Neural Processor Market Report Scope & Overview:

Get More Information on Neural Processor Market - Request Sample Report

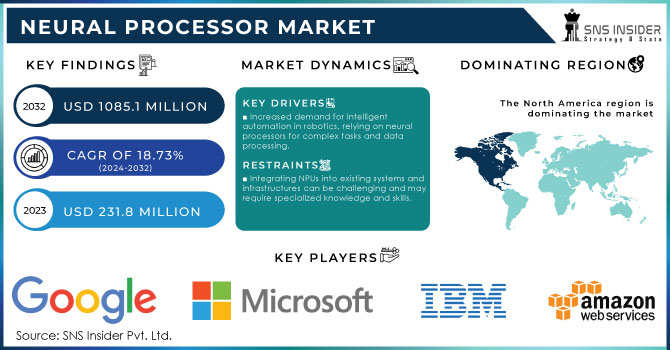

The Neural Processor Market was valued at USD 231.8 million in 2023 and is expected to reach USD 1085.1 million by 2032, growing at a CAGR of 18.73% from 2024-2032.

The neural processor market is experiencing rapid expansion, driven by the increasing demand for AI and machine learning applications across diverse industries. Neural processing units (NPUs) are specialized chips designed to accelerate AI tasks such as deep learning, natural language processing, and computer vision. These chips play a crucial role in efficiently managing large datasets and complex computations, sparking advancements in autonomous vehicles, robotics, and smart devices. One significant factor driving market growth is the growing incorporation of AI in consumer electronics, particularly smartphones. In 2023, over 90% of smartphones featured AI capabilities, with many high-end devices equipped with NPUs to enhance functionalities like facial recognition, voice assistants, and advanced photography. Leading companies like Apple, Huawei, and Qualcomm have integrated NPUs into their flagship models, highlighting the importance of this technology in the consumer market.

Additionally, the rise of autonomous vehicles is fueling demand for neural processors. These vehicles depend on NPUs for real-time decision-making and object detection. Tesla, for instance, integrates neural processors into its Full Self-Driving (FSD) computers, which can process up to 72 trillion operations per second (TOPS), enabling sophisticated decision-making in autonomous driving. As the industry advances toward fully autonomous systems, the need for powerful NPUs is expected to surge. In data centers, NPUs are revolutionizing AI workload processing. Google’s Tensor Processing Units (TPUs), deployed in their data centers, significantly enhance AI model performance in services like Google Search, Translate, and Photos. With TPUs, Google processes over 1 billion photos daily, improving both speed and efficiency.

In summary, the neural processor market is being propelled by the demand for faster and more efficient AI processing across various industries. Major innovations in consumer electronics, autonomous vehicles, and data centers are shaping the market’s robust growth.

Market Dynamics

Drivers

Increased demand for intelligent automation in robotics, relying on neural processors for complex tasks and data processing.

Growing adoption of neural processors in data centers enhances AI workload efficiency and supports large-scale AI applications like Google Search and Photos.

The rise of self-driving cars requires high-performance NPUs for real-time object detection and decision-making.

The rapid development of self-driving technology is a key driving factor for the expansion of the growth of the neural processor market. One of the critical premises for self-driving is real-time data processing that will help ensure the safety of all participants of the road and facilitate their optimal functioning. This data management is possible only with the help of neural processors, which are created to control the immense streams of data from a car’s cameras, sensors, as well as LiDAR systems, necessary for object detection, lane tracking, navigation decisions, and many other vital processes through AI-supported amelioration. NPUs enhance the capability of autonomous vehicles to process data rapidly and make accurate driving decisions. As a current example, the Full Self-Driving system by Tesla develops neural processors that can perform up to 72 TOPs while overseeing and organizing data from eight cameras and various sensors to see both close obstacles, such as road signs and signals, other cars, and pedestrians, as well as safely plan the car’s driving path. Therefore, the further development of self-driving technology is dependent on the further evolution of NPUs.

The enhancement of self-driving technology and the processes around it foster the expansion of the neural processor market. The further development of the safety and accuracy of self-driving technology is impossible without advanced NPUs and their rapidly increasing processors’ ability. Thus, the importance and value of NPUs as one of the leading facets of the self-driving future are evermore reinforced by this tendency.

The rapid growth of neural processors in data centers contributes to the significant increase in the efficiency of AI workloads as well as the implementation of large AI applications. As a specially designed processor to accelerate the performance of complex AI algorithms, neural processors perform significantly better in the area of computations required to implement cloud services. For example, Google uses NPUs to speed up computations in Google Search and Google Photos. Therefore, Google can accelerate the search for data in various sources and ensure that pictures are analyzed and provided to users in real-time. This technology allows the company to manage more than a billion photos daily while enhancing image search and recommendation options for the users.

Considering that the number of organizations that realize the benefits of the use of NPUs in data centers is rising, soon, their use becomes a common trend. This agent of change improves the operational performance of multiple organizations and enhances it by developing innovative solutions in the area of AI. Thus, currently, NPUs become crucial to the progression of data center and neural process market technologies.

Restraints

Integrating NPUs into existing systems and infrastructures can be challenging and may require specialized knowledge and skills.

The significant investment required for research and development of advanced NPUs can limit market entry for smaller companies.

The availability of compatible software and tools for neural processors may be insufficient, hindering their adoption in various applications.

The availability of compatible software and tools for neural processors (NPUs) is a critical factor influencing their adoption across various applications. Despite the rapid advancements in neural processing technology, many developers and organizations face challenges due to a lack of optimized software that can fully leverage the capabilities of NPUs. This limitation can hinder the effective implementation of NPUs in real-world applications, slowing down innovation and adoption rates. For instance, companies like NVIDIA have developed powerful NPUs, but the effectiveness of these processors often depends on the availability of suitable software frameworks and development environments. While NVIDIA provides software tools like TensorRT and CUDA to optimize AI workloads on their GPUs, a similar comprehensive ecosystem for NPUs is not always present. This disparity can create barriers for developers who want to integrate NPUs into their applications, leading to a reliance on traditional processors that have more mature software support.

A real-time example can be seen in the automotive industry, where companies are increasingly utilizing NPUs for autonomous vehicle applications. However, the absence of robust software frameworks that specifically cater to the unique requirements of NPUs can complicate the deployment of advanced driver assistance systems (ADAS). For instance, Tesla's Full Self-Driving (FSD) system relies heavily on its in-house software, but its neural processing capabilities could be further enhanced if more third-party software tools were available that are tailored for NPUs.

In summary, the insufficient availability of compatible software and tools for neural processors poses a significant challenge in the market. Addressing this gap is essential for fostering broader adoption and maximizing the potential of NPUs across various sectors, including automotive, healthcare, and data centers.

Segment Analysis

By Operation

The inference segment dominated the market and accounted for 66.7% of global revenue in 2023. One of the central factors underlying this trend is an increasing demand for real-time AI decision-making. As such, inference operations represent one of the driving forces behind the growth of neural processors on the market. This process involves the application of trained AI models to new data, allowing devices to make instant predictions or actions. With more and more AI-driven applications becoming widespread, such as advanced speech recognition, facial recognition, or completely autonomous systems of various kinds, the need for improved inference capabilities keeps increasing. Neural processors are a perfect match for this scenario as they are specifically designed for these purposes, providing better performance and lower power consumption rates compared to ordinary hardware. Such features make these devices crucial to AI technologies across several industries.

