Get More Information on Nucleotide Market - Request Sample Report

The Nucleotide Market Size was valued at USD 702.38 Million in 2023 and is expected to reach USD 1,319.80 Million by 2032, growing at a CAGR of 7.26% over the forecast period of 2024-2032.

The nucleotide market is evolving rapidly, driven by advancements in biotechnology and pharmaceuticals. Raw material analysis and pricing trends shape production costs, with fluctuations in ribose and phosphates influencing supply chains. Navigating the regulatory landscape and compliance requirements is crucial, as global authorities enforce stringent quality standards. Rising investments and funding analysis highlight growing interest in nucleotide-based innovations. A detailed product pipeline and R&D analysis reveal breakthroughs in RNA therapeutics, vaccines, and precision medicine. The impact of synthetic biology and genetic engineering is revolutionizing synthesis, making production more efficient and expanding applications in synthetic genomics. Our report provides exclusive insights into these key factors, offering a data-driven perspective on the dynamic nucleotide industry.

The US Nucleotide Market Size was valued at USD 207.40 Million in 2023 and is expected to reach USD 378.65 Million by 2032, growing at a CAGR of 6.92% over the forecast period of 2024-2032.

The U.S. nucleotide market is expanding rapidly, driven by advancements in biotechnology, pharmaceuticals, and food science. Increasing demand for RNA-based therapeutics and gene editing technologies, supported by organizations like the National Institutes of Health (NIH) and Biomedical Advanced Research and Development Authority (BARDA), is fueling growth. The presence of major players such as Thermo Fisher Scientific and Agilent Technologies strengthens research and development efforts. Additionally, the rising use of nucleotides in infant nutrition and functional foods, as recognized by the U.S. Food and Drug Administration (FDA), further boosts market demand. Strong regulatory frameworks and government funding contribute to the country’s dominance in nucleotide innovation and production.

Drivers

Advancements in Personalized Medicine and Nucleotide-Based Therapies Drive the Growth of the Nucleotide Market

The increasing adoption of personalized medicine is a key driver of the nucleotide market, as nucleotides serve as essential building blocks for developing targeted therapies. Advances in RNA-based drugs, mRNA vaccines, and antisense oligonucleotides are fueling the demand for high-quality nucleotides. In the U.S., organizations like the National Institutes of Health (NIH) and the Food and Drug Administration (FDA) are funding research into nucleotide-based treatments for cancer, neurodegenerative disorders, and rare genetic diseases. The rise of next-generation sequencing (NGS) and gene therapy innovations is further propelling the demand for nucleotides in diagnostics, drug discovery, and genetic modification. Companies such as Moderna and Pfizer continue to invest in synthetic nucleotides for advanced therapeutic solutions, increasing market growth. The rapid expansion of companion diagnostics and precision medicine approaches is also contributing to the increased usage of nucleotides, as they enable gene expression analysis, biomarker discovery, and molecular diagnostics. With pharmaceutical and biotech companies focusing on nucleotide-based formulations, the market is expected to see significant expansion in the coming years.

Restraints

High Production Costs and Complex Manufacturing Processes Restrain the Growth of the Nucleotide Market

The production of nucleotides involves complex biochemical synthesis, enzymatic modifications, and purification processes, leading to high operational costs. The need for specialized fermentation technology, advanced bioprocessing equipment, and stringent quality control further escalates expenses. Enzymes required for nucleotide synthesis are difficult to source and costly, making large-scale production financially challenging. Companies must invest in state-of-the-art production facilities and high-purity raw materials, increasing capital expenditure. Additionally, maintaining Good Manufacturing Practices (GMP) and pharmaceutical-grade nucleotide standards adds to compliance costs. Smaller biotech firms struggle to compete due to limited scalability and high entry barriers. The price volatility of raw materials, including ribose sugars, phosphate derivatives, and nitrogenous bases, further impacts profit margins. Manufacturers must navigate supply chain disruptions, geopolitical restrictions, and trade policies, increasing market uncertainty. Research institutions also face funding constraints when working on nucleotide-based applications. These financial burdens limit the widespread adoption of nucleotides in functional foods, pharmaceuticals, and genetic research. Cost-effective synthesis technologies and innovative production strategies are required to overcome these market challenges.

Opportunities

Growing Investments in Nucleotide-Based Vaccines and RNA Therapeutics Create New Growth Prospects for the Nucleotide Market

The success of mRNA vaccines for COVID-19, developed by Pfizer-BioNTech and Moderna, has demonstrated the potential of nucleotide-based therapeutics in treating infectious diseases, cancers, and rare genetic disorders. Government organizations such as Biomedical Advanced Research and Development Authority (BARDA) and the National Institutes of Health (NIH) are increasing investments in RNA-based drugs, self-amplifying RNA vaccines, and nucleotide analogs. The demand for oligonucleotide therapeutics, including small interfering RNAs (siRNAs) and antisense molecules, is growing due to their applications in personalized medicine and gene therapies. Companies are expanding their nucleotide synthesis capabilities to support the development of next-generation vaccines and precision medicine solutions. The ongoing research into long-lasting mRNA formulations, lipid nanoparticle delivery systems, and stable nucleotide analogs further enhances market potential. Advances in DNA and RNA synthesis technologies are improving cost-efficiency and production scalability. As clinical trials expand and FDA approvals increase, the nucleotide market will benefit from new treatment modalities and commercial applications, driving sustained growth in the pharmaceutical and biotech sectors.

Challenge

Intellectual Property Barriers and Patent Restrictions Limit Innovation in the Nucleotide Market

The nucleotide industry is dominated by patent-protected technologies and proprietary synthesis processes, restricting innovation among smaller biotech firms, academic researchers, and emerging manufacturers. Leading companies such as Thermo Fisher Scientific, Merck KGaA, and Agilent Technologies hold exclusive rights to advanced nucleotide synthesis techniques, genetic sequencing platforms, and proprietary enzymatic modifications, limiting competition. High licensing fees and strict intellectual property (IP) enforcement policies create challenges for startups and research institutions seeking to develop novel nucleotide-based applications. Additionally, complex patent landscapes, ongoing legal disputes, and restrictive patent extensions hinder the adoption of new synthesis methods and biotechnological advancements. This limits market entry for new players, slowing down the development of cost-effective and innovative nucleotide solutions. Companies must navigate IP negotiations, licensing agreements, and regulatory approvals to commercialize new nucleotide-based technologies. Collaboration between biotech firms, academic institutions, and government agencies is essential to overcoming these patent-related challenges and fostering a more competitive nucleotide market.

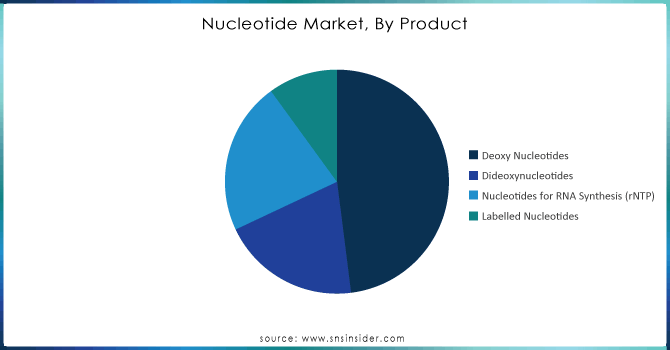

By Product

Deoxy nucleotides dominated the nucleotide market in 2023, holding a market share of 41.5% due to their essential role in DNA replication, sequencing, and genetic engineering. Their widespread application in polymerase chain reaction (PCR), next-generation sequencing (NGS), and synthetic biology has significantly contributed to market expansion. The National Institutes of Health (NIH) and the U.S. Food and Drug Administration (FDA) have emphasized the increasing role of deoxy nucleotides in gene therapy, vaccine development, and personalized medicine. The success of mRNA-based vaccines, such as COVID-19 vaccines developed by Moderna and Pfizer-BioNTech, has accelerated research in genetic and molecular medicine, further increasing demand for deoxy nucleotides. Additionally, CRISPR-Cas9 gene editing advancements require high-purity deoxy nucleotides for precise modifications, supporting their market growth. With continued investments from biotechnology firms, academic institutions, and pharmaceutical companies, deoxy nucleotides remain the preferred choice for genetic research, molecular diagnostics, and therapeutic applications. Growing R&D initiatives in cancer genomics, hereditary disease studies, and synthetic DNA production further drive the segment’s strong market presence, solidifying its leading position in the nucleotide industry.

By Technology

TaqMan Allelic Discrimination dominated the nucleotide market in 2023, accounting for a market share of 45.2%, driven by its high specificity, accuracy, and efficiency in genotyping and molecular diagnostics. This technology is widely used in genetic testing, pharmacogenomics, and clinical diagnostics, making it the preferred method for single nucleotide polymorphism (SNP) analysis and mutation detection. The Centers for Disease Control and Prevention (CDC) and NIH utilize TaqMan-based assays for infectious disease monitoring, hereditary disorder screening, and oncology research. Its role in COVID-19 variant tracking and personalized medicine initiatives has further strengthened its dominance. Pharmaceutical companies increasingly use TaqMan assays for biomarker identification and precision medicine applications, enhancing drug development processes. Additionally, government funding and academic research on genetic predisposition to diseases and forensic DNA analysis are fueling demand. As advancements in gene expression analysis, real-time PCR, and molecular epidemiology continue to grow, TaqMan Allelic Discrimination remains a cornerstone in genetic research and diagnostic applications, ensuring its leadership in the nucleotide market.

By Application

Diagnostics research dominated the nucleotide market in 2023, securing a market share of 37.9%, driven by the rising prevalence of infectious diseases, genetic disorders, and cancer. The increasing demand for high-precision molecular diagnostics and early disease detection has propelled the segment’s growth. The U.S. Food and Drug Administration (FDA) and NIH actively support advancements in next-generation sequencing (NGS), polymerase chain reaction (PCR), and nucleic acid-based diagnostic assays, strengthening their adoption in clinical and research settings. Nucleotides play a crucial role in biomarker discovery, prenatal genetic screening, and forensic DNA analysis, making them indispensable in modern healthcare. Government initiatives promoting precision medicine and liquid biopsy technologies have further accelerated the expansion of nucleotide-based diagnostic research. The use of nucleotide probes and primers in pandemic response efforts, such as COVID-19 and emerging viral diseases, has demonstrated the critical role of nucleotides in global health surveillance and epidemic control. With increasing investments in personalized medicine, disease diagnostics, and advanced genetic screening, the segment continues to hold a dominant position in the nucleotide market.

Need any customization research on Nucleotide Market - Enquiry Now

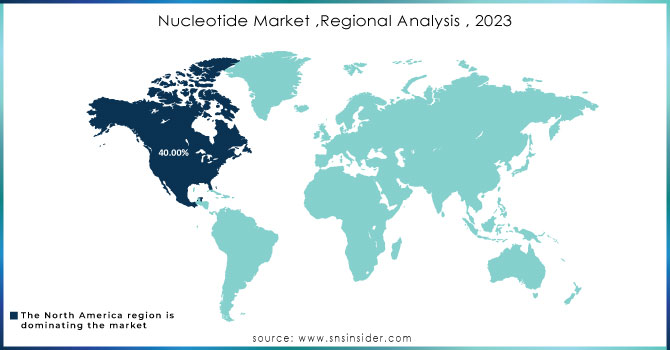

North America dominated the nucleotide market in 2023, holding a market share of 38.7%, driven by the region’s strong biotechnology and pharmaceutical industries, high R&D investments, and advanced healthcare infrastructure. The presence of leading companies such as Thermo Fisher Scientific, Merck KGaA, and New England Biolabs has fueled innovations in nucleotide-based diagnostics, therapeutics, and genetic research. The National Institutes of Health (NIH) and the U.S. Food and Drug Administration (FDA) have actively supported gene therapy, personalized medicine, and molecular diagnostics, increasing the demand for nucleotides. The United States led the market, accounting for over 80% of North America’s share, owing to its strong presence in next-generation sequencing (NGS), CRISPR gene editing, and mRNA vaccine production. The success of COVID-19 vaccines by Pfizer-BioNTech and Moderna, which rely on nucleotide synthesis, significantly boosted the market. Additionally, the U.S. government allocated $7 billion to the Advanced Research Projects Agency for Health (ARPA-H) to enhance biomedical and genomic research. Canada followed as the fastest-growing nation due to rising investments in synthetic biology and molecular diagnostics, while Mexico’s pharmaceutical sector expansion contributed to regional growth.

Moreover, Europe emerged as the fastest-growing region in the nucleotide market, with a significant market share, fueled by increasing investments in biopharmaceutical research, synthetic biology, and genetic engineering. The European Union’s Horizon Europe program, with a €95.5 billion budget, has significantly contributed to advancements in nucleotide-based therapeutics, gene therapies, and precision medicine. Germany led the market, holding over 35% of Europe’s share, driven by the strong presence of biotech firms such as Merck KGaA and Qiagen, as well as government-backed genomic research initiatives. The United Kingdom followed, with extensive support from the Wellcome Trust and UK Biobank, which are heavily involved in genomic sequencing and disease research. The French government’s investments in biotechnology startups have also propelled the region’s growth. Furthermore, the European Medicines Agency (EMA) has streamlined regulations for nucleic acid-based therapies, encouraging market expansion. The rising adoption of nucleotide-based food & beverage additives and animal feed across the European food industry has further accelerated demand, solidifying Europe’s position as the fastest-growing region in the nucleotide market.

Key Players

Ajinomoto Co., Inc. (IMP, GMP, Disodium 5'-Ribonucleotide)

Biorigin (Nucleotide Yeast Extract, RNA-rich Yeast Extract)

Biosynth Ltd. (Cytidine Monophosphate, Uridine Monophosphate)

CJ CheilJedang Corp. (5'-IMP, 5'-GMP, Ribonucleotide Mixtures)

Daesang Corporation (Disodium 5'-Ribonucleotide, Yeast Extract Nucleotides)

DSM Nutritional Products Ltd. (Purine Nucleotides, Pyrimidine Nucleotides)

F. Hoffmann-La Roche Ltd. (Research-grade Nucleotides, Synthetic Nucleotides)

Jena Bioscience GmbH (ATP Disodium Salt, CTP Sodium Salt)

Lallemand Inc. (Yeast RNA, Nucleotide-rich Yeast Extract)

MEIHUA HOLDINGS GROUP CO., LTD. (5'-IMP, 5'-GMP, Yeast-derived Nucleotides)

Merck KGaA (Adenosine Monophosphate, Guanosine Monophosphate, Nucleotide Solutions)

Meridian Bioscience, Inc. (dNTP Mix, PCR-grade Nucleotides)

New England Biolabs Inc. (dNTP Set, Modified Nucleotides)

Ohly GmbH (RNA Yeast Extract, 5'-Nucleotides)

Promega Corporation (dNTP Mix, ATP Solution, Nucleotide Triphosphates)

Prosol S.p.A. (Yeast-derived Nucleotides, Free Nucleotides)

Star Lake Bioscience (5'-IMP, 5'-GMP, Disodium 5'-Ribonucleotide)

Thermo Fisher Scientific Inc. (dNTP Mix, Nucleotide Triphosphates, RNA Nucleotides)

Tianjin Zhongrui Pharmaceutical Co., Ltd. (Disodium 5'-GMP, Disodium 5'-IMP)

Zhejiang Yaofi Bio-Tech Co., Ltd. (5'-IMP, 5'-UMP, Ribonucleotides)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 702.38 Million |

| Market Size by 2032 | USD 1,319.80 Million |

| CAGR | CAGR of 7.26% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Deoxy Nucleotides, Dideoxy nucleotides, Nucleotides for RNA Synthesis (rNTP), Others) •By Technology (TaqMan Allelic Discrimination, Gene Chips & Microarrays, SNP By Pyrosequencing, Others) •By Application (Pharmaceuticals, Diagnostics Research, Food & Beverage Additive, Animal Feed Additive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | CJ CheilJedang Corp., Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., DSM Nutritional Products Ltd., MEIHUA HOLDINGS GROUP CO., LTD., Star Lake Bioscience, Biorigin, Lallemand Inc., Ohly GmbH, Ajinomoto Co., Inc. and other key players |

Ans: The nucleotide market is expected to reach USD 1,319.80 million by 2032, growing at a CAGR of 7.26%.

Ans: Advancements in biotechnology, personalized medicine, and nucleotide-based therapies are key drivers of the nucleotide market.

Ans: Deoxy nucleotides led the nucleotide market in 2023, holding a 41.5% share due to their role in DNA replication and sequencing.

Ans: Innovations in synthetic biology, gene editing, and next-generation sequencing are transforming the nucleotide market.

Ans: Companies like Thermo Fisher Scientific, Merck KGaA, and Agilent Technologies are major contributors to the nucleotide market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Nucleotide Market Segmentation, By Product

7.1 Introduction

7.2 Deoxy Nucleotides

7.3 Dideoxy nucleotides

7.4 Nucleotides for RNA Synthesis (rNTP)

7.5 Others

8. Nucleotide Market Segmentation, By Technology

8.1 Introduction

8.2 TaqMan Allelic Discrimination

8.3 Gene Chips & Microarrays

8.4 SNP By Pyrosequencing

8.5 Other

9. Nucleotide Market Segmentation, By Application

9.1 Introduction

9.2 Pharmaceuticals

9.3 Diagnostics Research

9.4 Food & Beverage Additive

9.5 Animal Feed Additive

9.6 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Nucleotide Market by Country

10.2.3 North America Nucleotide Market By Product

10.2.4 North America Nucleotide Market By Technology

10.2.5 North America Nucleotide Market By Application

10.2.6 USA

10.2.6.1 USA Nucleotide Market By Product

10.2.6.2 USA Nucleotide Market By Technology

10.2.6.3 USA Nucleotide Market By Application

10.2.7 Canada

10.2.7.1 Canada Nucleotide Market By Product

10.2.7.2 Canada Nucleotide Market By Technology

10.2.7.3 Canada Nucleotide Market By Application

10.2.8 Mexico

10.2.8.1 Mexico Nucleotide Market By Product

10.2.8.2 Mexico Nucleotide Market By Technology

10.2.8.3 Mexico Nucleotide Market By Application

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Nucleotide Market by Country

10.3.2.2 Eastern Europe Nucleotide Market By Product

10.3.2.3 Eastern Europe Nucleotide Market By Technology

10.3.2.4 Eastern Europe Nucleotide Market By Application

10.3.2.5 Poland

10.3.2.5.1 Poland Nucleotide Market By Product

10.3.2.5.2 Poland Nucleotide Market By Technology

10.3.2.5.3 Poland Nucleotide Market By Application

10.3.2.6 Romania

10.3.2.6.1 Romania Nucleotide Market By Product

10.3.2.6.2 Romania Nucleotide Market By Technology

10.3.2.6.4 Romania Nucleotide Market By Application

10.3.2.7 Hungary

10.3.2.7.1 Hungary Nucleotide Market By Product

10.3.2.7.2 Hungary Nucleotide Market By Technology

10.3.2.7.3 Hungary Nucleotide Market By Application

10.3.2.8 Turkey

10.3.2.8.1 Turkey Nucleotide Market By Product

10.3.2.8.2 Turkey Nucleotide Market By Technology

10.3.2.8.3 Turkey Nucleotide Market By Application

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Nucleotide Market By Product

10.3.2.9.2 Rest of Eastern Europe Nucleotide Market By Technology

10.3.2.9.3 Rest of Eastern Europe Nucleotide Market By Application

10.3.3 Western Europe

10.3.3.1 Western Europe Nucleotide Market by Country

10.3.3.2 Western Europe Nucleotide Market By Product

10.3.3.3 Western Europe Nucleotide Market By Technology

10.3.3.4 Western Europe Nucleotide Market By Application

10.3.3.5 Germany

10.3.3.5.1 Germany Nucleotide Market By Product

10.3.3.5.2 Germany Nucleotide Market By Technology

10.3.3.5.3 Germany Nucleotide Market By Application

10.3.3.6 France

10.3.3.6.1 France Nucleotide Market By Product

10.3.3.6.2 France Nucleotide Market By Technology

10.3.3.6.3 France Nucleotide Market By Application

10.3.3.7 UK

10.3.3.7.1 UK Nucleotide Market By Product

10.3.3.7.2 UK Nucleotide Market By Technology

10.3.3.7.3 UK Nucleotide Market By Application

10.3.3.8 Italy

10.3.3.8.1 Italy Nucleotide Market By Product

10.3.3.8.2 Italy Nucleotide Market By Technology

10.3.3.8.3 Italy Nucleotide Market By Application

10.3.3.9 Spain

10.3.3.9.1 Spain Nucleotide Market By Product

10.3.3.9.2 Spain Nucleotide Market By Technology

10.3.3.9.3 Spain Nucleotide Market By Application

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Nucleotide Market By Product

10.3.3.10.2 Netherlands Nucleotide Market By Technology

10.3.3.10.3 Netherlands Nucleotide Market By Application

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Nucleotide Market By Product

10.3.3.11.2 Switzerland Nucleotide Market By Technology

10.3.3.11.3 Switzerland Nucleotide Market By Application

10.3.3.12 Austria

10.3.3.12.1 Austria Nucleotide Market By Product

10.3.3.12.2 Austria Nucleotide Market By Technology

10.3.3.12.3 Austria Nucleotide Market By Application

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Nucleotide Market By Product

10.3.3.13.2 Rest of Western Europe Nucleotide Market By Technology

10.3.3.13.3 Rest of Western Europe Nucleotide Market By Application

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Nucleotide Market by Country

10.4.3 Asia-Pacific Nucleotide Market By Product

10.4.4 Asia-Pacific Nucleotide Market By Technology

10.4.5 Asia-Pacific Nucleotide Market By Application

10.4.6 China

10.4.6.1 China Nucleotide Market By Product

10.4.6.2 China Nucleotide Market By Technology

10.4.6.3 China Nucleotide Market By Application

10.4.7 India

10.4.7.1 India Nucleotide Market By Product

10.4.7.2 India Nucleotide Market By Technology

10.4.7.3 India Nucleotide Market By Application

10.4.8 Japan

10.4.8.1 Japan Nucleotide Market By Product

10.4.8.2 Japan Nucleotide Market By Technology

10.4.8.3 Japan Nucleotide Market By Application

10.4.9 South Korea

10.4.9.1 South Korea Nucleotide Market By Product

10.4.9.2 South Korea Nucleotide Market By Technology

10.4.9.3 South Korea Nucleotide Market By Application

10.4.10 Vietnam

10.4.10.1 Vietnam Nucleotide Market By Product

10.4.10.2 Vietnam Nucleotide Market By Technology

10.4.10.3 Vietnam Nucleotide Market By Application

10.4.11 Singapore

10.4.11.1 Singapore Nucleotide Market By Product

10.4.11.2 Singapore Nucleotide Market By Technology

10.4.11.3 Singapore Nucleotide Market By Application

10.4.12 Australia

10.4.12.1 Australia Nucleotide Market By Product

10.4.12.2 Australia Nucleotide Market By Technology

10.4.12.3 Australia Nucleotide Market By Application

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Nucleotide Market By Product

10.4.13.2 Rest of Asia-Pacific Nucleotide Market By Technology

10.4.13.3 Rest of Asia-Pacific Nucleotide Market By Application

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Nucleotide Market by Country

10.5.2.2 Middle East Nucleotide Market By Product

10.5.2.3 Middle East Nucleotide Market By Technology

10.5.2.4 Middle East Nucleotide Market By Application

10.5.2.5 UAE

10.5.2.5.1 UAE Nucleotide Market By Product

10.5.2.5.2 UAE Nucleotide Market By Technology

10.5.2.5.3 UAE Nucleotide Market By Application

10.5.2.6 Egypt

10.5.2.6.1 Egypt Nucleotide Market By Product

10.5.2.6.2 Egypt Nucleotide Market By Technology

10.5.2.6.3 Egypt Nucleotide Market By Application

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Nucleotide Market By Product

10.5.2.7.2 Saudi Arabia Nucleotide Market By Technology

10.5.2.7.3 Saudi Arabia Nucleotide Market By Application

10.5.2.8 Qatar

10.5.2.8.1 Qatar Nucleotide Market By Product

10.5.2.8.2 Qatar Nucleotide Market By Technology

10.5.2.8.3 Qatar Nucleotide Market By Application

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Nucleotide Market By Product

10.5.2.9.2 Rest of Middle East Nucleotide Market By Technology

10.5.2.9.3 Rest of Middle East Nucleotide Market By Application

10.5.3 Africa

10.5.3.1 Africa Nucleotide Market by Country

10.5.3.2 Africa Nucleotide Market By Product

10.5.3.3 Africa Nucleotide Market By Technology

10.5.3.4 Africa Nucleotide Market By Application

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Nucleotide Market By Product

10.5.3.5.2 Nigeria Nucleotide Market By Technology

10.5.3.5.3 Nigeria Nucleotide Market By Application

10.5.3.6 South Africa

10.5.3.6.1 South Africa Nucleotide Market By Product

10.5.3.6.2 South Africa Nucleotide Market By Technology

10.5.3.6.3 South Africa Nucleotide Market By Application

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Nucleotide Market By Product

10.5.3.7.2 Rest of Africa Nucleotide Market By Technology

10.5.3.7.3 Rest of Africa Nucleotide Market By Application

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Nucleotide Market by country

10.6.3 Latin America Nucleotide Market By Product

10.6.4 Latin America Nucleotide Market By Technology

10.6.5 Latin America Nucleotide Market By Application

10.6.6 Brazil

10.6.6.1 Brazil Nucleotide Market By Product

10.6.6.2 Brazil Nucleotide Market By Technology

10.6.6.3 Brazil Nucleotide Market By Application

10.6.7 Argentina

10.6.7.1 Argentina Nucleotide Market By Product

10.6.7.2 Argentina Nucleotide Market By Technology

10.6.7.3 Argentina Nucleotide Market By Application

10.6.8 Colombia

10.6.8.1 Colombia Nucleotide Market By Product

10.6.8.2 Colombia Nucleotide Market By Technology

10.6.8.3 Colombia Nucleotide Market By Application

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Nucleotide Market By Product

10.6.9.2 Rest of Latin America Nucleotide Market By Technology

10.6.9.3 Rest of Latin America Nucleotide Market By Application

11. Company Profiles

11.1 CJ CheilJedang Corp.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Technology s Offered

11.1.4 The SNS View

11.2 Agilent Technologies Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Technology s Offered

11.2.4 The SNS View

11.3 Star Lake Bioscience Co., Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Technology s Offered

11.3.4 The SNS View

11.4 DSM Nutritional Products AG

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Technology s Offered

11.4.4 The SNS View

11.5 Thermo Fisher Scientific Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Technology s Offered

11.5.4 The SNS View

11.6 F. Hoffmann-La Roche Ltd.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Technology s Offered

11.6.4 The SNS View

11.7 MEIHUA HOLDINGS GROUP CO., LTD.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Technology s Offered

11.7.4 The SNS View

11.8 Biorigin

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Technology s Offered

11.8.4 The SNS View

11.9 Promega Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Technology s Offered

11.9.4 The SNS View

11.10 Lallemand Inc.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Technology s Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Product

Deoxy Nucleotides

Dideoxy nucleotides

Nucleotides for RNA Synthesis (rNTP)

Others

By Technology

TaqMan Allelic Discrimination

Gene Chips & Microarrays

SNP By Pyrosequencing

Other

By Application

Pharmaceuticals

Diagnostics Research

Food & Beverage Additive

Animal Feed Additive

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Medical Tape and Bandage Market Size was valued at USD 7.80 Billion in 2023, and is expected to reach USD 11.10 Billion by 2032, and grow at a CAGR of 4.12%.

Medical Writing Market was valued at USD 4.3 billion in 2023 and is expected to reach USD 10.5 billion by 2032, growing at a CAGR of 10.45% over the forecast period 2024-2032.

The Cardiac Safety Services Market Size was valued at USD 740 Million in 2023 and is expected to reach USD 1,888.34 Million by 2032 and grow at a CAGR of 11.48% over the forecast period 2024-2032.

Microplate Reader Market was valued at USD 486.89 million in 2023 and is expected to reach USD 941.32 million by 2032, growing at a CAGR of 7.6% from 2024-2032.

The Retinal Surgery Market was valued at USD 2.46 billion in 2023 and is expected to reach USD 4.16 billion by 2032 and grow at a CAGR of 6.05% by 2024-2032

The Vagus Nerve Stimulation Market Size was valued at USD 456.88 Million in 2023, and is expected to reach USD 1,074.62 Million by 2032, and grow at a CAGR of 10.48% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone