Get more information on Online Recruitment Market - Request Sample Report

The Online Recruitment Market size was valued at USD 11.38 billion in 2023 and is expected to grow to USD 41.14 billion by 2032 and grow at a CAGR of 15.35% over the forecast period of 2024-2032.

The increased number of job openings allows for online recruitment platforms to streamline processes like resume management solutions and employee screening tools. This demand is driven by a move to outsource manual recruiting processes to online platforms. The industry benefits from digital transformation, and the fourth industrial revolution generates new work opportunities that positively affect online recruitment. Increased adoption of cloud-based technologies, wider availability of high-bandwidth internet, and rise in social networking are some major market driving factors. Furthermore, the demand for smartphones is increasing which in turn has led to an upsurge in mobile-based recruitment solutions and this supports market growth. According to a recent study, the time to hire in the US is 39 days on average (it can go from more than a month depending on industry and job role). In the case of tech jobs, this can even go up to 43 days. That means US companies must pay on average $4,701 per hire. This encompasses everything from job postings, and recruiting software to the salaries of recruiters.

The market is continuously evolving, driven by technological advancements and changing job market dynamics. These platforms, being powered by artificial intelligence and machine learning algorithms are then becoming advanced enough to match job requirements with candidate profiles making the process of hiring much easier in terms of getting a good profile-candidate match from which both employer and employee benefit. 86% of job seekers now use social media in their job search, meaning it needs to be a part of your recruitment process. Impactful in hiring experience- 74% of HR professionals use structured interviews to screen candidates. Roughly 58% of the recruiters are using AI to improve their current recruitment tech, which helps in areas like resume screening or interview scheduling.

Drivers

The widespread availability of high-speed internet enhances access to online recruitment platforms, broadening the talent pool for employers.

Online recruitment reduces costs associated with traditional hiring methods, such as advertising and recruitment agency fees.

Digital platforms streamline the hiring process, enabling faster candidate search, application processing, and communication.

Integration of AI and machine learning improves candidate matching and reduces biases in the recruitment process.

Online platforms enable companies to reach a global audience, allowing access to a diverse and skilled talent pool.

The global online recruitment market has been supported by the increasing penetration of the internet which allows employers and job seekers to access digital platforms that offer jobs. According to the International Telecommunication Union, only 65% of people around the world have access to the internet as per its data until the year 2024. This wider access to the internet has changed how we job-hunt, making it possible for candidates from anywhere in the world to compete on a level playing field with employers all over. Just take the United States where the Pew Research Center claims internet penetration is already at almost 92%. This was a very high rate of connection, which meant that people could now connect (over the phone) to a given list of applications running on some important online recruitment platforms like LinkedIn, Indeed, and Glassdoor. Online recruitment is worldwide, with LinkedIn itself having over 900 million users globally.

The increased accessibility allows companies to access a wider talent pool, something that can be especially helpful for businesses seeking specialized skills they may not find locally. In 2024 the U.S., nearly all employers use (76%) of online job boards because it is hard to overlook how important Internet access has been in shaping recent recruitment trends. This growth in online hire is also being facilitated by increasing mobile access, with over half of all web traffic now coming from a mobile. This transition brings a possibility for desiring job seekers to expect locations of their choice and apply, further leading recruiters towards the direction that adds flexibility and efficiency in finding candidates from both employers and candidates.

Restraints

The ease of access to online platforms increases competition among companies for top talent, making it challenging to attract the best candidates.

Handling and protecting candidate data online raises concerns about privacy and security, which can affect user trust.

The high volume of applications from online platforms can be overwhelming, requiring efficient management and screening processes.

The Issues Related to data privacy act as major limitation in the market. the increasing volume of personal and sensitive data being shared on recruitment platforms, ensuring data protection is important. As per a survey by the International Association for Privacy Professionals (IAPP), 78 % of the companies have increased data breach and risk management concerns, and compliance with laws like GDPR (General Data Protection Regulation) & CCPA (Personal Privacy Act). This makes these concerns even more prevalent in recruitment, where candidate information such as resumes and contact details are especially sensitive. This includes additional costs associated with acquiring appropriate cybersecurity measures and more responsibilities in navigating the regulatory landscape for data protection, complicating company management of online recruitment processes.

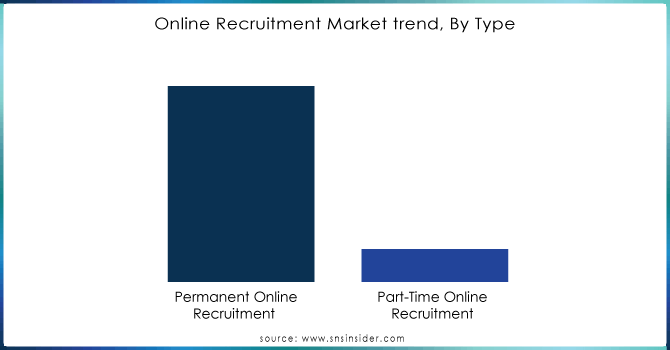

By Type

Permanent Online Recruitment held the largest revenue share of the market over 80% in 2023. Driven through several factors that comprehensively address the current requirements in a digital economy. Digital platforms have made the recruitment process more efficient and accessible, meeting the growing demand for permanent employees as organizations seek long-term stability and strategic alignment in their workforce. Online recruitment tools are getting smarter with their sophisticated filtering and matching process which ultimately improves the quality of hires while reduced hiring costs. Data analytics and advanced filtering algorithms ensure that companies utilizing these platforms to make permanent hires have access to a more extensive pool of talent and are well-placed to create better matches for their respective roles. All of these are designed to help employers determine if the candidate has enough experience and skills, but also align well with company culture/ values. Additionally, the security offered by permanent positions is highly valued by employees, attracting more qualified candidates in today’s job market.

The Part-time online recruitment segment, while smaller, serves a different market need. It meets the increased need for flexibility, especially among the young generation, freelancers, and those seeking work-life balance. This segment leverages same technological advancements but caters to industries/roles where flexible staffing is more prevalent such as retail, hospitality, emerging gig economy. The Part-time Online Recruitment segment, with a smaller market share in terms of revenue, is anticipated to become the fastest growing increasingly adopting flexible employment practices in response to changing work preferences and economic conditions.

Need any customization research on Online Recruitment Market - Enquiry Now

By Technology

The process of recruitment is getting digital from a traditional few years back. Corporations are witnessing massive growth, hiring a thousand candidates each day, and to organize this number of candidates have started using video interview technology with AI support. It simplifies the process of recruiting without the need to visit places that are not necessary, therefore saving time for job seekers and a great relief for companies.

The Chatbot segment is projected to grow with the significant annual growth rate during the forecast period, a result of growing AI based technology adoption by business. They improve a candidate's journey, make responding faster, and give advice on application. They also aid in people analytics providing insights into candidate behaviour and preferences. These technologies are changing the game on recruiting, and it is much faster to streamline all of those as part of technology progression.

By Application

The IT sector was the largest segment in online recruitment industry, which contributed over 25% of market share revenue on 2023. These initiatives have surged the demand for IT professionals in various industries, consequently resulted into a growing leadership footprint. Companies are using advanced technologies like artificial intelligence, machine learning, and cloud computing combined with their processes, and the need for qualified IT staff to manage or implement said solutions has risen sharply. IT sector has become one of the most significant industries in the online recruitment industry. The global movement to work from anywhere practise and increasing focus on cybersecurity as firms technologically transform corporate laboratory environments in addition has built upon this dominance. The IT sector, in which many positions need special technical knowledge or skills especially benefits from online recruitment solutions. The roles are matched with job requirements through these platforms using advanced algorithms and data analytics.

Utilizing a global talent pool has resulted in significant gains for employers to onboard complex, high specialized IT workforces. Something that is becoming more and more important, even key to your future competitiveness or making sure you can still operate in the modern world of technology. Organizations are continuing to hunt for talented IT professionals and this segment probably offers the unmatched level of dominance in as an offer, which should prevail at some extent with every online recruitment platform that does such services.

Regional analysis

North America held the largest share of more than 34% in the online recruitment market in 2023. This is further driven by a well-digitized corporate sector and the wide adoption of advanced technology companies. Both the U.S. and Canada are early adopters of new technology, such as sophisticated recruitment software featuring AI (artificial intelligence) and ML (machine learning), to help simplify recruiting tasks. In the most recent data, online recruiting platforms are used to some extent by around 80%-90% of U.S. companies. These innovations help an organisation in bridging the gap between their potential candidates and job openings, making recruitment a more responsive process while saving time & cost positioning North America as a key market for online recruitment solutions. North America benefits from a highly skilled workforce and a culture that embraces job mobility and career changes, driving the demand for online recruitment services. The region's strong economic environment and the presence of numerous global corporations necessitate a dynamic recruitment market that can adapt to rapidly changing employment needs and job specifications. Through recruitment marketing technology and AI, key employers in North America can automate repetitive activities like responding to the queries of job seekers; scheduling interviews with candidates for multiple roles or positions as well conducting initial screenings.

The APAC region, driven by factors that are unique and distinguishable in shaping your recruitment strategy for success. The online recruitment market in Asia Pacific is witnessing growth due to the increasing preference for automating talent acquisition and leading HR management solution providers extending their reach across emerging economies amidst the technological advancements shaping up an innovative business environment. There is a high global adoption of online recruiting as well, with many developed countries huge number of companies using the online platform. In Europe, this figure is on the order of 70% to 80%, for example. LinkedIn, Indeed, Glassdoor, and Monster are the top major job boards that are widely used. LinkedIn has more than 900 million members, and many companies have used this platform for recruitment. Mobile recruiting is becoming a big deal, and companies are beginning to optimize their career sites (and application processes) for smartphones, approximately 60% of those seeking jobs use their smartphones to search.

The major players in the market are SmartRecruiters, HireVue, Inc., Yello, BambooHR LLC, TalentLyft, flair.hr, Fountain, Recruitee.com, Avature, TestGorilla, Seek Limited, Guru.com, Monster Worldwide, Inc., CareerBuilder, LLC, ManpowerGroup Inc., Upwork Inc., and others in the final report.

January 2023 – Smart Recruiters introduced a new product with new features such as Zoom integration, Onboarding start date edit, and Interview Scheduler updates such as multi-day scheduling, multi-country posting, and remote work support, among others. This new product is critical in improving the experience of recruiting prospects.

In April 2023, Recruiter. com introduced a new platform called Recruiter Marketplace. It does this by providing a way to automatically bring employers and freelance candidates together, making global talent more accessible in the process.

The January 2023, SmartRecruiters introduced a product included new features like Zoom integration, edit the onboarding start date and improvements to interview scheduling. The first part allows developers to better schedule candidates allowing multi-day scheduling, multi-country posting and also remote work support.

LinkedIn Talent Hub Launched in 2023 by LinkedIn, they offer employers real-time insights into talent and market trends with LinkedIn from employers.

Zoho Corporation Pvt. In 2023, Ltd. upgraded its Zoho Recruit as well This end-to-end solution consists of an Applicant Tracking System (ATS), integration with onboarding as well as payroll, serving the needs for upcoming recruitment approaches.

| Report Attributes | Details |

| Market Size in 2023 | US$ 11.38 Bn |

| Market Size by 2032 | US$ 41.14 Bn |

| CAGR | CAGR of 15.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Type (Permanent Online Recruitment, Part-Time Online Recruitment) • By Job Type (Secretarial or Clerical, Accounting and Financial, Computing, Technical, and Engineering, Professional or Managerial, Medical, Hotel or Catering, Sales or Marketing, Other Industrial or Blue Collar) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Smart Recruiters, HireVue, Inc., Yello, BambooHR LLC, TalentLyft, flair.hr, Fountain, Recruitee.com, Avature, TestGorilla, Seek Limited, Guru.com, Monster Worldwide, Inc., CareerBuilder, LLC, ManpowerGroup Inc., Upwork Inc. |

| Key Drivers | • Increased emphasis on automation in the hiring process to aid market growth |

| Market Opportunities | • The expansion in job opportunities has boosted the demand for advanced recruiting platforms dramatically. |

Ans: 41.14 is the expected value of the Online Recruitment Market in the forecast period of 2032 with a CAGR of 15.35%.

Ans: USD 11.38 billion in 2023 is the market share of the Online Recruitment Market.

Ans. The major players in the market are Smart Recruiters, HireVue, Inc., Yello, BambooHR LLC, TalentLyft, flair.hr, Fountain, Recruitee.com, Avature, TestGorilla, Seek Limited, Guru.com, Monster Worldwide, Inc., CareerBuilder, LLC, ManpowerGroup Inc., Upwork Inc., and others in the final report.

Ans: North America is the dominating region in Online Recruitment Market.

Ans. The forecast period for the Online Recruitment Market is 2024-2032.

Table Of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Salary & Compensation Insights, 2023

5.2 Recruitment Efficiency & Hiring Trends, 2023

5.3 Candidate Behavior & Preferences, 2023

5.4 Fraud & Security in Online Hiring

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Online Recruitment Market Segmentation, By Application

7.1 Chapter Overview

7.2 IT

7.2.1 IT Market Trends Analysis (2020-2032)

7.2.2 IT Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Sales and Marketing

7.3.1 Sales and Marketing Market Trends Analysis (2020-2032)

7.3.2 Sales and Marketing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Finance

7.4.1 Finance Market Trends Analysis (2020-2032)

7.4.2 Finance Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Engineering

7.5.1 Engineering Market Trends Analysis (2020-2032)

7.5.2 Engineering Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Online Recruitment Market Segmentation, By Type

8.1 Chapter Overview

8.2 Permanent Online Recruitment

8.2.1 Permanent Online Recruitment Market Trends Analysis (2020-2032)

8.2.2 Permanent Online Recruitment Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Part-Time Online Recruitment

8.3.1 Part-Time Online Recruitment Market Trends Analysis (2020-2032)

8.3.2 Part-Time Online Recruitment Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Online Recruitment Market Segmentation, By Job Type

9.1 Chapter Overview

9.2 Secretarial or Clerical

9.2.1 Secretarial or Clerical Market Trends Analysis (2020-2032)

9.2.2 Secretarial or Clerical Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Accounting and Financial

9.3.1 Accounting and Financial Market Trends Analysis (2020-2032)

9.3.2 Accounting and Financial Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Computing

9.4.1 Computing Market Trends Analysis (2020-2032)

9.4.2 Computing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Professional or Managerial

9.5.1 Professional or Managerial Market Trends Analysis (2020-2032)

9.5.2 Professional or Managerial Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Technical and Engineering

9.6.1 Technical and Engineering Market Trends Analysis (2020-2032)

9.6.2 Technical and Engineering Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Sales or Marketing

9.7.1 Sales or Marketing Market Trends Analysis (2020-2032)

9.7.2 Sales or Marketing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Medical

9.8.1 Medical Market Trends Analysis (2020-2032)

9.8.2 Medical Market Size Estimates and Forecasts to 2032 (USD Billion)

9.9 Hotel or Catering

9.9.1 Hotel or Catering Market Trends Analysis (2020-2032)

9.9.2 Hotel or Catering Market Size Estimates and Forecasts to 2032 (USD Billion)

9.10 Others

9.10.1 Others Market Trends Analysis (2020-2032)

9.10.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Online Recruitment Market Segmentation, By Technology Type

10.1 Chapter Overview

10.2 Chatbot

10.2.1 Chatbot Market Trends Analysis (2020-2032)

10.2.2 Chatbot Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Application Tracking System

10.3.1 Application Tracking System Market Trends Analysis (2020-2032)

10.3.2 Application Tracking System Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Candidate Relationship Management Platform

10.4.1 Candidate Relationship Management Platform Market Trends Analysis (2020-2032)

10.4.2 Candidate Relationship Management Platform Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Video Interviewing

10.5.1 Video Interviewing Market Trends Analysis (2020-2032)

10.5.2 Video Interviewing Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Online Recruitment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.4 North America Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.5 North America Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.2.6 North America Online Recruitment Market Estimates and Forecasts, By Technology Type(2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.7.2 USA Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.7.3 USA Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.2.7.4 USA Online Recruitment Market Estimates and Forecasts, By Technology Type(2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.8.2 Canada Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.8.3 Canada Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.2.8.4 Canada Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.9.2 Mexico Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.9.3 Mexico Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.2.9.4 Mexico Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Online Recruitment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Online Recruitment Market Estimates and Forecasts, By Technology Type(2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.7.2 Poland Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.7.3 Poland Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.1.7.4 Poland Online Recruitment Market Estimates and Forecasts, By Technology Type(2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.8.2 Romania Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.8.3 Romania Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.1.8.4 Romania Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Online Recruitment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.4 Western Europe Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.5 Western Europe Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.2.6 Western Europe Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.7.2 Germany Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.7.3 Germany Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.2.7.4 Germany Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.8.2 France Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.8.3 France Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.2.8.4 France Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.9.2 UK Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.9.3 UK Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.2.9.4 UK Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.10.2 Italy Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.10.3 Italy Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.2.10.4 Italy Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.11.2 Spain Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.11.3 Spain Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.2.11.4 Spain Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.14.2 Austria Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.14.3 Austria Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.2.14.4 Austria Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Online Recruitment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.4 Asia Pacific Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.5 Asia Pacific Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.4.6 Asia Pacific Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.7.2 China Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.7.3 China Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.4.7.4 China Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.8.2 India Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.8.3 India Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.4.8.4 India Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.9.2 Japan Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.9.3 Japan Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.4.9.4 Japan Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.10.2 South Korea Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.10.3 South Korea Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.4.10.4 South Korea Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.11.2 Vietnam Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.11.3 Vietnam Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.4.11.4 Vietnam Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.12.2 Singapore Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.12.3 Singapore Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.4.12.4 Singapore Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.13.2 Australia Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.13.3 Australia Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.4.13.4 Australia Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Online Recruitment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.4 Middle East Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.5 Middle East Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.5.1.6 Middle East Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.7.2 UAE Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.7.3 UAE Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.5.1.7.4 UAE Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Online Recruitment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.4 Africa Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.5 Africa Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.5.2.6 Africa Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Online Recruitment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.4 Latin America Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.5 Latin America Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.6.6 Latin America Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.7.2 Brazil Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.7.3 Brazil Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.6.7.4 Brazil Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.8.2 Argentina Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.8.3 Argentina Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.6.8.4 Argentina Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.9.2 Colombia Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.9.3 Colombia Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.6.9.4 Colombia Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Online Recruitment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Online Recruitment Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Online Recruitment Market Estimates and Forecasts, By Job Type (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Online Recruitment Market Estimates and Forecasts, By Technology Type (2020-2032) (USD Billion)

12. Company Profiles

12.1 SmartRecruiters

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 HireVue, Inc.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Yello

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 BambooHR LLC

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 TalentLyft

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 flair.hr

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Fountain

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Recruitee.com

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Avature

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 TestGorilla

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Permanent Online Recruitment

Part-Time Online Recruitment

By Job Type

Secretarial or Clerical

Accounting and Financial

Computing

Professional or Managerial

Technical and Engineering

Sales or Marketing

Medical

Hotel or Catering

Others

By Technology Type

Application Tracking System

Candidate Relationship Management Platform

Video Interviewing

By Application

IT

Sales and Marketing

Finance

Engineering

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Data Exfiltration Market Size was valued at USD 73.35 Billion in 2023 and will reach USD 203.39 Billion by 2032 and grow at a CAGR of 12.0% by 2032.

The GCCs in the BFSI Market Size was USD 40.43 billion in 2023 & are expected to reach USD 132.18 Billion by 2032, growing at a CAGR of 12.54% by 2024-2032.

The Hyperscale Data Center Market, valued at USD 124.30 billion in 2023, is projected to reach USD 957.23 billion by 2032, growing at a robust CAGR of 25.48% of 2024-2032.

Network Slicing Market size was valued at USD 756 Million in 2023. It is expected to Reach USD 24231 Million by 2032 and grow at a CAGR of 47% over the forecast period of 2024-2032.

The Enterprise Resource Planning Software Market was valued at USD 62.49 billion in 2023 and is expected to reach USD 175.63 billion by 2032 & CAGR of 12.23% by 2032.

The Retail Media Platform Market Size was valued at USD 16.1 Billion in 2023 and will reach USD 33.7 Billion by 2032, growing at a CAGR of 8.6% by 2032.

Hi! Click one of our member below to chat on Phone