Nutraceutical Packaging Market Report Scope & Overview:

Get More Information on Nutraceutical Packaging Market - Request Sample Report

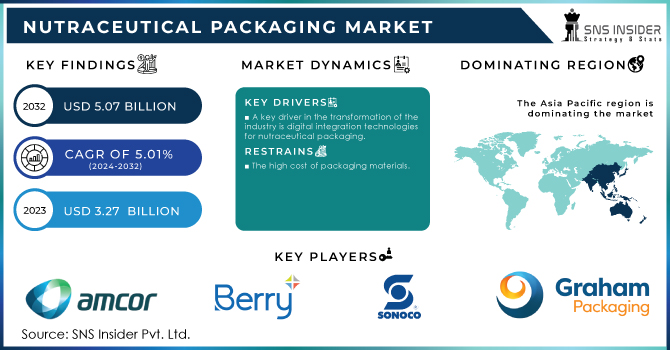

The Nutraceutical Packaging Market size was USD 3.27 billion in 2023 and is expected to Reach USD 5.07 billion by 2032 and grow at a CAGR of 5.01% over the forecast period of 2024-2032.

Increasing healthcare awareness and increased understanding of the benefits of preventive medicine have led to an increase in demand for nutraceutical products. In view of consumers search for ways to enhance their immune system and overall health, the influenza pandemic COVID19 has further fuelled demand for Nutraceutical products. The environmental impact of packaging is becoming more apparent to consumers, and they demand better sustainable solutions. As a result, solutions such as biodegradable and compostable materials are becoming increasingly needed for the packaging of nutraceuticals.

MARKET DYNAMICS

KEY DRIVERS:

-

A key driver in the transformation of the industry is digital integration technologies for nutraceutical packaging.

The integration of QR codes, NFC tags or Augmented Reality on the package offers interactive consumer engagement with product information, user suggestions and traceability. In addition, smart packaging helps to authenticate and combat the counterfeiting of products by strengthening consumer trust and loyalty. Furthermore, it will allow manufacturers to gain vital information about their supply chains and improve production efficiency.

RESTRAIN:

-

The high cost of packaging materials

A significant restraint may be the price of high quality, specialised packaging materials which are likely to have an impact on the overall cost of nutraceuticals. In order for manufacturers to maintain their competitiveness, quality must be taken into account as well as affordability.

OPPORTUNITY:

-

Growing need for Sustainability, green packaging

Sustainable packaging options are in increasing demand. The Nutraceutical packaging, produced from recycled or biodegradable materials, is in line with environmental concerns and attracts eco conscious consumers.

CHALLENGES:

-

A challenge could be the stability of packaging and shelf life

It may be challenging to develop packaging solutions that ensure the stability and potency of nutraceuticals for a longer period of time. In order to ensure the effectiveness of a product, packaging needs to be protected from degradation due to light, moisture and oxygen.

IMPACT OF RUSSIAN UKRAINE WAR

In many respects, the Russian Ukraine War has a negative impact on the nutraceutical packaging market. In particular, the war has disrupted the supply chain of raw materials essential for manufacturing dietary supplement packaging. Consequently, packaging material costs and shortages are increased. Second, the war is having an impact on finished goods as well. For nutraceutical companies, it means they are having difficulties getting their products onto the market. Third, the war is making matters more difficult in the economy. In this context, certain consumers are reducing their expenditure in particular on the purchase of nutritional products. Overall, the Russian Ukraine war has had a negative impact on the nutrition packaging market. The war disrupts supply chains, prevents finished goods from reaching the market and creates economic uncertainty. In addition, these factors lead to rising costs, a lack of packaging materials and reduced consumer demand for nutraceutical products.

IMPACT OF ONGOING RECESSION

The current recession is having an uneven impact on the nutraceutical packaging market. On the one hand, people become increasingly concerned about their health and are prepared to spend money on nutrition products. The demand for nutritional packaging is driven by this. However, there is also an increased consumer awareness about costs as a result of the recession. This is putting pressure on nutraceutical producers to lower their cost, which includes the costs of packaging.

In developed countries, such as the US and Europe, a recession could have an increased impact on the dietary supplement packaging market. It is because consumers in these countries are more prone to reduce their spending on discretionary goods, e.g. the use of dietary supplement products at a time of recession.

KEY MARKET SEGMENTS

By Material

-

Metal

-

Glass

-

Plastic

-

Others

By Product Type

-

Deitary Supplements

-

Functional Beverages

-

Others

Dietary Supplements holds the major share of around 68%. This is du to the increasing demand for the diet supplements.

By Product Form

-

Powder Granules

-

Solid & Soft Gel

-

Tablets & Capsules

-

Liquid

By Packaging Type

-

Jars & Canisters

-

Stick Packs

-

Blisters & Strips

-

Boxes & Cartons

-

Bottles

-

Bags & Pouches

-

Others

Bags & Pouches holds the major market share.

By Ingredient

-

Minerals

-

Amino Acids

-

Vitamins

-

Omega 3 Fatty Acids

-

Probiotics & Prebiotics

-

Others

REGIONAL ANALYSIS

Asia Pacific is the fastest growing market for the nutraceutical packaging. Due to the regions rise in population and rising disposable income there is a rise in demand for the nutraceutical packaging in this region. Due to growing acceptance of dietary supplements as well as foods, Europe is a strong market for the Packaging of Nutraceutical Products. A well established global market for dietary supplements makes North America a major driver of demand for novel and flexible packaging solutions. India Nutraceutical packaging market was worth 95 million in year 2022.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Nutraceutical Packaging market are Amcor Limited, Berry Global Inc, Nutra Solutions USA, Sonoco Products Company, Graham Packaging Company, Mondi Plc, Origin Pharma Packaging, Alpha Packaging, RPC Group, Flex-Pack and other players.

RECENT DEVELOPMENT

-

Berry Global Inc., launched the SuperlockPot in 2022, which provides a lifetime protection against dietary supplements.

-

In 2023, Amcor plc entered into a Joint Research Project Agreement with Nfinite Nanotechnology Inc to verify that nanocoating technology can be used in bio recyclable and compostable packaging for nutraceutical products.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.27 Bn |

| Market Size by 2032 | US$ 5.07 Bn |

| CAGR | CAGR of 5.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Metal, Paper & Paperboard, Glass, Plastic, Others) • by Product Type (Functional Foods, Deitary Supplements, Functional Beverages, Others) • by Product Form (Powder Granules, Solid & Soft Gel, Tablets & Capsules, Liquid) • by Packaging Type (Jars & Canisters, Stick Packs, Blisters & Strips, Boxes & Cartons, Bottles, Bags & Pouches, Caps & Closures, Others) • by Ingredient (Minerals, Amino Acids, Vitamins, Omega 3 Fatty Acids, Probiotics & Prebiotics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor Limited, Berry Global Inc, Nutra Solutions USA, Sonoco Products Company, Graham Packaging Company, Mondi Plc, Origin Pharma Packaging, Alpha Packaging, RPC Group, Flex-Pack |

| Key Drivers | • A key driver in the transformation of the industry is digital integration technologies for nutraceutical packaging. |

| Key Restraints | • The high cost of packaging materials |