NVH Testing Market Report Scope & Overview:

Get More Information on NVH Testing Market - Request Sample Report

The NVH Testing Market Size Growth was valued at USD 2.3 billion in 2023 and is expected to reach USD 3.9 billion by 2032 and grow at a CAGR of 6.1% over the forecast period 2024-2032.

The NVH (Noise, Vibration, and Harshness) testing market is experiencing notable advancements due to the increasing demand for enhanced product quality and regulatory compliance, particularly in the automotive and industrial sectors. Companies are integrating cutting-edge technologies to provide more accurate, reliable, cost-effective NVH testing solutions. For example, in September 2024, Advantech unveiled an audio extraction solution designed specifically for vehicle NVH testing. This technology aims to improve the precision of sound data capture, offering automotive manufacturers deeper insights into vehicle noise and vibration characteristics, which is crucial for optimizing vehicle acoustics.

Moreover, the integration of NVH testing at earlier stages of product development is becoming a trend. In April 2024, eMotors collaborated with Siemens to use Siemens’ NVH testing solutions to enhance the development of electric drive systems. This partnership underscores the growing importance of NVH testing in the electric vehicle (EV) industry, where reducing noise and vibration is essential for improving the user experience and vehicle performance. Similarly, Siemens expanded its NVH testing capabilities in November 2021 by adding prediction tools that allow manufacturers to anticipate noise and vibration challenges during the design phase. This predictive technology helps reduce development time and ensures product quality by identifying issues before physical prototypes are built. These recent developments illustrate how NVH testing technologies are evolving to meet the demands of the automotive and industrial sectors, with a stronger focus on early-stage integration, simulation, and predictive analytics to improve product design and performance.

NVH Testing Market Dynamics:

Drivers:

-

Rising Demand for Electric Vehicles (EVs) Drives Growth in NVH Testing Solutions

The rise of electric vehicles (EVs) is a significant driver for the NVH testing market. As EVs gain popularity, manufacturers are increasingly focusing on noise reduction technologies to enhance the driving experience. Unlike traditional vehicles, EVs often experience higher levels of cabin noise due to the absence of an internal combustion engine. Consequently, vehicle manufacturers are turning to advanced NVH testing to ensure smoother, quieter rides. These testing solutions help identify and mitigate noise and vibration sources in the powertrain, interior cabin, and suspension systems of EVs. Additionally, automakers are incorporating NVH testing early in the design process to refine vehicle acoustics, ensuring that their products meet consumer expectations for low noise levels. The growing shift towards EVs is pushing manufacturers to adopt more sophisticated NVH testing technologies to comply with regulatory standards and consumer preferences for a quieter, more comfortable driving experience.

-

Increasing Regulatory Pressure to Reduce Noise Pollution Fuels NVH Testing Demand

-

Growing Focus on Consumer Comfort and Product Quality Boosts NVH Testing Demand

-

Expansion of Smart Manufacturing and Industry 4.0 Promotes NVH Testing Integration

Restraint:

-

High Initial Investment Costs in Advanced NVH Testing Solutions Pose a Challenge

One of the primary challenges in the NVH testing market is the high initial investment required for advanced testing equipment and technologies. Many companies, particularly small and medium-sized enterprises (SMEs), find it difficult to justify the significant upfront costs associated with acquiring state-of-the-art NVH testing tools, such as high-performance sensors, data acquisition systems, and simulation software. While these tools offer greater precision and efficiency, the cost can be a barrier for organizations with limited budgets. Moreover, the maintenance and calibration of these advanced systems require additional resources, which further increases the financial burden. This high cost of implementation can hinder the adoption of NVH testing solutions, particularly in industries where noise and vibration control is not yet a priority. To address this restraint, companies may seek to adopt cost-effective, scalable solutions that offer a balance between performance and affordability.

Opportunity:

-

Rising Demand for Noise Reduction in Electric Vehicles Opens New Opportunities for NVH Testing

The growing demand for electric vehicles (EVs) presents a significant opportunity for the NVH testing market. As EVs become more prevalent, manufacturers are increasingly focusing on reducing noise and vibration to meet consumer expectations for a quiet, smooth driving experience. NVH testing solutions that cater specifically to electric powertrains, battery systems, and interior acoustics are in high demand. Additionally, as EVs use different power sources compared to traditional internal combustion engine vehicles, the need for specialized NVH testing is critical to ensuring performance and comfort. Manufacturers that provide NVH testing solutions tailored for the EV market are well-positioned to capitalize on this growth opportunity and play a key role in the development of next-generation electric vehicles.

