To get more information on Needle Coke Market - Request Free Sample Report

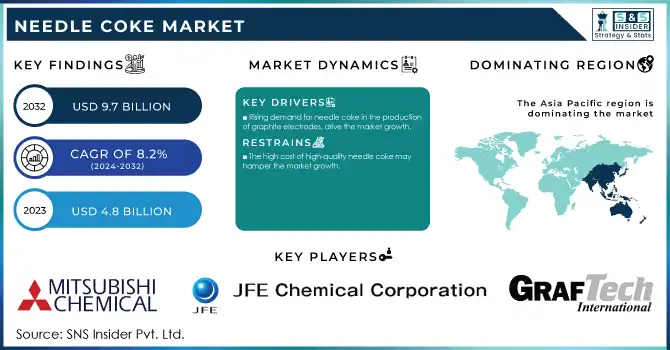

The Needle Coke Market size was valued at USD 4.8 Billion in 2023. It is expected to grow to USD 9.7 Billion by 2032 and grow at a CAGR of 8.2% over the forecast period of 2024-2032.

Growing electric vehicle (EV) production is one of the key factors driving the growth of the needle coke market. Needle coke is an essential input for graphite anodes used in lithium-ion batteries, the mainstay of powering EVs. With electric car numbers booming around the world right now, especially in large markets like China and Europe, the need for premium needle coke should continue to rise substantially in the coming years. Government support providing subsidies and carbon emissions standards for EVs has played a role in courting this domestic EV production growth, which is now also being backed by increasing consumer acceptance of cleaner mobility solutions. To help prolong battery life and increase energy density, battery makers are on the hunt for better, longer-lasting, and high-performance anode materials. As a result, this report anticipates rising demand for high-quality needle coke, which is required to fulfill the stringent quality standards of high-performing anodes, in line with the ongoing sustainable energy transition and electric mobility growth.

In Europe, the European Automobile Manufacturers' Association (ACEA) reported that electric vehicles accounted for 22% of all new car sales in the EU in 2023, continuing to rise as the European Union's Green Deal and emission reduction targets push for a transition to electric mobility.

Increased utilization of renewable energy also solar and wind power boosts the need for energy storage systems which in turn will increase the growth of energy storage devices and thereby drive the demand for high-performance batteries. Such renewable energy sources are intermittent, they are producing electricity only when the sun shines or the wind blows, and are therefore requiring effective and reliable energy storage systems with enough load balance to secure a level of stable power generation. Li-ion batteries are the dominant technology for good reason, offering the world-leading properties like energy density, long cycle life, and efficiency, but we need affordable and high-quality needle coke for graphite anodes.

For example, the European Union and China with its ambitious renewable sources targets of 40% of energy based on replicas of energy from renewables by 2030 and 20% by 2025, respectively. Together with global trends pushing towards decarbonization and green energy solutions, these initiatives further highlight the energy storage need in mitigating the variation of renewable energy output.

Drivers

Rising demand for needle coke in the production of graphite electrodes, drive the market growth.

Needle coke is a vital raw material component when generating graphite electrodes further along the line and thus, is an important factor driving market growth. Needle coke is used as the key raw material to produce high-quality graphite electrodes required in the electric arc furnace (EAF) process for the production of steel. With the global steel industry currently transforming towards more sustainable and energy-efficient steel production methods through the use of electric arc furnaces (EAFs), the demand for graphite electrodes has increased. Electric Arc Furnaces (EAFs), which melt down scrap steel using high-temperature electrical arcs, consume high-quality electrodes made from needle coke for optimal performance and durability. The EAF steelmaking trend, especially in China (the largest steel producer worldwide), Europe, and North America is causing rising needle coke demand. Additionally, with industries demanding greener and more sustainable steel solutions, the importance of needle coke in terms of high-performance electrodes for these advanced technologies is expected to power the growth of the needle coke market as a whole.

The U.S. Geological Survey (USGS) reports that the demand for needle coke, particularly for graphite electrodes, has been steadily rising as electric arc furnaces continue to gain popularity in the steel industry. The increased focus on EAF steel production, combined with rising steel demand in emerging markets, has led to a greater need for high-quality needle coke to manufacture graphite electrodes.

Restraint

The high cost of high-quality needle coke may hamper the market growth.

High-quality needle coke costs too much and acts as a major restraint for the growth of the needle coke market. Needle coke, which is used in highly critical applications such as graphite electrodes for electric arc furnaces and anodes for lithium-ion batteries, requires very high-purity petroleum pitch or coal tar pitch raw materials. This type of material is more complicated and energy-intensive to create, and it requires specialized equipment, enhancing production costs. Moreover, adequate feedstock availability is another constraint, besides global crude oil price fluctuations adding to the costs. Consequently, the elevated raw material cost translates into a higher production cost in industries utilizing needle coke for steel production and in electric vehicle batteries.

By Grade

The super-premium grade held the largest market share around 54% in 2023. This is due to its higher quality and importance in high-performance applications (graphite electrodes for electric arc furnaces (EAF) for the production of steel and lithium-ion batteries for electric vehicles). Featuring high thermal stability, low electrical resistance, and low levels of impurities, super-premium needle coke possesses unique structural properties, which are needed for precision and demanding applications. Graphite electrodes made from super-premium needle coke used in the steel industry improve energy efficiency in the electric arc furnace process, part of a critical transformation in steelmaking towards global practices that are more sustainable and energy-efficient.

By Application

Electrode held the largest market share around 48% in 2023. It is because of the key function of needle coke in the manufacturing of graphite electrodes, which are then utilized in electric arc furnaces (EAF), which are used in steel making. Needle coke-based graphite electrodes are in critical demand for carrying out electricity in the electric arc furnace (EAF) process, which is a more energy and environmentally friendly approach for steelmaking than traditional blast furnace technologies. With more of the world steel sector moving from BF to EAF technology-based brig there is a need for a continued supply of high-quality graphite electrodes as the market sweeps the globe in search of lower carbon energy-dense cemented carbon. These electrodes require a material with high thermal conductivity, low electrical resistance, and the capacity to withstand high temperatures; needle coke’s unique properties make it the best choice for the electrodes.

Asia Pacific held the largest market share around 54% in 2023. Industrialization taking place in various countries with the increased demand for electric vehicles in the region. Needle coke, so essential for global EAF steel production, is influenced by latent need in China, the world's largest steel producer. Electric Arc Furnace (EAF) technology, which consumes high-quality needle coke, is favored for being more energy-efficient and emitting less carbon than the conventional steelmaking approach. The rapid transition to electric mobility in the Asia Pacific, notably in China, Japan, and South Korea, has also driven up the demand for lithium-ion batteries, thus increasing the requirement for high-performance needle coke for battery anodes. It is also a significant market in terms of key manufacturers and consumers that further support its region's market dominance of the needle coke market. Additionally, various Asia Pacific governments are promoting cleaner and sustainable industry transitions that favor the consumption of needle coke in both the steel and battery production processes.

GrafTech International (Ultra-Pure Needle Coke, High-Quality Needle Coke)

JFE Chemical Corporation (Needle Coke for Graphite Electrodes, High-Performance Needle Coke)

Mitsubishi Chemical Corporation (Super-Premium Needle Coke, Needle Coke for Steelmaking)

Indian Oil Corporation Limited (IOCL Needle Coke, Petroleum Needle Coke)

Shaanxi Coal and Chemical Industry (Needle Coke, Petroleum Needle Coke)

Asbury Carbons (Needle Coke, Synthetic Needle Coke)

Koch Industries (Needle Coke, Petroleum Needle Coke)

Sinosteel Corporation (Needle Coke for Lithium Batteries, Ultra-High-Quality Needle Coke)

China National Petroleum Corporation (CNPC) (Needle Coke, High-Purity Needle Coke)

Phillips 66 (Petroleum Needle Coke, Ultra-High Performance Needle Coke)

Fushun Jinly Petrochemical (Needle Coke, Petroleum Needle Coke)

Shanxi Hongte Chemical (Needle Coke for Lithium-ion Batteries, Petroleum Needle Coke)

LG Chem (Needle Coke, High-Performance Needle Coke)

Dongjiang Chemical (Needle Coke, Carbon Needle Coke)

Mitsui Chemicals (High-Quality Needle Coke, Graphite Electrode Needle Coke)

Hunan Jinli New Materials (Petroleum Needle Coke, High-Performance Needle Coke)

C-Chem Co. Ltd. (Needle Coke for Steel Production, Ultra-Pure Needle Coke)

Pechiney (Alcan) (Needle Coke, Petroleum-Based Needle Coke)

ConocoPhillips (Needle Coke, Synthetic Needle Coke)

SGL Carbon (Needle Coke for Electrode Production, Graphite Needle Coke)

In 2023, Showa Denko, a leading producer of needle coke, has made significant investments in expanding its production capacity for super-premium needle coke. The company announced the construction of a new needle coke manufacturing plant in South Korea to meet the growing demand from the steel and battery industries.

In 2023, HEG Limited, one of the major players in the graphite electrode industry, expanded its production capacity in Madhya Pradesh, India.

In 2022, C-Chem, a major player in the production of high-quality needle coke, expanded its production capabilities by upgrading its facilities in Japan. The company focused on increasing the output of premium-grade needle coke specifically for use in graphite electrodes for steelmaking.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$4.8 Billion |

| Market Size by 2032 | US$9.7 Billion |

| CAGR | CAGR of8.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Super-Premium, Premium-Grade, Intermediate Grade) • By Application (Electrode, Silicon Metals & Ferroalloys, Carbon Black, Rubber Compounds, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GrafTech International, JFE Chemical Corporation, Mitsubishi Chemical Corporation, Indian Oil Corporation Limited (IOCL), Shaanxi Coal and Chemical Industry, Asbury Carbons, Koch Industries, Sinosteel Corporation, China National Petroleum Corporation (CNPC), Phillips 66, Fushun Jinly Petrochemical, Shanxi Hongte Chemical, LG Chem, Dongjiang Chemical, Mitsui Chemicals, Hunan Jinli New Materials, C-Chem Co. Ltd., Pechiney (Alcan), ConocoPhillips, SGL Carbon. |

| Key Drivers | • Rising demand for needle coke in the production of graphite electrodes, drive the market growth. |

| RESTRAINTS | •The high cost of high-quality needle coke may hamper the market growth. |

Ans: The Needle Coke Market was valued at USD 4.8 Billion in 2023.

Ans: The expected CAGR of the global Needle Coke Market during the forecast period is 8.2%.

Ans: The Electrode application will grow rapidly in the Needle Coke Market from 2024-2032.

Ans: Rising demand for needle coke in the production of graphite electrodes, drives the market growth.

Ans: The U.S. led the Needle Coke Market in the Asia Pacific region with the highest revenue share in 2023.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 By Production Capacity and Utilization, by Country, By Type, 2023

5.2 Feedstock Prices, by Country, By Type, 2023

5.3 Regulatory Impact, by l Country, By Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 By Grade Benchmarking

6.3.1 By Grade specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new By Grade launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Needle Coke Market Segmentation, By Grade

7.1 Chapter Overview

7.2 Super-Premium

7.2.1 Super-Premium Market Trends Analysis (2020-2032)

7.2.2 Super-Premium Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Premium-Grade

7.3.1 Premium-Grade Market Trends Analysis (2020-2032)

7.3.2 Premium-Grade Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Intermediate Grade

7.4.1 Intermediate Grade Market Trends Analysis (2020-2032)

7.4.2 Intermediate Grade Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Needle Coke Market Segmentation, by Application

8.1 Chapter Overview

8.2 Electrode

8.2.1 Electrode Market Trends Analysis (2020-2032)

8.2.2 Electrode Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Silicon Metals & Ferroalloys

8.3.1 Silicon Metals & Ferroalloys Market Trends Analysis (2020-2032)

8.3.2 Silicon Metals & Ferroalloys Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Carbon Black

8.4.1 Carbon Black Market Trends Analysis (2020-2032)

8.4.2 Carbon Black Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Rubber Compounds

8.5.1 Rubber Compounds Market Trends Analysis (2020-2032)

8.5.2 Rubber Compounds Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Others

8.6.1 Others Market Trends Analysis (2020-2032)

8.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Needle Coke Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.2.4 North America Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.2.5.2 USA Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.2.6.2 Canada Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.2.7.2 Mexico Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Needle Coke Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.1.5.2 Poland Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.1.6.2 Romania Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Needle Coke Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.2.4 Western Europe Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.2.5.2 Germany Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.2.6.2 France Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.2.7.2 UK Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.2.8.2 Italy Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.2.9.2 Spain Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.2.12.2 Austria Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Needle Coke Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.4.4 Asia Pacific Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.4.5.2 China Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.4.5.2 India Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.4.5.2 Japan Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.4.6.2 South Korea Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.2.7.2 Vietnam Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.4.8.2 Singapore Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.4.9.2 Australia Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Needle Coke Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.5.1.4 Middle East Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.5.1.5.2 UAE Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Needle Coke Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.5.2.4 Africa Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Needle Coke Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.6.4 Latin America Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.6.5.2 Brazil Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.6.6.2 Argentina Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.6.7.2 Colombia Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Needle Coke Market Estimates and Forecasts, By Grade (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Needle Coke Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 GrafTech International

10.1.1 Company Overview

10.1.2 Financial

10.1.3 By Product / Services Offered

10.1.4 SWOT Analysis

10.2 JFE Chemical Corporation

10.2.1 Company Overview

10.2.2 Financial

10.2.3 By Product / Services Offered

10.2.4 SWOT Analysis

10.3 Mitsubishi Chemical Corporation

10.3.1 Company Overview

10.3.2 Financial

10.3.3 By Product / Services Offered

10.3.4 SWOT Analysis

10.4 Indian Oil Corporation Limited

10.4.1 Company Overview

10.4.2 Financial

10.4.3 By Product / Services Offered

10.4.4 SWOT Analysis

10.5 Shaanxi Coal and Chemical Industry

10.5.1 Company Overview

10.5.2 Financial

10.5.3 By Product / Services Offered

10.5.4 SWOT Analysis

10.6 Asbury Carbons

10.6.1 Company Overview

10.6.2 Financial

10.6.3 By Product / Services Offered

10.6.4 SWOT Analysis

10.7 Koch Industries

10.7.1 Company Overview

10.7.2 Financial

10.7.3 By Product / Services Offered

10.7.4 SWOT Analysis

10.8 Sinosteel Corporation

10.8.1 Company Overview

10.8.2 Financial

10.8.3 By Product / Services Offered

10.8.4 SWOT Analysis

10.9 China National Petroleum Corporation (CNPC)

10.9.1 Company Overview

10.9.2 Financial

10.9.3 By Product / Services Offered

10.9.4 SWOT Analysis

10.10 Phillips 66

10.10.1 Company Overview

10.10.2 Financial

10.10.3 By Product / Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Grade

Super-Premium

Premium-Grade

Intermediate Grade

By Application

Electrode

Silicon Metals & Ferroalloys

Carbon Black

Rubber Compounds

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Steel Wire Market was valued at USD 102.1 billion in 2023 and is expected to reach USD 167.4 billion by 2032, growing at a CAGR of 5.7% from 2024 to 2032.

The Potash Market Size was valued at USD 60.36 Billion in 2023 and is expected to reach USD 91.73 Billion by 2032, growing at a CAGR of 4.76% from 2024-2032.

The Crop Protection Chemicals Market Size was valued at USD 64.57 Billion in 2023 and is expected to reach USD 102.31 Billion by 2032, growing at a CAGR of 5.30% over the forecast period of 2024-2032.

The Wax Emulsion Market was valued at USD 1.95 Billion in 2023 and is expected to reach USD 2.93 Billion by 2032, growing at a CAGR of 4.66% from 2024-2032.

The Self Compacting Concrete Market Size was valued at USD 13.4 billion in 2023 and is expected to reach USD 26.5 billion by 2032 and grow at a CAGR of 7.9% over the forecast period 2024-2032.

Active Ingredients Market was valued at USD 3.9 billion in 2023 and is expected to reach USD 6.2 billion by 2032 and grow at a CAGR of 5.4% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone