Get E-PDF Sample Report on Octyl Alcohol Market - Request Sample Report

The Octyl Alcohol Market Size was valued at USD 6.6 Billion in 2023 and is expected to reach USD 8.4 Billion by 2032 and grow at a CAGR of 2.7% over the forecast period 2024-2032.

The octyl alcohol market has experienced steady growth due to its versatile applications across multiple industries. It finds extensive use in the production of plasticizers, Industrial lubricants, flavors & fragrances, and pharmaceuticals. The increasing demand for these products, coupled with the expanding chemical industry, has propelled the growth of the octyl alcohol market.

One of the major trends in the octyl alcohol market is the increasing demand for bio-based octyl alcohol. With growing environmental concerns and the need for sustainable solutions, the market is witnessing a shift towards bio-based alternatives. This trend is expected to drive the growth of the octyl alcohol market in the coming years. Another significant trend is the rising demand for octyl alcohol in the pharmaceutical industry. Octyl alcohol is widely used as an intermediate in the production of pharmaceuticals, including drugs, ointments, and creams.

The expanding pharmaceutical sector, coupled with the increasing prevalence of chronic diseases, is expected to fuel the demand for octyl alcohol in the coming years. As of 2021, Europe has imposed strict regulatory standards through the Medical Devices Regulation (MDR) developed by European Union that requires coatings protecting, specifically for use with medical devices to be biocompatible and long-lasting. Similar kinds of regulatory changes and growing usage of coated device in minimally invasive surgeries in turn fuel Octyl Alcohol market.

Chemical intermediates are the fastest growing segment in the Octyl Alcohol Market as it finds extensive application in manufacturing plasticizers, lubricants, and coatings which are essential for automotive, construction, and packaging sectors. The chemicals are in big demand as industrialization and urbanization of countries like China and India race ahead. In 2023, for example, the construction sector is reported to have grown by 5.5% according to the National Bureau of Statistics of China in response, coatings and lubricants saw increased use.

Moreover, the Ministry of Commerce and Industry (MCI) in India touts 10% annual gains for the nation's automotive industry, a large consumer of plasticizers and lubricants. This is a driving growth aspect for octyl alcohol market as increase in the octyl alcohol supply and consumption has been observed to cater requirements of these two industries which are combining to propel the overall CAGR of octyl alcohol.

The advent of technological innovations in the chemical synthesis and production techniques is playing a pivotal role in improving octyl alcohol yield on as well as aiding in scalability thereby fostering the market expansion. Catalytic processes and the use of biotechnological methods have boosted yields and reduced energy input into manufacturing. In the process, these innovations help producers in meeting this increasing demand more sustainably and help them lower their production costs.

Market Dynamics

Drivers

Rising awareness among consumers regarding personal grooming and hygiene drive the market growth.

Growing awareness among consumers about personal grooming and hygiene is the prominent factor influencing the demand for Octyl Alcohol, especially in personal care and cosmetics. The rise in disposable incomes, urbanization, and changing lifestyle patterns have prompted more individuals to purchase skincare, haircare or hygiene products. Particularly pronounced is this trend among emerging nations in the Asia-Pacific and Latin American areas. This generated an increase in consumer spending on personal grooming goods due to a 4.8% rise in the per capita income of middle-income countries, according to the World Bank.

Augmenting the market growth is the increasing interest to health and wellness that has surged demand for skin care products with safe and efficacious ingredients such as octyl alcohol, used in emollients, surfactants and moisturizers. In 2023, Advanced Polymer Coatings developed a new range of anti-corrosive and biocompatible coatings for use in orthopedic implants. These coatings are designed to increase the longevity and safety of implants, particularly in joint replacements, which are in high demand due to the rising incidence of osteoporosis and arthritis.

Moreover, in 2023, BASF SE introduced bio-based octyl alcohol as part of its initiative to meet the growing demand for sustainable personal care ingredients, enhancing its portfolio for cosmetics and skincare markets.

These developments, alongside government statistics, such as the Indian Ministry of Chemicals and Fertilizers projecting an around 12% growth in the country’s cosmetics and personal care industry in 2023, underscore the increasing role of octyl alcohol in meeting consumer demands for grooming and hygiene products.

Restrain

Availability of substitutes such as decyl alcohol and cetyl alcohol hamper the market growth.

Octyl alcohol, a versatile chemical compound, finds extensive applications in various industries. However, the presence of substitutes like decyl alcohol and cetyl alcohol limits the growth potential of the octyl alcohol market. These alternative compounds possess similar properties and functionalities, making them viable options for many applications. The availability of substitutes creates a competitive environment within the market, as customers have more choices to meet their specific needs. This increased competition can lead to a decrease in demand for octyl alcohol, as customers may opt for readily available substitutes instead. Furthermore, the availability of substitutes can also impact the pricing dynamics of the octyl alcohol market. With multiple options to choose from, customers can negotiate better deals and potentially drive down the prices of octyl alcohol. This can further hinder the market's growth and profitability.

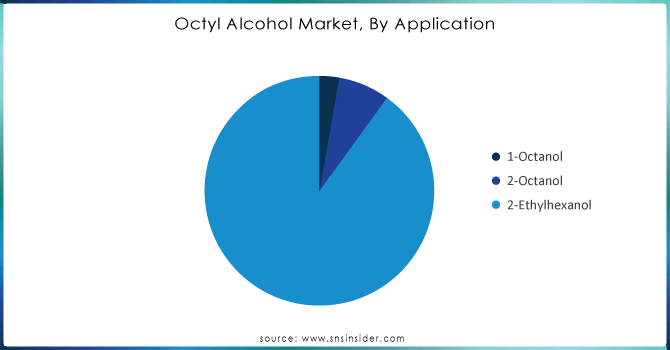

By Application

The 2-Ethylhexanol segment dominated the octyl alcohol market with a revenue share of more than 90% in 2023. This growth is due to its extensive use in various industries. It serves as a crucial component in the production of plasticized PVC for automobiles, acts as a solvent for surface coatings and inks, acts as a precursor for manufacturing plasticizers like dioctyl phthalate (DOP), and serves as a raw material for producing acrylate esters, which are essential in the manufacturing of emulsion paints and surface coatings.

Within the 2-Ethylhexanol segment, plasticizers accounted for the largest sub-segment in terms of revenue, comprising approximately 56% of the market share. This surge in demand is attributed to the increasing need for flexible and durable plastics across a wide range of industries, including automotive, construction, and packaging. Plasticizers play a vital role in enhancing the flexibility, durability, and processability of polymers. Moreover, the rising concerns regarding health and the environment have led to a growing demand for bio-based and non-phthalate plasticizers, further fueling the demand for plasticizers.

Get Customized Report as per your Business Requirement - Request For Customized Report

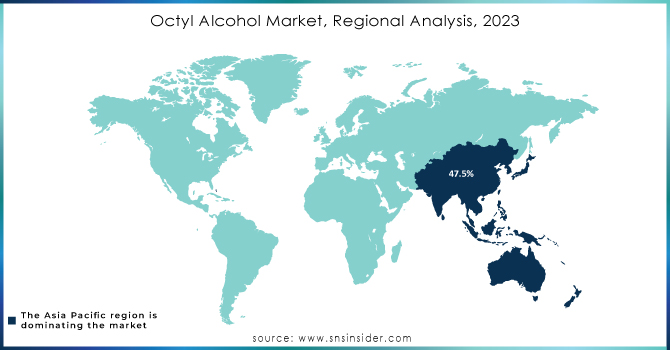

Asia Pacific dominated the Octyl Alcohol Market with the highest revenue share of about 47.5% in 2023. This remarkable growth is attributed to the rapid advancements witnessed in the cosmetics, cleaning chemicals, and pharmaceutical industries within the region. Notably, China's beauty and personal care industry experienced a significant surge in sales, reaching a staggering USD 70 billion in 2023. The remarkable progress of end-use industries in China, India, and Japan is expected to fuel the demand for octyl alcohol throughout the forecast period. India, in particular, has witnessed a surge in demand for cosmetics and personal care products, driven by increasing consumer awareness, urbanization, and evolving lifestyles. Meanwhile, Japan stands as a significant contributor to the market within the region, boasting a well-established cosmetics industry renowned for its innovation and high-quality offerings. The demand for octyl alcohol in Japan is primarily driven by the need for ingredients used in cosmetics and personal care products.

The rapid growth of these sectors in Asia Pacific has consequently driven the demand for octyl alcohol, leading to its market dominance. The rising disposable incomes and changing lifestyles of the region's population have resulted in an increased demand for personal care and cosmetic products. Octyl alcohol, with its properties as an emollient and solvent, is widely used in the formulation of skincare and haircare products. The growing consumer preference for such products has significantly contributed to the region's dominance in the octyl alcohol market.

North America is expected to grow with a significant CAGR of about 3.1% in the Octyl Alcohol Market during the forecast period of 2024-2031. The anticipated growth in the North American Octyl Alcohol Market is attributed to the region's robust industrial sector, coupled with the increasing demand for consumer goods, which is expected to drive the market's expansion. As industries continue to flourish, the need for octyl alcohol as a raw material or additive will rise correspondingly. Furthermore, the growing awareness among consumers regarding personal care and hygiene products is contributing to the surge in demand for octyl alcohol-based cosmetics and toiletries. Moreover, the pharmaceutical industry's continuous advancements and the development of innovative drug formulations are fueling the demand for octyl alcohol. Its applications in drug delivery systems, as well as its use as a solvent in pharmaceutical manufacturing processes, are driving its market growth.

Key Players

BASF SE (Isooctanol)

Sasol Limited (Alfol 810)

The Andhra Petrochemicals Limited

Arkema Group (Octyl Acrylate)

KLK OLEO

Axxence Aromatic GmbH

Liaoning Huaxing Group Chemical

Eastman Chemical Company (2-Ethylhexanol)

Dow Chemical Company (Octylphenol)

ExxonMobil Chemical Company (Exxal 8)

LG Chem (Octanol)

Mitsubishi Chemical Corporation (Octyl Acetate)

Evonik Industries AG (C8 Alcohol)

Perstorp Group (2-Ethylhexanoic Acid)

Oxea GmbH (2-Ethylhexanol)

Shandong Longda Chemical Co., Ltd. (N-Octanol)

Penta Manufacturing Company (Octyl Methoxycinnamate)

In Sept 2023, BASF made an exciting announcement regarding the expansion of its bio-based monomers portfolio. They introduced a proprietary process for producing 2-octyl Acrylate (2-OA), showcasing their unwavering dedication to innovation for a sustainable future. This new product boasts an impressive 73% 14C-traceable bio-based content, aligning with the standards set by ISO 16620.

In March 2023, companies like Andhra Petrochemicals Ltd and Bharat Petroleum Corporation Limited raised the prices of 2-ethylhexanol in India. This surge in prices can be attributed to the rising costs of raw materials, as well as the robust demand for the product in the market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.6 Bn |

| Market Size by 2032 | US$ 8.4 Bn |

| CAGR | CAGR of 2.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (1-Octanol, 2-Octanol, and 2-Ethylhexanol) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | SABIC, BASF, Sasol, The Andhra Petrochemicals Limited, Ecogreen Oleochemicals, KLK OLEO, Arkema, Axxence Aromatic GmbH, Liaoning Huaxing Group Chemical, BharatPetroleum |

| Key Drivers | • Growing demand for octyl alcohol from various end-use industries • Rising awareness among consumers regarding personal grooming and hygiene drive the market growth. |

| Market Restraints | • Availability of substitutes such as decyl alcohol and cetyl alcohol hamper the market growth. |

Ans. The Compound Annual Growth rate for the Octyl Alcohol Market over the forecast period is 2.7%.

Ans. The projected market size for the Octyl Alcohol Market is USD 8.4 billion by 2032.

Ans: India will grow with the highest CAGR in the Asia Pacific region.

Ans: The Europe region is expected to grow with a 3.3% CAGR during the forecast period.

Ans: Yes, you can ask for the customization as per your business requirement.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Octyl Alcohol Market Segmentation, By Application

Chapter Overview

7.2 1-Octanol

7.2.1 1-Octanol Market Trends Analysis (2020-2032)

7.2.2 1-Octanol Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Pharmaceutical

7.2.3.1 Pharmaceutical Market Trends Analysis (2020-2032)

7.2.3.2 Pharmaceutical Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Flavors & Fragrances

7.2.4.1 Flavors & Fragrances Market Trends Analysis (2020-2032)

7.2.4.2 Flavors & Fragrances Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Others

7.2.5.1 Others Market Trends Analysis (2020-2032)

7.2.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 2-Octanol

7.3.1 2-Octanol Market Trends Analysis (2020-2032)

7.3.2 2-OctanolMarket Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Agrochemicals

7.3.3.1 Agrochemicals Market Trends Analysis (2020-2032)

7.3.3.2 Agrochemicals Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Flavors & Fragrances

7.3.4.1 Flavors & Fragrances Market Trends Analysis (2020-2032)

7.3.4.2 Flavors & Fragrances Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Resins

7.3.5.1 Resins Market Trends Analysis (2020-2032)

7.3.5.2 Resins Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.6 Others

7.3.6.1 Others Market Trends Analysis (2020-2032)

7.3.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 2-Ethylhexanol

7.4.1 2-Ethylhexanol Market Trends Analysis (2020-2032)

7.4.2 2-Ethylhexanol Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.3 2-EH Nitrate

7.4.3.1 2-EH Nitrate Market Trends Analysis (2020-2032)

7.4.3.2 2-EH Nitrate Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.4 2-EH Acrylate

7.4.4.1 2-EH Acrylate Market Trends Analysis (2020-2032)

7.4.4.2 2-EH Acrylate Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.5 Plasticizers

7.4.5.1 Plasticizers Market Trends Analysis (2020-2032)

7.4.5.2 Plasticizers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.6 Others

7.4.6.1 Others Market Trends Analysis (2020-2032)

7.4.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Regional Analysis

8.1 Chapter Overview

8.2 North America

8.2.1 Trends Analysis

8.2.2 North America Octyl Alcohol Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.2.3 North America Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.2.2 USA

8.2.2.1 USA Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.2.3 Canada

8.2.3.1 Canada Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.2.4 Mexico

8.2.4.1 Mexico Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3 Europe

8.3.1 Eastern Europe

8.3.1.1 Trends Analysis

8.3.1.2 Eastern Europe Octyl Alcohol Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.3.1.3 Eastern Europe Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.4 Poland

8.3.1.4.1 Poland Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.5 Romania

8.3.1.5.1 Romania Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.6 Hungary

10.3.1.8.1 Hungary Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.7 Turkey

8.3.1.7.1 Turkey Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.8 Rest of Eastern Europe

8.3.1.8.1 Rest of Eastern Europe Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2 Western Europe

8.3.2.1 Trends Analysis

8.3.2.2 Western Europe Octyl Alcohol Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.3.2.3 Western Europe Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.4 Germany

8.3.2.4.1 Germany Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.5 France

8.3.2.5.1 France Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.6 UK

8.3.2.6.1 UK Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.7 Italy

8.3.2.7.1 Italy Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.8 Spain

8.3.2.8.1 Spain Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.9 Netherlands

8.3.2.9.1 Netherlands Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.10 Switzerland

8.3.2.10.1 Switzerland Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.11 Austria

8.3.2.11.1 Austria Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.12 Rest of Western Europe

8.3.2.12.1 Rest of Western Europe Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4 Asia-Pacific

8.4.1 Trends Analysis

8.4.2 Asia-Pacific Octyl Alcohol Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.4.3 Asia-Pacific Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.4 China

8.4.4.1 China Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.5 India

8.4.5.1 India Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.6 Japan

8.4.6.1 Japan Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.7 South Korea

8.4.7.1 South Korea Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.8 Vietnam

8.4.8.1 Vietnam Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.9 Singapore

8.4.9.1 Singapore Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.10 Australia

8.4.10.1 Australia Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.11 Rest of Asia-Pacific

8.4.11.1 Rest of Asia-Pacific Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5 Middle East and Africa

8.5.1 Middle East

8.5.1.1 Trends Analysis

8.5.1.2 Middle East Octyl Alcohol Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.4 UAE

8.5.1.4.1 UAE Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.5 Egypt

8.5.1.5.1 Egypt Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.6 Saudi Arabia

8.5.1.6.1 Saudi Arabia Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.7 Qatar

8.5.1.7.1 Qatar Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.8 Rest of Middle East

8.5.1.8.1 Rest of Middle East Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.2 Africa

8.5.2.1 Trends Analysis

8.5.2.2 Africa Octyl Alcohol Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.5.2.3 Africa Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.2.4 South Africa

8.5.2.4.1 South Africa Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.2.5 Nigeria

8.5.2.5.1 Nigeria Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.2.6 Rest of Africa

8.5.2.6.1 Rest of Africa Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6 Latin America

8.6.1 Trends Analysis

8.6.2 Latin America Octyl Alcohol Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.6.3 Latin America Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6.4 Brazil

8.6.4.1 Brazil Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6.5 Argentina

8.6.5.1 Argentina Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6.6 Colombia

8.6.6.1 Colombia Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6.7 Rest of Latin America

8.6.7.1 Rest of Latin America Octyl Alcohol Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9. Company Profiles

9.1 SABIC

9.1.1 Company Overview

9.1.2 Financial

9.1.3 Products/ Services Offered

9.1.4 SWOT Analysis

9.2 BASF

9.2.1 Company Overview

9.2.2 Financial

9.2.3 Products/ Services Offered

9.2.4 SWOT Analysis

9.3 Sasol

9.3.1 Company Overview

9.3.2 Financial

9.3.3 Products/ Services Offered

9.3.4 SWOT Analysis

9.4 The Andhra Petrochemicals Limited

9.4.1 Company Overview

9.4.2 Financial

9.4.3 Products/ Services Offered

9.4.4 SWOT Analysis

9.5 Ecogreen Oleochemicals

9.5.1 Company Overview

9.5.2 Financial

9.5.3 Products/ Services Offered

9.5.4 SWOT Analysis

9.6 KLK OLEO

9.6.1 Company Overview

9.6.2 Financial

9.6.3 Products/ Services Offered

9.6.4 SWOT Analysis

9.7 Arkema

9.7.1 Company Overview

9.7.2 Financial

9.7.3 Products/ Services Offered

9.7.4 SWOT Analysis

9.8 Axxence Aromatic GmbH

9.8.1 Company Overview

9.8.2 Financial

9.8.3 Products/ Services Offered

9.8.4 SWOT Analysis

9.9 Liaoning Huaxing Group Chemical

9.9.1 Company Overview

9.9.2 Financial

9.9.3 Products/ Services Offered

9.9.4 SWOT Analysis

9.10 BharatPetroleum,

9.10.1 Company Overview

9.10.2 Financial

9.10.3 Products/ Services Offered

9.10.4 SWOT Analysis

10. Use Cases and Best Practices

11. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Application

1-Octanol

Pharmaceutical

Flavors & Fragrances

Others

2-Octanol

Agrochemicals

Flavors & Fragrances

Resins

Others

2-Ethylhexanol

2-EH Nitrate

2-EH Acrylate

Plasticizers

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Rheology Modifiers Market size was USD 8.40 billion in 2023 and is expected to reach USD 11.99 billion by 2032 and grow at a CAGR of 4.04% over the forecast period of 2024-2032.

Green Solvents Market size was valued at USD 1.9 Billion in 2023 and is anticipated to touch USD 3.9 Billion by 2032, growing at a CAGR of 8.7% from 2024-2032.

The Recycled PET Market Size was valued at USD 8.9 billion in 2023 and is expected to reach USD 17.2 billion by 2032 and grow at a CAGR of 7.6% over the forecast period 2024-2032.

Ethylene Carbonate Market was valued at USD 393.14 Mn in 2023 and is expected to reach USD 661.55 Mn by 2032, growing at a CAGR of 5.96% from 2024-2032.

The Polyester Staple Fiber market is anticipated to have significant growth from 2024 to 2032, driven by increasing demand from a variety of end-use industries.

The Silicone Fluids Market size was USD 6.04 billion in 2023 and is expected to reach USD 9.16 billion by 2032 and grow at a CAGR of 4.74% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone