To Get More Information on Non-Fungible Token Market - Request Sample Report

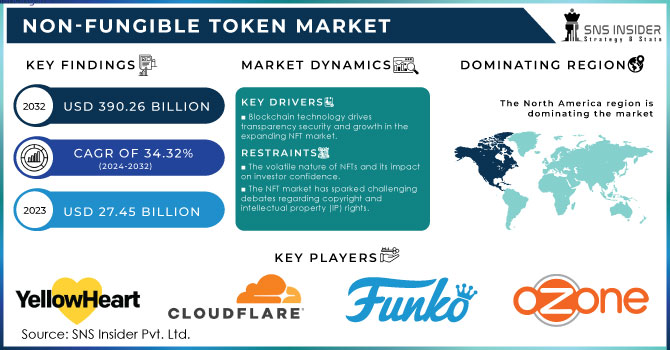

The Non-Fungible Token Market was valued at USD 27.45 Billion in 2023 and is expected to reach USD 390.26 Billion by 2032, growing at a CAGR of 34.32% over the forecast period 2024-2032.

The non-fungible token (NFT) market has witnessed remarkable growth in recent years, fueled by the escalating interest in digital assets and blockchain technology. Recent data from NFTevening reveals that consumer interest is on the rise, with over 40% of individuals likely to purchase digital collectibles in 2024. Generative art NFTs, created through innovative AI and algorithms, have experienced a staggering 165% increase in sales volume in 2023 compared to the previous year. Furthermore, 60% of gamers express a keen interest in owning NFTs linked to their favorite games, demonstrating the burgeoning convergence of the gaming and NFT ecosystems. In response to growing environmental concerns, approximately 70% of NFT projects are now implementing eco-friendly practices to mitigate their carbon footprint. Additionally, more than 30% of museums and galleries are exploring NFTs as a strategy to engage audiences and monetize digital art, reflecting a broader acceptance of NFTs within traditional art institutions.

These trends underscore the evolving landscape of the NFT market, emphasizing its growth potential and increasing integration into various sectors. The expansion of the NFT market is primarily driven by the rising demand for digital ownership and the widespread adoption of blockchain technology. In the finance sector, blockchain implementation could yield annual savings of at least USD 12 billion and reduce infrastructure costs by 30% for banks. The healthcare sector is also poised for significant benefits, with spending on blockchain integration expected to reach USD 5.61 billion by 2025, and 55% of healthcare applications likely to adopt commercialized blockchain solutions. As of March 2022, there were over 81 million registered wallets on blockchain platforms, and the FBI reportedly holds 1.5% of the global Bitcoin supply, underscoring the technology's growing influence and adoption across various industries. NFTs leverage blockchain to establish proof of ownership and authenticity, empowering artists, musicians, and creators to monetize their work more effectively. This innovative model allows creators to sell digital art directly to collectors without the need for intermediaries and enables them to earn royalties with every resale in secondary markets. This creator economy has revolutionized sectors such as art, entertainment, and gaming, and is expected to continue its expansion as more industries embrace the potential of NFTs.

Drivers

Blockchain technology is the foundation of the NFT market. Blockchain, being a decentralized ledger, guarantees essential qualities such as transparency, immutability, and security which are crucial for the operation of NFTs. Every NFT is one of a kind and can be tracked, providing evidence of ownership that is impossible to duplicate. The emergence of blockchain platforms such as Ethereum, providing smart contract features, has made it easier to create and exchange NFTs while guaranteeing their genuineness and distinctiveness. The decentralized nature of blockchain removes the requirement for intermediaries, cutting transaction costs and promoting peer-to-peer trading. This distribution allows creators and buyers more independence and self-governance, granting them direct entry to the market. Additionally, the transparency of blockchain increases confidence in the market by offering a public record of ownership, reducing the prevalence of fraud and counterfeiting problems that are common in traditional online marketplaces. Furthermore, advancements in blockchain technology are continuously developing. The implementation of Layer 2 solutions like Polygon and scaling technologies has increased the accessibility of NFTs to a wider audience by lowering energy usage and transaction costs. Due to ongoing improvements in blockchain technology, the NFT market is expected to expand, offering users safer, faster, and more cost-effective platforms.

The rise of the metaverse, a virtual world where individuals can engage with digital representations, has played a major role in the growth of the NFT industry. NFTs are fundamental components used in various parts of the metaverse such as virtual land, digital items, and avatars. The inclusion of NFTs in digital landscapes has opened up fresh opportunities for making money and possessing items, enabling individuals to purchase, sell, and exchange virtual goods that hold tangible worth. Platforms like Decentraland and The Sandbox enable users to buy virtual land through NFTs. Developing and customizing these virtual land parcels can bring about a parallel digital economy. The idea of owning digital assets in the metaverse is very attractive, especially for gamers and creators who can make money from their virtual creations. Moreover, companies are more and more embracing the metaverse to develop engaging marketing encounters, introducing digital products as NFTs. Technological advancements such as VR and AR are driving the increasing popularity of the metaverse, which in turn will strengthen the use of NFTs in this new digital landscape.

Restraints

The value of NFTs is incredibly volatile as they are generally very speculation-heavy assets. The high price volatility of NFTs creates uncertainty, which is unattractive to conservative investors. A few NFTs have sold for millions, many going to zero or close to zero value within months of their birth. This degree of risk naturally incurs a loss of faith, especially among more traditional investors who are hesitant to venture into a market so unstable. NFTs, which are entirely speculative markets by their nature, can also generate market bubbles. If speculative demand far exceeds actual use and worth, it would lead to a market crash (a situation where more people are trying to sell than buy), and creators as well as investors may stand to lose huge sums of money.

Legal disputes have arisen when creators mint NFTs of artworks without owning the rights to them in some instances. The ownership of a digital asset and the process of transferring or maintaining those rights in an NFT sale is still unclear. The growth of the NFT market may be impeded by legal uncertainties, causing potential legal hurdles for creators and buyers. Furthermore, the decentralized structure of blockchain can present challenges in enforcing intellectual property rights, adding another layer of complexity for artists, collectors, and rights holders.

By Type

The digital asset segment held a major market share of over 73% in 2023 and led the market. It encompasses unique digital creations like artwork, music, videos, and virtual goods within games and metaverses. This segment has gained significant traction, driven by platforms like OpenSea and Rarible, which allow creators to mint and sell their digital art as NFTs. The appeal of digital assets lies in their scarcity and the ability to trace ownership on the blockchain, leading to increased value and demand. Companies such as NBA Top Shot have capitalized on this trend by creating collectible digital highlights, and merging sports fandom with blockchain technology.

The physical asset segment is anticipated to have a progressive CAGR during 2024-2032, as it involves the tokenization of tangible items, such as real estate, artwork, collectibles, and luxury goods. This segment leverages blockchain technology to verify ownership and provenance, offering a secure and transparent way to trade physical assets. Investors can purchase fractional ownership through NFTs, making high-value assets more accessible. Companies like Myco utilize NFTs to represent ownership of physical items, enabling buyers to trade and sell these tokens while ensuring the underlying asset's authenticity.

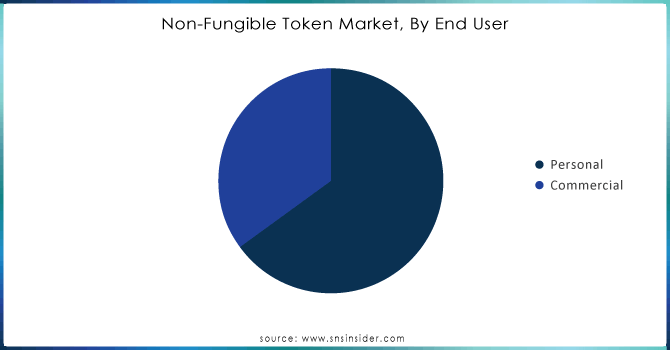

By End User

The personal led the Non-Fungible Token (NFT) market in 2023 with a 68% market share, as it is considered among regular buyers, sellers, and creators of NFTs for personal pleasure, investment, or collection reasons. The increasing popularity of digital art, collectibles, and virtual real estate has resulted in significant growth for this industry sector. People are more and more utilizing platforms such as OpenSea and Rarible to display and exchange their NFTs. Artistic individuals like Beeple have utilized this category to market their creations as NFTs, receiving significant interest and fetching high prices in the marketplace.

The commercial segment is the fastest-growing segment during 2024-2032, as companies and groups use NFTs for marketing, branding, and engagement goals. Businesses utilize NFTs to develop distinctive promotional strategies, loyalty initiatives, and engaging experiences to draw in customers and improve brand visibility. Big companies like Nike and Adidas have joined the NFT industry, launching unique digital shoes and collectibles to engage with their customers in new and creative ways. NFTs are being increasingly used in different sectors like entertainment, gaming, and real estate as companies like Ubisoft integrate them into games for exclusive in-game items.

Do You Need any Customization Research on Non-Fungible Token Market - Inquire Now

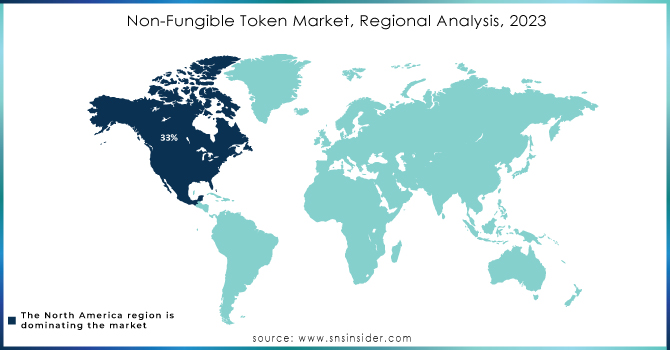

North America dominated the market regionally with a 33% market share in 2023, due to its advanced technology, substantial investments, and thriving digital art community. The United States houses numerous top NFT platforms like OpenSea and Rarible, enabling the trade of digital assets. Big companies such as NBA Top Shot and Twitter are also adopting NFTs, developing unique programs to improve interaction with users. Additionally, the area's favorable regulatory landscape and the existence of prominent technology firms help bolster its superiority.

Asia-Pacific region is expected to experience a faster growth rate during 2023-2032, due to heightened digitalization, a tech-savvy younger population, and growing cryptocurrency interest. Countries such as China, Japan, and South Korea are leading the way in developing new and creative uses in fields like gaming, art, and entertainment. Platforms such as Binance NFT and Rarible are becoming more popular, while initiatives like the Japanese anime NFT marketplace, AnimeNFT, focus on specific audiences.

The major key players in the Non-Fungible Token Market are:

YellowHeart, LLC (YellowHeart Tickets, YellowHeart Marketplace)

Cloudflare, Inc. (Cloudflare Stream for NFTs, Cloudflare IPFS Gateway)

PLBY Group, Inc. (Playboy NFT Art Collection, Playboy Rabbitars)

Dolphin Entertainment, Inc. (NFT Studio, Custom NFT Campaigns)

Funko (Funko Digital Pop! NFTs, Funko Digital Collectibles)

Ozone Networks, Inc. (OpenSea) (OpenSea Marketplace, OpenSea Drops)

Takung Art Co., Ltd. (Takung NFT Art Platform, Digital Art Trading)

Dapper Labs, Inc. (NBA Top Shot, CryptoKitties)

Gemini Trust Company, LLC. (Nifty Gateway, Gemini Exchange)

Onchain Labs, Inc. (Immutable X) (Immutable X Marketplace, Immutable X Mint)

Rarible, Inc. (Rarible Marketplace, Rarible DAO Governance Token)

SuperRare Labs (SuperRare Marketplace, SuperRare Spaces)

Enjin (Enjin Wallet, Enjin Marketplace)

Foundation Labs, Inc. (Foundation Marketplace, Creator NFTs)

Mintable (Mintable App, Mintable Pro)

Zora, Inc. (Zora Protocol, Zora Auction House)

MakersPlace (MakersPlace Marketplace, Unique Artist NFTs)

Decentraland (Decentraland Virtual Land NFTs, Decentraland Wearables)

Riot Games, Inc. (Riot Games NFTs, VALORANT Digital Collectibles)

The Sandbox (Sandbox LAND NFTs, Sandbox Game Assets)

September 2023: Franklin Mint introduced a new NFT collection in collaboration with the Great American Songbook Foundation, featuring iconic music memorabilia and exclusive digital art. This project aims to connect music enthusiasts with the rich history of American music through blockchain technology.

May 2024: Meta (formerly Facebook) announced the integration of a new NFT marketplace on its platforms, enabling users to create, buy, and sell NFTs directly through Facebook and Instagram. This feature aims to enhance social engagement with digital collectibles.

October 2023: Dapper Labs launched "NFL All Day," a platform where fans can buy, sell, and trade officially licensed NFL NFT moments. This platform aims to expand the sports NFT market and enhance fan engagement with interactive digital collectibles.

January 2024: Twitch announced a new feature allowing creators to mint and sell NFTs as part of their channels. This integration is designed to provide new revenue streams for streamers and strengthen community engagement.

February 2024: Adobe expanded its suite of features for NFT creators, allowing users to directly mint and sell NFTs through Adobe Express. This initiative aims to simplify the NFT creation process for artists and designers, making digital art more accessible.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 27.45 Billion |

| Market Size by 2032 | USD 390.26 Billion |

| CAGR | CAGR of 34.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Physical Asset, Digital Asset) • By End User (Personal, Commercial) • By Application (Collectibles, Art, Gaming, Utilities, Metaverse, Sports, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | YellowHeart, LLC., Cloudflare, Inc., PLBY Group, Inc., Dolphin Entertainment, Inc., Funko, Ozone Networks, Inc., Takung Art Co., Ltd., Dapper Labs, Inc., Gemini Trust Company, LLC., Onchain Labs, Inc., Rarible, Inc., SuperRare Labs, Enjin, Foundation Labs, Inc., Mintable, Zora, Inc., MakersPlace, Decentraland, Riot Games, Inc., The Sandbox |

| Key Drivers | • Blockchain technology drives transparency security and growth in the expanding NFT market. • The growing interconnection between the metaverse and NFTs fuels new opportunities for digital ownership and economic growth. |

| RESTRAINTS | • The volatile nature of NFTs and its impact on investor confidence. • The NFT market has sparked challenging debates regarding copyright and intellectual property (IP) rights. |

Ans: The Non-Fungible Token Market is expected to grow at a CAGR of 34.32% during 2024-2032.

Ans: The Non-Fungible Token Market was USD 27.45 Billion in 2023 and is expected to Reach USD 390.26 Billion by 2032.

Ans: Blockchain technology drives transparency security and growth in the expanding NFT market.

Ans: The Personal segment dominated the Non-Fungible Token Market.

Ans: North America dominated the Non-Fungible Token Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Non-Fungible Token Number of Active Wallets, by Region (2023)

5.2 Non-Fungible Token Transaction Volume, by Region

5.3 Non-Fungible Token Top Performing Categories (2023)

5.4 Environmental Impact Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Non-Fungible Token Market Segmentation, By Type

7.1 Chapter Overview

7.2 Physical Asset

7.2.1 Physical Asset Market Trends Analysis (2020-2032)

7.2.2 Physical Asset Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Digital Asset

7.3.1 Digital Asset Market Trends Analysis (2020-2032)

7.3.2 Digital Asset Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Non-Fungible Token Market Segmentation, By End User

8.1 Chapter Overview

8.2 Personal

8.2.1 Personal Market Trends Analysis (2020-2032)

8.2.2 Personal Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Commercial

8.3.1 Commercial Market Trends Analysis (2020-2032)

8.3.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Non-Fungible Token Market Segmentation, by Application

9.1 Chapter Overview

9.2 Collectibles

9.2.1 Collectibles Market Trends Analysis (2020-2032)

9.2.2 Collectibles Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.3 Video Clip

9.2.3.1 Video Clip Market Trends Analysis (2020-2032)

9.2.3.2 Video Clip Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.4 Audio Clip

9.2.4.1 Audio Clip Market Trends Analysis (2020-2032)

9.2.4.2 Audio Clip Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.5 Gamification

9.2.5.1 Gamification Market Trends Analysis (2020-2032)

9.2.5.2 Gamification Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.6 Others

9.2.6.1 Others Market Trends Analysis (2020-2032)

9.2.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Art

9.3.1 Art Market Trends Analysis (2020-2032)

9.3.2 Art Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.3 Pixel Art

9.3.3.1 Pixel Art Market Trends Analysis (2020-2032)

9.3.3.2 Pixel Art Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.4 Fractal/Algorithmic Art

9.3.4.1 Fractal/Algorithmic Art Market Trends Analysis (2020-2032)

9.3.4.2 Fractal/Algorithmic Art Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.5 Computer Generated Painting

9.3.5.1 Computer Generated Painting Market Trends Analysis (2020-2032)

9.3.5.2 Computer Generated Painting Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.6 2D/3D Painting

9.3.6.1 2D/3D Painting Market Trends Analysis (2020-2032)

9.3.6.2 2D/3D Painting Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.7 2D/3D Computer Graphics

9.3.7.1 2D/3D Computer Graphics Market Trends Analysis (2020-2032)

9.3.7.2 2D/3D Computer Graphics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.8 GIFs

9.3.8.1 GIFs Market Trends Analysis (2020-2032)

9.3.8.2 GIFs Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.9 Others

9.3.9.1 Others Market Trends Analysis (2020-2032)

9.3.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Gaming

9.4.1 Gaming Market Trends Analysis (2020-2032)

9.4.2 Gaming Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4.3 Trading Card Game (TCG)

9.4.3.1 Trading Card Game (TCG)Market Trends Analysis (2020-2032)

9.4.3.2 Trading Card Game (TCG)Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4.4 Video Game

9.4.4.1 Video Game Market Trends Analysis (2020-2032)

9.4.4.2 Video Game Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4.5 Strategy Role Playing Game (RPG)

9.4.5.1 Strategy Role Playing Game (RPG)Market Trends Analysis (2020-2032)

9.4.5.2 Strategy Role Playing Game (RPG)Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4.6 Others

9.4.6.1 Others Market Trends Analysis (2020-2032)

9.4.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Utilities

9.5.1 Utilities Market Trends Analysis (2020-2032)

9.5.2 Utilities Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5.3 Tickets

9.5.3.1 Tickets Market Trends Analysis (2020-2032)

9.5.3.2 Tickets Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5.4 Domain Names

9.5.4.1 Domain Names Market Trends Analysis (2020-2032)

9.5.4.2 Domain Names Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5.5 Assets Ownership

9.5.5.1 Assets Ownership Market Trends Analysis (2020-2032)

9.5.5.2 Assets Ownership Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Metaverse

9.6.1 Metaverse Market Trends Analysis (2020-2032)

9.6.2 Metaverse Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Sport

9.6.1 Sport Market Trends Analysis (2020-2032)

9.6.2 Sport Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Non-Fungible Token Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.4 North America Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.2.5 North America Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.6.2 USA Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.2.6.3 USA Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.7.2 Canada Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.2.7.3 Canada Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.2.8.3 Mexico Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Non-Fungible Token Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.6.3 Poland Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.7.3 Romania Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Non-Fungible Token Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.5 Western Europe Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.6.3 Germany Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.7.2 France Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.7.3 France Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.8.3 UK Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.9.3 Italy Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.10.3 Spain Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.13.3 Austria Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Non-Fungible Token Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.6.2 China Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.6.3 China Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.7.2 India Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.7.3 India Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.8.2 Japan Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.8.3 Japan Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.9.3 South Korea Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.10.3 Vietnam Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.11.3 Singapore Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.12.2 Australia Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.12.3 Australia Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Non-Fungible Token Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.5 Middle East Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.6.3 UAE Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Non-Fungible Token Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.4 Africa Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.2.5 Africa Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Non-Fungible Token Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.4 Latin America Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6.5 Latin America Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6.6.3 Brazil Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6.7.3 Argentina Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6.8.3 Colombia Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Non-Fungible Token Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Non-Fungible Token Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Non-Fungible Token Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 YellowHeart, LLC.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Cloudflare, Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 PLBY Group, Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Dolphin Entertainment, Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Funko

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Ozone Networks, Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Sustainable Solar

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Takung Art Co., Ltd.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Dapper Labs, Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Gemini Trust Company, LLC.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Physical Asset

Digital Asset

By Application

Collectibles

Video Clip

Audio Clip

Gamification

Others

Art

Pixel Art

Fractal/Algorithmic Art

Computer Generated Painting

2D/3D Painting

2D/3D Computer Graphics

GIFs

Others

Gaming

Trading Card Game (TCG)

Video Game

Strategy Role Playing Game (RPG)

Others

Utilities

Tickets

Domain Names

Assets Ownership

Metaverse

Sport

By End User

Personal

Commercial

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Data Center Construction Market Size was valued at USD 219.02 Billion in 2023 and will reach USD 388.92 Billion by 2032 and grow at a CAGR of 6.7% by 2032.

The Cloud TV Market was valued at USD 1.98 billion in 2023 and is expected to reach USD 12.24 Billion by 2032, growing at a CAGR of 22.44% from 2024-2032.

The Voice Picking Solutions Market Size was USD 2.6 Billion in 2023 & is expected to reach USD 8.78 Billion by 2032, growing at a CAGR of 14.5% by 2024-2032

Hyper-Automation Market was valued at USD 44.38 billion in 2023 and is expected to reach USD 179.96 billion by 2032, growing at a CAGR of 16.89% from 2024-2032.

The Dropshipping Market was valued at USD 303.2 Billion in 2023 and is expected to reach USD 1900.8 Billion by 2032, growing at a CAGR of 22.65% by 2032.

AI Trust, Risk, and Security Management Market was valued at USD 1.98 Bn in 2023 and will to reach USD 8.7 Bn by 2032, growing at a CAGR of 17.9% by 2032.

Hi! Click one of our member below to chat on Phone