Get More Information on Neuromorphic Computing Market - Request Sample Report

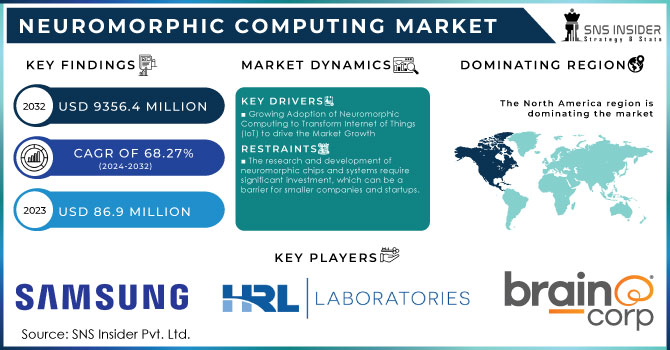

Neuromorphic Computing market size was valued at USD 86.9 Million in 2023. It is expected to Reach USD 9356.4 Million by 2032 and grow at a CAGR of 68.27% over the forecast period of 2024-2032.

The growth of the market is attributed to an increase in applications for neuromorphic technology such as deep learning, transistors and accelerators, next-generation semiconductors; autonomous systems including robotics drones, self-driving cars and artificial intelligence. For instance, in August 2023 a diverse consortium of researchers completed NeuRRAM - an all-new neuromorphic chip capable to simultaneously run various AI applications with greater precision and reduced energy consumption than equivalent possibilities. The integration of neuromorphic technology, along with AI and machine learning, has the potential to bolster the processing capabilities of defence systems and deliver rapid analytical insights to facilitate timely wartime decision-making. The technology is more energy saving, which can lead to better transportability (mobility, endurance and operation time) and portable for a soldier on field. Intel Corporation plans to install a Loihi chip to enable faster sensing by processing signals of biological nature from the camera, like neuromorphic technology in drone cameras. This means that complex algorithms running on robots can work efficiently using neuromorphic computing and so improve robotic systems efficiency both in terms of performance as well energy consumption. In September 2022, Intel Corporation, the Italian Institute of Technology, and the Technical University of Munich collaborated to unveil a novel approach to object learning utilizing neural networks. This joint effort aims to streamline and speed up robots acquiring knowledge about new objects upon deployment in various work environments.

Increasing use of machine learning, AI and higher I.P. is helps to drive the growth of Neuromorphic Computing Market. Enormous improvements are seen in neuromorphic computing technology. IBM's AI chip, launched in January 2023, uses 7nm technology for enhanced energy efficiency. This popular Swiss start-up's processors can cater for anywhere up to 1,000 frames per second - making SynSense a real-time solution. In October 2023, SiLC Technologies’ Launched Eyeonic Vision System delivers distance precision beyond 1,000 meters at the millimeter level. The chips from Eindhoven University that can detect cystic fibrosis with more than 90% accuracy. Working together with Lorser Industries, Brain Chip has achieved up to a >50% improvement in processing speed and energy efficiency on software defined radios — demonstrating the incredible transformative capabilities of neuromorphic computing across industries.

Drivers

Growing Adoption of Neuromorphic Computing to Transform Internet of Things (IoT) to drive the Market Growth

The ability of neuromorphic systems to process large amounts of data quickly and efficiently supports real-time applications in autonomous vehicles, robotics, and AI-driven systems.

The integration of neuromorphic computing with artificial intelligence and machine learning enhances the performance and capabilities of AI applications, driving demand across various sectors.

Neuromorphic computing's low-power and on-device processing capabilities make it well-suited for edge computing applications, reducing latency and improving performance in devices like smart sensors and autonomous systems.

Neuromorphic technology's potential in medical diagnostics and healthcare, such as biosensors for disease detection, propels market growth through improved diagnostic accuracy and speed.

The neuromorphic computing is having capability to pull data from many IoT devices, this technology is great for use in home automation applications as well as self-driving cars and health diagnostics. Neuromorphic computing allows AI algorithms to operate on effective network architectures and speedy data processing. Self-driving cars are one case that learns from other traffic to make faster decisions, and automated homes that adjust temperature and lighting based on the habits of people living in them. Furthermore, neuromorphic computing also reinforces IoT security by acting as an AI that help to identify any phishing or malicious activity. At CES 2024, Innatera introduced the Spiking Neural Processor T1 originating in neuromorphic microcontroller conceived for battery-operated AI running on a sensor-edge like smart homes accessories or wearables aiming energy efficiency IoT applications. For real-time processing algorithms with low power constraints, neuromorphic computing largely benefits AI and ML applications which they tend to be complementary such as autonomous systems, computer vision or natural language processing. Ideal use for this is IoT devices, robotics & autonomous vehicles. Areas are working towards full automation initiatives to drive efficiencies and improve quality. The ability of a neuromorphic chip can be employed in areas such as the military and cybersecurity for detecting anomalies, Image/object recognition e.g., by analyzing network traffic patterns. In September 2023, BrainChip Holdings Ltd worked with VVDN Technologies to help provide an Edge box that was powered by their very own Akida neuromorphic processors for it extend Edge AI capabilities.

Restraints

The research and development of neuromorphic chips and systems require significant investment, which can be a barrier for smaller companies and startups.

Designing neuromorphic systems that mimic the human brain's architecture and functionality is complex and challenging, slowing down widespread adoption.

The absence of industry standards for neuromorphic computing technologies can hinder interoperability and integration with existing systems and platforms.

The growing costs to design advanced chips and systems is the major restrain for growth of market. A new neuromorphic computer platform is a multimillion-dollar research and development (R&D) proposition globally. An entirely new neuromorphic chip, if developed from scratch by companies building it could cost just more than $50 million in advanced fabrication facilities and other operational expenses including material costs with specialized talent that a design would require. Much of the added cost comes from their complex nature, which often leads to new classes of materials and novel architectures. Moreover, the complex design and testing stages brings with it high costs and a time-suck. The high-cost barrier may discourage smaller companies and startups from entering the market, inhibiting competition/innovation in this area. Consequently, the rate of progress and adoption for neuromorphic computing could be slower than other more cost-effective technologies.

Segment Analysis

By Application

The image processing segment accounted for the largest market share of over 43% in 2023. This is because the computer vision has expanded across industries like automotive, healthcare and media & entertainment. A similar endpoint is the medical imaging which a significant facet of this sector. During the forecast period, image sensors and processing technologies are projected to support growth of revenue generation via Image Processing. Image processing is primarily about reducing visual information for the purpose of making it suitable for computer vision tasks, such as image recognition in this case to make subsequent steps much easier and more efficient. by being closer in operation to how the human brain works, it can give computers a much-needed boost in terms of understanding data and then converting that into an analysis. Artificial neural network models are also rising in popularity which aims at image processing and fast computation through the use of parallel architectures.

The signal-processing application segment held a market share of 26.5% in the year 2023 and is poised to register solid growth it generates revenue more efficiently during the forecast period Increasing need to process audio and acoustic signals is driving the signal-processing segment. The market is expected to grow during the forecast period with increasing adoption of Artificial Intelligence and Machine Learning across IT industry which in turn will favor the data processing segment. One of the top AI trends for organizations is autoML (automatic machine learning).

By End-Use

Consumer electronics was the leading segment in 2023, accounted for more than 56.5% share of revenue This is increasing the demand for neuromorphic chips in consumer electronics, where various electronic devices including laptops/PCs/tablets have gained popularity. Miniaturization of ICS stems from the demand for smaller and cheaper products according to consumer preferences, which subsequently drives growth in the global neuromorphic chip market.

Over the forecast frame, generating revenue from the automotive industry is projected to increase with significant growth rate. Many industries are using AI (Artificial Intelligence) and ML (Machine Learning) to automate the operations which help them in offering more efficient & quality products. Moreover, the growing adoption of AI and ML as a result faster speed, low power consumption, and efficient memory usage by these technologies is accelerating growth in automotive segment. This trend clearly shows how neuromorphic chips play a significant part in upgrading the function as well as capacity of automotive applications such as autonomous driving, and advanced driver-assistance systems (ADAS).

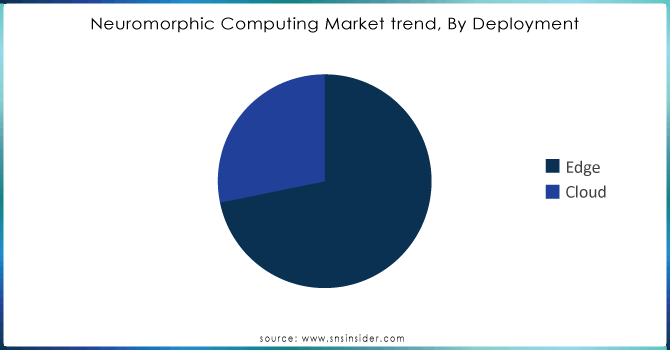

By Deployment

Edge segment led the market in 2023, accounted 71.8% of revenue share Growth of the segment is attributed to rise in adoption of edge computing for applications including touchless interfaces, voice-controlled cars and smart assistant robots. The increasing adoption of wireless networking will, in turn, raise interest towards the edge computing paradigm which is set to foster growth with respect to this vertical as more service providers look at hosting applications closer (or within) their end-user base. Edge computing is also being embraced at scale world over with the new generation of AI hardware supporting low-power applications and in-device adaptability fuelling broader market expansion beyond conventional micro data centres.

The cloud computing offers various technological benefits and expected to grow with fastest CAGR during the forecast period is expected in. These include a scalable data-managing platform for enterprise with secure one-click big-data storage and distribution. Cloud-based neuromorphic computing has the advantages of easy resource scaling, low initial hardware and software investment costs for users to share their workloads on demand with others around the world. Latency and security issues might serve as potential obstacles. The advancement in neuromorphic computing systems employ more powerful on-device processing capabilities mitigating the need for data canters and supporting expansion in cloud computing segment as well. The advantages of cloud computing, coupled with neuromorphic technology are appealing to the enterprise.

Need any customization research on Neuromorphic Computing market - Enquiry Now

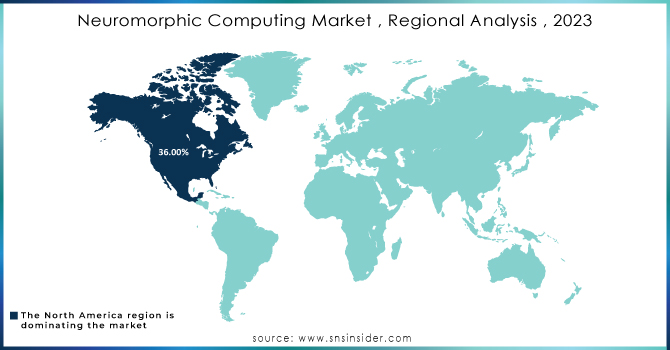

Regional analysis

North America dominated the market with revenue a share of more than 36% in the market during 2023 This is because, the US and Canada have deployed a significant number of neuromorphic computing applications earlier than other regions that puts them in leading position to drive change. One of the significant trends in North America is the movement toward AI-powered voice and speech recognition which has improved quality of various of speech engines for better user experience. During the forecast period, Europe is anticipated to witness substantial growth. The sector is home to several programmes and institutions oriented towards neuromorphic computing. Moreover, increasing adoption of biometric systems across various European countries is creating potential growth opportunities for the application areas in image processing utilizing neuromorphic computing. Europe's commitment to neuromorphic computing positions it as a key player in the field, provide many opportunities for companies and academics ready to innovate around this rapidly evolving technology

The major players are General Vision, Inc., Samsung Electronics Co., Ltd, Brain Corporation, HRL Laboratories LLC, Knowm Inc., BrainChip Holdings Ltd., International Business Machines Corporation, Hewlett Packard Company, Intel Corporation, CEA-Leti, Qualcomm Technologies, Inc, Vicarious FPC, Inc., Applied Brain Research Inc., and others in the final report.

IBM came up with an AI Chip built using 7nm technology that was so power efficient at, back in January,2023. The AI hardware accelerator chip offers state-of-the-art power efficiency and supports a wide range of model types. It is scalable from training large scale models in the cloud all the way down to enhancing security and privacy by bringing training closer to edge devices, allowing data almost never touching it's source.

In February SynSense combined forces with iniVation to address the rising demand for intelligent vision in high-performance consumer and industrial markets. Collaboration to develop neuromorphic technology for standalone processors, vision sensors and systems with integrated compute in sensor offering use cases across robotics, automotive consumer devices powered by the company’s edge AI product gallery.

SiLC Technologies October 2023, Eyeonic Vision System FMCW LiDAR Machine Vision The system supports rapid and accurate object identification, as well as the detection of polarization intensities and 3D distance to an accuracy of millimeters in distances greater than one kilometer.

The method for training neuromorphic chips to recognise cystic fibrosis using a biosensor was created by Dutch research scientists from Eindhoven University of Technology in September 2023. The "smart biosensor" has the potential for many point-of-care healthcare applications and could also be useful in enabling chips to automatically adjust themselves to their environments.

BrainChip Holdings Ltd. entered a collaboration with one of its technology partners, Lorser Industries Inc., for Neuromorphic computing arrangements in June 2023. In addition, the partnership gives BrainChip its first development deal for Akida in software-defined radio (SDR).

| Report Attributes | Details |

| Market Size in 2023 | USD 23.16 Bn |

| Market Size by 2032 | USD 81.12 Bn |

| CAGR | CAGR of 90% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software) • By Application (Signal Processing, Image Processing, Data Processing, Object Detection, Others) • By Deployment (Edge, Cloud) • By End-Use (Consumer Electronics, Automotive, Healthcare, Military & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | General Vision, Inc., Samsung Electronics Co., Ltd, Brain Corporation, HRL Laboratories LLC, Knowm Inc., BrainChip Holdings Ltd., International Business Machines Corporation, Hewlett Packard Company, Intel Corporation, CEA-Leti, Qualcomm Technologies, Inc, Vicarious FPC, Inc., Applied Brain Research Inc. |

| Key Drivers | • Growing Adoption of Neuromorphic Computing to Transform Internet of Things (IoT) to drive the Market Growth • The ability of neuromorphic systems to process large amounts of data quickly and efficiently supports real-time applications in autonomous vehicles, robotics, and AI-driven systems. |

| Market Restraints | • The research and development of neuromorphic chips and systems require significant investment, which can be a barrier for smaller companies and startups. |

Ans: The North American region is dominating the Neuromorphic Computing Market.

Ans: The Neuromorphic Computing Market is to grow at a CAGR of 86.27% Over the forecast period of 2024-2032.

Ans: The Neuromorphic Computing Market size was valued at USD 86.9 Mn in 2023

Ans. The forecast period for the Neuromorphic Computing Market is 2024-2032.

Ans. There are four segments cover in this report, By Component, By Application, By Deployment, By End-Use.

Table Of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Patent Analysis, 2023

5.2 Market Share by Key Technology Players, 2023

5.3 Workforce & Skill Trends, 2023

5.4 Government & Policy Impact

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Neuromorphic Computing Market Segmentation, By Application

7.1 Chapter Overview

7.2 Signal Processing

7.2.1 Signal Processing Market Trends Analysis (2020-2032)

7.2.2 Signal Processing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Image Processing

7.3.1 Image Processing Market Trends Analysis (2020-2032)

7.3.2 Image Processing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Data Processing

7.4.1 Data Processing Market Trends Analysis (2020-2032)

7.4.2 Data Processing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Object Detection

7.5.1 Object Detection Market Trends Analysis (2020-2032)

7.5.2 Object Detection Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Neuromorphic Computing Market Segmentation, By Deployment

8.1 Chapter Overview

8.2 Cloud

8.2.1 Cloud Market Trends Analysis (2020-2032)

8.2.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Edge

8.3.1 Edge Market Trends Analysis (2020-2032)

8.3.2 Edge Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Neuromorphic Computing Market Segmentation, By Component

9.1 Chapter Overview

9.2 Hardware

9.2.1 Hardware Market Trends Analysis (2020-2032)

9.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Software

9.3.1 Software Market Trends Analysis (2020-2032)

9.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Neuromorphic Computing Market Segmentation, By End-Use

10.1 Chapter Overview

10.2 Consumer Electronics

10.2.1 Consumer Electronics Market Trends Analysis (2020-2032)

10.2.2 Consumer Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Automotive

10.3.1 Automotive Market Trends Analysis (2020-2032)

10.3.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Healthcare

10.4.1 Healthcare Market Trends Analysis (2020-2032)

10.4.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Military & defiance

10.5.1 Military & defiance Market Trends Analysis (2020-2032)

10.5.2 Military & defiance Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Others

10.6.1 Others Market Trends Analysis (2020-2032)

10.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Neuromorphic Computing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.4 North America Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.5 North America Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.6 North America Neuromorphic Computing Market Estimates and Forecasts, By End-Use(2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.7.2 USA Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.7.3 USA Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.4 USA Neuromorphic Computing Market Estimates and Forecasts, By End-Use(2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.8.2 Canada Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.8.3 Canada Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.8.4 Canada Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.9.2 Mexico Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.9.3 Mexico Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.9.4 Mexico Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Neuromorphic Computing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Neuromorphic Computing Market Estimates and Forecasts, By End-Use(2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.7.2 Poland Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.7.3 Poland Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.7.4 Poland Neuromorphic Computing Market Estimates and Forecasts, By End-Use(2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.8.2 Romania Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.8.3 Romania Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.8.4 Romania Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Neuromorphic Computing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.4 Western Europe Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.5 Western Europe Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.6 Western Europe Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.7.2 Germany Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.7.3 Germany Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.7.4 Germany Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.8.2 France Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.8.3 France Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.8.4 France Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.9.2 UK Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.9.3 UK Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.9.4 UK Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.10.2 Italy Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.10.3 Italy Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.10.4 Italy Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.11.2 Spain Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.11.3 Spain Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.4 Spain Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.14.2 Austria Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.14.3 Austria Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.14.4 Austria Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Neuromorphic Computing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.4 Asia Pacific Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.5 Asia Pacific Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.6 Asia Pacific Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.7.2 China Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.7.3 China Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.7.4 China Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.8.2 India Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.8.3 India Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.8.4 India Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.9.2 Japan Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.9.3 Japan Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.9.4 Japan Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.10.2 South Korea Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.10.3 South Korea Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.10.4 South Korea Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.11.2 Vietnam Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.11.3 Vietnam Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.4 Vietnam Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.12.2 Singapore Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.12.3 Singapore Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.12.4 Singapore Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.13.2 Australia Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.13.3 Australia Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.13.4 Australia Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Neuromorphic Computing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.4 Middle East Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.5 Middle East Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.6 Middle East Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.7.2 UAE Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.7.3 UAE Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.7.4 UAE Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Neuromorphic Computing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.4 Africa Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.5 Africa Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.6 Africa Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Neuromorphic Computing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.4 Latin America Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.5 Latin America Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.6 Latin America Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.7.2 Brazil Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.7.3 Brazil Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.7.4 Brazil Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.8.2 Argentina Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.8.3 Argentina Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.8.4 Argentina Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.9.2 Colombia Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.9.3 Colombia Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.9.4 Colombia Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Neuromorphic Computing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Neuromorphic Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Neuromorphic Computing Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Neuromorphic Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12. Company Profiles

12.1 General Vision, Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Samsung Electronics Co., Ltd.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Brain Corporation

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 HRL Laboratories LLC

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Knowm Inc.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 BrainChip Holdings Ltd.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 International Business Machines Corporation

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Hewlett Packard Company

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Intel Corporation

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 CEA-Leti

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Hardware

Software

By Application

Signal Processing

Image Processing

Data Processing

Object Detection

Others

By Deployment

Edge

Cloud

By End-Use

Consumer Electronics

Automotive

Healthcare

Military & defiance

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Digital Map Market was valued at USD 21.3 billion in 2023 and is expected to reach USD 67.8 billion by 2032, growing at a CAGR of 13.8% by 2032.

The Exposure Management Market Size was valued at USD 1.99 billion in 2023 and is expected to reach USD 15.11 billion by 2032 and grow at a CAGR of 25.3% over the forecast period 2024-2032.

The Aquaponics Market was valued at USD 1.5 Billion in 2023 and is expected to reach USD 4.7 Billion by 2032, growing at a CAGR of 13.83% by 2032.

The Terahertz Technology Market was valued at USD 1.0 billion in 2023 and is expected to reach USD 4.5 billion by 2032, growing at a CAGR of 18.49% from 2024-2032.

The Crypto Wallet Market size was valued at USD 9.95 Billion in 2023 & It is estimated to reach USD 74.52 Billion by 2032, growing at a CAGR of 25.09% over the forecast period of 2024-2032.

The AI Agents Market Size was valued at USD 3.7 Billion in 2023 and is expected to reach USD 103.6 Billion by 2032, growing at a CAGR of 44.9% by 2024-2032.

Hi! Click one of our member below to chat on Phone