Off-highway Vehicle Lighting Market Size & Overview

Get More Information on Off-highway Vehicle Lighting Market - Request Sample Report

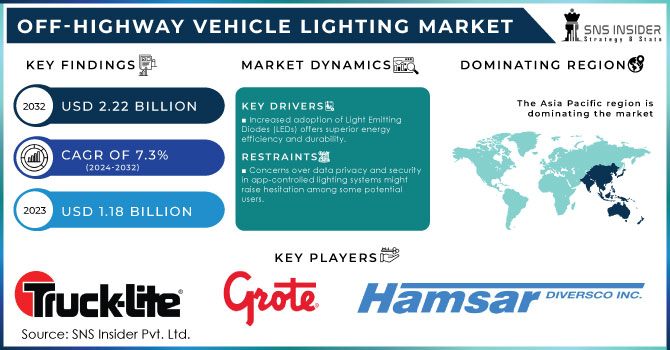

The Off-highway Vehicle Lighting Market Size was valued at USD 1.18 billion in 2023 and is expected to reach USD 2.22 billion by 2032 and grow at a CAGR of 7.3% over the forecast period 2024-2032. The ever-increasing demand for construction and mining equipment globally necessitates proper lighting solutions for safe and efficient operations, especially during low-light conditions. The stringent government regulations regarding vehicle lighting and workplace safety further push the adoption of advanced lighting systems. Advancements in the market are evident in the growing popularity of Light Emitting Diodes (LEDs) as a dominant light source. LEDs offer significant advantages over traditional halogen bulbs. They boast superior energy efficiency, leading to lower power consumption and reduced fuel costs for vehicles.

The LEDs provide unparalleled durability with a longer lifespan, translating to lower maintenance needs. A prime example is the "intelliLight" system by Tyri, a wirelessly connected lighting solution for heavy vehicles, controlled through a mobile app, showcasing the integration of smart technology with lighting. The initial cost of LED lighting systems can be higher compared to traditional options, although this gap is narrowing as LED production costs decrease. The complexity of integrating advanced lighting systems into existing off-highway vehicles can pose a challenge, especially for older models.

Off-Highway Vehicle Lighting Market Dynamics:

Key Drivers:

-

Increased adoption of Light Emitting Diodes (LEDs) offers superior energy efficiency and durability.

-

Integration of smart technology with lighting, like app-controlled systems, enhances functionality and user experience.

The Off-highway Vehicle Lighting Market is witnessing a revolution with the integration of smart technology. This means traditional light switches are being replaced by app-controlled systems on your smartphone or tablet. This innovation significantly improves how operators interact with their vehicle's lighting. App control allows for better visibility in challenging conditions like fog or dust. It can also enable features like strobing lights for increased safety awareness. These smart systems can be programmed for specific tasks. This not only streamlines operations but empowers operators with greater control over their workspace. Ultimately, this integration of smart technology with lighting creates a more efficient and user-friendly experience for those working with off-highway vehicles.

Restraints:

-

Concerns over data privacy and security in app-controlled lighting systems might raise hesitation among some potential users.

-

Limited availability of skilled technicians for installation and maintenance of advanced lighting systems can create hurdles.

The advanced LED lighting offers undeniable benefits but its complexity requires technicians with specialized knowledge and training. This can be a hurdle for wider adoption, particularly in remote areas or for older fleets that may not have access to a readily available pool of qualified personnel. Troubleshooting and repairs for these advanced systems necessitate a deeper understanding of not just electrical components but also potential software integration. Without a readily available workforce possessing these skills, some operators may be hesitant to invest in these innovative lighting solutions, potentially hindering the overall growth of the Off-highway Vehicle Lighting Market. Addressing this gap through targeted training programs and certifications for technicians can ensure a smoother path for integrating these advanced lighting systems and maximizing their benefits.

Opportunities:

-

Integration of internet-of-things (IoT) technology with lighting systems can enable real-time monitoring, remote diagnostics, and predictive maintenance.

-

Growing focus on night-time operations in construction and mining opens doors for innovative lighting solutions that enhance visibility and safety during off-peak hours.

Challenges:

-

Limited availability of skilled technicians hinders installation and maintenance of advanced systems.

Off-highway Vehicle Lighting Market Segments:

By Product

-

LED

-

Halogen

-

HID

-

Incandescent

LEDs are the dominating sub-segment in the Off-highway Vehicle Lighting Market by product holding around 65-70% of market share. The LEDs offer significant advantages that have driven their rise to the top. LEDs boast superior energy efficiency, translating to lower power consumption and reduced fuel costs for vehicles. This is a major factor for cost-conscious operators in the construction and agriculture sectors. Additionally, LEDs provide unparalleled durability with a longer lifespan compared to halogen bulbs. This translates to lower maintenance needs and reduced downtime for off-highway vehicles, a critical factor for maximizing productivity. While the upfront cost of LED systems can be slightly higher, the long-term savings on energy and maintenance solidify their dominance in the Off-highway Vehicle Lighting Market.

By Application

- Head Lamp

- Tail Lamp

- Work Light

- Others

Work Light is the dominating sub-segment in the Off-highway Vehicle Lighting Market by application holding around 45-50% of market share. Off-highway vehicles often operate in low-light or harsh weather conditions, and work lights provide essential illumination for the work area. This is particularly crucial for construction projects that may extend into nighttime hours or for agricultural equipment operating in pre-dawn or dusk settings. The ability of work lights to cast a wide and powerful beam ensures operators have optimal visibility to perform their tasks safely and efficiently. Advancements in LED technology have further enhanced the dominance of work lights, offering even more powerful and energy-efficient options for off-highway vehicles.

By End-Use

-

Construction

-

Agriculture/Farming/Forestry

Construction is the dominating sub-segment in the Off-highway Vehicle Lighting Market by end-use. The ever-increasing demand for construction projects necessitates the use of a wide range of off-highway vehicles, from excavators and loaders to cranes and dump trucks. These vehicles rely heavily on proper lighting systems to ensure safe and efficient operation during various stages of construction, especially in low-light conditions. Stringent safety regulations on construction sites further emphasize the need for high-quality lighting, propelling the demand for advanced lighting solutions in the construction sector. As the construction industry continues to expand globally, the Off-highway Vehicle Lighting Market for construction applications is poised for continued growth.

By Vehicle Type

-

Excavator

-

Loader

-

Crane

-

Dump Truck

-

Tractor

-

Other

Excavators are the dominating sub-segment in the Off-highway Vehicle Lighting Market by vehicle type. This is due to the versatility and extensive range of motion of excavators, requiring exceptional illumination across various work zones. Excavator operators need clear visibility not only for digging and trenching but also for loading and moving in tight spaces. Work lights, headlights, and even auxiliary lighting play a crucial role in ensuring excavator operations are conducted safely and productively. The growing demand for excavators in construction, demolition, and landscaping projects further cements their position as the leading vehicle type driving growth in the Off-highway Vehicle Lighting Market.

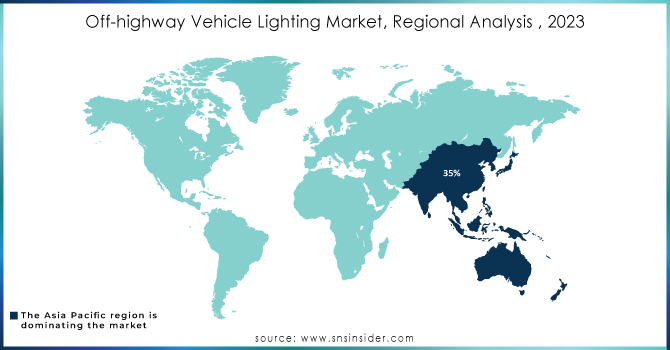

Off-highway Vehicle Lighting Market Regional Analyses

The Asia Pacific is the dominating region in the Off-highway Vehicle Lighting Market, capturing over 35% of market share. The region is experiencing a significant rise in infrastructure development and mining activities, particularly in countries like China and India. This surge in construction and mining projects necessitates a vast fleet of off-highway vehicles, all requiring proper lighting systems.

North America holds the second-highest position in the Off-highway Vehicle Lighting Market. This region boasts a well-developed construction sector and a strong presence of leading off-highway vehicle manufacturers. The supportive government policies promoting energy efficiency and safety regulations mandating advanced lighting systems contribute to market growth.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Off-highway Vehicle Lighting Market Companies

The major key players are Truck-Lite; Grote Industries; ECCO Safety Group; APS Lighting and Safety, Hamsar Diversco Inc.; WESEM; HELLA GmbH & Co. KGaA; J.W. Speaker Corporation, ABL Lights Group; Peterson Manufacturing Co. and other key players.

Off-highway Vehicle Lighting Market Recent Development

-

In Sept. 2022: Marelli has bolstered its innovation capabilities by opening a new Technical R&D Center in Bangalore, India. This center will focus on key areas like electronics, automotive lighting, and technologies for both traditional and electric vehicle engines.

-

In April 2022: WESEM introduces the CRP2 work lamp, a powerful alternative to halogen lamps. This innovative light boasts a Combo beam, combining wide and focused light patterns for optimal illumination around and in front of vehicles.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.18 Billion |

| Market Size by 2032 | US$ 2.22 Billion |

| CAGR | CAGR of 7.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• by Product (LED, HID, Incandescent, Halogen) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Truck-Lite; Grote Industries; ECCO Safety Group; APS Lighting and Safety, Hamsar Diversco Inc.; WESEM; HELLA GmbH & Co. KGaA; J.W. Speaker Corporation, ABL Lights Group; Peterson Manufacturing Co. |

| Key Drivers | • Increase in demand for mining trucks as a result of increased spending on mining activities. • The rapid rate of urbanization around the world is driving the demand for off-highway vehicles. |

| RESTRAINTS | • The high cost of LED lights is a major restraint. • A specific power supply is needed. |