Oilfield Services Market Report Scope & Overview:

Get More Information on Oilfield Services Market - Request Sample Report

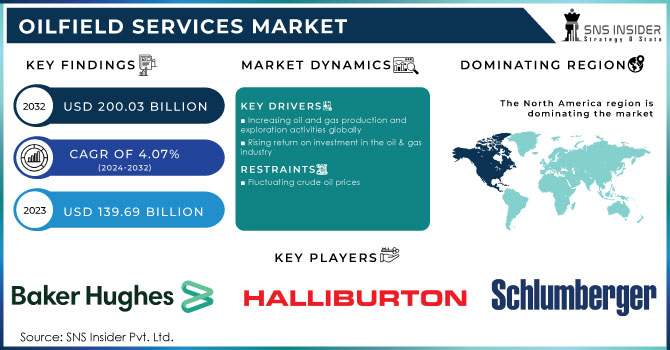

The Oilfield Services Market size was valued at USD 139.69 billion in 2023 and is expected to grow to USD 200.03 billion by 2032 and grow at a CAGR of 4.07% over the forecast period of 2024-2032.

Oilfield services refer to the various activities and operations that are involved in the exploration, drilling, production, and maintenance of oil and gas wells. These services are essential for the smooth functioning of the oil and gas industry, and they include a wide range of activities such as drilling, well completion, well testing, well intervention, and well maintenance.

The oilfield services industry is highly specialized and requires a skilled workforce with expertise in various areas such as geology, engineering, and technology. The services provided by this industry are critical to the success of oil and gas companies, as they help to maximize production and minimize downtime.

In recent years, the oilfield services industry has undergone significant changes due to the increasing demand for energy and the development of new technologies. As a result, companies in this industry are constantly innovating and adapting to meet the evolving needs of their clients.

Impact of COVID-19

During the Covid-19 pandemic demand for the oil & gas industry was reduced drastically. To prevent the spread of the virus government imposed a strict lockdown and restrictions on traveling and transportation which hampered the consumption of fuel. Due to this overall oil demand is reduced across the world. The oilfield activities such as drilling, completion & workover, exploration, processing & separation were suspended due to a shortage of labor. To avoid further contamination government had quarantined the people which restricted the gathering of people and ultimately reduced the demand for global oilfield services.

Market Dynamics

Drivers

-

Increasing oil and gas production and exploration activities globally

-

Increasing shale gas extraction

-

Rising return on investment in the oil & gas industry

-

Rising demand for energy

-

Technological advancement in oilfields

Shale gas refers to the natural gas that is found in the deposits of shale. Shale gas is used for electricity generation and domestic cooling and heating purpose. The abundant shale gas sources which are easily available and the reduced natural gas prices increase the shale gas extraction activities which drive the growth of the oilfield service market globally. Rapidly rising oil and gas exploration activities and shifting preference for using renewable energy resources are the key factors that drive the market growth of oilfield services.

Restrain

-

Fluctuating crude oil prices

The constant fluctuation in crude oil and natural gas prices hamper the oilfield service market globally. Continuously fluctuating raw material prices can directly impact the oilfield service market.

Opportunities

-

Rapidly rising investment in the oil and gas industry

Challenges

-

Stringent government regulations for approval

-

Rising environmental concern regarding the E&P activities

Impact of Russia-Ukraine War:

The ongoing conflict between Russia and Ukraine has had a significant impact on the oilfield services market. The instability in the region has caused a decrease in oil production, which has led to a decrease in demand for oilfield services. This has resulted in a decline in revenue for companies operating in the oilfield services market. Furthermore, the sanctions imposed on Russia by the international community have also had an impact on the oilfield services market. Many companies that operate in Russia have been forced to halt their operations due to the sanctions, which have further decreased the demand for oilfield services.

Impact of Recession

The oilfield services market has been significantly affected by the recent recession. The downturn in the global economy has led to a decrease in demand for oil and gas, resulting in a decline in exploration and production activities. This has had a direct impact on the oilfield services market, which provides support services to the oil and gas industry.

The recession has caused a reduction in capital spending by oil and gas companies, leading to a decrease in demand for oilfield services. This has resulted in a decrease in revenue for companies operating in this market. In addition, the recession has led to a decrease in the price of oil, which has further impacted the profitability of oilfield services companies.

Key Market Segmentation

On the basis of Type, the Oilfield Services Market is further segmented into Equipment rental, Field operation, and Analytical & consulting services.

On the basis of the Services, the Oilfield Services Market is classified into Workover & Completion services, Production, Drilling Services, Subsea Services, Seismic Services, Processing & Separation Services, and others

On the basis of the Application, the Oilfield Services Market is further bifurcated into Onshore and Offshore.

By Type

-

Equipment rental

-

Field operation

-

Analytical & consulting services

By Services

-

Workover & Completion services

-

Production

-

Drilling Services

-

Subsea Services

-

Seismic Services

-

Processing & Separation Services

-

Others

By Application

-

Onshore

-

Offshore

Regional Analysis

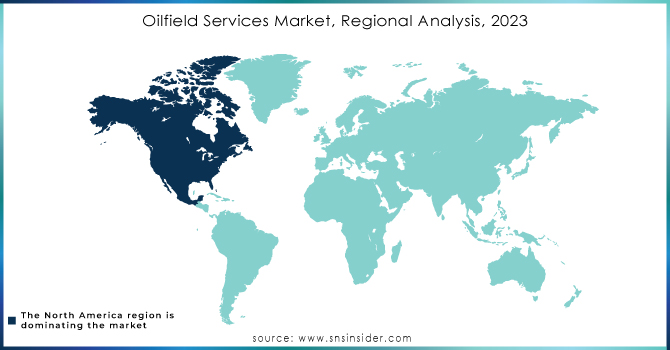

North America region dominated the market with the highest revenue share in 2021 and is expected to show significant growth during the predicted period. This growth trend is especially driven by the presence of key players like Schlumberger in the country USA. Schlumberger designed and developed advanced tools for flow control, well integrity, well intervention, and well drilling. This developed technology by market players has helped the USA to grow in the oilfield service market. The presence of abundant sources of shale gas and the high production and consumption capacity of oil and gas propels the growth of the oilfield service market significantly.

After the North America region Asia-Pacific region is expected to show lucrative growth between 2023-2030. China is the country that has the highest number of shale gas reserves. To fulfill the ever-growing demand for energy from this country government of China has decided to shift its focus to shale gas production which requires oilfield services. Therefore, key market players are interested in investing in China for oilfield services as well as shale gas extraction services. Rapidly growing population, increasing urbanization along with high disposable income in the countries like China and India will drive the market for oilfield services in the future.

Need any customization research on Oilfield Services Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Baker Hughes Company, Halliburton, Schlumberger Limited, Weatherford, Superior Energy Services, NOV Inc., China Oilfield Services Limited, Archer Oilfield Engineers, Expro Group, TechnipFMC plc, General Electric, Trican, Welltec A/S, Basic Energy Corporation, Nabors Industries Ltd, Pioneer Natural Resources Company, Edgo and Other Players

| Report Attributes | Details |

| Market Size in 2023 | USD 139.69 Bn |

| Market Size by 2032 | USD 200.03 Bn |

| CAGR | CAGR of 4.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Equipment rental, Field operation, and Analytical & consulting services) • By Services (Workover & Completion service, Production, Drilling Services, Subsea Services, Seismic Services, Processing & Separation Services, and others) • By Application (Onshore and Offshore) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Baker Hughes Company, Halliburton, Schlumberger Limited, Weatherford, Superior Energy Services, NOV Inc., China Oilfield Services Limited, Archer Oilfield Engineers, Expro Group, TechnipFMC plc, General Electric, Trican, Welltec A/S, Basic Energy Corporation, Nabors Industries Ltd, Pioneer Natural Resources Company, Edgo. |

| Key Drivers | • Increasing oil and gas production and exploration activities globally • Increasing shale gas extraction |

| Market Opportunities | • Rapidly rising investment in the oil and gas industry |