Meanwhile, the training segment is expected to register substantial growth in CAGR during the forecast period, which is also based on several factors. One such is the emergence of increasingly complex and detailed AI models, which implies new ways to train these systems. This concept determines the purpose of training, which may be defined as teaching AI models to identify patterns and make predictions based on vast data sets. These processes require substantial computational power, and with more industries, such as healthcare, finance, or autonomous vehicles, investing in AI, specialized hardware demand keeps rising. Neural processors are specifically engineered to manage these tasks more effectively, thus becoming a crucial factor in the training of complicated models.

By Application

The smartphones and tablets segment had the largest share of market revenue in 2023. More manufacturers are implementing AI in these devices, and their use of neural processors is rapidly increasing as greater demands are put on these applications. Neural processors are used to provide significant enhancement in performance for applications such as facial recognition, voice assistance, and real-time translation of spoken language. With the rise of AI-driven applications like augmented reality and enhanced photography, manufacturers are rapidly adapting their devices to take advantage of neural processors. As more and more companies compete in producing better AI mobile devices, the smartphones and tablets segment has secured its position as the driving force in the use of neural processors.

Autonomous vehicles segment is anticipated to witness significant growth during the forecast period. Recent applications of AI and new technology such as sensor systems and, in the present case, neural processors, have helped to develop a new type of vehicle requiring no human intervention. With neural processors, AI systems can make rapid decisions about the environment, and the most frequently imagined of these is autonomous vehicle object recognition, route planning, and collision avoidance systems.

Regional Analysis

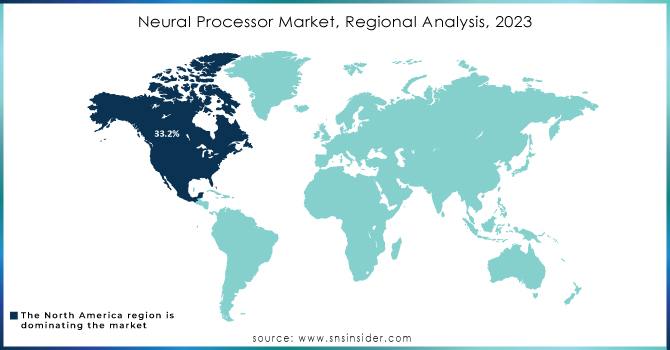

North America dominated the market with a 33.2% share in 2023. The region's neural processor market is experiencing robust growth, fueled by the increasing demand for sophisticated artificial intelligence applications. The rise of cloud computing and edge devices is accelerating the adoption of neural processors across multiple sectors, including healthcare, automotive, and finance. Moreover, major players in the region are investing heavily in research and development to enhance the capabilities and performance of neural processors.

The U.S. market is marked by rapid technological advancements, especially in deep learning and natural language processing. Leading tech companies are launching new models of neural processors that improve both computational power and energy efficiency. Additionally, the growing emphasis on smart devices and the Internet of Things (IoT) is driving market expansion, as these applications necessitate strong processing capabilities.

Need Any Customization Research On Neural Processor Market - Inquiry Now

Key players

The major key players are

Companies along with one of their manufacturers

NVIDIA Corporation - Tesla GPUs

Intel Corporation - Xeon Scalable Processors

Google LLC - Tensor Processing Units (TPUs)

Amazon Web Services, Inc. - Graviton Processors

Qualcomm Incorporated - Snapdragon Processors

IBM Corporation - IBM POWER Processors

Microsoft Corporation - Azure Sphere

AMD (Advanced Micro Devices, Inc.) - EPYC Processors

Graphcore Limited - Intelligence Processing Unit (IPU)

Apple Inc. - Apple M1 Chip

Baidu, Inc. - Kunlun AI Chip

Huawei Technologies Co., Ltd. - Ascend AI Processors

Micron Technology, Inc. - GDDR6 Memory

Xilinx, Inc. - Versal ACAP

Arm Holdings Limited - Cortex-A Series Processors

Synaptics Incorporated - ClearView AI Processors

Tenstorrent Inc. - Grayskull AI Processor

MediaTek Inc. - Dimensity Processors

Marvell Technology Group Ltd. - ThunderX Processors

Achronix Semiconductor Corporation - Speedster FPGAs

Major suppliers:

TSMC (Taiwan Semiconductor Manufacturing Company)

Micron Technology

Foxconn Technology Group

Seagate Technology

ASE Group

GlobalFoundries

Pegatron Corporation

TSMC (Taiwan Semiconductor Manufacturing Company)

Falanx (contract manufacturer)

Foxconn Technology Group

SMIC (Semiconductor Manufacturing International Corporation)

TSMC (Taiwan Semiconductor Manufacturing Company)

ON Semiconductor

TSMC (Taiwan Semiconductor Manufacturing Company)

SoftBank Group (parent company)

Ams AG

TSMC (Taiwan Semiconductor Manufacturing Company)

TSMC (Taiwan Semiconductor Manufacturing Company)

GlobalFoundries

TSMC (Taiwan Semiconductor Manufacturing Company)

Recent Developments

In September 2024, Intel Corporation launched its Core Ultra 200V processors, featuring a neural processing unit that is four times faster than the previous generation, enhancing power efficiency and computational capability for laptops.

In June 2024, Advanced Micro Devices Inc. unveiled its AI processors, including the MI325X accelerator, at the Computex technology trade show, highlighting new neural processing units designed for on-device AI tasks in AI PCs. The MI350 series is expected to deliver 35 times better inference capabilities compared to earlier models, reflecting AMD's commitment to significant performance improvements.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 231.8 million |

| Market Size by 2032 | USD 1085.1 million |

| CAGR | CAGR of 18.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Operation (Training, Inference) • By Application (Smartphones and Tablets, Autonomous Vehicles, Robotics and Drones, Healthcare and Medical Devices, Smart Home Devices and IoT, Cloud and Data Center AI, Industrial Automation and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NVIDIA Corporation, Intel Corporation, Google LLC, Amazon Web Services, Inc., Qualcomm Incorporated, IBM Corporation, Microsoft Corporation, AMD (Advanced Micro Devices, Inc.), Graphcore Limited, Apple Inc., Baidu, Inc. |

| Key Drivers | • Increased demand for intelligent automation in robotics, relying on neural processors for complex tasks and data processing. • Growing adoption of neural processors in data centers enhances AI workload efficiency and supports large-scale AI applications like Google Search and Photos. |

| RESTRAINTS | • Integrating NPUs into existing systems and infrastructures can be challenging and may require specialized knowledge and skills. • The significant investment required for research and development of advanced NPUs can limit market entry for smaller companies. |

Ans- Neural Processor Market was valued at USD 231.8 million in 2023 and is expected to reach USD 1085.1 million by 2032, growing at a CAGR of 18.73% from 2024-2032.

Ans- the CAGR of neural processor market during the forecast period is of 18.73% from 2024-2032.

Ans- In 2023, North America led the neural processor market, capturing a significant revenue share of 33.2%.

Ans- one main growth factor for the neural processor market is

Ans- challenges in neural processor market are

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Neural Processor Market Segmentation, by Application

7.1 Chapter Overview

7.2 Smartphones and Tablets

7.2.1 Smartphones and Tablets Market Trends Analysis (2020-2032)

7.2.2 Smartphones and Tablets Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Autonomous Vehicles

7.3.1 Autonomous Vehicles Market Trends Analysis (2020-2032)

7.3.2 Autonomous Vehicles Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Robotics and Drones

7.4.1 Robotics and Drones Market Trends Analysis (2020-2032)

7.4.2 Robotics and Drones Market Size Estimates and Forecasts to 2032 (USD Million)

7.5 Healthcare and Medical Devices

7.5.1 Healthcare and Medical Devices Market Trends Analysis (2020-2032)

7.5.2 Healthcare and Medical Devices Market Size Estimates and Forecasts to 2032 (USD Million)

7.6 Smart Home Devices and IoT

7.6.1 Smart Home Devices and IoT Market Trends Analysis (2020-2032)

7.6.2 Smart Home Devices and IoT Market Size Estimates and Forecasts to 2032 (USD Million)

7.7 Cloud and Data Center AI

7.7.1 Cloud and Data Center AI Market Trends Analysis (2020-2032)

7.7.2 Cloud and Data Center AI Market Size Estimates and Forecasts to 2032 (USD Million)

7.8 Industrial Automation

7.8.1 Industrial Automation Market Trends Analysis (2020-2032)

7.8.2 Industrial Automation Market Size Estimates and Forecasts to 2032 (USD Million)

7.9 Others

7.9.1 Others Market Trends Analysis (2020-2032)

7.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Neural Processor Market Segmentation, by Operation

8.1 Chapter Overview

8.2 Training

8.2.1 Training Market Trends Analysis (2020-2032)

8.2.2 Training Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Inference

8.3.1 Inference Market Trends Analysis (2020-2032)

8.3.2 Inference Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Neural Processor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.4 North America Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.5.2 USA Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.6.2 Canada Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.7.2 Mexico Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Neural Processor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.5.2 Poland Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.6.2 Romania Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.7.2 Hungary Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.8.2 Turkey Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Neural Processor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.4 Western Europe Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.5.2 Germany Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.6.2 France Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.7.2 UK Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.8.2 Italy Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.9.2 Spain Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.12.2 Austria Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Neural Processor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia Pacific Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.4 Asia Pacific Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5.2 China Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5.2 India Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5.2 Japan Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6.2 South Korea Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.7.2 Vietnam Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.8.2 Singapore Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.9.2 Australia Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.10.2 Rest of Asia Pacific Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Neural Processor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.4 Middle East Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.5.2 UAE Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.6.2 Egypt Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.8.2 Qatar Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Neural Processor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.4 Africa Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.5.2 South Africa Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.7.2 Rest of Africa Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Neural Processor Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.4 Latin America Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.5.2 Brazil Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.6.2 Argentina Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.7.2 Colombia Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Neural Processor Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Neural Processor Market Estimates and Forecasts, by Operation (2020-2032) (USD Million)

10. Company Profiles

10.1 NVIDIA Corporation

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Intel Corporation

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Google LLC

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Amazon Web Services, Inc

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Qualcomm Incorporated

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 IBM Corporation

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Microsoft Corporation

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 AMD (Advanced Micro Devices, Inc.)

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Graphcore Limited

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Apple Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Operation

Training

Inference

By Application

Smartphones and Tablets

Autonomous Vehicles

Robotics and Drones

Healthcare and Medical Devices

Smart Home Devices and IoT

Cloud and Data Center AI

Industrial Automation

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Point-of-Sale Display Market was valued at USD 14.08 Billion in 2023 and will reach USD 28.33 Billion by 2032 and grow at a CAGR of 8.11% by 2024-2032.

The Transparent Display Market Size was valued at USD 2.42 Billion in 2023 and is expected to reach USD 56.17 Billion by 2032 and grow at a CAGR of 41.89% over the forecast period 2024-2032

The Micro Server IC Market size was valued at USD 1.68 billion in 2023 and is expected to grow to USD 4.88 billion by 2032 and grow at a CAGR of 12.6% over the forecast period of 2024-2032.

The Wireless Home Security Camera Market Size was valued at USD 8.25 Bn in 2023, and will reach $28.94 Bn by 2032, and grow at a CAGR of 15.09% by 2024-2032

The Home Security Systems Market was valued at USD 54.9 billion in 2023 and is projected to reach USD 109.18 billion by 2032, growing at a CAGR of 7.94% from 2024 to 2032.

Bioelectronics and Biosensors Market size was valued at USD 31.78 billion in 2023 and is expected to grow to USD 70.8 billion by 2032 and grow at a CAGR Of 9.32 % over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone