To Get More Information on Online Gambling & Betting Market - Request Sample Report

The Online Gambling & Betting Market was valued at USD 81.86 Billion in 2023 and is expected to reach USD 218.02 Billion by 2032, growing at a CAGR of 11.54% over the forecast period 2024-2032.

The online gambling and betting market has witnessed remarkable growth over the past decade, fueled by technological advancements, increased internet penetration, and evolving consumer preferences. As mobile technology continues to reshape the landscape, more individuals are embracing various forms of online betting, including sports betting, casino games, poker, and lotteries. One of the most significant trends driving this surge is the rising preference for mobile devices. Approximately 75% of online gamblers now engage in gaming activities via mobile platforms, reflecting the industry's shift towards accessible and convenient options. The typical online gambler is around 34 years old, with a notable male-to-female ratio of 3:1, indicating a predominantly male demographic.

While this vibrant industry offers substantial opportunities, it also presents considerable challenges. Approximately 10 million Americans struggle with gambling addiction, and around 1 in 20 college students are identified as compulsive gamblers. These statistics underscore the necessity for awareness and responsible gambling practices. Behaviors such as using gambling as an escape or experiencing guilt afterward may signal developing issues, highlighting the importance of monitoring gaming habits. As the iGaming community expands, it is projected that there will be around 593 million enthusiasts by 2024. Stakeholders must prioritize responsible gambling practices to ensure a sustainable and healthy gaming environment. This focus not only protects consumers but also strengthens the overall reputation of the industry.

The impact of online gambling extends beyond entertainment; it plays a crucial role in various industries, particularly in sports. The sports industry significantly benefits from online betting, which drives engagement and viewership for sporting events. In 2022, the sports betting industry employed over 200,000 individuals and saw participation from more than 25 million Americans. Sports betting platforms provide fans with the opportunity to place bets on various outcomes, creating an immersive experience that enhances their connection to the sport. Below is the table for active gamblers globally:

|

Country |

Active Gamblers (million) |

|

United States |

58 |

|

Germany |

29 |

|

The Netherlands |

1.1 |

|

United Kingdom |

29 |

|

Canada |

19.3 |

|

Australia |

6.8 |

|

France |

27 |

Market Dynamics

Drivers

The increase in worldwide internet access has had a major effect on the Online Gambling and Betting Market. Due to increased high-speed internet availability, a wider range of individuals can now participate in online gambling. This ease of access has enabled the expansion of different platforms, such as mobile apps and websites, enabling individuals to place bets and gamble conveniently from their residences. The availability of online gambling sites has lured in new players, especially younger individuals who are familiar with digital transactions and online entertainment. With the rise of smartphones, mobile gambling has significantly increased as users prefer to gamble while being mobile. Moreover, enhancements in online technology, such as the introduction of 5G, have enhanced the overall user experience, enabling quicker transactions and better-quality streaming for live betting occasions.

Live dealer games have played a major role in the growth of the Online Gambling and Betting Market. Live dealer games combine the ease of online gaming with the social aspect of brick-and-mortar casinos, appealing to players who want a genuine gambling experience without going to a physical venue. These games include actual dealers who engage with players via live video streams, enabling interactive gameplay and communication in real time. This new method closes the divide between online and offline betting, attracting a broader range of people. Gamers value the honesty and genuineness of live dealer games, being able to observe the gameplay as it happens and engage with the dealer and fellow players. In addition, a wide range of live dealer games such as blackjack, roulette, baccarat, and poker are offered to suit different player tastes. The increasing popularity of live dealer games is projected to grow further as operators invest in top-notch streaming technology and skilled dealers, contributing to overall market expansion.

Restraints

Security issues pose a major limitation for the Online Gambling and Betting Market. Online gambling platforms are appealing to cybercriminals because they deal with sensitive personal and financial data. Data breaches and hacking incidents have the potential to cause significant financial harm to operators and players, leading to a loss of confidence in the industry. Moreover, the utilization of cryptocurrencies in internet betting, despite offering benefits, can also bring about security threats. Players might worry about the safety of their online wallets and the risk of fraud or theft. Operators need to implement strong security measures like encryption, firewalls, and frequent security audits to safeguard their platforms and ensure player trust. The rise of fresh cybersecurity risks requires operators to stay watchful and take proactive steps in their security measures. Not meeting this requirement may lead to serious harm to reputation and a decrease in customer confidence, ultimately affecting market expansion.

Market Segmentation Analysis

By Type

The sports betting segment dominated the market with more than 50% market share in 2023, fueled by the rise in the legalization of sports wagering in different areas and the growing fascination with live sports. Due to technological advancements, bettors now can place bets live during events, increasing both excitement and engagement. Big companies such as DraftKings and FanDuel have taken advantage of this trend by providing creative platforms and a variety of betting choices like in-game betting and prop bets. These businesses have also put money into marketing strategies to appeal to a wider audience, specifically targeting younger age groups who prefer interacting with digital platforms.

