Off-Road Motorcycle Market Size & Overview:

Get More Information on Off-Road Motorcycle Market - Request Sample Report

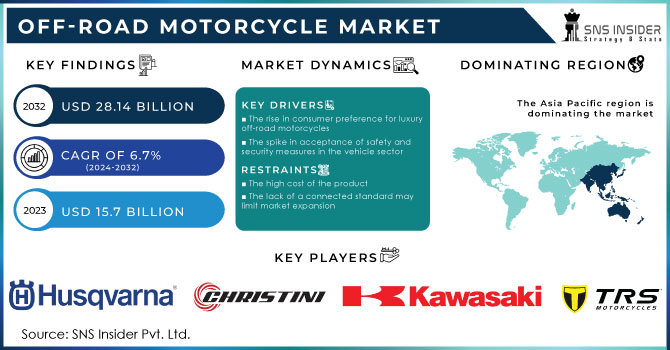

The Off-Road Motorcycle Market Size was valued at USD 15.7 billion in 2023 and is expected to reach USD 28.14 billion by 2032, growing at a CAGR of 6.7% over the forecast period 2024-2032

The worldwide off-road motorbike market is expanding rapidly and will continue to do so in the coming years. Off-road motorcycles are built for difficult terrain and unpaved roads. Off-road riders favor off-road motorcycles because of qualities such as energy efficiency, comfort, and maneuverability. Off-road bikes are primarily utilized for a variety of purposes, including military patrolling and off-road bike racing. This motorbike is ideal for mountainous places because of the high torque engine, which allows the motorcycle to climb steep slopes. Furthermore, it has an appealing shape that attracts youth and aids in changing their preferences. Automobile sector advancements pave the way for enhanced and safer off-road motorcycles in terms of comfort, suspension, and safety.

Off-road motorcycles are non-road licensed motorcycles that are used for off-road riding or for recreational purposes. They may be driven on any type of all-terrain road, including trail routes. They are the best prepared in terms of racing, tournaments, and adventure. Off-road bikes are becoming increasingly popular among riders and bike enthusiasts as recreational vehicles. In comparison to on-road bikes, the machines feature more torque and ground clearance.

MARKET DYNAMICS:

KEY DRIVERS:

-

The rise in consumer preference for luxury off-road motorcycles

-

The spike in acceptance of safety and security measures in the vehicle sector

-

The rising popularity of off-road motorbike racing among the younger generation

RESTRAINTS:

-

The high cost of the product

-

The lack of a connected standard may limit market expansion

-

An unpleasant sitting configuration

OPPORTUNITIES:

-

Investments in automation

-

Introduction of new and technologically advanced goods

-

Rising consumer demand for high speed, appealing design, and digital dashboards

-

Government attempts to produce cars for mountainous locations all present new opportunities in the business

CHALLENGES:

-

The biggest issue for the Off-road Motorcycle Market is projected to be intense competition

-

Fluctuating prices

-

Altering OEM preferences

IMPACT OF COVID-19:

As off-road and adventure motorcycles were being offered from showrooms, the COVID-19 had a zero-sum impact on the market. The features and benefits of these motorcycles, as well as increased interest in adventure racing, have aided market expansion. Lockdown measures that are loosened can enhance sales momentum and relieve market stress. The end-use industry is severely impacted by the global economic crisis caused by the lockdown. Because researchers must remain at home during the lockdown, automotive technology research and development will be hampered. Due to job losses and people returning home, there will be a decrease in inwardly connected vehicles.

Market, By Type:

The market is divided into six categories based on the kind of type: Dirt Bikes, Trial Bikes, Enduro Bikes, Adventure bikes, Kids Motorbikes, and Others. These motorcycles have tough tires and suspensions for cross-country riding or traveling on uneven terrain.

Market, By Application:

The market is divided into applications, which are further divided into Defense, and Recreational. The recreational sector of the Off-Road Motorcycles market is estimated to account for the greatest market share. Consumers who want to use their motorcycles for off-road enjoyment on country roads and in places with minimum construction criteria can use off-road motorcycles for recreational reasons.

Market, by Distributional Channel

The market is separated into two types of Distributional Channels: OEM, and Aftermarket. In 2023, the OEM ruled the global off-road motorbike market. An original equipment manufacturer (OEM) develops systems or components for use in another company's final product. OEM elements, such as processors and software, are frequently included or integrated into the solutions sold by computer manufacturers.

MARKET SEGMENTATION:

By Type:

-

Dirt Bikes

-

Trial Bikes

-

Enduro Bikes

-

Adventure bikes

-

Kids Motorbikes

-

Others

By Application:

-

Defense

-

Recreational

By Distribution Channel:

-

OEM

-

Aftermarket

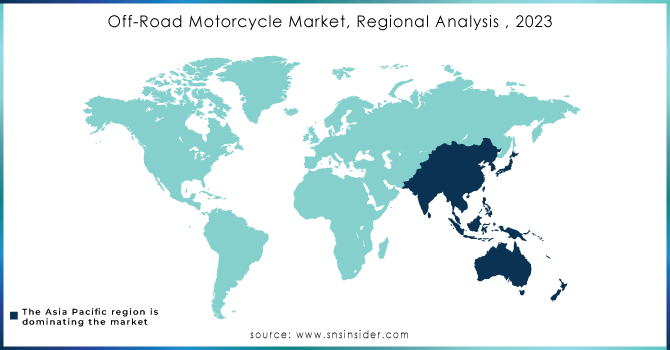

REGIONAL ANALYSIS:

Due to a large population interested in adventure tours and a love of biking, APAC is likely to lead the worldwide industry. The market may benefit from a shift in demand from speed to features. Customers may be attracted by motorcycle manufacturers' investments and the creation of completely knocked down (CKD) facilities. Showrooms promoting the latest models, as well as competitions designed to generate interest, can help the off-road motorbike business. Due to a significant number of motocross events and customer interest in recreational activities, North America is expected to increase at a rapid pace throughout the projection period. Engines, powertrains, brakes, and combustion technologies that are more capable can entice customers to showrooms.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

-

North America

-

The USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS:

Husqvarna Motorcycles GmbH, TRS Motorcycles, Chritini Technologies, Kawasaki Heavy Industries Ltd., Suzuki Motors, Ural Motorcycles, KTM AG, BMW Group, ROKON International Inc., Benelli QJSrl, Ducati Motor Holding Spa, Alta Motors, Honda Motor Co. Ltd., Piaggio & C Spa, Triumph Motorcycles Ltd., Yamaha Motor Co. Ltd., ROKON, Torrot, Betamotor, Suzuki Motor Corp, Sherco, and Kuberg (Czech Republic) are some of the major players in the industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 15.7 Billion |

| Market Size by 2032 | US$ 28.14 Billion |

| CAGR | CAGR of 6.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Dirt Bikes, Trial Bikes, Enduro Bikes, Adventure bikes, Kids Motorbikes, Others), by Application (Defense, Recreational) • by Distribution Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Husqvarna Motorcycles GmbH, TRS Motorcycles, Chritini Technologies, Kawasaki Heavy Industries Ltd., Suzuki Motors, Ural Motorcycles, KTM AG, BMW Group, ROKON International Inc., Benelli QJSrl, Ducati Motor Holding Spa, Alta Motors, Honda Motor Co. Ltd., Piaggio & C Spa, Triumph Motorcycles Ltd., Yamaha Motor Co. Ltd., ROKON, Torrot, Betamotor, Suzuki Motor Corp, Sherco, and Kuberg (Czech Republic) |

| Key Drivers | •The rise in consumer preference for luxury off-road motorcycles. •The spike in acceptance of safety and security measures in the vehicle sector. |

| RESTRAINTS | •The high cost of the product. •The lack of a connected standard may limit market expansion. •An unpleasant sitting configuration. |