Nuclear Imaging Equipment Market Report Scope & Overview:

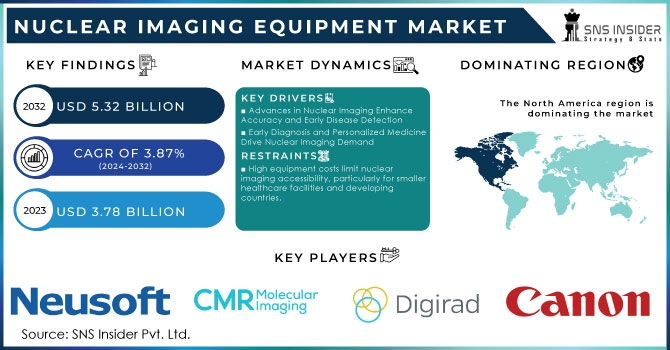

The Nuclear Imaging Equipment Market was valued at USD 3.78 billion in 2023, and it is expected to reach USD 5.32 billion by 2032, registering a CAGR of 3.87% from 2024 to 2032.

Nuclear imaging equipment that also represent one of the most efficient tools in medicine are PET and SPECT scanners. They can be used to diagnose cancer, examine organ functions and detect brain abnormalities. The strength of these machines is that they enable detailed internal images, helping to develop proper diagnoses and treatment. Over the time, these imaging devices have significantly contributed to the development of medical science. Moreover, the development of the technology in this area is one of the main factors that drive market growth.

Get More Information on Nuclear Imaging Equipment Market - Request Sample Report

The increase in demand that is associated with the number of chronic diseases, such as cancer, cardiovascular and neurological diseases is a great benefit. Due to the fact that a nuclear imaging is the most accurate way to diagnose these illnesses, the technology is in constant demand. In addition, the development of hybrid imaging systems, that will combine PET and CT functions, influence the usage of nuclear imaging systems, as they broaden the capabilities of it. Moreover, it is a globally acquired advantage as the population in whole is getting older and the elderly people have a faster pace of getting the above-mentioned diseases, so the demand for the diagnostics is tied to the age of a population. An additional point is the increasing popularity of healthcare and the growing amount of people who are afraid of getting a chronic disease. The early stages of all kinds of illnesses, including the chronic ones, can be noticed earlier due to regular check-ups that may suppose the usage of nuclear imaging systems, so the market in this sphere can be considered to be prospective.

The following are some of the factors propelling the market increasing worldwide cancer incidence, improvement in technology, clinical procedures and research, as well as an increase in the number of procedures in the field of nuclear medicine imaging. In 2022, there were 20 million new cancer cases worldwide, with a total death toll of 9.7 million. According to WHO, some 53.5 million people were alive within 5 years following a cancer diagnosis.

Moreover, several diseases are afflicting numerous populations across the globe, making the overall industry surge. There are many different diseases, such as cardiovascular diseases, cancer, neurologic diseases, and metabolic diseases, which have high prevalence rates and require the use of modern, advanced diagnostic and treatment processes for proper checkup, diagnosis, and management. All these have massively helped the overall industry’s growth. Nuclear imaging is a type of diagnostic imaging that plays a significant role in diagnosing, staging, and monitoring disease progression for all the above diseases. Furthermore, nuclear imaging provides a substantial amount of functional and metabolic information that has been less impacted. With the increase in the numbers of these chronic diseases, the demand for nuclear imaging machines is expected to grow further. Finally, healthcare professionals prefer nuclear imaging to accurately track disease progression and treatment response in order to better assess the patient’s well-being.

In January 2024: GE Healthcare partnered to acquire MIM Software, which is an international leader in the delivery of medical imaging analysis and artificial intelligence solutions. The solutions are applicable across radiation oncology molecular radiotherapy, diagnostic imaging and urology to imaging centers, hospitals, specialty clinics and research organizations around the world. Based on this acquisition, GE Healthcare seeks to exploit MIM Software’s skills in imaging analytics and digital workflow. The company plans to use them in different care domains to facilitate innovation. As a global healthcare provider, this strategic acquisition will empower GE Healthcare to grow by setting it apart. It will enhance its solutions to improve the health of patients and health systems around the world.

MARKET DYNAMICS

DRIVERS

Technological advances in nuclear imaging are enhancing imaging qualities, accuracy, and diagnostic scopes. Meanwhile, they prompt applications of the technology and improve abilities to detect diseases before their occurrence.

