The Natural Refrigerants Market size was USD 1.59 billion in 2023 and is expected to Reach USD 2.77billion by 2032 and grow at a CAGR of 6.34% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Natural Refrigerants Market - Request Sample Report

The Natural Refrigerants Market is witnessing substantial growth due to the increasing focus on sustainable and eco-friendly cooling solutions. Natural refrigerants such as ammonia (NH3), carbon dioxide (CO2), and hydrocarbons (propane, isobutane) are gaining traction as they have a minimal environmental impact compared to synthetic refrigerants like hydrofluorocarbons (HFCs) and chlorofluorocarbons (CFCs). These refrigerants are known for their low Global Warming Potential (GWP) and zero Ozone Depletion Potential (ODP), making them ideal for industries aiming to meet stringent environmental regulations and reduce carbon footprints.

A significant trend in the market is the rising adoption of natural refrigerants in commercial refrigeration, industrial applications, and HVAC systems. The push toward energy-efficient cooling technologies is further driving their adoption. For instance, the food and beverage sector are increasingly using ammonia-based systems for refrigeration due to their high efficiency and reliability. Similarly, carbon dioxide is being widely utilized in supermarket refrigeration and heat pumps, while hydrocarbons are emerging as preferred choices in domestic and small-scale cooling systems. The demand for natural refrigerants is also supported by government initiatives promoting green energy and policies encouraging the phase-down of HFCs under the Kigali Amendment to the Montreal Protocol. Furthermore, advancements in refrigeration technologies, such as transcritical CO2 systems, are boosting the market by offering enhanced performance and reduced operational costs.

According to research a growing shift toward ammonia, particularly in industrial refrigeration, where it accounts for a significant portion of installations globally. The adoption of carbon dioxide systems in commercial refrigeration has also surged in recent years, with a notable increase in supermarket chains employing CO2-based technologies. Additionally, propane and isobutane are now incorporated in over 50% of newly manufactured domestic refrigerators worldwide, reflecting their rising acceptance across end-use sectors.

MARKET DYNAMICS

DRIVERS

The Natural Refrigerants Market is witnessing significant growth, driven by stringent environmental regulations and policies promoting sustainable practices. Regulations such as the Kigali Amendment to the Montreal Protocol and the European Union's F-gas regulations aim to phase out hydrofluorocarbons (HFCs) due to their high global warming potential (GWP). These mandates are accelerating the transition to eco-friendly natural refrigerants like ammonia (NH3), carbon dioxide (CO2), and hydrocarbons (propane and isobutane), which offer low GWP and ozone depletion potential (ODP).

The market is poised for robust growth as industries across HVAC, refrigeration, and cold chain logistics adopt natural refrigerants to comply with these policies and reduce their carbon footprint. According to market trends, technological advancements are enabling the development of energy-efficient systems compatible with natural refrigerants, while growing demand for sustainable cooling solutions in emerging economies further supports market expansion. However, challenges such as high initial installation costs and safety concerns related to toxicity or flammability remain key barriers. Despite this, the market is projected to grow at a substantial compound annual growth rate (CAGR) in the coming years, driven by rising investments in green technologies, increasing consumer awareness, and supportive government incentives fostering a sustainable refrigeration ecosystem.

RESTRAINT

The high initial investment is a key restraint in the natural refrigerants market, as the installation of systems using these refrigerants involves significant costs. Specialized components and advanced equipment are required to ensure efficiency, safety, and compliance with environmental regulations. These systems often need robust infrastructure, including high-pressure compressors and reinforced pipelines, which further add to the upfront expenses. Despite these costs, the market is witnessing steady growth due to increasing adoption in industries such as food and beverage, HVAC, and cold chain logistics. Stringent environmental regulations and rising consumer demand for energy-efficient solutions are driving this trend. Additionally, advancements in technology, such as improved system designs and enhanced safety mechanisms, are helping to overcome these barriers. The market is expected to grow at a healthy pace as industries worldwide transition towards sustainable solutions, with key players focusing on cost reduction and system optimization to boost adoption.

MARKET SEGMENTATION

By Type

Hydrocarbons, including propane (R-290) and isobutane (R-600a), segment dominated with the market share over 42% in 2023, due to their excellent efficiency, low global warming potential, and favorable thermodynamic properties. These refrigerants are widely used in residential, commercial, and industrial refrigeration, as well as in air conditioning systems. Their growing adoption is largely driven by strict environmental regulations aimed at reducing greenhouse gas emissions and the shift toward sustainable solutions. Additionally, hydrocarbons are readily available and cost-effective, making them a preferred choice for both new systems and retrofits in refrigeration and cooling applications, ensuring their continued market dominance.

By End-Use Industry

The industrial segment dominated with the market share over 38% in 2023, driven by its extensive use in large-scale operations, including manufacturing, production, and heavy refrigeration systems. Natural refrigerants, particularly ammonia and CO2, are widely favored in these industries for their superior energy efficiency and minimal environmental impact compared to synthetic alternatives. Ammonia, for instance, is highly effective in large industrial refrigeration systems, offering excellent thermodynamic properties and lower operating costs. CO2 is also gaining popularity due to its environmentally friendly characteristics and non-toxic nature. With stringent environmental regulations and a growing focus on sustainability, industries are increasingly opting for these natural refrigerants to comply with regulations like the Montreal Protocol and reduce their carbon footprint.

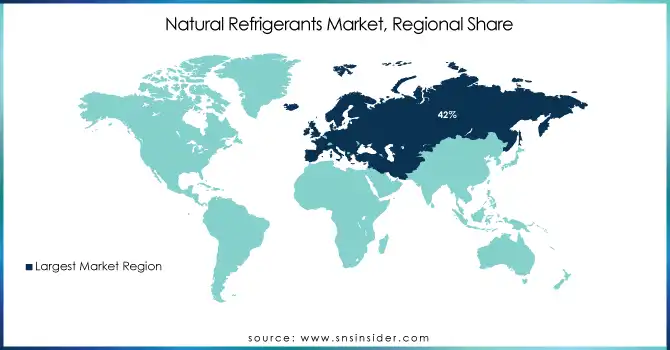

KEY REGIONAL ANALYSIS

Europe region dominated with the market share over 42% in 2023, due to its robust regulatory framework and strong commitment to environmental sustainability. The region’s leadership is primarily driven by the European Union's F-gas regulations, which aim to phase out high global-warming potential (GWP) refrigerants in favor of more eco-friendly alternatives. These regulations encourage the use of natural refrigerants such as CO2, ammonia, and hydrocarbons, which are considered safer for the environment due to their lower GWP. Additionally, Europe's focus on reducing carbon emissions and tackling climate change further propels the adoption of natural refrigerants in sectors like refrigeration, air conditioning, and heating.

Asia-Pacific is emerging as the fastest-growing region in the Natural Refrigerants Market, fueled by rapid industrialization and increased environmental consciousness. The region's expanding economies, particularly in China, Japan, and India, are driving the demand for refrigeration solutions across industries such as food processing, pharmaceuticals, and retail. Governments in these countries are implementing strict environmental regulations and incentives to curb the use of traditional, high-GWP (Global Warming Potential) refrigerants, favoring natural alternatives like CO2, ammonia, and hydrocarbons. The growing recognition of the harmful effects of synthetic refrigerants on climate change has further accelerated the adoption of more sustainable options.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Some of the major key players of the Natural Refrigerants Market

Suppliers for (refrigerant lifecycle management, providing natural refrigerants like CO₂ and hydrocarbons to support the industry's shift to eco-friendly cooling solutions) on Natural Refrigerants Market

In March 2023: Danfoss announced its acquisition of BOCK GmbH, a leading manufacturer of carbon dioxide and low-GWP compressors. BOCK GmbH boasts one of the largest portfolios of compressors designed for natural refrigerants such as hydrocarbons, CO2 (R744), and other low-GWP refrigerants. This acquisition is set to drive energy efficiency and accelerate the global shift towards natural and low-GWP refrigerants.

In February 2023: Linde entered into a long-term agreement and committed an investment of approximately USD 1.8 billion to provide clean hydrogen and nitrogen to OCI’s new world-scale blue ammonia plant in Beaumont, Texas. The Beaumont facility is poised to enhance and expand the world-leading blue ammonia and clean fuels platform.

In April 2024: GEA announced the delivery of a custom two-stage ammonia refrigeration system for the U.K.’s tallest cold storage facility in Easton, Lincolnshire. Scheduled to become operational by late 2024, the fully automated facility will run entirely on renewable energy.

In March 2024: Panasonic revealed plans to introduce three new models of commercial air-to-water heat pumps in September 2024. Targeting multidwelling units and light commercial properties in Europe, these compact, energy-efficient models will utilize environmentally friendly natural refrigerants.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.59 Billion |

| Market Size by 2032 | USD 2.77 Billion |

| CAGR | CAGR of 6.34% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hydrocarbons, Ammonia, Carbon Dioxide) • By End-Use Industry (Industrial, Commercial, Domestic) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Puyang Zongwei Fine Chemical Co. Ltd, Sinochem, A-Gas International, Airgas Inc., Linde Group, Shangdong Yueon Chemical Co Ltd, Emerson Electric Co., GEA Group AG, Cooltech Applications, Carel Industries S.P.A., Danfoss A/S, Engie Refrigeration GmbH, Bitzer SE, Mayekawa Mfg. Co. Ltd, Johnson Controls International plc, Carnot Refrigeration, Secop GmbH, Mitsubishi Heavy Industries, Honeywell International Inc., Panasonic Corporation. |

| Key Drivers | • The Natural Refrigerants Market is experiencing rapid growth, driven by stringent environmental regulations, technological advancements, and rising demand for eco-friendly, energy-efficient cooling solutions across industries. |

| RESTRAINTS | • High installation costs for natural refrigerant systems pose a challenge, but the market grows due to environmental regulations and energy-efficient trends. |

Ans: Europe dominated the Natural Refrigerants Market in 2023

Ans: The “Hydrocarbons” segment dominated the Natural Refrigerants Market.

Ans: The Natural Refrigerants Market is experiencing rapid growth, driven by stringent environmental regulations, technological advancements, and rising demand for eco-friendly, energy-efficient cooling solutions across industries.

Ans: The Natural Refrigerants Market was USD 1.59 billion in 2023 and is expected to Reach USD 2.77 billion by 2032.

Ans: The Natural Refrigerants Market is expected to grow at a CAGR of 6.34% during 2024-2032.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Natural Refrigerants Market Segmentation, By Type

7.1 Chapter Overview

7.2 Hydrocarbons

7.2.1 Hydrocarbons Market Trends Analysis (2020-2032)

7.2.2 Hydrocarbons Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Ammonia

7.3.1 Ammonia Market Trends Analysis (2020-2032)

7.3.2 Ammonia Hydroxide Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Carbon Dioxide

7.4.1 Carbon Dioxide Market Trends Analysis (2020-2032)

7.4.2 Carbon Dioxide Hydroxide Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Natural Refrigerants Market Segmentation, By End-Use Industry

8.1 Chapter Overview

8.2 Industrial

8.2.1 Industrial Market Trends Analysis (2020-2032)

8.2.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Commercial

8.3.1 Commercial Market Trends Analysis (2020-2032)

8.3.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Domestic

8.4.1 Domestic Market Trends Analysis (2020-2032)

8.4.2 Domestic Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Natural Refrigerants Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.4 North America Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.5.2 USA Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.6.2 Canada Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Natural Refrigerants Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Natural Refrigerants Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.6.2 France Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific Natural Refrigerants Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia-Pacific Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.4 Asia-Pacific Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 China Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 India Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 Japan Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.9.2 Australia Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia-Pacific Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Natural Refrigerants Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Natural Refrigerants Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.4 Africa Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Natural Refrigerants Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.4 Latin America Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Natural Refrigerants Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Natural Refrigerants Market Estimates and Forecasts, By End-Use Industry (2020-2032) (USD Billion)

11. Company Profiles

11.1 Puyang Zongwei Fine Chemical Co. Ltd

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Sinochem

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 A-Gas International

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Airgas Inc

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Linde Group

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Shangdong Yueon Chemical Co Ltd

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Emerson Electric Co

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 GEA Group AG

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Cooltech Applications

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Carel Industries S.P.A.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Hydrocarbons

Ammonia

Carbon Dioxide

By End-Use Industry

Industrial

Commercial

Domestic

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Pyridine & Pyridine Derivatives Market size was USD 736.67 million in 2023 and is expected to reach USD 1139.72 million by 2032 and grow at a CAGR of 4.97% over the forecast period of 2024-2032.

The Aroma Chemicals Market Size was valued at USD 5.59 Billion in 2023 and is expected to reach USD 8.66 Billion by 2032, growing at a CAGR of 4.99% over the forecast period of 2024-2032.

Explore key trends and growth factors in the Vetiver Oil Market. Discover the rising demand in cosmetics, aromatherapy, and perfumery, along with insights into regional markets and major companies driving the 2024 forecast.

Base Oil Market was valued at USD 20.86 billion in 2023 and is projected to reach USD 33.20 billion by 2032, growing at a CAGR of 5.3% from 2024 to 2032.

The Lignin Derivatives Market Size was USD 11.1 Billion in 2023 and is expected to reach USD 16.7 Billion by 2032 and grow at a CAGR of 4.7% by 2024-2032.

The Phase-transfer Catalyst Market size was valued at USD 1.1 Billion in 2023. It is expected to grow to USD 1.81 Billion by 2032 and grow at a CAGR of 5.7% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone