Get more information on Narrowband IoT (NB-IoT) Chipset Market - Request Sample Report

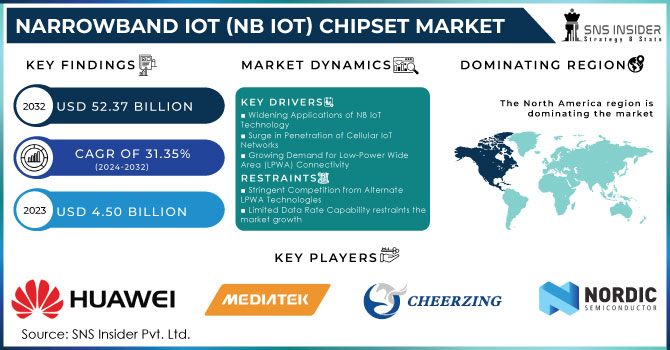

The Narrowband IoT (NB IoT) Chipset Market Size was valued at USD 4.50 billion in 2023 and is expected to reach USD 52.37 billion by 2032 and grow at a CAGR of 31.35% over the forecast period 2024-2032.

Rising demand for IoT landscape due to its low power consumption, and wide area connectivity is significantly influencing the Narrowband IoT Chipset Market. According to the IoT Analytics State of Spring 2023 report, the connected IoT devices are expected to grow by 16% as compared to 2022 i.e. around 16.7 billion and it is to become more than 20 billion by 2027. In 2021, the IoT investments in India tripled to US$ 15 billion across both technology products and services components. Global IoT connectivity is driven mainly by Wi-Fi, Bluetooth, and cellular IoT. However, these technologies require high bandwidth and speed to work properly. But Narrowband IoT chipsets require narrow bandwidth and deep network penetration to work for long-term connectivity. This focus on efficient and flexible results makes the NB IoT chipsets ideal for applications. For Example, Qualcomm launched a series of NB IoT chipset devices, one among them is QNE, which are known for their low power consumption and compact sizes.

NB IoT operates on cellular networks, offering wider coverage and better penetration compared to traditional short-range options like Bluetooth. Additionally, NB IoT boasts extended device lifespans due to its frugal power consumption, allowing for deployments in remote locations or scenarios where frequent battery changes are impractical. Network service providers are actively rolling out NB IoT services, creating a robust foundation for device development and deployment. This growing infrastructure fosters trust and encourages businesses to invest in NB IoT solutions. Various Governments worldwide are heavily investing in smart grid solutions, transportation systems, and environment monitoring initiatives to develop their infrastructures. These projects require sensors and devices that can efficiently collect and transmit data that aligns with the strengths of NB IoT devices. According to the case study by GSMA for IoT and Essential Utility Services: India Market; the smart utility Internet of Things (IoT) connections will total 3.5 billion globally by 2030, up from 1.7 billion in 2021. Growth will be particularly strong in developing countries, where many companies are still in the early stages of their IoT journeys. In Sub-Saharan Africa, for example, smart utility connections will increase almost six-fold between 2021 and 2030, reaching 152 million. And it is expected to grow nearly 30% of IoT connections by 2030 in the region.

Advancements in the 5G network can also empower the Narrowband IoT Chipset Market further. The integration of NB IoT with 5G infrastructure could unlock various new possibilities for critical applications requiring ultra-reliable, and less-lagging communication. Gatehouse Satcom, a leading satellite communication company said that the finalization of 3GPP’s Release 17 satellite has marked a significant milestone in the 5G technology with the introduction of space-based 5G Narrowband IoT (NB IoT) and direct-to-device connectivity. This development declares the growing interest in satellite-based 5G services, which brings new demands on NB IoT system architecture to ensure uninterrupted network coverage across extensive geographical areas and to address existing connectivity challenges globally.

The Narrowband IoT Chipset Market is growing due to a confluence of factors, including the growing adoption of NB IoT technology by telecom operators, the benefits of NB IoT for low-power communication, and the increasing demand for smart solutions across various industries. As external influences like smart infrastructure development and 5G integration continue to evolve, the Narrowband IoT Chipset Market is poised for a future characterized by sustained growth and innovation.

NB-IoT chipsets offer low power consumption, long-range connectivity, and higher connected data rates suitable for many applications. For utilities such as water, gas, or electricity NB IoT helps in smart metering installation which allows real-time monitoring and increases efficiency. Deploying several sensors and creating opportunities such as smart parking solutions, environmental monitoring systems, connected street lights, etc., makes easy management of resources leading to better citizen services. One of the industrial applications for NB IoT is a tool that helps automate some operations in factory and oil and gas fields, where tools are monitored periodically from remote sites to factories. The downtime is reduced and operations are optimized with NB IoT chipsets performing maintenance operations on the sensor data collected. NB IoT chipsets link sensors that can detect soil moisture, temperature, and nutrient levels, thereby enabling precision farming practices to ensure efficient crop yields and resource management processes. It also helps in tracking livestock and remotely manages irrigation systems. In the global logistics system, NB IoT can support real-time tracking of goods as well as vehicles and assets being transported. This leads to more efficient logistics, and fewer chances of theft, and the data it gathers helps for optimal delivery routing.

With cellular networks gaining wider reach to 4G LTE, and the deployment of 5G NR will further enable NB IoT chipsets to be integrated with a better infrastructure. NB IoT uses existing cellular infrastructure with minor changes which means network operators can provide support at low cost. Dedicated networks for low-power IoT applications are less necessary due to the underlying scalability of cellular networks and their ability to easily handle more NB IoT devices with time. They also come with built-in security features such as user authentication, and data encryption which are vital for secure communication in IoT applications. The near-ubiquitous coverage of wireless networks ensures that NB IoT devices can run smoothly across different geographical boundaries. This is key to asset tracking and logistics use cases where you have assets moving across international borders.

The exponential growth of IoT devices necessitates technologies that offer long-range connectivity while minimizing power consumption. NB IoT chipsets are designed for ultra-low power consumption, enabling devices to operate for years on a single battery charge. This eliminates frequent battery replacements and reduces maintenance costs for large-scale IoT deployments. By minimizing power consumption, NB IoT chipsets contribute to lower battery costs and smaller device form factors. This translates to cost-effective solutions for a wider range of IoT applications. Compared to traditional Bluetooth or Wi-Fi, NB IoT offers significantly wider network coverage, allowing devices to connect even in remote locations. This is crucial for applications like smart agriculture, environmental monitoring, and connected infrastructure. NB IoT utilizes a narrow bandwidth for communication, minimizing congestion on cellular networks. This ensures reliable connectivity for a massive number of low-data-rate IoT devices.

Restraints

NB IoT chipsets have a strong presence in the market but also face challenges from other Low-Power Wide-Area (LPWA) technologies such as LoRaWAN and LTE-M. Also, LoRaWAN coverage extends farther than NB IoT and it is indicated for deployments in far-off or scarcely populated areas. Moreover, it functions in the unlicensed spectrum which can lower costs for some use cases. LoRaWAN offers lower data rates that may become a problem in high-density use cases. LTE-M is slower than NB IoT chipsets and supports modem downlink/uplink speeds of 300/375 kbps. It also uses existing LTE infrastructure, meaning that in some cases it may be cheaper and faster to deploy.

While NB IoT has low power consumption and wide-area connectivity, it is also limited in data rate capability. NB IoT is optimized for small short packets of data, which means it's not too practical if you need to pass large loads of continuous data in/out regularly. Higher data rates are often needed by applications such as video surveillance, real-time traffic monitoring, or industrial automation. I think it is likely that NB IoT will struggle to see adoption in these sectors due to its limitations here. However, NB IoT may not fully serve the increasing demand for data-driven applications across sectors. That could put a restraint on market expansion in high data throughput types of segments.

By Deployment

The guard band provides a spectrum that can be used for LTE carriers which makes the segment dominating during the forecasted period. NB IoT carriers can be deployed in the LTE guard band without impacting the capacity of an adjacent, co-channel E-UTRA (LTE) FDD or TDD deployment. The guard-band option enables the use of spectrum at the channel edges of existing LTE carriers. The guard-band deployment consumes less mobile broadband capacity over the fact of it than in-band. Benefits like no extra spectrum cost, reuse of antenna system and RF module, and better coexistence performance over in-band mode offer vital potential to grow guard band deployment for NB IoT.

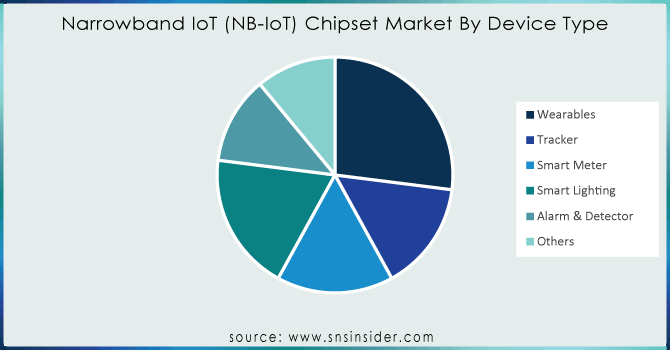

By Device Type

The market has been further divided into alarms & detectors, smart parking, smart meters, intelligent lighting, trackers, wearables and others based on type of device. In view of the rapidly increasing demand for sports, fitness equipment and medical devices related to personal care and diagnostics, the wearables segment held a dominant market share. While the increase in disposable income, together with increased awareness of health and fitness, is promoting this.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

The narrowband-IoT (NB IoT) market is leading in the healthcare industry and is anticipated to remain predominant over the outlook period 2022-2030. This is due to the plethora of benefits that NB IoT provides for healthcare use-cases. For example, by utilizing NB IoT the medical devices like heart rate monitors and blood pressure can be used for patient monitoring from remote locations. NB IoT can also be used for inventory management in hospitals, medical equipment tracking and more.

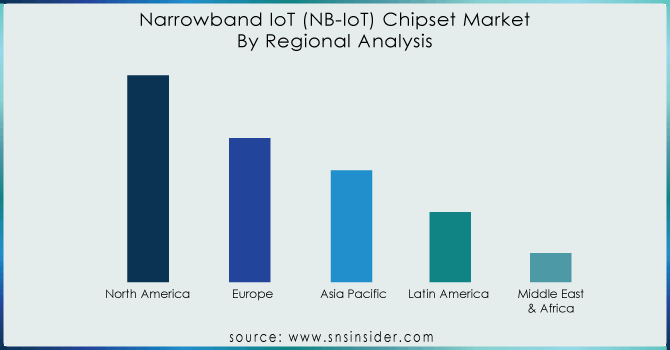

North America held the biggest market share in 2023 and is expected to keep growing at a rapid pace of 44.15% CAGR. This is due to several factors, including the presence of major telecom providers with expertise in NB IoT solutions, a high concentration of tech-savvy consumers, and widespread adoption of new technologies across various sectors.

Europe is the fastest-growing market, driven by the increasing use of NB IoT in cars and transportation. Being a major player in the global NB IoT industry due to the large number of major corporations and early adoption of the technology, the UK has the biggest market share followed by Germany.

Asia-Pacific is also expected to grow due to factors like the expansion of high-speed internet infrastructure, growing internet usage, and government initiatives promoting smart cities. China has the biggest market share in this region, while India is seeing the fastest growth.

The Key Player in Global Narrowband IoT (NB-IoT) Chipset Market are Huawei, RDA, MediaTek, Cheerzing, Altair Semiconductor (Sony Group Company), Intel, Telit Communications, Nordic Semiconductor, Sequans Communications, Qualcomm, ZTE, Sanechips, u-blox, Samsung, Sierra Wireless, Sercomm, Quectel, Verizon Wireless, AT&T Inc, Ericcson Corporation, and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.50 Billion |

| Market Size by 2032 | US$ 52.37 Billion |

| CAGR | CAGR of 31.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (Standalone, in-band, guard-band) • By Device Type (Wearables, Tracker, Smart Meter, Smart Lighting, Alarm & Detector, Others) • By Application (Healthcare, Infrastructure, Building Automation, Manufacturing, Safety and Security, Agriculture, Automotive and Transportation, Energy and Utilities, Consumer Electronics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Huawei, RDA, MediaTek, Cheerzing, Altair Semiconductor (Sony Group Company), Intel, Telit Communications, Nordic Semiconductor, Sequans Communications, Qualcomm, ZTE, Sanechips, u-blox, Samsung, Sierra Wireless, Sercomm, Quectel, Verizon Wireless, AT&T Inc, Ericcson Corporation, and Other Players. |

| Key Drivers | • Widening Applications of NB IoT Technology • Surge in Penetration of Cellular IoT Networks • Growing Demand for Low-Power Wide Area (LPWA) Connectivity |

| Restraints | • Stringent Competition from Alternate LPWA Technologies • Limited Data Rate Capability restraints the market growth |

Ans: The Narrowband IoT (NB IoT) Chipset Market is expected to grow at a CAGR of 31.35%.

Ans: Narrowband IoT (NB IoT) Chipset Market size was USD 4.50 billion in 2023 and is expected to Reach USD 52.37 billion by 2032.

Ans: The surge in penetration of cellular IoT Networks raises the growth of the Narrowband IoT (NB IoT) Chipset Market.

Ans: The healthcare segment by application is dominating the Narrowband IoT (NB IoT) Chipset Market.

Ans: North America is the dominating region in the Narrowband IoT (NB IoT) Chipset Market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Narrowband IoT (NB IoT) Chipset Market Segmentation, By Deployment

7.1 Introduction

7.2 Standalone

7.3 In-band

7.4 Guard-band

8. Narrowband IoT (NB IoT) Chipset Market Segmentation, By Device Type

8.1 Introduction

8.2 Wearables

8.3 Tracker

8.4 Smart Meter

8.5 Smart Lighting

8.6 Alarm & Detector

8.7 Others

9. Narrowband IoT (NB IoT) Chipset Market Segmentation, By Application

9.1 Introduction

9.2 Healthcare

9.3 Infrastructure

9.4 Building Automation

9.5 Manufacturing

9.6 Safety and Security

9.7 Agriculture

9.8 Automotive and Transportation

9.9 Energy and Utilities

9.10 Consumer Electronics

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Narrowband IoT (NB IoT) Chipset Market by Country

10.2.3 North America Narrowband IoT (NB IoT) Chipset Market By Deployment

10.2.4 North America Narrowband IoT (NB IoT) Chipset Market By Device Type

10.2.5 North America Narrowband IoT (NB IoT) Chipset Market By Application

10.2.6 USA

10.2.6.1 USA Narrowband IoT (NB IoT) Chipset Market By Deployment

10.2.6.2 USA Narrowband IoT (NB IoT) Chipset Market By Device Type

10.2.6.3 USA Narrowband IoT (NB IoT) Chipset Market By Application

10.2.7 Canada

10.2.7.1 Canada Narrowband IoT (NB IoT) Chipset Market By Deployment

10.2.7.2 Canada Narrowband IoT (NB IoT) Chipset Market By Device Type

10.2.7.3 Canada Narrowband IoT (NB IoT) Chipset Market By Application

10.2.8 Mexico

10.2.8.1 Mexico Narrowband IoT (NB IoT) Chipset Market By Deployment

10.2.8.2 Mexico Narrowband IoT (NB IoT) Chipset Market By Device Type

10.2.8.3 Mexico Narrowband IoT (NB IoT) Chipset Market By Application

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Narrowband IoT (NB IoT) Chipset Market by Country

10.3.2.2 Eastern Europe Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.2.3 Eastern Europe Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.2.4 Eastern Europe Narrowband IoT (NB IoT) Chipset Market By Application

10.3.2.5 Poland

10.3.2.5.1 Poland Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.2.5.2 Poland Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.2.5.3 Poland Narrowband IoT (NB IoT) Chipset Market By Application

10.3.2.6 Romania

10.3.2.6.1 Romania Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.2.6.2 Romania Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.2.6.4 Romania Narrowband IoT (NB IoT) Chipset Market By Application

10.3.2.7 Hungary

10.3.2.7.1 Hungary Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.2.7.2 Hungary Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.2.7.3 Hungary Narrowband IoT (NB IoT) Chipset Market By Application

10.3.2.8 Turkey

10.3.2.8.1 Turkey Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.2.8.2 Turkey Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.2.8.3 Turkey Narrowband IoT (NB IoT) Chipset Market By Application

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.2.9.2 Rest of Eastern Europe Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.2.9.3 Rest of Eastern Europe Narrowband IoT (NB IoT) Chipset Market By Application

10.3.3 Western Europe

10.3.3.1 Western Europe Narrowband IoT (NB IoT) Chipset Market by Country

10.3.3.2 Western Europe Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.3.3 Western Europe Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.3.4 Western Europe Narrowband IoT (NB IoT) Chipset Market By Application

10.3.3.5 Germany

10.3.3.5.1 Germany Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.3.5.2 Germany Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.3.5.3 Germany Narrowband IoT (NB IoT) Chipset Market By Application

10.3.3.6 France

10.3.3.6.1 France Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.3.6.2 France Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.3.6.3 France Narrowband IoT (NB IoT) Chipset Market By Application

10.3.3.7 UK

10.3.3.7.1 UK Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.3.7.2 UK Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.3.7.3 UK Narrowband IoT (NB IoT) Chipset Market By Application

10.3.3.8 Italy

10.3.3.8.1 Italy Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.3.8.2 Italy Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.3.8.3 Italy Narrowband IoT (NB IoT) Chipset Market By Application

10.3.3.9 Spain

10.3.3.9.1 Spain Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.3.9.2 Spain Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.3.9.3 Spain Narrowband IoT (NB IoT) Chipset Market By Application

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.3.10.2 Netherlands Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.3.10.3 Netherlands Narrowband IoT (NB IoT) Chipset Market By Application

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.3.11.2 Switzerland Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.3.11.3 Switzerland Narrowband IoT (NB IoT) Chipset Market By Application

10.3.3.12 Austria

10.3.3.12.1 Austria Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.3.12.2 Austria Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.3.12.3 Austria Narrowband IoT (NB IoT) Chipset Market By Application

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Narrowband IoT (NB IoT) Chipset Market By Deployment

10.3.3.13.2 Rest of Western Europe Narrowband IoT (NB IoT) Chipset Market By Device Type

10.3.3.13.3 Rest of Western Europe Narrowband IoT (NB IoT) Chipset Market By Application

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Narrowband IoT (NB IoT) Chipset Market by Country

10.4.3 Asia-Pacific Narrowband IoT (NB IoT) Chipset Market By Deployment

10.4.4 Asia-Pacific Narrowband IoT (NB IoT) Chipset Market By Device Type

10.4.5 Asia-Pacific Narrowband IoT (NB IoT) Chipset Market By Application

10.4.6 China

10.4.6.1 China Narrowband IoT (NB IoT) Chipset Market By Deployment

10.4.6.2 China Narrowband IoT (NB IoT) Chipset Market By Device Type

10.4.6.3 China Narrowband IoT (NB IoT) Chipset Market By Application

10.4.7 India

10.4.7.1 India Narrowband IoT (NB IoT) Chipset Market By Deployment

10.4.7.2 India Narrowband IoT (NB IoT) Chipset Market By Device Type

10.4.7.3 India Narrowband IoT (NB IoT) Chipset Market By Application

10.4.8 Japan

10.4.8.1 Japan Narrowband IoT (NB IoT) Chipset Market By Deployment

10.4.8.2 Japan Narrowband IoT (NB IoT) Chipset Market By Device Type

10.4.8.3 Japan Narrowband IoT (NB IoT) Chipset Market By Application

10.4.9 South Korea

10.4.9.1 South Korea Narrowband IoT (NB IoT) Chipset Market By Deployment

10.4.9.2 South Korea Narrowband IoT (NB IoT) Chipset Market By Device Type

10.4.9.3 South Korea Narrowband IoT (NB IoT) Chipset Market By Application

10.4.10 Vietnam

10.4.10.1 Vietnam Narrowband IoT (NB IoT) Chipset Market By Deployment

10.4.10.2 Vietnam Narrowband IoT (NB IoT) Chipset Market By Device Type

10.4.10.3 Vietnam Narrowband IoT (NB IoT) Chipset Market By Application

10.4.11 Singapore

10.4.11.1 Singapore Narrowband IoT (NB IoT) Chipset Market By Deployment

10.4.11.2 Singapore Narrowband IoT (NB IoT) Chipset Market By Device Type

10.4.11.3 Singapore Narrowband IoT (NB IoT) Chipset Market By Application

10.4.12 Australia

10.4.12.1 Australia Narrowband IoT (NB IoT) Chipset Market By Deployment

10.4.12.2 Australia Narrowband IoT (NB IoT) Chipset Market By Device Type

10.4.12.3 Australia Narrowband IoT (NB IoT) Chipset Market By Application

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Narrowband IoT (NB IoT) Chipset Market By Deployment

10.4.13.2 Rest of Asia-Pacific Narrowband IoT (NB IoT) Chipset Market By Device Type

10.4.13.3 Rest of Asia-Pacific Narrowband IoT (NB IoT) Chipset Market By Application

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Narrowband IoT (NB IoT) Chipset Market by Country

10.5.2.2 Middle East Narrowband IoT (NB IoT) Chipset Market By Deployment

10.5.2.3 Middle East Narrowband IoT (NB IoT) Chipset Market By Device Type

10.5.2.4 Middle East Narrowband IoT (NB IoT) Chipset Market By Application

10.5.2.5 UAE

10.5.2.5.1 UAE Narrowband IoT (NB IoT) Chipset Market By Deployment

10.5.2.5.2 UAE Narrowband IoT (NB IoT) Chipset Market By Device Type

10.5.2.5.3 UAE Narrowband IoT (NB IoT) Chipset Market By Application

10.5.2.6 Egypt

10.5.2.6.1 Egypt Narrowband IoT (NB IoT) Chipset Market By Deployment

10.5.2.6.2 Egypt Narrowband IoT (NB IoT) Chipset Market By Device Type

10.5.2.6.3 Egypt Narrowband IoT (NB IoT) Chipset Market By Application

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Narrowband IoT (NB IoT) Chipset Market By Deployment

10.5.2.7.2 Saudi Arabia Narrowband IoT (NB IoT) Chipset Market By Device Type

10.5.2.7.3 Saudi Arabia Narrowband IoT (NB IoT) Chipset Market By Application

10.5.2.8 Qatar

10.5.2.8.1 Qatar Narrowband IoT (NB IoT) Chipset Market By Deployment

10.5.2.8.2 Qatar Narrowband IoT (NB IoT) Chipset Market By Device Type

10.5.2.8.3 Qatar Narrowband IoT (NB IoT) Chipset Market By Application

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Narrowband IoT (NB IoT) Chipset Market By Deployment

10.5.2.9.2 Rest of Middle East Narrowband IoT (NB IoT) Chipset Market By Device Type

10.5.2.9.3 Rest of Middle East Narrowband IoT (NB IoT) Chipset Market By Application

10.5.3 Africa

10.5.3.1 Africa Narrowband IoT (NB IoT) Chipset Market by Country

10.5.3.2 Africa Narrowband IoT (NB IoT) Chipset Market By Deployment

10.5.3.3 Africa Narrowband IoT (NB IoT) Chipset Market By Device Type

10.5.3.4 Africa Narrowband IoT (NB IoT) Chipset Market By Application

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Narrowband IoT (NB IoT) Chipset Market By Deployment

10.5.3.5.2 Nigeria Narrowband IoT (NB IoT) Chipset Market By Device Type

10.5.3.5.3 Nigeria Narrowband IoT (NB IoT) Chipset Market By Application

10.5.3.6 South Africa

10.5.3.6.1 South Africa Narrowband IoT (NB IoT) Chipset Market By Deployment

10.5.3.6.2 South Africa Narrowband IoT (NB IoT) Chipset Market By Device Type

10.5.3.6.3 South Africa Narrowband IoT (NB IoT) Chipset Market By Application

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Narrowband IoT (NB IoT) Chipset Market By Deployment

10.5.3.7.2 Rest of Africa Narrowband IoT (NB IoT) Chipset Market By Device Type

10.5.3.7.3 Rest of Africa Narrowband IoT (NB IoT) Chipset Market By Application

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Narrowband IoT (NB IoT) Chipset Market by country

10.6.3 Latin America Narrowband IoT (NB IoT) Chipset Market By Deployment

10.6.4 Latin America Narrowband IoT (NB IoT) Chipset Market By Device Type

10.6.5 Latin America Narrowband IoT (NB IoT) Chipset Market By Application

10.6.6 Brazil

10.6.6.1 Brazil Narrowband IoT (NB IoT) Chipset Market By Deployment

10.6.6.2 Brazil Narrowband IoT (NB IoT) Chipset Market By Device Type

10.6.6.3 Brazil Narrowband IoT (NB IoT) Chipset Market By Application

10.6.7 Argentina

10.6.7.1 Argentina Narrowband IoT (NB IoT) Chipset Market By Deployment

10.6.7.2 Argentina Narrowband IoT (NB IoT) Chipset Market By Device Type

10.6.7.3 Argentina Narrowband IoT (NB IoT) Chipset Market By Application

10.6.8 Colombia

10.6.8.1 Colombia Narrowband IoT (NB IoT) Chipset Market By Deployment

10.6.8.2 Colombia Narrowband IoT (NB IoT) Chipset Market By Device Type

10.6.8.3 Colombia Narrowband IoT (NB IoT) Chipset Market By Application

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Narrowband IoT (NB IoT) Chipset Market By Deployment

10.6.9.2 Rest of Latin America Narrowband IoT (NB IoT) Chipset Market By Device Type

10.6.9.3 Rest of Latin America Narrowband IoT (NB IoT) Chipset Market By Application

11. Company Profiles

11.1 Huawei

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 RDA

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 MediaTek

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Cheerzing

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Altair Semiconductor

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Intel

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Telit Communications

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Nordic Semiconductor

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Sequans Communications

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Qualcomm

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Deployment:

Stand-Alone

Guard Band

In-Band

By Device Type

Wearables

Tracker

Smart Meter

Smart Lighting

Alarm & Detector

Others

By Application

Healthcare

Infrastructure

Building Automation

Manufacturing

Safety and Security

Agriculture

Automotive and Transportation

Energy and Utilities

Consumer Electronics

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The IPS Displays Market size is expected to be valued at USD 65.03 Billion in 2023. It is estimated to reach USD 120.56 Billion by 2032, with a growing CAGR of 7.1% over the forecast period 2024-2032.

The Digital Fault Recorder Market Size was valued at USD 1.6 Billion in 2023 and is expected to grow at a CAGR of 8.84% to reach USD 3.4 Billion by 2032.

The Washing Machine Market Size was valued at USD 62.22 Billion in 2023 and is expected to reach USD 117.54 Billion by 2032 and grow at a CAGR of 7.4% over the forecast period 2024-2032.

The Application-Specific Integrated Circuit Market Size is Projected to reach USD 32.12 Billion by 2032 and grow at a CAGR of 6.3% During 2024-2032.

The Enterprise Manufacturing Intelligence Market Size was valued at USD 5.18 Billion in 2023 and is expected to grow to USD 16.11 Billion by 2032 and grow at a CAGR of 13.44% over the forecast period of 2024-2032

The OLED Display Market Size was valued at USD 44.07 Billion in 2023 and is expected to grow at a CAGR of 13.7% to reach USD 138.85 Billion by 2032.

Hi! Click one of our member below to chat on Phone