To get more information on Occupational Health Market - Request Free Sample Report

The Occupational Health Market size was valued at USD 4.98 billion in 2023 and is expected to reach USD 7.45 billion by 2032, growing at a CAGR of 4.62% over the forecast period of 2024-2032.

The occupational health market is growing rapidly, driven by the increased awareness of workers' health and safety at the workplace and stricter regulations applied to industries such as manufacturing, construction, and oil and gas. The growth of this market is largely fueled by the growing demand for comprehensive occupational health services, including physical wellness programs, mental health support, ergonomic interventions, and workplace safety solutions.

The increasing focus on safety and the requirement of organizations to safeguard the workforce from all environmental risks, physical strains, and psychosomatic stress. For example, manufacturing industries, chemical-based industries, and pharmaceutical sectors continue with the high implementation of health services to meet all the expectations of workplace safety regulations, thus reducing all the dangers related to long exposure to hazardous environment.

Besides traditional services offered at OHS service sites, such as PPE and safety training, there is an increased demand for mental health services and stress management programs. Many companies are now embracing wellness initiatives to ensure that employees do not burn out and are productive at work. The integration of telemedicine solutions and wearable health technology has altered the delivery of occupational health services, where it can be possible for people to go for remote consultations and real-time health monitoring.

Drivers

Increased scrutiny and more strict enforcement in industries with higher risk such as construction, manufacturing, oil, gas, and chemicals give rise to the increased demands for overall occupational health service.

The OSHA, which mandates the existence of programs for health and safety at an organization's workplace is part of government. These are primarily to ensure that risk for the employee is kept to a minimum and is protected against physical injury or exposure to toxic substances. An estimated 2.78 million workers die from occupational accidents and work-related diseases while an additional 374 million workers suffer from non-fatal occupational accidents.

These policies make companies invest in health checks, workplace safety training, PPE, and ergonomic solutions. In addition, with increased fines and legal liability for non-compliance, organizations are adopting occupational health programs to ensure compliance with safety standards and reduce risks associated with workplace accidents, illnesses, and injuries. The sustained implementation of safety standards and increasing penalties for non-compliance will further propel the occupational health market across all industries.

There is an enormous shift in focus towards the mental health of the employees which is becoming an important determinant of employee productivity, engagement, and retention.

Because workplace stress and burnout have emerged as significant issues in many industries, companies are now adding mental health support services to their occupational health programs. Mental health-related problems, including anxiety, depression, and stress, have a direct impact on employees' well-being and contribute to increased absenteeism, reduced work efficiency, and healthcare costs.

Businesses understand that a fit and enthusiastic workforce is healthy only by addressing both their physical health and mental well-being. A lot of firms have nowadays started to adopt the offering of mental health services among their occupational health service through counseling services, stress management workshops, or the availability of psychological support. Increased demand coupled with the ever-increasing influence of mental health issues over the workplace creates business and encourages businesses to promote those services, contributing to its further growth. Moreover, there is improving access to mental health support on account of the use of such technologies as telemedicine, and digital health platforms, mainly for remote workers.

Restraint

High cost of implementing comprehensive occupational health programs.

SMEs are challenged in adopting such services due to financial constraints. The cost of implementing such programs normally involves investment in infrastructure like safety equipment, training, health screenings, and continuing health monitoring systems.

Moreover, businesses usually have to weigh the costs of keeping an employee healthy against other costs in running the business. Taking wellness initiatives, mental health resources, and constant updates of health regulations, for instance, can add up and be very expensive. A business may find that a program like occupational health too costly, especially for firms with low margins of profitability. As such, some companies may take up the alternative of minimalistic, simple compliance measures instead of more encompassing health management solutions.

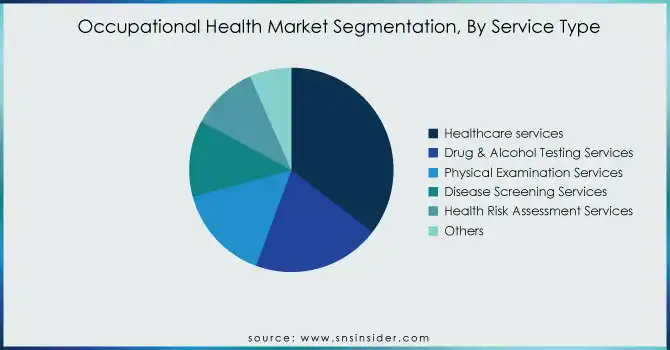

By Service Type

The Healthcare Services segment dominated the market with a market share of 35% IN 2023 due to the imperative demand for preventing diagnosing health needs within the workplace. Some examples include routine health checks, vaccinations, mental health, and wellness programs that keep an entire workforce productive and in good standing with regulatory safety mandates. Healthcare services are frequently included in corporate wellness programs, which have become a priority for businesses across many industries due to the growing recognition of the link between employee health and overall organizational performance. High-risk industries such as manufacturing and construction require regular healthcare assessments, including physical examinations and disease screenings.

This segment is further supplemented by the rising concerns of worker health, especially in regions that have stringent requirements in terms of regulatory requirements, like North America. As firms strive to improve the health conditions of their employees and minimize absenteeism, the demand for healthcare services continues to surge, making this the biggest and most consistent segment of the occupational health market.

By Site Location

The On-Site segment dominated the occupational health market, with a market share of 45% in 2023. On-site health services represent immediate access to medical care, health screenings, and first-aid services that an industry may need in cases involving high-risk environments, like construction, mining, and heavy manufacturing. These services directly reach out in a cost-effective manner regarding employee health issues to ensure worker safety and improve time in travel rather than losing in the process; thus it enhances the involvement of employees in health programs. On-site services are a preferred long-run choice for large enterprises and organizations involved in industries with higher health risk levels wherein the number of people in employment is significant.

The Telehealth services segment is the fastest-growing segment of the market, with demand growing with the advances in digital health technologies. Remote and hybrid work models have created a more urgent need for virtual consultations by industries that have a dispersed workforce. Telehealth is attractive, especially for employees in a remote location or flexible workplaces, because it provides on-the-job medical advice and consultation without requiring them to attend the doctor's office. Indeed, the convenience, cost-effectiveness, and accessibility of telehealth services explain why it is gaining rapid uptake, especially among mid- and large companies that want to offer such comprehensive healthcare options to all workers, regardless of their locality.

By End-User

The large enterprise segment dominated the occupational health market in 2023 and is expected to grow fastest throughout the forecast period. The largest organizations can invest in elaborate occupational health programs that provide on-site services, healthcare assessment, mental health, and preventive care against diseases. This is because such enterprises usually carry a bigger risk factor of injury at workplaces and health risks. In addition, large organizations are more likely to have regulatory requirements that entail occupational health compliance, promoting the need for service adoption.

The large enterprises increasingly focusing on employee well-being to enhance productivity, reduce healthcare expenses, and retain top talent. With a larger workforce, often global, such companies are at the helm of adopting innovative solutions, such as telehealth services and advanced health monitoring tools, to manage and track the health of employees across different regions.

North America dominated the market with a 38% market share in 2023, Occupational Health as regulatory standards in the region, especially in the U.S., are quite stringent. According to OSHA rules, firms are compelled to develop robust health and safety programs at workplaces, resulting in increased usage of occupational health services among manufacturing, construction, and healthcare sectors, among others. Other factors are the region's robust infrastructure for healthcare services, the use of advanced technologies, and high workplace safety awareness. Companies in North America integrate telemedicine, health monitoring tools, and employee wellness programs into their overall worker wellness plans to ensure workforce well-being and compliance with safety standards. As regulatory frameworks become tighter and businesses focus on improving the work environment, North America is likely to continue its leadership in the market.

The Asia Pacific region is growing the fastest in the occupational health market, driven by rapid industrialization and urbanization, particularly in emerging economies such as China, India, and Southeast Asian nations. As these countries continue to industrialize, workplace safety will be a priority, forcing businesses to invest in occupational health programs to meet growing regulatory demands. There is also an increasing interest in employee well-being, including mental health, which businesses are increasingly realizing helps improve productivity and retain talent. Countries like China and India, with massive manufacturing sectors, are witnessing a significant increase in demand for health and safety services. As regulatory frameworks continue to strengthen and the awareness of occupational health is improving, Asia Pacific will be expected to continue its rapid market growth in the coming years, powered by both industrial expansion and increased investment in worker safety.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Concentra, Inc. (Concentra Telemedicine, Occupational Medicine Clinics)

MedExpress Urgent Care (Workplace Injury Treatment, Employer Health Services)

HCA Healthcare (Workplace Wellness Programs, Occupational Health Services)

Sonic Healthcare Limited (Occupational Pathology Services, Pre-employment Health Checks)

Premise Health (Onsite Wellness Centers, Digital Health Solutions)

HealthWorks (Drug and Alcohol Testing, Occupational Medicine Services)

Select Medical Holdings Corporation (WorkStrategies Program, Outpatient Rehabilitation)

Proactive Occupational Medicine (Fitness-for-Duty Exams, Occupational Injury Care)

Centura Health Corporation (Employee Wellness Screenings, Injury Prevention Programs)

Aspen Medical (Occupational Health Clinics, Workplace Vaccination Programs)

WorkCare, Inc. (Incident Intervention, Employee Health Evaluations)

U.S. HealthWorks (Workplace Injury Care, Pre-Employment Screenings)

Bupa Occupational Health (Health Assessments, Mental Health Support)

Maxicare Healthcare Corporation (Pre-Employment Medical Exams, Health and Safety Training)

Fresenius Medical Care (Occupational Dialysis Programs, Workplace Health Monitoring)

Nova Medical Centers (Occupational Medicine Clinics, DOT Examinations)

Healius Limited (Workplace Pathology Services, Occupational Health Consultations)

AXA PPP Healthcare (Workplace Wellbeing Solutions, Occupational Health Assessments)

Mount Sinai Selikoff Centers for Occupational Health (Medical Surveillance Programs, Occupational Injury Management)

Iqarus (A KBR Company) (Remote Occupational Health Solutions, Medical Risk Assessments)

Recent Developments

In June 2024, Concentra, the largest provider of occupational health services in the U.S., is preparing to go public with an IPO that could raise USD 585 million. The company, part of Select Medical, operates 547 standalone occupational health centers across 41 states and 151 onsite health clinics in 37 states, alongside a telemedicine program.

In June 2024, Premise Health, a leading provider of direct healthcare services for employers and unions, was honored with the 2023 ABOHN Employer Recognition Award by the American Board for Occupational Health Nurses (ABOHN). This prestigious award acknowledges organizations that demonstrate a strong commitment to credentialing and supporting occupational health nurses through ongoing professional and personal development.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.98 Billion |

| Market Size by 2032 | US$ 7.45 Billion |

| CAGR | CAGR of 4.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Service Type (Healthcare Services, Drug & Alcohol Testing Services, Physical Examination Services, Disease Screening Services, Health Risk Assessment Services, Others) • By Site Location (On-site, Off-site, Telehealth Services) •By End User (Small Size Enterprises, Mid-size Enterprises, Large Enterprises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Concentra, Inc., MedExpress Urgent Care, HCA Healthcare, Sonic Healthcare Limited, Premise Health, HealthWorks, Select Medical Holdings Corporation, Proactive Occupational Medicine, Centura Health Corporation, Aspen Medical, WorkCare, Inc., U.S. HealthWorks, Bupa Occupational Health, Maxicare Healthcare Corporation, Fresenius Medical Care, Nova Medical Centers, Healius Limited, AXA PPP Healthcare, Mount Sinai Selikoff Centers for Occupational Health, Iqarus (A KBR Company), and other players. |

| Key Drivers | •Increased scrutiny and more strict enforcement in industries with higher risk such as construction, manufacturing, oil, gas, and chemicals give rise to the increased demands for overall occupational health service. •There is an enormous shift in focus towards the mental health of the employees which is becoming an important determinant of employee productivity, engagement, and retention. |

| Restraints | •The major constraint that will negatively impact the growth of the occupational health market is the high cost of implementing comprehensive occupational health programs. |

Ans- The Occupational Health Market was valued at USD 4.98 billion in 2023 and is expected to reach USD 7.45 billion by 2032.

Ans – The CAGR rate of the Occupational Health Market during 2024-2032 is 4.62%.

Ans- The Healthcare services segment dominated the market by 35%

Ans- North America held the largest revenue share by 38%.

Ans- Asia Pacific is the fastest-growing region in the Occupational Health Market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Market Share by Service Type

5.2 Market Share by Site Location

5.3 Emerging Services or Technologies

5.4 Shifting Employer Preferences

5.5 Adoption Rates

5.6 Impact of New Policies

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Occupational Health Market Segmentation, by Service Type

7.1 Chapter Overview

7.2 Healthcare services

7.2.1 Healthcare Services Market Trends Analysis (2020-2032)

7.2.2 Healthcare Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Drug & Alcohol Testing Services

7.3.1 Drug & Alcohol Testing Services Market Trends Analysis (2020-2032)

7.3.2 Drug & Alcohol Testing Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Physical Examination Services

7.4.1 Physical Examination Services Market Trends Analysis (2020-2032)

7.4.2 Physical Examination Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Disease Screening Services

7.5.1 Disease Screening Services Market Trends Analysis (2020-2032)

7.5.2 Disease Screening Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Health Risk Assessment Services

7.6.1 Health Risk Assessment Services Market Trends Analysis (2020-2032)

7.6.2 Health Risk Assessment Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.7.1 Others Market Trends Analysis (2020-2032)

7.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Occupational Health Market Segmentation, by Site Location

8.1 Chapter Overview

8.2 On-site

8.2.1 On-site Market Trends Analysis (2020-2032)

8.2.2 On-site Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Off-site

8.3.1 Off-site Market Trends Analysis (2020-2032)

8.3.2 Off-site Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Telehealth Services

8.4.1 Telehealth Services Market Trends Analysis (2020-2032)

8.4.2 Telehealth Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Occupational Health Market Segmentation, by End User

9.1 Chapter Overview

9.2 Small size enterprises

9.2.1 Small size enterprises Market Trends Analysis (2020-2032)

9.2.2 Small size enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Mid-size enterprise

9.3.1 Mid-size Enterprise Market Trends Analysis (2020-2032)

9.3.2 Mid-size Enterprise Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Large enterprise

9.4.1 Large Enterprise Market Trends Analysis (2020-2032)

9.4.2 Large Enterprise Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Occupational Health Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.4 North America Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.2.5 North America Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.6.2 USA Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.2.6.3 USA Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.7.2 Canada Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.2.7.3 Canada Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.2.8.3 Mexico Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Occupational Health Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.1.6.3 Poland Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.1.7.3 Romania Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Occupational Health Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.2.5 Western Europe Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.2.6.3 Germany Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.7.2 France Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.2.7.3 France Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.2.8.3 UK Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.2.9.3 Italy Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.2.10.3 Spain Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.2.13.3 Austria Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Occupational Health Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.4.5 Asia Pacific Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.6.2 China Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.4.6.3 China Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.7.2 India Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.4.7.3 India Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.8.2 Japan Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.4.8.3 Japan Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.4.9.3 South Korea Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.4.10.3 Vietnam Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.4.11.3 Singapore Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.12.2 Australia Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.4.12.3 Australia Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Occupational Health Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.5.1.5 Middle East Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.5.1.6.3 UAE Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Occupational Health Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.4 Africa Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.5.2.5 Africa Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Occupational Health Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.4 Latin America Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.6.5 Latin America Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.6.6.3 Brazil Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.6.7.3 Argentina Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.6.8.3 Colombia Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Occupational Health Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Occupational Health Market Estimates and Forecasts, by Site Location (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Occupational Health Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11. Company Profiles

11.1 Concentra, Inc.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 MedExpress Urgent Care

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 HCA Healthcare

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Sonic Healthcare Limited

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Premise Health

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 HealthWorks

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Select Medical Holdings Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Proactive Occupational Medicine

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Centura Health Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Aspen Medical

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Service Type

Healthcare services

Drug & Alcohol Testing Services

Physical Examination Services

Disease Screening Services

Health Risk Assessment Services

Others

By Site Location

On-site

Off-site

Telehealth Services

By End User

Small size enterprises

Mid-size enterprise

Large enterprises

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)