Wireless Transformation

With the growing need for automation, predictive maintenance, and IIoT integration across industries, Operational Technology (OT) has emerged as a huge market driver. Industry 4.0 and smart manufacturing will accelerate the development of SCADA, DCS, and MES to maintain business efficiency and reduce human intervention for real-time operation monitoring. This also increases the need for cyber security in the industrial environment due to the rise in cyber threats, forcing industries to replace their legacy OT infrastructure. Sustainability initiatives and rising energy efficiency programs will be another major driver, especially for the Building Management System (BMS) component which is anticipated to achieve the highest growth rate. In addition, the shift from wired OT solutions to wireless OT Solutions is increasing with the uptake of cloud computing and AI-enabled analytics for decision-making.

Restrain:

-

Restrain in Operational Technology Adoption High Costs Integration Complexity Cybersecurity Risks and Workforce Shortages

High initial investment and integration complexity are significant restraints in the Operational Technology (OT) market as it is cost-prohibitive to upgrade legacy systems. Multiple industries continue to use legacy infrastructure and moving to modern OT solutions including SCADA, DCS, and IIoT-based automation requires a huge capex investment. Moreover, the shortage of skillful labor and expertise in the management of advanced OT systems is becoming a critical challenge for industries such as oil & gas, manufacturing, and pharmaceuticals. Another significant restraint is cybersecurity risk; devices connected in the OT domain end naturalistically making them vulnerable to cyber-attacks, as for decades OT networks were meant for industrial isolated environments.

Opportunity:

-

Emerging Opportunities in Operational Technology Digital Twins 5G Cloud Edge Computing and Smart Infrastructure Growth

Opportunities in the OT market such as digital twins, 5G-enabled industrial networks, and cloud-based edge computing quickly gain traction. Industries such as semiconductors & electronics, pharmaceuticals, and medical devices will grow exponentially as they depend on precision manufacturing and real-time data processing. Considering the growing investments in smart grids, renewable energy, and connected infrastructure, this provides a lucrative opportunity for OT providers. Along with this, the increasing requirement for remote monitoring solutions as well as IIoT-based asset management will provide a lucrative market landscape throughout 2024-2032 across horizontal and vertical industries.

Challenges:

-

Interoperability Challenges in Operational Technology IT OT Integration Compliance Data Privacy and Wireless Adoption Barriers

Another important challenge is the lack of interoperability between IT and OT systems. While many industries are beginning their transformations by adopting a mix of cloud computing, AI-enabled analytics, and IoT-driven monitoring within manufacturing and other OT infrastructure, bridging the gap between the new solutions and the existing OT environment remains a challenge. Regulatory compliance and data privacy concerns are also stumbling blocks, especially in highly regulated industries such as healthcare, energy, and aerospace. The slow adoption of wireless OT in mission-critical sectors owing to network reliability and latency concerns continues to constrain the quicker scalability of contemporary OT solutions.

Segment Analysis

By Components

In 2023, Computer Numerical Control (CNC) systems accounted for the largest share of operational technology, as they are one of the most broadly adopted technologies in precision manufacturing and automation of manufacturing processes. CNC machines have a broad application in the automotive, aerospace, machine manufacture, and electronics industries, where it is essential to maintain high precision and repeatability, and efficiency demand is also high. In addition, the increasing transition to Industry 4.0, smart factories, and digital twin technologies also contributed to higher demand for CNC systems used for real-time monitoring and predictive maintenance. It was also helped by developments in multi-axis CNC machines & hybrid CNC (additive & subtractive manufacturing) and AI-driven automation.

Building Management Systems represents the fastest-growing category in terms of CAGR from 2024-2032. With authorities across the globe implementing stricter energy regulations and green building certifications (LEED, BREEAM), BMS has emerged as an attractive solution with a wide deployment potential (Nativi et al, 2020). IoT, Artificial Intelligence (AI) driven Automation, along with Cloud-Based Automated Building Analytics brings smartness to a BMS, in terms of efficiency, by monitoring every BMS component from a central location and smarter with real-time insights into HVAC, lighting, and security systems. BMS market growth is further accelerated by rapid urbanization, expansion of cities, and rising building automation in commercial and residential spaces respectively.

By Technology

In 2023, the Operational Technology (OT) market has been driven by Wired technology because of its reliability, stability, and security, which are essential for any industrial application. Oil & gas, manufacturing, energy & power, and aerospace & defense sectors use wired SCADA, DCS, and CNC systems, as these industries are latency-sensitive and require continuous operations. However, mission-critical processes where any signal interference, data transmission, or security breach may lead to huge operational and financial loss prefer wired networks, such as Ethernet, PROFIBUS, and Modbus. Traditional industries have relied heavily on an established infrastructure, and wired systems help to maintain that status quo since replacing these networks will often lead to significant downtime and prohibitive costs.

Wireless technology is projected to grow at the fastest rate from 2024 to 2032 owing to the growing industrial IoT (IIoT) adoption, 5G, cloud-based solutions, and AI-driven automation. Industrial verticals are transitioning to Wi-Fi, LPWAN, Zigbee, and private 5G networks for remote monitoring, predictive maintenance, and asset tracking due to the requirement for flexibility, scalability, and low-cost solutions. Deployment of wireless for smart factories, smart grids, and connected infrastructure will ramp up wireless even quicker. Also, the increasing use of cybersecurity and data encryption technologies to avert security threats of wireless networks is providing it an edge as a suitable substitute to wired systems in the contemporary industrial environment.

By Industry

In 2023, the operational Technology (OT) market was led by the Oil & Gas sector (with 19.45% of the total market share) owing to the extensive use of SCADA, DCS, and remote monitoring systems for upstream, midstream, and downstream operations. The company's pipeline monitoring, asset management, and real-time analysis of handling huge operational data are other complex operational requirements of the industry that create the demand for using highly reliable and secure OT infrastructure. The sector is also governed as a result of increased expenditure in refinery automation, predictive maintenance, and digital oilfield technologies. Most of the Oil & Gas companies are also implementing AI-powered analytics, IIoT-based remote sensors, and Cyber Security Solutions, to improve efficiencies and lower operational risks.

The Semiconductor & Electronics industry is expected to grow with the fastest CAGR (2024-2032). The increasing number of smart factories, the miniaturization trend of the semiconductor chips, and the growing adaptation of Industry 4.0 are driving semiconductor manufacturing to integrate MES, SCADA, and advanced robotics. The growth in this sector is also fuelled by the rising demand for AI chipsets, IoT devices, and 5G infrastructure. Semiconductor manufacturing is heavily funded by governments around the world to reduce reliance on imports and to boost domestic chip production even further, which is also accelerating the market growth. Cleanroom automation, machine vision, and AI-based defect detection will continue to propel fast-paced OT solution adoption in this sector.

Regional Analysis

In 2023, North America's dominance with 36.6% of the global Operational Technology (OT) market share owing to a rich industrial automation ecosystem, adoption of advanced manufacturing technologies, and large investments in cybersecurity and IIoT in the region. A region that includes major players like Rockwell Automation, Emerson Electric, and General Electric (GE) a significant investment has been in building OT infrastructure. Besides this, SCADA, DCS, and MES solutions can also help manufacturing units optimize their processes–especially in countries like the U.S. and Canada, which have a stronghold on industries such as oil & gas, aerospace & defense, and semiconductors. The Biden administration's CHIPS Act incorporated industrial cybersecurity provisions in a bid to increase domestic semiconductor production supply chain resiliency, which has also contributed to accelerating OT deployment in chip manufacturing facilities.

Asia-Pacific region is projected to register the fastest CAGR from 2024-2032, on account of rapid industrialization, the emergence of smart factories, government-backed infrastructure projects coupled with investments in semiconductor and electronics manufacturing. OT is being built at the forefront in countries such as China, Japan, South Korea, and India. Market growth is being accelerated by China’s “Made in China 2025” strategy and large investments by companies like Huawei, Foxconn, and SMIC in automation and IIoT-driven manufacturing. More precision manufacturing is in store, as Japan’s Toyota and Mitsubishi Electric combine AI-aided CNC machines and digital twins. The semiconductor fabs of South Korea’s Samsung and SK Hynix are expanding, depending massively on SCADA and MES for real-time process optimization. India is also seeing a rise in Building Management Systems (BMS) and smart grid solutions through its Smart Cities Mission.

Need any customization research on Operational Technology Market - Enquiry Now

Key players

Some of the major players in the Operational Technology Market are:

-

Siemens (SIMATIC PLCs, TIA Portal)

-

Schneider Electric (EcoStruxure, Modicon PLCs)

-

Rockwell Automation (Allen-Bradley Controllers, FactoryTalk Software)

-

Honeywell (Experion Process Knowledge System, ControlEdge PLCs)

-

ABB (Ability System 800xA, AC500 PLCs)

-

Emerson Electric Co (DeltaV Distributed Control System, Ovation Control System)

-

General Electric (Predix Platform, PACSystems Controllers)

-

Yokogawa Electric (CENTUM VP DCS, ProSafe-RS Safety System)

-

Mitsubishi Electric (MELSEC PLCs, iQ-R Series Controllers)

-

Omron (Sysmac Automation Platform, NX Series I/O)

-

Inductive Automation (Ignition SCADA, Ignition Edge)

-

Beckhoff Automation (TwinCAT Automation Software, CX Series Embedded PCs)

-

Bosch Rexroth (IndraControl PLCs, IndraDrive Drives)

-

Fanuc (Series 30i/31i CNCs, R-30iB Plus Robot Controller)

-

Delta Electronics (DVP Series PLCs, ASDA Servo Drives)

Recent Trends

-

In October 2024, Siemens and ServiceNow joined forces to integrate generative AI and cybersecurity into shopfloor operations, enhancing automation and resilience in industrial environments.

-

In February 2025, Schneider Electric upgrades its SCADAPack™ RTUs with advanced cybersecurity features to strengthen operational technology (OT) security in critical infrastructure sectors like water and energy.

-

In August 2024, Rockwell Automation introduced upgraded Industrial Data Centers with enhanced cybersecurity and virtualization, enabling secure and efficient data management for modern OT environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 179.56 Billion |

| Market Size by 2032 | USD 369.64 Billion |

| CAGR | CAGR of 8.38% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Components (Supervisory Control and Data Acquisition (SCADA), Distributed Control System (DCS), Manufacturing Execution System (MES), Functional Safety, Building Management System (BMS), Plant Asset Management (PAM), Variable Frequency Drives (VFD), Computer Numerical Control (CNC), Others) • By Technology (Wired, Wireless) • By Industry (Oil & Gas, Pharmaceuticals, Energy & Power, Pulp & Paper, Food & Beverages, Chemicals, Metals & Mining, Automotive, Semiconductor & Electronics, Machine Manufacturing, Aerospace & Defense, Medical Devices, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens, Schneider Electric, Rockwell Automation, Honeywell, ABB, Emerson, General Electric, Yokogawa Electric, Mitsubishi Electric, Omron, Inductive Automation, Beckhoff Automation, Bosch Rexroth, Fanuc, Delta Electronics. |