Get More Information on Near-infrared Imaging Market - Request Sample Report

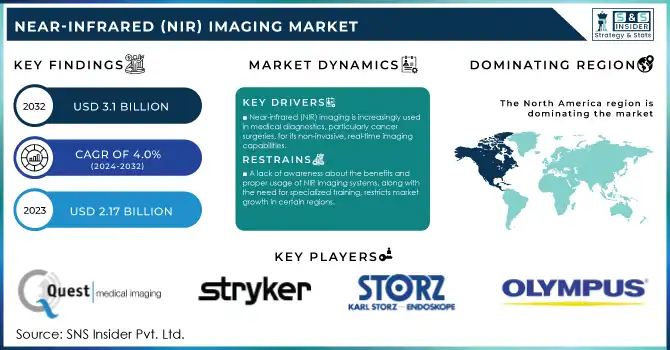

The Near-infrared (NIR) Imaging Market Size was valued at USD 2.17 Billion in 2023 and is expected to reach USD 3.1 billion by 2032, growing at a CAGR of 4.0% over the forecast period 2024-2032.

The global near-infrared (NIR) imaging market has experienced huge growth as government initiatives along with funding have fueled the growth of the NIR imaging market. In 2023, many governments have invested in research and development (R&D) in healthcare innovation, especially in medical imaging. In 2023, the U.S. National Institutes of Health (NIH) allocated about $5.5 billion to cancer research, most of which was directed towards early-stage detection technologies such as near-infrared imaging (NIR). The Horizon Europe program has allocated €2.2 billion for health-related R&D in Europe, a substantial portion of which focuses on NIR imaging technologies.

Governments also recognize the potential of NIR imaging in improving healthcare outcomes by enabling non-invasive and accurate diagnostic procedures. For example, multiple U.S. FDA-approved NIR imaging devices are available for use in clinical settings to visualize tumor marginalization and measure brain activity, and disease progression. This approval and support have led to technological progress and widespread adoption in the clinic and research. An expanding number of government health agencies are expected to continue driving the market forward, particularly with NIR reagents that are new tech with an increased number of approvals. Governmental regulators have established the standards of regulation for the use of NIR imaging technologies, which help to assure safety, efficacy, and quality control. These efforts are expected to continue driving the growth of the NIR imaging market across various regions.

Drivers

Near-infrared (NIR) imaging is gaining significant traction in medical diagnostics, especially for cancer surgeries, due to its non-invasive nature and ability to provide real-time imaging for better treatment decisions.

Continuous advancements in NIR imaging systems, such as the integration of fluorescence and bioluminescence technologies, are enhancing diagnostic accuracy and expanding their applications in various medical fields.

The rising application of near-infrared (NIR) imaging in medical diagnostics is one of the key drivers contributing to the growth of the near-infrared (NIR) imaging market especially in surgical applications. Utilising NIR imaging this is real-time, high-resolution, and non-invasive imaging, allowing surgical decisions to be made in a more informative manner for complex procedures. Due to the higher resolution for visualizing tissues (especially in differentiating cancerous and healthy tissues), it has become more conventional for use in several fields including cancer surgeries, cardiovascular surgeries, along with gastrointestinal surgeries.

For example, a paper published by Fluoptics discusses that NIR imaging improves accuracy in surgical-oriented oncology by providing fluorescent-image-guided tumor resections, which results in improved outcomes for patients. Systems like Fluobeam 800 have been incorporated into operating theaters to provide surgeons with accurate tumor margins during cancer surgeries, thereby decreasing recurrence rates. Moreover, NIR imaging can enhance the real-time imaging of vascular structures, thus facilitating the efficiency of reconstructive surgeries according to a recent study. Moreover, NIR imaging can enhance the real-time imaging of vascular structures, thus facilitating the efficiency of reconstructive surgeries. Not only the NIR imaging can improve the accuracy of these surgical strokes. They are also used in preclinical imaging, which is a crucial step of drug development workflow to enable clearer visualization of disease progression (and response to therapy) in animal models. This increasing utility of NIR imaging in clinical and research settings is anticipated to further propel its widespread adoption across the broad spectrum of medical specialties.

Restraints

The high upfront costs associated with acquiring and implementing NIR imaging systems, along with maintenance costs, may limit their adoption, particularly in low-resource healthcare settings.

A lack of awareness about the benefits and proper usage of NIR imaging systems, along with the need for specialized training, restricts market growth in certain regions.

The factor restraining the growth of the near-infrared imaging market is the high initial costs of equipment. The up-front investment needed for NIR imaging systems is high mainly because of complex hardware and software. Such technology costs can prevent smaller healthcare facilities or research laboratories from adopting these technologies. Routine maintenance, calibration, and potential upgrades only add to this cost burden. Hence, these technologies may get incorporated by bigger hospitals or institutions with good budget plans, but smaller clinics or facilities may lack the capital to incorporate these in any emerging market. This leaves a discontinuity in the adoption of NIR imaging in general, especially in resource-limited countries with low healthcare budgets or lack of funding for advanced diagnostic devices. That alone makes implementation costlier due to the high price and the specialization needs to train staff to use this system effectively.

By Product

The reagents segment accounted for the largest revenue share of 54% in the near-infrared imaging market in 2023 The dominance is primarily due to the importance of the reagents in enhancing the specificity and sensitivity of NIR imaging. They help to increase tissue contrast during imaging procedures and are critical for the detection and diagnosis of many conditions, such as cancer, neurological, and vascular diseases.

The market growth is also attributed to the government initiatives for the development and approval of near-infrared imaging reagents. Several new NIR imaging contrast agents have been approved by the U.S. FDA since 2023, which are one of the essential determinants to broaden the application scope of NIR imaging technologies. Such contrast agents enable improved imaging and real-time monitoring, thus playing a vital role in medical imaging. In addition, ongoing research projects funded by institutions like the NIH are aimed at creating next-generation agents that might yield optimal results with lower toxicity. The rising demand for accurate diagnostic tools in medical and research applications has propelled the market for reagents to new heights.

At the same time, the increasing healthcare costs worldwide have prompted the government to better diagnostic accuracy, thereby increasing demand for NIR reagents. The development and subsequent evolution of these reagents are expected to drive the market in the near future being that a constant state of innovation is likely to enhance the efficiency of medical imaging techniques.

By Application

The preclinical imaging segment was the largest application segment in 2023, with a share of 33% in terms of revenue. This segment's market share dominance and prominence can be explained by the increased focus on early-stage disease identification and drug discovery. Near-infrared technologies for preclinical imaging allow the non-invasive monitoring and assessment of disease progress in animal models, providing a unique opportunity to study the preclinical safety and efficacy of new therapeutic compounds before testing in humans.

Governments have had a big part in funding preclinical research, especially animal imaging, investing a huge amount of money into various studies. As an example in 2023, the US NIH National Cancer Institute (NCI) dedicated more than $3 billion to cancer research, some of which were directed towards the development of preclinical imaging technologies for accelerating cancer drug discovery. In addition, the European Commission has sponsored a large number of projects under Horizon 2020 focused on the development of innovative imaging technologies (NIR) employed in preclinical settings. These investments have pushed toward the development of preclinical imaging, leading to the broad application of NIR technology in research institutions and universities.

NIR imaging can supply both the high-resolution images required in small animal studies and is preferable over the use of harmful radiation, leading investigators to select this imaging modality for many preclinical applications when animal welfare and the requirement for precise statistics is a primary focus. This trend is projected to continue as governments promote additional developments in preclinical imaging modalities, and will keep this section dominating the near infra-red imaging market for the coming future.

By End-Use

The near-infrared imaging market was dominated by hospitals and clinics in 2023, attaining the largest revenue share accounting for about 43%. The growth in this segment is mainly attributed to the increasing adoption of non-invasive NIR imaging technologies for clinical diagnostics especially in the field of oncology, neurology, and vascular diseases. NIR imaging serves as a base for many applications nowadays due to the non-invasive, low-cost, and high-resolution diagnostic capabilities of NIR imaging in hospitals and clinics which enable early disease detection and patient follow-up.

To promote the integration of NIR imaging within healthcare systems, the government has played a vital role. As an example, the U.S. Centers for Medicare & Medicaid Services (CMS) has established for hospitals and clinics to start being reimbursed to perform advanced diagnostic imaging technologies, which include NIR-based techniques. As a result, healthcare providers have begun to integrate NIR imaging into their diagnostic protocols. In the same vein, European governments have financed projects that aim to borrow state-of-the-art imaging technologies to be part of public healthcare, making these technologies available to hospitals and clinics.

A rise in the availability of portable and user-friendly NIR imaging devices is another factor that will likely propel the growth of these devices in hospitals and clinics aside from government funding. These devices, often equipped with advanced reagents, enable healthcare providers to conduct real-time, accurate imaging at the point of care, thus improving patient outcomes and reducing healthcare costs. As governments continue to invest in healthcare infrastructure, the hospitals and clinics segment will likely maintain its dominant position in the near-infrared imaging market.

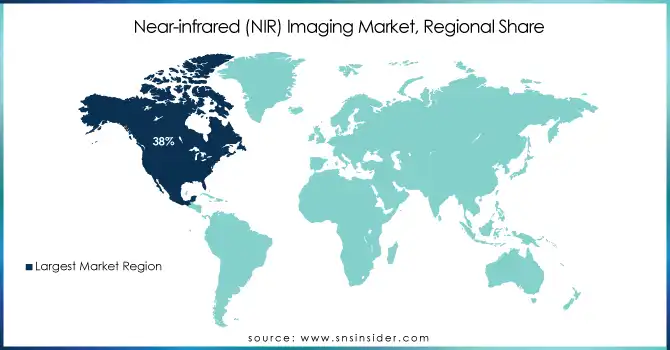

North America held the largest revenue share 38% in 2023. The market in this region was the largest owing to the presence of effective healthcare infrastructure, high healthcare expenditure, and the presence of key market players in this region. The market was led by the U.S., which accounted for a large portion of the global revenue. The growing use of advanced imaging technologies, favourable government support for medical research, and the conducive regulatory environment for NIR-based devices are the significant factors contributing to its dominance in the region. Furthermore, several NIR imaging devices were granted approvals by the U.S. FDA, which significantly contributed to the growth of the market in 2023.

On the other hand, the Asia-Pacific (APAC) region will grow with the highest CAGR during the forecast period. The increasing availability of healthcare infrastructure, rising healthcare spending, and improving adoption of imaging technologies in Asian countries such as China, Japan, and India are further propelling this growth. Government reports indicate that the healthcare market in China is expected to be achieving $1 trillion in market value by the year 2030 while NIR technologies will play an important role in medical imaging development. Moreover, the Government of India is also investing in the digitization of healthcare which is likely to augment opportunities for NIR imaging devices in hospitals and clinics traded here.

Get Customized Report as per Your Business Requirement - Request For Customized Report

The European Commission announced a new funding opportunity in January 2024, planning to invest €25 million into the development of novel near-infrared imaging technologies. The funding, announced today, is part of the Horizon Europe program that facilitates partnerships to conquer the most pressing healthcare problems.

The NIR-D7000 was introduced by Olympus in April 2023 for medical and industrial applications.

Hamamatsu Photonics launched the NIR-A1200, a near-infrared camera for industrial and scientific applications, in March 2023.

In May 2023, PerkinElmer launched NIRQuest 5000, an imaging system for research and clinical applications.

Key Service Providers/Manufacturers

Hamamatsu Photonics (NIR-A1200, ORCA-R2)

Olympus Corporation (NIR-D7000, AlphaTIRF)

PerkinElmer, Inc. (NIRQuest 5000, Vectra Polaris)

FLIR Systems, Inc. (A6780sc, T1020)

Teledyne DALSA (Calibir GXF, Z-Trak 3D)

Bruker Corporation (Alpha II, INVENIO R)

Thermo Fisher Scientific (DXR3, Nicolet iS50)

Edmund Optics Inc. (VSD NIR Camera, EO-1312M)

Raytheon Technologies Corporation (X8500sc, NightSight)

Carl Zeiss AG (ZEISS LSM 980, Axiocam 702 NIR)

Key Users

Siemens Healthineers

General Electric (GE Healthcare)

Philips Healthcare

Johnson & Johnson (Ethicon)

Medtronic plc

Abbott Laboratories

Boston Scientific Corporation

Roche Diagnostics

Stryker Corporation

Canon Medical Systems Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.17 Billion |

| Market Size by 2032 | USD 3.1 Billion |

| CAGR | CAGR of 4.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Devices {Near-infrared Fluorescence Imaging Systems, Near-infrared Fluorescence & Bioluminescence Imaging Systems}, Reagents {Indocyanine Green (ICG), Other Reagents}) • By Application (Preclinical Imaging, Cancer Surgeries, Gastrointestinal Surgeries, Cardiovascular Surgeries, Plastic/Reconstructive Surgeries, Others) • By End-use (Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Research Laboratories) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hamamatsu Photonics, Olympus Corporation, PerkinElmer, Inc., FLIR Systems, Inc., Teledyne DALSA, Bruker Corporation, Thermo Fisher Scientific, Edmund Optics Inc., Raytheon Technologies Corporation, Carl Zeiss AG |

| Key Drivers | • Near-infrared (NIR) imaging is gaining significant traction in medical diagnostics, especially for cancer surgeries, due to its non-invasive nature and ability to provide real-time imaging for better treatment decisions. • Continuous advancements in NIR imaging systems, such as the integration of fluorescence and bioluminescence technologies, are enhancing the diagnostic accuracy and expanding their applications in various medical fields. |

| Restraints | • The high upfront costs associated with acquiring and implementing NIR imaging systems, along with maintenance costs, may limit their adoption, particularly in low-resource healthcare settings. |

Ans: The projected market size for the Near-infrared (NIR) imaging Market is USD 3.1 Billion by 2032

Ans: The North America region dominated the Near-infrared (NIR) imaging Market in 2023.

Ans: The CAGR of the Near-infrared (NIR) imaging Market is 4.0% During the forecast period of 2024-2032.

Ans: The Hospitals & Clinics end-use segment dominated the Near-infrared (NIR) imaging Market in 2023.

Ans:

Continuous advancements in NIR imaging systems, such as the integration of fluorescence and bioluminescence technologies, are enhancing the diagnostic accuracy and expanding their applications in various medical fields?.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Near-infrared (NIR) imaging Market Segmentation, By Product

7.1 Chapter Overview

7.2 Devices

7.2.1 Devices Market Trends Analysis (2020-2032)

7.2.2 Devices Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Near-infrared Fluorescence Imaging Systems

7.2.3.1 Near-infrared Fluorescence Imaging Systems Market Trends Analysis (2020-2032)

7.2.3.2 Near-infrared Fluorescence Imaging Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Near-infrared Fluorescence & Bioluminescence Imaging Systems

7.2.4.1 Near-infrared Fluorescence & Bioluminescence Imaging Systems Market Trends Analysis (2020-2032)

7.2.4.2 Near-infrared Fluorescence & Bioluminescence Imaging Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Reagents

7.3.1 Reagents Market Trends Analysis (2020-2032)

7.3.2 Reagents Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Indocyanine Green (ICG)

7.3.3.1 Indocyanine Green (ICG) Market Trends Analysis (2020-2032)

7.3.3.2 Indocyanine Green (ICG) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Other Reagents

7.3.4.1 Other Reagents Market Trends Analysis (2020-2032)

7.3.4.2 Other Reagents Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Near-infrared (NIR) imaging Market Segmentation, By Application

8.1 Chapter Overview

8.2 Preclinical Imaging

8.2.1 Preclinical Imaging Market Trends Analysis (2020-2032)

8.2.2 Preclinical Imaging Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Cancer Surgeries

8.3.1 Cancer Surgeries Market Trends Analysis (2020-2032)

8.3.2 Cancer Surgeries Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Gastrointestinal Surgeries

8.4.1 Gastrointestinal Surgeries Market Trends Analysis (2020-2032)

8.4.2 Gastrointestinal Surgeries Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Cardiovascular Surgeries

8.5.1 Cardiovascular Surgeries Market Trends Analysis (2020-2032)

8.5.2 Cardiovascular Surgeries Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Plastic/Reconstructive Surgeries

8.6.1 Plastic/Reconstructive Surgeries Market Trends Analysis (2020-2032)

8.6.2 Plastic/Reconstructive Surgeries Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Near-infrared (NIR) imaging Market Segmentation, By End-use

9.1 Chapter Overview

9.2 Hospitals & Clinics

9.2.1 Hospitals & Clinics Market Trends Analysis (2020-2032)

9.2.2 Hospitals & Clinics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Pharmaceutical & Biotechnology Companies

9.3.1 Pharmaceutical & Biotechnology Companies Market Trends Analysis (2020-2032)

9.3.2 Pharmaceutical & Biotechnology Companies Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Research Laboratories

9.4.1 Research Laboratories Market Trends Analysis (2020-2032)

9.4.2 Research Laboratories Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Near-infrared (NIR) imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.4 North America Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.5 North America Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.6.2 USA Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.3 USA Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.7.2 Canada Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.3 Canada Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.7.2 France Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.3 France Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Near-infrared (NIR) imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.4 Asia Pacific Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.6.2 China Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.3 China Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.7.2 India Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.3 India Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.8.2 Japan Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.3 Japan Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.12.2 Australia Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.3 Australia Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Near-infrared (NIR) imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Near-infrared (NIR) imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.4 Africa Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.5 Africa Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Near-infrared (NIR) imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.4 Latin America Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.5 Latin America Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Near-infrared (NIR) imaging Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Near-infrared (NIR) imaging Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Near-infrared (NIR) imaging Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Hamamatsu Photonics

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Olympus Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 PerkinElmer, Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 FLIR Systems, Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Teledyne DALSA

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Bruker Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Thermo Fisher Scientific

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Edmund Optics Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Raytheon Technologies Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Carl Zeiss AG

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Devices

Near-infrared Fluorescence Imaging Systems

Near-infrared Fluorescence & Bioluminescence Imaging Systems

Reagents

Indocyanine Green (ICG)

Other Reagents

By Application

Preclinical Imaging

Cancer Surgeries

Gastrointestinal Surgeries

Cardiovascular Surgeries

Plastic/Reconstructive Surgeries

Others

By End-use

Hospitals & Clinics

Pharmaceutical & Biotechnology Companies

Research Laboratories

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Orthopedic Devices Market size was USD 60.00 Billion in 2023 and is expected to reach USD 89.60 Billion by 2032 and grow at a CAGR of 4.5% over the forecast period of 2024-2032.

Glioblastoma Multiforme Treatment Market was valued at USD 2.76 billion in 2023 and is expected to reach USD 5.98 billion by 2032, growing at a CAGR of 9% over the forecast period 2024-2032.

The Healthcare Contract Management Software Market Size was valued at USD 1.52 billion in 2023 and is expected to reach USD 9.1 billion by 2032 at a CAGR of 22.0%.

The Scanning Electron Microscopes Market Size was valued at USD 4.75 Billion in 2023, and is expected to reach USD 9.36 Billion by 2032, and grow at a CAGR of 9.77%.

Airway Disease Treatment Market was valued at $ 2.23 billion in 2023 and is expected to reach $ 3.54 billion by 2032, growing at a CAGR of 5.29% from 2024-2032.

The Corporate Wellness Market Size was valued at USD 64.11 billion in 2023 and will reach USD 123.35 billion in 2032, with a CAGR of 7.60% by 2024-2032.

Hi! Click one of our member below to chat on Phone