Oncology Drugs Market Size & Report Overview:

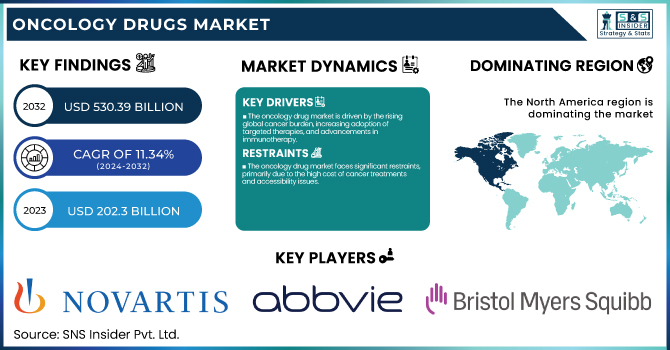

The global Oncology Drugs Market size was USD 202.3 billion in 2023, is projected to reach USD 530.39 billion by 2032, growing at an 11.34% CAGR over the forecast period 2024-2032.

This report indicates the increasing incidence and prevalence of cancer, leading to greater demand for oncology therapies and impacting prescription patterns in different regions. The research focuses on R&D spending in drug development, with a focus on the importance of innovation in targeted therapies and immuno-oncology. It also discusses patient access and treatment compliance trends, which are affected by drug price, healthcare policies, and changing market access approaches. The report also analyzes oncology drug pricing dynamics and their impact on market development. In addition, it offers a snapshot of healthcare expenditure on oncology medicines, examining government, commercial, private, and out-of-pocket spend contributions in various regions.

Get More Information on Oncology Drugs Market - Request Sample Report

Oncology Drugs Market Dynamics

Drivers

-

The oncology drug market is driven by the rising global cancer burden, increasing adoption of targeted therapies, and advancements in immunotherapy.

Cancer, according to the World Health Organization (WHO), is a leading cause of death globally, and in 2023 it claimed about 10 million lives. This increasing trend has triggered interest in successful therapies, especially precision medicine. Therapies such as tyrosine kinase inhibitors (TKIs) and monoclonal antibodies have transformed the treatment of cancer by enhancing outcomes for patients while minimizing toxicity. Immunotherapy, such as PD-1/PD-L1 inhibitors Keytruda (Merck) and Opdivo (Bristol-Myers Squibb), has picked up considerable momentum because of its capacity to offer long-term remission. Government funding and initiatives towards cancer research have also accelerated drug development. The U.S. National Cancer Institute (NCI) invested USD 7.3 billion in cancer research in 2023, speeding up the approval of new therapies. The advent of combination therapies, which combine chemotherapy with targeted or immune-based therapies, has further increased efficacy. Additionally, growing awareness, early detection, and individualized treatment strategies have resulted in improved survival rates, thus driving market growth. The growing pipeline of new drugs, with more than 1,200 oncology drugs under clinical trials, guarantees ongoing developments in the space, further propelling demand for effective cancer therapies.

Restraints

-

The oncology drug market faces significant restraints, primarily due to the high cost of cancer treatments and accessibility issues.

The cost of immunotherapy on average can range more than USD 150,000 annually, making it not an affordable option for most patients, especially in middle- and low-income countries. The patent protection of bestseller drugs also inhibits generic entry, thus sustaining high prices. Additionally, high regulatory approvals increase the time spent to bring new treatments to market. The process of U.S. FDA approval for oncology medicines can extend for many years, involving costly clinical trials and post-marketing surveillance. Another difficulty is the serious adverse effects that occur with chemotherapy and targeted treatments, such as immune-related adverse events, that may require discontinuation of therapy. The complexity of combination therapies also raises safety concerns, effectiveness, and reimbursement policies.

Opportunities

-

The expansion of precision medicine, AI-driven drug discovery, and increased R&D investments.

Personalized treatment strategies, through genetic profiling and biomarker discovery, have improved the efficacy of drugs and reduced side effects. Companion diagnostics, including Roche's FoundationOne CDx, are growing in prominence to facilitate the choice of targeted therapies, thereby boosting treatment rates. Artificial intelligence and machine learning are transforming drug development, expediting clinical trials, and cutting down on costs. Firms such as IBM Watson and BenevolentAI are using AI to discover new drug targets and refine treatment approaches. Moreover, with the development of cell and gene therapies, like CAR-T therapies Kymriah (Novartis) and Yescarta (Gilead), new opportunities are arising to treat hematological cancers. Growing collaborations between pharmaceutical entities and biotech organizations are promoting innovation, resulting in faster drug approvals. Additionally, the growing uptake of biosimilars, fueled by cost savings and patent losses of leading biologics, will further boost affordability and accessibility. Government support for cancer research, along with increased patient awareness and screening initiatives, will further drive market growth opportunities. The ongoing emphasis on the development of next-generation cancer therapies, including RNA-based therapies and tumor-infiltrating lymphocyte (TIL) therapies, will fuel future growth.

Challenges

-

One of the biggest challenges in the oncology drug market is drug resistance, which limits treatment effectiveness and increases the need for alternative therapies.

Most cancers eventually become resistant to targeted medications over time, and treatment must be changed repeatedly. For example, patients with non-small cell lung cancer (NSCLC) who are treated with EGFR inhibitors such as Tarceva (Erlotinib) develop resistance within one year. This obstacle can only be overcome through ongoing research in combination therapies and new drug mechanisms. The second significant challenge is the high oncology drug development failure rate, with almost 95% of cancer drugs being rejected in clinical trials because of efficacy or safety issues. Cancer biology is so complex that it is hard to create treatments that are universally effective. Moreover, manufacturing issues related to biologics and cell therapies, like the stability of live-cell therapies, complicate large-scale production and affordability. Regulatory barriers continue to be a major challenge since gaining market approval for new therapies is a function of having detailed data on long-term efficacy and safety. Ethical issues of genetically modified cell therapies and limited diversity in clinical trials, in which most studies are not represented by diverse ethnic populations, complicate market expansion. Overcoming these challenges necessitates ongoing innovation, better trial designs, and increased regulatory support to get new oncology drugs to market effectively.

Oncology Drugs Market Segmentation Analysis

By Drug Class

The targeted drugs segment dominated the oncology drugs market in the world in 2023, representing more than 48.9% of the market. This segment's dominance is due to the growing use of precision medicine, enhanced effectiveness, and lower side effects in comparison to chemotherapy. The capability of targeted drugs to target specifically cancer cells while leaving normal cells intact has facilitated their extensive usage.

By Therapy

The targeted therapy segment dominated the market in 2023 with over 46.7% of the overall share. The segment dominates because it has high specificity to target cancer cells, minimize toxicity, and enhance patient outcomes. Progress in molecular diagnostics and the identification of biomarkers have also driven the use of targeted therapy.

At the same time, the immunotherapy market is expected to be the fastest-growing over the forecast period. The growing use of immune checkpoint inhibitors, monoclonal antibodies, and CAR-T cell therapies has driven its fast growth. The fact that immunotherapy is capable of bringing long-term remission and lowering relapse rates is a primary driver of its high growth.

By Indication

The others category, comprising unusual and virulent cancers, comprised more than 30.5% of the market in 2023. The elevated prevalence of numerous cancer types and the emergence of new therapies aided the segment in achieving its highest share.

The breast cancer segment is projected to expand at the highest rate as a result of the rising incidence of breast cancer worldwide, enhanced awareness, and the improvement in personalized medicine. The greater availability of targeted drugs and hormone therapies specifically designed for breast cancer has also fueled its expansion.

By Dosage Form

The injectables segment maintained the top market position in 2023 with more than 56.7% market share, mainly because of the growing use of biologics and targeted cancer therapies. Injectable cancer drugs such as monoclonal antibodies and immune checkpoint inhibitors are sought after for their greater bioavailability and effectiveness against different forms of cancers.

The solid dosage form category, including tablets and capsules, is anticipated to post moderate growth. The ease of oral administration, along with continuous research into oral formulations for targeted therapies, is fueling its market presence.

By Distribution Channel

The hospital pharmacies segment led the market in 2023 with over 64.5% of the overall share. The rise in the number of hospital admissions for cancer treatment and the presence of specialized oncology medicines in hospital pharmacies helped it gain a strong hold.

The online pharmacies segment is expected to grow at the fastest rate based on the growth of digital healthcare services. Improved accessibility, cancer medication discounts, and growing e-commerce platform penetration have fueled the growth of online pharmacies in the oncology drugs market.

Oncology Drugs Market Regional Insights

North America led the market in 2023 with a share of more than 49.7%, attributed mainly to the concentration of major pharmaceutical firms, robust research infrastructure, and increased healthcare spending. The U.S. is an important contributor, with institutions such as the National Cancer Institute (NCI) spending USD 7.3 billion on cancer research. Moreover, the extensive use of targeted therapy and immunotherapy, such as checkpoint inhibitors like Keytruda and Opdivo, has driven market growth.

Europe was the second-largest market share, with support coming from positive reimbursement policies, robust clinical research, and growing cancer screening programs. Germany, the U.K., and France lead in oncology drug approvals. On the other hand, Asia-Pacific is projected to be the fastest-growing market, with a growing cancer burden, health infrastructure, and increasing investment in biosimilars. China and India are seeing a boom in clinical trials and local drug manufacturing.

Get More Information on Oncology Drugs Market - Enquiry Now

Key Players in Oncology Drugs Market

-

F. Hoffmann-La Roche Ltd. – Avastin, Herceptin, Tecentriq, Perjeta, Kadcyla, Alecensa, Rozlytrek

-

AbbVie Inc. – Venclexta, Imbruvica, Empliciti

-

Novartis AG – Kymriah, Kisqali, Tabrecta, Scemblix, Jakavi, Tafinlar, Mekinist

-

Pfizer Inc. – Ibrance, Lorbrena, Talzenna, Inlyta, Xtandi, Besponsa, Daurismo

-

Bristol Myers Squibb Company – Opdivo, Yervoy, Revlimid, Pomalyst, Breyanzi, Abecma, Reblozyl

-

GlaxoSmithKline plc. – Zejula, Jemperli, Blenrep

-

Eli Lilly and Company – Verzenio, Cyramza, Retevmo, Jaypirca

-

AstraZeneca – Tagrisso, Imfinzi, Lynparza, Enhertu, Calquence

-

Sanofi – Sarclisa, Libtayo, Jevtana

-

Bayer AG – Stivarga, Nubeqa, Xofigo, Vitrakvi

-

Merck & Co., Inc. – Keytruda, Welireg, Tepmetko

Recent Developments

-

In March 2025, Jazz Pharmaceuticals announced the acquisition of Chimerix for USD 935 million, securing rights to the brain cancer drug candidate dordaviprone. With the FDA decision expected by August 18 for its use in recurrent H3 K27M-mutant diffuse glioma, Jazz aims for a swift return on investment if approved.

-

In March 2025, Pfizer’s breast cancer drug, Vepdegestrant, showed mixed results in a key trial. While it did not significantly delay cancer progression for all patients, it achieved its targets in a subset with a specific genetic mutation.

| Report Attributes | Details |

| Market Size in 2023 | USD 202.30 billion |

| Market Size by 2032 | USD 530.39 billion |

| CAGR | CAGR of 11.34% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class [Cytotoxic Drugs, Targeted Drugs, Hormonal Drugs, Others] • By Therapy [Chemotherapy, Targeted Therapy, Immunotherapy] • By Indication [Lung Cancer, Stomach Cancer, Colorectal Cancer, Breast Cancer, Prostate Cancer, Others] • By Dosage Form [Solid, Liquid, Injectable] • By Distribution Channel [Hospital Pharmacies, Retail Pharmacies, Online Pharmacies] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | F. Hoffmann-La Roche Ltd., AbbVie Inc., Novartis AG, Pfizer Inc., Bristol Myers Squibb Company, GlaxoSmithKline plc., Eli Lilly and Company, AstraZeneca, Sanofi, Bayer AG, Merck & Co., Inc. |