The casino segment accounted for a rapid CAGR and is the fastest-growing during 2024-2032, due to the increasing popularity of online casinos and advancements in gaming technology. Online casinos provide a wide range of games like slot machines, table games, and live dealer options, giving players a similar immersive experience as traditional casinos. For instance, Bet365 and 888 Holdings are leading the way by utilizing advanced technology to improve user interaction, offering features like high-quality streaming and interactive gameplay.

By Device

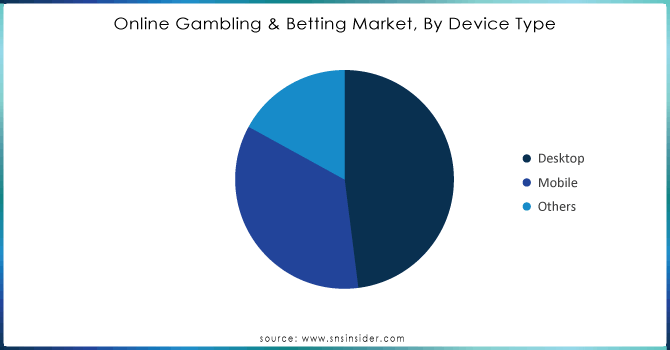

The desktop dominated with a 48% market share in 2023, making up a significant portion of overall earnings. The reason for this dominance lies in factors such as bigger screens, better processing power, and stronger internet connectivity. Desktop platforms provide a more engaging gaming experience with advanced graphics, interactive game options, and user-friendly interfaces, enhancing players' immersion. Well-known apps such as PokerStars and Bet365 have customized their sites for computer users, offering a wide range of casino games, sports betting, and live dealer choices.

The mobile segment is anticipated to have a progressive CAGR during 2024-2032, due to the rising popularity of smartphones and their convenience. Due to the increasing popularity of mobile apps, individuals can access gambling opportunities at any time and in any place, thus making mobile platforms very attractive. Apps like 888 Casino and DraftKings have taken advantage of this shift by creating advanced mobile applications that offer a wide variety of services such as sports betting, live casinos, and slot games.

Do You Need any Customization Research on Online Gambling & Betting Market - Inquire Now

Regional Analysis

Europe held a market share of 42% in 2023 and led the market regionally, representing a large portion of the worldwide market. Reasons for this dominance stem from established regulations, widespread internet usage, and societal acceptance of gambling. Nations such as the UK, Germany, and Sweden are at the forefront, providing a wide range of betting choices like sports betting, online casinos, and poker. Key players such as Bet365, William Hill, and Kindred Group have a strong presence in Europe, utilizing advanced technology to improve user satisfaction and grow their services.

The APAC region is expected to have a significant growth rate during 2024-2032, due to fast urbanization, rising disposable incomes, and the widespread use of smartphones. Nations like China, Japan, and Australia are experiencing notable expansion, as more customers are adopting internet gambling websites. Regulatory changes in multiple countries are also creating a more conducive atmosphere for the gambling sector. Paddy Power Betfair and 888 Holdings are growing in the APAC area by providing tailored content and easy-to-use platforms to appeal to customers.

Key Players

The major key players in the Online Gambling & Betting Market are:

William Hill (Sportsbook, Casino)

Bet365 (Sports Betting, Poker)

Paddy Power Betfair PLC (Betting Exchange, Sportsbook)

Betsson AB (Online Casino, Sports Betting)

Ladbrokes Coral Group PLC (Sports Betting, Virtual Sports)

The Stars Group Inc. (PokerStars, Betfair Casino)

888 Holdings PLC (888poker, 888casino)

Sky Betting and Gaming (Sky Bet, Sky Casino)

Kindred Group PLC (Unibet, 32Red)

GVC Holdings PLC (Ladbrokes, bwin)

DraftKings Inc. (Daily Fantasy Sports, Sportsbook)

FanDuel (Daily Fantasy Sports, Sportsbook)

Caesars Entertainment Corporation (Caesars Sportsbook, WSOP)

Betfair International (Sports Betting, Exchange Betting)

BetMGM (Sports Betting, Casino)

Sportingbet (Sports Betting, Live Betting)

Parimatch (Online Sports Betting, Casino Games)

LeoVegas AB (LeoVegas Casino, Live Casino)

Mr Green Ltd. (Mr Green Casino, Sports Betting)

Evolution Gaming (Live Casino Solutions, Game Shows)

Recent Developments

August 2024: Dublin-based online sports betting and gaming company Flutter Entertainment on Tuesday announced the opening of a new Global Capability Centre (GCC) in Hyderabad with an investment outlay of USD 3.5 million.

August 2024: Hard Rock Casino Rockford and Hard Rock Digital unveiled the debut of Hard Rock Bet, now live in Illinois offering its top-rated online sports betting app statewide and with on-property wagering at the soon-to-be-opened sportsbook at Hard Rock Casino Rockford.

July 2024: The New Zealand government announces a curated approach to online casino regulation, targeting reductions in harm and improvements in consumer protection and tax revenue.

July 2024: Vanuatu, the small island nation with the boast of being shortly followed by Antigua to offer online gambling licenses during the late '90s has presented a new regulatory framework offering applications online.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 81.86 Billion |

| Market Size by 2032 | USD 218.02 Billion |

| CAGR | CAGR of 11.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Sports Betting, Casinos, Poker, Bingo, Others) • By Type (Desktop, Mobile, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | William Hill, Bet365, Paddy Power Betfair PLC, Betsson AB, Ladbrokes Coral Group PLC, The Stars Group Inc., 888 Holdings PLC, Sky Betting and Gaming, Kindred Group PLC, GVC Holdings PLC, DraftKings Inc., FanDuel, Caesars Entertainment Corporation, Betfair International, BetMGM, Sportingbet, Parimatch, LeoVegas AB, Mr Green Ltd., Evolution Gaming |

| Key Drivers | • The impact of increased internet access on the growth of the online gambling and betting market. • Live dealer games revolutionize the online gambling and betting market with enhanced social interaction and authentic experiences. |

| RESTRAINTS | • Navigating security challenges in the online gambling and betting market to ensure trust and growth. |

Ans: The Online Gambling & Betting Market is expected to grow at a CAGR of 11.54% during 2024-2032.

Ans: The Online Gambling & Betting Market was USD 81.68 Billion in 2023 and is expected to Reach USD 218.02 Billion by 2032.

Ans: Live dealer games revolutionize the online gambling and betting market with enhanced social interaction and authentic experiences.

Ans: The desktops segment dominated the Online Gambling & Betting Market.

Ans: Europe dominated the Online Gambling & Betting Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Market Penetration Rates (2023)

5.2 Betting Volume and Activity, (2023), by Region

5.3 Platform Performance Metrics, by Region

5.4 Customer Retention Rates, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Online Gambling & Betting Market Segmentation, by Type

7.1 Chapter Overview

7.2 Sports Betting

7.2.1 Sports Betting Market Trends Analysis (2020-2032)

7.2.2 Sports Betting Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Casinos

7.3.1 Casinos Market Trends Analysis (2020-2032)

7.3.2 Casinos Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 iSlots

7.3.3.1 iSlots Market Trends Analysis (2020-2032)

7.3.3.2 iSlots Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 iTable

7.3.4.1 iTable Market Trends Analysis (2020-2032)

7.3.4.2 iTable Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 iDealer

7.3.5.1 iDealer Market Trends Analysis (2020-2032)

7.3.5.2 iDealer Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.6 Others

7.3.6.1 Others Market Trends Analysis (2020-2032)

7.3.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Poker

7.4.1 Poker Market Trends Analysis (2020-2032)

7.4.2 Poker Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Bingo

7.5.1 Bingo Market Trends Analysis (2020-2032)

7.5.2 Bingo Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Online Gambling & Betting Market Segmentation, by Device

8.1 Chapter Overview

8.2 Desktop

8.2.1 Desktop Market Trends Analysis (2020-2032)

8.2.2 Desktop Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Mobile

8.3.1 Mobile Market Trends Analysis (2020-2032)

8.3.2 Mobile Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Other

8.4.1 Other Market Trends Analysis (2020-2032)

8.4.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Online Gambling & Betting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Online Gambling & Betting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Online Gambling & Betting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Online Gambling & Betting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Online Gambling & Betting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Online Gambling & Betting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Online Gambling & Betting Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Online Gambling & Betting Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Online Gambling & Betting Market Estimates and Forecasts, by Device (2020-2032) (USD Billion)

10. Company Profiles

10.1 William Hill

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Bet365

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Paddy Power Betfair PLC

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Betsson AB

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Ladbrokes Coral Group PLC

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 The Stars Group Inc.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 888 Holdings PLC

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Sky Betting and Gaming

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Kindred Group PLC

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 GVC Holdings PLC

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Sports Betting

Casinos

iSlots

iTable

iDealer

Other iCasino Games

Poker

Bingo

Others

By Device

Desktop

Mobile

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Insurance Telematics Market, valued at USD 4.1 billion in 2023 is expected grow at a CAGR of 18.91% over 2024-2032, to reach USD 18.70 billion by 2032.

The Green Data Center Market size was valued at USD 62.9 billion in 2023 and will reach USD 272.2 billion by 2032 and grow at a CAGR of 17.7% by 2032.

The Contactless Payment Market was valued at USD 45.33 billion in 2023 and will reach USD 194.51 Billion by 2032, growing at a CAGR of 17.59 % by 2032.

Multi-Cloud Management Market was valued at USD 9.84 billion in 2023 and will reach USD 86.24 billion by 2032, growing at a CAGR of 27.34% by 2032.

The Data Wrangling Market was valued at USD 3.2 Billion in 2023 and is expected to reach USD 12.6 Billion by 2032, growing at a CAGR of 16.59% from 2024-2032.

The Data Center Transformation Market Size was valued at USD 13.85 Billion in 2023 and will reach USD 35.73 Billion by 2032 and grow at a CAGR of 11.2% by 2032.

Hi! Click one of our member below to chat on Phone