Get More Information on Nitrile Gloves Market - Request Sample Report

The Nitrile Gloves Market Size was valued at USD 10.0 billion in 2023, and is expected to reach USD 16.2 billion by 2032, and grow at a CAGR of 5.5% over the forecast period 2024-2032.

The nitrile gloves market is undergoing constant changes with factors, essentially driven by growing awareness of personal protective equipment, regulatory pressure in terms of strict safety parameters required by several industries, and advancements in manufacturing technologies. One key driver here is the growing demand for nitrile gloves in medical and healthcare segments as it is more puncture and chemical-resistant than latex gloves. The growth in demand is matched by the operational pressures upon supply chains, as demonstrated in November 2023, when U.S. medical glove manufacturers were subject to intense competition from their Chinese peers to illustrate the level of market competition. The fact portrays the challenges in developing a reliable supply chain for producers in the U.S. looking to reduce dependence on imports from other nations but also being forced to spend more on production and meeting higher regulatory demands.

The growing interest in PPE, which comprises nitrile gloves, appeared in August 2023 in the market as a result of the increased demand from other areas, such as health care, food processing, and various industrial applications. Interest is on the increase in nitrile gloves rather than other materials because they are hypoallergic and more long-lasting than others, thus also meeting the company safety standard norms in their respective industries. For example, PPE demand is gaining traction, and nitrile gloves entail much importance since they are a crucial factor in keeping frontline workers safe and safe to meet hygiene requirements. This is what is driving manufacturers to innovate with expanded capacities of production to meet the global surge of demand.

Glove technology advancement is also giving shape to market dynamics. Kimberly-Clark Europe launched its new generation of nitrile gloves in January 2024. Boasting improved chemical protection and higher tactile sensitivity, new-generation nitrile gloves are ideal for laboratory and healthcare environments, where precision coupled with safety is the absolute necessity. Such innovations show how companies are responding to the growing demand for specific gloves that are engineered to meet particular professional needs in this area, it reflects a shift towards more individually tailored PPE solutions aimed at increasing user safety and comfort. A focus on innovation in support of not only nitrile glove adoption but also the directions taken by the industry toward developing products that meet very high standards in safety and performance criteria.

Moreover, the nitrile gloves market also has some problems such as production downtimes and also fluctuating prices of raw materials. A nitrile gloves manufacturing plant worth $123 million faced setbacks in January 2024 wherein for a temporary period, it had shortages of raw materials which led to hindrance in the supply chain and hence indicated vulnerabilities in the product logistics. It influences the market price and availability of nitrile gloves. Despite these challenges, manufacturers are indeed seeking ways to deal with better management of their risk in terms of the supply chain. These range from sourcing raw materials from alternative locations and investing in automation of its production to ensure quality and supply. Other campaigns, collaborations between industries, and generally government efforts to enhance a country's domestic capabilities also affect the nitrile glove market. For example, it was announced in May 2021 a major partnership to strengthen the U.S. domestic glove manufacturing base, addressing national security concerns about PPE shortages in emergencies. This is a broader trend in which governments and industries collaborate to build stronger supply chains and reduce reliance on imports. Such efforts can be seen to boost the stability of the nitrile gloves market in the long run, supplying a steady flow to meet the rising demand across various segments. Such developments aptly portray the complex playing out of dynamics between market forces and technological and strategic initiatives that are influencing the nitrile gloves market in its future direction.

Drivers:

The healthcare and industrial sectors rank top among primary consumers of nitrile gloves as they demand robust protective barriers against contamination and chemical exposure. In the health sector, nitrile gloves are widely preferred because they are puncture-resistant, thereby forming defense against pathogenic organisms that could lead to infections. The urgency to put in place high precautionary measures in hospitals and clinics, especially in surgery and intensive care, gave an impetus to rising demand for quality gloves. In industrial applications like use of chemicals, food processing, and manufacturing, the individual requires gloves that are resistant to oils, solvents, or other hostile substances in a simple way. Nitrile is hypoallergenic as compared to latex as it provokes allergic reactions to several individuals and would be suitable for prolonged use. Some regulatory provisions that outline further requirements to incorporate nitrile gloves in critical sectors are related to guidelines from the Occupational Safety and Health Administration (OSHA) and, more significantly in Europe, the Personal Protective Equipment (PPE) Directive. These define the need for protective equipment when an imminent risk of harm exists.

Technology has brought great improvement in the market for nitrile gloves, making them comfortable, dexterous, and protective. For instance, improvements in material science have led to the development of ultra-thin nitrile gloves that are just as protective as the thicker ones while providing greater tactile sensitivity, which is very important in healthcare and laboratories where precision is quite needed. Textured fingertips and special coatings enhance grip capabilities and make this glove suitable for small instrumentation and delicate procedure handling. In addition, through ergonomic designs, fatigue in hands is minimized when used for a long duration, thereby ensuring the comfort of the user and complying with security protocols. Such developments reflect an emerging trend in high-performance gloves in terms of both safety and usability standards. These technological advancements, therefore, broaden the scope of use of nitrile gloves into a wide-scale application in various fields apart from their original uses, such as electronics manufacturing and cleanroom environments.

Restraint:

The production of nitrile gloves is heavily dependent on acrylonitrile and butadiene, petrochemical derivatives whose market prices tend to fluctuate according to variations in the prices of crude oil and imbalances in the global supply and demand. Such dependency makes the market of nitrile gloves susceptible to very volatile fluctuations in the costs of raw materials. For instance, geopolitical tensions, blockades, or natural calamities can cause disruptions in the supply chain with abrupt movements in the fluctuations in the costs of raw materials. The global supply chain has experienced stress over the last few years due to various factors such as the COVID-19 pandemic and trade disputes, which have led to shortages of key materials followed by price increases. This, in turn, directly impacts the cost of manufacturing nitrile gloves, squeezing the margin profit for producers as prices soar for consumers. This restraint would thus create the challenge of overall growth and stability of the market for nitrile gloves. Volatile prices may discourage investment as well as innovation in that sector.

Opportunity:

The increased awareness of hygiene and safety protocols across industries has thrown open new space for nitrile gloves beyond their traditional confine in healthcare and industrial sectors. For example, in the food processing industry, there has been growing acceptance of nitrile gloves as they ensure protection against contamination and maintain food quality and safety. Nitrile gloves are highly differentiated from latex gloves with no risk of allergic reactions; thus, in the handling of food, they are ideal for cooks and chefs who have to handle foods for a long period without any allergic reactions. Similarly, the same nitrile gloves were found to be very popular in the beauty and personal care business because the industry uses them in salons and spas against chemical attacks during bleaching, hair coloring, and nail services treatments to be safe for use between the personnel and customers. The electronics manufacturing sector, which demands cleanroom conditions and careful handling of sensitive components, is the other emerging market for nitrile gloves. Manufacturers have now begun to focus on developing gloves with low particulate shedding and ESD properties that can suit this sector. However, if companies can diversify their products and offer them to these non-traditional sectors, they may be able to build from this growing demand for high-quality, specialized gloves to further expand the market.

Challenge:

Nitrile gloves are highly protective, strong, and resistant to synthetic content, and they do not degrade in the environment. Therefore, disposal of used gloves, especially in large numbers, has been added to the plastic waste problem in the environment. The health industry wastes tons of millions of gloves daily after using one time. This strains landfill capacities and poses a risk to wildlife and ecosystems if not disposed of properly. In industry, contaminated hazardous substances on the gloves are involved in complicated disposal processes where treatment is required to prevent harming the ecosystem. Nitrile glove use in all sectors is on the rise; this increases the evils. Thereby environmental agencies and groups begin to scrutinize more. Some have investigated biodegradable options and recycling initiatives, though the process and product can still be considered relatively in their infancy for sustainable gloves. The other concerns include cost, performance, and regulatory compliance or approval. The industry faces a pending environmental problem until and unless the viable solutions to this menace are applied at a wider scale; the nitrile glove, in an innovative way does highlight the need for something more sustainable practice in its manufacture and disposal.

By Type

In 2023, the powder-free segment dominated and accounted for a market share of around 70% in the nitrile gloves market. The demand for powder-free nitrile gloves is growing mainly because of their applicability in health and food industries that are highly vulnerable to contamination risks. Powder-free gloves avoid allergic reactions due to powder, which acts as a safe factor for medical people and patients. For example, in surgery, where accuracy and asepsis are the utmost concern, hospitals now opt for powder-free gloves to prevent the entry of dust into sterile fields. Powder-free gloves are preferred by food processing industries as well because the products manufactured for consumption require zero tolerance for contamination. The standards of regulation have followed this trend as it will also work towards minimizing the risk of contamination. This is part of the broader shift across sectors looking to safe, comfortable, and regulatory-compliant choices.

By Grade

In 2023, the medical-grade segment dominated and accounted for a maximum market share for nitrile gloves, approximately about 60%. This dominance in the market of nitrile gloves has been mainly contributed by the increased demand for high-quality protective equipment due to heightened awareness surrounding infection control and safety protocols among healthcare service providers. These are high-grade nitrile gloves meant for intense barrier protection purposes, mainly in hospitals, clinics, and laboratories. For example, when performing surgeries and conducting medical checkups, the healthcare worker completely relies on these nitrile gloves to avoid contaminating the patients and consequently keep them safe as well. The COVID-19 pandemic also accelerated the need for high-grade medical gloves because health institutions looked forward to achieving maximum safety for their staff and patients. Strict regulations governing the healthcare sector, including medical-grade products and hygiene, remain the biggest value-adding factor to the nitrile gloves market segment with the leading share.

By Texture

In 2023, the micro-roughened segment dominated and accounted for a significant market share in the nitrile gloves market, of about 55%. This is because of their ability to match comfort with functionality, making micro-roughened gloves the perfect product for many applications, especially in the health and industrial sectors. A textured surface improves grip and control, which are integral factors when a person is required to handle medical instruments and conduct sensitive procedures. For instance, for surgery, in which gloves should be micro-roughened and possess a very good touch without allowing you to slip, these are the best nitrile gloves because they can provide delicate sensitivity without sacrificing grip. The most favorite in the automotive and manufacturing sectors is this type of glove as people handle oily or wet parts most of the time; such nitrile gloves protect their hands while working. Because of flexibility and performance, these can be termed the most favorite nitrile gloves in the whole world and occupy the first position in the market.

By End-use

The medical and healthcare segment dominated the nitrile gloves market, accounting for a market share of approximately 65% in 2023. This is due to a greater need for infection control and safety measures in healthcare centers, especially after the COVID-19 pandemic. Due to enhanced protection against pathogens and chemical substances, nitrile gloves have become the first choice for doctors during surgeries, check-ups, and patient handling. By using nitrile gloves for surgical procedures, for instance, the instances of cross-contamination are significantly reduced while offering a clean environment that ensures the safety to the patient. Protection equipment demands for healthcare facilities are high and adhere to strict regulatory standards, which fuel the demand for high-quality nitrile gloves. Continuous innovation in glove technology, such as enhanced tactile sensitivity and comfort, is also assisting in the strong dominance of the segment, thereby emphasizing the importance of this protection for not just the healthcare workers but also the patients.

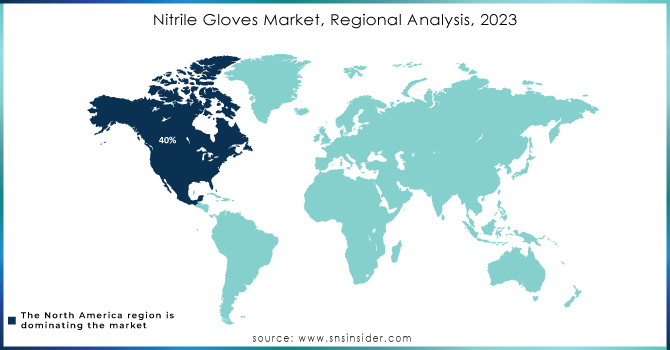

In 2023, North America dominated the nitrile gloves market with an approximate market share of around 40%. This is because of the strong healthcare infrastructure present in the region and strict standards related to safety and hygiene. Nitrile gloves have witnessed great growth rates both in the United States and Canada on account of intense infection control awareness among medical settings, laboratories, and food production places. For example, in hospitals and healthcare providers, there was the emphasis on personal protective equipment following the outbreak of the COVID-19 pandemic, which has drawn high demand for procurement. In turn, this demand has propelled the growth of the market. The presence of key manufacturers and suppliers in the region has also made the availability of high-quality nitrile gloves easier, all of which advocate for market supremacy. Advanced healthcare technologies and safety measures taken in advance again advance North America's dominant position in the nitrile gloves market.

Moreover, in 2023, Asia-Pacific emerged as the fastest-growing region in the nitrile gloves market, projected at around 12% compound annual growth rate. This is mainly driven by industrialization, which is growing more rapidly in the newly developing healthcare Industry, and a growing awareness of hygiene standards in countries such as China, India, and Southeast Asian nations. The region has significant investments in healthcare infrastructure particularly in the aftermath of the global pandemic, which has increased demand for personal protective equipment such as nitrile gloves. For instance, India invested in expanding its capacity to manufacture both local and foreign demand, becoming an important player in the global supply chain of nitrile gloves. Among key factors, growth in the food processing and automotive sectors has led to increased consumption of nitrile gloves in Asia-Pacific, mainly due to a rise in demand from businesses to standardize safety and protect their workforce. All this makes Asia-Pacific a dynamic and highly growing market for nitrile gloves.

Get Customized Report as per Your Business Requirement - Request For Customized Report

April 2023: Ammex unveiled a new line of disposable gloves that would protect users from anything from the office to the garage to outer space.

March 2023: Medline Industries, LP, headquartered in Mundelein, Illinois, opens a new LEED-certified distribution center located in Hammond, Los Angeles. The new facility will process more than $200 million in annual orders and distribute thousands of individual products to healthcare providers.

January 2023: UK-based company Unigloves (UK) Ltd. acquires Derma Shield business. The acquisition could enhance the business prospects of Unigloves to build on a portfolio of hand and arm protection products.

3M (3M Glucose Monitoring System, 3M Lancing Device)

Adenna LLC (Adenna Glucose Test Strips, Adenna Glucometer)

Ammex Corporation (Ammex Glucose Test Strips, Ammex Glucometer)

Ansell Healthcare (Ansell Glucose Testing Supplies, Ansell Glucometer)

Atrium Medical Care (Atrium Glucose Monitoring Devices, Atrium Blood Glucose Test Strips)

Cardinal Health (Cardinal Health Glucose Monitoring System, Cardinal Health Blood Glucose Test Strips)

Dynarex Corporation (Dynarex Glucose Test Strips, Dynarex Glucometer)

Hartalega Holdings Berhad(Hartalega Glucose Monitoring System, Hartalega Test Strips)

Honeywell International Inc (Honeywell Glucose Monitoring Device, Honeywell Test Strips)

Kimberly Clark (Kimberly Clark Glucose Test Strips, Kimberly Clark Glucometer)

McKesson Corporation (McKesson Glucose Monitoring System, McKesson Blood Glucose Test Strips)

Medline Industries (Medline Glucose Monitoring Devices, Medline Test Strips)

Mercator Medical S.A (Mercator Glucose Test Strips, Mercator Glucometer)

Shield Scientific B.V. (Shield Glucose Monitoring Devices, Shield Blood Glucose Test Strips)

Supermax Corporation Berhad (Supermax Glucose Monitoring System, Supermax Test Strips)

Supermax Healthcare Limited (Supermax Glucometer, Supermax Blood Glucose Test Strips)

Top Glove Corporation (Top Glove Glucose Monitoring System, Top Glove Test Strips)

Unigloves Limited (Unigloves Glucose Testing Supplies, Unigloves Glucometer)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.0 Billion |

| Market Size by 2032 | US$ 16.2 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Powdered, Powder-free) •By Grade (Medical, Industrial, Food) •By Texture (Smooth, Micro-roughened, Aggressively Textured) •By End-use (Medical & Healthcare, Food & Beverage, Automotive, Oil & Gas, Construction, Chemical, Pharmaceutical, Metals & Machinery, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Top Glove Corporation, Hartalega Holdings Berhad, Unigloves Limited, Adenna LLC, Kossan Rubber, Industries Bhd, Superior Gloves, MCR Safety, Supermax Corporation Berhad, Ammex Corporation and other key players |

| Key Drivers | • The increasing adoption of nitrile gloves in healthcare and industrial sectors due to their superior chemical resistance and durability is a significant driver • Innovations such as enhanced tactile sensitivity, textured fingertips, and ergonomic designs are driving the adoption of nitrile gloves |

| RESTRAINTS | • Fluctuations in prices of raw materials and supply chain disruptions can affect production costs, leading to higher prices for end consumers and impacting market growth |

Ans: During the projected period, the disposable gloves market is expected to develop because to an increase in the occurrence of contagious diseases and COVID-19. Despite the fact that the COVID-19 pandemic is still transforming the growth of numerous industries, the outbreak's immediate impact differs. Furthermore, due to increased demand for disposable gloves around the world as a result of the COVID-19 epidemic, the industry has seen an unanticipated increase.

Ans: Smooth, Micro-roughened And Aggressively Textured are the sub-segments of by Texture segment

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Nitrile gloves have a longer shelf life, less friction, and are more puncture resistant than latex gloves.

Ans: From an initial value of US$ 388 million in 2022 the nitrile gloves market is predicted to rise at a CAGR of 8.5 percent to reach a market size of US$ 633 million in 2028.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Region, 2023

5.2 Import and Export Analysis, by Country, by Region, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Region, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Nitrile Gloves Market Segmentation, by Type

7.1 Chapter Overview

7.2 Powdered

7.2.1 Powdered Market Trends Analysis (2020-2032)

7.2.2 Powdered Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Powder-free

7.3.1 Powder-free Market Trends Analysis (2020-2032)

7.3.2 Powder-free Market Size Estimates and Forecasts to 2032 (USD Million)

8. Nitrile Gloves Market Segmentation, by Grade

8.1 Chapter Overview

8.2 Medical

8.2.1 Medical Market Trends Analysis (2020-2032)

8.2.2 Medical Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Industrial

8.3.1 Industrial Market Trends Analysis (2020-2032)

8.3.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Food

8.4.1 Food Market Trends Analysis (2020-2032)

8.4.2 Food Market Size Estimates and Forecasts to 2032 (USD Million)

9. Nitrile Gloves Market Segmentation, by Texture

9.1 Chapter Overview

9.2 Smooth

9.2.1 Smooth Market Trends Analysis (2020-2032)

9.2.2 Smooth Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Micro-roughened

9.3.1 Micro-roughened Market Trends Analysis (2020-2032)

9.3.2 Micro-roughened Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Aggressively Textured

9.4.1 Aggressively Textured Market Trends Analysis (2020-2032)

9.4.2 Aggressively Textured Market Size Estimates and Forecasts to 2032 (USD Million)

10. Nitrile Gloves Market Segmentation, by End-use

10.1 Chapter Overview

10.2 Medical & Healthcare

10.2.1 Medical & Healthcare Market Trends Analysis (2020-2032)

10.2.2 Medical & Healthcare Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 Food & Beverage

10.3.1 Food & Beverage Market Trends Analysis (2020-2032)

10.3.2 Food & Beverage Market Size Estimates and Forecasts to 2032 (USD Million)

10.4 Automotive

10.4.1 Automotive Market Trends Analysis (2020-2032)

10.4.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Million)

10.5 Oil & Gas

10.5.1 Oil & Gas Market Trends Analysis (2020-2032)

10.5.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Million)

10.6 Construction

10.6.1 Construction Market Trends Analysis (2020-2032)

10.6.2 Construction Market Size Estimates and Forecasts to 2032 (USD Million)

10.7 Chemical

10.7.1 Chemical Market Trends Analysis (2020-2032)

10.7.2 Chemical Market Size Estimates and Forecasts to 2032 (USD Million)

10.8 Pharmaceutical

10.8.1 Pharmaceutical Market Trends Analysis (2020-2032)

10.8.2 Pharmaceutical Market Size Estimates and Forecasts to 2032 (USD Million)

10.9 Metals & Machinery

10.9.1 Metals & Machinery Market Trends Analysis (2020-2032)

10.9.2 Metals & Machinery Market Size Estimates and Forecasts to 2032 (USD Million)

10.10 Others

10.10.1 Others Market Trends Analysis (2020-2032)

10.10.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Nitrile Gloves Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.4 North America Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.2.5 North America Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.2.6 North America Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.7.2 USA Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.2.7.3 USA Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.2.7.4 USA Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.2.8 Canada

11.2.8.1 Canada Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.8.2 Canada Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.2.8.3 Canada Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.2.8.4 Canada Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.2.9 Mexico

11.2.9.1 Mexico Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.9.2 Mexico Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.2.9.3 Mexico Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.2.9.4 Mexico Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Nitrile Gloves Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.4 Eastern Europe Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.1.6 Eastern Europe Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.1.7 Poland

11.3.1.7.1 Poland Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.7.2 Poland Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.1.7.3 Poland Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.1.7.4 Poland Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.1.8 Romania

11.3.1.8.1 Romania Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.8.2 Romania Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.1.8.3 Romania Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.1.8.4 Romania Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.9.2 Hungary Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.1.9.3 Hungary Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.1.9.4 Hungary Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.10.2 Turkey Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.1.10.3 Turkey Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.1.10.4 Turkey Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.1.11.4 Rest of Eastern Europe Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Nitrile Gloves Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.4 Western Europe Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.2.5 Western Europe Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.2.6 Western Europe Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.2.7 Germany

11.3.2.7.1 Germany Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.7.2 Germany Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.2.7.3 Germany Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.2.7.4 Germany Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.2.8 France

11.3.2.8.1 France Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.8.2 France Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.2.8.3 France Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.2.8.4 France Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.2.9 UK

11.3.2.9.1 UK Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.9.2 UK Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.2.9.3 UK Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.2.9.4 UK Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.2.10 Italy

11.3.2.10.1 Italy Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.10.2 Italy Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.2.10.3 Italy Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.2.10.4 Italy Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.11.2 Spain Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.2.11.3 Spain Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.2.11.4 Spain Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.12.2 Netherlands Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.2.12.3 Netherlands Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.2.12.4 Netherlands Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.13.2 Switzerland Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.2.13.3 Switzerland Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.2.13.4 Switzerland Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.2.14 Austria

11.3.2.14.1 Austria Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.14.2 Austria Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.2.14.3 Austria Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.2.14.4 Austria Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.15.2 Rest of Western Europe Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.3.2.15.3 Rest of Western Europe Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.3.2.15.4 Rest of Western Europe Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Nitrile Gloves Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia Pacific Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.4 Asia Pacific Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.4.5 Asia Pacific Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.4.6 Asia Pacific Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.4.7 China

11.4.7.1 China Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.7.2 China Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.4.7.3 China Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.4.7.4 China Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.4.8 India

11.4.8.1 India Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.8.2 India Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.4.8.3 India Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.4.8.4 India Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.4.9 Japan

11.4.9.1 Japan Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.9.2 Japan Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.4.9.3 Japan Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.4.9.4 Japan Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.4.10 South Korea

11.4.10.1 South Korea Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.10.2 South Korea Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.4.10.3 South Korea Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.4.10.4 South Korea Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.11.2 Vietnam Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.4.11.3 Vietnam Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.4.11.4 Vietnam Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.4.12 Singapore

11.4.12.1 Singapore Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.12.2 Singapore Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.4.12.3 Singapore Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.4.12.4 Singapore Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.4.13 Australia

11.4.13.1 Australia Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.13.2 Australia Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.4.13.3 Australia Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.4.13.4 Australia Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.14.2 Rest of Asia Pacific Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.4.14.3 Rest of Asia Pacific Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.4.14.4 Rest of Asia Pacific Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Nitrile Gloves Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.4 Middle East Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.5.1.5 Middle East Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.5.1.6 Middle East Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.5.1.7 UAE

11.5.1.7.1 UAE Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.7.2 UAE Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.5.1.7.3 UAE Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.5.1.7.4 UAE Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.8.2 Egypt Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.5.1.8.3 Egypt Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.5.1.8.4 Egypt Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.9.2 Saudi Arabia Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.5.1.9.3 Saudi Arabia Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.5.1.9.4 Saudi Arabia Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.10.2 Qatar Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.5.1.10.3 Qatar Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.5.1.10.4 Qatar Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.5.1.11.4 Rest of Middle East Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Nitrile Gloves Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.4 Africa Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.5.2.5 Africa Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.5.2.6 Africa Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.7.2 South Africa Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.5.2.7.3 South Africa Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.5.2.7.4 South Africa Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.8.2 Nigeria Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.5.2.8.3 Nigeria Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.5.2.8.4 Nigeria Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.9.2 Rest of Africa Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.5.2.9.3 Rest of Africa Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.5.2.9.4 Rest of Africa Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Nitrile Gloves Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.4 Latin America Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.6.5 Latin America Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.6.6 Latin America Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.6.7 Brazil

11.6.7.1 Brazil Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.7.2 Brazil Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.6.7.3 Brazil Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.6.7.4 Brazil Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.6.8 Argentina

11.6.8.1 Argentina Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.8.2 Argentina Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.6.8.3 Argentina Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.6.8.4 Argentina Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.6.9 Colombia

11.6.9.1 Colombia Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.9.2 Colombia Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.6.9.3 Colombia Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.6.9.4 Colombia Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Nitrile Gloves Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.10.2 Rest of Latin America Nitrile Gloves Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

11.6.10.3 Rest of Latin America Nitrile Gloves Market Estimates and Forecasts, by Texture (2020-2032) (USD Million)

11.6.10.4 Rest of Latin America Nitrile Gloves Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

12. Company Profiles

12.1 Top Glove Corporation

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Hartalega Holdings Berhad

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Unigloves Limited

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Adenna LLC

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Kossan Rubber

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Industries Bhd

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Superior Gloves

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 MCR Safety

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Supermax Corporation Berhad

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Ammex Corporation

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Powdered

Powder-free

By Grade

Medical

Industrial

Food

By Texture

Smooth

Micro-roughened

Aggressively Textured

By End-use

Medical & Healthcare

Food & Beverage

Automotive

Oil & Gas

Construction

Chemical

Pharmaceutical

Metals & Machinery

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Explore the Glue Laminated Timber Market, focusing on trends in sustainable construction, architectural innovation, and demand for eco-friendly building materials. Learn about key applications in residential, commercial, and industrial construction drivin

Basalt Fiber Market Size was valued at USD 269.9 million in 2023 and is expected to reach USD 733.5 million by 2032 and grow at a CAGR of 11.8% from 2024-2032.

The Ceramic Matrix Composites Market Size was valued at USD 9.6 Billion in 2023. It is expected to grow to USD 23.8 Billion by 2032 and grow at a CAGR of 10.7% over the forecast period of 2024-2032.

The Ammonium Sulfate Market Size was valued at USD 4.06 Billion in 2023 and is expected to reach USD 6.15 Billion by 2032, at a CAGR of 4.73% from 2024-2032.

The Foam Glass Market Size was valued at USD 2.0 billion in 2023 and is expected to reach USD 3.3 billion by 2032 and grow at a CAGR of 5.6% over the forecast period 2024-2032.

The Isostearic Acid Market Size was valued at USD 524.5 million in 2023 and is expected to reach USD 846.8 million by 2032 and grow at a CAGR of 5.5% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone