Online Event Ticketing Market Report Scope and Overview:

Get More Information on Online event ticketing market - Request Sample Report

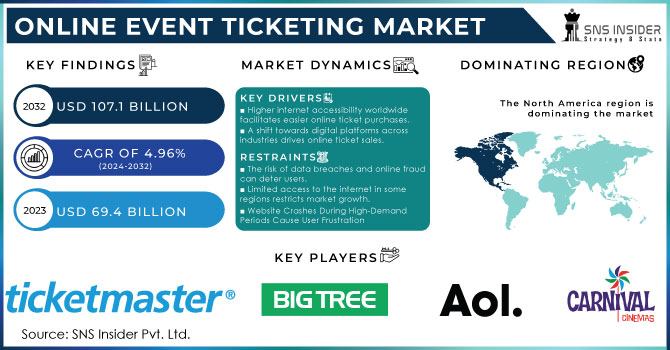

The Online event ticketing market size was valued at USD 69.4 Billion in 2023. It is expected to hit USD 107.1 Billion by 2032 and grow at a CAGR of 4.96 % over the forecast period of 2024-2032.

The online event ticketing market is growing due to the continuously growing adoption internet across the world and the growing popularity of mobile apps for reserving tickets to films, sports activities, and live shows, in Asia Pacific. Customers in this region will pay extra internet handling fees to avoid long queues. This trend is driven by aggressive promotion and advertising by online ticketing services, making ticket purchasing through smartphones and tablets more convenient. Increased disposable income in emerging countries is also boosting market growth by driving higher spending on entertainment. The ease of comparing prices and services online is encouraging more consumers to adopt online ticketing. The surge in global internet users has created significant opportunities for e-marketers. By 2023, online ticket purchases in the United States were dominated by Ticketmaster, which held the majority share of 61% of event ticket transactions. Event Ticket Center and SeatGeek, both taking up 21% of the market, were among the standout players. ACE Ticket followed closely behind at 20%, with Gold Coast Tickets holding 16%. North America's strong presence in online ticket purchasing systems was clear, as these companies were responsible for most event ticket sales, showing a high consumer preference for internet platforms in the region.

Online ticketing vendors specialize in advertising marketing and promotional efforts, offering user-friendly apps, and redesigning websites to improve the booking experience. The substantial use of 4G and 5G has made mobile booking more famous than conventional online methods. Continuous updates and improvements to mobile interfaces have further driven growth in this sector. Features like seating preferences, mobile tickets, and combination deals are enhancing the customer experience. Additionally, new technologies like RFID tags and prepaid smart cards are simplifying the ticketing technique, especially for multi-day events. Social media and technological advancements in data evaluation and wireless technology are also transforming event advertising and promotions, creating more customized and attractive experiences for clients.

Drivers

Higher internet accessibility worldwide facilitates easier online ticket purchases.

A shift towards digital platforms across industries drives online ticket sales.

Innovations like blockchain for ticket verification and AI for customer service enhance user experience.

Increased penetration of the internet is a major driver for the online event ticketing market. With more people getting access to the internet globally, the capacity consumer base for online ticketing platforms has expanded dramatically. This widespread connectivity helps less complicated and quicker access to online services, together with tickets for events concerts, and sports activities to theaters. The proliferation of excessive-speed internet and broadband services, mainly driving the market, has played an important role in this boom. For example, in India, the wide variety of Internet users is predicted to reach 900 million by 2025, growing due to the lower cost of data plans and initiatives of govt. promoting digital inclusion. This surge in internet users directly correlates with an increase in online transactions, such as ticket purchases. Moreover, the upward push of mobile internet usage has similarly bolstered this trend. As of 2024, mobile internet users are over 60% of overall internet traffic globally. This shift highlights the growing dependence on smartphones for diverse activities, including buying event tickets, which gives extraordinary convenience and accessibility. These factors together make multiplied internet penetration a pivotal driver for the online event ticketing market.

Restraints

The risk of data breaches and online fraud can deter users.

Limited access to the internet in some regions restricts market growth.

Website crashes or technical glitches during high-demand periods can cause user frustration.

Issues with ticket scalping and counterfeit tickets can undermine consumer trust, Lack of awareness about online ticketing options in certain demographics.

The restraint in the online event ticketing market is cybersecurity issues. As a huge number of transactions are going through online, the risk related to data breaches, and cyber fraud has emerged as a pressing issue for customers and corporations alike. Instances of hacking attempts, phishing scams focused on target ticket buyers, and unauthorized access to personal information have raised alarm amongst users, impacting trust among platforms of online ticketing. Despite improvements in cybersecurity technology, the evolving nature of cyber threats continues to venture into the industry. Mitigating those risks requires strong security features, including encryption protocols, multi-factor authentication, and ongoing cybersecurity training for workers and customers. Building trust through transparency in data handling with practices is crucial to retaining consumer confidence in online ticketing offerings.

