Get more information on Neobanking Market - Request Sample Report

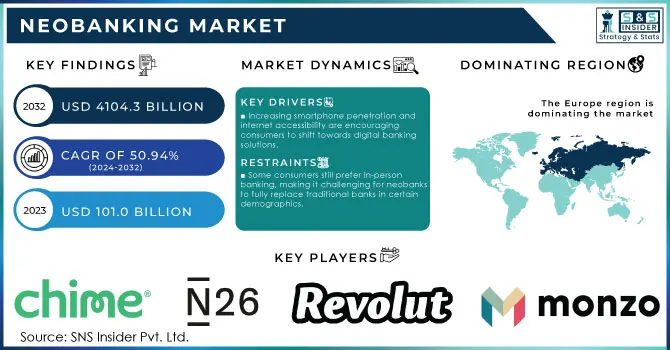

Neobanking Market was valued at USD 101.0 Billion in 2023 and is expected to reach USD 4104.3 Billion by 2032, while growing at a CAGR of 50.94% over the forecast period of 2024-2032.

The Neobanking Market is rapidly expanding as demand for digital banking solutions grows, influenced by evolving consumer preferences and financial technology advancements. As fully digital, branchless entities, neobanks are transforming the banking industry with app-based services that resonate with a tech-savvy customer base. By 2023, approximately 73% of global banking consumers reported using digital-only banking services, highlighting a shift toward accessible, convenient digital options. Europe leads in this adoption trend, with the UK alone surpassing 20 million Neobank users by early 2024, driven by supportive regulations and high consumer trust.

AI and machine learning innovations further fuel neobanking growth, enhancing user experiences through tailored products, faster processing, and predictive insights. For instance, Indian neo-bank Jupiter leverages AI to analyze spending patterns and recommend personalized financial solutions, leading to a 50% user base increase within a year. Additionally, open banking initiatives, particularly in Europe and Asia-Pacific, stimulate competition and enable neobanks to leverage traditional bank data (with consent) to provide more customized services.

The global proliferation of smartphones, projected to exceed 5.5 billion users by 2024, also drives growth. High mobile adoption rates in developing markets allow neobanks to scale quickly in areas with limited traditional banking access; Nubank in Brazil, for example, added nearly 10 million users from 2022 to 2023, especially among underserved populations.

Regulatory developments continue to support expansion. In the U.S., the Office of the Comptroller of the Currency (OCC) has started issuing limited banking licenses to neobanks, allowing them to broaden services without traditional bank partnerships. Growing consumer awareness of neobanks' lower fees, favorable interest rates, and easy account setup further accelerates adoption. As neobanks diversify into areas like loans, investments, and insurance, they are set to attract even more customers, driving substantial global market growth.

Market Dynamics

Drivers

Increasing smartphone penetration and internet accessibility are encouraging consumers to shift towards digital banking solutions.

Advanced technologies, such as AI and machine learning, enhance user experiences through personalized services and efficient processing.

The integration of chatbots and digital assistants improves customer engagement and support, making banking more accessible.

The Neobanking Market has significantly benefited from the integration of chatbots and digital assistants, which enhance customer engagement and support, ultimately making banking services more accessible. These AI-driven tools provide immediate responses to customer inquiries, effectively addressing the challenges often encountered in traditional banking. In contrast to conventional banks, where wait times for customer service can be lengthy, neobanks utilize chatbots to offer real-time assistance, resolving common questions and issues around the clock. This swift access to information enables customers to quickly address their concerns, boosting overall satisfaction and loyalty. Chatbots are capable of managing a wide variety of tasks, from basic account inquiries to more complex operations like transaction tracking and payment processing. For instance, users can effortlessly check their account balances, transfer funds, or receive personalized financial advice tailored to their spending habits, all through an easy-to-use chat interface. This level of convenience not only meets the expectations of tech-savvy customers but also attracts those who might be reluctant to embrace digital banking due to worries about accessibility and support.

Moreover, digital assistants can learn from user interactions, continuously refining their responses to offer more personalized experiences. By analyzing customer data, they can provide tailored recommendations that empower users to make informed financial choices. This level of personalization builds trust and connection, which are crucial for retaining customers in a competitive market. Additionally, the implementation of chatbots and digital assistants allows neobanks to efficiently scale their customer service operations. As their customer base grows, these tools can handle increasing volumes of inquiries without necessitating a proportional rise in staffing, leading to reduced operational costs and freeing up resources for other business areas.

In conclusion, the integration of chatbots and digital assistants serves as a vital driving force in the Neobanking Market, enhancing customer support and engagement while making banking services more user-friendly and accessible.

Restraints

Some consumers still prefer in-person banking, making it challenging for neobanks to fully replace traditional banks in certain demographics.

Heavy reliance on digital infrastructure means any technical issues or outages can disrupt services, impacting user trust.

Some consumers still prefer in-person banking, making it challenging for neobanks to fully replace traditional banks in certain demographics.

The rapid expansion of the Neobanking Market faces a significant obstacle: many consumers still favor in-person banking, hindering neobanks' ability to completely replace traditional banks. Established banks, with their branch networks, provide face-to-face interactions that foster personal connections and trust, which are particularly important during complex transactions and major financial decisions. Older or less tech-savvy customers often rely on these in-person experiences for their reliability and immediate support, areas where digital-only platforms may struggle to compete.

Moreover, in-person banking remains crucial in rural and underserved areas, where limited internet access makes it difficult for consumers to depend entirely on app-based banking. Even in technologically advanced markets, the existence of physical branches helps build brand trust and credibility. Traditional banks also offer personalized services, such as financial advice and loan consultations, which can be hard to replicate online. While neobanks are recognized for their convenience, low fees, and speed, they frequently face challenges in forming the deep personal relationships that brick-and-mortar banks provide. This gap can negatively affect customer loyalty, especially during financial uncertainties when consumers often seek direct, personalized support. Topics such as debt management and large loans may be easier to discuss in person than through digital channels.

To overcome this challenge, neobanks are improving customer support through chatbots, video consultations, and AI-driven personalized recommendations. Some are also exploring hybrid models by collaborating with traditional banks to provide limited in-person services. However, until neobanks can fully replicate the trust and personal touch of traditional banking, they may find it difficult to cater to certain consumer demographics. To effectively meet these varied preferences, neobanks must continue to innovate in customer engagement and trust-building strategies.

Segment Analysis

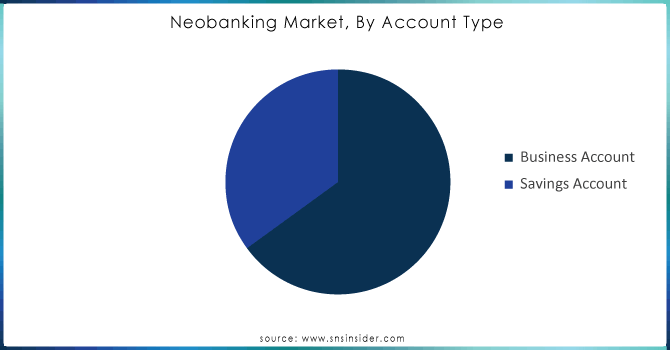

Account Type

Business accounts dominated the market in 2023, capturing over 68.6% of total revenue. A growing number of businesses worldwide are choosing neobanking as their preferred option for handling bulk payments. Neobank platforms contribute to the growth of this segment by streamlining processes and minimizing human intervention in vendor disbursements and other transactions with stakeholders.

The savings account segment is expected to experience the highest compound annual growth rate (CAGR) during the forecast period. Furthermore, many health tech companies are partnering with fintech firms to develop and launch products and services that meet the increasing demand in this sector. For example, In March 2023, Fino Payments Bank partnered with Practo, a health tech platform, to launch a health savings account. This account combines features such as medical insurance coverage, smart savings options, and a health debit card, allowing users to manage healthcare expenses efficiently.

Do you need any custom research on Neobanking Market - Enquire Now

By Application

The enterprise segment dominated the market in 2023 and represented over 51.8% of total revenue. These platforms provide a variety of enterprise-related services, such as credit management, transaction management, and asset management. Numerous neobanking service providers targeting SMEs are actively pursuing acquisitions to enhance their product offerings and improve customer experiences. For example, in April 2023 Chime, a prominent neobanking platform, acquired Gohenry, a digital banking service for children and teens, in a deal valued at USD 75 million. This acquisition aims to enhance Chime’s offerings by integrating youth-focused financial education tools into its platform, further expanding its user base and promoting financial literacy among younger audiences.

Moreover, the personal application segment is expected to experience the fastest growth during the forecast period. The widespread adoption of smartphones has encouraged customers to utilize neobanking services due to their convenience and user-friendly interfaces. These services are delivered via mobile app platforms, allowing users to perform money transfers and payments with ease. The simplicity of opening and managing accounts is likely to further drive the growth of neobanking in this segment in the coming years.

Regional Analysis

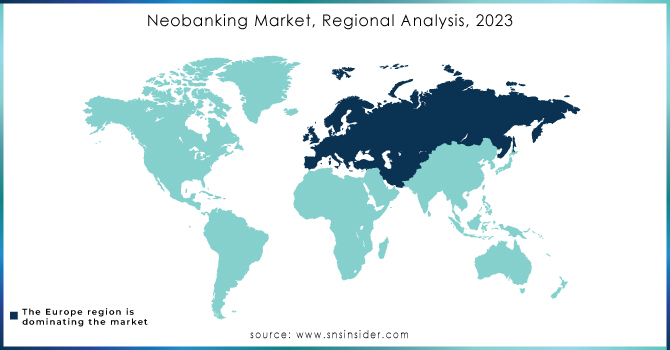

In 2023, Europe dominated the market, capturing over 30.6% of total revenue. This growth is primarily attributed to advancements in innovative technologies and the early adoption of new solutions. European companies are actively introducing new product platforms and forming strategic partnerships to bolster their market presence. Additionally, many neobanks have established brick-and-mortar distribution channels to implement an online-to-offline (O2O) model, generating new growth opportunities.

The Asia Pacific region is anticipated to be the fastest-growing market during the forecast period. The increasing adoption of Internet services, coupled with the rising use of smartphones, is expected to drive market growth. Moreover, the demand for convenient banking services and the proliferation of digital-only banks in countries such as Japan, India, and China will further stimulate growth in this region. The youthful demographics of the Asia Pacific are also likely to facilitate the adoption of neobanks.

Key Players

The major key players along with their products

Chime - Chime Account

N26 - N26 Bank Account

Revolut - Revolut Card

Monzo - Monzo Bank Account

Ally Bank - Ally Interest Checking Account

Starling Bank - Starling Personal Account

Varo Bank - Varo Savings Account

TransferWise (now Wise) - Wise Multi-Currency Account

Aspire - Aspire Business Account

Open - Open SME Banking

Zeta - Zeta Banking Stack

Judo Bank - Judo Business Loan

Lili - Lili Business Banking Account

Kiva - Kiva Loan Platform

Qonto - Qonto Business Account

Tink - Tink Payment Initiation

Tommy - Tommy Business Account

Bank Novo - Novo Business Checking Account

Zelle - Zelle Payment Service

NerdWallet - NerdWallet Financial Management Tools

Recent Developments

March 24: Starling Bank launched a business account aimed specifically at freelancers and self-employed individuals, featuring tailored tools for invoicing and expense tracking.

February 24: Chime partnered with several retailers to offer exclusive discounts to users who utilize their Chime Card for purchases.

January 24: Revolut launched a new subscription service that provides users with advanced financial tools, including budgeting insights and investment features.

| Report Attributes | Details |

| Market Size in 2023 | USD 101.0 billion |

| Market Size by 2032 | USD 4104.3 billion |

| CAGR | CAGR of 50.94 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Account Type (Business Account, Savings Account) • By Application (Enterprises, Personal, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Chime, N26, Revolut Monzo, Ally Bank, Starling Bank, Varo Bank, TransferWise (now Wise), Aspire Open |

| Key Drivers | • Increasing smartphone penetration and internet accessibility are encouraging consumers to shift towards digital banking solutions. • Advanced technologies, such as AI and machine learning, enhance user experiences through personalized services and efficient processing. • The integration of chatbots and digital assistants improves customer engagement and support, making banking more accessible. |

| Market Restraints | • Some consumers still prefer in-person banking, making it challenging for neobanks to fully replace traditional banks in certain demographics. • Heavy reliance on digital infrastructure means any technical issues or outages can disrupt services, impacting user trust. • Some consumers still prefer in-person banking, making it challenging for neobanks to fully replace traditional banks in certain demographics. |

Ans- The Neobanking Market was valued at 101.0 Billion in 2023 and is projected to reach USD 4104.3 Billion by 2032.

Ans- The CAGR of the Neobanking Market during the forecast period is of 50.94% from 2024-2032.

Ans- In 2023, Europe dominated the Neobanking Market and held a significant revenue share.

Ans- Some of the major growth drivers of the Neobanking Market are:

Increasing smartphone penetration and internet accessibility are encouraging consumers to shift towards digital banking solutions.

Advanced technologies, such as AI and machine learning, enhance user experiences through personalized services and efficient processing.

The integration of chatbots and digital assistants improves customer engagement and support, making banking more accessible.

Ans- The Neobanking Market faces challenges such as:

Some consumers still prefer in-person banking, making it challenging for neobanks to fully replace traditional banks in certain demographics.

Heavy reliance on digital infrastructure means any technical issues or outages can disrupt services, impacting user trust.

Some consumers still prefer in-person banking, making it challenging for neobanks to fully replace traditional banks in certain demographics.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics

4.1 Market Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Neobanking Market Segmentation, by Account Type

7.1 Chapter Overview

7.2 Business Account

7.2.1 Business Account Market Trends Analysis (2020-2032)

7.2.2 Business Account Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Savings Account

7.3.1 Savings Account Market Trends Analysis (2020-2032)

7.3.2 Savings Account Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Neobanking Market Segmentation, by Application

8.1 Chapter Overview

8.2 Enterprises

8.2.1 Enterprises Market Trends Analysis (2020-2032)

8.2.2 Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Personal

8.3.1 Personal Market Trends Analysis (2020-2032)

8.3.2 Personal Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Others

8.3.1 Others Market Trends Analysis (2020-2032)

8.3.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Neobanking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.2.4 North America Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.2.5.2 USA Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.2.6.2 Canada Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Neobanking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Neobanking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.2.6.2 France Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Neobanking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.4.5.2 China Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.4.5.2 India Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.4.5.2 Japan Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.4.9.2 Australia Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Neobanking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Neobanking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.5.2.4 Africa Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Neobanking Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.6.4 Latin America Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Neobanking Market Estimates and Forecasts, by Account Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Neobanking Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Chime

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 N26

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Revolut

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Monzo

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Ally Bank

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Starling Bank

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Varo Bank

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 TransferWise (now Wise)

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Aspire

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Open

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Account Type

Business Account

Savings Account

By Application

Enterprises

Personal

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Edge Computing Market size was valued at USD 16.21 Billion in 2023 and is expected to reach USD 245.30 Billion in 2032 and grow at a CAGR of 35.24% over the forecast period 2024-2032.

The Contactless Payment Market was valued at USD 45.33 billion in 2023 and will reach USD 194.51 Billion by 2032, growing at a CAGR of 17.59 % by 2032.

The Connected Agriculture Market was valued at USD 4.7 billion in 2023 and USD 17.6 billion by 2032, growing at a CAGR of 16.0% from 2024-2032.

The Artificial Intelligence of Things Market was valued at USD 28.15 Bn in 2023 and is projected to grow at a CAGR of 33.13% over 2024-2032 to reach USD 369.18.

IT Operations Management Software Market was valued at USD 52.34 billion in 2023 and will reach USD 134.98 billion by 2032, growing at a CAGR of 11.17% by 2032.

The Connected Enterprise Market was valued at USD 475.2 Billion in 2023 and will reach USD 6519.7 Billion by 2032, growing at a CAGR of 33.79% by 2032.

Hi! Click one of our member below to chat on Phone