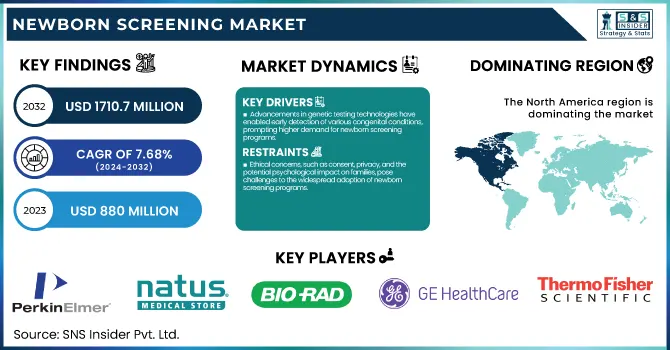

The Newborn Screening Market size was USD 880 million in 2023 and is expected to reach USD 1,710.7 million by 2032, growing at a 7.68% CAGR from 2024 to 2032.

To Get more information on Newborn Screening Market - Request Free Sample Report

The Newborn Screening Market report provides key statistical insights and trends shaping the industry. It includes information on the incidence and prevalence of congenital disorders identified via screening programs and regional adoption rates of screening tests in 2023. The report examines healthcare spending from government, private and out-of-pocket sources, and trends in funding. It analyzes the advances in screening technologies such as NGS and AI-driven technologies and their impact on diagnostics. The report also delves into regulatory and compliance trends shaping screening policies across the globe. It includes an analysis of the market dynamics for newborn screening kits and devices and highlights the demand and regional variations. Such insights enable stakeholders to develop laws to expand in change, technological advancements, and investment opportunities in neonatal healthcare. Government initiatives to improve awareness of the early detection of disease in infants, coupled with the expansion of the global newborn screening market, are contributing to the growth of this industry. According to the National Organization for Rare Disorders (NORD), almost 4 million infants are screened each year in the United States for specific rare diseases that, in the absence of early detection and treatment, may lead to permanent disability or death.

Drivers

Advancements in genetic testing technologies have enabled early detection of various congenital conditions, prompting higher demand for newborn screening programs.

The increment in the newborn screening programs has been largely driven by advancements in genetic testing technologies that have greatly improved the diagnosis of congenital conditions. Recent projects emphasize this trend. In October 2024, NHS England announced a world-first study to screen 100,000 newborns for over 200 genetic conditions through whole genome sequencing (WGS). This approach is used for the routine screening of treatable, rare conditions shortly after birth so that there can ideally be timely intervention to improve or save lives.” So far, more than 500 blood samples have been collected at 13 hospitals, which will soon expand to about 40 hospitals nationwide. Also in August 2024, Queensland, Australia, became the first in the world to offer an advanced heel prick test that can detect hundreds of genetic conditions in newborns. Funded by a $5.5 million federal grant, this effort will initially test 60,000 babies where their parents consent, with the plan to add conditions as treatments are available.

In the United States, a study published in October 2024 found that genome sequencing detected 120 babies with serious and treatable health conditions among 4,000 tested newborns. In contrast, conventional screening techniques identified only 10 of those cases. This significant disparity highlights the efficacy of advanced genetic testing in early disease detection. These developments reflect a global shift towards integrating comprehensive genetic testing into standard newborn screening protocols, aiming to facilitate early diagnosis and intervention for a broader spectrum of congenital conditions.

Restraint:

Ethical concerns, such as consent, privacy, and the potential psychological impact on families, pose challenges to the widespread adoption of newborn screening programs.

Ethical issues greatly affect the implementation of neonatal screening programs. A major concern is genetic discrimination, which occurs when people identified with certain genetic traits could be discriminated against in the workplace or their access to insurance. For example, the services of a U.S. startup that will screen embryos for intelligence have raised concerns that they promote genetic superiority and social inequality. Another major issue is privacy. When genetic data from newborns are collected and stored, strict protections are needed to ensure these aren’t accessed or used inappropriately. Without appropriate data protection, there can be data breaches exposing sensitive personal information. Informed consent is yet another contentious concern. Ensuring full parental comprehension of the risks implications, and limitations, of genetic testing, especially when results might prognosticate future health risks without consequential specificity, is also quite challenging. This uncertainty can be stressful and anxiety-provoking for families. Moreover, the possibility of false positives or uncertain results may lead to unnecessary interventions or emotional distress.

Opportunity:

The development and widespread adoption of point-of-care testing solutions offer timely and convenient diagnostic capabilities, enhancing accessibility and efficiency in newborn screening.

POC testing solutions have a considerable opportunity for improved diagnosis and intervention of numerous congenital disorders through integration into newborn screening programs. Existing methods for newborn screening are considered tedious procedures requiring centralized laboratories and longer waiting periods for results that delay vital medical treatments. Conversely, POC testing allows for rapid, in-field testing to enable diagnosis and treatment. Recent developments highlight this potential. In September 2023, Mylab Discovery Solutions launched 'MyNeoShield,' a patent-pending POC device to run all seven standard newborn screening tests. This device gives results in four hours a tremendous leap over traditional methods, which could take 24 hours or more. Such rapid turnaround times are crucial, especially in remote or underserved areas where timely medical action within the critical 48-hour window is essential.

In Queensland, Australia, "the world's first" new rollout began around mid-2024, deploying a more sophisticated heel prick test to identify hundreds of genetic illnesses in newborns. This will greatly increase the number of disorders going from 32 to up to 50 which can be detected earlier leading to improved intervention and treatment outcomes. USD 5.5 million for this project from the federal government, which is significant due to POC testing being funded by a public health program in their state. Most notably, several of these developments highlight a global momentum towards autosomal recessive POC testing being used in newborn screening due to the need for rapid, non-invasive, and cost-effective diagnostic alternatives. Point-of-care comprehensive screenings also expedite diagnoses and guarantee that infants receive timely medical treatments, which leads to better outcomes and a decreased incidence of congenital disorders.

Challenge:

Stigma and discrimination associated with certain conditions detected through newborn screening can deter parents from participating, leading to underutilization of these programs.

The stigma and discrimination associated with conditions identified through newborn screening are major barriers to the successful implementation of these programs. Anticipate a good amount of knowledge gap, as according to a survey conducted in May 2024, almost half 49% of parents did not know the conditions tested for in newborn screening tests. People don't see the detailed information available to them which can lead to confusion and anxiety when a customer receives unexpected results. In addition, 75% of parents with a child who received a positive result of newborn screening had difficulties interpreting the results of the tests, while 34% of parents who had received a positive newborn screening result did not feel sufficiently supported by medical practitioners.

In the Indian context, cultural factors further exacerbate these challenges. Deep-seated beliefs attributing health conditions to fate or karma contribute to the stigma surrounding genetic testing. Individuals may avoid these newborn screening programs for fear of social ostracization and discrimination. Additionally, fears regarding privacy and the potential misuse of genetic information for discrimination in employment or insurance heighten resistance to such testing. Addressing these issues requires comprehensive public education to demystify newborn screening and genetic testing, ensuring that parents are well-informed about the benefits and limitations. Better communication between healthcare providers and families is needed to help parents understand test results and the next steps. By putting in place policies to ensure protection against discrimination and data privacy, fears around such screenings can also be alleviated, leading to wider participation in newborn screening programs.

By Technology

The tandem mass spectrometry segment dominated the market and accounted for a 25% share in the newborn screening market in 2023. The technology's high sensitivity, specificity, and simultaneous detection of multiple disorders have contributed to this substantial market share. The advent of tandem mass spectrometry technology has revolutionized newborn screening by allowing multiple metabolic disorders to be tested on a single blood spot. Data from government statistics corroborates how significant technology like this is in newborn screening programs. For example, the U.S. Health Resources and Services Administration (HRSA) states that tandem mass spectrometry enables the detection of over 50 unique disorders, whereas previously there were only a few detectable disorders. Such expansion has resulted in the earlier diagnosis and treatment of rare but serious genetic disorders, positively impacting the health of patients for both themselves and their families.

Tandem mass spectrometry's ability to process large numbers of samples rapidly and accurately has made it a valuable tool for use in public health screening programs. As many states are now screening for 20–30 different disorders in their routine state early newborn screening panels, it is no surprise that adoption of this technology has been reported by State health departments. The cost-effectiveness of tandem mass spectrometry in detecting multiple disorders from a single test has also contributed to its widespread adoption, aligning with government efforts to improve healthcare efficiency and reduce long-term medical costs associated with late-diagnosed genetic disorders.

By Test Type

In 2023, dry blood spot tests led the newborn screening market with more than 46% of the revenue share. This substantial market share can be attributed primarily to the simplicity, cost-effectiveness, and reliability of dry blood spot testing in global newborn screening programs. The prevalence and success of dry blood spot tests are highlighted in government statistics. According to the U.S. Centers for Disease Control and Prevention (CDC), nearly all of the 4 million babies born in the United States each year undergo newborn screening using dry blood spot tests. Such a high coverage rate speaks to the accessibility of the test and acceptance of the test in healthcare systems.

According to the U.K. National Health Service (NHS), more than 97% of all newborns in 2023 were screened in the appropriate time frame for bloodspot testing, illustrating how deeply embedded the test has become in postnatal care. Dry blood spot tests, for example, can identify many disorders by analyzing a small sample, making them ideal for high-throughput screening initiatives. They are the cornerstone of newborn screening programs worldwide owing to their ease of collection, stability in transport, and ability to facilitate multiple analyses. In addition, WHO has highlighted dry blood spot testing as a pivotal component in advancing newborn screening efforts in low- and middle-income countries, emphasizing its role in global health initiatives targeting the prevention of fatal or debilitating conditions in infants that are amenable to treatment intervention.

By Product

In 2023, the instruments segment accounted for the largest market share 74%. significantly to the overall newborn screening tests, the need for specialized instruments is paramount to conduct these tests successfully and promptly in various healthcare settings. Recent government data shows the potential importance of more advanced screening instruments for newborns. According to the U.S. Health Resources and Services Administration (HRSA), advances in screening equipment have led to the successful implementation of newborn screening programs that test for more than 30 different conditions in a majority of states, a dramatic increase from just a few decades ago. These advances have enabled the expansion of newborn screening to more disorders that can be detected accurately and efficiently with sophisticated screening tools.

The increase in market share of the instruments segment is also owing to continuous government investments in upgrading newborn screening infrastructure. For example, the Centers for Disease Control and Prevention's (CDC) Newborn Screening Quality Assurance Program assists state health departments in monitoring and improving their screening which facilitates improved quality testing throughout the country. Well-maintained and well-calibrated instruments are essential to meet the high sensitivity and specificity demanded by newborn screening tests, according to data collected by the program. Furthermore, the FDA among other regulatory bodies has been highly engaged in validation, further facilitating and propelling innovation in the market. These approvals have also resulted in the advent of better, faster, and more precise screening tools which helped establish the dominance of the instruments segment in the newborn screening market.

By End User

In 2023, the clinical laboratories segment held a large share of the newborn screening market. This dominant position is mainly attributed to the key function of the clinical laboratories in the processing and analysis of all samples for newborn screening and their ability to perform high test volumes due to advanced equipment and expertise. Government data show the important role clinical laboratories play in newborn screening programs. State public health laboratories and specialized clinical laboratories process millions of newborn screening samples each year, according to the U.S. Centers for Disease Control and Prevention (CDC). In 2023, these laboratories collectively analyzed samples from approximately 98% of all newborns in the United States, demonstrating their extensive reach and capacity.

According to the Association of Public Health Laboratories (APHL), in 2023, the total number of initial screens performed by accredited newborn screening laboratories across the U.S. surpassed 4 million, although many labs also perform necessary secondary and confirmatory testing. This high volume of testing underscores the significant market share held by clinical laboratories in the newborn screening ecosystem. In addition, government policies have bolstered the role of clinical laboratories in newborn screening. For instance, the Newborn Screening Saves Lives Reauthorization Act of 2022 in the U.S. provided funding for improving laboratory quality and capacity, recognizing their critical role in early disease detection and prevention.

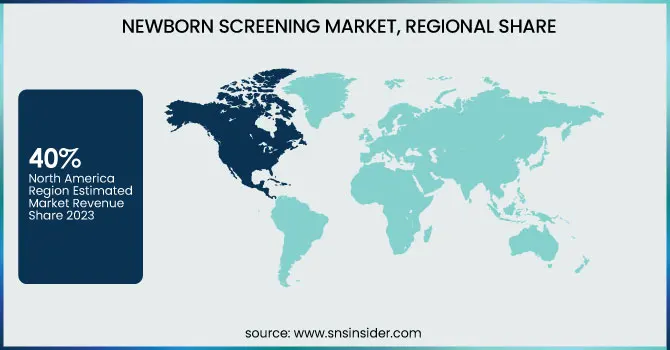

North America held the largest share of the global newborn screening market in 2023, accounting for nearly 40% of the total market share. The country is also being led due to its advanced healthcare infrastructure, high range of awareness, and strong support from governments for various newborn screening programs. According to the U.S. Centers for Disease Control and Prevention (CDC), newborn screening in the United States catches nearly 4 million infants each year, with all states screening for at least 31 of the 35 recommended core conditions.

The Asia-Pacific region is expected to register the highest CAGR during the forecast period. Such rapid growth is being attributed to increasing government initiatives, high birth rates, and rising awareness regarding early disease detection in newborns. In India, for example, the government's Rashtriya Bal Swasthya Karyakram (RBSK) program has been introducing newborn screening services throughout the country. The Indian Council of Medical Research (ICMR) states that multiple states have initiated extensive newborn screening programs and some have reached 90%+ coverage for certain conditions such as congenital hypothyroidism. China, another major player in the Asia-Pacific region, has made great progress in newborn screening. The National Health Commission of China reported in 2023 that the country's newborn screening coverage for phenylketonuria and congenital hypothyroidism exceeded 98% nationwide. This high coverage rate, combined with the large population base, contributes significantly to the region's growing market share and rapid CAGR in the newborn screening market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Service Providers/Manufacturers

PerkinElmer, Inc. (EnLite Neonatal TREC Kit, NeoBase 2 Non-Derivatized MSMS Kit)

Natus Medical Incorporated (ALGO 5 Newborn Hearing Screener, Echo-Screen III Hearing Screener)

Bio-Rad Laboratories, Inc. (Neonatal hTSH kit, VARIANT™ NBS Sickle Cell Program)

GE Healthcare (Giraffe Incubator Carestation, Corometrics 170 Series Fetal Monitor)

Thermo Fisher Scientific Inc. (Neonatal Total Galactose Kit, MassARRAY System)

Agilent Technologies, Inc. (SureScan Microarray Scanner, 2100 Bioanalyzer)

Waters Corporation (ACQUITY UPLC System, Xevo TQ-S Mass Spectrometer)

Trivitron Healthcare (Neomass AAAC Kit, Newborn Screening Software)

Baebies, Inc. (SEEKER Platform, FINDER Platform)

Medtronic plc (INVOS™ Cerebral/Somatic Oximeter, Nellcor™ Pulse Oximetry)

Masimo Corporation (Rad-97 Pulse CO-Oximeter, Pronto Pulse CO-Oximeter)

Zentech S.A. (Neonatal G6PD Assay, NeoMass AAAC Kit)

Demant A/S (AccuScreen Newborn Hearing Screener, MADSEN AccuScreen)

Hill-Rom Holdings, Inc. (Welch Allyn Spot Vision Screener, Panda Warmer)

Revvity (GSP® Neonatal Screening System, DELFIA® Xpress System)

Natera, Inc. (Panorama Non-Invasive Prenatal Test, Horizon Carrier Screening)

OZ Systems (eSP™ Newborn Screening Management Software, Telepathy CCHD Screening)

Abionic SA (IVD CAPSULE PSP, IVD CAPSULE Ferritin)

Metascreen (Metascreen Metabolic Screening Test)

Cordlife Group Limited (Metascreen Newborn Metabolic Screening, Eyescreen Paediatric Vision Screening)

Recent Developments

In November 2024, the UK National Screening Committee launched a pilot program for newborn SMA screening in select regions of England, with potential nationwide expansion.

In November 2023, Trivitron Healthcare launched "EkSahiShuruat," an initiative aimed at increasing awareness about newborn screening in India.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 880 Million |

| Market Size by 2032 | USD 1710.7 Million |

| CAGR | CAGR of 7.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments, Reagents) • By Test Type (Dry Blood Spot Test, CCHD, Hearing Screen) • By Technology (Tandem Mass Spectrometry, Pulse Oximetry, Electrophoresis, Enzyme Based Assay, DNA Assay, Others) • By End User (Hospitals, Clinical Laboratories) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PerkinElmer Inc., Natus Medical Incorporated, Bio-Rad Laboratories Inc., GE Healthcare, Thermo Fisher Scientific Inc., Agilent Technologies Inc., Waters Corporation, Trivitron Healthcare, Baebies Inc., Medtronic plc, Masimo Corporation, Zentech S.A., Demant A/S, Hill-Rom Holdings Inc., Revvity, Natera Inc., OZ Systems, Abionic SA, Metascreen, Cordlife Group Limited. |

Ans. The projected market size for the Newborn Screening Market is USD 1710.7 Million by 2032.

Ans: The North American region dominated the Newborn Screening Market in 2023.

Ans. The CAGR of the Newborn Screening Market is 7.68% During the forecast period of 2024-2032.

Ans: • Advancements in genetic testing technologies have enabled early detection of various congenital conditions, prompting higher demand for newborn screening programs.

Ans: The Dry Blood Spot Test, Test Type segment dominated the Newborn Screening Market.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of Congenital Disorders (2023)

5.2 Screening Test Adoption Rates (2023), by Region

5.3 Healthcare Spending on Newborn Screening, by Source (Government, Private, Out-of-Pocket) (2023)

5.4 Growth in Usage of Advanced Screening Technologies (2020-2032)

5.5 Regulatory and Compliance Trends, by Region (2023)

5.6 Market Trends in Screening Kits and Devices (2023-2032)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Newborn Screening Market Segmentation, By Product

7.1 Chapter Overview

7.2 Instruments

7.2.1 Instruments Market Trends Analysis (2020-2032)

7.2.2 Instruments Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Reagents

7.3.1 Reagents Market Trends Analysis (2020-2032)

7.3.2 Reagents Market Size Estimates and Forecasts to 2032 (USD Million)

8. Newborn Screening Market Segmentation, By Test Type

8.1 Chapter Overview

8.2 Dry Blood Spot Test

8.2.1 Dry Blood Spot Test Market Trends Analysis (2020-2032)

8.2.2 Dry Blood Spot Test Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 CCHD

8.3.1 CCHD Market Trends Analysis (2020-2032)

8.3.2 CCHD Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Hearing Screen

8.4.1 Hearing Screen Market Trends Analysis (2020-2032)

8.4.2 Hearing Screen Market Size Estimates and Forecasts to 2032 (USD Million)

9. Newborn Screening Market Segmentation, By Technology

9.1 Chapter Overview

9.2 Tandem Mass Spectrometry

9.2.1 Tandem Mass Spectrometry Market Trends Analysis (2020-2032)

9.2.2 Tandem Mass Spectrometry Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Pulse Oximetry

9.3.1 Pulse Oximetry Market Trends Analysis (2020-2032)

9.3.2 Pulse Oximetry Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Electrophoresis

9.4.1 Electrophoresis Market Trends Analysis (2020-2032)

9.4.2 Electrophoresis Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Enzyme Based Assay

9.5.1 Enzyme Based Assay Market Trends Analysis (2020-2032)

9.5.2 Enzyme Based Assay Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 DNA Assay

9.6.1 DNA Assay Market Trends Analysis (2020-2032)

9.6.2 DNA Assay Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Newborn Screening Market Segmentation, By End User

10.1 Chapter Overview

10.2 Hospitals

10.2.1 Hospitals Market Trends Analysis (2020-2032)

10.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 Clinical Laboratories

10.3.1 Clinical Laboratories Market Trends Analysis (2020-2032)

10.3.2 Clinical Laboratories Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Newborn Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.2.4 North America Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.2.5 North America Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.2.6 North America Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.2.7.2 USA Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.2.7.3 USA Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.2.7.4 USA Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.2.7 Canada

11.2.7.1 Canada Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.2.7.2 Canada Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.2.7.3 Canada Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.2.7.3 Canada Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.2.8 Mexico

11.2.8.1 Mexico Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.2.8.2 Mexico Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.2.8.3 Mexico Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.2.8.3 Mexico Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Newborn Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.1.4 Eastern Europe Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.1.6 Poland

11.3.1.6.1 Poland Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.1.6.2 Poland Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.1.6.3 Poland Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.1.6.3 Poland Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.1.7 Romania

11.3.1.7.1 Romania Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.1.7.2 Romania Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.1.7.3 Romania Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.1.7.3 Romania Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.1.8 Hungary

11.3.1.8.1 Hungary Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.1.8.2 Hungary Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.1.8.3 Hungary Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.1.8.3 Hungary Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.1.9 Turkey

11.3.1.9.1 Turkey Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.1.9.2 Turkey Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.1.9.3 Turkey Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.1.9.3 Turkey Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Newborn Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.2.4 Western Europe Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.2.5 Western Europe Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.2.5 Western Europe Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.2.6 Germany

11.3.2.6.1 Germany Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.2.6.2 Germany Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.2.6.3 Germany Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.2.6.3 Germany Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.2.7 France

11.3.2.7.1 France Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.2.7.2 France Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.2.7.3 France Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.2.7.3 France Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.2.8 UK

11.3.2.8.1 UK Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.2.8.2 UK Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.2.8.3 UK Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.2.8.3 UK Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.2.9 Italy

11.3.2.9.1 Italy Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.2.9.2 Italy Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.2.9.3 Italy Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.2.9.3 Italy Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.2.11.2 Spain Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.2.11.3 Spain Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.2.11.3 Spain Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.2.11 Netherlands

11.3.2.11.1 Netherlands Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.2.11.2 Netherlands Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.2.11.3 Netherlands Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.2.11.3 Netherlands Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.2.12 Switzerland

11.3.2.12.1 Switzerland Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.2.12.2 Switzerland Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.2.12.3 Switzerland Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.2.12.3 Switzerland Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.2.13 Austria

11.3.2.13.1 Austria Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.2.13.2 Austria Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.2.13.3 Austria Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.2.13.3 Austria Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.3.2.14 Rest of Western Europe

11.3.2.14.1 Rest of Western Europe Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.3.2.14.2 Rest of Western Europe Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.3.2.14.3 Rest of Western Europe Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.3.2.14.3 Rest of Western Europe Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Newborn Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia Pacific Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.4.4 Asia Pacific Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.4.5 Asia Pacific Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.4.5 Asia Pacific Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.4.6 China

11.4.6.1 China Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.4.6.2 China Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.4.6.3 China Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.4.6.3 China Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.4.7 India

11.4.7.1 India Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.4.7.2 India Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.4.7.3 India Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.4.7.3 India Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.4.8 Japan

11.4.8.1 Japan Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.4.8.2 Japan Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.4.8.3 Japan Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.4.8.3 Japan Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.4.9 South Korea

11.4.9.1 South Korea Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.4.9.2 South Korea Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.4.9.3 South Korea Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.4.9.3 South Korea Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.4.11.2 Vietnam Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.4.11.3 Vietnam Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.4.11.3 Vietnam Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.4.11 Singapore

11.4.11.1 Singapore Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.4.11.2 Singapore Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.4.11.3 Singapore Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.4.11.3 Singapore Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.4.12 Australia

11.4.12.1 Australia Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.4.12.2 Australia Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.4.12.3 Australia Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.4.12.3 Australia Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.4.13 Rest of Asia Pacific

11.4.13.1 Rest of Asia Pacific Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.4.13.2 Rest of Asia Pacific Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.4.13.3 Rest of Asia Pacific Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.4.13.3 Rest of Asia Pacific Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Newborn Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.5.1.4 Middle East Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.5.1.5 Middle East Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.5.1.5 Middle East Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.5.1.6 UAE

11.5.1.6.1 UAE Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.5.1.6.2 UAE Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.5.1.6.3 UAE Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.5.1.6.3 UAE Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.5.1.7 Egypt

11.5.1.7.1 Egypt Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.5.1.7.2 Egypt Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.5.1.7.3 Egypt Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.5.1.7.3 Egypt Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.5.1.8 Saudi Arabia

11.5.1.8.1 Saudi Arabia Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.5.1.8.2 Saudi Arabia Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.5.1.8.3 Saudi Arabia Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.5.1.8.3 Saudi Arabia Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.5.1.9 Qatar

11.5.1.9.1 Qatar Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.5.1.9.2 Qatar Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.5.1.9.3 Qatar Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.5.1.9.3 Qatar Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Newborn Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.5.2.4 Africa Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.5.2.5 Africa Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.5.2.8.3 Africa Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.5.2.6 South Africa

11.5.2.6.1 South Africa Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.5.2.6.2 South Africa Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.5.2.6.3 South Africa Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.5.2.8.3 South Africa Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.5.2.7 Nigeria

11.5.2.7.1 Nigeria Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.5.2.7.2 Nigeria Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.5.2.7.3 Nigeria Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.5.2.8.3 Nigeria Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.5.2.8 Rest of Africa

11.5.2.8.1 Rest of Africa Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.5.2.8.2 Rest of Africa Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.5.2.8.3 Rest of Africa Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.5.2.8.3 Rest of Africa Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Newborn Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.6.4 Latin America Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.6.5 Latin America Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.6.5 Latin America Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.6.6 Brazil

11.6.6.1 Brazil Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.6.6.2 Brazil Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.6.6.3 Brazil Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.6.6.3 Brazil Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.6.7 Argentina

11.6.7.1 Argentina Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.6.7.2 Argentina Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.6.7.3 Argentina Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.6.7.3 Argentina Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.6.8 Colombia

11.6.8.1 Colombia Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.6.8.2 Colombia Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.6.8.3 Colombia Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.6.8.3 Colombia Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

11.6.9 Rest of Latin America

11.6.9.1 Rest of Latin America Newborn Screening Market Estimates and Forecasts, By Product (2020-2032) (USD Million)

11.6.9.2 Rest of Latin America Newborn Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Million)

11.6.9.3 Rest of Latin America Newborn Screening Market Estimates and Forecasts, By Technology (2020-2032) (USD Million)

11.6.9.3 Rest of Latin America Newborn Screening Market Estimates and Forecasts, By End User (2020-2032) (USD Million)

12. Company Profiles

12.1 PerkinElmer Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Natus Medical Incorporated

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Bio-Rad Laboratories Inc.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 GE Healthcare

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Thermo Fisher Scientific Inc.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Agilent Technologies Inc.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Waters Corporation

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Trivitron Healthcare

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Baebies Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Medtronic plc

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Instruments

Reagents

By Test Type

Dry Blood Spot Test

CCHD

Hearing Screen

By Technology

Tandem Mass Spectrometry

Pulse Oximetry

Electrophoresis

Enzyme Based Assay

DNA Assay

Others

By End User

Hospitals

Clinical Laboratories

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Robotic Radiotherapy Market Size was valued at USD 1.15 Bn in 2023 and is expected to reach USD 3.18 Bn by 2032 and grow at a CAGR of 12.02% over the forecast period 2024-2032.

The Gene Therapy Market Size was valued at USD 9.2 Billion in 2023, and is expected to reach USD 54.39 Billion by 2032, and grow at a CAGR of 23.12%.

Digital Dentistry Market size valued at USD 6.96 billion in 2023, expected to reach USD 17.20 billion by 2032, growing at a CAGR of 10.60% from 2024 to 2032.

The Wireless Health Market Size was valued at USD 198.7 Billion in 2023 and is expected to reach USD 896.3 Billion by 2032, growing at a CAGR of 18.2% over the forecast period 2024-2032.

The Nucleic Acid Isolation and Purification Market Size was valued at USD 6.60 Billion in 2023 and is expected to reach USD 16.38 Billion by 2032 and grow at a CAGR of 11.18% over the forecast period 2024-2032.

Disposable Syringes Market Size was valued at USD 14.7 Billion in 2023 and is expected to reach USD 29.06 billion by 2032, growing at a CAGR of 7.88% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone