Get more information on Neuromorphic Chip Market - Request Sample Report

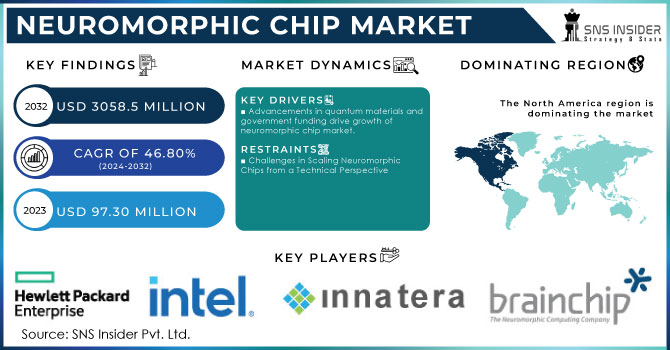

Neuromorphic Chip Market Size was valued at USD 97.30 Million in 2023 and is expected to reach USD 3058.5 Million by 2032 and grow at a CAGR of 46.80% over the forecast period 2024-2032.

The Neuromorphic chip market is seeing a substantial increase in growth due to progress in artificial intelligence (AI) and the growing need for computing systems that can mimic the human brain's information processing capabilities. The market's potential is exemplified by the recent creation of a large-scale Neuromorphic computer that operates 50 times faster and uses 100 times less energy than traditional systems. Equipped with more than 1,000 AI chip designed for specialized tasks, this system features 1.15 billion artificial neurons and 128 billion artificial synapses, enabling it to execute 20 quadrillion operations per second. This advancement in Neuromorphic computing, which involves combining processing power and memory, allows for parallel processing and lowers energy usage, transforming the way AI tasks are handled. Neuromorphic chip have an energy efficiency rating of 15 trillion operations per watt (TOPS/W), surpassing typical neural processing units, and are set to transform AI research and applications. As Neuromorphic computing advances further, it is anticipated to have a significant impact on the advancement of future AI technology, specifically in the creation of extensive language models that can adapt to new data seamlessly, therefore lessening the training workload of existing AI implementations. Continued research efforts and possible commercial uses are fueling the growth of the Neuromorphic chip market, showing a promising upward trend. The worldwide creation and use of comparable Neuromorphic systems by research organizations demonstrate the global enthusiasm for this technology and its ability to revolutionize multiple industries. As the capabilities and size of these systems grow, the Neuromorphic chip industry is expected to quickly grow, fostering advancements in AI and other interconnected industries.

The Neuromorphic chip Market is set to experience significant expansion thanks to advancements in Spiking Neural Networks (SNNs) and the creation of innovative instruction set architectures that challenge conventional computing limits. The market's potential is showcased by the recent development of a high-capacity Neuromorphic chip that can accommodate more than 2 million neurons and 100 million synapses on one chip. This advancement in Neuromorphic computing, which tackles crucial issues like scalability, flexibility, and on-chip learning, represents a major milestone. Different from traditional neural networks, SNNs work with discrete, event-based signals that closely imitate the biological processes of the brain, enabling specialized Neuromorphic chip to effectively manage dynamic environments and new data. The debut of a fresh instruction set architecture (ISA) allows for quick state changes and loading of parameters, making it easier to build intricate neural models and learning regulations. Additionally, the improved connectivity mechanism greatly enhances on-chip storage efficiency, establishing a solid hardware base for constructing neural networks at a brain-scale level. These developments make Neuromorphic chip an essential solution in the post-Moore era, tackling storage and power limitations that traditional computing designs find difficult to conquer. As scientists further develop these chip by incorporating on-chip learning capacities for real-time adaptation and enhancement, the Neuromorphic chip industry is projected to grow quickly, fostering advancements in artificial intelligence and related sectors. The rise is also backed by the rising use of Neuromorphic computing in different sectors, as these chip provide unmatched efficiency and scalability for intricate AI tasks. The ongoing development of Neuromorphic chip, like the Darwin 3, highlights their ability to transform AI and computing, establishing them as a key element in upcoming technological advancements.

The growth of the Neuromorphic chip market is being fueled by advancements in quantum materials and large investments from the government to develop energy-efficient computing systems that imitate the complexity of the human brain. One key factor driving progress is the DOE's strategic funding efforts, like the USD 2 million granted in 2020 for five risky but potentially rewarding research endeavors in Neuromorphic computing. These initiatives, chosen through the DOE's call for proposals "Neuromorphic Computing for Accelerating Scientific Discovery," aim to create brain-mimicking software and power-saving hardware in a two-year timeframe. Moreover, the DOE's dedication to this area is highlighted by the USD 12.6 million in continued support for the Quantum Materials for Energy Efficient Neuromorphic Computing (Q-MEEN-C) center, which is directed by the University of California San Diego. This facility is leading research on quantum materials, a type of new materials with intricate quantum behaviors that could lead to more energy-efficient Neuromorphic computing. The Q-MEEN-C's efforts showcase the overall shift in the Neuromorphic chip industry towards utilizing quantum materials to address the constraints of existing semiconductor technologies. These resources are viewed as crucial in boosting computational ability and decreasing local energy usage, thus making neuromorphic chip more feasible and expandable for upcoming AI purposes. The DOE's financial commitment in this field speeds up scientific advancements and establishes neuromorphic chip as a vital part of future computing technologies, fueling market expansion as industries demand smarter, eco-friendly options.

The growth of the neuromorphic chip market is quick due to advancements in spike-based dynamic computing and the creation of highly energy-efficient systems. The introduction of the "Speck" chip highlights the importance of combining spiking neural networks (SNNs) with dynamic computing mechanisms. The Speck chip, which can work with a low standby power of 0.42 mW and real-time power as low as 0.70 mW, is a significant advancement in neuromorphic computing. This chip mimics the brain's neural activity patterns by using asynchronous event-driven processing and sparse, dynamic input handling to achieve significant energy efficiency. The Speck chip demonstrates how sophisticated neuromorphic systems can effectively control energy usage by dealing with the "dynamic imbalance" in SNNs and integrating attention-based frameworks. Innovations play a vital role in satisfying the rising need for energy-efficient, high-performing computing options in fields such as autonomous systems and edge computing. This expansion is also backed by significant funding from public and private sources. The U.S. Department of Energy's current funding efforts to promote neuromorphic computing technologies illustrate the important impact of these innovations on market growth. The advancement of energy-efficient chips such as Speck not only boosts computing power but also follows overall industry movement towards greener and more effective computing options, reinforcing the neuromorphic chip market's lead in technological progress.

Restraints

There are major technical hurdles that must be overcome for neuromorphic computing technology to be widely utilized on a large scale. One significant challenge is making sure that neuromorphic chips are able to handle a variety of intricate tasks with great dependability. These chips aim to replicate the brain's neural structure using spiking neural networks (SNNs), necessitating accurate simulation of neuron-synapse connections. Creating precise and effective neuron-synapse models is challenging because of the complex structure of biological neural networks, which requires simulating different types of neurons and synapses with great accuracy. Moreover, neuromorphic chips need to keep power usage low while managing significant computational requirements. Efficiency in power is crucial due to the significant energy demands linked to extensive neural computations. The difficulty is in finding a balance between high processing power and low energy consumption, as neuromorphic chips are anticipated to surpass traditional computer systems in terms of energy efficiency. Handling changing and varied input data in real-time, while maintaining reliable performance and stability, continues to be a major hurdle. The complexity and cost are increased by the requirement for specialized materials and manufacturing processes in order to create neuromorphic chips. Dealing with these technical obstacles requires continuous research and innovation to enhance the design, features, and scalability of neuromorphic chips.

Segment Analysis

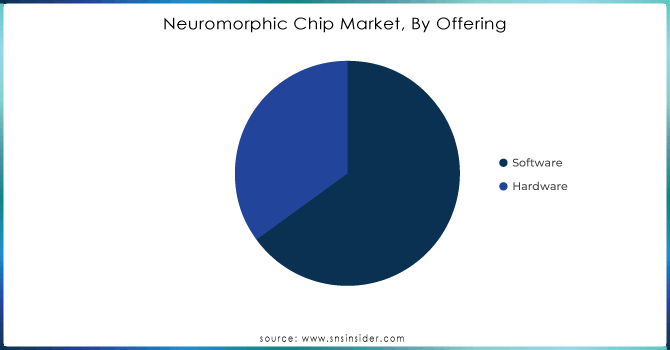

By Offering

In 2023, software holds the majority revenue share at 65% in the neuromorphic chip market, demonstrating its critical importance in the advancement and implementation of these sophisticated computer systems. The rise in dominance is due to the growing complexity of neuromorphic systems, necessitating advanced software to maximize their hardware capabilities. Businesses are making great progress in this field by creating advanced software platforms that improve the performance and effectiveness of neuromorphic chips. An example is IBM releasing software tools that aim to enhance the TrueNorth neuromorphic chip's performance, replicating the brain's neural network for efficient information processing. Intel has also created software frameworks that work with its Loihi neuromorphic processors, allowing for more sophisticated machine learning and cognitive computing uses. Another important player, BrainChip Holdings, provides the Akida neural processor along with strong software support for real-time edge AI processing. These software advancements enhance the computational abilities of neuromorphic chips and help incorporate them into real-world uses like robotics, autonomous cars, and Internet of Things (IoT) gadgets. The dominant position of the software sector is also credited to its facilitation of adaptive learning algorithms and simulation tools necessary for the creation and evaluation of neuromorphic systems. As neuromorphic computing advances, the demand for more sophisticated software solutions is expected to rise, leading to increased growth and innovation in this field. The combination of state-of-the-art hardware and advanced software is essential for progressing neuromorphic computing, enabling these systems to fulfill the rigorous needs of current applications and achieve exceptional performance and energy efficiency.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End User

Based On End User, Consumer Electronics is captured the largest share revenue in Neuromorphic chip market with 41% of share in 2023. The consumer electronics industry views neuromorphic computing as a promising tool for facilitating high-performance computing and achieving ultra-low power consumption goals. For example, AI technologies such as Alexa and Siri use cloud computing and the internet to process and answer verbal commands and inquiries. Neuromorphic chips have the potential to allow different sensors and devices to function smartly even without requiring an internet connection. Many processes, such as biometrics, require high power and a large amount of data. In the case of speech recognition, the cloud processes audio data and sends it back to the phone. Wearable gadgets are rapidly expanding technology that significantly affects personal healthcare, impacting both the economy and society. Power consumption, processing speed, and system adaptation are key in the future of smart wearables as sensors are widely used in pervasive and distributed networks. Moreover, the realm of artificial intelligence enhances the potential of intelligent wearable sensory devices. The growing complexity of advanced systems and smart apps necessitates sensory devices to precisely characterize tangible items. Wearables are now capable of advanced functions such as image identification and natural language processing thanks to specialized neuromorphic devices like IBM's True North. During a crisis, neuromorphic wearables are able to alert medical staff, track essential body functions, recognize irregularities, and react quickly. The growing fascination with neuromorphic engineering indicates that hardware-spiking neural networks are viewed as a vital upcoming technology with great promise in important areas like edge computing and wearable gadgets.

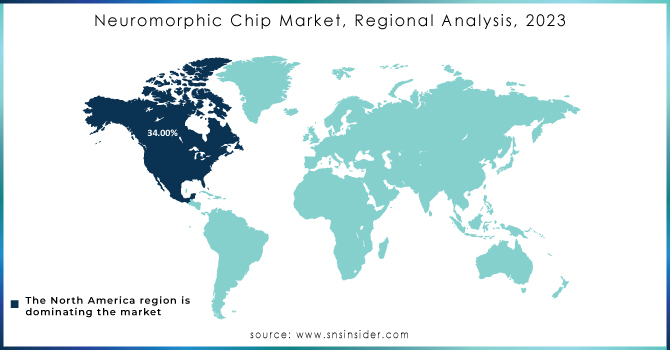

In 2023, North America held a majority of the revenue in the Neuromorphic Chip Market with a 34% share. North America, home to key players like Intel Corporation and IBM Corporation, is experiencing significant growth in the neuromorphic chip market. This expansion is driven by a combination of government initiatives, investment activities, and strategic collaborations. For instance, in September 2023, private companies, such as the USD 45.6 million provided by the U.S. National Science Foundation for semiconductor research through the CHIPS and Science Act of 2022” This funding, part of the NSF Future of Semiconductors (FuSe) program, includes contributions from major companies like Samsung, Ericsson, IBM, and Intel, highlighting a robust public-private partnership aimed at advancing semiconductor technologies and workforce development. Concurrently, the Canadian government is also fostering growth in artificial intelligence, which is anticipated to benefit neuromorphic computing. In June 2023, Canada proposed the Artificial Intelligence and Data Act (AIDA) to ensure the responsible and trustworthy development of AI technologies. This legislation is expected to bolster Canada’s AI industry and, consequently, support neuromorphic advancements. Additionally, research institutions are making strides in neuromorphic technology; for example, in June 2023, Los Alamos National Laboratory announced progress on a new memristive device, which could enable the creation of artificial synapses for next-generation neuromorphic computing. The region's increasing defense expenditures are further fueling demand for neuromorphic chips, which are critical for applications such as AI, autonomous vehicles, and edge computing due to their high-performance and low-power capabilities. As AI and machine learning continue to gain traction in the U.S., the need for sophisticated neuromorphic chips is expected to rise, supported by ongoing government and private sector funding in technology innovation and smart technologies.

Asia-Pacific is the second fastest region in Neuromorphic Chip Market with 28% of share in 2023. The quick growth is fueled by multiple important factors, such as strong technological progress, higher investments in R&D, and the growing need for energy-efficient computing solutions in different industries. Big companies like Preferred Networks from Japan and Samsung Electronics from South Korea are playing a major role in fueling this growth in the region. Preferred Networks, a company with a reputation for proficiency in artificial intelligence and machine learning, has been actively creating neuromorphic chips aimed at improving AI processing performance while lowering power usage. In 2023, Preferred Networks unveiled its newest neuromorphic chip that employs spiking neural networks for efficient computing in edge applications. Samsung Electronics, a prominent player in semiconductor technology worldwide, has also made significant progress in neuromorphic computing. The company revealed its innovative neuromorphic chip prototype designed to improve data processing abilities in mobile and IoT devices. This chip combines new materials and designs to enhance both performance and energy efficiency. Furthermore, research organizations in the area, like the Chinese Academy of Sciences, are engaging in innovative projects that advance the limits of neuromorphic technology. Their study concentrates on creating neuromorphic systems that are both scalable and adaptive, able to serve a variety of purposes from robotics to smart city solutions. The increasing focus on AI and machine learning, along with strategic investments and technological advancements, is driving Asia-Pacific's leadership in the neuromorphic chip market. With the ongoing progress in these developments, the area is projected to strengthen its role as a major contributor in the worldwide neuromorphic chip market.

The key players in the neuromorphic chip market are Hewlett Packard Enterprise, Intel Corp., Brain chip Holdings Ltd., IBM, Innatera, Koniku, Samsung Electronics Limited, General Vision Inc., Qualcomm, Nepes Corp, Ceryx Medical & Other Players.

In March 2024, a team of researchers at KAIST developed the inaugural AI semiconductor utilizing neuromorphic computing technology to process a vast language model (LLM) with minimal energy usage. Technology aims to allow chips to perform more complex tasks with flexibility and reasoning, while consuming less energy, by developing integrated circuits that mimic the human nervous system.

In September 2023, SynSense, the leading global supplier of ultra-low-power neuromorphic hardware and application solutions, unveiled the Xylo IMU neuromorphic development kit (HDK). This new HDK enables users to develop motion processing applications based on IMU for industrial monitoring, analysis of human movement, and interaction with computers. SynSense's open-source Python tool chain, rockpool, enables developers to explore new use cases and research applications by providing training and deployment support for SNN models on Xylo IMU.

In April 2024, Intel revealed they had developed the biggest neuromorphic system globally. Known as Hala Point, a big neuromorphic system deployed at Sandia National Laboratories, uses Intel's Loihi 2 processor to advance brain-inspired AI research and address efficiency and sustainability issues in current AI.

In May 2024, scientists at SSD create a new instruction set architecture and incorporate on-chip learning in a large neuromorphic chip. Specialized chips for neuromorphic computing are being created to enhance the advantages of SNNs more effectively. These chips present a new direction from the standard computing structure, providing a hopeful answer to limitations in storage and power in the post-Moore era.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 97.30 Million |

| Market Size by 2032 | USD 3058.5 Million |

| CAGR | CAGR of 46.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Components (Software, Hardware) • By Application (Signal Recognition, Image Recognition, Data Mining) • By Vertical (Aerospace & Defense, Automotive, Industrial, IT & Telecom, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hewlett Packard Enterprise, Intel Corp., Brain chip Holdings Ltd., IBM, Innatera, Koniku, Samsung Electronics Limited, General Vision Inc., Qualcomm, Nepes Corp. and Ceryx Medical. |

| Key Drivers |

• Advancements in quantum materials and government funding drive growth of neuromorphic chip market. • Advancements in Dynamic Computing Drive Expansion in the Neuromorphic Chip Market. |

| Restraints |

• Challenges in Scaling Neuromorphic Chips from a Technical Perspective |

The Neuromorphic Chip Market was valued at USD 44.77 Million in 2023.

The expected CAGR of the global Neuromorphic Chip Market during the forecast period is 67.2%.

The Asia Pacific region is anticipated to record the Fastest Growing in the Neuromorphic Chip Market.

The Automotive segment is leading in the market revenue share in 2023.

The North America region with the Highest Revenue share in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Wafer Production Volumes, by Region (2023)

5.2 Chip Design Trends (Historic and Future)

5.3 Fab Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Nueromorphic Chip Market Segmentation, by Offering

7.1 Chapter Overview

7.2 Software

7.2.1 Software Market Trends Analysis (2020-2032)

7.2.2 Software Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Hardware

7.3.1 Hardware Market Trends Analysis (2020-2032)

7.3.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Million)

8. Nueromorphic Chip Market Segmentation, by Application

8.1 Chapter Overview

8.2 Signal Recognition

8.2.1 Signal Recognition Market Trends Analysis (2020-2032)

8.2.2 Signal Recognition Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Image Recognition

8.3.1 Image Recognition Market Trends Analysis (2020-2032)

8.3.2 Image Recognition Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Data Mining

8.4.1 Data Mining Market Trends Analysis (2020-2032)

8.4.2 Data Mining Market Size Estimates and Forecasts to 2032 (USD Million)

9. Nueromorphic Chip Market Segmentation, by End User

9.1 Chapter Overview

9.2 Aerospace & Defence

9.2.1 Aerospace & Defence Market Trends Analysis (2020-2032)

9.2.2 Aerospace & Defence Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Automotive

9.3.1 Automotive Market Trends Analysis (2020-2032)

9.3.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Consumer Electronics

9.4.1 Consumer Electronics Market Trends Analysis (2020-2032)

9.4.2 Consumer Electronics Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Healthcare

9.5.1 Healthcare Market Trends Analysis (2020-2032)

9.5.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Industrial

9.6.1 Industrial Market Trends Analysis (2020-2032)

9.6.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Nueromorphic Chip Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.2.4 North America Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.5 North America Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.2.6.2 USA Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6.3 USA Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.2.7.2 Canada Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7.3 Canada Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.2.8.2 Mexico Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8.3 Mexico Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Nueromorphic Chip Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.1.6.2 Poland Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6.3 Poland Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.1.7.2 Romania Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7.3 Romania Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.1.8.2 Hungary Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8.3 Hungary Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.1.9.2 Turkey Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9.3 Turkey Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Nueromorphic Chip Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.2.4 Western Europe Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.5 Western Europe Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.2.6.2 Germany Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6.3 Germany Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.2.7.2 France Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7.3 France Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.2.8.2 UK Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8.3 UK Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.2.9.2 Italy Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9.3 Italy Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.2.10.2 Spain Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10.3 Spain Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.2.13.2 Austria Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13.3 Austria Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Nueromorphic Chip Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia-Pacific Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.4.4 Asia-Pacific Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.5 Asia Pacific Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.4.6.2 China Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6.3 China Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.4.7.2 India Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7.3 India Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.4.8.2 Japan Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8.3 Japan Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.4.9.2 South Korea Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9.3 South Korea Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.4.10.2 Vietnam Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10.3 Vietnam Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.4.11.2 Singapore Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11.3 Singapore Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.4.12.2 Australia Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12.3 Australia Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.4.13.2 Rest of Asia-Pacific Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13.3 Rest of Asia-Pacific Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Nueromorphic Chip Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.5.1.4 Middle East Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.5 Middle East Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.5.1.6.2 UAE Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6.3 UAE Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.5.1.7.2 Egypt Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7.3 Egypt Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.5.1.9.2 Qatar Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9.3 Qatar Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Nueromorphic Chip Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.5.2.4 Africa Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.5 Africa Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.5.2.6.2 South Africa Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6.3 South Africa Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Nueromorphic Chip Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.6.4 Latin America Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.5 Latin America Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.6.6.2 Brazil Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6.3 Brazil Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.6.7.2 Argentina Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7.3 Argentina Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.6.8.2 Colombia Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8.3 Colombia Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Nueromorphic Chip Market Estimates and Forecasts, by Offering (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Nueromorphic Chip Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Nueromorphic Chip Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11. Company Profiles

11.1 Hewlett Packard Enterprise

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Intel Corp.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Brain chip Holdings Ltd.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 IBM

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Innatera

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Koniku

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Samsung Electronics Limited

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 General Vision Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Qualcomm

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Nepes Corp

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Offering

Software

Hardware

By Application

Signal Recognition

Image Recognition

Data Mining

By End User

Aerospace & Defence

Automotive

Consumer Electronics

Healthcare

Industrial

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia-Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Adaptive Optics Market was valued at USD 690.90 million in 2023 and is expected to reach USD 6632.27 million by 2032, growing at a CAGR of 28.61% over the forecast period 2024-2032.

The AI in Networks Market Size was valued at USD 8.33 Billion in 2023 and is expected to reach USD 101.29 Billion by 2032, at 32.14% CAGR, during 2024-2032

The Smart Hardware ODM Market is experiencing significant growth as the demand for connected and intelligent devices surges across various sectors.

The Distributed Acoustic Sensing (DAS) Market was valued at USD 631.45 million in 2023 and is expected to grow at a CAGR of 10.37% by forecasts 2024-2032.

The Fiber Optics Gyroscope Market Size was valued at USD 1.05 Billion in 2023 and is expected to grow at a CAGR of 4.73% to reach USD 1.59 Billion by 2032.

The Automotive Connector Market Size was valued at USD 7.67 Billion in 2023 and is expected to grow at a CAGR of 6.85% to Reach USD 13.92 Billion by 2032.

Hi! Click one of our member below to chat on Phone