The modern applications of nuclear imaging technologies, such as hybrid imaging systems, including PET/CT and SPECT/CT, allow obtaining combined images of both anatomical and function details of the organs. Moreover, AI and machine learning programs are used in nuclear imaging techniques, as the new analyzation methods may improve the quality and imaging procedures. In modern medicine, it is revolutionizing, as AI is more efficient at reading the scans and provides scores of accuracies for each analysis. AI can recognize the trends that human would miss, which can provide diagnostic confirmation and reduces errors in decision-making. In addition, these technologies can affect the scopes of nuclear imaging since they could be used in new scopes, such as neurology or orthopedics. The analyses signal the disease long before its appearance, which can increase the range of applications. Detecting cancer earlier, for example, has been found to improve the chances of survival. Therefore, with these points in mind, it is possible to conclude that technological advances improve nuclear imaging.

Early diagnosis and personalized medicine drive demand for nuclear imaging by enabling tailored treatment plans and improving patient outcomes.

The major demand drivers for nuclear imaging technologies are early diagnosis and personalized medicine. This stems from the fact that the ability to discover diseases at the early stage is associated with their more successful treatment and positive patient outcomes. Moreover, nuclear imaging technologies, including PET and SPECT scanners, serve as one of the main approaches to achieving the mentioned goals because these modalities can deliver a comprehensive picture of the internal organs and tissues in the human body. Moreover, they help visualize the potentially disease-related changes that other technologies cannot reveal. Therefore, this imaging is also directly connected with personalized medicine, which presupposes delivering unique healthcare interventions corresponding precisely to the characteristics of a specific patient, such as their genome, lifestyle, and some other distinguishing disease markers. While nuclear imaging provides the required information to create such personalized medicine plans, they usually serve as blueprints for medical professionals, offering them sophisticated recommendations on the selection of healthcare interventions. The nuclear imaging in oncology helps determine the exact sizes of tumors and tailor a targeted therapy plan, known to be more efficient and less toxic than traditional treatment. Similar cases in a cardiology setting are evaluating various aspects of the heart function and blood flow with nuclear imaging and offering an advanced, precise intervention plan appropriate to the type of the cardiovascular pathology.

RESTRAIN

High equipment costs limit nuclear imaging accessibility, particularly for smaller healthcare facilities and developing countries.

High cost of equipment is one of the major barriers to the accessibility of nuclear imaging. The purchase, installation, and the maintenance of advanced technologies, such as PET or SPECT scanners, require significant investment. Smaller healthcare facilities and some developing countries cannot afford it. Another issue is the insufficient budget and an urgent need for investment in healthcare infrastructure in the context of developing countries. They must allocate resources to the purchase of other equipment and the improvement of healthcare services, nuclear imaging thus becoming less accessible for them. In the result, the technology may not be available in some geographical areas, influencing the possibility of early disease detection and relevant therapy planning. As they help identify the conditions that are difficult to detect using other diagnostic methods, the existence of such disparities is an issue. They call for the development of new cost-effective solutions and investments in the necessary medical equipment to ensure that the technologies are accessible in all parts of the world.

KEY MARKET SEGMENTATION

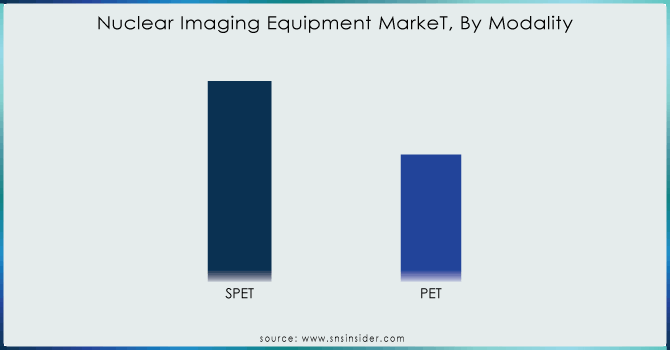

By Modality

The single photon emission computed tomography segment, and it was 59% in 2023. SPECT equipment is commonly more cost-effective, which allows it to be used by a bigger amount of healthcare facilities. Besides, this kind of imaging involves various radiotracers and imaging agents that are appropriate for specific diagnostic tests and provide a certain degree of advantages.

The Positron emission tomography is expected to grow at the fastest CAGR 4.04% over the forecast period. Advancement in PET imaging technology is a vital factor driving the market growth. Better resolution is offered by the PET scanners facilitate and provide more precise metabolic information, which is of utmost importance across several specialties including oncology, neurology, and cardiology. Research and developmental studies are being continuously carried out with the focus to improve PET imaging techniques.

Need any customization research on Nuclear Imaging Equipment Market - Enquiry Now

By Application

The oncology segment was leading and has the largest revenue share of 49.21% in 2023. The prevalence of cancer in the population and advanced nuclear imaging equipment to detect and stage the tumour contributed to this outcome. PET and SPECT imaging supply vital information regarding the diagnosis of cancer and the planning and control of treatment.

The cardiology segment is expected to grow at the fastest rate 4.11% over the forecast period. The increased incidence of cardiovascular diseases and the increased understanding about the nuclear imaging possibilities of diagnosing are the factors anticipated to drive the sector.

By End-use

The biggest share of revenue, 52.75%, was grabbed by the hospitals segment in 2023. The adoption rates of nuclear imaging equipment have been rising quickly in hospitals. This is likely because the hospital setting is better equipped to handle more complex cases. In such cases, the detailed diagnostic precision of nuclear imaging and the ability to perform PET and SPECT scans are of immense importance to accurate diagnosis and treatment planning. At the same time, hospitals also typically have larger budgets and resources compared to standalone imaging centers.

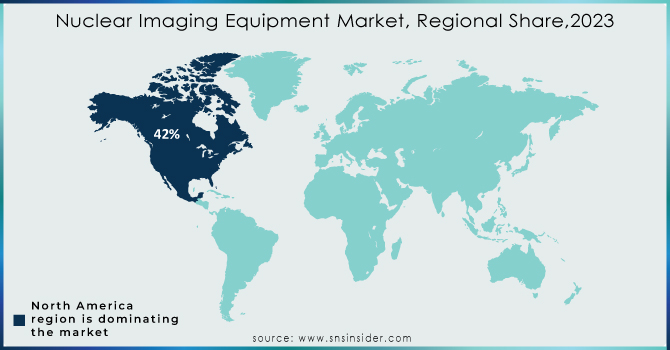

REGIONAL ANALYSIS

North America dominated the market and accounted for the largest revenue share of 42.00% in 2023 and is expected to stay dominant over the forecast period. The well-established healthcare infrastructure, high adoption of advanced technology and the high patient population suffering from chronic diseases are the factors contributing to its large revenue share in the nuclear imaging equipment market.

Asia Pacific is expected to register the highest CAGR of 4.06% moreover the forecast period. The high number of cases of cancer, increasing healthcare expenditure and the development in healthcare infrastructure in this region’s countries, such as Thailand, Malaysia, China, and India, could moreover tribute to the growth of the market.

In September 2023: the installation of Pet CT scan Vision 600 – PET CT scanner was installed in India’s Kokilaben Dhirubhai Ambani Hospital. This is a major step in the fight against cancer by enabling early detection of malignancies and other lesions.

Key Players

The major key players are DIGIRAD Corporation, Neusoft Corporation, CANON MEDICAL SYSTEMS CORPORATION, SurgicEye GmbH, CMR Naviscan., Absolute Imaging Inc., Bartec Technologies Ltd., BCL X-Ray Canada Inc., TTG Imaging Solutions, LLC., Lucerno Dynamics LLC.m, Berthold Technologies GmbH & Co.KG, Incom Inc., Koninklijke Philips N.V., GE Healthcare, Siemens Healthineers AG and others.

Recent Developments

In May 2023: Koninklijke Philips N.V., Elekta, and Mercurius Health announced a 3-year agreement to install diagnostic and therapeutic oncology equipment at Mercurius Health’s newly acquired Robert Janker Klinik cancer center in Bonn, Germany. This collaboration highlights the growing trend of comprehensive cancer care solutions incorporating nuclear imaging technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 3.78 billion |

| Market Size by 2032 | US$ 5.38 Billion |

| CAGR | CAGR of 3.87% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Modality (SPET, PET) • By Application (Cardiology, Oncology, Neurology, Others) • By End-use (Hospitals, Imaging Centers, R&D, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DIGIRAD Corporation, Neusoft Corporation, CANON MEDICAL SYSTEMS CORPORATION, SurgicEye GmbH, CMR Naviscan., Absolute Imaging Inc., Bartec Technologies Ltd., BCL X-Ray Canada Inc., TTG Imaging Solutions, LLC., Lucerno Dynamics LLC.m, Berthold Technologies GmbH & Co.KG, Incom Inc., Koninklijke Philips N.V., GE Healthcare, Siemens Healthineers AG |

| Key Drivers | • Technological advances in nuclear imaging are enhancing imaging qualities, accuracy, and diagnostic scopes. Meanwhile, they prompt applications of the technology and improve abilities to detect diseases before their occurrence. • Early diagnosis and personalized medicine drive demand for nuclear imaging by enabling tailored treatment plans and improving patient outcomes. |

| RESTRAINTS | • High equipment costs limit nuclear imaging accessibility, particularly for smaller healthcare facilities and developing countries. |