Segment Analysis

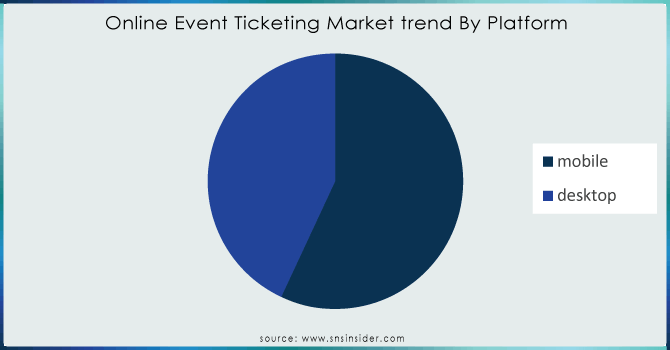

By Platform

The Mobile segment held the largest share of revenue 55% In 2023 and is expected to grow at a significant annual growth rate. The preference for mobile devices stems from declining charges of the internet and the extensive adoption of 3G and 4G connectivity. Mobile booking is seen as simpler than traditional online methods, with user-friendly interfaces and frequent updates enhancing the experience. Service providers also use loyalty programs to retain mobile platform users. The speed and reliability of online booking drive the growth of the market.

The desktop segment is projected to grow significantly with a CAGR of 4.92%, with desktops offering larger screens, and a better browsing experience. This allows users to view event details and seating charts more easily, improving conversion rates and customer satisfaction. Desktops often have advanced security features, providing users with confidence when sharing personal and financial information, which is crucial for those who prioritize data protection. This sense of security can drive more online transactions on desktop platforms.

Need any customization research on Online event ticketing market - Enquiry Now

By Event Type

In 2023, the music segment held the largest revenue share at 37% and is projected to grow at a CAGR of 5.01%. The rising popularity of live music events and immersive experiences drives demand for online ticket purchases. Music enthusiasts are looking for concerts and festivals, while advancements in mobile apps and websites enhance user interfaces, personalized recommendations, and real-time ticket updates, boosting market growth. In 2023, Live Nation organized over 50,000 events, with revenue reaching approximately USD 22.73 billion, highlighting the growing demand for online ticketing. Online platforms are integrating with music streaming services, making ticket purchasing more accessible. Trends like "the Taylor Swift effect" influence consumer travel decisions, prompting companies like AirAsia to integrate event bookings within their apps.

The sports segment held a revenue share of 29% in 2023, is expected to grow significantly, driven by major events like the NFL, FIFA World Cup, Olympics, ICC Cricket World Cup, and IPL. support of the government for sports events also boosts demand for tickets, resulting in increasing traffic on online platforms. The movie ticketing segment remains competitive with services like Fandango and Movietickets.com offering discounts and partnerships with cinemas.

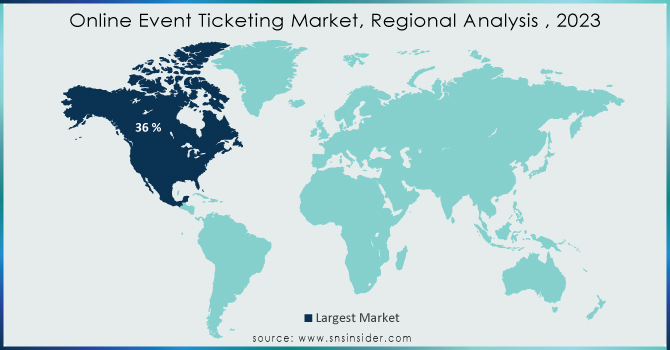

Regional Analysis

North America led the market in 2023, accounting for 36% of the revenue share, pushed by way of higher per capita income and growing internet access within the U.S. And Canada. Mobile film ticketing services are projected to become a primary source of revenue in North America because of the convenience they provide. The US market is projected to grow substantially, driven by a tech-savvy population with large amounts of disposable income and a thriving entertainment sector. A survey through Variety Intelligence Platform and UTA IQ observed that 37% of U.S. respondents were willing to attend live music concerts, indicating strong growth potential for the music application segment. The STOP Act, recently enacted in the U.S., prohibits deceptive ticket-selling websites and restricts unauthorized use of names in domain names.

Asia Pacific is anticipated to achieve the fastest CAGR of 5.60%, driven by rising internet and smart device penetration. Economic growth, a shift towards Western lifestyles, increasing broadband access, and new cinema launches are expected to drive market growth in India and China. In India, movie-ticketing service providers benefit from high demand, with BookMyShow handling approx. 35,000 transactions daily and selling more than 95,300 tickets nationwide. This contrasts with the U.S., where preferred seating is an additional service, whereas it is essential in India and China.

Key Players

The Major players in the market are Carnival Cinemas, AOL Inc. (Yahoo), PVR LTD., Tickets Please, Bigtree, Ticketmaster, StubHub, Cinemark Holdings, Inc., KyaZoonga, Inc, EasyMovies, Cineplex Inc., VOX Cinemas, TickPick LLC, and others in the final report.

Recent Developments

In October 2023, Patreon acquired Moment, a platform that hosts and tickets digital events such as concerts and podcasts. Patreon intends to integrate Moment's features into its creator tools.

Seat Unique raised 7 million euros (9 million USD) in a series A funding round in June 2023, following ticket sales exceeding 30 million euros (32.6 million USD). The website collaborates with more than 40 venues, clubs, and promoters in the UK to offer exclusive access to sporting events such as The Ashes 2023, Premier League, Formula 1, and Wimbledon. The financial backing will help Seat Unique grow in new markets and enhance current partnerships.

Evvnt Inc. launched a Mobile Box Office app in April 2023 to enhance event ticket sales at gates and doors. This application permits event planners and locations to efficiently handle ticket sales, handle payments, and check in guests using mobile devices, with a user-friendly interface tailored for fast-paced events.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 59.4 billion |

| Market Size by 2032 | US$ 107.1 Billion |

| CAGR | CAGR of 4.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Desktop, Mobile) • By Event Type (Sports, Music, Movies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Carnival Cinemas, AOL Inc. (Yahoo), PVR LTD., Tickets Please, Bigtree, Ticketmaster, StubHub, Cinemark Holdings, Inc., KyaZoonga, Inc, EasyMovies, Cineplex Inc., VOX Cinemas, TickPick LLC, and others |

| Key Drivers | • Higher internet accessibility worldwide facilitates easier online ticket purchases. • A shift towards digital platforms across industries drives online ticket sales. |

| RESTRAINTS | • Limited access to the internet in some regions restricts market growth. • Website crashes or technical glitches during high-demand periods can cause user frustration. |

Ans. The projected market size for the Online Event Ticketing Market is USD 107.1 billion by 2032.

Ans. The CAGR of the Online Event Ticketing Market is 4.96% During the forecast period of 2024-2032.

Ans: The Asia Pacific region is expected to grow with the highest CAGR during the forecast period of 2024-2032.

Ans: The music event type segment dominated the Online Event Ticketing Market.

Ans: the Key players in the market are Carnival Cinemas, AOL Inc. (Yahoo), PVR LTD., Tickets Please, Bigtree, Ticketmaster, StubHub, Cinemark Holdings, Inc., KyaZoonga, Inc, EasyMovies, Cineplex Inc., VOX Cinemas, TickPick LLC, and others in the final report.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Online Event Ticketing Market Segmentation, By Platform

7.1 Introduction

7.2 Desktop

7.3 Mobile

8. Online Event Ticketing Market Segmentation, By Event Type

8.1 Introduction

8.2 Sports

8.3 Music

8.4 Movies

9. Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 Trend Analysis

9.2.2 North America Online Event Ticketing Market by Country

9.2.3 North America Online Event Ticketing Market By Platform

9.2.4 North America Online Event Ticketing Market By Event Type

9.2.5 USA

9.2.5.1 USA Online Event Ticketing Market By Platform

9.2.5.2 USA Online Event Ticketing Market By Event Type

9.2.6 Canada

9.2.6.1 Canada Online Event Ticketing Market By Platform

9.2.6.2 Canada Online Event Ticketing Market By Event Type

9.2.7 Mexico

9.2.7.1 Mexico Online Event Ticketing Market By Platform

9.2.7.2 Mexico Online Event Ticketing Market By Event Type

9.3 Europe

9.3.1 Trend Analysis

9.3.2 Eastern Europe

9.3.2.1 Eastern Europe Online Event Ticketing Market by Country

9.3.2.2 Eastern Europe Online Event Ticketing Market By Platform

9.3.2.3 Eastern Europe Online Event Ticketing Market By Event Type

9.3.2.4 Poland

9.3.2.4.1 Poland Online Event Ticketing Market By Platform

9.3.2.4.2 Poland Online Event Ticketing Market By Event Type

9.3.2.5 Romania

9.3.2.5.1 Romania Online Event Ticketing Market By Platform

9.3.2.5.2 Romania Online Event Ticketing Market By Event Type

9.3.2.6 Hungary

9.3.2.6.1 Hungary Online Event Ticketing Market By Platform

9.3.2.6.2 Hungary Online Event Ticketing Market By Event Type

9.3.2.7 Turkey

9.3.2.7.1 Turkey Online Event Ticketing Market By Platform

9.3.2.7.2 Turkey Online Event Ticketing Market By Event Type

9.3.2.8 Rest of Eastern Europe

9.3.2.8.1 Rest of Eastern Europe Online Event Ticketing Market By Platform

9.3.2.8.2 Rest of Eastern Europe Online Event Ticketing Market By Event Type

9.3.3 Western Europe

9.3.3.1 Western Europe Online Event Ticketing Market by Country

9.3.3.2 Western Europe Online Event Ticketing Market By Platform

9.3.3.3 Western Europe Online Event Ticketing Market By Event Type

9.3.3.4 Germany

9.3.3.4.1 Germany Online Event Ticketing Market By Platform

9.3.3.4.2 Germany Online Event Ticketing Market By Event Type

9.3.3.5 France

9.3.3.5.1 France Online Event Ticketing Market By Platform

9.3.3.5.2 France Online Event Ticketing Market By Event Type

9.3.3.6 UK

9.3.3.6.1 UK Online Event Ticketing Market By Platform

9.3.3.6.2 UK Online Event Ticketing Market By Event Type

9.3.3.7 Italy

9.3.3.7.1 Italy Online Event Ticketing Market By Platform

9.3.3.7.2 Italy Online Event Ticketing Market By Event Type

9.3.3.8 Spain

9.3.3.8.1 Spain Online Event Ticketing Market By Platform

9.3.3.8.2 Spain Online Event Ticketing Market By Event Type

9.3.3.9 Netherlands

9.3.3.9.1 Netherlands Online Event Ticketing Market By Platform

9.3.3.9.2 Netherlands Online Event Ticketing Market By Event Type

9.3.3.10 Switzerland

9.3.3.10.1 Switzerland Online Event Ticketing Market By Platform

9.3.3.10.2 Switzerland Online Event Ticketing Market By Event Type

9.3.3.11 Austria

9.3.3.11.1 Austria Online Event Ticketing Market By Platform

9.3.3.11.2 Austria Online Event Ticketing Market By Event Type

9.3.3.12 Rest of Western Europe

9.3.3.12.1 Rest of Western Europe Online Event Ticketing Market By Platform

9.3.2.12.2 Rest of Western Europe Online Event Ticketing Market By Event Type

9.4 Asia-Pacific

9.4.1 Trend Analysis

9.4.2 Asia Pacific Online Event Ticketing Market by Country

9.4.3 Asia Pacific Online Event Ticketing Market By Platform

9.4.4 Asia Pacific Online Event Ticketing Market By Event Type

9.4.5 China

9.4.5.1 China Online Event Ticketing Market By Platform

9.4.5.2 China Online Event Ticketing Market By Event Type

9.4.6 India

9.4.6.1 India Online Event Ticketing Market By Platform

9.4.6.2 India Online Event Ticketing Market By Event Type

9.4.7 Japan

9.4.7.1 Japan Online Event Ticketing Market By Platform

9.4.7.2 Japan Online Event Ticketing Market By Event Type

9.4.8 South Korea

9.4.8.1 South Korea Online Event Ticketing Market By Platform

9.4.8.2 South Korea Online Event Ticketing Market By Event Type

9.4.9 Vietnam

9.4.9.1 Vietnam Online Event Ticketing Market By Platform

9.4.9.2 Vietnam Online Event Ticketing Market By Event Type

9.4.10 Singapore

9.4.10.1 Singapore Online Event Ticketing Market By Platform

9.4.10.2 Singapore Online Event Ticketing Market By Event Type

9.4.11 Australia

9.4.11.1 Australia Online Event Ticketing Market By Platform

9.4.11.2 Australia Online Event Ticketing Market By Event Type

9.4.12 Rest of Asia-Pacific

9.4.12.1 Rest of Asia-Pacific Online Event Ticketing Market By Platform

9.4.12.2 Rest of Asia-Pacific Online Event Ticketing Market By Event Type

9.5 Middle East & Africa

9.5.1 Trend Analysis

9.5.2 Middle East

9.5.2.1 Middle East Online Event Ticketing Market by Country

9.5.2.2 Middle East Online Event Ticketing Market By Platform

9.5.2.3 Middle East Online Event Ticketing Market By Event Type

9.5.2.4 UAE

9.5.2.4.1 UAE Online Event Ticketing Market By Platform

9.5.2.4.2 UAE Online Event Ticketing Market By Event Type

9.5.2.5 Egypt

9.5.2.5.1 Egypt Online Event Ticketing Market By Platform

9.5.2.5.2 Egypt Online Event Ticketing Market By Event Type

9.5.2.6 Saudi Arabia

9.5.2.6.1 Saudi Arabia Online Event Ticketing Market By Platform

9.5.2.6.2 Saudi Arabia Online Event Ticketing Market By Event Type

9.5.2.7 Qatar

9.5.2.7.1 Qatar Online Event Ticketing Market By Platform

9.5.2.7.2 Qatar Online Event Ticketing Market By Event Type

9.5.2.8 Rest of Middle East

9.5.2.8.1 Rest of Middle East Online Event Ticketing Market By Platform

9.5.2.8.2 Rest of Middle East Online Event Ticketing Market By Event Type

9.5.3 Africa

9.5.3.1 Africa Online Event Ticketing Market by Country

9.5.3.2 Africa Online Event Ticketing Market By Platform

9.5.3.3 Africa Online Event Ticketing Market By Event Type

9.5.2.4 Nigeria

9.5.2.4.1 Nigeria Online Event Ticketing Market By Platform

9.5.2.4.2 Nigeria Online Event Ticketing Market By Event Type

9.5.2.5 South Africa

9.5.2.5.1 South Africa Online Event Ticketing Market By Platform

9.5.2.5.2 South Africa Online Event Ticketing Market By Event Type

9.5.2.6 Rest of Africa

9.5.2.6.1 Rest of Africa Online Event Ticketing Market By Platform

9.5.2.6.2 Rest of Africa Online Event Ticketing Market By Event Type

9.6 Latin America

9.6.1 Trend Analysis

9.6.2 Latin America Online Event Ticketing Market by Country

9.6.3 Latin America Online Event Ticketing Market By Platform

9.6.4 Latin America Online Event Ticketing Market By Event Type

9.6.5 Brazil

9.6.5.1 Brazil Online Event Ticketing Market By Platform

9.6.5.2 Brazil Online Event Ticketing Market By Event Type

9.6.6 Argentina

9.6.6.1 Argentina Online Event Ticketing Market By Platform

9.6.6.2 Argentina Online Event Ticketing Market By Event Type

9.6.7 Colombia

9.6.7.1 Colombia Online Event Ticketing Market By Platform

9.6.7.2 Colombia Online Event Ticketing Market By Event Type

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Online Event Ticketing Market By Platform

9.6.8.2 Rest of Latin America Online Event Ticketing Market By Event Type

10. Company Profiles

10.1 Carnival Cinemas

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 The SNS View

10.2 AOL Inc. (Yahoo)

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 The SNS View

10.3 PVR LTD.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 The SNS View

10.4 Tickets Please

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 The SNS View

10.5 Bigtree

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 The SNS View

10.6 Ticketmaster

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 The SNS View

10.7 StubHub

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 The SNS View

10.8 Cinemark Holdings, Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 The SNS View

10.9 KyaZoonga, Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 The SNS View

10.10 EasyMovies

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 The SNS View

11. Competitive Landscape

11.1 Competitive Benchmarking

11.2 Market Share Analysis

11.3 Recent Developments

11.3.1 Industry News

11.3.2 Company News

11.3.3 Mergers & Acquisitions

12. USE Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Platform

Desktop

Mobile

By Event Type

Sports

Music

Movies

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

Cloud Data Warehouse Market was valued at USD 6.71 billion in 2023 and is expected to reach USD 43.57 billion by 2032, growing at a CAGR of 23.18% from 2024-2032.

The Vector Database Market was valued at USD 1.6 Billion in 2023 and is expected to reach USD 10.6 Billion by 2032, growing at a CAGR of 23.54% by 2032.

The Ransomware Protection Market was valued at USD 25.59 billion in 2023 and is expected to reach USD 91.80 billion by 2032, growing at a CAGR of 15.29% by 2032.

Data Annotation Tools Market was valued at USD 1.6 billion in 2023, is expected to reach USD 11.8 billion by 2032, growing at a CAGR of 24.40% over 2024-2032.

The Aquaponics Market was valued at USD 1.5 Billion in 2023 and is expected to reach USD 4.7 Billion by 2032, growing at a CAGR of 13.83% by 2032.

The Web Content Management Market Size was valued at USD 8.13 Billion in 2023 and will reach USD 28.76 Billion by 2032 and grow at a CAGR of 15.1% by 2032.

Hi! Click one of our member below to chat on Phone