To get more information on Naval Communication Market - Request Free Sample Report

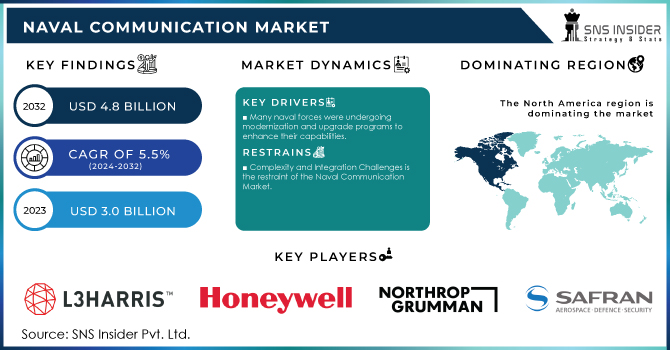

The Naval Communication Market Size was valued at USD 3.0 billion in 2023, and is expected to reach USD 4.8 billion by 2032, and grow at a CAGR of 5.5% over the forecast period 2024-2032.

The constant updating and implementation of a series of resolutions and codes on navigation issues and performance standards for shipborne navigational and radiocommunications equipment, namely the SOLAS, STCW, and COLREG, necessitated the development of new navigation and communication systems to ensure the safety of naval assets at sea. The ongoing research and development towards the development of advanced maritime technologies, such as stealth submarines and unmanned marine systems, is intended to inspire potential investments in the development and implementation of sophisticated navigation systems, to ensure vessel safety, and high-performance communication systems that can ensure the swift, stealthy, and encrypted flow of telemetry data between the naval fleet and the control station.

Geopolitical concerns and national defence expenditures have a considerable impact on the naval communication industry. The geopolitical context, which includes international conflicts, territorial disputes, and regional security concerns, has a direct influence on the demand for naval communication systems. To protect their maritime interests and preserve a competitive advantage, naval forces across the world prioritise the development and upgrade of their communication capabilities. The requirement for sophisticated communication systems to assist naval operations is driven by geopolitical considerations such as greater military presence, territorial claims, and evolving security concerns.

The naval communication market encompasses a range of technologies and solutions designed to facilitate communication and information exchange within naval fleets and between naval units and command centers. This includes communication between ships, submarines, aircraft, and shore-based facilities. The market is driven by the increasing need for secure and reliable communication systems in the face of evolving maritime threats, geopolitical tensions, and the advancement of naval technology.

The market has seen advancements including improved satellite communication systems, communication technologies, secure data networks, high-frequency radio systems, and encrypted communication protocols. Navies have been transitioning toward network-centric warfare strategies, which require seamless integration of communication systems to share real-time data, intelligence, and situational awareness among different units. This drives the demand for advanced networking solutions.

As communication systems become more digitized and interconnected, there is an increasing need to address cybersecurity threats that could potentially compromise sensitive military information and disrupt operations. Satellites play a crucial role in naval communication, enabling long-range and secure communication in remote maritime areas. Advancements in satellite technology have improved coverage and bandwidth capabilities.

MARKET DYNAMICS

DRIVERS:

Many naval forces were undergoing modernization and upgrade programs to enhance their capabilities.

Network-centric warfare is the driver of the Naval Communication Market.

The shift toward network-centric warfare emphasized the need for seamless communication and data sharing among different naval assets. This approach enhances decision-making and operational effectiveness by enabling real-time information exchange.

RESTRAIN:

Defense budgets of many nations are finite, and naval communication systems compete for funding with other critical defense needs.

Complexity and Integration Challenges is the restraint of the Naval Communication Market.

Integrating new communication systems with existing naval infrastructure and platforms can be complex and costly. Compatibility issues and technical challenges might arise when trying to ensure seamless communication across various platforms and networks.

OPPORTUNITY:

The integration of unmanned systems into naval operations offers opportunities for communication systems.

Technological Innovation is an opportunity for the Naval Communication Market.

Ongoing technological advancements create opportunities for the development of more efficient, secure, and interoperable naval communication systems. Innovations such as software-defined radios, advanced signal processing, and cognitive communication techniques could lead to enhanced capabilities.

CHALLENGES:

Communicating effectively underwater poses unique challenges due to the limitations of traditional radio waves.

Interoperability and Standardization are the challenges of the Naval Communication Market.

Ensuring interoperability between communication systems from different nations and different branches of the military is a complex challenge. Lack of standardized protocols and equipment can hinder coordination during joint operations.

IMPACT OF RUSSIA-UKRAINE WAR

The Ukraine conflict is suffocating trade and logistics in Ukraine and the Black Sea area. The hunt for alternative trade channels for Ukrainian commodities has expanded significantly the need for land and maritime transportation infrastructure and services. Many goods must now be procured from further afield for Ukraine's trading partners. This has boosted worldwide vessel demand and the expense of global transportation. Grains are of special relevance because of the Russian Federation's and Ukraine's dominant positions in agrifood markets, as well as their link to food security and poverty alleviation. Grain prices and transportation costs have been rising since 2021, but the Ukraine crisis has worsened this trend and reversed a recent drop in shipping prices.

The cost of transporting dry bulk items, such as grains, is expected to rise by over 60% by 2022. Concurrent increases in grain prices and freight costs would result in a nearly 4% increase in worldwide consumer food prices. Higher shipping costs account for nearly half of this impact. The Russian Federation is a global powerhouse in the markets for fuel and fertiliser, both of which are critical inputs for farmers globally. Supply disruptions can result in reduced grain yields and higher prices, with major ramifications for global food security. In this conflict, the naval communication market gained less profit up to 1.1-1.5%.

IMPACT OF ONGOING RECESSION

As a result of the worldwide economic slump, the international shipping sector has seen a significant slowdown, with excess shipping capacity, personnel being paid off, fewer earnings, and shipowners looking to cut expenses. This study discusses the consequences of these changes for maritime security. These include an increase in the number of ships anchored in areas that may be vulnerable to pirate assault, as well as the possibility that ships may be less adequately maintained and operated. However, the most significant consequences are felt by seafarers, who face lower salaries and working conditions. The International Maritime Organisation (IMO), industry groups, and shipowners are being urged to solve these challenges before safety and security suffer as a result of rising risks of maritime accidents and pollution. In the ongoing recession, the Naval Communication Market lost up to 3.4-4.5%

By Application

Intelligence Surveillance and Reconnaissance (ISR)

Command and Control

Routine Operations

Others

By Platform

Submarines

Ships

Unmanned Systems

By System Technology

Naval Radio Systems

Naval Satcom Systems

Communication Management Systems

Naval Security Systems

REGIONAL ANALYSIS

North America: North America has a vast network of naval bases, command centres, and research facilities that stimulate innovation and fuel demand for naval communication systems. The region's emphasis on maritime security, sea lanes protection, and naval force projection drives market expansion even further. While other areas, such as Europe and Asia-Pacific, have considerable naval capabilities and defence spending, North America is likely to dominate the market owing to its sophisticated naval forces, defence industry experience, and significant resources allocated to naval modernization. The region's substantial presence of major defence contractors reinforces its market dominance.

Asia Pacific: The strengthening of strategic military alliances between the United States and several Asia-Pacific sovereign nations, as well as subsequent reinforcement of military deployment and intervention, has resulted in a complex scenario whereby regional countries, such as China, have been encouraged to modernise their defense capabilities quickly for the sake of protecting their interests. China hopes to have the Type 093B SHANG-class guided-missile nuclear attack submarine in service by the mid-2020s.

Need any customization research on Naval Communication Market - Enquiry Now

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Key players

The Major Players are Honeywell International Inc., Northrop Grumman Corporation, Safran SA, FLIR Systems, Inc., Thales Group, General Dynamics Corporation, Bae Systems plc, Lockheed Martin Corporation, L3Harris Technologies, Inc., Raytheon Technologies Corporation and other players.

RECENT DEVELOPMENT

In 2022: BAE Systems was given a contract by the US Defence Advanced Research Projects Agency (DARPA) to create management software that combines military sensors with land, air, and marine weapons. The contract, for a total of USD 24.9 million, is part of the service's Mission-Integrated Network Control (MIC) initiative to develop a secure network overlay to handle multi-domain kill webs. The programme would leverage secure control of any available communications or networking resources in disputed contexts to guarantee that vital data reaches the correct user at the right time.

In 2021: Lockheed Martin purchased Ultra Electronics' naval systems business, which expanded navy communication and electronic warfare capabilities by providing sophisticated solutions for communication, surveillance, and electronic countermeasures in marine environments.

In 2021: Honeywell has introduced two new robust navigation systems: the Honeywell Compact Inertial Navigation System and the Honeywell Radar Velocity System.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.0 Bn |

| Market Size by 2032 | US$ 4.8 Bn |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Intelligence Surveillance and Reconnaissance (ISR), Command and Control, Routine Operations, Others) • By Platform (Submarines, Ships, Unmanned Systems) • By System Technology (Naval Radio Systems, Naval Satcom Systems, Communication Management Systems, Naval Security Systems) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Honeywell International Inc., Northrop Grumman Corporation, Safran SA, FLIR Systems, Inc., Thales Group, General Dynamics Corporation, Bae Systems plc, Lockheed Martin Corporation, L3Harris Technologies, Inc., Raytheon Technologies Corporation |

| Key Drivers | • Many naval forces were undergoing modernization and upgrade programs to enhance their capabilities. • Network-centric warfare is the driver of the Naval Communication Market. |

| Market Restraints | • Defense budgets of many nations are finite, and naval communication systems compete for funding with other critical defense needs. • Complexity and Integration Challenges is the restraint of the Naval Communication Market. |

Ans. The Compound Annual Growth rate for the Naval Communication Market over the forecast period is 5.5%.

Ans. USD 4.57 Billion is the projected Naval Communication Market size of the market by 2030.

Ans. The Naval Communication Market is anticipated to reach USD 2.98 Billion by 2022.

Ans. In the naval communication industry, the command-and-control sector is expected to have the biggest market share. In naval operations, command and control systems are critical for successful coordination, situational awareness, and decision-making. As the complexity of naval operations grows, so does the need for modern command and control technologies.

Ans. The ships category is predicted to develop significantly in the naval communication market, with a large CAR. Ships play an important part in naval operations as platforms, and they require powerful communication systems to support their coordination and command duties. The growing emphasis on marine security, as well as the necessity to confront new threats, has increased demand for advanced communication solutions in the ship segment. Naval modernization programmes aiming at improving operational capabilities add to the need for efficient and dependable communication systems.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Naval Communication Market, By Platform

8.1 Submarines

8.2 Ships

8.3 Unmanned Systems

9. Naval Communication Market, By System Technology

9.1 Naval Radio Systems

9.2 Naval Satcom Systems

9.3 Communication Management Systems

9.4 Naval Security Systems

10. Naval Communication Market, By Application

10.1 Intelligence Surveillance and Reconnaissance (ISR)

10.2 Command and Control

10.3 Routine Operations

10.4 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Naval Communication Market by Country

11.2.2 North America Naval Communication Market by Application

11.2.3 North America Naval Communication Market by Platform

11.2.4 North America Naval Communication Market by System Technology

11.2.5 USA

11.2.5.1 USA Naval Communication Market by Application

11.2.5.2 USA Naval Communication Market by Platform

11.2.5.3 USA Naval Communication Market by System Technology

11.2.6 Canada

11.2.6.1 Canada Naval Communication Market by Application

11.2.6.2 Canada Naval Communication Market by Platform

11.2.6.3 Canada Naval Communication Market by System Technology

11.2.7 Mexico

11.2.7.1 Mexico Naval Communication Market by Application

11.2.7.2 Mexico Naval Communication Market by Platform

11.2.7.3 Mexico Naval Communication Market by System Technology

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Naval Communication Market by country

11.3.1.2 Eastern Europe Naval Communication Market by Application

11.3.1.3 Eastern Europe Naval Communication Market by Platform

11.3.1.4 Eastern Europe Naval Communication Market by System Technology

11.3.1.5 Poland

11.3.1.5.1 Poland Naval Communication Market by Application

11.3.1.5.2 Poland Naval Communication Market by Platform

11.3.1.5.3 Poland Naval Communication Market by System Technology

11.3.1.6 Romania

11.3.1.6.1 Romania Naval Communication Market by Application

11.3.1.6.2 Romania Naval Communication Market by Platform

11.3.1.6.4 Romania Naval Communication Market by System Technology

11.3.1.7 Turkey

11.3.1.7.1 Turkey Naval Communication Market by Application

11.3.1.7.2 Turkey Naval Communication Market by Platform

11.3.1.7.3 Turkey Naval Communication Market by System Technology

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Naval Communication Market by Application

11.3.1.8.2 Rest of Eastern Europe Naval Communication Market by Platform

11.3.1.8.3 Rest of Eastern Europe Naval Communication Market by System Technology

11.3.2 Western Europe

11.3.2.1 Western Europe Naval Communication Market by Application

11.3.2.2 Western Europe Naval Communication Market by Platform

11.3.2.3 Western Europe Naval Communication Market by System Technology

11.3.2.4 Germany

11.3.2.4.1 Germany Naval Communication Market by Application

11.3.2.4.2 Germany Naval Communication Market by Platform

11.3.2.4.3 Germany Naval Communication Market by System Technology

11.3.2.5 France

11.3.2.5.1 France Naval Communication Market by Application

11.3.2.5.2 France Naval Communication Market by Platform

11.3.2.5.3 France Naval Communication Market by System Technology

11.3.2.6 UK

11.3.2.6.1 UK Naval Communication Market by Application

11.3.2.6.2 UK Naval Communication Market by Platform

11.3.2.6.3 UK Naval Communication Market by System Technology

11.3.2.7 Italy

11.3.2.7.1 Italy Naval Communication Market by Application

11.3.2.7.2 Italy Naval Communication Market by Platform

11.3.2.7.3 Italy Naval Communication Market by System Technology

11.3.2.8 Spain

11.3.2.8.1 Spain Naval Communication Market by Application

11.3.2.8.2 Spain Naval Communication Market by Platform

11.3.2.8.3 Spain Naval Communication Market by System Technology

11.3.2.9 Netherlands

11.3.2.9.1 Netherlands Naval Communication Market by Application

11.3.2.9.2 Netherlands Naval Communication Market by Platform

11.3.2.9.3 Netherlands Naval Communication Market by System Technology

11.3.2.10 Switzerland

11.3.2.10.1 Switzerland Naval Communication Market by Application

11.3.2.10.2 Switzerland Naval Communication Market by Platform

11.3.2.10.3 Switzerland Naval Communication Market by System Technology

11.3.2.11.1 Austria

11.3.2.11.2 Austria Naval Communication Market by Application

11.3.2.11.3 Austria Naval Communication Market by Platform

11.3.2.11.4 Austria Naval Communication Market by System Technology

11.3.2.12 Rest of Western Europe

11.3.2.12.1 Rest of Western Europe Naval Communication Market by Application

11.3.2.12.2 Rest of Western Europe Naval Communication Market by Platform

11.3.2.12.3 Rest of Western Europe Naval Communication Market by System Technology

11.4 Asia-Pacific

11.4.1 Asia-Pacific Naval Communication Market by country

11.4.2 Asia-Pacific Naval Communication Market by Application

11.4.3 Asia-Pacific Naval Communication Market by Platform

11.4.4 Asia-Pacific Naval Communication Market by System Technology

11.4.5 China

11.4.5.1 China Naval Communication Market by Application

11.4.5.2 China Naval Communication Market by Platform

11.4.5.3 China Naval Communication Market by System Technology

11.4.6 India

11.4.6.1 India Naval Communication Market by Application

11.4.6.2 India Naval Communication Market by Platform

11.4.6.3 India Naval Communication Market by System Technology

11.4.7 Japan

11.4.7.1 Japan Naval Communication Market by Application

11.4.7.2 Japan Naval Communication Market by Platform

11.4.7.3 Japan Naval Communication Market by System Technology

11.4.8 South Korea

11.4.8.1 South Korea Naval Communication Market by Application

11.4.8.2 South Korea Naval Communication Market by Platform

11.4.8.3 South Korea Naval Communication Market by System Technology

11.4.9 Vietnam

11.4.9.1 Vietnam Naval Communication Market by Application

11.4.9.2 Vietnam Naval Communication Market by Platform

11.4.9.3 Vietnam Naval Communication Market by System Technology

11.4.10 Singapore

11.4.10.1 Singapore Naval Communication Market by Application

11.4.10.2 Singapore Naval Communication Market by Platform

11.4.10.3 Singapore Naval Communication Market by System Technology

11.4.11 Australia

11.4.11.1 Australia Naval Communication Market by Application

11.4.11.2 Australia Naval Communication Market by Platform

11.4.11.3 Australia Naval Communication Market by System Technology

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Naval Communication Market by Application

11.4.12.2 Rest of Asia-Pacific Naval Communication Market by Platform

11.4.12.3 Rest of Asia-Pacific Naval Communication Market by System Technology

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Naval Communication Market by Country

11.5.1.2 Middle East Naval Communication Market by Application

11.5.1.3 Middle East Naval Communication Market by Platform

11.5.1.4 Middle East Naval Communication Market by System Technology

11.5.1.5 UAE

11.5.1.5.1 UAE Naval Communication Market by Application

11.5.1.5.2 UAE Naval Communication Market by Platform

11.5.1.5.3 UAE Naval Communication Market by System Technology

11.5.1.6 Egypt

11.5.1.6.1 Egypt Naval Communication Market by Application

11.5.1.6.2 Egypt Naval Communication Market by Platform

11.5.1.6.3 Egypt Naval Communication Market by System Technology

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Naval Communication Market by Application

11.5.1.7.2 Saudi Arabia Naval Communication Market by Platform

11.5.1.7.3 Saudi Arabia Naval Communication Market by System Technology

11.5.1.8 Qatar

11.5.1.8.1 Qatar Naval Communication Market by Application

11.5.1.8.2 Qatar Naval Communication Market by Platform

11.5.1.8.3 Qatar Naval Communication Market by System Technology

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Naval Communication Market by Application

11.5.1.9.2 Rest of Middle East Naval Communication Market by Platform

11.5.1.9.3 Rest of Middle East Naval Communication Market by System Technology

11.5.2 Africa

11.5.2.1 Africa Naval Communication Market by country

11.5.2.2 Africa Naval Communication Market by Application

11.5.2.3 Africa Naval Communication Market by Platform

11.5.2.4 Africa Naval Communication Market by System Technology

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Naval Communication Market by Application

11.5.2.5.2 Nigeria Naval Communication Market by Platform

11.5.2.5.3 Nigeria Naval Communication Market by System Technology

11.5.2.6 South Africa

11.5.2.6.1 South Africa Naval Communication Market by Application

11.5.2.6.2 South Africa Naval Communication Market by Platform

11.5.2.6.3 South Africa Naval Communication Market by System Technology

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Naval Communication Market by Application

11.5.2.7.2 Rest of Africa Naval Communication Market by Platform

11.5.2.7.3 Rest of Africa Naval Communication Market by System Technology

11.6 Latin America

11.6.1 Latin America Naval Communication Market by Country

11.6.2 Latin America Naval Communication Market by Application

11.6.3 Latin America Naval Communication Market by Platform

11.6.4 Latin America Naval Communication Market by System Technology

11.6.5 Brazil

11.6.5.1 Brazil Naval Communication Market by Application

11.6.5.2 Brazil Naval Communication Market by Platform

11.6.5.3 Brazil Naval Communication Market by System Technology

11.6.6 Argentina

11.6.6.1 Argentina Naval Communication Market by Application

11.6.6.2 Argentina Naval Communication Market by Platform

11.6.6.3 Argentina Naval Communication Market by System Technology

11.6.7 Colombia

11.6.7.1 Colombia Naval Communication Market by Application

11.6.7.2 Colombia Naval Communication Market by Platform

11.6.7.3 Colombia Naval Communication Market by System Technology

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Naval Communication Market by Application

11.6.8.2 Rest of Latin America Naval Communication Market by Platform

11.6.8.3 Rest of Latin America Naval Communication Market by System Technology

12 Company profile

12.1 Honeywell International Inc.

12.1.1 Company Overview

12.1.2 Financials

12.1.3 Product/Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Northrop Grumman Corporation

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Safran SA

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 FLIR Systems, Inc.

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Thales Group

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 General Dynamics Corporation

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Bae Systems plc

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 Lockheed Martin Corporation

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Product/Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 L3Harris Technologies, Inc

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Raytheon Technologies Corporation

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The More Electric Aircraft Market Size was valued at USD 3.25 billion in 2023 and is expected to reach USD 14.19 billion by 2032 with a growing CAGR of 17.8% over the forecast period 2024-2032.

The Aircraft Engine Nacelle Market size was USD 3.98 billion in 2023 and is expected to reach USD 4.86 billion by 2032, growing at a CAGR of 2.3% over the forecast period of 2024-2032.

The Automatic Identification System Market Size was valued at USD 276 million in 2023, expected to reach USD 518.47 million by 2032 with a growing CAGR of 7.3% over the forecast period 2024-2032.

The Marine Electric Vehicle Market Size was valued at USD 10.0 billion in 2023 and is expected to reach USD 32.3 billion by 2032 and grow at a CAGR of 13.9% over the forecast period 2024-2032.

The Shoulder Fired Weapons Market Size was valued at a CAGR of 4.80% over the forecast period 2023-2030.

The Passenger Security Market Size was valued at USD 6.52 billion in 2023 and is expected to reach USD 12.40 billion by 2032 with a growing CAGR of 7.41% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone