The Oil & Gas Fabrication Market was valued at USD 5.29 Billion in 2023 and is projected to reach USD 8.23 Billion by 2032, growing at a compound annual growth rate (CAGR) of 5.10% from 2024 to 2032.

Oil and gas fabrication is a crucial process in the energy industry. It involves the construction and assembly of equipment and structures used in the exploration, production, and transportation of oil and gas. This includes drilling rigs, pipelines, storage tanks, and refineries. To ensure the safety and efficiency of these structures, oil and gas fabrication requires a high level of expertise and precision.

To Get More Information on Oil & Gas Fabrication Market - Request Sample Report

Metal fabrication is a crucial component of the oil and gas industry. This process involves the construction of products by combining standardized parts through one or more independent processes, such as bending, cutting, and assembling. Steel production, for instance, relies heavily on these processes. Metal fabrication companies supply all types of equipment used by the oil and gas industries. The fabrication technique offers numerous benefits, including maximum speed efficiency, high safety standards, and cost efficiency. Quality standards are also upheld, ensuring that the final product meets the necessary requirements.

In addition to technical expertise, oil, and gas fabrication also requires a deep understanding of industry regulations and standards. Fabricators must adhere to strict safety guidelines and environmental regulations to ensure that their products meet the highest standards of quality and reliability.

Drivers

Increasing investment in manufacturing activities

Rapidly rising the oil and gas production and exploration activities

Increasing demand for fabrication solutions

Rising need for advanced technologies in the oil and gas industry

The increasing demand for fabrication solutions has led to a surge in the need for fabricated metal parts in two critical areas of oil and gas extraction: at the well sites and within the transportation pipeline. Additionally, the rapidly increasing production of oil and gas, coupled with the rise in fabrication activities, is a significant driving force behind the oil and gas fabrication market. The market for oil and gas fabrication is also driven by the increasing production of oil and gas. As the demand for these resources continues to grow, so does the need for fabrication solutions that can keep up with the pace of production. This has led to a rise in fabrication activities, which in turn has created a significant demand for fabricated metal parts.

Restrain

Increasing adoption of renewable energy sources

Shifting consumer focus to reduce the harmful effects of greenhouse gases

Opportunities

Increasing demand and consumption of oil and gas

Challenges

Strict regulations are imposed by the government to curb the carbon footprint.

Implementation of strict government regulations aimed at reducing carbon emissions is a significant challenge for the oil and gas fabrication market. These regulations will require companies in the industry to adopt new technologies and processes to minimize their environmental impact. This presents an opportunity for companies to invest in research and development to create innovative solutions that meet the new standards while also improving efficiency and profitability. It is crucial for businesses in the oil and gas fabrication market to prioritize sustainability and take proactive steps to reduce their carbon footprint.

Due to the Covid-19 pandemic oil and gas fabrication market has been affected globally. The global health crisis has caused a decline in demand for oil and gas products, resulting in a decrease in production and revenue for companies in the industry. Furthermore, the pandemic has disrupted supply chains and caused delays in project timelines, leading to additional costs and reduced efficiency. Many companies have had to implement cost-cutting measures and reduce their workforce to stay afloat during these challenging times.

The Russia-Ukraine war affected the oil and gas fabrication market significantly. This has been due to the disruption of supply chains, the imposition of sanctions, and the overall instability in the region. The oil and gas fabrication market is a crucial component of the energy industry, providing essential equipment and services for the exploration, production, and transportation of oil and gas. The market includes a wide range of products, such as drilling rigs, pipelines, storage tanks, and refineries.

The Russia-Ukraine war has disrupted the supply chains for many of these products, causing delays and increased costs. This has been particularly evident in the pipeline sector, where many projects have been put on hold or canceled due to the political and economic uncertainty in the region. All of these factors affected the oil and gas fabrication market considerably.

Impact of Recession:

The ongoing recession has had a significant impact on the oil and gas fabrication market. The downturn in the global economy has led to a decrease in demand for oil and gas products, resulting in a decline in the fabrication market. This has had a profound impact on the industry, with many companies struggling to stay afloat. One of the main effects of the recession on the oil and gas fabrication market has been a decrease in investment. With many companies facing financial difficulties, they have been forced to cut back on their spending. This has led to a reduction in the number of new projects being undertaken, which has had a knock-on effect on the fabrication market.

By Type

Downstream

Midstream

Upstream

By Application

Structural Steel Fabrication

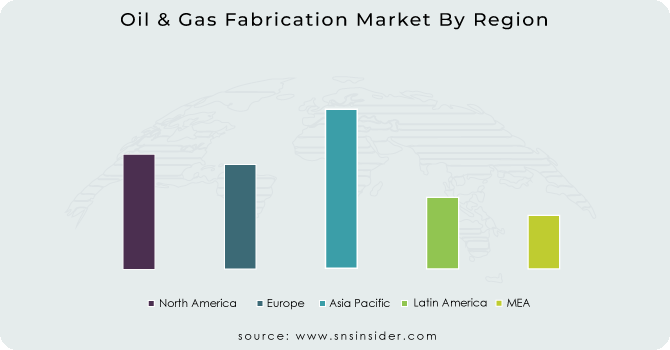

Process Equipment Fabrication

The Asia Pacific region accounted for the region to have the highest revenue share in the oil and gas fabrication market. This trend is expected to continue during the predicted period, owing to the rising demand for fuel in the region. Countries such as India, China, and Japan are the major consumers of oil and gas products, which further fuels the market for oil and gas fabrication in this region. This growth is also attributed to the presence of the largest oil and gas reserves across the globe.

The North America region is also expected to show significant growth during the forecast period. This growth is attributed to the rapidly increasing production of oil and gas. Exploration of new oilfields and reserves also helps to drive the oil and gas fabrication market.

Overall, the oil and gas fabrication market is expected to witness robust growth in the coming years, driven by the increasing demand for energy and the exploration of new oil and gas reserves. If the world continues to rely on fossil fuels for its energy needs, then the oil and gas fabrication market will play a critical role in meeting the increasing demand for energy.

Do You Need any Customization Research on Oil & Gas Fabrication Market - Enquire Now

REGIONAL COVERAGE:

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

south Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of the Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

The major players are Gulf Piping Company (IMCC Group), Newpark Resources Inc., Joulon, Derrick Services (UK) Limited (DSL), STI Group, Northern Weldarc LTD., Chantier Davie Canada Inc., Larsen & Toubro Limited, Lamprell plc, NPCC, Drydocks World, Eversendai, and Lefebvre Engineering FZC.

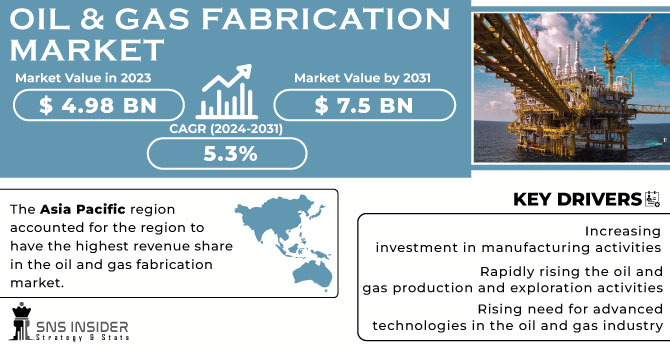

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.98 Bn |

| Market Size by 2031 | US$ 7.5 Bn |

| CAGR | CAGR of 5.3 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Downstream, Midstream, and Upstream) • By Application (Structural Steel Fabrication and Process Equipment Fabrication) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Gulf Piping Company (IMCC Group), Newpark Resources Inc., Joulon, Derrick Services (UK) Limited (DSL), STI Group, Northern Weldarc LTD., Chantier Davie Canada Inc., Larsen & Toubro Limited, Lamprell plc, NPCC, Drydocks World, Eversendai, and Lefebvre Engineering FZC. |

| Key Drivers | • Increasing investment in manufacturing activities • Rapidly rising the oil and gas production and exploration activities |

| Market Opportunities | • Increasing demand and consumption of oil and gas |

The Oil & Gas Fabrication Market recorded a value of USD 4.98 billion in 2023.

The expected CAGR of the global Oil & Gas Fabrication Market during the forecast period is 5.3 %

The major competitors of the Oil & Gas Fabrication Market are Gulf Piping Company (IMCC Group), Newpark Resources Inc., Joulon (Derrick Services (UK) Limited (DSL)), STI Group, Northern Weldarc LTD., Chantier Davie Canada Inc., Larsen & Toubro Limited, Lamprell plc, NPCC, Drydocks World, Eversendai, and Lefebvre Engineering FZC.

Asia Pacific region is likely to lead the Oil & Gas Fabrication Market during the forecast period.

Increasing investment in manufacturing activities, rapidly rising oil and gas production and exploration activities, increasing demand for fabrication solutions, and rising need for advanced technologies in the oil and gas industry are the driving factors of the oil & gas fabrication market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine- Russia War

4.3 Impact of Ongoing Recession

4.3.1 Introduction

4.3.2 Impact on major economies

4.3.2.1 US

4.3.2.2 Canada

4.3.2.3 Germany

4.3.2.4 France

4.3.2.5 United Kingdom

4.3.2.6 China

4.3.2.7 Japan

4.3.2.8 South Korea

4.3.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Oil & Gas Fabrication Market Segmentation, By Type

8.1 Downstream

8.2 Midstream

8.3 Upstream

9. Oil & Gas Fabrication Market Segmentation, By Application

9.1 Structural Steel Fabrication

9.2 Process Equipment Fabrication

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 North America Oil & Gas Fabrication Market by Country

10.2.2North America Oil & Gas Fabrication Market by Type

10.2.3 North America Oil & Gas Fabrication Market by Application

10.2.4 USA

10.2.4.1 USA Oil & Gas Fabrication Market by Type

10.2.4.2 USA Oil & Gas Fabrication Market by Application

10.2.5 Canada

10.2.5.1 Canada Oil & Gas Fabrication Market by Type

10.2.5.2 Canada Oil & Gas Fabrication Market by Application

10.2.6 Mexico

10.2.6.1 Mexico Oil & Gas Fabrication Market by Type

10.2.6.2 Mexico Oil & Gas Fabrication Market by Application

10.3 Europe

10.3.1 Europe Oil & Gas Fabrication Market by Country

1.3.3.2 Europe Oil & Gas Fabrication Market by Type

10.3.3 Europe Oil & Gas Fabrication Market by Application

10.3.4 Germany

10.3.4.1 Germany Oil & Gas Fabrication Market by Type

10.3.4.2 Germany Oil & Gas Fabrication Market by Application

10.3.5 UK

10.3.5.1 UK Oil & Gas Fabrication Market by Type

10.3.5.2 UK Oil & Gas Fabrication Market by Application

10.3.6 France

10.3.6.1 France Oil & Gas Fabrication Market by Type

10.3.6.2 France Oil & Gas Fabrication Market by Application

10.3.7 Italy

10.3.7.1 Italy Oil & Gas Fabrication Market by Type

10.3.7.2 Italy Oil & Gas Fabrication Market by Application

10.3.8 Spain

10.3.8.1 Spain Oil & Gas Fabrication Market by Type

10.3.8.2 Spain Oil & Gas Fabrication Market by Application

10.3.9 The Netherlands

10.3.9.1 Netherlands Oil & Gas Fabrication Market by Type

10.3.9.2 Netherlands Oil & Gas Fabrication Market by Application

10.3.10 Rest of Europe

10.3.10.1 Rest of Europe Oil & Gas Fabrication Market by Type

10.3.10.2 Rest of Europe Oil & Gas Fabrication Market by Application

10.4 Asia-Pacific

10.4.1 Asia Pacific Oil & Gas Fabrication Market by Country

10.4.2Asia Pacific Oil & Gas Fabrication Market by Type

10.4.3 Asia Pacific Oil & Gas Fabrication Market by Application

10.4.4 Japan

10.4.4.1 Japan Oil & Gas Fabrication Market by Type

10.4.4. 2Japan Oil & Gas Fabrication Market by Application

10.4.5. South Korea

10.4.5.1 South Korea Oil & Gas Fabrication Market by Type

10.4.5.2. South Korea Oil & Gas Fabrication Market by Application

10.4.6 China

10.4.6.1 China Oil & Gas Fabrication Market by Type

10.4.6.2. China Oil & Gas Fabrication Market by Application

10.4.7 India

10.4.7.1 India Oil & Gas Fabrication Market by Type

10.4.7.2. India Oil & Gas Fabrication Market by Application

10.4.8 Australia

10.4.8.1 Australia Oil & Gas Fabrication Market by Type

10.4.8.2. Australia Oil & Gas Fabrication Market by Application

10.4.9 Rest of Asia-Pacific

10.4.9.1 APAC Oil & Gas Fabrication Market by Type

10.4.9.2. APAC Oil & Gas Fabrication Market by Application

10.5 The Middle East & Africa

10.5.1 The Middle East & Africa Oil & Gas Fabrication Market by Country

10.5.2 The Middle East & Africa Oil & Gas Fabrication Market by Type

10.5.3The Middle East & Africa Oil & Gas Fabrication Market by Application

10.5.4 Israel

10.5.7.1 Israel Oil & Gas Fabrication Market by Type

10.5.7.2 Israel Oil & Gas Fabrication Market by Application

10.5.5 UAE

10.5.5.1 UAE Oil & Gas Fabrication Market by Type

10.5.5.2 UAE Oil & Gas Fabrication Market by Application

10.5.6South Africa

10.5.6.1 South Africa Oil & Gas Fabrication Market by Type

10.5.6.2 South Africa Oil & Gas Fabrication Market by Application

10.5.7 Rest of Middle East & Africa

10.5.7.1 Rest of Middle East & Asia Oil & Gas Fabrication Market by Type

10.5.7.2 Rest of Middle East & Asia Oil & Gas Fabrication Market by Application

10.6 Latin America

10.6.1. Latin America Oil & Gas Fabrication Market by Country

10.6.2. Latin America Oil & Gas Fabrication Market by Type

10.6.3 Latin America Oil & Gas Fabrication Market by Application

10.6.4 Brazil

10.6.4.1 Brazil Oil & Gas Fabrication Market by Type

10.6.4.2 Brazil Oil & Gas Fabrication Market by Application

10.6.5Argentina

10.6.5.1 Argentina Oil & Gas Fabrication Market by Type

10.6.5.2 Argentina Oil & Gas Fabrication Market by Application

10.6.6Rest of Latin America

10.6.6.1 Rest of Latin America Oil & Gas Fabrication Market by Type

10.6.6.2 Rest of Latin America Oil & Gas Fabrication Market by Application

11. Company Profile

11.1 Gulf Piping Company (IMCC Group)

11.1.1 Market Overview

11.1.2 Financials

11.1.3 Product/Services/Offerings

11.1.4 SWOT Analysis

11.1.5 The SNS View

11.2 Newpark Resources Inc.

11.2.1 Market Overview

11.2.2 Financials

11.2.3 Product/Services/Offerings

11.2.4 SWOT Analysis

11.2.5 The SNS View

11.3 Joulon

11.3.1 Market Overview

11.3.2 Financials

11.3.3 Product/Services/Offerings

11.3.4 SWOT Analysis

11.3.5 The SNS View

11.4 STI Group

11.4.1 Market Overview

11.4.2 Financials

11.4.3 Product/Services/Offerings

11.4.4 SWOT Analysis

11.4.5 The SNS View

11.5 Northern Weldarc LTD.

11.5.1 Market Overview

11.5.2 Financials

11.5.3 Product/Services/Offerings

11.5.4 SWOT Analysis

11.5.5 The SNS View

11.6 Chantier Davie Canada Inc.

11.6.1 Market Overview

11.6.2 Financials

11.6.3 Product/Services/Offerings

11.6.4 SWOT Analysis

11.6.5 The SNS View

11.7 Larsen & Toubro Limited

11.7.1 Market Overview

11.7.2 Financials

11.7.3 Product/Services/Offerings

11.7.4 SWOT Analysis

11.7.5 The SNS View

11.8 Lamprell plc

11.8.1 Market Overview

11.8.2 Financials

11.8.3 Product/Services/Offerings

11.8.4 SWOT Analysis

11.8.5 The SNS View

11.9 NPCC

11.9.1 Market Overview

11.9.2 Financials

11.9.3 Product/Services/Offerings

11.9.4 SWOT Analysis

11.9.5 The SNS View

11.10 Drydocks World

11.10.1 Market Overview

11.10.2 Financials

11.10.3 Product/Services/Offerings

11.10.4 SWOT Analysis

11.10.5 The SNS View

11.11 Eversendai

11.11.1 Market Overview

11.11.2 Financials

11.11.3 Product/Services/Offerings

11.11.4 SWOT Analysis

11.11.5 The SNS View

11.12 Lefebvre Engineering FZC

11.12.1 Market Overview

11.12.2 Financials

11.12.3 Product/Services/Offerings

11.12.4 SWOT Analysis

11.12.5 The SNS View

11.13 Derrick Services (UK) Limited (DSL)

11.13.1 Market Overview

11.13.2 Financials

11.13.3 Product/Services/Offerings

11.13.4 SWOT Analysis

11.13.5 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

13. USE Cases And Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Circuit Breaker Market was valued at USD 17.03 billion in 2023 and is expected to reach USD 31.68 billion by 2032, growing at a CAGR of 7.28% from 2024-2032.

The Hydrogen Storage Tanks and Transportation Market size was valued at USD 0.2 Billion in 2023 and is expected to grow to USD 6.0 Billion by 2031 with an emerging CAGR of 53% over the forecast period of 2024-2031.

The Power Transformer Market size was USD 22.96 billion in 2023 and is expected to grow to USD 44.80 billion by 2032 & grow at a CAGR of 7.71% by 2024-2032.

The Virtual Pipeline Market size was valued at USD 1.26 billion in 2023 and is expected to grow to USD 2.02 billion by 2032 and grow at a CAGR of 5.4% over the forecast period of 2024-2032.

The Remote Power Panel Market size was valued at USD 1.10 billion in 2023 and is expected to grow to USD 1.65 billion by 2031 with a growing CAGR of 5.2 % over the forecast period of 2024-2031.

The Bio-LNG Market size was valued at USD 0.627 billion in 2022 and is expected to grow to USD 13.30 billion by 2030 and grow at a CAGR of 46.5 % over the forecast period of 2023-2030.

Hi! Click one of our member below to chat on Phone