-

Growing Adoption of Virtual Prototyping and Simulation Creates Demand for NVH Testing Solutions

-

Increasing Focus on Sustainable Products and Eco-Friendly Manufacturing Drives NVH Testing Innovation

| Regulation/Standard | Description | Industry Application | Region |

|---|---|---|---|

| ISO 2631 (Part 1) | Provides guidelines for measuring and evaluating human exposure to whole-body vibration. | Automotive, Aerospace, Industrial Machinery | Global |

| ISO 3744:2010 | Specifies methods for the determination of sound power levels of noise sources. | Industrial Equipment, HVAC, Electrical Appliances | Global |

| UNECE Regulation No. 51 | Establishes noise limits for motor vehicles, focusing on vehicle noise emissions. | Automotive Industry | Europe, Global Compliance |

| SAE J2889-1 | Provides guidelines for NVH testing methods for electric vehicles and powertrains. | Automotive, Electric Vehicle Manufacturing | North America, Europe |

| IEC 61672-1:2013 | Defines the performance requirements for sound level meters used in noise testing. | Noise measurement in multiple industries including automotive | Global |

These standards and regulations are integral for the NVH testing market as they ensure product performance and safety while maintaining environmental and consumer safety. ISO 2631 and ISO 3744 help in standardizing the testing methods across industries like automotive and aerospace, while UNECE and SAE specifically impact automotive noise regulations. These standards help guide manufacturers in developing vehicles, industrial equipment, and consumer goods that are compliant with international noise and vibration safety regulations.

NVH Testing Market Segmentation Overview

By Offering

In 2023, the hardware segment dominated the NVH testing market, capturing a 65% market share. Within hardware, the sensors and transducers subsegment emerged as the leader, contributing approximately 35% of the overall hardware segment. The demand for precise and accurate noise and vibration measurements has led to significant investments in sensor technology. These sensors are critical in detecting vibrations and noise levels in various applications, such as automotive, aerospace, and industrial equipment testing. For instance, advanced piezoelectric sensors and accelerometers are widely used for real-time monitoring of NVH parameters, which boosts their market share within the hardware segment.

By Application

In 2023, environmental noise testing dominated the NVH testing market by application, with a 40% market share. Environmental noise testing is essential for complying with regulations on noise pollution and ensuring products meet legal noise level limits. This is particularly prominent in urban development and transportation projects, where noise control is a significant concern. The adoption of advanced testing technologies has driven growth in this segment, with industries such as construction and transportation being primary users. For example, in automotive, manufacturers use environmental noise testing to ensure that vehicles comply with noise regulations in urban environments.

By End-use Industry

The automotive and transportation industry dominated the NVH testing market in 2023, capturing a 50% market share. This sector relies heavily on NVH testing to improve vehicle comfort and performance, particularly as consumer demand for quieter, more efficient electric vehicles (EVs) continues to rise. In 2023, the increasing adoption of EVs has particularly driven demand for NVH solutions, as electric powertrains typically generate different types of noise compared to traditional internal combustion engines. Companies like Tesla and other major automotive manufacturers invest heavily in NVH testing technologies to enhance the customer experience and meet regulatory noise standards, reinforcing the automotive sector's dominance in the market.

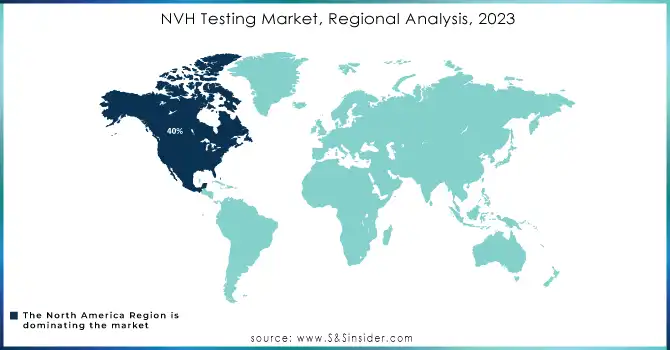

NVH Testing Market Regional Analysis

In 2023, North America dominated the NVH testing market, capturing approximately 40% market share. The region’s dominance can be attributed to the extensive automotive and aerospace sectors, which rely heavily on NVH testing to improve product quality and compliance with stringent noise regulations. The United States and Canada lead the market within this region due to their strong automotive manufacturing base and high investments in advanced testing technologies. For instance, U.S.-based companies like General Motors, Ford, and Tesla integrate NVH testing into their vehicle development processes to ensure that their products meet stringent environmental noise standards, enhancing their market competitiveness. The U.S. automotive industry alone significantly influences the adoption of NVH technologies, as manufacturers prioritize noise reduction for better customer experiences and regulatory compliance. Additionally, North America’s aerospace sector, with companies such as Boeing and Lockheed Martin, also contributes to the high demand for NVH solutions, as noise control is essential in aircraft design for both passenger comfort and environmental standards.

Moreover, the Asia Pacific (APAC) is expected to emerge as the fastest growing in the NVH testing market from 2024-2032, with an estimated CAGR of 7.5%. This rapid growth can be attributed to the region’s booming automotive and industrial sectors, particularly in countries like China, India, and Japan. China, as the world's largest automobile producer and consumer, is seeing a surge in electric vehicle (EV) production, where NVH testing plays a crucial role in enhancing vehicle comfort and noise reduction. China’s robust automotive sector, alongside growing infrastructure projects, has driven demand for NVH testing solutions, helping the country to lead the market in this region. India’s expanding automotive industry, fueled by increasing manufacturing and export activities, further bolstered NVH testing adoption. Additionally, Japan, with its technological advancements and global automotive players like Toyota and Honda, has accelerated the development and implementation of NVH testing solutions, especially in the electric vehicle sector. As the region continues to industrialize and prioritize environmental noise reduction, the demand for advanced NVH testing technologies is expected to rise, making APAC the fastest-growing market for NVH testing in 2023.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players in NVH Testing Market

-

Brüel & Kjær (HBK – Hottinger Brüel & Kjær) (Type 4507-B Microphone, 3560-C Power Amplifier)

-

Crystal Instruments (VI-5000 Vibration Controller, Coda NVH Testing System)

-

Data Physics Corporation (SignalCalc NVH, Vibration Test Systems)

-

Dewesoft d.o.o. (DeweSoft SIRIUS, Dewesoft X Software)

-

Dytran Instruments, Inc. (Model 3035A Accelerometer, Model 3313A Microphone)

-

ESI Group (VA One Simulation Software, SYSNOISE Simulation Tool)

-

GRAS Sound & Vibration (GRAS 40AE Microphone, GRAS 12AA Accelerometer)

-

HEAD acoustics GmbH (ARTES Measuring System, HA-1 Head and Torso Simulator)

-

IMC Test & Measurement GmbH (IMC FAMOS Software, IMC Buslink)

-

Kistler Group (KiS-3304 Dynamic Signal Analyzer, Type 8694A Piezoelectric Accelerometer)

-

Larson Davis (PCB Piezotronics) (Model 700 Series Sound Level Meter, 426A1 Microphone)

-

m+p international (m+p Analyzer, m+p VibPilot)

-

Meggitt PLC (Meggitt 5900 Series Accelerometer, Vibro-Meter Vibration Sensor)

-

Microflown Technologies (Microflown Particle Velocity Sensor, Microflown Acoustic Sensor)

-

MTS Systems Corporation (MTS 329 Series Controller, MTS System 793 Series)

-

National Instruments Corporation (NI) (PXIe-4499 Dynamic Signal Analyzer, NI LabVIEW Software)

-

Polytec GmbH (Polytec PSV-500 Scanning Vibrometer, Polytec HSN-100 Sensor)

-

Signal.X Technologies LLC (SIGNAL.X Dynamic Analyzer, PXI-4080 Dynamic Signal Conditioner)

-

Siemens Digital Industries Software (Simcenter Testlab, Simcenter SCADAS)

-

Spectris plc (HBM QuantumX Data Acquisition System, Brüel & Kjær Type 4508 Microph

Recent Developments

April 2024: Emotors leveraged Siemens NVH testing solutions to refine its e-drive development for electric vehicles. This collaboration enhanced noise, vibration, and harshness (NVH) performance, ensuring quieter and more efficient operation of e-drives. Siemens' tools enabled faster development cycles while meeting stringent noise standards.

June 2023: Bertrandt inaugurated its first North African facility in Rabat, Morocco. This site focuses on electrical and product development, electronic systems, and industrialization services for the local market. It is expected to play a key role in Bertrandt's global expansion strategy.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.3 Billion |

| Market Size by 2032 | US$ 3.9 Billion |

| CAGR | CAGR of 6.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Offering (Hardware [Sensors and Transducers, Data Acquisition Systems, Analyzers, Meters], Software [Analysis and Simulation Software, Reporting and Presentation Software], Services [Installation and Maintenance, Consulting Services]) •By Application (Environmental Noise Testing, Modal Analysis Testing, Sound Intensity Testing, Structural Testing, Pass-by Noise Testing, Others) •By End-use Industry (Automotive and Transportation, Aerospace and Defense, Industrial Equipment, Consumer Electronics, Power Generation, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Brüel & Kjær (HBK – Hottinger Brüel & Kjær), National Instruments Corporation (NI), HEAD acoustics GmbH, Siemens Digital Industries Software, MTS Systems Corporation, GRAS Sound & Vibration, Dewesoft d.o.o., IMC Test & Measurement GmbH, Signal.X Technologies LLC, ESI Group and other key players |

| Key Drivers | • Growing Focus on Consumer Comfort and Product Quality Boosts NVH Testing Demand • Expansion of Smart Manufacturing and Industry 4.0 Promotes NVH Testing Integration |

| RESTRAINTS | • High Initial Investment Costs in Advanced NVH Testing Solutions Pose a Challenge |